Understanding Stop Orders in Cryptocurrency

Stop orders automate your risk management so you're ready for anything. Keep more of your hard-earned profits and avoid preventable losses — it's time to gain an edge with stop orders.

Whether you're looking to lock in gains before they slip away or limit losses if the market turns against you, stop orders are essential for navigating the stormy crypto.

Imagine effortlessly executing trades by snapping up available prices from the order book — you're acquiring assets at the going market rate, but also slightly diminishing the exchange's liquidity. What if you could improve your trading experience? By setting a limit order at your preferred price, you not only bolster the market's liquidity (with exchanges often sweetening the deal via fee discounts), but also boost your odds of securing that perfect buy or sell.

Thanks to the diverse range of order types at your disposal, you can bend the trading experience however you like. These nifty tools are designed to help you expertly navigate through the stormy seas of risk management.

Among these trusty companions are stop orders, which can be your lifeline for minimizing losses and maximizing gains when the market takes an unexpected turn.

Dive into this article to uncover the secrets of stop orders, explore the nuances between stop orders and stop limit orders, and find answers to your most pressing questions.

Stop Orders in Cryptocurrency Explained

A stop order in crypto serves as a savvy risk management instrument, enabling you to effortlessly buy or sell a cryptocurrency when its price hits a pre-chosen bullseye, smartly called the stop price.

By wielding stop orders, you can expertly safeguard your winnings, trim potential losses, and execute trades in tune with the eternally shifting cryptoverse.

What Types of Stop Orders Are There in Crypto Trading

The terms stop limit, stop market, and stop loss orders refer to distinct order types in trading, each with its own specific function and purpose. Let's dive in and crack the code on these nifty critters:

Stop Limit

A stop limit order is a dynamo trading tool mashing up stop orders and limit orders, often employed to automatically purchase or offload a digital asset once it hits a specific price level.

To really get a handle on stop limit orders, let's dissect them into their core components. The stop price serves as the catalyst for placing the limit order. As the market touches the stop price, a limit order springs into action at your designated price (the limit price).

