Crypto Backtest Feature: Check Your Bot’s Performance

Bitsgap’s Backtesting feature allows you to analyze your bot’s performance in the past and adjust your settings to improve its performance going forward.

Bistgap has a fantastic tool to test your bot’s performance retrospectively and find out early on if your bot is going to perform well and run efficiently in the future.

With the Backtest feature, you can test your bot configurations and decide if you want to move with it for real. Intrigued? Let’s unpack it.

What Is Crypto Backtest

Crypto Backtest is a feature that analyzes how well your bot would have done in the past. In other words, backtesting assesses the effectiveness of your trading strategy with your bot’s chosen settings by discovering how it would play out using historical data.

If backtesting yields favorable results, you can have the confidence to apply it going forward. If not, you may adjust your settings until the results are favorable.

Benefits of Using Crypto Backtest

- Backtesting is one of the key components of developing an effective trading strategy. It gives you a clear overview of your bot’s performance in the past before committing to real capital.

- While manual backtesting is a labor-intensive and time-consuming process, automated Backtest runs against robust historical data sets in seconds and gives you better, sound-proof results free from manual errors.

- Backtest allows you to forecast your bot’s performance based on historical data and adjust your settings to yield better results in the future.

- Finally, Backtest helps you formulate the optimal trading strategy that leads to lower risks and higher returns.

How Does Crypto Backtest Work

With Bitsgap’s Backtest, you can analyze your bot’s performance based on historical data of a trading pair for a selected period.

Before launching your GRID bot using actual capital, you can use Backtest to understand its potential risks and profitability and adjust your settings accordingly.

The underlying theory in backtesting is that any strategy that did well in the past is likely to perform well in the future. Backtesting with positive results assures you that your strategy is fundamentally sound and is likely to be profitable if implemented.

👉 Conversely, backtesting with poor results signals you to alter or dismiss your strategy.

It’s important to note that the Backtest results should be used for reference only and are not always indicative of the bot’s future performance. However, the Backtest allows you to draw some sound conclusions about optimizing your bot’s settings and adjusting your strategy to yield better results in the future.

