Limit Order in Crypto Trading

Tired of emotional and impulsive trades? Limit orders can change that. Learn how to potentially improve your trading outcomes with this useful type of order..

Just like in the stock market, there are various types of orders in crypto, each of which requires understanding for effective use. In this piece, we’ll talk about a limit order and what sets it apart from other orders.

As the great investor Warren Buffett once said, "Be fearful when others are greedy and greedy when others are fearful." And what better way to channel your inner Buffett than by using limit orders to stay cool, calm, and collected in the face of market chaos?

Indeed, if you want to get more control over your trades and never miss a potentially lucrative opportunity, then limit orders are your safest bet.

However, what do you do if you’re not yet sure what a limit order is and how it’s different from all the other types of orders available on your exchange and the Bitsgap platform?

Your first step is to read this article and take lessons from this fairly straightforward and comprehensive piece to guide you through trading perils. Your second step is, of course, to practice. But that’s a different story, surely worth another article.

Limit Order Definition

A limit order is an instruction to buy or sell at a certain price or better. Such conditioned trading gives you more say and control over market pricing.

You may place limits on both buy and sell orders, and when the price reaches your limit price or better, an exchange will fulfill your order automatically.

When placing a limit order, you’ll have to stipulate how much you want to purchase or sell and the maximum amount you’re willing to pay for it.

Sell Limit Order vs Buy Limit Order

While a sell limit order will be executed at your specified price or higher, a buy limit order will be executed at your specified price or lower.

For example, with ether currently trading at 1,955 USDT, you may want to place a limit order to buy one ether (ETH) as soon as the price drops to 1,920 USDT or lower. Conversely, you may want to place a sell limit order when ether’s price reaches 2,000 UDT or higher. So, if you buy at 1,920 and sell at 2,000, you’ll pocket the difference of 80 USDT.

One of the advantages of limit orders is that you can define the price you’re willing to pay or receive for a transaction without having to continually monitor market conditions. However, if the price you set is never reached or exceeded, your limit order may never be filled.

Limit Order vs Market Order

When buying stock or crypto, you have two options in terms of execution — place an order at “market” or “limit” prices. While market orders are executed immediately at the current market price, limit orders specify the highest or lowest price at which you’re willing to buy or sell an asset.

To better understand these two types of orders, consider buying a car as a useful analogy. You may buy a car from a dealer at a price shown on the window sticker, or you can try to negotiate a better price and hold out until the dealer agrees to it. By the same logic, in a market order, you want to close the deal as quickly as possible, regardless of the price. If you use a limit order, however, you’ll wait for the price to fall within your acceptable range first.

Limit Order and Stop Order

Although there are different variations of stop orders, they are always conditional on a specific price that is not yet in the market. Once the price becomes available, a stop order is automatically executed. When the stop price is reached or surpassed, the stop order will automatically convert into a standard market order. Unlike limit orders, the market won’t see your stop order until it’s triggered.

Limit Order vs Stop Limit Order

Combining both limit and stop orders, a stop limit order specifies not one but two prices: a stop price and a limit price. In a stop limit order, the limit order to sell or buy gets triggered only when a coin’s price reaches the stop price.

For example, suppose you buy BTC at 19,280 USDT, expecting it to increase in value in the near future. You also decide to place a stop limit order to sell your bitcoin should market conditions turn against your optimistic forecast. So you set the stop price at 19,000 USDT and the limit at 19,100 USDT. Your limit order gets activated once bitcoin trades for 19,000 USDT or worse.

There are two main risks associated with stop limit orders — non-fulfillment and partial fulfillment. Even if your stop price is hit, you might not be able to secure the price you set as a limit. Also, if you use a stop limit order as a stop loss to exit a long position, it might not close, leaving you with decreasingly valued coins that may continue to slide in price.

Limit Order All or None

All or none (AON) is a type of contingent order that requires the whole order rather than a part of it to be fulfilled. This way, the AON instructions stipulate whether to fill the order completely or not at all.

For example, if you want to buy the full bitcoin for 19,500 USDT with an AON order, you say you’re not willing to buy anything less than one bitcoin for the price.

Limit Order vs Stop Loss

Both stop loss and stop limit orders may be used to limit potential losses and enter/exit the position at times when it would be difficult to do so manually. However, there are distinctions between the two that must be understood for proper use.

A sell stop order is a variation of a stop loss order that protects a long position and executes a market sell order if the price drops below a certain threshold. On the other hand, a buy stop order protects short positions and is triggered when the market price rises above a certain level. Finally, stop limit orders function similarly to stop loss orders, except that at the stop price, the order converts into a limit order that will only execute at the limit price or better.

