GRID Trading with the Bitsgap GRID Bot

GRID Trading has never been easier with Bitsgap's GRID bot. Learn how this powerful tool can help you take your trading game to the next level!

Amongst the many strategies available, the GRID trading strategy is arguably the most popular. Learn what GRID trading is and how you can use Bitsgap’s GRID bot for max benefit.

It's a bad idea to make decisions based on gut feelings alone. Only by analyzing the market and using tried and true strategies can you expect to make a steady dime.

One such well-trodden strategy is GRID trading.

Suitable for both beginners and pros, GRID trading can help you master the market and achieve superior trading results.

Fortunately, with technology at its finest, you don’t have to follow the GRID strategy manually; instead, you just launch a bot to do all the hard work for you.

Tag along as we explain how it all works.

What Is GRID Trading?

GRID trading is a trading strategy commonly used in the forex and crypto markets that profits from an asset's natural price volatility.

GRID trading involves placing orders above and below a predetermined price level at incrementally higher and lower prices, thereby forming a grid of orders.

Since the strategy profits from buying below a set price and selling higher, it’s most effective in a sideways market where an asset’s price bounces within a horizontal range.

How GRID Trading Works

Although GRID trading doesn’t require sophisticated market forecasting, it works best when the market goes sideways. In other words, the prices need to go consistently up and down for GRID trading to be effective and profitable.

Though other automated systems may use slightly different iterations of the GRID strategy, we'll focus on how Bitsgap's GRID trading works here.

By following the GRID strategy, the system preemptively places buy and sell orders at predetermined intervals based on an asset’s current market price. By doing so, the system ensures that it enters the trade regardless of the price direction, making small gains as the price steadily fluctuates.

For example, to profit from the ETH sideways market, you may set up limit buy and sell orders at every 50 USDT below and above the current market price.

Pros and Cons of GRID Trading

The main advantages of GRID trading are that it’s fairly simple, doesn’t require market forecasting, and can be readily automated. The strategy allows you to profit even if you aren't well-versed in technical analysis, which is a huge advantage for a novice. Finally, it's been tested, used, and proven reliable and efficient by both institutional and retail investors.

The difficulty of monitoring and/or closing several positions in a wide grid and the risk of losing money if conditions change, however, are major downsides.

In the end, it is up to you to decide when to close the grid, get out of the trades, and pocket the gains. Otherwise, the market might turn against you and exit the sideways trend before you can take action. Fortunately, there are tools that can help you take the necessary precautions, such as putting Stop Loss and Take Profit orders to limit risks and secure returns lest the unforeseen happens.

What Is Bitsgap’s GRID Bot Strategy

Bitsgap’s GRID bot strategy works with postponed limit buy and sell orders within predefined price levels. The bot divides the specified price range into multiple tiers, creating an order matrix, or “grid of orders," as it’s commonly called (Pic. 1).

By following a classic GRID strategy, the bot benefits from even minute market fluctuations.

A grid is interchangeable in itself, meaning for every purchase order, the bot will create a sell order above the executed price. That means that the bot automates the process of buying low and selling high, saving you countless hours that you may have spent studying charts or monitoring the price action.

In short, the GRID bot reliably generates steady income based on the grid specifications and other features (like Trailing, Stop Loss, and Take Profit) that you provide.

How to Use Bitsgap’s GRID Trading Bot

Here are your comprehensive instructions for setting up and launching a new GRID bot on Bitsgap.

1.To start a new bot on the Bitsgap platform, click on the [Start new bot] button on top of the interface and choose the [GRID bot] from the list of available options.

