DeFi Lending Tokens You Should Know About

Turn the page to demystify COMP, JST, and AAVE, as we unlock the secrets of the trailblazing DeFi protocols that are redefining the world of lending.

The realm of decentralized finance (DeFi) is expanding at an impressive pace, with innovative projects popping up all the time. Yet how do you know where and how to invest? Join us as we uncover one such DeFi facet worth exploring — DeFi lending tokens.

DeFi stands for financial applications built on blockchain networks via smart contracts, primarily on the Ethereum platform. This exciting landscape includes services such as cryptocurrency lending, decentralized exchanges, derivatives, and payment platforms.

The staggering $42 billion currently held in DeFi protocols unquestionably signals a seismic shift in the traditional financial paradigm.

Join us in this exploration as we delve into the bustling DeFi marketplace and put the spotlight on significant lending protocols like Compound (COMP), JustLend (JST), and AAVE (AAVE).

What Is Decentralized Finance (DeFi)?

DeFi represents a new financial infrastructure that eliminates the need for intermediaries, all while harnessing the transparency and security offered by blockchain. This means no more exorbitant middleman fees or time-consuming paperwork — DeFi platforms foster a trust rooted in technology, ensuring assets are transferred quickly and safely.

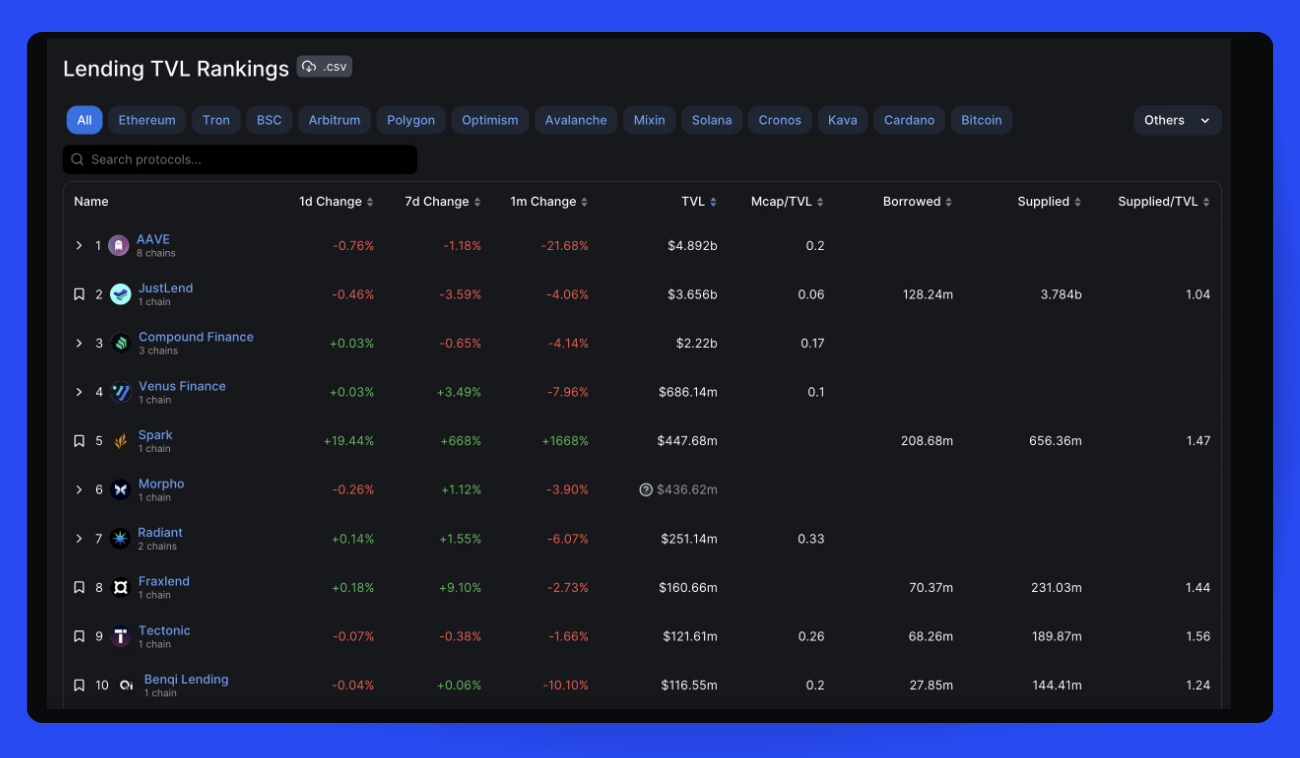

It's no exaggeration to say that decentralized finance has been on a meteoric rise in recent years; and although the surge has subsided somewhat during a bearish market in 2022-2023, the total value locked in DeFi protocols still stays at a whopping $42 billion. Just look at the below chart, courtesy of DefiLlama:

