Cryptocurrency Tax Obligations for Automated Trading

Are you an automated cryptocurrency trader? You may owe taxes on your trading profits, but determining your tax obligations can be complex. This article outlines the key tax implications you need to know about cryptocurrencies and automated trading.

In this article, we discuss tips for record keeping and tax reporting for your automated crypto trading strategy.

Automated cryptocurrency trading platforms such as Bitsgap and others of its ilk have gained traction as the cryptocurrency market has evolved. These tools can significantly amplify your cryptocurrency profits. Yet, the tax reporting process can turn into a daunting task, particularly for traders transacting dozens, hundreds, or even thousands of trades across various exchanges. This guide provides insights on maintaining records and handling tax reports for your automated crypto trading approach.

Understanding The Tax Implications of Cryptocurrencies

Broadly, authorities consider digital currencies such as bitcoin as assets or investments. Just as if you were playing the stock market, when your digital gold swells in value and you decide to cash in, the shadow of the capital gains tax looms over your profit. Likewise, if you earn these digital nuggets through methods such as staking, the taxman's hand will extend towards your earnings, expecting its share in the form of income tax.

👉 NB: In this piece, our main focus will be on the taxation landscape of bitcoin and its ilk in the United States. Should your residence fall outside this region, we highly recommend seeking information from resources specific to your legal jurisdiction.

As previously noted, the US tax system subjects cryptocurrency to two types of taxes: capital gains tax (when you sell your cryptocurrency) and income tax (when you earn cryptocurrency).

The specific tax bracket you fall into, based on your personal income, and the duration you've held your crypto assets (short term versus long term), will influence the tax amount and the percentage you pay on your crypto income. This varies from investor to investor and can be impacted by conventional income sources like stocks, salary, and other investments.

If you earn cryptocurrency or sell your crypto within less than a year of acquisition, the tax rate will range from 10-37%. Conversely, if you sell your cryptocurrency after holding it for over a year, the tax rate will range from 0-20%.

However, not every cryptocurrency transaction triggers a tax event! There are no taxable events when you:

- Hold cryptocurrency

- Purchase cryptocurrency with fiat currency and keep it

- Transfer crypto from one personal wallet to another

- Use cryptocurrency as collateral for a loan

Tax Reporting for Automated Traders

In the U.S., income, including from crypto, is not subject to a uniform tax rate. Instead, taxpayers pay varying tax rates on different portions of income as they move up the tax brackets. For instance, a taxpayer with an annual income of $35,000 will pay 10% tax on the initial $10,250 and 12% on the remaining $24,750, amounting to $3,995 in tax.

While this may appear to be a straightforward computation, maintaining a record of your profit and loss in terms of the US dollar (or your domestic fiat currency) across all your crypto-to-crypto exchanges can be challenging, particularly if you trade on multiple platforms. Therefore, for algo traders aiming to streamline their year-end tax reporting, meticulous record-keeping is essential.

Record-Keeping Tips for Crypto Traders

The most critical document you need to maintain is your transaction history from each exchange you've traded on during the year. Fortunately, most cryptocurrency exchanges facilitate this by enabling users to export a CSV (or Excel) file, which includes records of every transaction and trade made during the year.

Storing this file can substantially simplify your tax reporting and the calculation of your capital gains or losses.

However, be wary if you're using decentralized exchanges, as they may not provide a downloadable trade history report. In such situations, it may be necessary to manually record your trades.

When the year ends, you can transfer your trading history files from your exchanges into your preferred cryptocurrency tax software tool, or you could manually compute the figures using a spreadsheet editor.

As another option, you could employ dedicated cryptocurrency tax software such as CoinLedger. This software entirely streamlines the tax reporting process for cryptocurrency investors, much like Bitsgap, by seamlessly integrating and interacting with top cryptocurrency platforms. With just a click, you can import all your past trade data from your respective crypto exchanges. Leveraging this historical data, CoinLedger will automatically generate all the required tax reports.

You could also choose to peruse our subsequent section titled "Crypto Tax Software Tools" for a more automated approach to your needs.

