New Buy the Dip Bot: Earns You Coins When Price Is Falling

Formerly one of the most popular GRID strategies, Buy the Dip is now packed in the standalone BTD Bot that allows you to profit from a clear downtrend.

Ride the downtrend wave and win more coins with the newly revamped Buy the Dip Bot from Bitsgap. Learn how it works and how to benefit.

Everyone wants to feel like their opinion matters. With Bitsgap, we make sure you get what you asked for. The Buy the Dip (BTD) bot is a testament to how closely we follow your feedback and develop valuable, handy tools you can use to profit.

Previously one of the GRID bot’s most successful strategies, BTD is now a standalone bot with default and bespoke settings. From the revamped interface to manual adjustments, the updated Buy the Dip bot makes winning on a downtrend easier than ever. Let’s see what has changed and how you can take advantage of it.

What Does the Buy the Dip Strategy Mean?

Buying the dip is a popular investment strategy that involves buying an asset after its price has fallen. Traders ’buying into the dip’ assume that the price decline is a short-term aberration and an opportunity to buy the asset at a bargain price.

👉 So if you’re looking to build a larger position in any specific coin, you may take advantage of this temporary price decline to increase your portfolio.

Moreover, once the coin price bounces back, you can sell out your acquired position partially or in full, reaping good returns. Unsurprisingly, the most common example in crypto when investors are scurrying to buy into the dip involves Bitcoin (Pic. 1).

We all know perfectly well that Bitcoin has taken a heavy blow in 2022. For some, the outlook is pessimistic. Not for the others, however.

Opportunists are snatching at a chance to buy Bitcoin at a discount to cash in when the price bounces back (which it inevitably will). Which side are you going to take? We’re buying into the dip!

What Is the New Buy the Dip Bot?

To automatically capitalize on short-term price declines and accumulate a more prominent position in a falling market, Bitsgap has developed something super special and profitable — the Buy the Dip bot.

Previously, you could have chosen the Buy the Dip strategy from the available GRID bot strategies when trading f.e. on Binance or OKX. Now, the BTD bot comes separately in a fully remodeled fashion as a standalone bot.

Let’s see what else has changed.