How to Use Backtest on Bitsgap

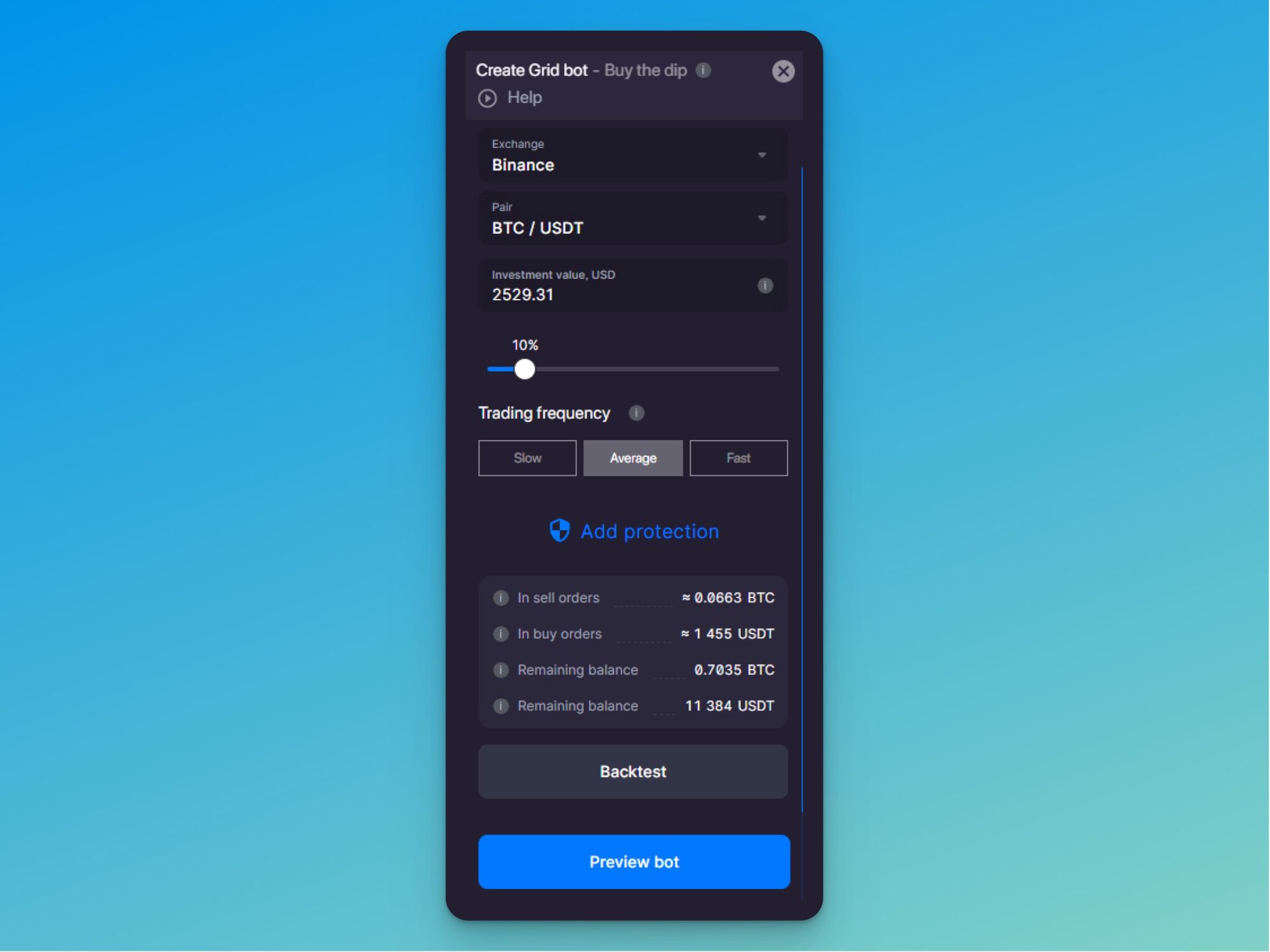

The Backtest feature is available in your bot’s settings (Pic. 1). So, whenever you want to start a new bot, you specify your settings and then run Backtest using the selected features and trading pair.

