Earn More with the Bot Strategies Widget

Explore the power of Bitsgap's preconfigured bot strategies. Select from hundreds of trading strategies and earn more from your crypto trading.

Welcome to the new platform’s widget, Bot Strategies! The widget lets you choose predefined profitable strategies to instantly earn more from trading crypto.

You’ve probably noticed that the Bitsgap platform has recently welcomed a new, fantastic addition to its functionality called Bot Strategies.

The new widget allows you to use an advanced filter to customize the sorting of predefined bot strategies depending on the type of bot, connected exchanges, available balance, and desired trading direction (Long or Short).

Let’s look into the new functionality in more detail to help you understand how it works.

What Is the Bot Strategies Widget and How Does It Work?

Bot Strategies is a new widget that displays and lets you choose the best of the available preconfigured trading strategies based on your preferences and expected profit percentage.

The system picks up strategies automatically for both the demo and live trading modes, with no difference between the two.

How Does the System Calculate & Select Strategies?

The system selects and displays strategies based on historical data of asset price changes over a period of time specified in the filter (30, seven, or three days).

The approach is quite similar to running a backtest: the system constructs a grid based on previous data to model the bot's activity, then uses that grid to determine the ideal settings and predict the bot's profit. In other words, the algorithm searches for high and low values within a specified time frame (here — 30 days, 7 days, or 3 days), then builds bot grids with varying steps, tests them, and chooses the one with the optimal ratio of trading volume to profit. In addition, the algorithm sorts trading pairs according to trading volume and intensity.

👉 It's important to remember that Backtest and Bot Strategies outcomes may vary. When doing a manual backtest, we always begin on the first day at 00:00:01 and end on the final day at 23:59:59. In Strategies, if we start at 12:00 on July 10 (the last day of the period) and rewind three days, we’ll arrive at 12:00 on July 7 (we'd have a full day if we did a manual backtest). This explains the difference.

Where Do I Find Bot Strategies?

When you click on the [Bots] tab, you’ll automatically see the BTC/USDT in the middle of the interface and the Bot Strategies widget to your right. If you open a bot launcher or select an active bot, the Strategies widget moves down (Pic. 1):

The Bot Strategies Widget Components

If you click on any specific strategy, you’ll see a bot launcher with the strategy’s predefined settings. You have two options — either swiftly launch the bot with the specified parameters or tamper with the settings.

👉 Please note that strategies do not account for extra features like Trailing Up, Trailing Down, Stop Loss, and Take Profit, so if you want to configure those and other additional settings, you’ll need to do so in [Manual adjustment].

