How Does the Gemini Trading Bot Work?

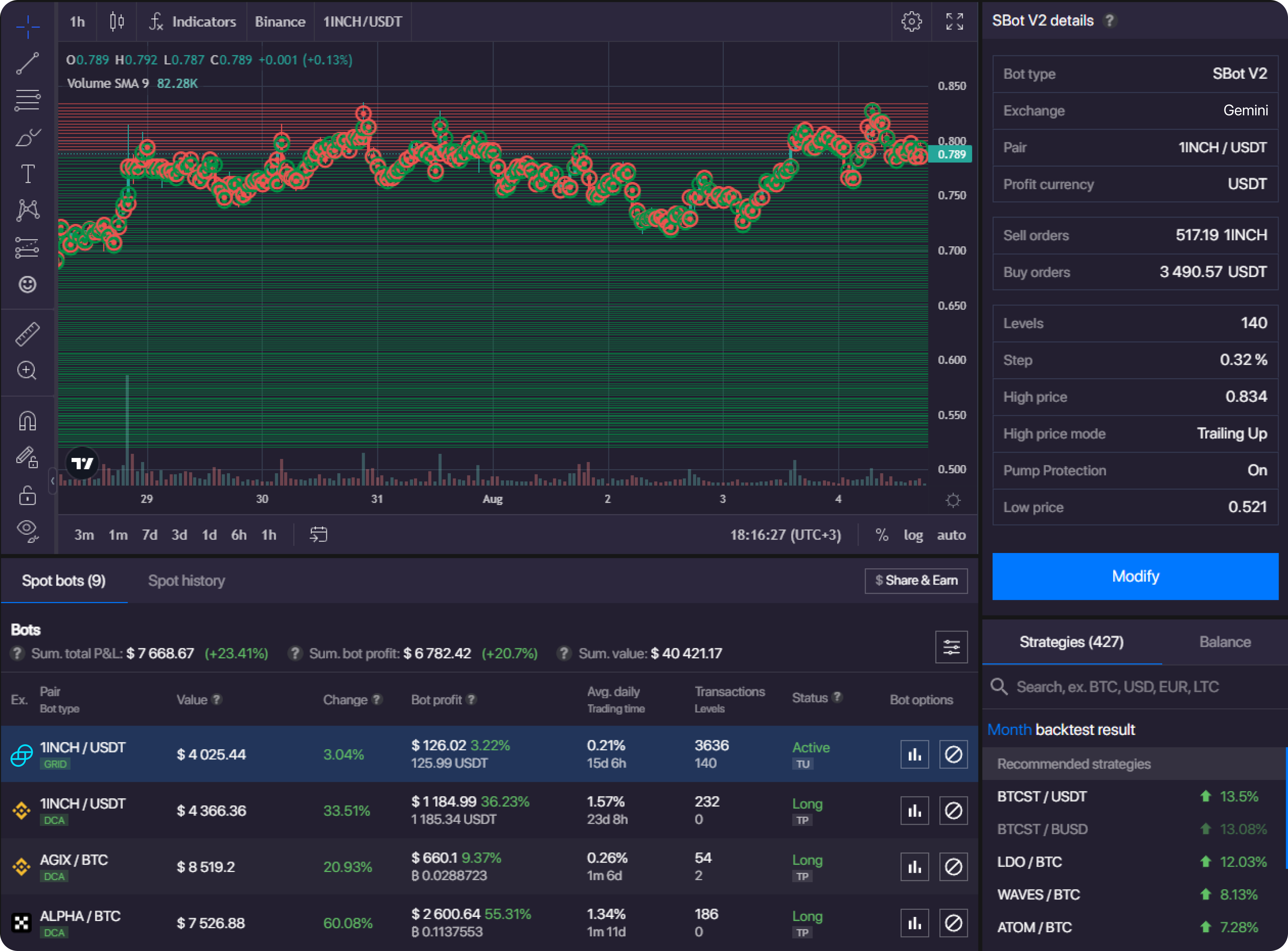

The Gemini Trading Bot, powered by the advanced Bitsgap interface, enables the automation of trading strategies on the Gemini exchange. The BItsgap platform is user-friendly, allowing traders to quickly set up their own automated bots using strategies like Dollar-Cost Averaging (DCA), GRID, and BTD. For example, the GRID bot from Bitsgap simplifies grid trading, a well-known strategy that sets pending buy and sell orders at specified price intervals to form a grid.

As market prices change, the bot executes sales at higher prices and purchases at lower prices, capitalizing on market volatility without the need for predicting trends or using indicators. The BTD bot, on the other hand, automates the process of buying on dips, a highly effective strategy during market downtrends. It continuously purchases the base currency as prices drop, helping to average down the buying price and prepare for potential rebounds.

Similarly, Bitsgap’s DCA bot automates the dollar-cost averaging strategy by distributing investments into regular buys and sells to secure a more favorable average price, thereby lessening the impact of volatility. This bot not only performs simple averaging but also dynamically adjusts trade sizes based on market conditions to ensure safer entries.