With the potential of DeFi now in your purview, let's explore some of its prominent products:

- Lending and borrowing: DeFi lending protocols like MakerDAO provide opportunities to earn attractive returns on your cryptocurrency assets. Moreover, platforms such as Compound offer the capacity to earn interest income or secure a collateralized cryptocurrency loan tailored to your needs.

- Decentralized exchanges (DEX): offer an exciting new way to trade cryptocurrencies directly with others without central authorities. These peer-to-peer marketplaces use smart contracts to enable secure transactions without custodians. Innovations like automated market makers have helped DEXs solve liquidity issues, attracting many users to DeFi and driving incredible growth. DEX aggregators and wallet extensions further fueled this growth by optimizing token prices, fees, and slippage to get users the best rates.

- Derivatives: DeFi derivative platforms employ synthetic price feeds to facilitate the trading of a wide range of financial assets on the blockchain network. They also offer the chance to speculate on prices and wager on outcomes in DeFi prediction markets.

- Payments: DeFi payment channels allow for swift and easy payment transactions. The process of initiating payments from DeFi platforms is as straightforward as making payments via credit or debit cards.

What Is DeFi Lending, and How Does DeFi Lending Work?

DeFi lending is a revolutionary practice that's akin to traditional banking services, yet it's powered by peer-to-peer (P2P) decentralized applications (DApps). What's beautiful about this? It empowers individuals to lend and borrow funds, creating an exciting income stream for those who hold cryptocurrencies.

DeFi lending is refreshingly simple to understand. Its focus is on delivering crypto loans in a trustless environment — eliminating intermediaries from the equation. Users can confidently secure their crypto assets on DeFi lending platforms, while borrowers can effortlessly seek loans from these platforms, thanks to the power of P2P lending.

Moreover, DeFi lending protocols allow lenders to reap interest on their crypto assets. In a transformative shift from traditional banking systems, DeFi lending invites everyday individuals to step into the shoes of a bank, lending their assets to others while earning interest.

DeFi lending relies heavily on lending pools, similar to a bank's loan department. Users can contribute their assets to these pools, which are then swiftly allocated among borrowers via smart contracts.

The type of interest one receives as a lender can vary, and there are several methods for allocating that interest. Borrowers have the opportunity to truly understand the system too, as each lending pool might deploy a unique borrowing strategy.

One striking difference between the DeFi and traditional lending models is the process. Traditional banking can often be a drawn-out process with constant checks on a user's status. In contrast, DeFi lending is all about efficiency — loans are approved swiftly as long as the collateral requirements are met.

Smart contracts make everything smoother too, handling the review process and giving both borrowers and lenders an easier time. Typically, DeFi lending yields higher returns than its traditional counterparts — another reason to consider stepping into this innovative space.

