How Does the WhiteBIT Trading Bot Work?

Bitsgap offers three types of WhiteBIT Trading Bots: DCA, GRID, and BTD. The DCA WhiteBIT Trading Bot follows the DCA trading strategy and divides your investment across periodic purchases or sales. DCA bots are handy when you don’t have the time or experience to judge the most opportune time to buy.

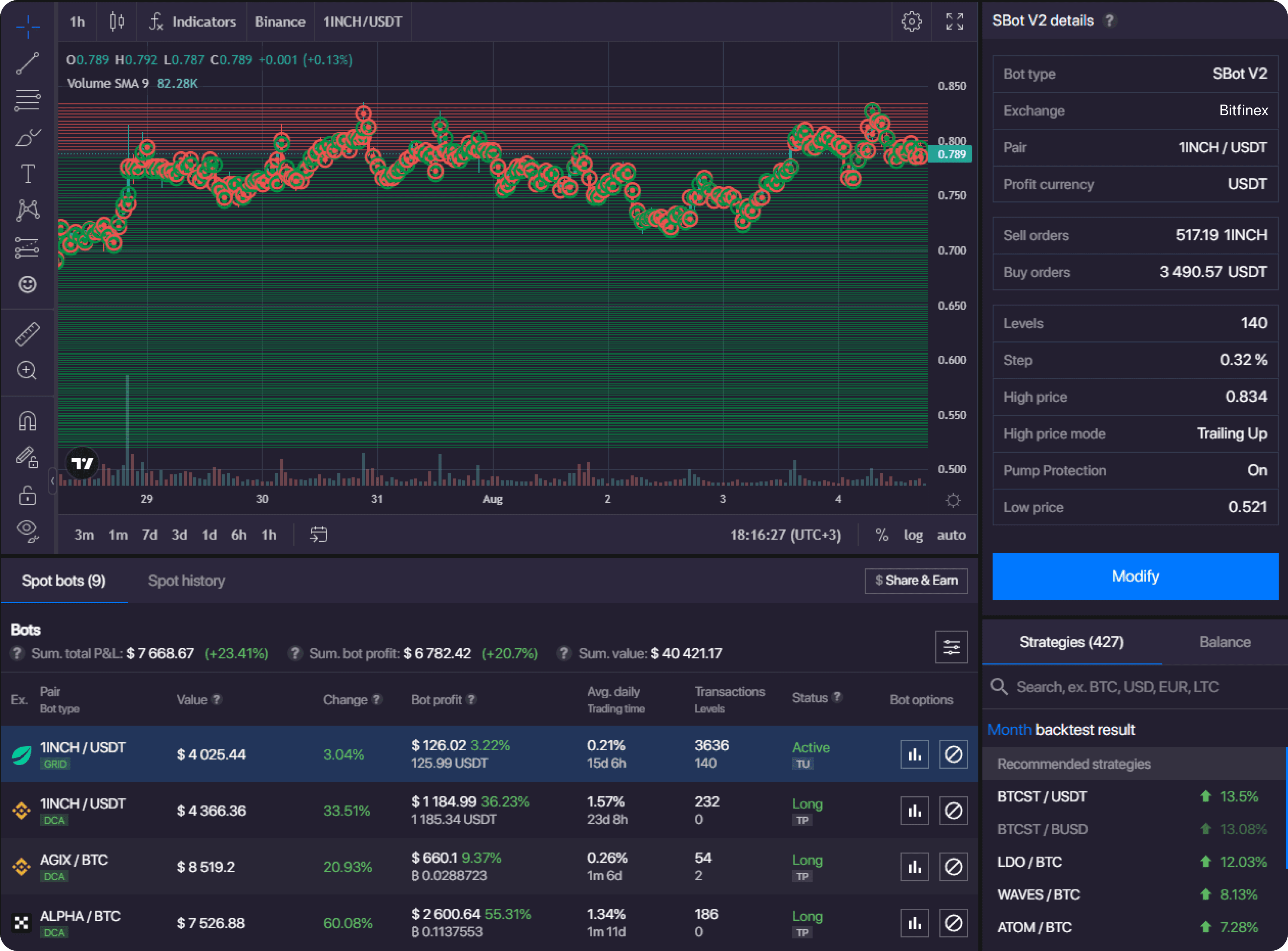

The GRID WhiteBIT Trading Bot follows the GRID trading strategy and places orders above and below a set price at certain regular intervals. The GRID trading bot offers a fantastic opportunity to capitalize on price volatility within a sideways market.

The BTD WhiteBit Trading Bot follows the “buy the dip” strategy, which means the bot buys coins after they’ve fallen in value. Rather than emotionally trying to time market bottoms, Bitsgap’s BTD bot applies cold calculation to turn downward corrections into discounted accumulation opportunities. When sentiment recovers and the uptrend resumes, you can sell off your bargained assets and lock in a substantial ROI.

Don’t have time to figure it out? Bitsgap has dozens of ready-made optimized strategies for all bots, so all you have to do is launch it!