Decentralized Finance (DeFi): Introduction and Perspectives

Think traditional banking and finance is obsolete? Learn how decentralized finance (DeFi) is disrupting the status quo and opening new opportunities with our in-depth look at this emerging field.

Our beginner's guide to decentralized finance (DeFi) explores how it's disrupting traditional systems by putting you in control.

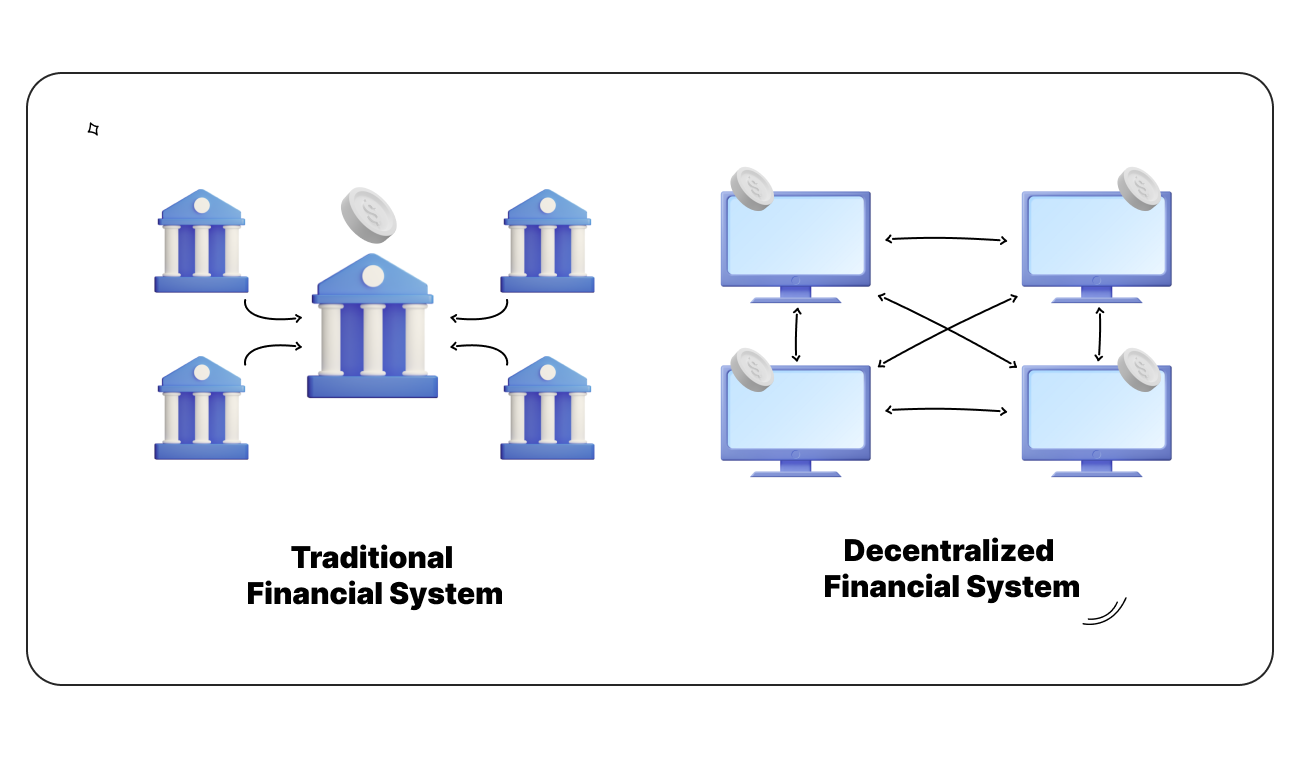

DeFi, aka decentralized finance, is the new hotness sweeping the financial scene. Instead of relying on bigwig banks and stuffy institutions to handle our money, DeFi lets regular Joes and Janes provide financial services for each other. How does it work? By using blockchain technology to connect people directly via decentralized networks rather than centralized middlemen.

This radical concept is a far cry from traditional finance, where giant corporations and bureaucracies control the flow of finances. With DeFi, control goes back to the people. Now anyone can lend, borrow, trade, or manage assets without asking permission from some higher-up in a suit and tie.

