Smart Contract Trading on Decentralized Platforms: A New Stage of Automation?

By combining advanced risk management with real-time market analysis, smart contract systems are reshaping how we think about trading in the decentralized ecosystem.

The convergence of blockchain technology, smart contracts, and decentralized finance (DeFi) has ushered in a revolutionary era in digital trading. Smart contract trading on decentralized platforms represents a significant leap forward in financial automation, enabling trustless, transparent, and efficient transactions without traditional intermediaries. As the global cryptocurrency market continues to mature, these automated trading systems are reshaping how we think about asset exchange and portfolio management.

In this article, we'll explore the fundamental components of this emerging technology: smart contracts and their self-executing capabilities, the architecture and advantages of decentralized platforms, and how these elements combine to create sophisticated automated trading systems. By understanding these key pillars, readers will gain insight into how smart contract trading is transforming the landscape of digital finance and potentially setting the stage for the future of automated trading.

What Are Smart Contracts?

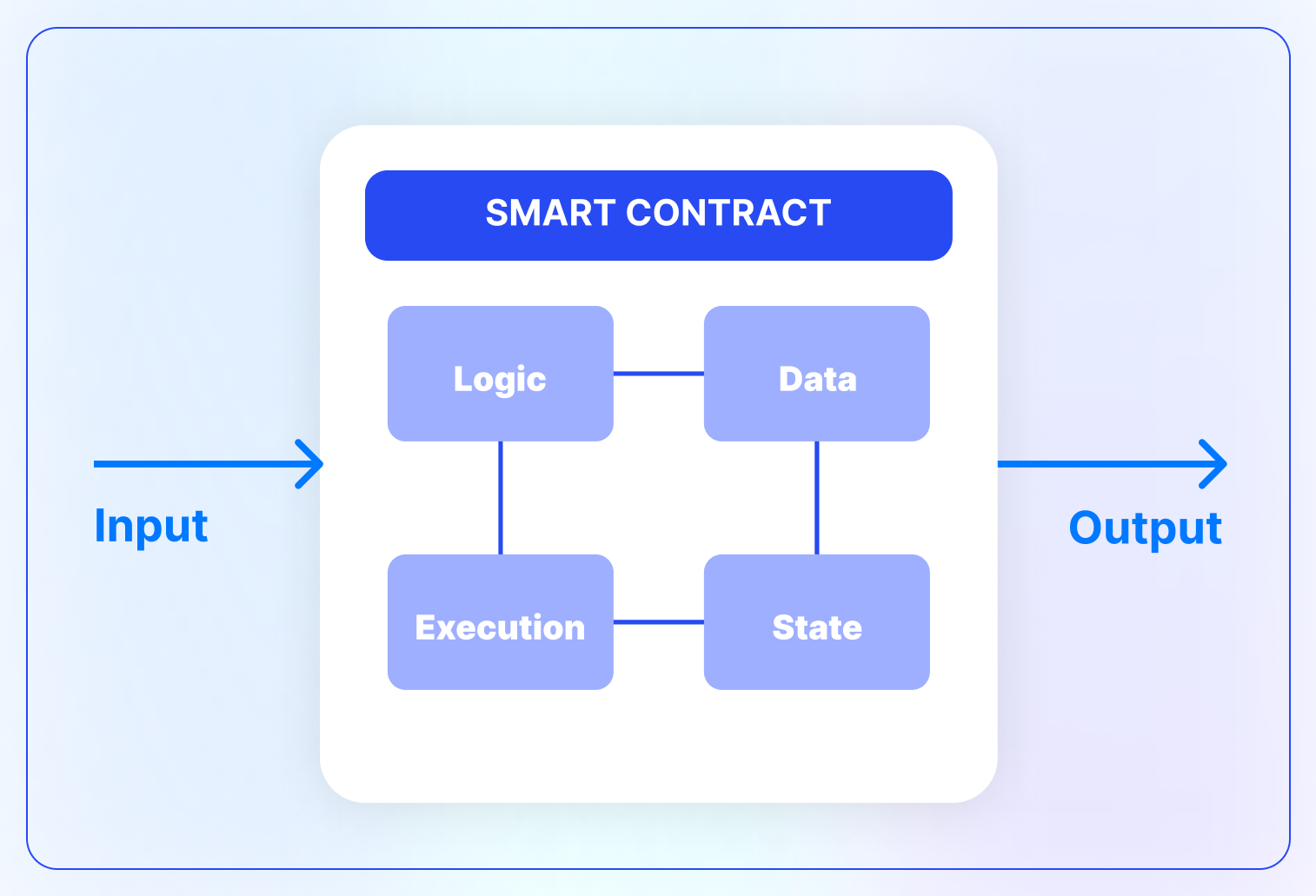

Smart contracts are self-executing digital agreements written in code and stored on a blockchain network. These automated protocols automatically enforce and execute predefined terms and conditions when specific criteria are met, eliminating the need for traditional intermediaries or manual intervention. Just as traditional contracts outline the rules and penalties around an agreement, smart contracts do the same but with the added capability of automatically enforcing these rules through code.

At their core, smart contracts function like digital vending machines: once specific conditions are satisfied (like inserting the correct amount of money), they automatically execute the programmed action (dispensing the selected item). In the blockchain context, these conditions could be anything from reaching a certain price point for a cryptocurrency to receiving funds in a specified wallet address.

Key characteristics of smart contracts include:

- Immutability: Once deployed on the blockchain, the contract's code cannot be altered, ensuring transparency and preventing manipulation.

- Deterministic Execution: Given the same input conditions, smart contracts will always produce the same results, making them predictable and reliable.

- Decentralization: They operate on distributed networks, meaning no single entity controls their execution.

- Transparency: All parties can verify the contract's terms and execution history on the blockchain.

These features make smart contracts particularly valuable for financial applications, where they can automate complex transactions, reduce counterparty risk, and minimize the need for trust between parties. The technology has evolved significantly since its introduction on the Ethereum blockchain in 2015, and now supports sophisticated financial operations ranging from simple token swaps to complex derivatives trading.

What Are Decentralized Platforms?