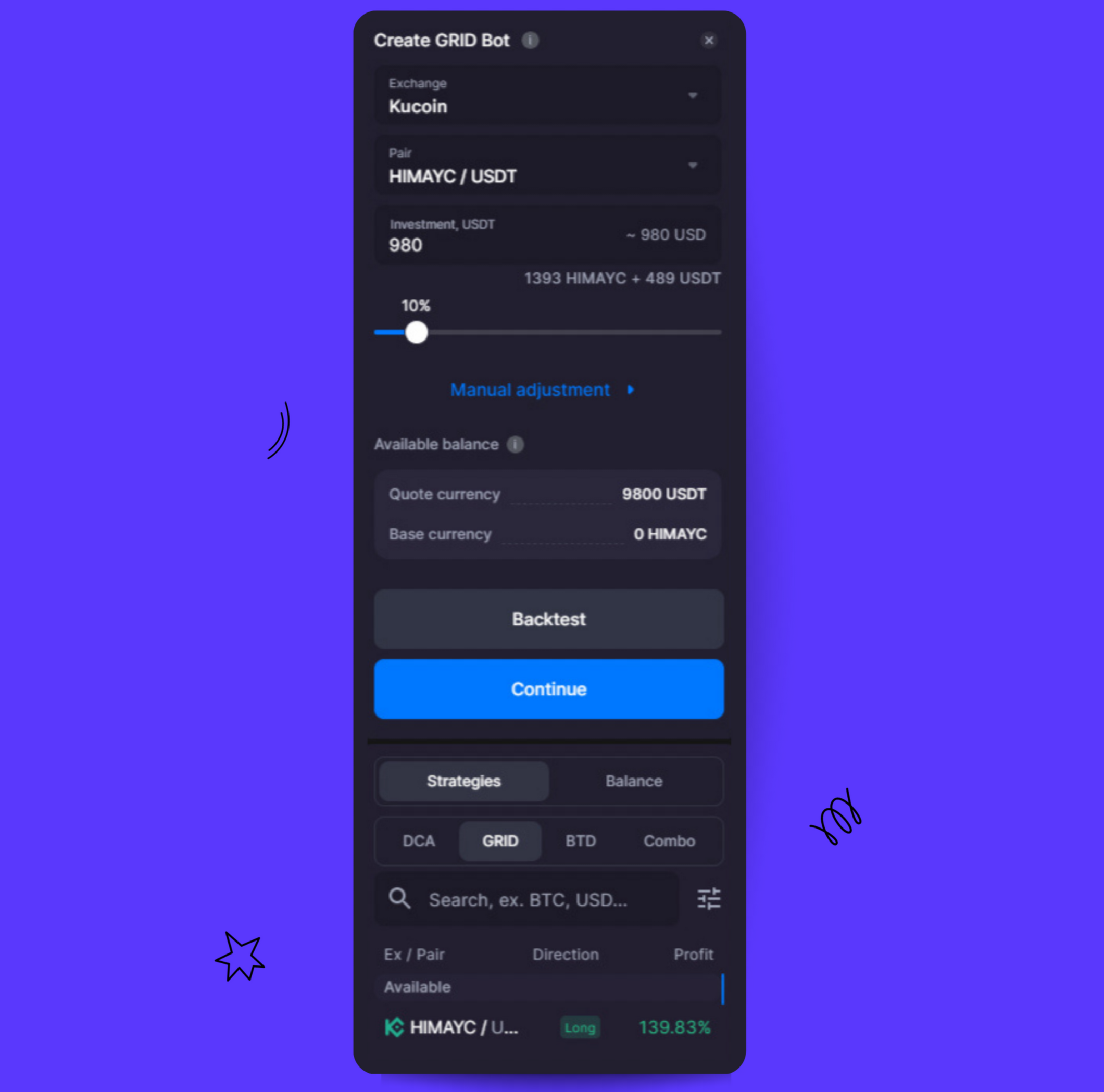

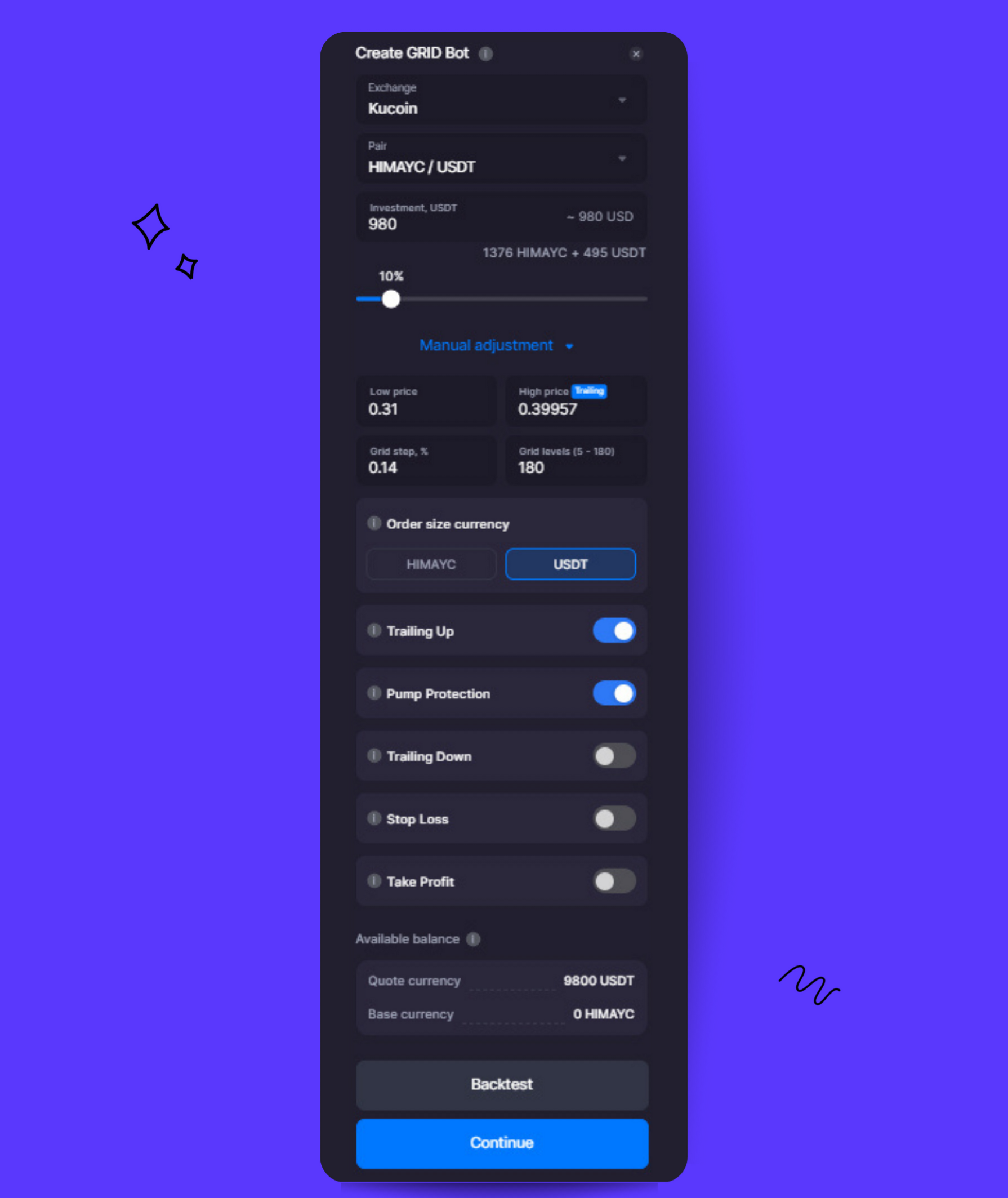

2. You may create your first GRID bot by selecting an exchange, a trading pair, and a desired amount of investment from the corresponding menus on the right side of the screen and tweaking the advanced parameters in [Manual adjustment] to suit your trading strategy (Pic. 2):