How Does Limit Order Work?

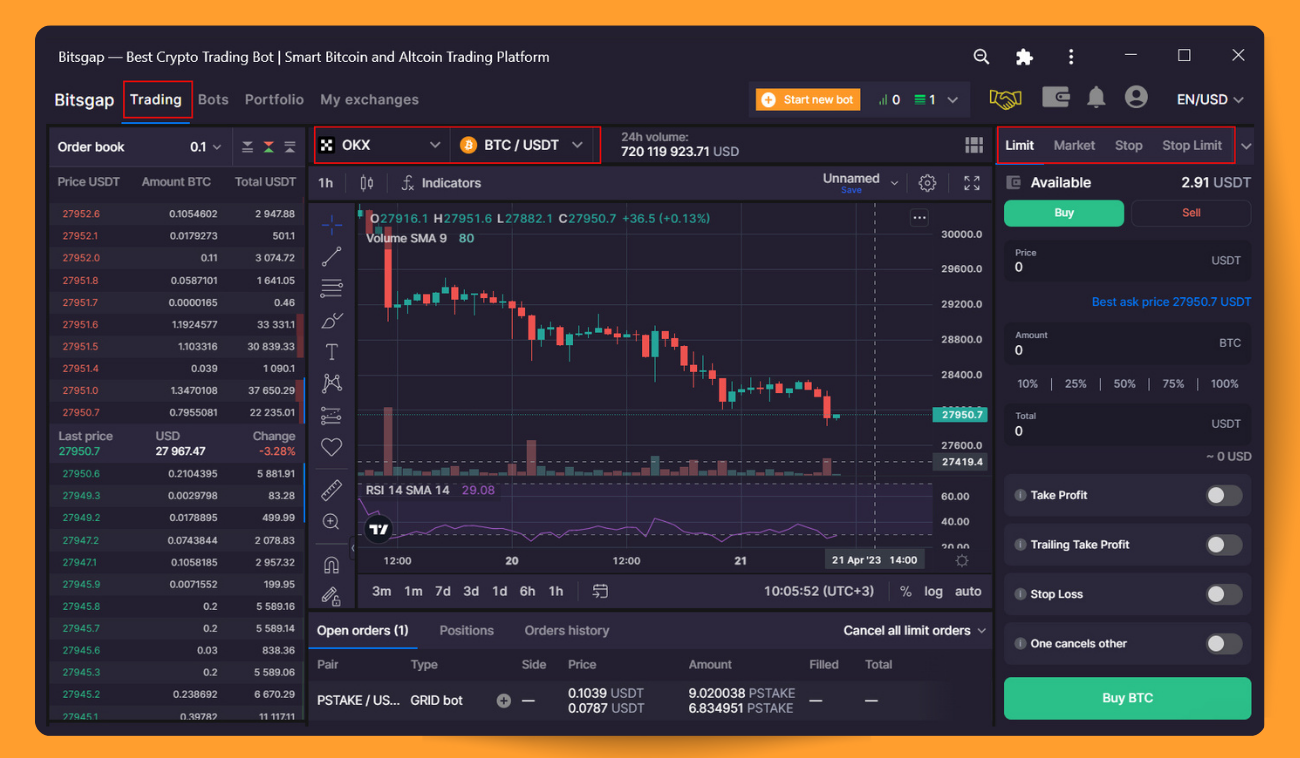

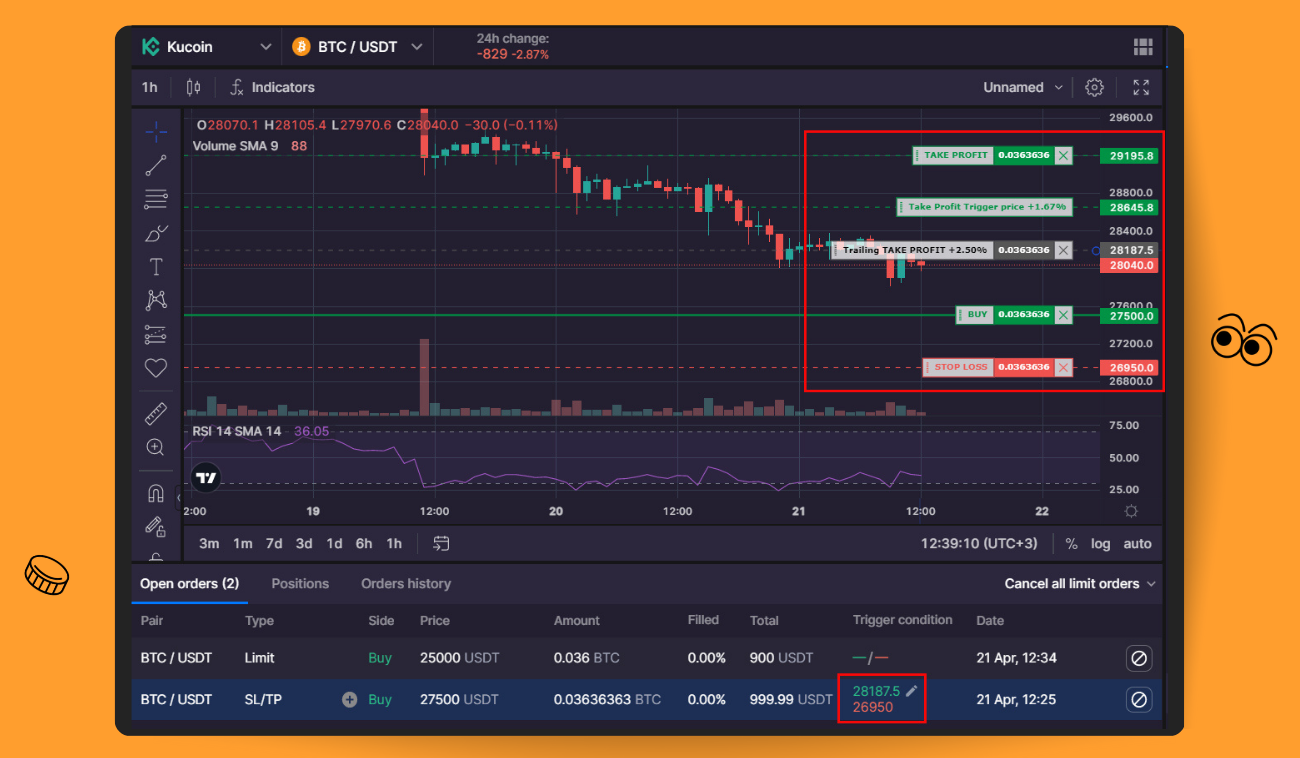

You place a limit order at your exchange, on Bitsgap, or another similar trading platform that is connected to your exchange via encrypted API keys. In that limit order, you specify the coin, the amount, the price, and your position (buy or sell) (Pic. 1).

Your order won’t be executed until the specified price is reached. However — and it’s something to keep in mind — in extremely volatile or less liquid markets, execution of the limit order is not assured.

Cryptocurrency Limit Order Example

Let’s say Jim is looking to buy some DOGE but is concerned about the price. For days, the coin’s price has been fluctuating within a horizontal price range without going anywhere in particular. Instead of waiting around all day in front of his computer, Jim can place a limit order to buy DOGE at a price at which he is comfortable making a purchase. When the price of DOGE drops to Jim's objective, his buy limit order will be executed, and he will be able to acquire DOGE at his desired price.

How to Place a Limit Order on Bitsgap Platform

To place a limit order on Bitsgap, you’ll need to click on the [Trading tab], select your exchange, a trading pair, and choose [Limit] from the menu that opens on your right (Pic. 2):

After you click on [Limit], you’ll need to specify the price you’re willing to pay (or sell) for an asset and the amount you want to trade. To turn your limit order into a smart order, choose other features like [Take Profit], [Stop Loss], [Trailing Take Profit], and [One cancels other].

If you toggle on [Take Profit] you can set a target price, which will place a buy/sell limit order once the price reaches the target.

In the same fashion, you can set [Trailing Take Profit], which will follow the price to increase your profits at a selected distance once triggered.

If you toggle on [Stop Loss], you can specify a stop loss percentage, which will place a market sell/buy order once it reaches the stop price.