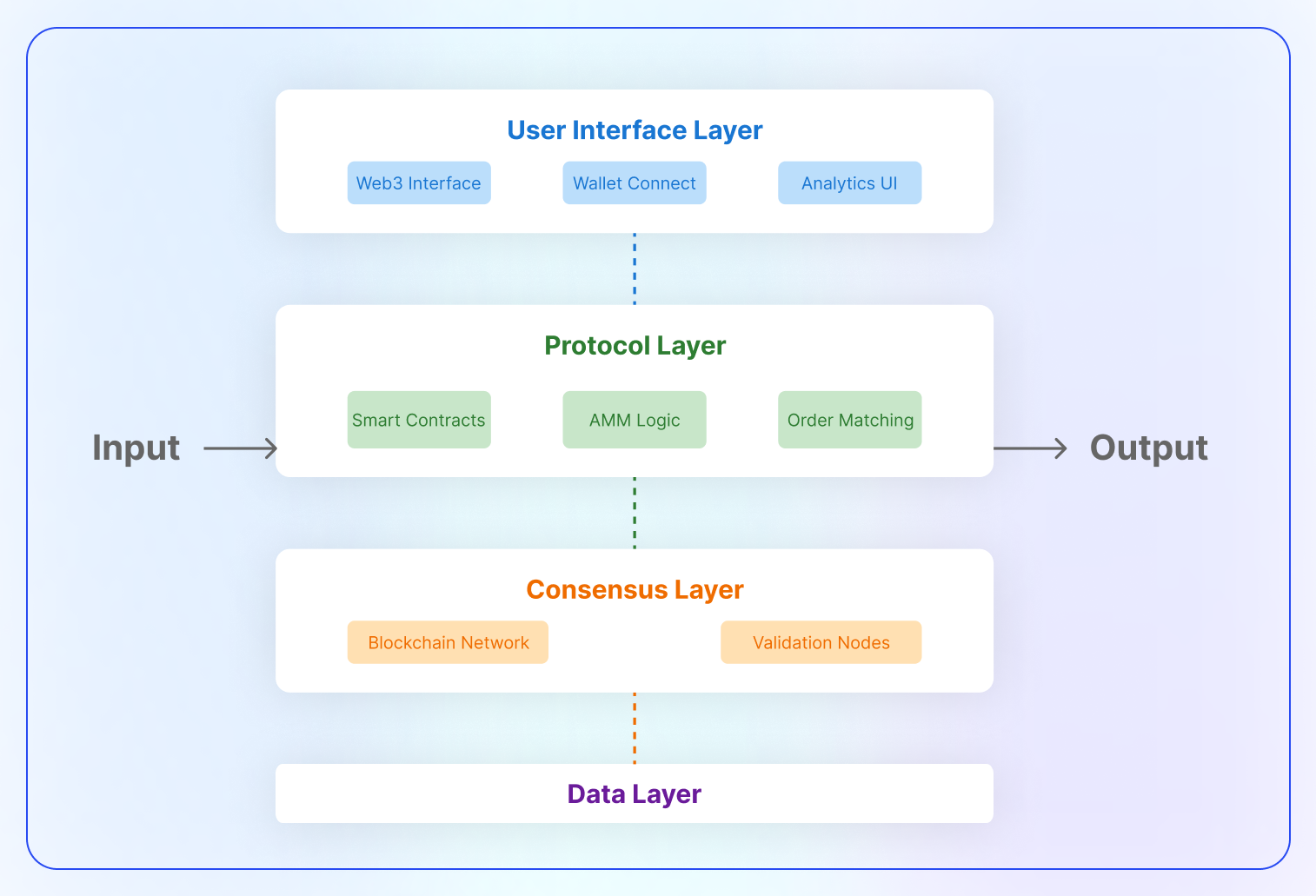

Decentralized platforms, often referred to as decentralized exchanges (DEXs) or DeFi platforms, are blockchain-based systems that operate without central authorities or intermediaries. Unlike traditional centralized exchanges where a single entity controls operations and holds custody of assets, decentralized platforms distribute control and execution across a network of participants through smart contracts and blockchain technology.

Architecture of Decentralized Platforms:

- Protocol Layer

- Smart contracts form the foundational rules and logic

- Automated Market Maker (AMM) mechanisms manage liquidity and pricing

- Order matching and execution systems operate autonomously

- Consensus Layer

- Blockchain network validates and records all transactions

- Distributed nodes maintain transaction history and state

- Cryptographic protocols ensure security and immutability

- User Interface Layer

- Web3 interfaces connect users to the underlying protocols

- Wallet integration enables direct interaction with smart contracts

- Real-time data feeds and analytics tools support trading decisions

Key Advantages of Decentralized Platforms:

- Enhanced Security

- Non-custodial nature means users retain control of their assets

- No central point of failure for hackers to target

- Transparent code allows for community auditing and verification

- Increased Privacy

- No KYC requirements in most cases

- Pseudonymous transactions protect user identity

- Reduced data collection compared to centralized exchanges

- Improved Accessibility

- 24/7 operation without downtime

- Global access without geographical restrictions

- Lower barriers to entry for users and developers

- Greater Transparency

- All transactions and smart contract code are publicly visible

- Price discovery mechanisms are algorithmic and verifiable

- Open-source nature enables community oversight

- Reduced Counterparty Risk

- No reliance on centralized intermediaries

- Automatic settlement through smart contracts

- Collateralization and liquidation processes are automated

These architectural elements and advantages make decentralized platforms particularly attractive for modern financial applications, enabling everything from simple token swaps to complex DeFi protocols. However, it's important to note that these platforms also face challenges, such as scalability limitations, potential smart contract vulnerabilities, and the need for users to manage their own security carefully.

The innovative architecture of decentralized platforms continues to evolve, with new solutions emerging to address current limitations while maintaining the core benefits of decentralization. This ongoing development makes them increasingly viable alternatives to traditional financial infrastructure.

What Is Smart Contract Trading?

Smart contract trading represents a revolutionary approach to digital asset trading where automated programs execute trades based on predefined conditions. Unlike traditional trading methods that rely on manual order placement or basic automation scripts, smart contract trading leverages blockchain technology to create self-executing trades that are immutable, transparent, and trustless.

