How Does a Cryptocurrency Trading Bot Work?

Think you need to be glued to your screen to capitalize on cryptocurrency price swings? Not with the crypto trading bot. Keep reading to find out how bots can trade 24/7 so you don't have to.

Crafting consistent, repeatable strategies in a highly volatile crypto market is a puzzle that even seasoned traders can find complex. That's where crypto trading bots come in.

The world of cryptocurrency trading can be a gold mine, but it often demands an unblinking eye on the fluctuating market. This relentless observation can prove exhausting rapidly, and it might feel as if the effort outweighs the gains, especially when considering multiple small yet profitable trades.

But behold, there's a smarter path! While humans may falter at repetitive tasks, computers excel. Consequently, many shrewd cryptocurrency traders employ crypto trading bots to shoulder the monotonous tasks.

In this article, we will demystify these algorithmic machines, dissect their inner mechanics, and illuminate how you can harness their impeccable prowess to reap the benefits of automated trading.

What Is a Crypto Trading Bot

Crypto trading bots are like robo-traders running on autopilot. These digital sentinels tirelessly scan market data 24/7 for profit opportunities, unaffected by the fear and greed that can cloud human judgment. Though not guaranteed money-makers, with the right strategy settings, these bots can rake in digital gains.

Of course, they can also go haywire and lose their digital shirt if not properly monitored — beneath their algorithmic exteriors, they still remain dependent on their human creators to survive the volatile crypto landscape. But when optimized, bots bring order to the crypto chaos, executing computed trades at lightning speeds.

Contrary to what you might have heard, most trading bots don't demand a high level of technical expertise to operate. You can easily configure them to trade a specific cryptocurrency following your unique trading strategy.

Some also provide backtesting, enabling you to trial a strategy before employing it in your trades, thus significantly mitigating your risk exposure.

Trading Bot Mechanics: How Trading Bots Work

Trading bots in cryptocurrency execute transactions based on a variety of market indicators and pre-set parameters ingrained into the code. These parameters can range from simplistic to intricate, depending on the complexity of the bot and the trading methodology it's programmed to execute.

Their directives are drawn from an arsenal of market indicators such as moving averages, the relative strength index (RSI), Bollinger Bands, and the Moving Average Convergence Divergence (MACD). Additional parameters might encompass trading volume, price, time frame, and data from the order book, which are in themselves intensely tracked by human traders. Yet, the trading bots serve as an essential relief, removing the burden of manual tracking.

When the market circumstances match the pre-determined parameters, the bot autonomously carries out the trades.

Example of Bot Trading

Our friend Jimmy, a keen crypto enthusiast, decides he has had enough of the tedious task of manually tracking his bitcoin investments. He hears stories of how automated trading strategies could yield considerable crypto gains, and he is eager to put this to the test. Thus, he puts on his digital armor, lifts his virtual sword, and ventures into the world of trading bots.

Jimmy chooses to surf the bitcoin price waves for his grand experiment. He selects Bitsgap as his robotic companion and links his exchange to Bitsgap's trading platform with a unique access token, an encrypted API key. This key doesn't have access to funds or data but can trade seamlessly on his behalf nonetheless.

Analyzing the bitcoin price chart, he determines that the cryptocurrency will likely have a stable trading day and will trade within a sideways trend. To capitalize on this, Jimmy chooses Bitsgap's GRID bot and adjusts its settings to buy bitcoin when its daily price falls by 2% and to sell when the price increases by 2% from the adjusted baseline.

After clicking [Start bot], Jimmy diverts his focus to other tasks, leaving the bot to carry out trades based on the pre-set rules. At some point later in the day, he assesses the bot's performance and is pleased to find that the automated trading strategy is yielding profits.

Jimmy's approach turns out to be successful. However, he knows that if the results were different, he could have easily adjusted the bot's settings based on its performance.

Trading Bots Advantages and Disadvantages

Before saddling up with a crypto trading bot, pause and carefully weigh the risks against the rewards. To avoid getting thrown from the saddle, here's what you need to consider:

Benefits of Trading Bots

There are several significant advantages to using cryptocurrency trading bots, including:

- Automation: Trading bots automate the trading process, offering a distinct advantage in the 24/7 cryptocurrency market. They monitor the markets and execute trades all day, every day, without human intervention.

- Neutralizing emotion: Trading can be stressful and emotionally charged, leading to rash decisions. Trading bots, on the other hand, operate strictly on pre-established logic, removing human emotion from the process and potentially leading to more calculated trading decisions.

- Quick execution: Trading bots can execute trades immediately when their criteria are fulfilled. This rapid operation is critical in the fast-moving cryptocurrency market, where prices can fluctuate within seconds.

