How to Build and Monitor a Portfolio of Cryptocurrency Assets

Tired of lackluster crypto portfolio performance? This guide provides the know-how you need to assemble, monitor, and optimize a diversified portfolio using savvy asset selection and Bitsgap's powerful management arsenal.

Think buying crypto is a piece of cake now? Sure, accessing coins is easier than ever. But crafting a killer crypto portfolio? That still takes skill.

Factors like asset allocation, risk management, and portfolio balancing require thoughtful strategy. Without the right know-how, it's easy for profits to slip away.

This guide will equip you to build, track, and adapt a stellar crypto portfolio. You'll learn proven methods for asset selection, diversification, and risk adjustment. We'll also explore Bitsgap’s versatile arsenal of cutting-edge tools that enable effective portfolio management. Ready to play the portfolio game at a whole new level? Let's dive in.

What Is a Crypto Portfolio?

A crypto portfolio represents your personal stake in the digital asset landscape — the mix of cryptocurrencies you hold as investments. Just like a traditional portfolio balancing stocks and other assets, your crypto holdings reflect your goals, risk appetite, and market outlook.

You tailor your portfolio by selecting from thousands of coins and tokens, like Bitcoin and Ethereum along with emerging altcoins. Some favor bluechip cryptos for stability while others invest in newer, higher-risk assets for potential gains.

Effective management of a cryptocurrency portfolio involves diversification to mitigate risk, regular review and rebalancing to adapt to market shifts, and staying informed about the latest industry trends and technological developments. The aim is not just wealth storage, but growth through strategic crypto selection and allocation.

How To Build a Crypto Portfolio

Creating a crypto portfolio requires navigating trade-offs between risk and reward. Here's a structured approach to building a portfolio aligned with your investment goals:

- Know Your Aims: Outline your financial objectives, time horizons, and appetite for risk. Will you focus on long-term portfolio growth or target short-term profit taking? Defining your investment goals and preferences is essential for shaping strategy. You may look for insightful tips on choosing the right strategies for your investments here: Your Basic Guide to Long-Term Riches.

- Build Your Knowledge: Research the array of cryptocurrencies, like bluechip coins Bitcoin and Ethereum, alternative altcoins such as Litecoin and Cardano, and application tokens representing blockchain projects. Learning about crypto asset types will empower informed portfolio decisions. Looking for fresh ideas and interesting projects? This guide might help: Interesting Blockchain Projects for Investment 2024

- Build a Stable Core: Consider anchoring your portfolio with major cryptocurrencies like Bitcoin and Ethereum. Their sizeable market caps and liquidity often make them foundational holdings.

- Spread the Risk: Avoid overexposure by allocating across various cryptocurrencies. Diversification insulates your portfolio from volatility and isolated asset collapse.

- Add Calculated Risk: Devote a small share to higher-risk, high-potential cryptocurrencies or tokens. These assets can represent fledgling technologies and projects with room for substantial growth.

- Strategic Apportioning: Determine target allotments of capital for each holding. A prudent approach allocates more to established assets, and less to speculative ones with higher risk profiles.

- Counterbalance Shifts: Crypto's volatility can skew your portfolio's ratios. Rebalance periodically to restore target allocations. Quarterly, bi-yearly or annual reviews provide discipline based on your goals.

- Mitigate Downside: Employ risk-control methods like stop-losses and prudent position sizing. Cryptocurrencies can see extreme volatility — invest sensibly. For more insights into effective risk management, read the guide: Balance Risk & Reward Like a Pro

- Mind the Developments: Stay current on market news, trends and innovations. The crypto landscape changes swiftly — remaining informed enables astute portfolio decisions.

- Adapt With Agility: Regularly review your holdings as objectives or market dynamics shift. Be ready to take gains or cut losses as needed. An adaptive approach keeps your portfolio aligned with evolving conditions.

- Lock It Down: Use hardware wallets for sizable holdings. Enable multi-factor authentication on exchanges. Prioritize robust security measures to protect your assets from theft and loss. Learn about Bitsgap’s advanced security protocols and uncompromising focus on customer safety by reading 5 Layers of Security.