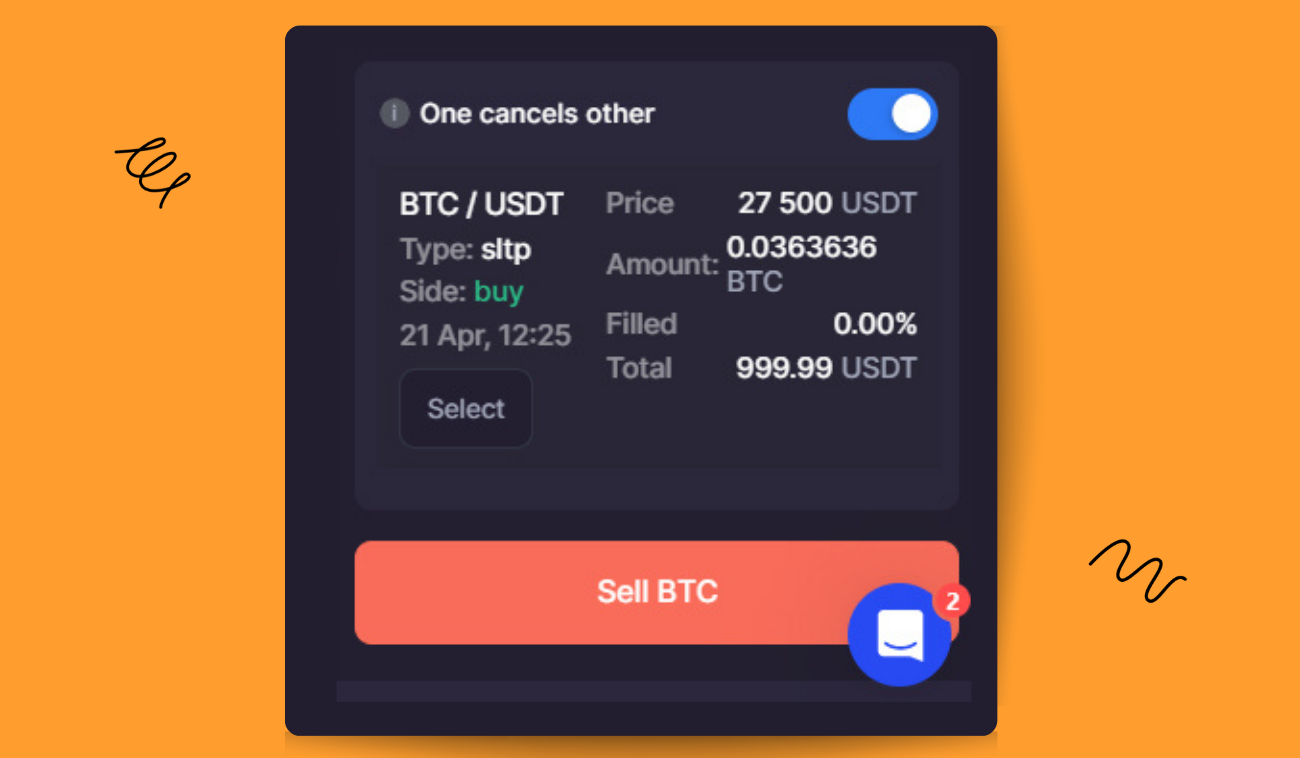

If you have a similar order but in the other direction, it will become available in the next section [One cancels other] (Pic. 3):

One cancels the other is a pair of conditional orders in which the execution of one order automatically cancels the other order.