What Tax Forms Do You Need to Complete?

Capital gains or losses from your cryptocurrency trading activities should be declared on the IRS Form 8949.

Form 8949 is the designated tax form for reporting transactions involving capital assets, such as cryptocurrencies, along with stocks and bonds.

For a comprehensive guide on completing Form 8949, refer to this blog post: "Reporting Cryptocurrency to the IRS".

Regrettably, ordinary income is not as straightforward to report as capital gains with Form 8949.

The ordinary income derived from activities like mining, staking, interest accounts, or work compensation is typically reported on different tax forms, depending on your circumstances.

- Schedule C: If you have earned cryptocurrency through business operations such as contract payments, operating a cryptocurrency mining setup, or running a node, it's usually classified as self-employment income and should be reported on Schedule C. It also enables you to deduct business expenses like electricity used for mining.

- Schedule B: If you have earned income from staking or interest rewards from lending your cryptocurrency, it's generally reported on Schedule B.

- Schedule 1: If you have earned cryptocurrency from airdrops, forks, or other hobby-related crypto income, it's usually reported on Schedule 1 as other income. (This is not subject to self-employment tax.)

You can also learn more about crypto taxes by perusing this definitive guide: Crypto Tax Guide for the USA 2023.

Crypto Tax Software Tools

To ensure your cryptocurrency investment activities are free of tax mistakes, we handpicked a list of some of the best cryptocurrency tax software tools. These tools cater to a range of activities from mining to trading, offering automated tracking for all transactions. They also allow for the generation of reports that are ready for submission to your accountant or directly to the IRS.