- Mind the Taxes: Know your jurisdiction's crypto tax obligations. Meticulously log transactions to satisfy capital gains reporting requirements. Tax awareness helps ensure full compliance. For more information on taxes, check out this guide: The ABC of Crypto Tax

Constructing a crypto portfolio is a fluid process demanding active management. With diligent stewardship, your holdings can mature in step with the rest of this exciting asset class. Hopefully, by starting to follow the steps outlined above, you’ll be on track to make your portfolio shine in no time. Need further guidance? Then read on.

What an Ideal Crypto Portfolio Should Look Like?

Crypto portfolios are highly personal, dependent on one's risk appetite, goals, timeframe, and market expertise. While optimal holdings vary investor to investor, certain principles apply:

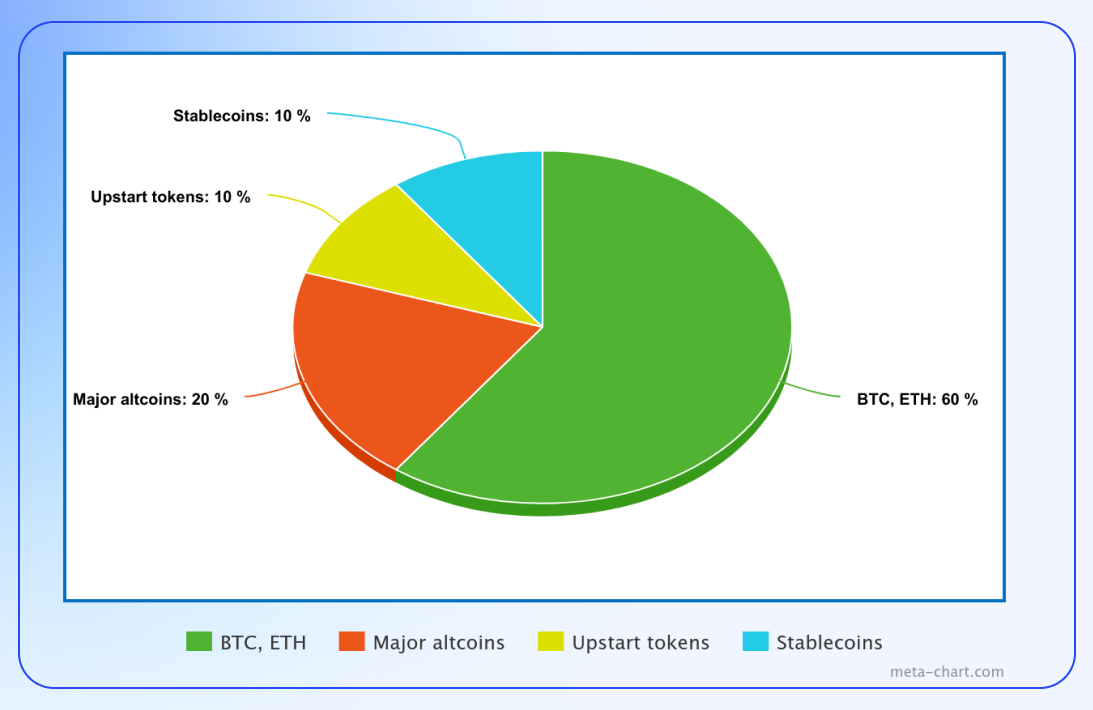

- Core Holdings (50-70%): The majority is often allotted to Bitcoin (BTC) and Ethereum (ETH) — established market leaders boasting the highest market caps and relative stability versus other cryptos.

- Major Altcoins (20-40%): These are well-established cryptocurrencies with solid market caps and liquidity next to BTC and ETH. Examples include Binance Coin (BNB), Cardano (ADA), Solana (SOL), and Polkadot (DOT). They offer both stability and good growth potential.

- Upstart Coins and Tokens (5-20%): These smaller market cap assets have elevated risk but also greater possible gains. They often represent new crypto sectors like DeFi (decentralized finance), NFTs (non-fungible tokens) and Web3 innovations.

- Stablecoins (0-10%): Holdings may incorporate stablecoins such as USDT, USDC or DAI. These reduce volatility during downtrends while enabling swift capital deployment into fresh opportunities without fiat conversion.

- Other Considerations:

- Align with Risk Tolerance: Aggressive investors may allot more capital to speculative altcoins. Conservative investors often favor larger core asset concentrations. Portfolio composition should fit your risk profile.