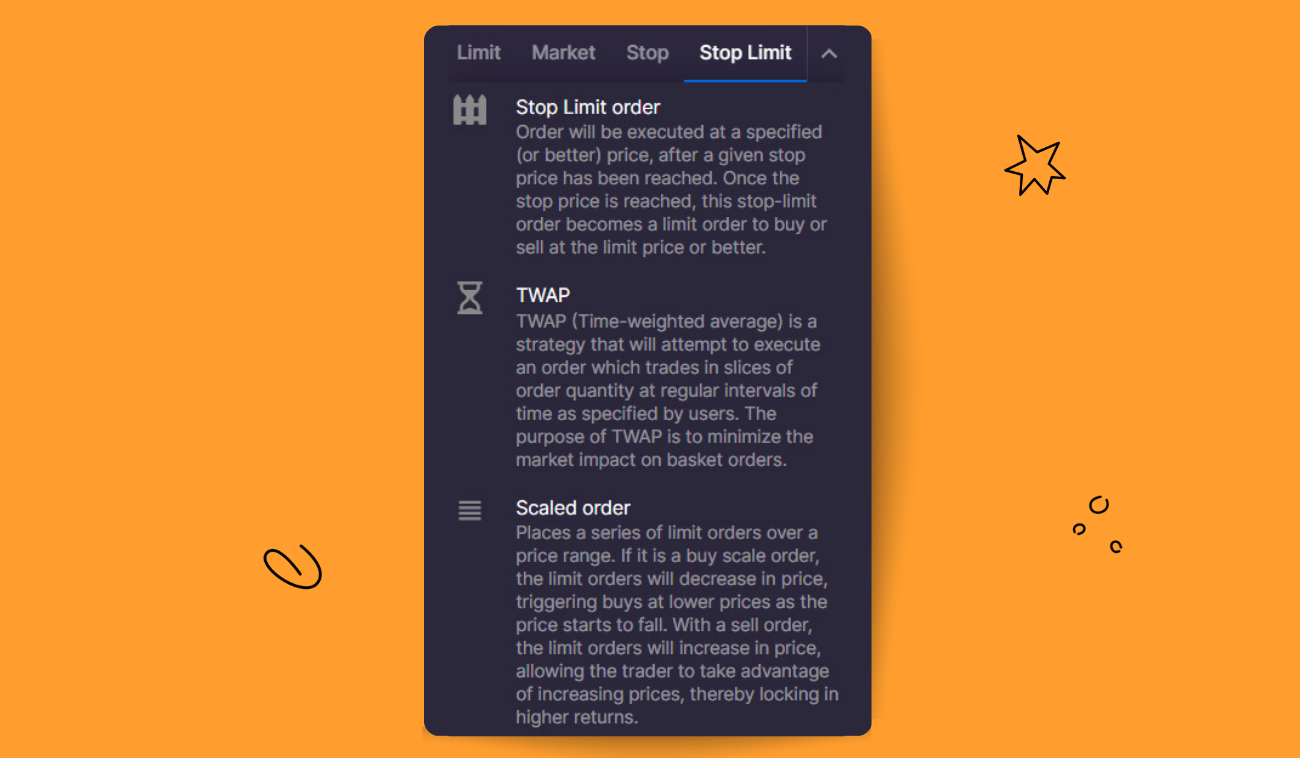

Other Order Types Available on Bitsgap

Apart from a limit order, you can also place other types of orders on Bitsgap. Here’s your quick rundown of all the options available (Pic. 4):

- Market Order is an order to sell or buy a coin immediately at the market price (which typically is at or very close to the current ask or bid price).

- Stop Order is a stop market order that lets you purchase or sell coins at the current market price as soon as the trigger price is reached.

- Stop Limit Order is a stop order that places a limit order to buy or sell a coin as soon as a predetermined stop price is reached.

- TWAP is an algorithmic order that disperses a large order into smaller quantities and executes them at regular intervals over time.

- Scaled Order is an order that consists of a number of limit orders in sequence, either descending or ascending in price.

Can You Change a Limit Order?

Yes, you can change the limit order price. For smart orders, you can change both the limit price and triggering conditions. To do that, click on the chart and move your current order price to a new level; otherwise, select your smart order in a list of open orders and click [Trigger conditions] (Pic. 5):

Can You Cancel a Limit Order?

Yes, you can cancel your limit order either by clicking the cross icon on the chart or by clicking the stop icon in a list of orders next to the limit order you’d like to cancel.

Conclusion

In the world of crypto trading, understanding the different types of orders available can be crucial to your success. Among these orders is the limit order, which allows you to control the price at which you buy or sell an asset.

By setting a limit price, you can avoid missing out on profitable trades while staying calm during market chaos. However, it's important to note that execution is not always guaranteed in volatile or less liquid markets. With the Bitsgap platform, you can easily place and customize limit orders along with other order types, such as market orders, stop orders, and TWAP.

FAQs

What Is a Cryptocurrency Limit Order?

A limit order is an instruction to buy or sell crypto at a certain price or better. If a buy limit order will only execute if the price reaches the limit price or lower, a sell limit order is the opposite — it will execute if a coin’s price reaches the limit price or higher. In short, limit orders will only be filled if the price meets the requirements for the order.

What’s the Difference between Limit Order and Market Order?

Market orders are instructions to complete a transaction at the current market price as soon as possible. Limit orders, on the other hand, allow you to choose prices at which you are ready to purchase or sell.

What’s a Sell Limit Order Example?

If a trader wants to sell 50 ADA when ADA’s price reaches 0.430000, he or she will place a sell limit order for that amount, setting a trigger price at 0.430000. As soon as ADA reaches the limit price, the order will execute, and a trader will pocket the returns from the sale.

What’s a Limit Order Book?

A limit order book is a book that shows every open limit order along with its associated price and quantity. As we’ve learned, limit orders are instructions to purchase or sell crypto at a predetermined price. Limit order books show the accumulation of these standing limit orders as well as the supply and demand for crypto at different prices. The limit order book is a vital resource for traders, since it reveals a wealth of data regarding the volume and direction of trades in a given asset.

Can a Crypto Limit Order Be Partially Filled?

Yes, a limit order can be partially filled. If only a fraction of the coins are available at the limit price or better, this part of the order will be filled instantly, while the remainder will remain in the limit order book. Suppose you place a limit order to buy 1000 ADA at 0.430000. If there are only 500 ADA available at the price, they will be bought immediately, while the remaining ADA will stay as a standing limit order until either the price reaches 0.430000 again or you cancel the order.