👉 Of course, it's not all rainbows and butterflies. DeFi comes with its own set of risks and disadvantages that we have to keep in mind. But the potential is exciting.

This article is your all-access pass to the world of DeFi. We'll dive into its beginnings, explore how it differs from your grandpa's finance, and spotlight some real-world DeFi applications.

Naturally, no backstage tour would be complete without uncovering the not-so-glamorous aspects, so we'll also delve into DeFi’s potential downsides. And finally, we'll cap it off with a look at what the future might hold.

What Is Decentralized Finance (DeFi)?

DeFi, short for decentralized finance, refers to a collection of blockchain-based applications providing peer-to-peer alternatives to traditional financial services and institutions.

Think of DeFi as the Robin Hood of finance. It's on a mission to overthrow the old guard (that's the traditional, centralized financial institutions we're all so used to) and replace them with good ol' peer-to-peer interactions. The end goal? Well, it's nothing short of a financial revolution, where everyone gets to play ball.

👉 From your daily bread-and-butter banking needs, loans, and mortgages, all the way to the knotty world of contracts and asset trading — DeFi is stepping up to the plate. It's putting the 'peer' back in 'peer-to-peer', and it's doing it with style.

DeFi History Recap: How Did DeFi Come About?

DeFi’s electrifying journey is entwined with the meteoric rise of cryptocurrencies, but it's not all about those shiny crypto tokens. Sure, you could argue that the grand debut of Bitcoin in 2009 was the starting gun for the DeFi race. In its wake, Bitcoin skyrocketed the popularity of decentralized tokens and gave birth to services like exchanges. But Bitcoin isn't the star player in the DeFi league. That honor goes to Ethereum (which, ironically, owes its existence to Bitcoin).

Ethereum's big innovation was the introduction of smart contracts, which opened the floodgates for developers to create a plethora of decentralized apps, including our beloved DeFi. Even today, Ethereum is the turf where most DeFi protocols choose to play ball.

But let's rewind a bit. Some of the superstars of DeFi, like MakerDAO, were actually conceptualized before Ethereum was even launched. MakerDAO, a lending protocol that lets users borrow cryptocurrencies in a flash or earn interest from lending out crypto tokens, was birthed in 2014, but only officially launched in 2017. The same year saw the launch of numerous other DeFi protocols, including some of the earliest decentralized exchanges.

Remember EtherDelta? It was one of the first decentralized exchanges that allowed traders to swap tokens without the need for a pesky centralized authority. It enjoyed its heyday during the initial coin offerings (ICOs) of 2017, but ran into a bit of a pickle when it was hacked in 2017 and its founder, Zachary Coburn, was accused of operating an unlicensed exchange in 2018.

Speaking of ICOs, these offerings soared in popularity in 2017 and are another milestone in the DeFi timeline. They allowed anyone, from organizations to Joe Blow, to fund a new financial project. ICOs were pretty much a poster child for the DeFi ethos. However, as with any gold rush, ICOs attracted their fair share of shady characters looking for a quick buck without delivering anything of real value.

Still, the ICO heyday gave birth to some DeFi protocols that are still thriving today, like the lending and borrowing system Aave and the peer-to-peer asset exchange network 0x.

Around the same time, protocol developers began shifting from a peer-to-peer focus to one that relied more on pooled funds, or what you might call a “user-to-contract” approach. One of the most successful protocols to adopt this approach was Uniswap, launched in 2018. Uniswap uses liquidity pools and automated market makers to facilitate the exchange of any ERC-20 token. It remains a key player in the DeFi arena today. Then there's Compound, another 2018 debutant that helped shape the lending protocol space. But its true claim to fame came in 2020, which we'll get to in a bit.

Fast forward to the COVID pandemic in March 2020, when the price of ETH took a nose-dive, dropping by a third in a single day. This shockwave led to a surge in gas fees and liquidations, leaving Maker in a bit of a pickle. Their solution? Cook up a spicy new token auction to handle the sitch. Fast forward a bit more to mid-2020, and you'll find Compound launching COMP tokens too, giving users a juicy incentive to borrow and lend through its system. This sparked the somewhat controversial but oh-so-popular trend of yield farming, where users juggle different tokens to cream off the best yields.