The fundamental components of smart contract trading create a comprehensive framework that enables automated, secure, and efficient trading operations. Let's explore each component in detail:

- Automated Execution Logic

At the heart of smart contract trading lies the automated execution logic, which acts as the "brain" of the trading system. This component determines when and how trades are executed based on carefully defined parameters:

- Predefined Trading Rules and Conditions

- Trading rules are encoded as immutable instructions within the smart contract

- These rules can range from simple limit orders to complex multi-step trading strategies

- Conditions might include specific price points, time intervals, or market events

- Example: A smart contract could be programmed to automatically buy an asset when its price drops below a certain threshold and sell when it rises above another

- Price Triggers and Market Condition Parameters

- Smart contracts continuously monitor price feeds through oracle services

- Multiple price sources can be aggregated to ensure accuracy

- Market conditions such as volume, liquidity, and volatility can be incorporated

- Parameters can be set to trigger trades based on technical indicators or market trends

- Risk Management Protocols

- Built-in safety mechanisms protect against extreme market movements

- Position size limits prevent overexposure to any single asset

- Circuit breakers can pause trading during unusual market conditions

- Multiple validation checks ensure trade execution aligns with strategy parameters

- Asset Management

Effective asset management is crucial for successful smart contract trading, ensuring proper handling and optimization of digital assets:

- Digital Wallet Integration

- Secure connection to users' blockchain wallets

- Multi-wallet support for different blockchain networks

- Private key management and security protocols

- Automated balance checking and fund allocation

- Token Allowances and Approvals

- Smart contracts manage permissions for token transfers

- Automated approval processes for DEX interactions

- Regular auditing of allowances for security

- Revocation mechanisms for unused approvals

- Portfolio Rebalancing Mechanisms

- Automatic portfolio weight adjustments

- Target allocation maintenance across assets

- Periodic rebalancing based on market conditions

- Tax-efficient trading considerations

- Transaction Processing

The transaction processing component ensures efficient and reliable execution of trades:

- Gas Fee Optimization

- Dynamic gas price adjustment based on network conditions

- Transaction batching to reduce overall costs

- Gas price prediction algorithms

- Priority setting for critical transactions

- Emergency gas price overrides for urgent trades

- Slippage Protection

- Maximum slippage tolerance settings

- Price impact calculations before execution

- Order splitting for large trades

- Alternative routing options for better prices

- Reversion mechanisms for excessive slippage

- Failed Transaction Handling

- Automatic retry mechanisms with adjusted parameters

- Error logging and notification systems

- Recovery procedures for stuck transactions

- Compensation strategies for failed trades

- Alternative execution paths when primary routes fail

These components work together seamlessly to create a robust trading system. For example, when a trading opportunity arises, the automated execution logic identifies the signal, the asset management component ensures sufficient funds are available and properly allocated, and the transaction processing component executes the trade with optimal gas fees while protecting against slippage.

Understanding these components is crucial for both developers creating smart contract trading systems and traders using them. Each component plays a vital role in ensuring trades are executed efficiently, safely, and in accordance with the intended strategy.

What Is Smart Contract Trading on Decentralized Platforms?: Sophisticated Automated Trading Systems

When implemented on decentralized platforms, smart contract trading evolves into a sophisticated ecosystem that combines the power of automation with the benefits of decentralization. This integration creates advanced trading systems with unique capabilities and features:

- Advanced Trading Strategies

Smart contract trading enables sophisticated trading strategies that would be difficult or impossible to execute manually:

- Arbitrage between different DEXs

Arbitrage trading on decentralized exchanges represents one of the most sophisticated applications of smart contract trading. At its core, this strategy capitalizes on price inefficiencies across different decentralized exchanges, executing trades that profit from these discrepancies while simultaneously helping to maintain market equilibrium.

In practice, smart contracts continuously monitor price feeds across multiple DEXs like Uniswap, SushiSwap, and Curve Finance. When a price difference exceeds the threshold for profitable trading (accounting for gas fees and slippage), the smart contract springs into action. For instance, if Ethereum is trading at $2,000 on Uniswap but $2,010 on SushiSwap, the contract can automatically purchase ETH on Uniswap and sell it on SushiSwap, capturing the price difference as profit.