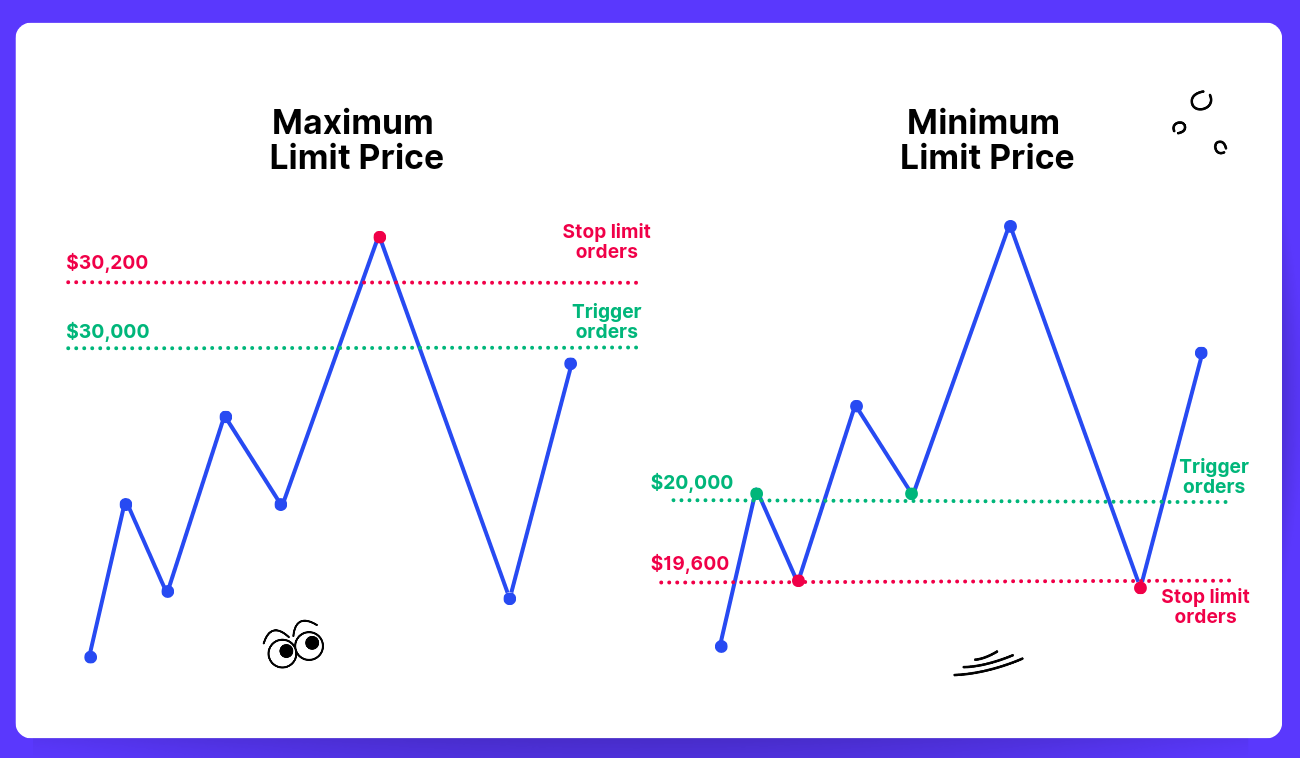

So, when cooking up a stop limit order, you'll need to hash out two separate price points: the stop price and limit price (Pic. 1). The order leaps into action and kicks off the limit order as soon as the stop price is reached. Meanwhile, the limit price calls the shots on the price where the order will come through once the stop price kicks in.

Stop Market

A stop market order is a well-timed directive to purchase or offload crypto as soon as the digital asset's price touches the pre-established threshold, dubbed the stop price. Once the stop price is hit, the order shapeshifts into a market order, executing immediately at whatever the current market price may be.

Stop market orders cater to long (stop loss) and short (stop buy) plays alike, giving you a safety net to catch profits and avoid losing your shirt.

👉 Suppose you anticipate a crypto asset's value to skyrocket upon hitting a particular price. In that case, you can set a buy stop order to participate in the asset's upward trajectory. Similarly, if you own an asset and wish to dodge a potential loss, placing a sell stop order at a predetermined price below the current value can help cap your losses, keeping your investments out of harm's way.

Stop Loss

A stop loss is a conditional directive to close an existing order upon reaching a specific price level. As the cryptocurrency's price grazes the predetermined level, the order seamlessly morphs into a market order, executing at the next available price. The stop loss can be set at any price level, directing the crypto exchange to buy or sell the asset based on the existing position.

👉 For instance, let's say you purchased Polkadot (DOT) at $5.00 and wish to protect your investment by not losing more than 10% of its value. You would set a stop loss order at $4.50. If the price of DOT falls to or dips below $4.50, your stop loss order would spring into action, and your DOT would be sold at the next available market price.

Stop Order vs Limit Order

A stop order, once activated, can transform into different types of orders, such as a market order or limit order. When a stop order morphs into a market order, it ensures your order will be executed at the very next market price available. However, that price could differ from your stop price due to the market's volatile nature.

On the other hand, a stop-limit order, the dynamic duo of stop orders and limit orders, metamorphoses into a limit order when your stop price is reached. While granting you more command over your execution price, it does not guarantee your order will be filled, especially if the market price does not match or top your limit price.

In a nutshell, a stop order that evolves into a market order cements the completion of your order but not at a particular price. A stop limit order gives you more reign over the price yet does not assure execution.

How Do Stop Orders Work

Stop orders are designed to spring into action based on a trigger — the price threshold you predetermine. Once your specified price is attained, the stop order leaps into life, prompting your linked buy or sell order to take effect.

Upon activation, the stop order morphs into another order type you have tethered to it, be it a limit or market order. The order then proceeds as though it were that tied order type. The perk of employing a stop order over a regular order type is the enhanced functionality and mastery it affords you. It permits traders to rein in risks and automatically execute their trading strategies.

Example of Stop Order

Jimmy was trading a coin he was convinced had mammoth potential. However, our boy Jimmy wanted a bit of insurance in case he was off the mark about where this asset was headed.

He decided to put in a stop loss order to cap his losses if things didn't pan out as he envisioned. Jimmy placed his stop loss at 10% of what his cryptocurrency was currently worth and sat back to see what would unfold.

Before long, the price of the asset suffered a traumatic calamity and started to nosedive. The coin lost 30% of its value in a matter of minutes, but thanks to his stop loss order, Jimmy had only lost 10%.