The advent of Yearn and SushiSwap in 2020 were other key moments for DeFi. Yearn hops between different DeFi lending protocols to maximize gains while SushiSwap lures liquidity from other protocols by dangling its own native tokens as bait.

Since then, new protocols have been popping up like mushrooms, with DeFi interest and values ebbing and flowing with the larger crypto industry.

Today, more DeFi protocols are launching on non-Ethereum blockchains, looking to capitalize on the improvements made to the original smart contracts format. The future of DeFi is still up in the air, but there's no denying its phenomenal growth over the past few years.

DeFi vs Traditional Finance

In the current financial landscape, the power lies with the centralized authorities. They're the ones who dictate the rules, the ones who decide who gets to play and who's left on the bench. The Fed and SEC? They set the laws and tweak them whenever they see fit.

For the average Joe and Jane, this means we're often left doing what they want us to do. Want to get a car loan, mortgage, or trade some stocks? You'll need to go through these intermediaries, these financial middlemen, who take their cut from every transaction.

DeFi offers a simple yet revolutionary solution: Why let intermediaries have all the profits? It believes in the power of peer-to-peer, in cutting out the middlemen, and putting financial power back in the hands of the people.

👉 Consider this: Today, you might stash your savings in a bank and receive a measly 0.40% interest. The bank then loans your money to another customer at 4% interest, scooping up the 3.6% difference as profits. In the DeFi world, that 3.6% doesn't disappear into the bank's coffers. Instead, you lend directly to others and get the full 4% return.

What makes DeFi special is its foundation – blockchain and cryptocurrency.

Traditional banking keeps your transactions in a private ledger, managed by a large financial institution. Blockchain, on the other hand, is a public ledger. It's like a community noticeboard where every transaction is recorded in an encrypted form, visible to all.

This distributed nature of blockchain means all DeFi participants have identical copies of this public ledger, ensuring transparency and security. It's like having multiple witnesses confirming each transaction, making it nigh impossible for any fraudulent activity to slip through the cracks.

Moreover, the decentralized aspect of blockchain means there's no puppet master pulling the strings. Transactions are verified and recorded by the participants of the blockchain themselves.

Proponents of DeFi argue that this decentralized, transparent model is far superior to the shadowy, behind-the-scenes operations of centralized finance.

DeFi Advantages and Disadvantages

For a full picture of DeFi and its potential impacts, it's crucial to get the low-down on its upsides and downsides. Naturally, we'll kick things off with the good stuff.

- Decentralization

DeFi is all about decentralization — spreading the love when it comes to oversight, data storage, server space, and more. It's democratizing banking and finance, and that's a big deal. A good chunk of DeFi offerings are cozying up on Ethereum, the second-biggest player in the blockchain game, renowned for its super decentralized, no-permission-needed vibe. This makes it an open playground for all those dabbling in DeFi application development and use. Plus, the no-holds-barred nature of blockchain in DeFi applications paves the way for interoperability, encouraging a potpourri of third-party integrations.

- Immutability

Thanks to the magic of cryptography and consensus algorithms, blockchain has earned its stripes in immutability. In simple terms, once something's logged on the blockchain network, it's there for good — no tampering allowed. This rock-solid reliability bolsters the trustworthiness of DeFi solutions when it comes to financial transactions.

- Transparency

DeFi isn't just about security; it's big on transparency, too. The distributed ledger chronicles all the comings and goings on the blockchain network. This clarity can ramp up due diligence and help users dodge financial scams and bad business behavior. Plus, the audit trail makes it a cinch to track transaction tweaks, ensuring the cleanliness of financial ecosystems.

- Lending & Borrowing

DeFi is nurturing a thriving scene of peer-to-peer lending and borrowing solutions, offering major perks to users. With the help of cryptographic verification mechanisms and smart contract integration, middlemen get the boot, the verification process gets a speed boost, and safeguards for transaction parties are put in place.

- Savings

The emergence of DeFi savings products is a headline act in the DeFi world. Users can rake in interest on assets locked into lending protocols like Compound, sparking the birth of numerous DeFi savings apps. These apps tap into various lending protocols to supercharge users' interest-earning potential.

