COMBO Trading Bot: Your Way to Profit From Binance Futures

With Bitsgap COMBO Trading Bot, you have a unique opportunity to maximize your chances to win on Binance Futures, no difference whether it is a rising or falling market.

Bitsgap has a powerful smart trading tool designed explicitly for trading futures on the Binance exchange—COMBO Binance Day Trading Bot. What is it, and how does it work?

With Bitsgap, you have a unique opportunity to diversify your trading strategy by trading futures. You can use DCA or GRID bots in the spot market. But for futures, we’ve cooked something exceptional—COMBO Bot.

The COMBO Binance Day Trading Bot from Bitsgap has shown fantastic results of generating good returns on rising and falling markets up to 1,000% faster than spot trading.

Want to learn more about the COMBO Bot? Let’s jump right in.

What Is Futures Trading?

Trading in cryptocurrency futures mimics futures trading in other markets. It involves using futures contracts, i.e., binding agreements to purchase or sell an asset at a future date and price.

Unlike traditional futures contracts, crypto futures are perpetual, meaning they don’t expire and can be opened or closed anytime. So if you see examples online about a farmer, a trader, and a futures contract for the following year’s harvest, you can safely ignore those examples as they don’t apply to the crypto market.

One of the differences between futures and spot trading is that in futures, you do not actually acquire an asset but instead trade on speculation of how the price will perform in the future. In other words, by opening up a futures contract, you place a bet on a price increase (Long) or decrease (Short).

Another difference (and an added benefit, for that matter) is leverage. Leverage allows you to use fewer funds to achieve better results that (most probably) could never be achieved if you traded with the same money in the spot market.

Leverage: Risks & Rewards

For example, with 10x leverage, you “borrow” a contract with a volume ten times higher than the price you pay, thereby agreeing to an analogous liquidation risk.

Liquidation price is the price level at which your position is automatically closed, and you lose all your funds. It happens when the price starts moving opposite your initial bet (down for a long position and up for a short one).

Say you have $100 and decide to use 10x leverage. Then what you’ll be effectively trading with is $1,000.

The bigger the leverage, the closer your liquidation price is to the entry price.

Depending on your margin (available funds on your balance) and leverage, you can lose all your money if the price moves as little as 5% off your entry price.

On the contrary, if it moves in the direction you predicted, you can reap double-digit rates easily.

So the bottom line is: despite the well-known preconceptions about the futures, such as risks of significant losses or complexity of trading mechanics, futures trading is not as difficult as it’s often painted.

With a solid understanding of the futures market, the right strategy, and Bitsgap’s COMBO bot, you can maximize your returns and receive decent profits!

How Does the COMBO Trading Bot Work?

The COMBO Binance Day Trading Bot from Bitsgap combines DCA and GRID strategies. This way, the bot uses the GRID algorithm to benefit from price fluctuations and DCA to optimize the entry price.

The built-in trailing function allows the bot to follow the market movement in both directions by automatically placing GRID and DCA levels above and below the entry price. At the same time, the trailing of Stop Loss secures generated returns.

On activation, the bot uses 50% of your investment multiplied by the chosen leverage. The remaining half is used for DCA and GRID orders.

If the price moves outside the initial set-up range, the bot may place additional orders using an extra margin of up to 1.5x from the available funds.

Once your position is active, the bot will place a series of Take Profit orders (sell orders for a long position and buy orders for a short one).

For example, suppose your position is long. In that case, the remaining 50% of your balance will be equally distributed in green DCA buy orders. And If you’re shorting, it will be distributed in red DCA sell orders (Pic. 1).

As soon as the bot executes a DCA order, it increases the position’s size while adjusting your entry price (which will fluctuate as more orders get executed).

So in a long position, the entry or P&L price will be trailing down as the total price paid for all orders is averaging through DCAs. As soon as the price moves in a favorable direction and surpasses the P&L price, the sell order gets triggered. The sell orders in a long position are GRID orders, and the bot will sell your position in chunks based on the number of GRID levels.

If your bot sells out an entire position in profit, it will use 50% of the investment again to open up a new set of DCA and GRID levels around the market price.

Want to learn more about the COMBO Binance Trading Bot? Check out the article in our Help Center.

How Can I Start the COMBO Trading Bot?

Before you start the COMBO Binance Day Trading Bot, you’ll have to open a futures wallet on Binance and connect it to Bitsgap first.

Below are a few detailed instructions on how to open an account and connect it to Bistgap:

👉 Open a Futures account and pass a test on Binance

To open a futures wallet, you need to pass a test on the Binance exchange. The test ensures that you have a basic understanding of trading futures and the risks/rewards involved.