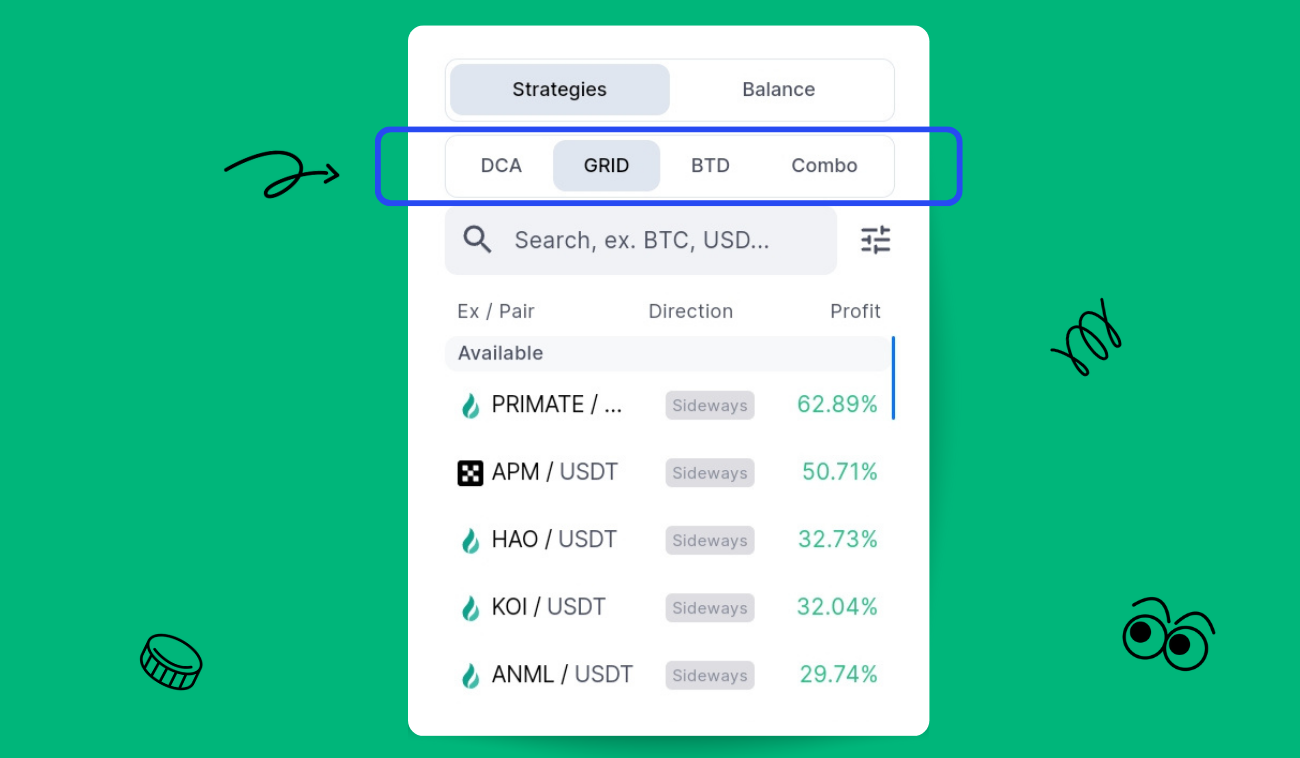

Bot Type Switching Filter

At the top of the [Strategies] tab, there is a filter that allows you to select a specific type of bot for the system to offer strategies (Pic. 2). For example, if you want to see predetermined profitable DCA strategies, you click on [DCA].

The list displays all profitable strategies, regardless of linked exchanges and other criteria relevant to your use case. Select the Advanced filter — the "mixer" icon next to the Search field — to see custom strategies specifically tailored to your account (more on the Advanced filter below).

If you don’t have any exchanges connected to your live trading mode, you’ll see the [Connect now] button in the strategy section. If you click it, you’ll see a modal window for adding your first exchange.