While he still lost some dough on the trade, it was far less than if he hadn't had the stop loss. Now Jimmy had enough money left to try again and a shot at profits on his next crypto adventure.

Stop Order to Sell: Sell Stop Order

The concept behind sell stop orders is quite straightforward. They're designed to shield long positions in bullish markets when an unanticipated bearish reversal strikes. By setting a sell stop order, you can automatically trigger a sell if the price dips below a predetermined level.

Why? If the price falls that much, it could very well continue to plummet. To cap these potential losses, you use sell stop orders as an automated risk management tool.

Imagine a momentum trader spots a bullish trend that seems set to continue. They enter a long position when a bullish candle surges past the local resistance. To safeguard their position, they set a sell stop order just below the previous local support level. This way, even if the price suddenly plunges to the stop loss level, the trader's loss remains limited.

👉 Here’s another example. Bob was dead certain the price of Avalanche (AVAX) was going to blast off. At the moment, AVAX was chilling at $12. Bob, feeling inspired, jumped into a long position, buying AVAX, planning to sell when the price went to the moon. But Bob also had a backup plan: he set a sell stop order at $10.50, a cool $1.50 less than the market rate, just in case. As the crypto market did its usual shimmy and shake, AVAX plummeted to $10.50. Bob's sell stop order kicked in, and his long position slammed shut by selling AVAX at whatever price was next in line, keeping his losses in check.

Stop Order to Buy: Buy Stop Order

Buy stop orders are the mirror image of sell stop orders. They're employed to protect short positions.

👉 Consider an example. Jane had a hunch that Solana’s (SOL) price was about to crash and burn. At the moment, SOL was exchanging hands at $20 a pop. Jane decided to short SOL, selling it now in hopes of buying it back for a song later. But she also wanted to cover her position in case her spidey senses were off, and SOL wound up blasting into orbit instead. So Jane set a buy stop order at $25, which was $5 more than SOL's current going price. As the market did its usual rollercoaster ride, SOL unexpectedly skyrocketed to $25. Jane's buy stop order sprang into action, and her short position was automatically closed by buying SOL at whatever price was next on the menu, keeping her losses to a minimum. Had she not put in a buy stop order, the losses could have been far worse.

Trailing Stop Order

A trailing stop order is a conditional order that uses a trailing amount — instead of a rigid stop price — to figure out when it's time to launch a market order. This trailing amount, measured in either points or percentages, happily chases (or "trails") a crypto's price as it ascends (for sell orders) or plunges (for buy orders).

Once you've sent your trailing stop order out into the wild, it loiters around until it's sparked to life by a specific shift in the inside bid price (for sell orders) or the inside ask price (for buy orders). When that moment comes, it morphs into a market order, raring to be executed.

As the market order springs into action, it'll most likely result in an execution. However, don't bank on a guarantee for any precise execution price or price range. The final execution price could land above, right on the money, or below the trailing stop's very own trigger price.