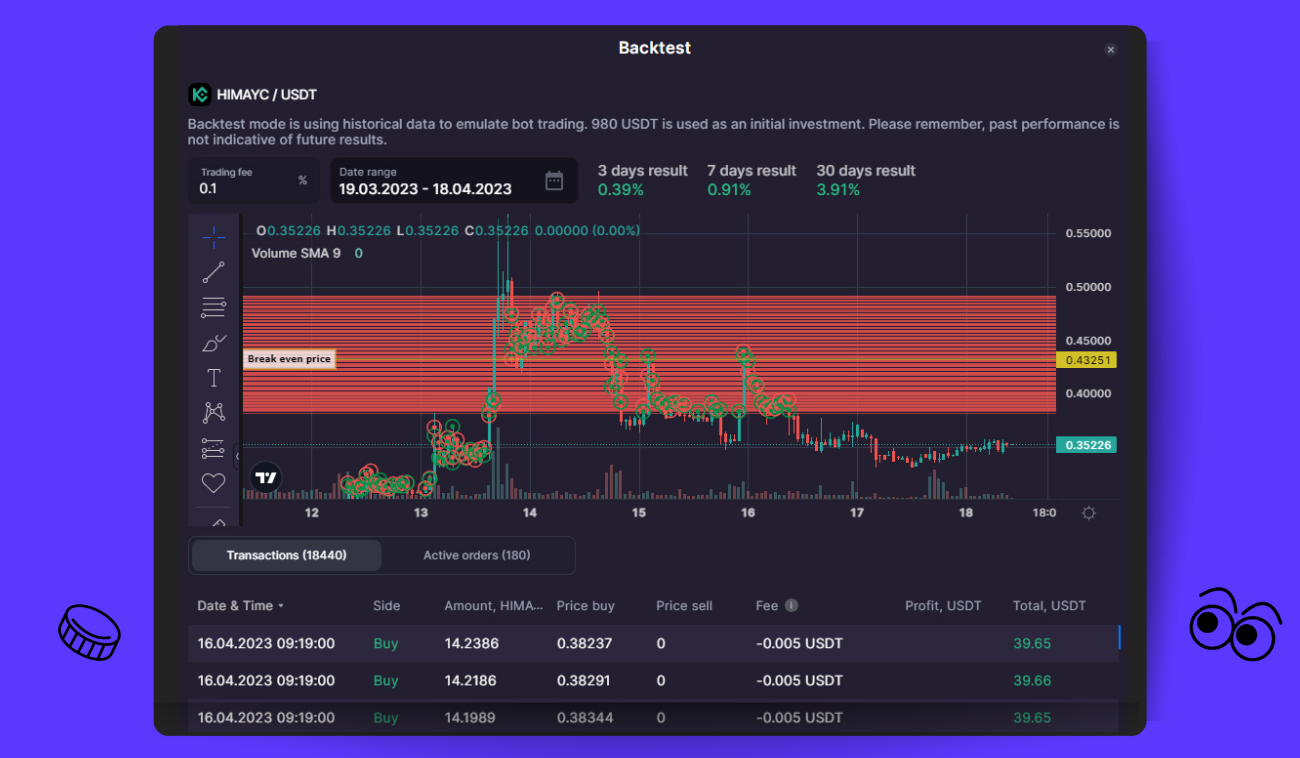

3. If you click on [Continue] now, your bot will start with a profitable default strategy. You can test it by clicking on [Backtest], which evaluates the bot’s performance on past data (Pic. 3). By changing the settings and running Backtest again, you’ll see how the chosen settings affect the bot’s performance. You may adjust your strategy until you achieve the desired result.

4. Click on [Manual adjustment], if you want to check or adjust the default settings (Pic. 4):

The default strategy splits the lower and upper bounds of the trading range in half relative to the asset’s current market price. The system will place initial sell orders above it while placing initial purchase orders below. The ratio will dynamically adjust as soon as prices begin to fluctuate within the grid. To change the current price range, simply modify the chart's [Low Price] and [High Price] values or input them manually.

The [Grid levels] parameter shows the number of open orders your bot will generate, while [Grid step] — the price distance between grid levels. Since [Grid step] directly determines the spacing between bot orders, adjusting one field will have an effect on the other. It’s typically recommended to use a wider grid when market volatility is high and a tighter grid when the market is flattening.

By default, the GRID orders are fixed in size in the quote currency. We recommend leaving this option on when the market moves sideways. This ensures that all levels of the grid get the same proportional share of the overall investment. As the price drops and the value of the base currency declines, more coins become available for purchase. However, when the price rises, the bot will buy a smaller fraction of the base currency since it can only spend an allocated amount of the other currency.

You can also choose an option to fix orders in terms of the base currency, so that every time the bot trades, it purchases and sells the same amount of the base currency. The required initial investment will be substantially higher, but so will the returns during rallies.

You may also toggle on and off such options as Trailing Up and Down, Pump Protection, Stop Loss, and Take Profit.

To learn more about these variable options, please refer to our comprehensive piece on customizable settings in the Help Center.

We highly recommend setting Stop Loss and Take Profit to protect your investment against unfavorable exposure and lock in your profits upon reaching target objectives.

5. When you’re done tinkering with the bot’s settings, click [Continue] to review them, and then — [Start Bot] to launch your bot.