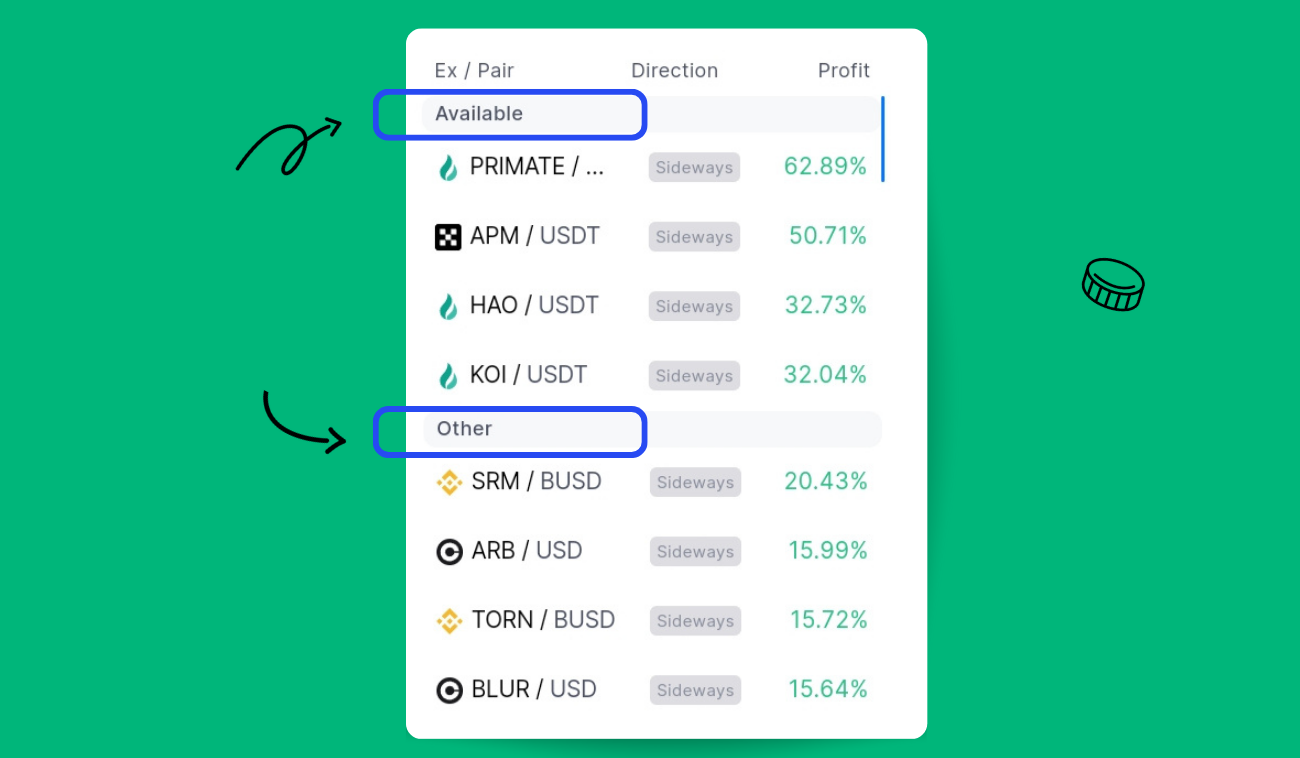

“Available” and “Other” Strategies

If you have sufficient balance on connected exchanges to launch the strategies calculated by the system, then you’ll see them broken into “Available” and “Other” (Pic. 3). Conversely, if you don’t have enough balance, all the strategies will be ranked by their profit potential.

The “Available” list includes strategies currently available to you, taking into account the overall balance and coins at your disposal at the moment.

👉 The system calculates how much investment is required to run a particular strategy and compares this amount with your available balance. If you don’t have enough funds to launch the bot according to the strategy’s settings, it won’t be displayed in the “Available” section.

The “Other” section shows the rest of the strategies that don’t account for your funds, ranked by their profit potential based on backtest data.

To launch a bot from the “Other” strategies, you need to have either one of the quote or base currencies, or both, on your balance. If you don’t have those, you can make a deposit, convert one currency to another, buy it with a credit card, or use any other method offered by your exchange.

On Bitsgap, you can do so by manually trading any other coin for a coin that’s part of a trading pair. For example, if you only have BTC and BNB on your balance but would like to run a BTC/USDT bot, you can exchange BNB for USDT on Bitsgap’s [Trading] page.

If you don’t have sufficient funds to launch the bot, all strategies will be displayed in one list without separation into “Available” and “Other.” When you click on a strategy, a bot launcher will open, informing you about insufficient funds. By clicking on [Investment], you’ll see the minimum required investment for the strategy (Pic. 4):