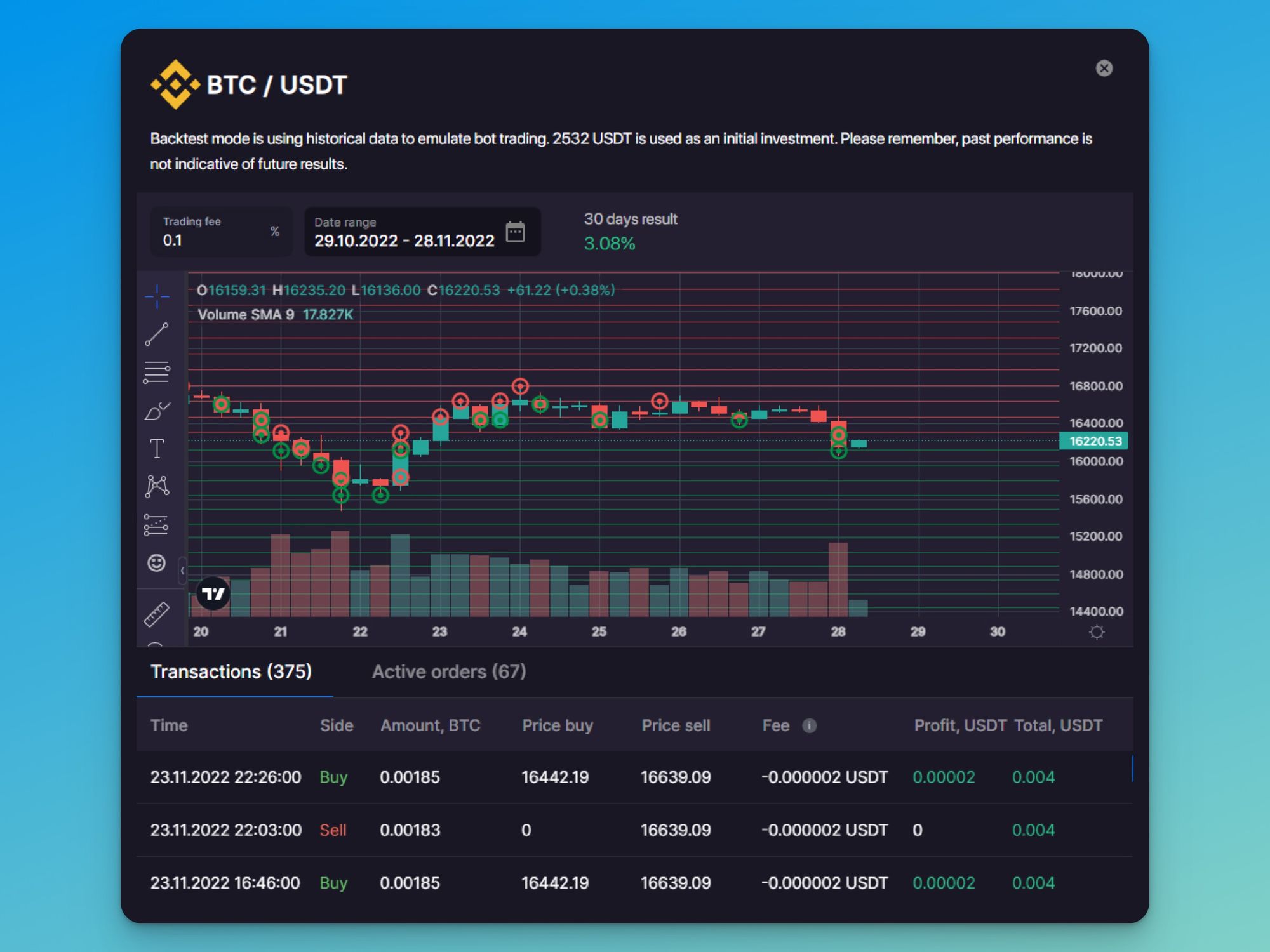

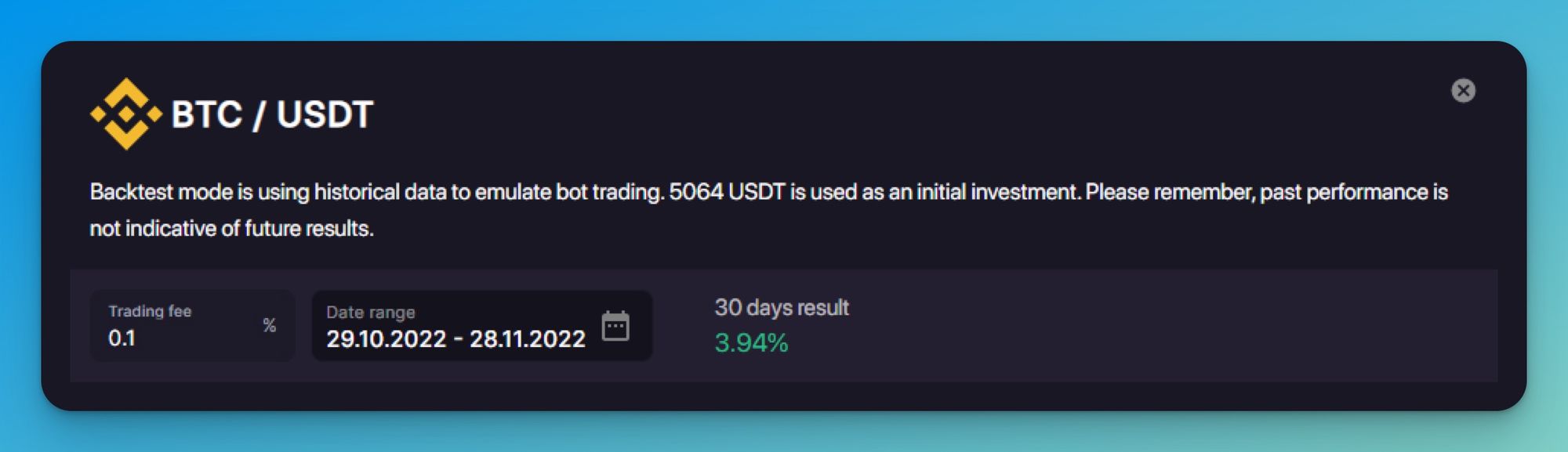

When ready, click the [Backtest] button to start your bot’s performance evaluation. In the window that follows, you can see how your bot would have performed if it started N days ago in the past (Pic. 2).