Modern arbitrage smart contracts have evolved to handle complex scenarios, including multi-hop trades across several protocols and even cross-chain opportunities. These systems can route trades through multiple intermediary tokens to find the most profitable paths, often executing several trades within a single transaction to ensure the arbitrage opportunity doesn't disappear.

- Yield Farming Optimization

Yield farming optimization through smart contracts represents an automated approach to maximizing returns in DeFi protocols. These systems continuously analyze yields across various lending platforms, liquidity pools, and staking opportunities to identify the most profitable opportunities while considering associated risks.

The smart contract monitors real-time APY rates across protocols like Aave, Compound, and specialized yield aggregators. It factors in not just the base lending or liquidity provision rates, but also additional reward tokens, governance tokens, and other incentives. The system automatically calculates the true APY, considering compound interest effects and the current market value of reward tokens.

When better opportunities arise, the contract can automatically migrate funds, but only after considering gas costs and other transaction fees to ensure the move is profitable. It also manages the regular harvesting of reward tokens and can automatically reinvest them to optimize compound returns.

- Liquidity Provision Management

Smart contract-based liquidity provision management automates the complex task of providing liquidity to decentralized exchanges while maximizing returns and minimizing risks. This system actively manages liquidity positions across various protocols, adjusting them based on market conditions and price movements.

The core functionality includes dynamic position management, where the contract adjusts liquidity ranges in response to price movements, particularly important in concentrated liquidity protocols like Uniswap V3. The system continuously monitors impermanent loss exposure and can implement various strategies to mitigate this risk, such as adjusting position ranges or rebalancing between different pairs.

The contract also optimizes fee earnings by positioning liquidity where it's most likely to be utilized, based on trading volume patterns and price volatility. It can automatically compound earned fees back into the position and adjust liquidity ranges to capture more trading fees while managing risk exposure.

- Flash Loan Integration for Complex Transactions

Flash loans represent one of the most innovative features in DeFi, and their integration into smart contract trading enables sophisticated trading strategies that would be impossible in traditional finance. These uncollateralized loans, which must be borrowed and repaid within a single transaction block, enable complex arbitrage and restructuring operations without requiring significant initial capital.

Smart contracts can use flash loans to execute complex trading strategies that involve multiple steps. For example, a contract might borrow a large amount of assets through a flash loan, use these assets to exploit arbitrage opportunities across multiple exchanges, repay the loan with a portion of the profits, and return the remainder to the user.

The system can also use flash loans for more complex operations like debt refinancing or collateral swaps. For instance, a contract might use a flash loan to temporarily repay a debt position, move the collateral to a different platform offering better rates, open a new debt position, and repay the flash loan, all atomically within a single transaction.

These advanced trading strategies demonstrate the power of smart contract automation in DeFi, enabling sophisticated trading operations that were previously impossible or impractical to execute manually.

- Risk Management Features

Sophisticated risk management tools protect assets and optimize trading performance:

- Stop-loss and Take-profit Mechanisms

Automated stop-loss and take-profit mechanisms serve as crucial safeguards against market volatility. These sophisticated tools operate continuously, monitoring positions and executing protective measures without requiring constant user attention.

The system implements multiple layers of protection, starting with basic price-based triggers that automatically close positions when specific thresholds are reached. More advanced features include trailing stop-losses that dynamically adjust as prices move favourably, allowing profits to run while maintaining downside protection. The intelligence of these mechanisms extends to their ability to adapt to market conditions – during periods of high volatility, they can automatically widen their parameters to avoid premature triggering while maintaining essential protection.

What sets these systems apart is their emergency response capabilities. During extreme market events, such as flash crashes or unusual volatility spikes, enhanced protection protocols activate, potentially closing positions or hedging exposure through alternative markets to safeguard capital.

- Position Size Calculations

Position sizing represents one of the most critical aspects of risk management in smart contract trading. The system employs sophisticated algorithms to determine optimal position sizes based on multiple risk factors and market conditions.