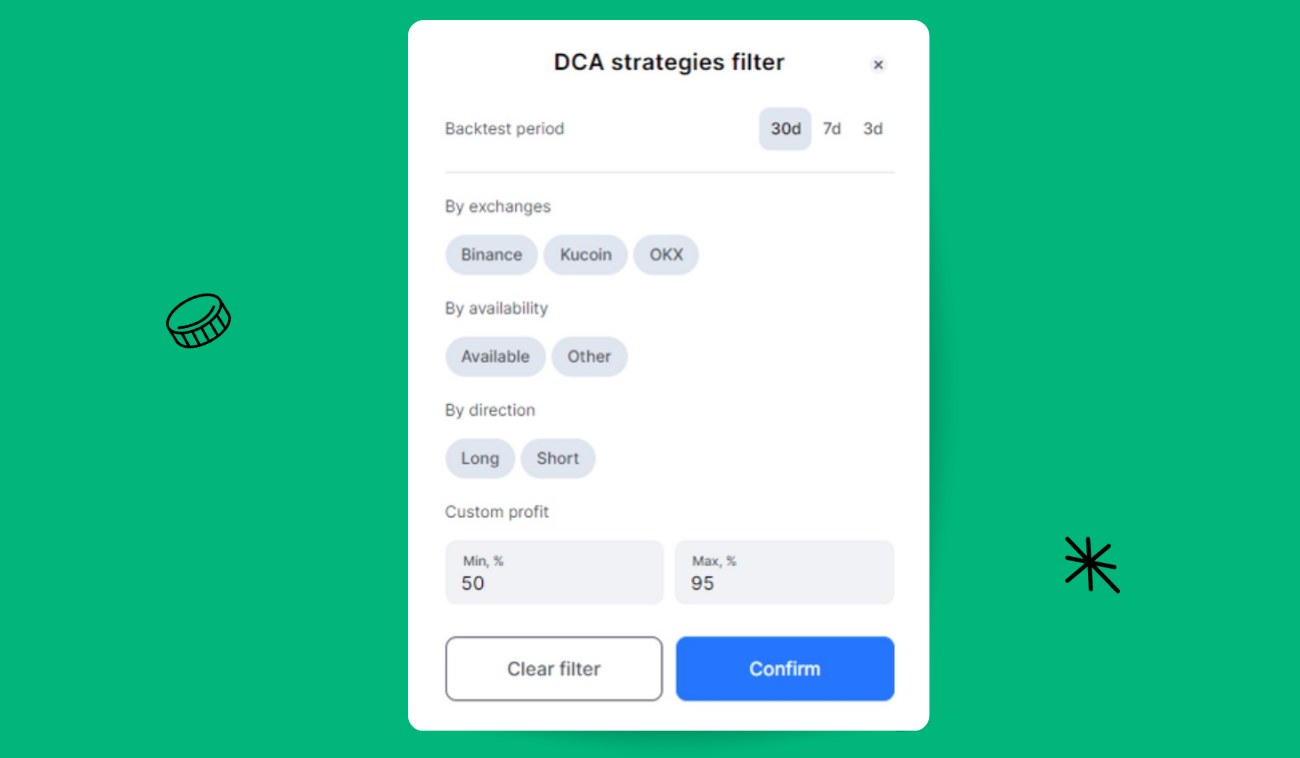

Advanced Filter

The advanced filter (Pic. 5) allows you to customize the search for strategies according to the following criteria:

- by exchanges — works like a checkbox, allowing you to select several connected exchanges;

- by availability — filters strategies by available investment;

- by direction — displays direction for the DCA and COMBO bots (long or short);

- custom profit — filters strategies depending on specified profit. By default, the filter shows the minimum and maximum profit values.

If you choose anything from the Advanced filter, you’ll see a blue dot on the "mixer" filter icon. Advanced filter settings are reset when switching between bot types.

Sorting of Strategies

For GRID and BTD bots, strategies are sorted by default in descending order of profit percentage so that the most lucrative options appear first. For DCA and COMBO bots, you can sort strategies by direction (long or short), which then defaults to sorting by profit within the strategy group (Pic. 6):

Bottom Line

Bitsgap has added the Bot Strategies widget with advanced filters for easy strategy search. The widget allows you to easily find the most lucrative opportunities based on your available balance and connected exchanges. Now, earning in crypto has become a tad bit easier, hasn’t it?

Want to test new functionality? Then head to the platform now!