- Effective market analysis: Trading bots can analyze vast quantities of data across multiple markets at once, a task impossible for a human trader. This capability allows them to spot trading opportunities that a human trader might overlook.

- Backtesting: Many trading bots offer backtesting, meaning they can test trading strategies against past market data to evaluate their effectiveness before risking any real money.

- Risk management: Bots can be programmed to manage risk by distributing investments across various assets and setting stop loss orders, which automatically close a position to limit potential losses.

Risks of Trading Bots

Despite these advantages, there are potential concerns and limitations associated with using cryptocurrency trading bots:

- Market volatility: Cryptocurrencies are notorious for their price volatility. While trading bots can react quickly to changes, they might not always be able to anticipate or effectively manage sudden market crashes or spikes unless specifically programmed to do so.

- Monitoring requirement: Trading bots require regular oversight to ensure they're operating correctly. Misconfigured settings, software glitches, or connectivity problems can result in unwanted trades or missed opportunities.

- Technical expertise: Setting up and configuring some trading bots demands technical knowledge. Fully leveraging these bots’ features often involves understanding intricate trading strategies and being able to accurately configure these.

- Security risks: As trading bots generally require access to your crypto exchange account, this can pose a security risk if the bot or the platform it's hosted on is compromised. Using trustworthy, secure trading bots is crucial.

- Limited effectiveness: A trading bot's effectiveness is only as good as its programming and the strategy it's set to follow. There's no guarantee of making profits, especially in fluctuating markets. Moreover, a strategy that performs well in one market condition may not in another.

- Cost: While some trading bots are free, others carry a cost. It's important to consider these costs when calculating potential profits. Some bots also have transaction fees or require a subscription.

- Regulatory risks: In certain jurisdictions, the use of trading bots may be legally ambiguous. Always ensure compliance with local laws and regulations.

What Trading Pair Should You Choose for a Crypto Bot?

Bitcoin is often the best base currency to use in crypto trading due to its high liquidity and trading volume. On most exchanges, bitcoin trading pairs usually have the highest trading volume. High trading volume typically results in smaller spreads, which can allow you to capitalize on smaller price movements.

Smaller trading pairs (altcoin/altcoin pairs or altcoin/bitcoin pairs) can sometimes offer profitable opportunities due to their price volatility. However, these pairs often have lower trading volumes, which can lead to larger spreads and higher slippage. This can increase the risk and difficulty in executing trades.

So, it's crucial to carefully evaluate smaller trading pairs and account for potential price swings, especially in low-volume trading pairs. Large, sudden price movements can significantly impact trading strategies, particularly those that rely on small, steady gains.

Therefore, while bitcoin is often an excellent base for trading, diversification into smaller pairs can also be beneficial if done cautiously and with an understanding of the associated risks.

Crypto Trading Bot Strategies

Crypto trading bots can be programmed to implement numerous well-known strategies. Here are a few examples:

- Dollar-Cost Averaging (DCA) is a strategy where a bot invests a fixed dollar amount in a particular cryptocurrency at regular intervals, regardless of the price. Over time, this can result in acquiring the cryptocurrency at an average cost, hence the strategy's name.

- GRID trading bots are automated trading instruments that employ the GRID trading technique. This trading approach enables you to earn profits by setting a sequence of long or short orders at pre-defined intervals surrounding a target price, thereby forming a trading grid.

- Arbitrage bots exploit price discrepancies across various markets. For instance, if a cryptocurrency is sold at a higher price on one exchange than another, the bot can buy the cryptocurrency from the less expensive exchange and sell it on the pricier one for a profit.

- Scalping is a high-frequency trading strategy that seeks to profit from minor price changes. A bot is required for this strategy due to the high-speed trading that is challenging for a human to execute effectively.

What Are Bitsgap’s Bots and How Do They Work?

Since its establishment in 2016, Bitsgap has grown to become a leading force in the crypto aggregation space, boasting connections to over 15 exchanges, a team exceeding 100 members, and a thriving community of more than 500K traders.

At the heart of Bitsgap's offerings is its cloud-based, automated crypto trading platform with a full array of manual and automated trading tools.