- Diversify Across Sectors: Look beyond market capitalization to diversify into different crypto sectors like privacy, supply chain, finance and entertainment.

- Time Horizon: Long-term investors may prioritize assets with robust fundamentals and vision. Short-term traders often favor technical analysis of price action and sentiment. Consider timeframe when assessing investments.

- Liquidity: Keep part of your portfolio in assets with high liquidity that can be exited swiftly if needed. Liquidity enables agility.

Of course, there’re many more philosophies for constructing a crypto portfolio beyond the principles discussed. Some apply the 80/20 rule, allocating 80% to blue chip cryptos like Bitcoin and Ethereum and 20% to higher risk, high reward mid and low cap assets. Others use a 40/30/30 split — 40% top cryptos, 30% large caps, 30% mid/small caps for amplified risk-return. Others swear by diversification, highlighting the necessity to spread investments over a variety of cryptos by sector and utility, such as payment coins (e.g., Bitcoin, Ripple), financial crypto products, and smaller crypto tokens with growth potential.

Whatever method you choose, remember that the ideal crypto portfolio is a moving target, morphing with the market and tailored to your specific risk tolerance and goals. While aggressive traders seek maximum gains, conservative investors prioritize capital preservation. Regardless of strategy, best practices apply.

Stay vigilant — success requires continuously tracking advancements in blockchain technology and shifts in the regulatory landscape. No portfolio is static. Rebalance periodically to align with your objectives as they evolve. Don't fall prey to overconfidence; cryptocurrency's volatility commands modesty.

Mitigate downside through prudent risk management tools, never allocating more than you can afford to lose.

Where Can I Look for the Best Crypto Portfolios?

Building an effective crypto portfolio requires researching and evaluating strategies. Useful avenues to find and analyze model portfolios include:

- Social Trading Platforms: Follow top-ranked veteran traders and mirror their strategies through platforms like eToro that enable social investing features. The performance and risk metrics help identify portfolios worth emulating.

- Cryptocurrency Portfolio Trackers: Platforms like Delta and CoinStats let you monitor crypto investments. Some provide model portfolios or enable followers to view and replicate high-performing portfolios from their user community.

- Forums and Social Media: Crypto-focused forums like Bitcointalk, Reddit communities (such as r/CryptoCurrency and r/CryptoMarkets), and social media platforms (Twitter, Telegram groups, Discord channels) are great places to see what portfolios others are creating and why they choose certain allocations.

- Cryptocurrency News and Analysis Sites: Websites that provide news, analysis, and insights, like CoinTelegraph, CoinDesk, and CryptoSlate, sometimes feature articles on portfolio strategies and market trends.

- Financial Advisors and Crypto Hedge Funds: A growing number of financial advisors provide personalized crypto portfolio guidance. Crypto hedge funds and asset managers may also reveal sample holdings, offering perspective on professional-grade allocation strategies.

- Crypto Indices: Index products like the Bitwise 10 Crypto Index or Grayscale Digital Large Cap Fund exemplify broad market exposure. Their construction provides diversified allocation models for reference.

- Educational Platforms and Courses: Crypto investment courses on sites like Coursera, Udemy, and specialized learning platforms will often analyze sample portfolios, providing instructional exposure to various allocation strategies.

- Research Papers and Reports: Look for research papers from financial institutions and universities, as well as industry reports that may include sample portfolios or discuss optimal portfolio diversification.

- Influencers and Thought Leaders: Crypto luminaries frequently divulge portfolio allocations, but treat recommendations with prudent skepticism. Let their perspectives inspire reflection rather than blind adherence.

- Automated Investment Services: Crypto robo-advisor services like ICONOMI algorithmically construct and manage portfolios, exemplifying automated balanced asset allocation. Study their model portfolios for insights.

Remember, there is no universally "best" crypto portfolio; what's best for others may not be best for you. It's important to always do your own research (DYOR) before adopting any investment strategy.

How to Monitor Your Cryptocurrency Portfolio

Actively monitoring your crypto portfolio is vital for performance tracking, data-driven decisions, and responding to changing conditions. Besides the above-mentioned crypto portfolio trackers, consider employing these effective tactics:

- Set Up Price Alerts: Get notifications from portfolio apps and exchanges when target crypto assets hit designated price thresholds. This keeps you updated on material movements without nonstop market-watching. Technically adept users can connect exchange APIs to portfolio trackers for automated syncing of transaction data and holdings.