Most Promising DeFi Coins Native to Lending Protocols

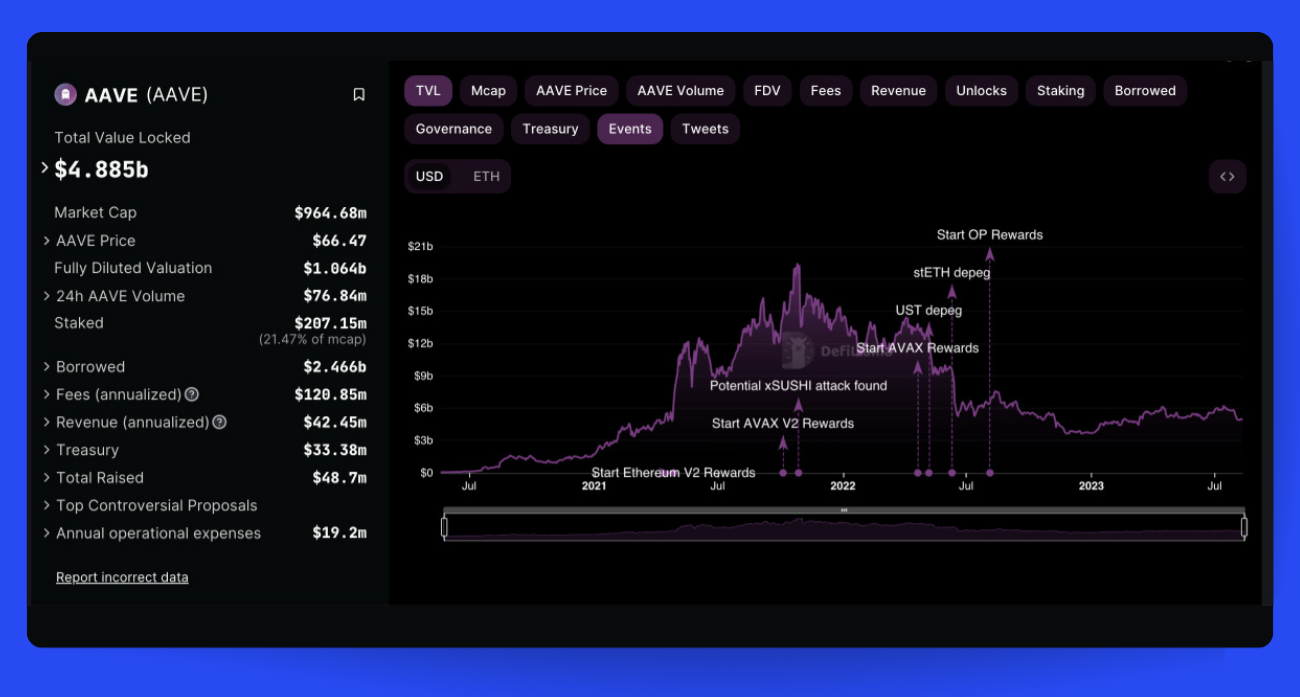

Aave (AAVE)

Aave, a protocol rooted in Ethereum, provides an automated method for obtaining crypto loans. You can pledge your cryptocurrency as collateral to borrow different types of cryptocurrencies, up to a specific portion of the collateral's value. This specific portion is referred to as the loan-to-value (LTV), and Aave restricts the borrowed amount to 80% of the ongoing value of the pledged collateral.

To automate the borrowing process, Aave uses smart contracts. These are programs that determine the terms of the loan, collect the collateral that has been deposited, and distribute the borrowed cryptocurrency.

How Does Aave Lending Work?

If you're looking to lend cryptocurrency on Aave, it's a straightforward process. You would start by linking your digital wallet to the platform and then browsing through a list of assets that accept deposits. These deposits give you a fixed annual percentage yield (APY), which is paid out in the same type of asset you deposited. So, if you deposit DAI, you'll earn your interest in DAI.

When you supply cryptocurrency to Aave, your tokens go into liquidity pools, which are then used for lending to other borrowers. The interest paid by these borrowers goes into the lending pools, with a percentage of these fees being distributed to you, the depositor.

If you’re a developer, then you might want to take advantage of Aave’s Flash loans, unique loans that are both borrowed and paid back within the same blockchain block. These loans are specifically designed to capitalize on arbitrage opportunities. You can write smart contracts to request a Flash Loan, perform a trade, and then repay the loan, all within the same transaction. Aave charges a 0.09% fee for every Flash Loan transaction, which is borne by the borrower.

How Does Aave Borrowing Work?

If you're looking to borrow cryptocurrency on the Aave platform, the first step is to deposit your own cryptocurrency as collateral. Interestingly, as soon as you deposit your collateral into the liquidity pools, you start earning interest on these deposits.

After your funds are deposited, you can explore the range of supported crypto assets to borrow from. Aave intelligently calculates how much you're eligible to borrow. This is determined dynamically based on the value of your deposited cryptocurrency, the value of the asset you want to borrow, and the volatility of that asset. After selecting the cryptocurrency you want to borrow, you confirm the transaction, and the chosen crypto is deposited directly into your connected wallet.

Aave loans are always overcollateralized, implying that the value of the deposited assets always surpasses the value of the crypto loan. This borrowing limit is set by Aave to safeguard lenders and liquidity providers from losses if the loan collateral decreases in value. Assets with higher volatility typically have a lower Loan-to-Value (LTV) ratio compared to more stable assets.