- Tokenization

Tokenization can enable fractional ownership of tangible properties or act as digital shares in specific applications. It can also provide a taste of other assets, both tangible and digital, like digital currencies, fiat money, oil, or even gold.

Now, of course, for the downsides.

As a recent advent, decentralized finance hasn't been put through the wringer with extensive or widespread usage. Plus, government bodies are starting to scrutinize the systems it's establishing, gearing up for potential regulation. Here are some of the other risks that DeFi brings to the table:

- Consumer protection? Naah, never heard of it.

DeFi has flourished in a lawless land, free from rules and regulations. But this also means users may find themselves up the creek without a paddle if a transaction goes belly-up. For instance, in centralized finance, the Federal Deposit Insurance Corp. (FDIC) covers deposit account holders up to $250,000 per account, per institution if a bank bites the dust. Furthermore, banks are legally obligated to stash away a portion of their capital as reserves, ensuring stability and your ability to cash out whenever you want. DeFi offers no such safety nets.

- Hackers

While the blockchain might be virtually unbreakable, other parts of DeFi are ripe for hacking, which could lead to stolen or lost funds. All of DeFi's potential uses hinge on software systems that are susceptible to hacker attacks.

- Collateral

Collateral is something valuable that you use to secure a loan. When you take out a mortgage, for example, the loan is backed by the house you're purchasing. Almost all DeFi lending transactions demand collateral equal to at least 100% of the loan's value, often more. These hefty requirements mean many potential borrowers can't qualify for various types of DeFi loans.

- Private keys

hen dealing with DeFi and cryptocurrency, you're tasked with safeguarding the wallets used to stash your cryptocurrency assets. Wallets are locked up with private keys. Lose a private key, and you lose access to your funds.

DeFi Applications

DeFi applications encompass a variety of components across different levels of the financial ecosystem. Right at the base, you've got things like digital assets, wallets, oracles, and asset bridges. Then you've got the next level up — that's where you'll find stablecoins, lending platforms, and exchanges. Finally, at the service level, you'll find all sorts of financial derivatives.

Now, to really get a handle on this, let's dive into some of the top DeFi projects that’ll show you the full spectrum of financial services that comprise the DeFi ecosystem.

DeFi Examples

Some of the top DeFi projects include:

MakerDAO

MakerDAO is an Ethereum-based blockchain protocol that’s rallying a distributed network of computers to keep DAI, a dollar-tailing stablecoin, on the straight and narrow.

As part of the burgeoning decentralized finance (DeFi) sector, MakerDAO is a cog in the larger machine known as the Maker protocol. This ingenious system takes a cocktail of crypto assets to keep DAI cruising along, completely ditching the need for stuffy old banks or government oversight.

How does it work? Enter two key players: DAI and MKR tokens. Users lock up collateral like ETH to take out DAI loans. The loans are supervised by the wise MKR token holders, who vote on policies to keep DAI stable. For example, MKR token holders can vote on the types of cryptocurrencies that can be locked into the protocol or dictate the price at which these assets would be auctioned off in a liquidation event.

Uniswap

Uniswap stands tall as a premier decentralized crypto exchange, leveraging a novel trading model known as an automated liquidity protocol. Constructed atop the Ethereum blockchain, Uniswap is compatible with all ERC-20 tokens and infrastructure.

Uniswap also wears its open-source badge with pride. This means anyone with the know-how can clone the code and build their own decentralized exchanges. It even lets users list tokens on the exchange free of charge.

This is DeFi in its purest form. On Uniswap, you alone control your funds through private keys. Goodbye to depositing assets with exchanges — on Uniswap, your keys stay in your hands.

Aave

Aave is a decentralized platform in the cryptocurrency universe, enabling users to lend and borrow crypto assets. It employs smart contracts to automate the process, setting predefined rules for fund distribution, collateral management, and fee allocation.

To get a loan, you'll need to overcollateralize with crypto worth more than you borrow. This protects lenders if you default. If collateral drops too low, Aave's smart contracts automatically liquidate assets to cover losses.

Borrowers get crypto loans on autopilot, lenders earn interest on deposits. No middlemen, bureaucracy or paperwork. Just immutable code executing loans according to preset rules.

Aave also has its own AAVE token for governance voting. Stake AAVE in the protocol to earn interest and influence Aave's future.