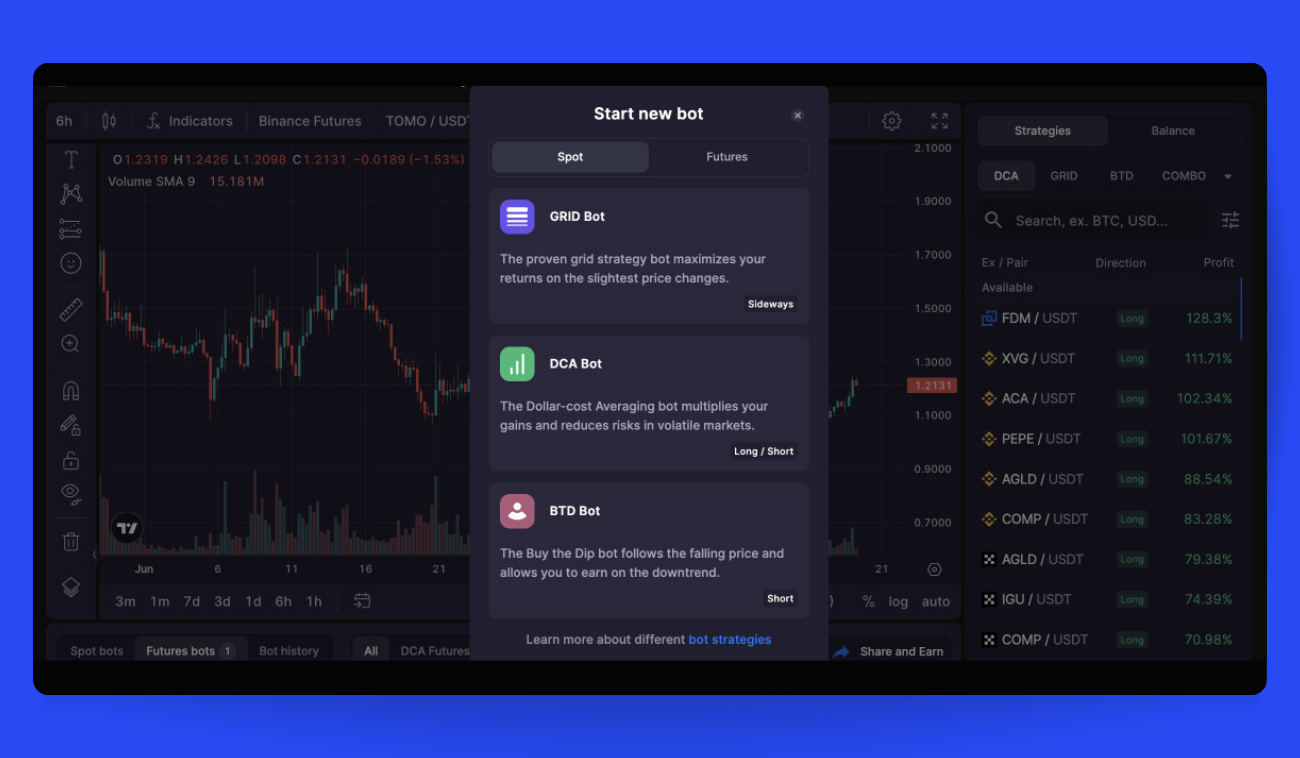

Now, let’s take a glimpse into Bitsgap’s highly acclaimed crypto trading bots below.

Short on time? Check out our video that explains Bitsgap trading bots in a nutshell:

Introduction to the Bitsgap Bots.

- GRID Trading Bot employs the GRID trading strategy, a go-to technique in both forex and crypto trading spheres. This bot forms a grid packed with limit buy and sell orders within certain price ranges. It can generate profits from both upward and downward market movements, making it highly efficient in swing markets. Discover more about GRID here.

- DCA Trading Bot employs the Dollar Cost Averaging (DCA) strategy. It spreads your investment over regular purchases (or sales), allowing the bot to secure a more favorable average price for your position and mitigate volatility impacts. If you're seeking to augment your trading with indicator signals and robust risk management tools, the DCA bot is the way to go! Discover more about DCA here.

- BTD Trading Bot employs the Buy the Dip trading strategy, amassing a coin portfolio as the price of a coin decreases. It is most effective in a downtrend market, providing opportunities to acquire coins at discounted prices. Discover more about BTD here.

- COMBO Trading Bot merges both DCA and GRID trading strategies to reap profits from the futures market. Its innovative design and use of leverage allow the COMBO bot to generate profits at a pace 1,000% faster. Discover more about COMBO here.

- DCA Futures Trading Bot focuses on the strategy of purchasing or selling coins in small, consistent amounts, maintaining your position's stability regardless of market fluctuations. Contrarily to its spot market counterpart, the DCA Futures bot is designed for rapid, substantial returns in the dynamic futures market. Unlike COMBO, the DCA Futures bot operates in cycles. It opens a position and then averages or closes it with a single order, avoiding the complex process of resetting and averaging orders that characterizes the COMBO bot's operations. Discover more about DCA Futures here.

Furthermore, all these bots have demonstrated impressive returns in the crypto market, garnering a substantial user base, with 3.7M bots activated and total trading volumes surpassing $300B in 2022.

However, Bitsgap offers much more than just trading bots!