Aave loans don't have a specified repayment timeline. However, the repayment should be in the same form of cryptocurrency that was borrowed. For instance, if you borrow $200 worth of USDT, you'll need to repay it in USDT (plus interest).

What Are the Benefits and Applications of AAVE Token?

Aave facilitates borrowing and lending by issuing two distinct types of tokens: aTokens, which are given to lenders as a means to earn interest on their deposits, and AAVE tokens, which are the native tokens of the Aave platform.

The AAVE cryptocurrency provides several benefits to its holders:

- Borrowers who take loans in AAVE are not subjected to any fees.

- Those who use AAVE as their collateral benefit from fee reductions.

- Owners of AAVE tokens have the privilege of previewing loans before they become available to the broader public, provided they pay a fee in AAVE.

- Last but not least, borrowers who use AAVE as collateral have the opportunity to borrow a slightly larger amount.

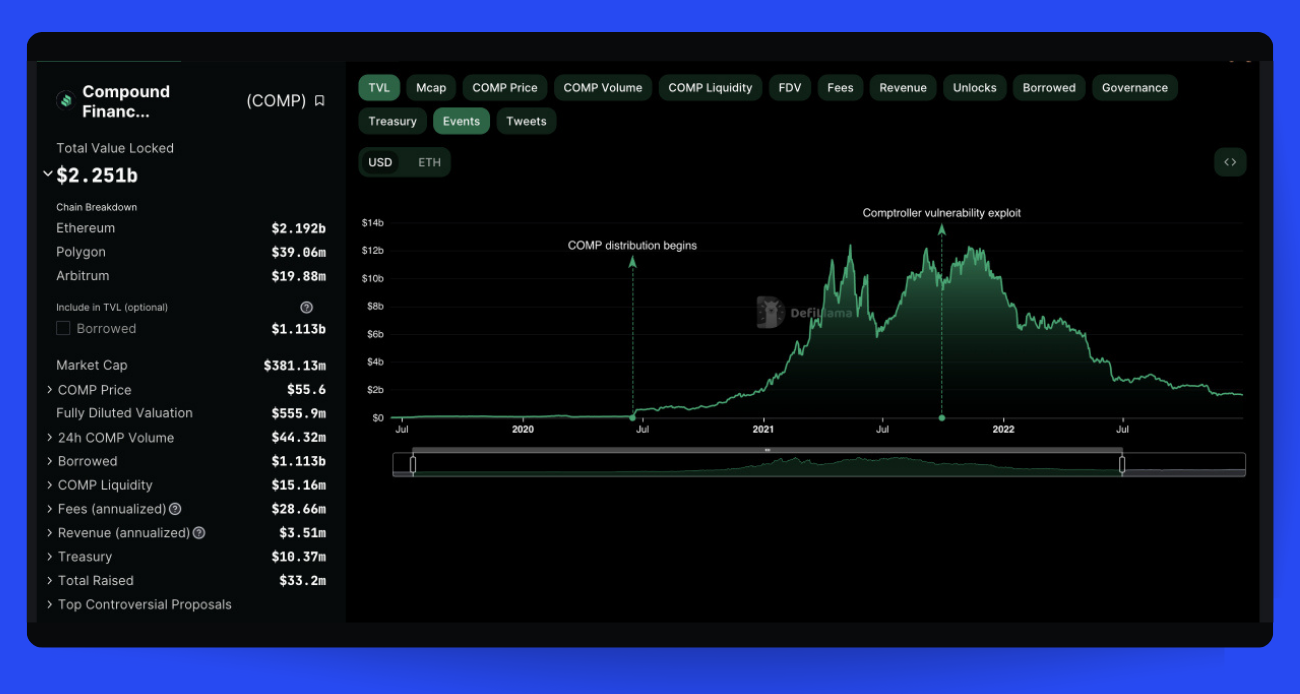

Compound (COMP)

Much like Aave, Compound is software that operates on the Ethereum network and is revolutionizing the way we think about money markets.

As one of the growing number of decentralized finance (DeFi) protocols, Compound leverages multiple cryptocurrencies to provide this service, facilitating the necessary lending and borrowing without a financial middleman.

In simpler terms, Compound offers a platform where users can deposit their cryptocurrency into lending pools, which borrowers can then access. In return, those who lend their assets earn interest on their deposits.

How Does Compound Lending Work?

Again, in a similar vein to Aave, Compound facilitates the lending and borrowing of a specific range of cryptocurrencies.