At its core, the position sizing mechanism analyzes the relationship between potential risk and reward, considering factors such as account size, market volatility, and overall portfolio exposure. The system dynamically adjusts position sizes based on market conditions – reducing exposure during high volatility periods and potentially increasing it when markets are more stable.

The intelligence extends to portfolio-level analysis, where positions are sized not just individually but in the context of existing positions and their correlations. This comprehensive approach helps maintain balanced exposure across different assets and strategies while preventing overconcentration in any single position or correlated group of positions.

- Collateral Management

Collateral management in smart contract trading represents a sophisticated balancing act between maximizing capital efficiency and maintaining adequate safety margins. The system continuously monitors collateral ratios across different protocols and positions, ensuring they remain within safe parameters while optimizing for capital efficiency.

The automated management system handles multiple collateral types simultaneously, adjusting positions based on changes in collateral value or market conditions. It can automatically rebalance collateral when needed, moving assets between different positions or protocols to maintain optimal ratios and minimize borrowing costs.

A key feature is the system's ability to anticipate potential issues before they become critical. By monitoring market trends and volatility, it can proactively adjust collateral levels, potentially adding more collateral during periods of increased risk or optimizing collateral allocation when market conditions are favorable.

- Liquidation Protection

Liquidation protection represents the last line of defense in smart contract trading risk management, employing multiple sophisticated mechanisms to prevent forced liquidations of positions. This system operates proactively rather than reactively, continuously monitoring position health and implementing protective measures before liquidation thresholds are approached.

The heart of liquidation protection lies in its automated health factor monitoring system. This system tracks not just current position health but also projects potential future scenarios based on market volatility and price trends. When positions approach dangerous levels, the system can automatically implement various protective measures, such as adding collateral, adjusting leverage, or partially closing positions.

One of the most innovative aspects is the integration of flash loans for emergency liquidation protection. If a position is approaching liquidation and traditional protective measures are insufficient, the system can utilize flash loans to temporarily add collateral or restructure the position, providing crucial time for more permanent solutions to be implemented.

The early warning system plays a crucial role, alerting users to potential risks well before they become critical. This includes monitoring not just individual position health but also market conditions that could lead to increased liquidation risk, such as rising volatility or unusual market movements.

These risk management features work together synergistically to create a comprehensive protection system. For example, the position sizing system might reduce exposure based on signals from the liquidation protection system, while the collateral management system could automatically adjust based on stop-loss parameters. This integration ensures that risk is managed holistically across all aspects of trading operations.

- Market Analysis Integration

Comprehensive market analysis tools inform trading decisions:

- On-chain Data Analysis

On-chain data analysis serves as the foundation for informed decision-making in smart contract trading, providing real-time insights into blockchain activity that can signal market movements before they occur. This sophisticated analysis system operates by continuously monitoring and interpreting blockchain transactions and network metrics.

The system tracks significant wallet movements, particularly focusing on "whale" addresses known to influence market dynamics. When large holders begin moving assets between wallets or exchanges, this can signal impending market activity. The analysis goes beyond simple transaction monitoring – it interprets complex patterns in smart money flow, identifying sophisticated trading strategies employed by successful traders and institutional players.

Network metrics provide crucial context for trading decisions. By analyzing gas prices and network congestion, the system can optimize transaction timing and cost efficiency. DEX volume analysis offers insights into market depth and trading activity across different protocols, helping identify emerging trends and potential market inefficiencies.

- Price Feed Oracles

Price feed oracles represent a critical infrastructure component in smart contract trading, ensuring reliable and accurate price data across multiple sources. This system goes beyond simple price aggregation, implementing sophisticated mechanisms to ensure data integrity and reliability.

The integration of multiple independent oracle sources creates a robust price discovery mechanism. Each price feed is weighted based on historical reliability and current market conditions. Time-weighted average price (TWAP) calculations help smooth out short-term price volatility and resist manipulation attempts. Cross-chain price verification adds another layer of security, comparing prices across different blockchain networks to identify and filter out anomalies.