- Regularly Rebalance: Review and rebalance your holdings on a regular cadence like monthly, quarterly or biannually. This realigns the portfolio to target allocations based on your strategy.

- Market Research: Stay current on market conditions through crypto news sources, social media, forums etc. This contextualizes portfolio performance and allows anticipating trends.

- Keep Records for Tax Purposes: Log details like dates, amounts, and rates for every trade. This supports tax reporting and tallying capital gains/losses.

- Diversification Analysis: Regularly evaluate portfolio composition to confirm adequate diversification and avoid overconcentration in particular assets or sectors.

- Performance Benchmarks: Gauge returns versus relevant benchmarks like Bitcoin price growth, total crypto market capitalization increases, or comparable portfolios.

- Security Checks: Verify account and asset security through periodic reviews. Update wallet passwords, back up private keys, and use hardware wallets for substantial holdings

- Reflection and Adjustment: Re-examine the logic behind each position. If the original thesis no longer applies, reassess whether it should remain in the portfolio.

- Track Your Trades: Review trading patterns periodically. You may uncover behaviors to refine strategy, like overtrading or emotional decision-making.

- Risk Assessment: Frequently analyze portfolio risk as market dynamics shift. Risk profiles of various crypto assets can change over time, demanding updated assessments.

Proactive tracking, informed analysis and periodic adjustments keep your crypto portfolio aligned with targets and evolving conditions. The market’s movements may be out of your control, but your mindset and process for steering your portfolio is not.

Which Tools Does Bitsgap Have for Tracking & Monitoring Crypto Portfolio?

For the uninitiated, Bitsgap is a crypto trading platform that aggregates exchanges and enables sophisticated trading across venues via a unified interface. Beyond basic trading, it provides robust portfolio tracking and bot performance monitoring, allowing comprehensive real-time oversight of holdings and automated strategies. Here we’ll explains how to use this robust toolset.

First and foremost, you can monitor the real-time performance of your Bitsgap bot by checking the profits it has accumulated since launch, understanding the distribution of assets it manages, and seeing how prevailing market prices impact the value of the funds managed by the bot.

You will find the bot's "Performance" window on the right-hand side whenever you click on your bot (Pic. 2).

Here, assess the bot's operational effectiveness and scrutinize its results. With the most recent update, it's not just about the raw data anymore; you can now get a dynamic view of your bot's performance through an interactive profit chart and asset allocation graphic. These tools offer crucial perspectives on your bot's profit-making ability and how it allocates assets.

The chart will display the average daily profit, which represents the bot's daily earnings on average, calculated by dividing the total profit your bot has made by its trading duration. Position PNL reflects the potential gains or losses due to price fluctuations of the base currency within the bot's open orders. These gains and losses are provisional until the bot concludes its operations by executing a sale or purchase of the base currency at the prevailing market rate. For a more tailored analysis, you can select different time intervals on the chart to dissect the bot's performance across various periods.

The “Position” block provides key data points including:

- “Position PNL” — Unrealized profit/loss shown in absolute terms and percentage.

- “Amount” — Total funds allocated to active orders in the traded currency.

- “Entry price” — Average cost basis of the current traded currency position.

The "Asset allocation" section (Pic. 3) provides a snapshot of the base and quote currencies currently tied up in open orders, alongside the profit generated and the cumulative value of the funds you've traded.

- “Profit”— the aggregate sum of actual profits the bot has secured since you first set it in motion.

- The "Position" — the current quantity of the base currency that your bot is holding. The percentage displayed as "Position %" indicates your "Position PNL," which is the unrealized profit you have at that point.

- “Orders” — the amount of quote currency that is locked in active orders.