If you're the proud owner of any of the supported crypto, you can effortlessly deposit or lend any amount to the Compound protocol. It's akin to placing your money into a savings account, but instead of depositing your money into a bank, you transfer your crypto into the Compound wallet and start accruing interest on your crypto instantly in the same token that you lent. The cryptocurrency you send merges into a massive pool of the same token in a smart contract within the Compound protocol, contributed by thousands of people worldwide.

How Does Compound Borrowing Work?

Once you've deposited your crypto into Compound, you've unlocked the ability to borrow against it. The beauty of Compound is that it doesn't require a credit check, enabling anyone, anywhere in the world with crypto, the freedom to borrow. The borrowing limit, or collateral factor, is determined by Compound based on the quality of the asset. For instance, if you've deposited 1000 DAI worth $1000 and the collateral factor for DAI is set at 50% by Compound, you're eligible to borrow $500 worth of any other supported cryptocurrency. And, just like with traditional banks, you'll need to pay interest on the amount you borrow.

What Are the Benefits and Applications of COMP Token?

Compound streamlines the process of borrowing and lending through the issuance of two unique types of tokens. There are cTokens, distributed to lenders as a mechanism to accrue interest on their deposits, and COMP tokens, the intrinsic tokens representative of the Compound platform.

COMP is the governance token of the Compound protocol, and a fixed amount is distributed daily to all lenders and borrowers using the Compound protocol. The distribution of COMP tokens occurs every time an Ethereum block is mined (approximately every 15 seconds), in an amount proportional to the interest accrued on each asset. As a COMP token-holder, you have the power to:

- Propose and vote on amendments to the protocol or delegate the vote to someone else.

- Supervise the protocol's reserves and treasury.

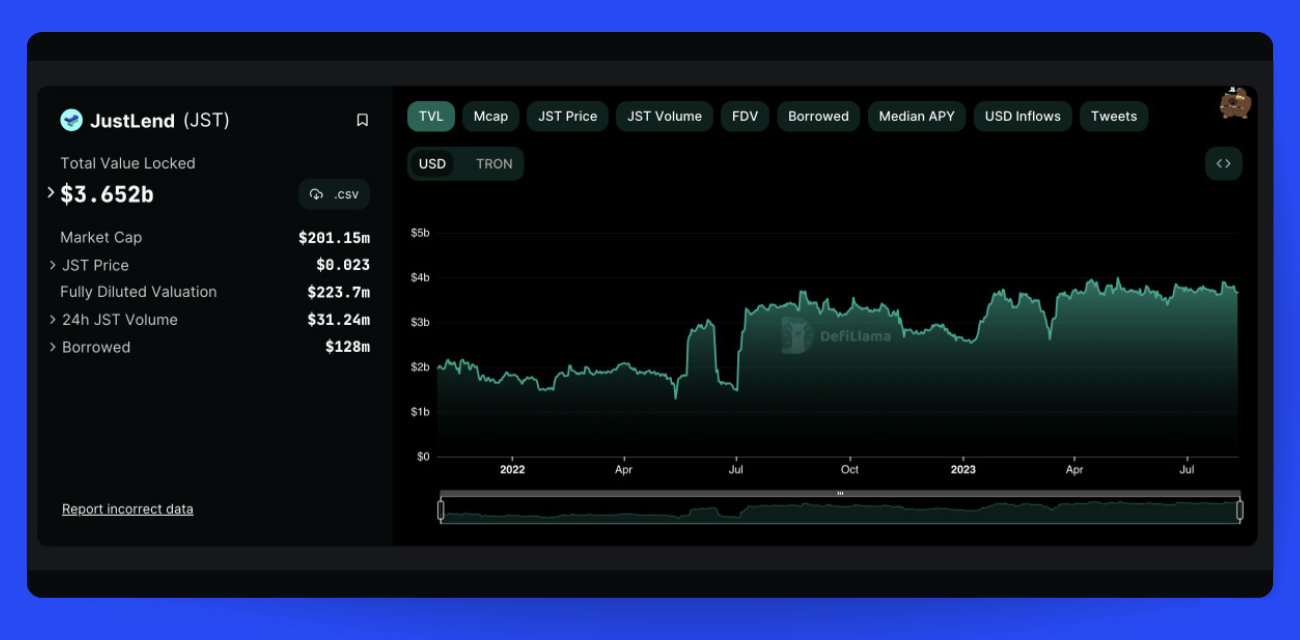

JustLend (JST)

JUST is a dynamic DeFi platform, rapidly evolving to offer a wide array of decentralized financial services, including JustStable, JustLend, JustSwap, JustLink, and cross-chain tokens. The platform is built on the robust foundation of the TRON network and utilizes a decentralized stablecoin system consisting of USDJ and its own token, JST.