The system maintains constant vigilance over data quality through heartbeat checks, ensuring price feeds remain fresh and accurate. Fallback systems stand ready to take over if primary oracle sources fail, ensuring continuous operation even during market stress or technical issues.

- Market Sentiment Indicators

Market sentiment analysis provides crucial context for trading decisions by aggregating and analyzing data from multiple sources to gauge market psychology and potential price movements. This sophisticated system combines traditional technical analysis with modern social media monitoring and on-chain metrics.

The system processes vast amounts of social media data, analyzing conversations and sentiment across multiple platforms to identify shifting market attitudes. This analysis is combined with technical indicators like trading volume patterns and options market data to create a comprehensive view of market sentiment.

Funding rate analysis from perpetual futures markets provides insights into trader positioning and market expectations. The integration of fear and greed indices helps quantify market sentiment, while order book analysis reveals immediate supply and demand dynamics.

- Volume and Liquidity Monitoring

Volume and liquidity monitoring systems provide critical insights into market depth and trading conditions, essential for executing trades efficiently and minimizing market impact. This sophisticated analysis helps traders understand where and when to execute trades for optimal results.

Real-time liquidity depth analysis continuously monitors available liquidity across multiple protocols and trading pairs. The system creates detailed volume profiles, tracking how trading activity distributes across price levels and time periods. This information helps predict potential slippage and market impact before executing trades.

A key feature is the analysis of liquidity provider behavior, tracking how major liquidity providers adjust their positions and what this might signal about market conditions. Cross-protocol liquidity aggregation provides a comprehensive view of available liquidity across the DeFi ecosystem, helping identify the most efficient routing for large trades.

The real power of these market analysis tools lies in their integration. For example, when on-chain analysis identifies significant whale movement, the system can automatically cross-reference this with liquidity depth data to assess potential market impact. Similarly, sentiment analysis might be weighted differently based on the credibility of price feeds and actual on-chain activity.

The system can also adapt its analysis based on market conditions. During periods of high volatility, it might place greater emphasis on real-time liquidity monitoring and price feed verification. During quieter periods, longer-term sentiment indicators and whale wallet tracking might take precedence.

- Automation Capabilities

Automated execution of various trading strategies:

- Dollar-Cost Averaging

Dollar-cost averaging represents one of the most fundamental yet powerful automated trading strategies in the smart contract ecosystem. This systematic approach to asset accumulation removes emotional bias from investment decisions while optimizing for long-term value accumulation.

The system executes purchases on a predetermined schedule, but with sophisticated adaptations for blockchain-specific considerations. Rather than rigid timing, the system monitors gas prices and network congestion, adjusting execution timing to optimize transaction costs. When gas prices spike, purchases might be briefly delayed until network conditions improve, ensuring more of the investment goes into assets rather than fees.

What sets modern DCA systems apart is their dynamic nature. Purchase amounts can adjust automatically based on market conditions, portfolio performance, or predefined rules. For instance, the system might increase purchase amounts during significant market downturns or reduce them during periods of extreme volatility. Multi-asset DCA strategies distribute investments across several assets, automatically adjusting allocations based on correlation analysis and risk metrics.

- Portfolio Rebalancing

Automated portfolio rebalancing brings sophisticated portfolio management techniques to the decentralized finance space. This system maintains desired asset allocations through intelligent, cost-effective trading operations that consider multiple factors beyond simple price movements.

The core functionality revolves around maintaining target portfolio weights, but the implementation is far more nuanced than simple threshold-based trading. The system considers tax implications of trades, potentially harvesting tax losses when rebalancing opportunities arise. Custom rebalancing schedules can be implemented based on market conditions rather than fixed time periods, allowing the portfolio to adapt to changing market dynamics.

Risk-based portfolio adjustments add another layer of sophistication. The system can automatically adjust target allocations based on changing risk metrics, market volatility, or correlation changes between assets. Transaction cost optimization ensures that rebalancing trades are executed efficiently, potentially batching multiple adjustments together when beneficial.

- Grid Trading Strategies

Grid trading represents a sophisticated approach to market making and volatility harvesting in decentralized markets. This automated system creates a network of orders at different price levels, automatically buying and selling as prices move through these levels.