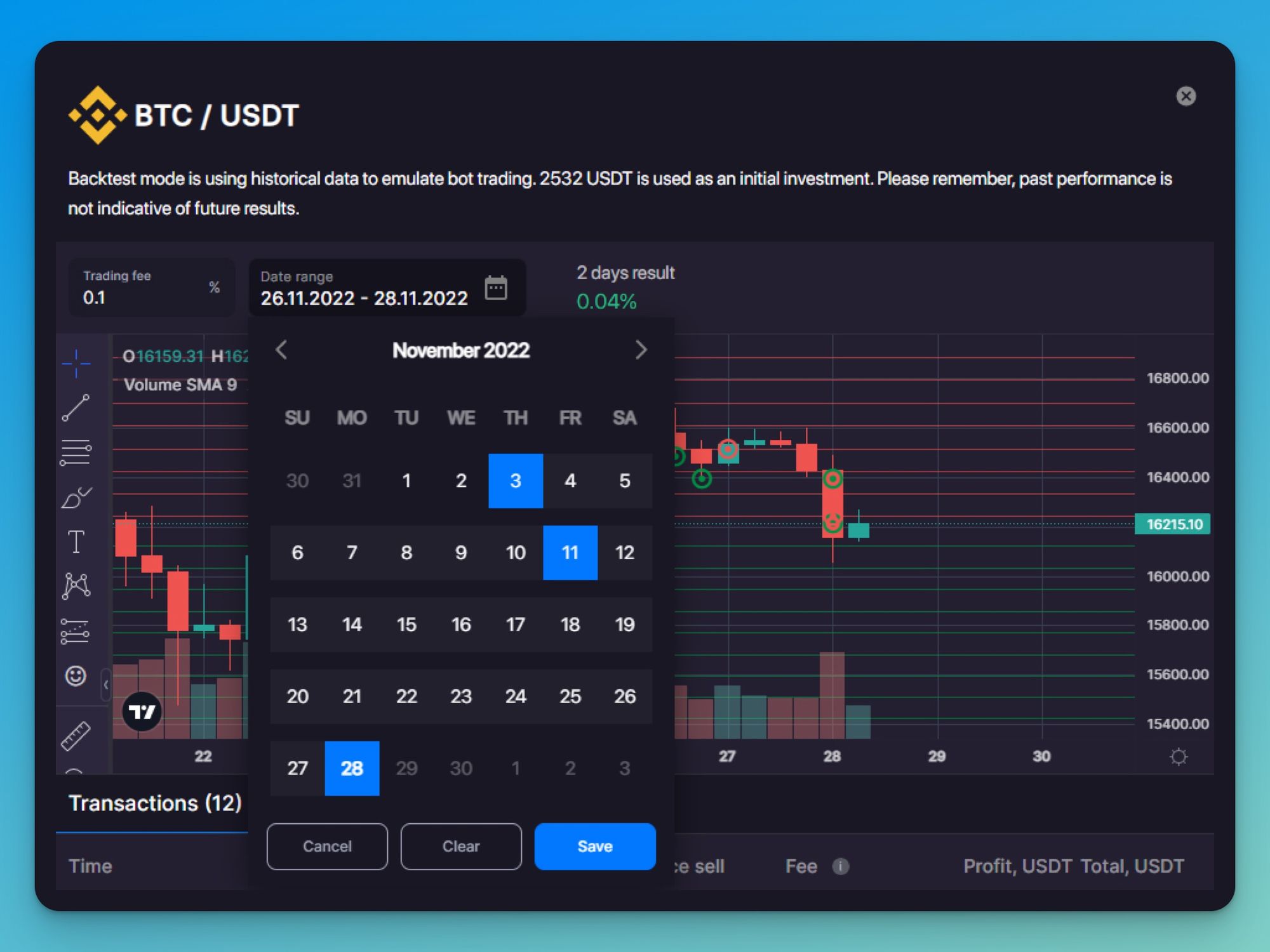

You can choose whatever time interval suits you best, up to 30 previous days from the current day of evaluation. Select your desired period using a calendar in the Data range section and click Save (Pic. 3).

The system automatically recalculates the bot’s performance using the chosen data range.

👉 If unsatisfied with the Backtest results, you can go back to your bot’s settings and adjust the GRID parameters (or trading frequency) and your initial investment to see how it affects your bot’s performance.

For example, if we use the investment of 2,530 USDT and the average trading frequency in the Buy the Dip bot, then our 30-day results yield an average of 3.08%. However, if we invest 5,061 USDT and choose a slower trading frequency, the bot’s results change to 3.94% (Pic. 4).

History tends to repeat itself. So learn from the past to apply favorable scenarios to the future. Once you find the configuration that worked on the old data, just click Preview bot and Confirm, and your bot will start working to make money immediately!

Want to learn more about the Backtest feature? Head to the Helpdesk for more information.

Eager to launch your bot and try the Backtest feature? Go to the platform by clicking the button below to start and test your new bot today!