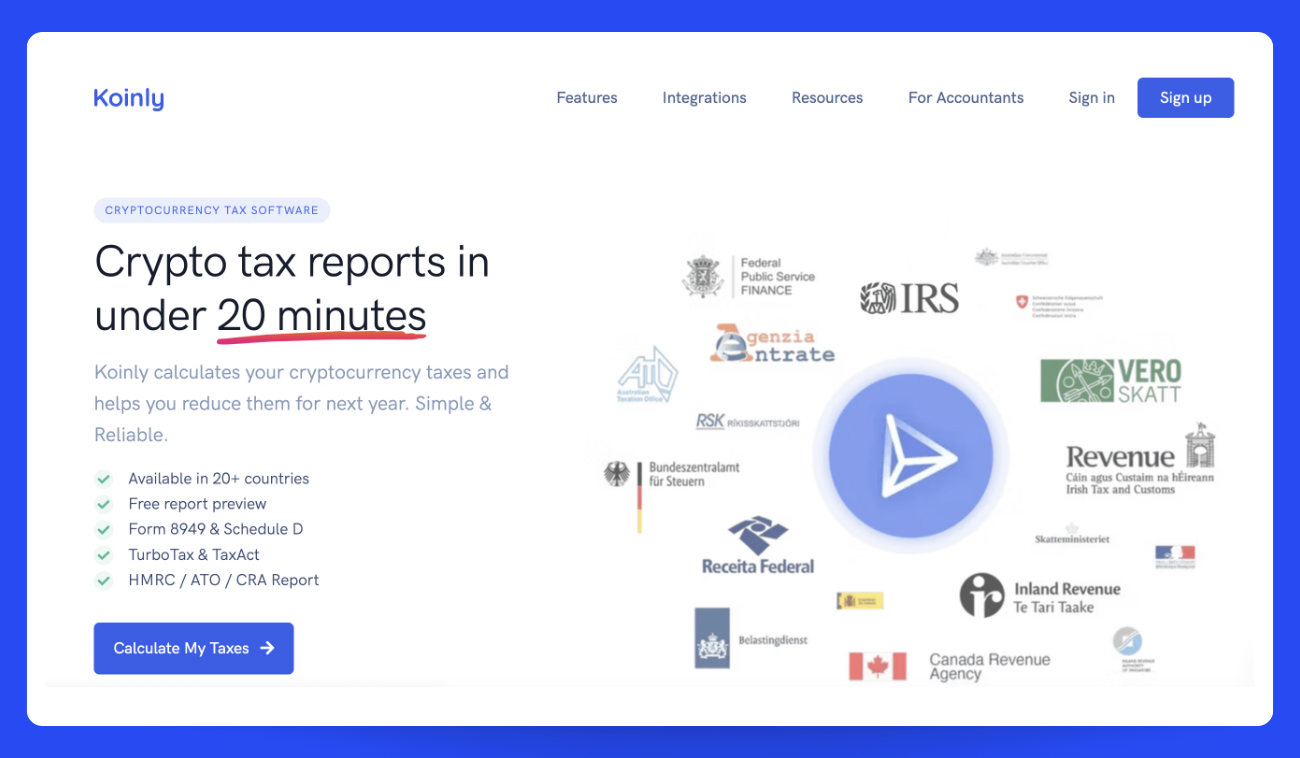

Koinly

Koinly's seamless integration with a multitude of exchanges and wallets ensures not a single transaction slips through the cracks. Its automated data importing system meticulously tracks and reconciles every fee on your exchanges, leaving no room for error.

But Koinly doesn't just specialize in calculation and report generation. It also boasts advanced transaction filtering and sorting, empowering you to pinpoint precisely which transactions led to specific gains.

Linking your wallets and exchanges is a breeze. Simply upload a .csv file or use the API to connect your investment accounts, and watch as the software imports all your data effortlessly.

Compatible with over 300 exchanges and wallets, Koinly stands out as one of the most accessible and versatile crypto tax software options out there.