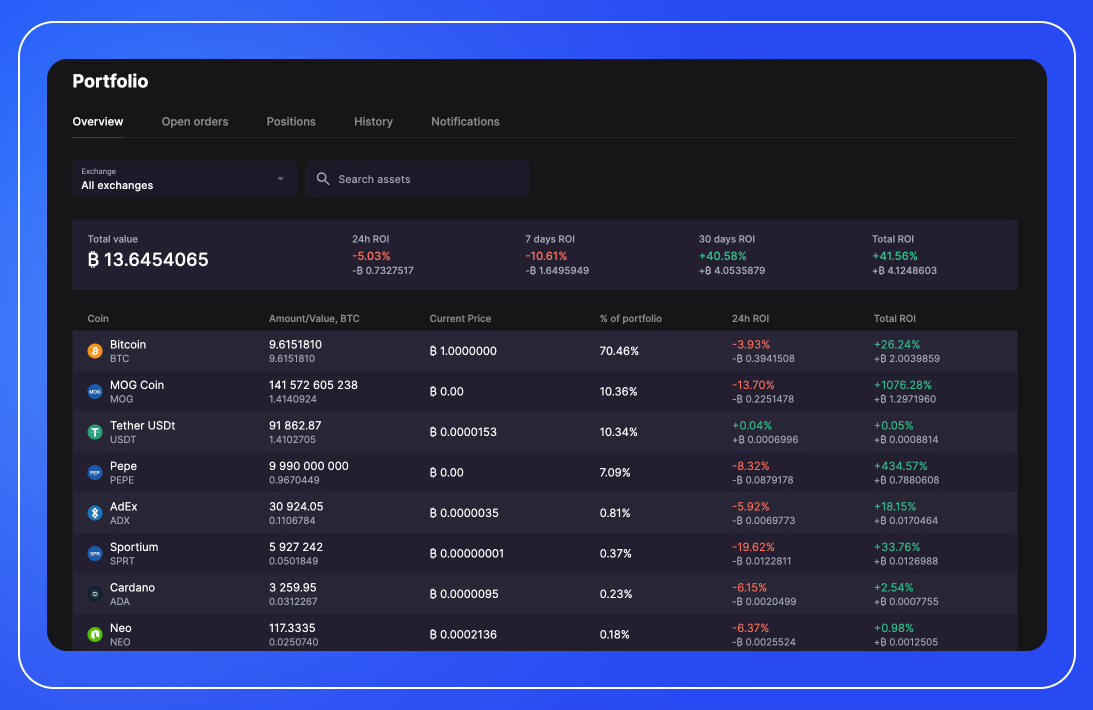

In addition to bot tracking, Bitsgap provides portfolio-level monitoring (Pic. 4) with key metrics including:

- 7, 30-day, and total ROI - Short, medium and long-term return on investment figures.

- Asset allocation percentage - The proportion of total portfolio value held in each asset.

- Total portfolio value - Aggregate value across all holdings.

These portfolio-wide statistics, alongside granular asset breakdowns, are vital for comprehending overall investment performance and asset distribution. This holistic perspective complements detailed bot analytics for comprehensive oversight.

If that sounds good, then you can take Bitsgap for a spin (free, no credit card required, and no strings attached) for the whole week, and then choose whatever plan suits your needs and budget best. See what it feels like to have a centralized hub to execute cross-exchange trades, create automated bots, and monitor your portfolio's every move through dynamic charts and metrics.

Conclusion

Building a thriving crypto portfolio is part art, part science. The art lies in cultivating a mindset of flexibility, curiosity, and embracing calculated risk. The science comes from strategically balancing stability and growth potential.

Blend core holdings like Bitcoin and Ethereum to anchor your portfolio. Complement them with a selection of promising altcoins for their disruptive capabilities. Diversify across market caps, industries, and blockchain niches to allow opportunities to surface. Incorporate stablecoins to enable smooth entries and exits.

Rebalance periodically as projects and markets shift. Continuously learn, track trends and adapt. Construct your portfolio as a living, breathing entity. Patiently executed, a balanced crypto portfolio transcends short-term volatility and manifests long-term visions.

FAQ

What Is a Portfolio Token?

A portfolio token, in the context of cryptocurrencies, is a type of digital asset that represents a diversified basket of other cryptocurrency assets bundled into a single token. This concept is similar to traditional finance's exchange-traded funds (ETFs) or mutual funds, where investors can buy a single asset that provides exposure to a group of underlying assets.

The idea behind a portfolio token is to offer investors an easy and convenient way to diversify their holdings without having to purchase each individual cryptocurrency. When an investor buys a portfolio token, they effectively own a share of the entire portfolio that the token represents.