JustLend bears a resemblance to Compound on Ethereum. However, while Compound currently offers low APY rates, JustLend stands out by offering interest rates in the double-digits.

JustLend's mission is to create asset pools based on a supply and demand algorithm for assets like TRX and TRC20. The platform allows users to deposit TRX and TRC20 tokens in return for interest on each asset class, and borrow additional tokens for varied purposes.

With its significant upgrade this year, JustLend introduced two exciting new features:

- Staked TRX. This feature allows you to stake your TRX tokens and in return, you receive sTRX tokens, paving a way higher yields.

- Energy Rental. This innovative feature gives you the freedom to rent Energy or halt your rental anytime you wish. This is a game-changer as it's a far more cost-effective way to acquire Energy compared to the traditional method where you stake or burn TRX to gain Energy for transactions on the JustLend protocol.

How Does JustLend Lending Work?

Like you might have anticipated, JustLend operates in a manner akin to the previously discussed lending protocols. The key idea behind JustLend DAO protocol is the pooling of all user-supplied assets, which enhances liquidity and fosters monetary equilibrium. What's more, as a supplier, you have the freedom to withdraw your assets at any moment, without having to wait for a loan to mature.

The assets you supply are represented by jTokens (a TRC-20 token). As a token holder, you can procure corresponding jTokens on JustLend DAO and adhere to the relevant guidelines to earn interest.

How Does JustLend Borrowing Work?

As a user of JustLend DAO, you first need some jTokens as collateral — these represent your underlying crypto assets deposited to the platform. With your jTokens ready, you can now easily borrow any available asset on JustLend.

Unlike peer-to-peer lending, you don't need to set an expiry date or find a specific lender. All you do is choose the asset you want to borrow. The borrowing happens in real-time, with interest rates adjusted based on current supply and demand in the market.

For example, borrowing TRX may cost 2% interest, while stablecoins like TRC20-USDT might be 5%. Rates vary across assets, calculated automatically based on market conditions.

What Are the Benefits and Applications of JST Token?

JustLend simplifies the borrowing and lending journey via two distinct types of tokens. First, there are jTokens, issued to lenders as a tool for earning interest on their deposits. Then, we have JST tokens, which are native JustLend tokens.

JST is a TRC20 token and serves as the unique token for governing dApps and the entire Just ecosystem. As a JST holder, you have a say in the project's future direction. You can participate in decision-making processes via voting, or even submit your own proposals for the community to review and vote on.

JST is also an incentive token. You can earn JST through various activities such as mining, participating in campaigns, or even through trading or direct purchases on cryptocurrency exchanges.

Where to Trade JST, COMP, AAVE?

Locating JST, COMP, AAVE, or any other in-demand DeFi tokens on major exchanges is a breeze. And when you pair your exchanges with Bitsgap, you can wave goodbye to juggling multiple tabs and focus solely on what's of utmost importance — trading using state-of-the-art tools and a cutting-edge terminal. Thanks to Bitsgap, you can bring together as many as 17 exchanges under a single umbrella, with nothing more than an encrypted API key needed. It's that straightforward!

Bitsgap also boasts a clever trading terminal equipped with advanced order options, including hedging and trailing features, and a wealth of highly profitable trading bots for both futures and spot markets.

Why not give it a spin?

Sign up today for a seven-day free trial and experience the difference yourself!

The Bottom Line

If you're scouting for promising investments in lending protocol coins, then JustLend (JST), Compound (COMP), and Aave (AAVE) surely deserve a spot on your radar. That being said, always remember, as you venture into lending, borrowing, or investing in crypto assets, to arm yourself with thorough research and a robust risk management strategy. After all, the value of cryptocurrencies is known for its ebbs and flows. So, strap in tightly and get ready for an electrifying ride into the world of DeFi!

FAQs

What Are the Top DeFi Tokens?

Some of the top DeFi tokens include Uniswap (UNI), Lido (LDO), Maker (MKR), Aave (AAVE), Synthetix Network (SNX), Injective (INJ), and Kava (KAVA).