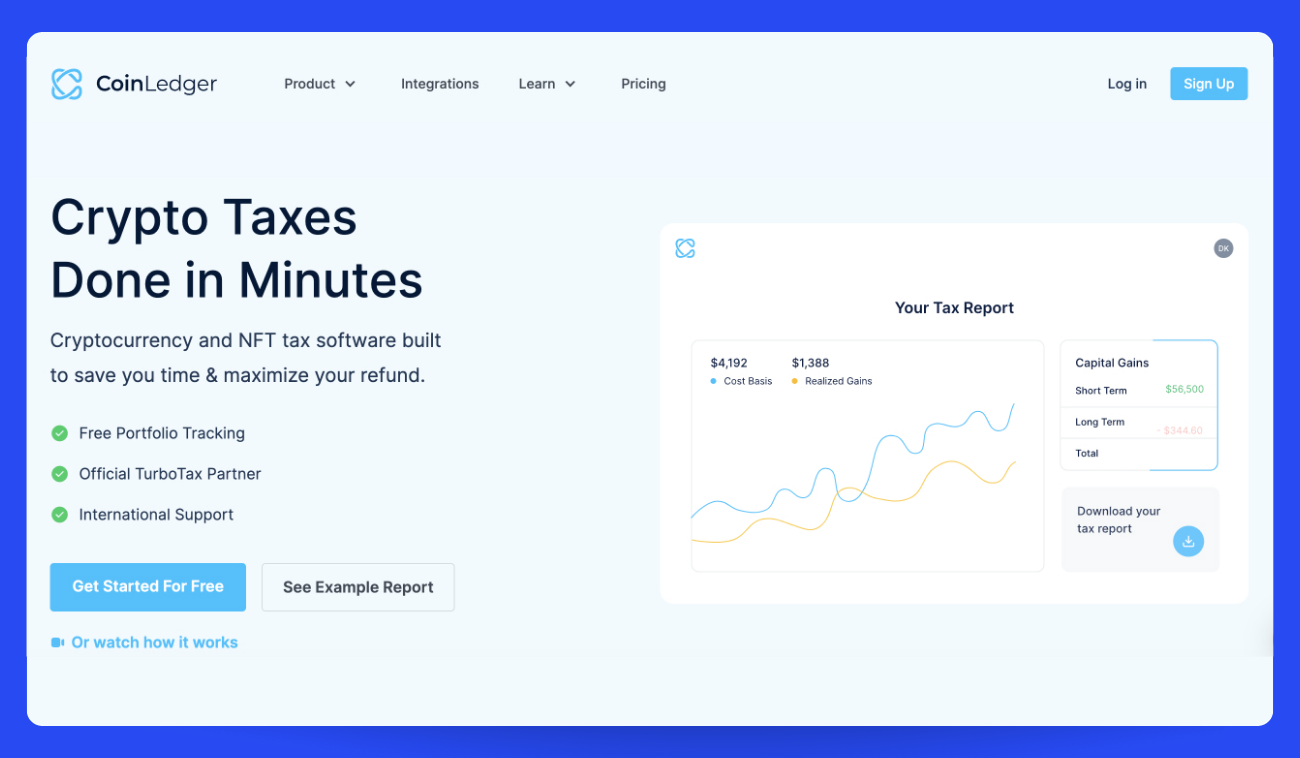

CoinLedger

With over 300,000 satisfied users and unlimited exchange support, CoinLedger is a crypto tax prep powerhouse.

Real-time profit and loss tracking allows you to stay on top of your crypto tax situation 24/7. CoinLedger seamlessly imports your transaction data from all your crypto platforms and generates a downloadable tax form for your records or to send to your accountant. It doesn't get easier than that!

With support for a whopping 10,000+ cryptocurrencies across countless global exchanges and wallets, CoinLedger has you covered no matter your trading scope. You'll also benefit from handy tax-loss harvesting assistance, crypto tax tips, and robust auditing tools.