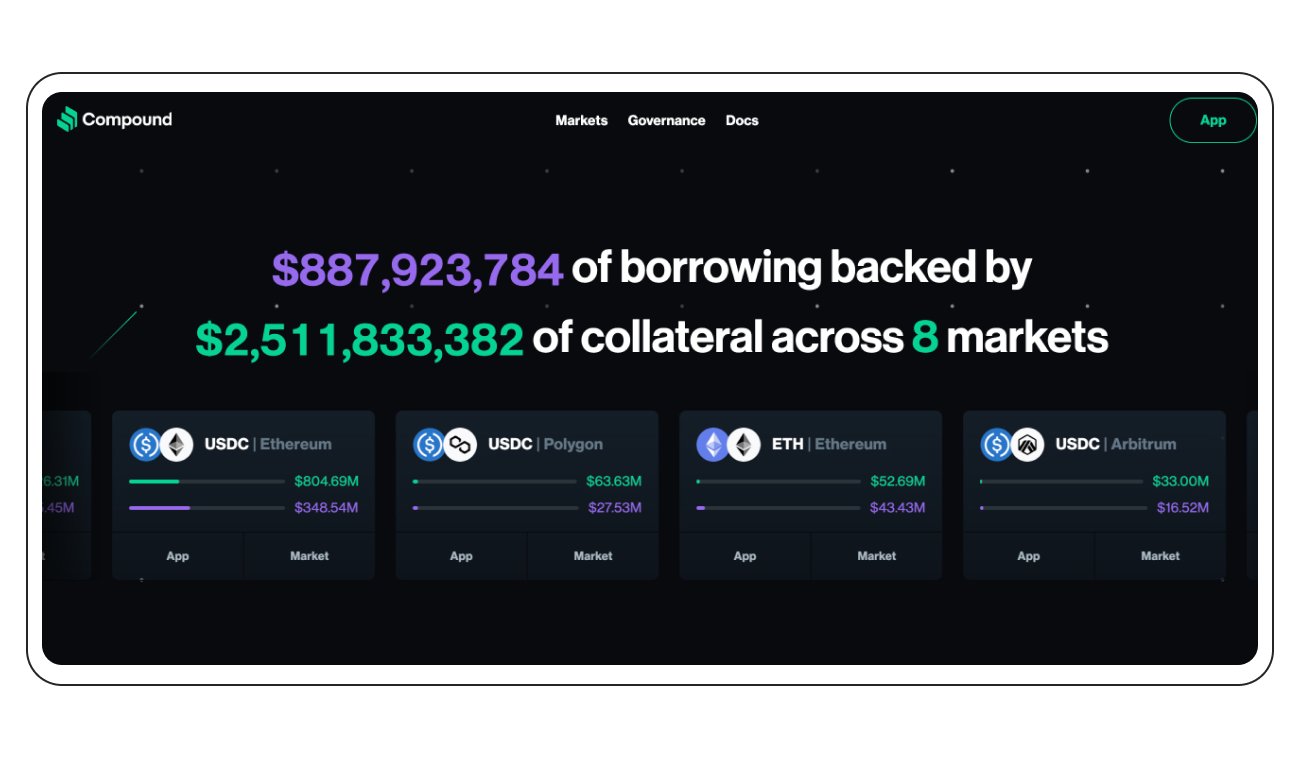

Compound

Compound is like a magical money market running on Ethereum. Users deposit crypto into pools that loan out funds on autopilot.

For lenders, it's as simple as locking up tokens and watching interest roll in. Once deposited, Compound whips up cTokens — protocol tokens representing your share of the pool. Fancy cDAI and cETH? You got it! cTokens can be freely traded but always redeemable for the underlying asset.

On the other side, borrowers tap pools for instant crypto credit lines. No paperwork, credit checks or bureaucrats — just code executing loans according to Compound's rules.

To stoke activity, Compound dolls out COMP tokens as rewards. The more you interact with markets, the more COMP you earn.