Bitsgap also provides —

- A highly secure trading environment with regularly updated security measures,

- A vibrant community of over 500K satisfied traders and a multitude of social media channels,

- An exceptional affiliate program with its own benefits and contests, and

- Frequent promotional campaigns and giveaways!

Why not start trading with Bitsgap’s bots today and reap all the benefits?

Looking for more options? Here’s your guide to the Best Automated Trading Software + Top 5 Crypto Trading Bots

How Much Crypto Do You Need to Launch a Bot

Luckily, running a bot doesn't require a substantial amount of cryptocurrency. You can commence with a modest sum of money, or even no money at all, if you prefer. This is possible on platforms like Bitsgap that allow you to trial your strategies, enabling you to gauge their real-time performance before committing any capital.

The demo mode, aka paper trading, could potentially save you a significant amount of money since most strategies necessitate some degree of fine-tuning in order to become profitable. It's fundamental to understand that a trading algorithm isn't entirely autonomous, and some degree of oversight and management of the bot is required to yield profits.

Bottom Line

As we’ve learned, crypto trading bots present several benefits, including the capacity for round-the-clock trading, the elimination of emotional bias from trading choices, enhanced transaction velocity, and the simultaneous analysis of extensive data volumes. Yet they also carry inherent risks and limitations, such as consistent monitoring requirements, potential security concerns, and the unpredictability of market fluctuations.

Despite their limitations, crypto bots can prove to be highly profitable if you invest time in learning their proper use. They also offer a fantastic means of adding more coins to your portfolio as you anticipate larger gains. Minor profits can accumulate over time, and in a stagnant market cycle, you could potentially double your portfolio's coin count as you patiently await more substantial profits during a bull market.

FAQs

What Is Automated Crypto Trading?

Automated cryptocurrency trading involves carrying out purchase and sale transactions in cryptocurrency markets via predefined trading guidelines. These guidelines may hinge on a variety of elements including time, price, market volume, or a mathematical model, with the goal being to profit from market opportunities without requiring constant human oversight.

This type of trading employs bots — software applications that interact with exchanges and make choices on your behalf according to your specified rules. These bots are capable of analyzing market activities such as price, volume, orders, and time, and can even leverage this information to forecast market trends, carry out transactions, and handle risk.

What Is Algorithmic Trading in Crypto?

Algorithmic trading in the realm of cryptocurrency, also termed as automated crypto trading, is the application of advanced computer algorithms to carry out trading operations based on predefined rules. These rules could be dependent on a host of factors including time, price points, trading volume, or intricate mathematical models.

One of the major benefits of algorithmic trading is its ability to process enormous volumes of data and conduct trades at a speed that far surpasses human capability. It also eliminates the factor of emotional bias, ensuring that the trading strategy faithfully adheres to its established parameters.

Nonetheless, it's crucial to acknowledge that while algorithmic trading can aid in managing and potentially profiting from the volatility of the crypto market, it is not without risks due to the inherently unstable and unpredictable character of cryptocurrency markets.

What Is Trading Bot Efficiency?

Trading bot efficiency refers to the effectiveness of a trading bot in performing its functions. It's a comprehensive measure that encompasses various aspects, including the bot's profitability, its accuracy in predicting market movements, the speed at which it carries out operations, and its ability to manage risk.

The profitability of a trading bot is one critical aspect, often evaluated by comparing the bot's performance against a specific benchmark, such as the overall market performance or the results of a human trader.

Another component of efficiency is the bot's accuracy in forecasting market trends or price fluctuations. This is usually quantified as the percentage of correct predictions the bot makes.

Speed is also a vital element of a trading bot's efficiency. The ability of a bot to carry out trades at a pace that surpasses human capabilities can provide a significant advantage, especially in volatile markets where prices can shift rapidly.

Lastly, a bot's proficiency in managing risk is essential for its overall efficiency. An effective bot should not only strive to maximize profits but also limit potential losses. This could be achieved through various means, such as setting stop-loss orders, diversifying investments, or dynamically adjusting to market volatility.

However, it's crucial to understand that a bot's efficiency can fluctuate based on factors like market conditions, the quality of its programming, the strategy it employs, and the rules set by the user. These elements should be carefully considered when assessing the efficiency of a trading bot.

How Does the Grid Strategy Generate Profit?

The Grid trading strategy operates by executing numerous small trades to take advantage of a relatively horizontal market. All cryptocurrencies experience minor price fluctuations throughout the day, and by utilizing a bot, such as the one provided by Bitsgap, you can profit several times within a single day.

However, it's crucial to factor in trading fees as well. The price gap you set must strike a balance — it should be narrow enough to ensure frequent trades throughout the day, but also wide enough to ensure that transaction fees do not consume all your gains.