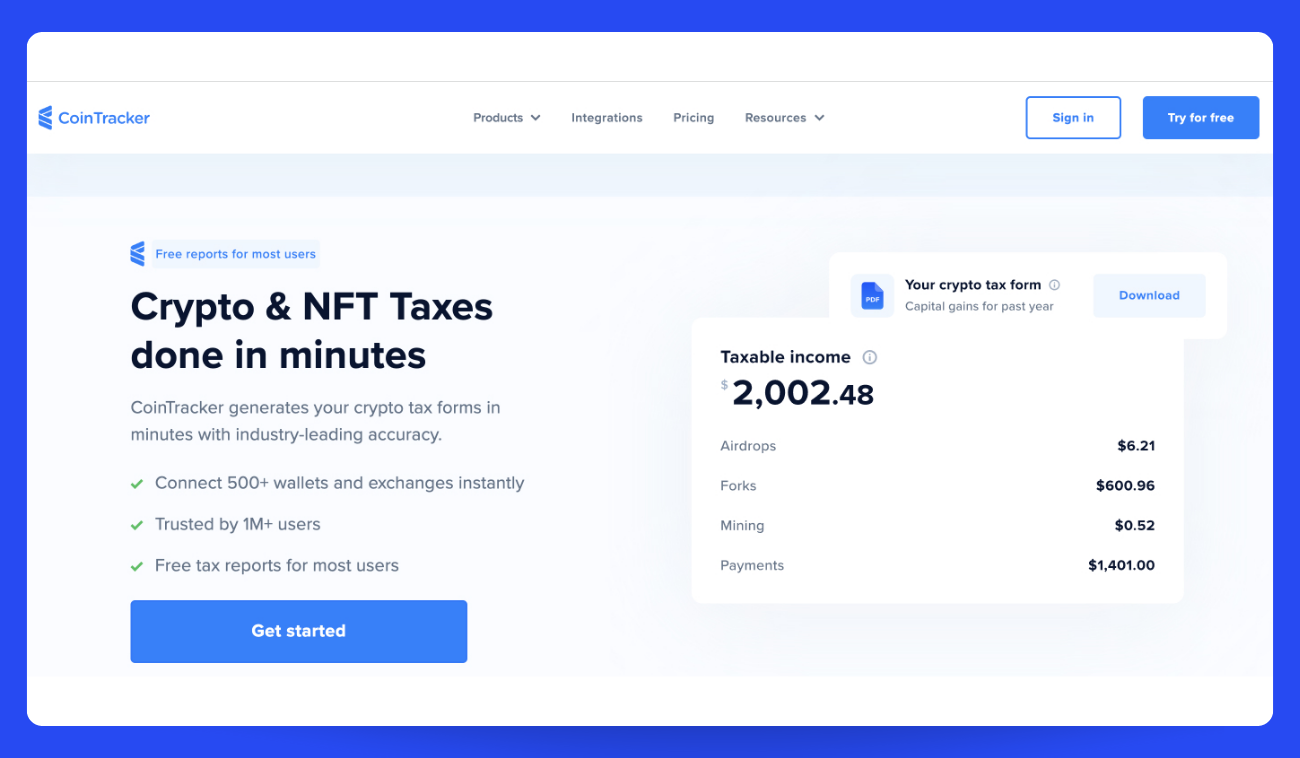

CoinTracker

With over one million happy users, CoinTracker stands out as a leading crypto tax software. It simplifies portfolio tracking, transaction importing, and harnessing tax savings through loss harvesting.

In just minutes, you can generate ready-to-file tax reports for TurboTax or your accountant. Calculate capital gains, profits, and losses with ease. The unlimited plan even provides personalized CPA support.

CoinTracker shines with comprehensive customer service across the US, UK, Canada, Australia, India, and beyond. With coverage for a whopping 10,000+ cryptocurrencies, CoinTracker has you covered no matter your trading landscape.

In Conclusion

Reporting taxes on cryptocurrency is a relatively uncomplicated procedure, but it can become more laborious with an increase in the number of transactions across various exchanges. Nonetheless, there's no cause for alarm. With meticulous record keeping and automated software, you can ensure a smooth and effortless reporting process when the year comes to a close.

Looking for an Automated Trading Platform?

Hey friend, have we got an awesome opportunity for you!

Bitsgap is THE platform to automate your crypto trades and take your investing to the next level. This powerhouse brings together 17 top exchanges so you can effortlessly trade across multiple platforms. Plus, our smart automation tools let you create customized bots using any strategy — DCA, GRID, you name it! Set it and forget it while your bot works around the clock to grow your gains.

Don't know where to start? No worries, our Strategy Suggestions use backtesting to recommend proven profitable setups. Just pick one, click start, and watch the profits roll in.

So what are you waiting for? Try Bitsgap now and take the hassle out of trading! With tools this great at your fingertips, making money in crypto has never been easier. The future is automated — let's get started!

FAQs

How Are Crypto Gifts Taxed?

In case you're in a giving mood and thinking about bestowing some cryptocurrency onto a loved one, you'll be relieved to know that it won't usually trigger any extra tax liabilities. Typically, the taxman doesn't take a bite out of cryptocurrency gifts until the benefactor has been overly generous to the tune of over $12.92 million in their lifetime. And don't worry, the person on the receiving end of this digital windfall is never liable to pay taxes for simply accepting your gift.

That said, if you're planning to shower any individual with cryptocurrency presents exceeding a fair market value of $16,000 within a given year, be prepared to fill out a gift tax return alongside your usual tax documentation. But take a breath, this form is essentially for bookkeeping and doesn't automatically mean you'll have to fork out any tax on your generous gesture.

How Are Crypto Donations Taxed?

Get pumped, crypto donors — your donations come with sweet tax perks! When you give crypto to registered charities, it's not considered a taxable disposal. Even better, you can claim your donation as a tax deduction!

If you're deducting over $500, just report it on Form 8283 — no biggie.

Now here's the really exciting part — the amount you can deduct depends on how long you held the crypto:

- Held less than a year? Deduct the lower of the fair market value or your cost basis.

- Held over a year? Deduct the lower of the fair market value or your cost basis.

See, nothing to fear! Just more tax advantages to feel good about when you donate crypto to great causes.

How Are Stablecoins Taxed?

Although stablecoins were specifically engineered for transactional purposes, they are subject to the same tax laws as other digital currencies. When you part ways with your stablecoin, you may experience a capital gain or loss, although given their nature, any capital gain is likely to hover around none.