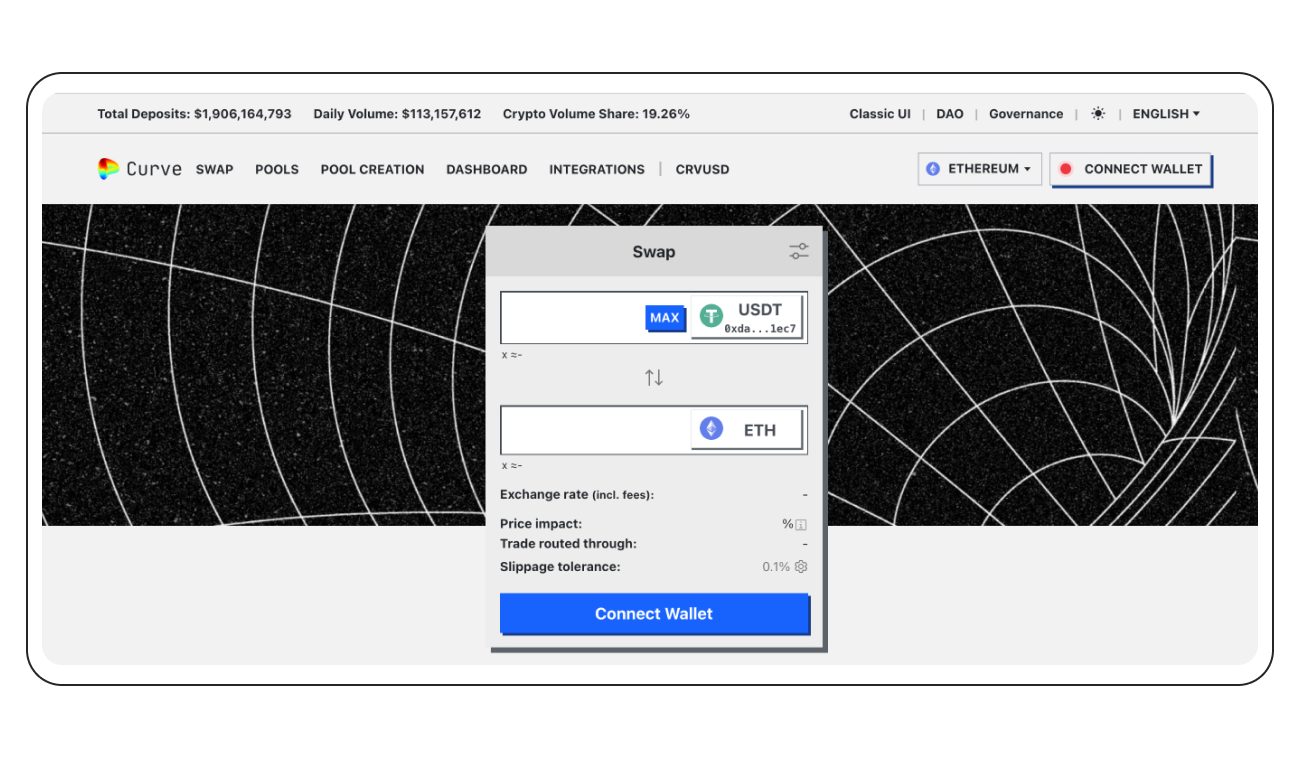

Curve Finance

Curve is an Automated Market Maker (AMM) platform that shares many features with Uniswap and Balancer. However, it sets itself apart by exclusively supporting liquidity pools composed of similar behaving assets, such as stablecoins, or wrapped versions of similar assets like wBTC. This strategy allows Curve to utilize more efficient algorithms and boast the lowest levels of fees, slippage, and impermanent loss of any DEX on the Ethereum blockchain. Through this targeted approach, Curve carves out its niche in the world of decentralized finance.

Yearn Finance

Yearn Finance offers a bouquet of products that include lending aggregation, yield generation, and insurance on the Ethereum blockchain. This protocol is helmed by a diverse group of independent developers and directed by YFI token holders.

It all started when developer Andre Cronje got sick of switching between different DeFi platforms to chase better interest rates. So he built Yearn to do it for him.

Users deposit tokens into Yearn and get yield-bearing tokens back. Behind the scenes, Yearn shifts funds between lending protocols like AAVE and Compound as rates change. In a successful collaboration with Curve Finance, Yearn Finance introduced a pool of yield-bearing USD tokens that included four y-tokens: yDAI, yUSDT, yUSDC, and yTUSD, collectively dubbed as yUSD.