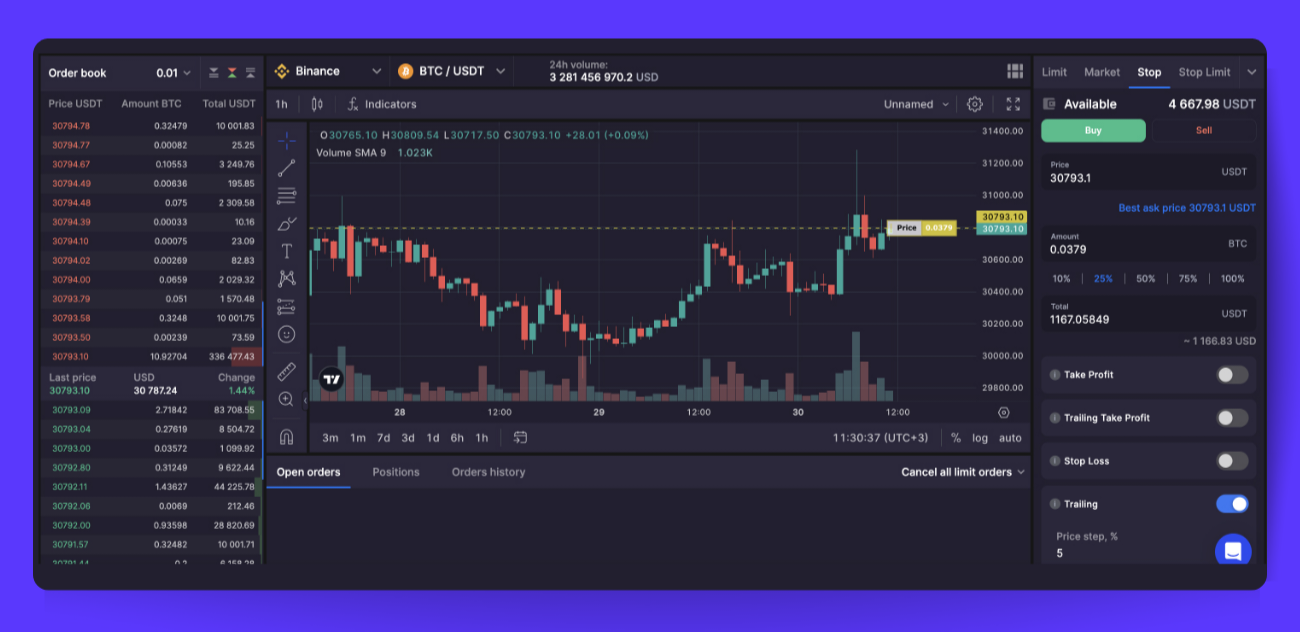

For example, on Bitsgap, you can toggle on the trailing option for the stop market order (Pic. 2):

The Trailing option is like a handy helper when you want your open stop market order to tag along as the price shifts by a specific percentage. It lets you set the stop market order and then kick back, letting the automation handle the rest — no need to fuss over moving your order manually. The trailing adjusts the order as the price changes by a set percentage in the price step, which you can set at a minimum of 0.2%.

Let's dive into an example of how this nifty feature works in real trading:

👉 Imagine the BTC price is at 30k, and you're itching to place a stop order to buy the coin at 32k with a price step of 5%. As soon as the price dips by 5% (down to 28.5k), your stop order scoots over to 29.925k (by 5%). If the price keeps tumbling, the order will scoot again once the price deviation hits 5%.

As you can see, the trailing springs into action every 5% and nudges the open order 5% up or down from its previous position.

To learn more about Trailing for Stop Market on Bitsgap, head to the Help Center.

Stop Limit Orders in Crypto

A stop limit order is an advanced trading tool that combines the features of a stop order and a limit order. When the cryptocurrency reaches your stop price, a limit order is automatically triggered. The limit order is then executed at the specified limit price or better.

If you are not sure how limit orders work, consider perusing this primer first. No time? No worries, here’s a brief explainer — unlike the lightning-fast market order, a limit order patiently waits for the perfect moment — when the cryptocurrency reaches the price level you've chosen.

So, a stop limit order is like a dynamic duo, with two prices you need to set:

- The stop price – This level is like the call to action for your limit order, which will only jump into action if the price touches the limit price you've set. Otherwise, it'll hang back, ready for action.

- The limit price – This is the second price that you set for your stop limit order. Once the stop price kicks the limit order into gear, the limit price will only execute if the cryptocurrency reaches that level.

Here’s how it’s going to work.

👉 Suppose you're long ETH at $1,800 and want to protect your profits. You set a stop price at $2,200 (22% above $1,800) and a limit price at $2,180 (21% above $1,800) in case of price gaps. If Ethereum rises to $2,200, your stop limit order is triggered, and it will execute at the limit price of $2,180 or better, securing a gain of at least 21%. If Ethereum jumps to $2,500 without touching $2,200 first, your stop limit order will not be activated, and your position will remain open. However, if the price reaches $2,200 and then continues to rise, your order will be executed at the limit price of $2,180, capping your gain at 21%, even though the price eventually reached $2,500.

Can a Stop Order Be Reversed?

If a stop order hasn't been executed yet, it can be canceled just like any regular order. As long as the price hasn't reached the stop trigger price, the order remains open, allowing you to cancel it anytime you want.

However, once the stop order is triggered by the price reaching the stop price, the sale (or purchase) is executed as a market order. At this stage, the stop order has already transformed into a market order and been transacted, making it impossible to cancel.

If a stop loss order has been executed at a loss, the position is now closed. If you wish to maintain your position open, you would need to buy back in at the current market price. After execution, there's no way to reverse the stop loss order.