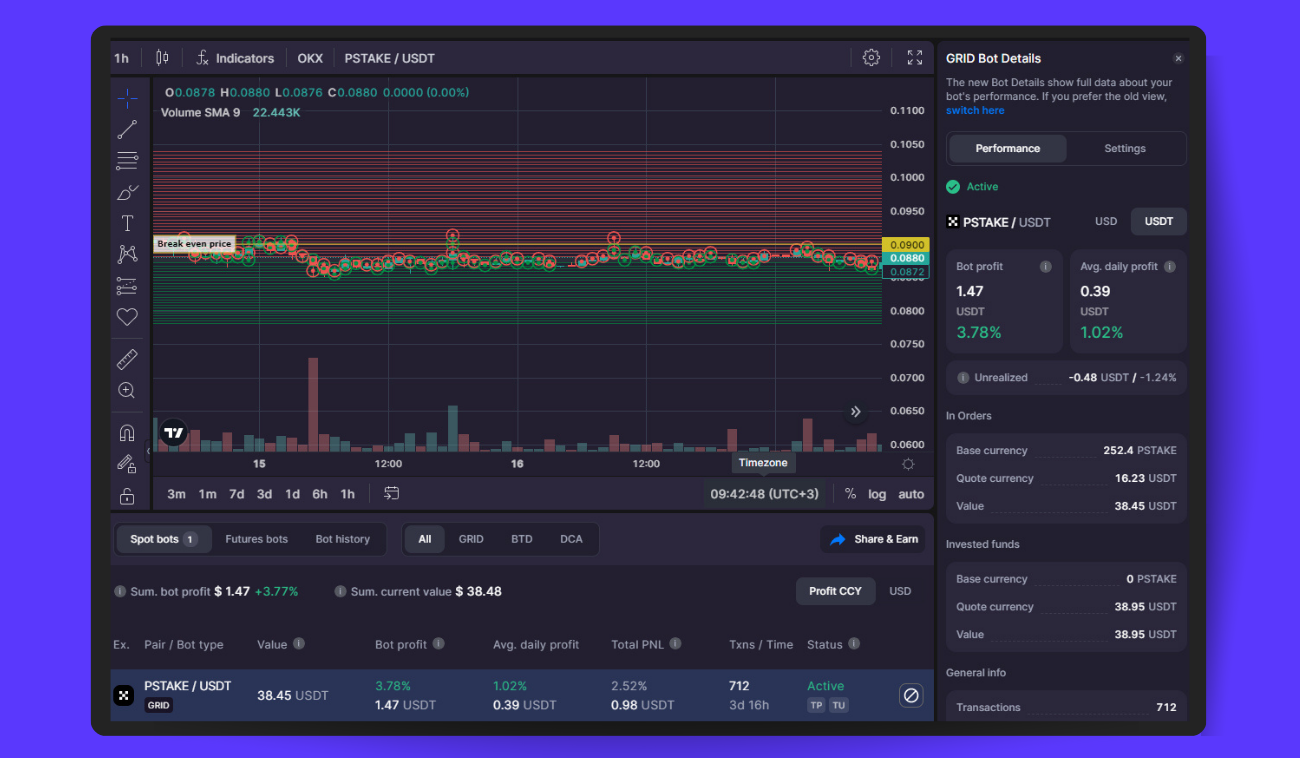

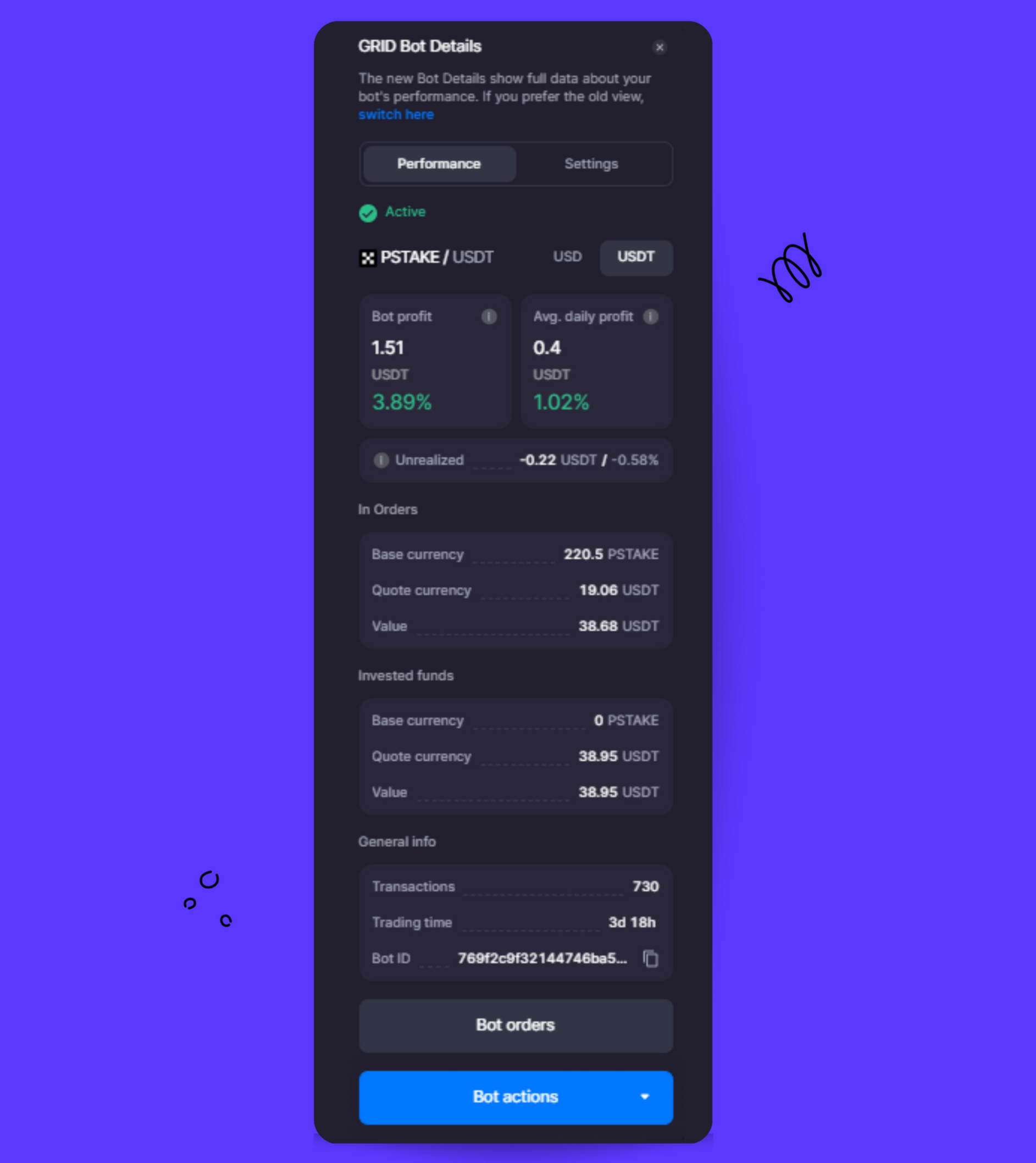

6. Should you wish to track your bot’s performance, click on it, and review the results in the window that opens on the right (Pic. 5).

The bot’s total and daily profit, the unrealized profit and loss (P&L), the amount of time spent trading, and the total number of trades are all shown here. If you click on [Bot orders], you’ll see all the bot’s completed trades. If you want to modify your running bot, click on [Bot actions]. To learn more about the bot’s stats, refer to this piece on our blog.

Ready to test drive the GRID bot from Bitsgap? Sign up for a seven-day free trial on the PRO plan today!

Bottom Line

The GRID trading strategy is one of the most straightforward and readily automated trading strategies that’s been tested and proven for years. It works by creating a grid of orders within a predefined trading range at incrementally increasing and decreasing levels from the asset’s current price. The logic behind the grid is very simple — you buy low and sell high. By using the Bitsgap GRID bot, you can fully automate the strategy and employ additional tools to secure your returns.

FAQ

Is Grid Trading Profitable?

Provided you’ve chosen an adequate market opportunity (a sideways trend) and taken great care setting up your grid, you’ll have all the chances of settling with good returns. Keep an eye on the grid as a whole instead of micromanaging every transaction inside it, and close your bot after it reaches a certain level of profit, say 10% or 15%.