Then Yearn launched vaults — baskets that earn yield farming rewards and sell them automatically. Vaults made yield aggregation simple for anyone with crypto assets.

Now Yearn runs like a decentralized hedge fund, shifting user capital around the DeFi landscape for profit. Users get passive yields without needing expert knowledge.

DeFi Future

Just like AI and machine learning have shaken up wealth management, DeFi is poised to revolutionize banking and financial services. Let's look at five promising DeFi trends that are poised to make a significant mark on the industry:

- Ethereum's transition from proof-of-work to proof-of-stake makes it an even more attractive platform for DeFi applications, offering efficiency and sustainability.

- The emergence of cross-chain technologies promises to reduce network congestion and scale DeFi to new heights by providing a broader selection of protocols.

- Stablecoins are the linchpin in bridging traditional finance and DeFi, and their growing volume and the advent of tokenized national currencies in the DeFi ecosystem are steps toward a more inclusive financial future.

- The diversification of DeFi's product range, such as the incorporation of non-fungible tokens as collateral, paves the way for vibrant virtual economies and markets, enhancing the liquidity and transferability of digital assets.

Think about it: any financial service you've used could potentially be swapped out for a decentralized protocol or blockchain token. We're watching it happen right now with lending and trading. In DeFi lending, the whole lender-borrower matchmaking, risk management, and even the transfer of value is streamlined.

Over in the investment world, crypto tokens and blockchain algorithms are starting to edge out traditional ETFs, mutual funds, and even hedge funds. They're offering lower fees and removing barriers to entry. But most importantly, DeFi protocols are open to all, unlike banks that can be picky about who they serve. With DeFi, if you've got the means to access it, you're in.

And, here's the kicker: for banks, FinTechs, and anyone eager to stay ahead, DeFi's open-source foundation means you can quickly roll out innovative and unique products. A lot of this tech magic happens at the infrastructure and middleware level, which is perfect for crafting valuable, niche applications at breakneck speeds. It's no wonder DeFi has picked up steam so fast—developers can whip up new products in just days.

Bottom Line

DeFi is all about creating an open, decentralized, permissionless, and autonomous financial universe, with the power of blockchain technology at its core. The innovative force of distributed ledger technology (DLT), coupled with the magic of automation and smart contracts, promises to skyrocket efficiencies while waving goodbye to middlemen.

Of course, it may take some time for DeFi to become mainstream for the average Joe and Jane. It's an emerging tech frontier, after all, brimming with both sparkling successes and growing pains. Regulatory hiccups are bound to happen, especially where the little guy's investments are concerned, but these moments can also pave the way for a DeFi landscape that knows how to balance wild innovation with the right amount of oversight.

Wrapping it all up, let’s just say that the horizon looks lit with the promise of expansion and breakthroughs. So all we gotta do is sit tight.

Oh, and yes, if you’re looking to automate your crypto trading, then look no further than Bitsgap. Here, you’ll be able to manage up to 17 crypto exchange accounts seamlessly from one unified dashboard. Currently, these are centralized exchanges, but we're expanding our horizons to include DEXs — because, let's be real, DEXs are the bomb. At your command, we've got an arsenal of trading bots like DCA, GRID, BTD, COMBO, and DCA Futures, each with a history of impressive performance. Backtesting, trailing features, smart orders — you’ve got it all. Plus, a week-long trial on the PRO plan and a life-long Demo mode if you’re shy.

FAQs

What Is Decentralized Finance Meaning?

Decentralized Finance, commonly known as DeFi, is a disruptive movement that’s about crafting an open-source, permission-free, and extensively interoperable suite of protocols. These are constructed atop public smart contract platforms, with Ethereum being a prime example.

What Is DeFi Full Form?

DeFi stands for Decentralized Finance, which aims to recreate traditional financial systems in a totally decentralized way, without intermediaries such as banks or brokers.

What Is DeFi Concept?

The idea behind Decentralized Finance, or DeFi, is a transformative shift in the financial landscape, striving to make financial services more accessible to everyone by removing middlemen and decentralizing the services typically controlled by traditional financial institutions. It leverages the power of blockchain technology and smart contracts.