The innovation lies in the dynamic nature of the grid creation and management. Grid levels aren't simply set at fixed intervals – they adjust based on market volatility, trading volume, and price action. During periods of high volatility, the grid might widen to capture larger price movements, while tightening during more stable periods to increase trading frequency.

The system implements sophisticated profit-taking mechanisms, automatically closing profitable trades while maintaining the overall grid structure. Risk management is deeply integrated, with position sizes adjusting based on market conditions and overall portfolio exposure. Multi-asset grid strategies can operate across multiple trading pairs simultaneously, managing correlations and overall risk exposure.

- Pair Trading Execution

Pair trading automation brings statistical arbitrage strategies to decentralized markets, implementing sophisticated correlation analysis and execution logic to profit from temporary price discrepancies between related assets.

The system continuously monitors correlations between asset pairs, identifying statistical relationships and potential trading opportunities. When price relationships deviate from historical norms, the system can automatically execute trades to capitalize on the expected convergence. Sophisticated spread monitoring considers not just price differences but also trading volumes, liquidity depth, and market impact.

Position sizing for paired trades involves complex calculations considering historical volatility, correlation strength, and current market conditions. The system maintains market neutrality through careful position balancing, automatically adjusting positions as market conditions change. Risk management for paired positions considers both individual asset risks and the relationship between the paired assets.

These automation capabilities work together to create a comprehensive trading ecosystem. For example, the DCA system might coordinate with portfolio rebalancing to maintain target allocations while accumulating new assets. Grid trading strategies might adjust their parameters based on pair trading signals, while all systems consider overall portfolio risk metrics and market conditions.

The true power of these automation capabilities lies in their ability to operate continuously and consistently, executing complex strategies that would be impractical to implement manually. By removing emotional bias and maintaining strict discipline in strategy execution, these systems can potentially achieve more consistent results than manual trading approaches.

Key Benefits of Smart Contract Trading on Decentralized Platforms:

Here's a structured table of the key benefits of smart contract trading on decentralized platforms:

Current Limitations and Considerations:

And here’s the overview of current limitations and considerations in smart contract trading:

Conclusion

Smart contract trading on decentralized platforms represents a significant evolution in the cryptocurrency trading landscape, combining the power of automation with the transparency and security of blockchain technology. Through sophisticated smart contracts, traders can now implement complex strategies that execute automatically, operate continuously, and adapt to changing market conditions without requiring constant manual oversight.

The integration of advanced trading strategies, from arbitrage and yield farming to sophisticated grid trading systems, has opened new opportunities for market participants. These strategies, enhanced by comprehensive risk management features and real-time market analysis capabilities, enable traders to operate more efficiently while maintaining careful control over their risk exposure.

The automation capabilities we've explored demonstrate how smart contract trading is revolutionizing the way traders interact with decentralized markets. From simple dollar-cost averaging to complex pair trading strategies, these systems can execute sophisticated trading operations while maintaining security through decentralized infrastructure and transparent code.

However, it's important to acknowledge the current limitations and challenges in this space. Technical complexity, market constraints, and various risk factors require careful consideration and expertise to navigate successfully. The infrastructure supporting these systems continues to evolve, gradually addressing these challenges while opening new possibilities for automated trading.

For traders looking to enter the world of automated cryptocurrency trading but preferring to start with centralized exchanges, platforms like Bitsgap offer an accessible entry point. While Bitsgap operates differently from decentralized platforms and doesn't connect with DEXs, it provides a robust suite of trading tools for centralized exchange users. By connecting to more than 15 major centralized exchanges, Bitsgap enables users to automate their trading strategies through various tools including smart orders, DCA bots, GRID bots, and BTD (Buy The Dip) bots. The platform also offers comprehensive portfolio management with actionable analytics and an AI Assistant, making it a powerful alternative for traders focusing on centralized exchange operations.

As the cryptocurrency trading landscape continues to evolve, both decentralized and centralized solutions will play crucial roles in shaping the future of automated trading, offering traders a diverse range of tools and opportunities to implement their strategies effectively.