How Does the HTX Trading Bot Work?

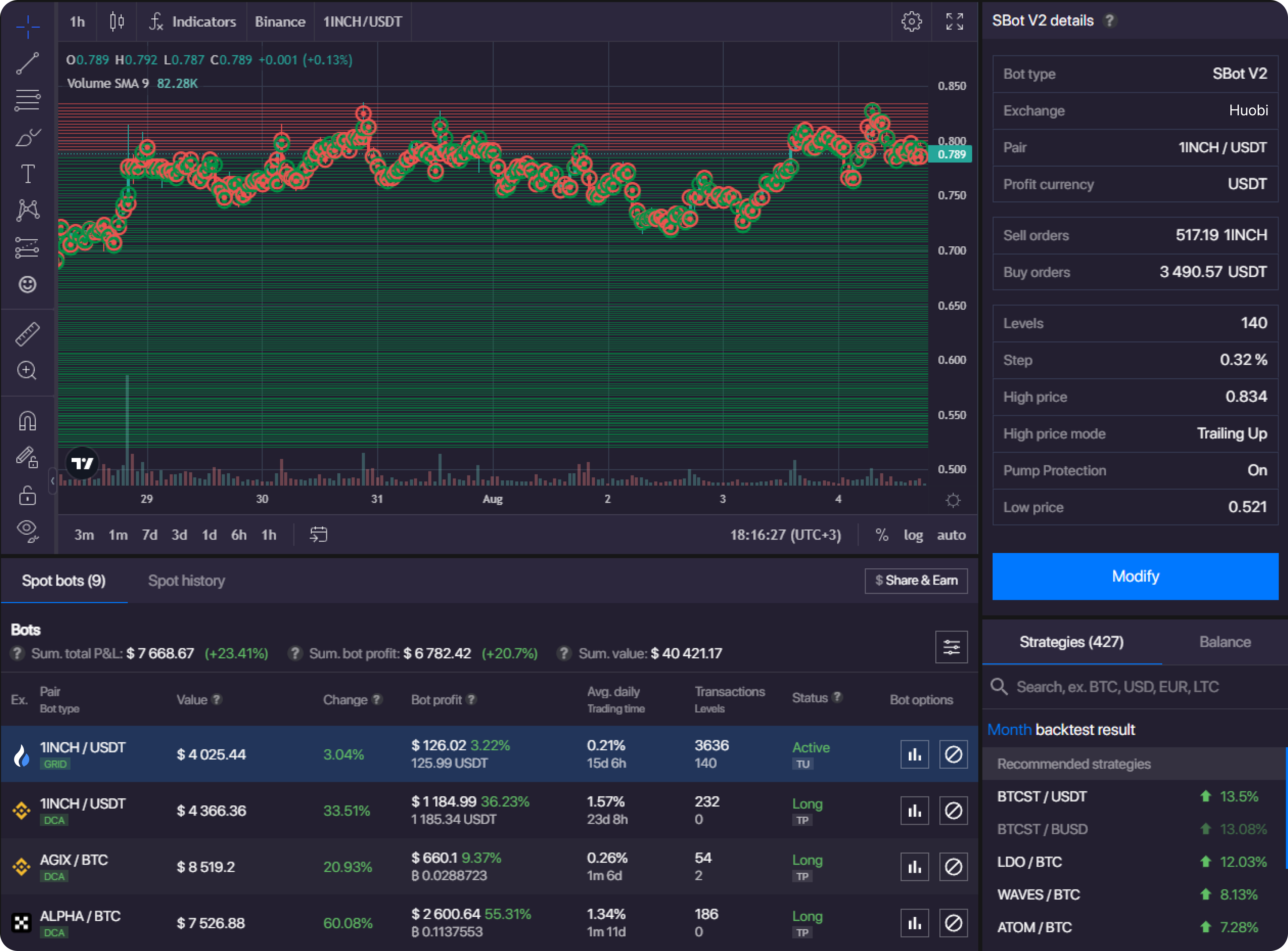

As mentioned, the Huobi Trading Bot by Bitsgap is an umbrella term that unites three distinct strategies under one roof — DCA, GRID, and BTD.

Among the most popular is the GRID bot executing high-frequency buying and selling between preset price bands. The trader defines upper and lower limits forming a price grid. Each buy order automatically places a higher sell order, and vice versa, ensuring the bot captures moves up or down. Everything stays automated through Bitsgap’s management.

The DCA bot takes a different approach — steadily accumulating positions to smooth entry pricing. By dividing investment into periodic purchases or sales, it mitigates timing risks and impact costs that large single entries incur.

Finally, the BTD bot instantly buys dips the moment prices drop to specified levels. This allows traders to capitalize on fear-driven declines by aggressively acquiring more base currency. When the recovery comes, greater holdings amplify gains.

Together these bots provide diverse avenues for hands-free Huobi trading. Customize GRID range, DCA schedules, or dip limits to match outlook and preferences, then let automation handle the rest.