You should be mindful of the risk of price gaps through the stop trigger price. If this occurs, the stop order will be executed at the next available price, potentially resulting in a loss larger than anticipated. Stop orders do not guarantee execution at the exact stop price.

When to Use a Stop Order

There are several scenarios when a stop order might be just what the doctor ordered, but the good ol' stop loss is probably the most popular of all. Cryptocurrency day traders often use stop-loss orders to limit their potential losses on a trade.

So, let's say you want to set up a stop loss—you'd usually pick an amount of loss that you can stomach if things go belly up. Many traders are cool with a 10% stop loss, but you should go with whatever makes you feel comfortable. That way, you're putting a lid on your losses at 10% (or whatever you choose) instead of a more disastrous number.

Additionally, you could use a stop order to buy assets that show increasing momentum, as mentioned earlier. If executed correctly, this could put you in an excellent position to profit as the price continues to rise. However, timing this strategy can be challenging, so it's essential not to invest all your capital into a single trade based on momentum alone.

Bitsgap Smart Order Trading

If you're looking for a variety of advanced order types for your crypto trading, Bitsgap won't disappoint (Pic 3). Bitsgap offers an array of sophisticated order types beyond just the standard limit, market and stop orders. The selection includes time-weighted average price (TWAP) orders, scaled orders, and one cancels the other (OCO) orders.

Let's explore these more detail:

- TWAP orders aim to achieve the best average price for large orders by breaking them into smaller chunks and executing them over time. This minimizes market impact and slippage. TWAP is ideal when your order size exceeds available liquidity or during volatile periods without a clear trend.

- Scaled orders place multiple limit orders at increasing or decreasing price points. This lets you enter and exit positions with precision according to plan.

- OCO orders combine stop and limit orders so that when one order executes, the other automatically cancels. This helps lock in profits or limit losses. Experienced traders frequently use OCOs to manage risk and gain an edge.

You can improve the effectiveness of almost any order type by incorporating intelligent trading and hedging features, such as Take Profit, Stop Loss, and Trailing. To gain a deeper understanding of how these features can be applied to stop market orders, consider exploring this informative article in the Help Center.

With Bitsgap's intelligent tools, you get the control and convenience of automated exits paired with the flexibility of manual orders. See your stop markets and other orders reach their full potential with a customized strategy tailored to your risk tolerance!

FAQs

What Is Stop Order and Limit Order Difference?

A limit order is an instruction to buy or sell a particular cryptocurrency at a specified price. Keep in mind that you can't set a plain limit order to buy crypto above the market price, because a better price is already available. So, if you wanted to buy a $100 crypto for $100 or less, you can set a limit order that won't be filled unless the price you specified becomes available.

Similarly, you can set a limit order to sell crypto when a specific price is available. Imagine that you own crypto worth $75 per coin and want to sell if the price reaches $80 per coin. A limit order can be set at $80, which will be filled only at that price or better. Just remember that you can't set a limit order to sell below the current market price because better prices are available.

Stop orders come in a few different flavors, but they all are essentially conditional, based on a price that isn't yet available in the market when the order is initially placed. When the future price is available, a stop order will be triggered, but depending on its type, the broker will execute them differently.

Many brokers now use the term "stop on quote" for their order types to clarify that the stop order will be activated only when a valid quoted price in the market has been met. For example, if you set a stop order with a stop price of $100, it will be triggered only if a valid quote at $100 or better is met.

A regular stop order will become a traditional market order when your stop price is met or exceeded. A stop order can also be set as an entry order. If you wanted to open a position when the price of crypto is rising, a stop market order could be set above the current market price, which turns into a regular market order when your stop price has been met.

What Are Crypto Stop Orders?

A stop order is designed to buy or sell a cryptocurrency once it reaches the specified stop price. Stop orders can be either market or limit orders. A stop market order is triggered when the price reaches a predefined target (the stop price), at which point it is executed immediately. Stop limit orders are somewhat more complex as they combine a stop with a limit order, and thus, involve two price levels: A stop price, which transforms the order into a buy or sell order, and a limit price, which determines the highest price traders are willing to pay to purchase the cryptocurrency or the lowest price they are willing to accept for selling it.

What Is Stop Loss in Cryptocurrency Trading?

A stop loss order for cryptocurrency is a crucial instrument in managing risk, as it automatically terminates a position once the price attains a predetermined threshold.