👉 Connect your Futures wallet to Bitsgap

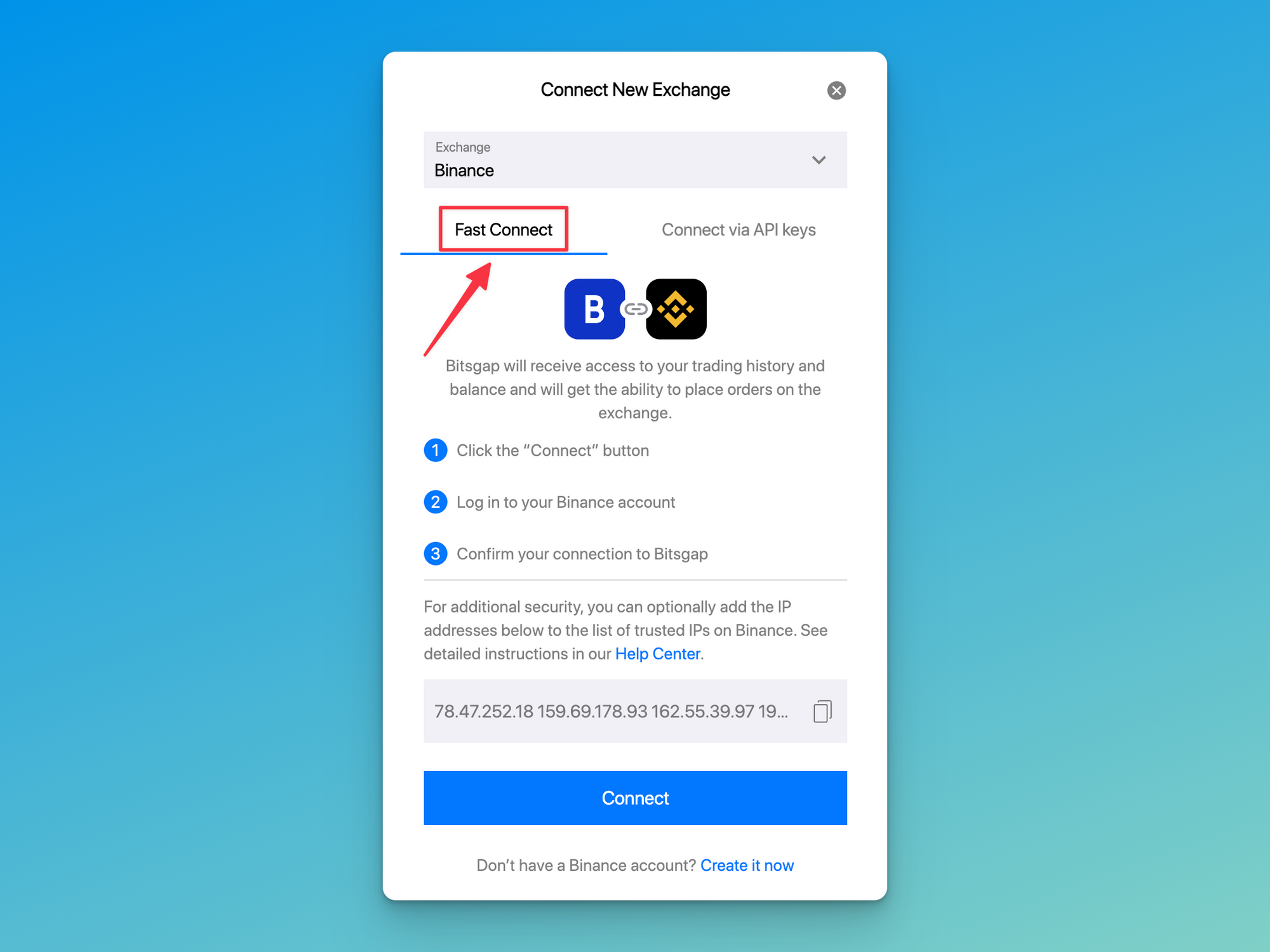

To connect your futures wallet to Bitsgap, you’ll need to create, configure, and connect your Binance Futures API key to the Bitsgap platform. You can create your API keys manually or use Fast API Connection (preferred).

Binance Fast API Connection allows you to start using Bitsgap without manually creating and updating API keys every 90 days. If you prefer to use this option, you can do so by going to “My exchanges” → “Binance” → “Fast Connect.” To learn more, read the Binance Fast Connect article on our blog.

With a futures wallet on Binance and connected Binance to Bistgap, you are fully ready to kick start the COMBO bot:

- On the Bitsgap interface, click on the “Start new bot” button in the top right.

- Select “COMBO Bot.”

- Configure your COMBO Bot and click Start.

Before you start the COMBO Binance Trading Bot, make sure to practice with GRID and DCA bots in the spot market. Please, be aware that the algorithm behind the COMBO bot algorithm is different from other bots, but it helps if you’ve practiced on other bots first.

Suffice it to say that futures trading is risky, so make sure you familiarize yourself with the basics and understand how the leverage works.

Ready to kick start the bot and start profiting from trading futures on Binance? Launch the COMBO Binance Trading Bot now!