Revamped Interface

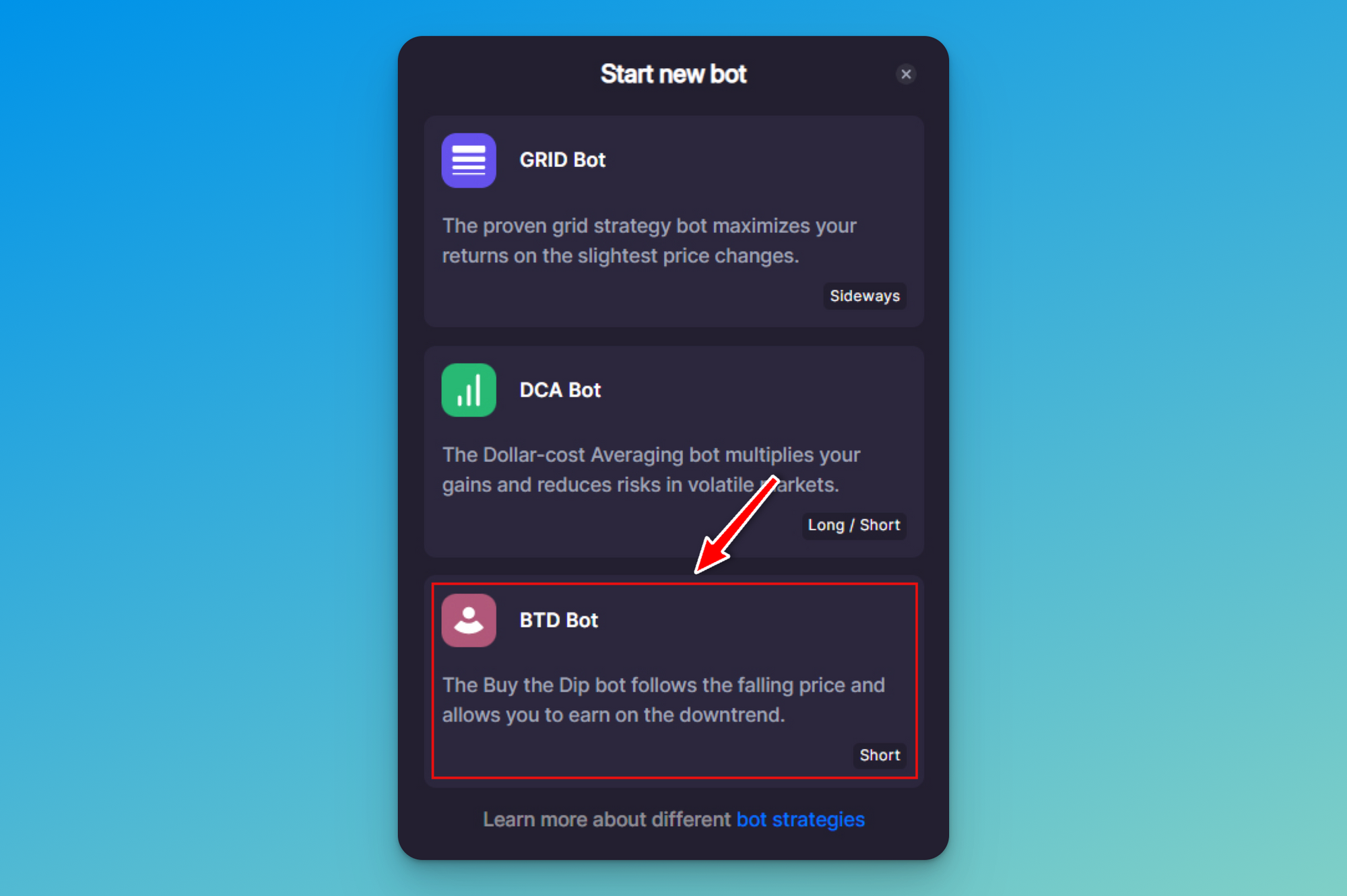

The remodeled interface allows you to start your BTD bot in as few as three clicks. To launch the BTD bot, click on the [Start new bot] button located on the top of the Bitsgap interface and select BTD from the list (Pic. 2):

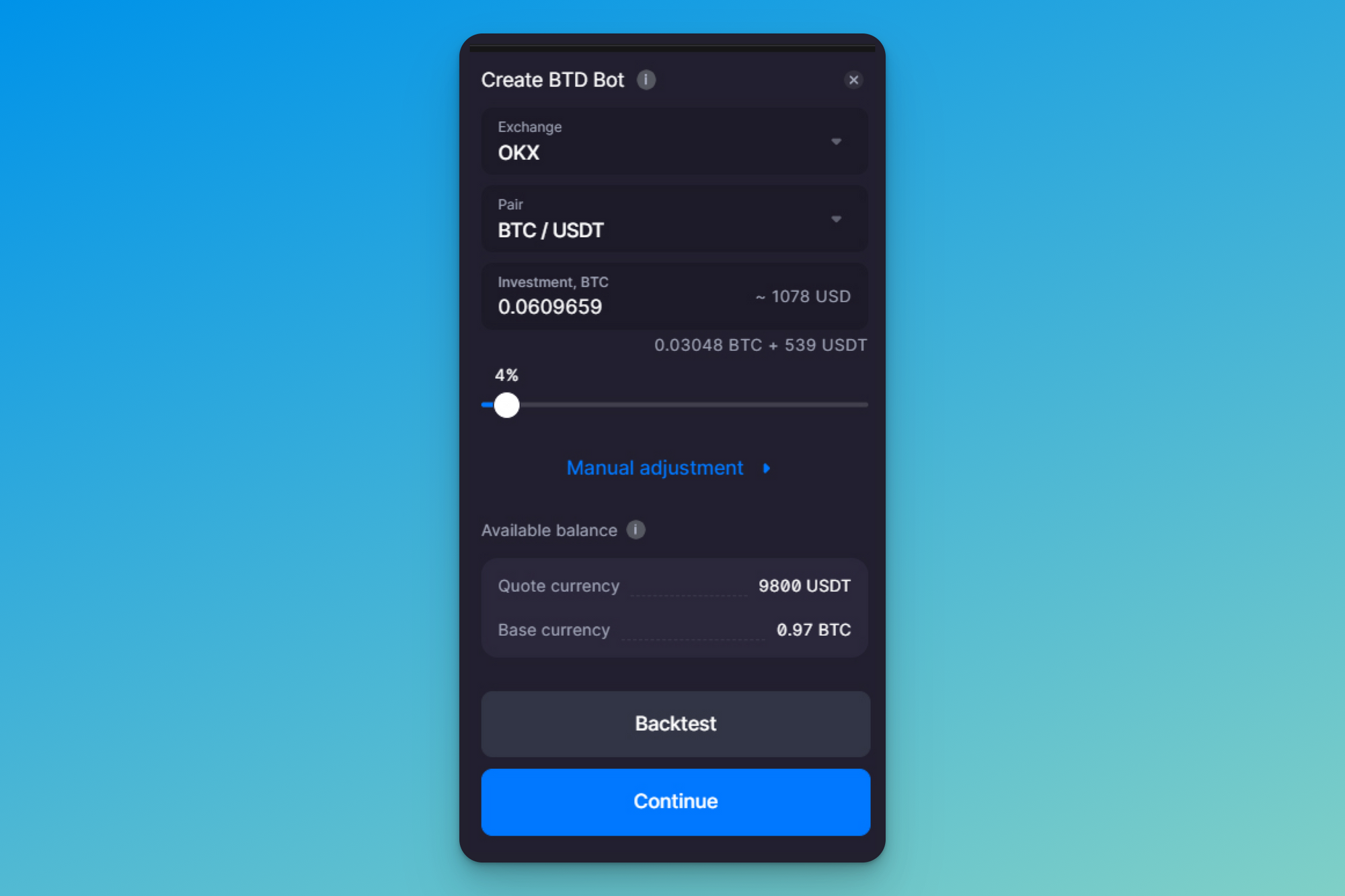

To start your BTD bot with the default settings, just choose an exchange, a trading pair, an investment, and click [Continue] (Pic. 3). That’s it. You only have to click three times to start profiting from the downtrend market!

By default, your bot will set up 50 grid levels at a grid step of 0.45%. Should you wish to change anything in the default settings, you can always do so by clicking on [Manual adjustment].

Manual Adjustment

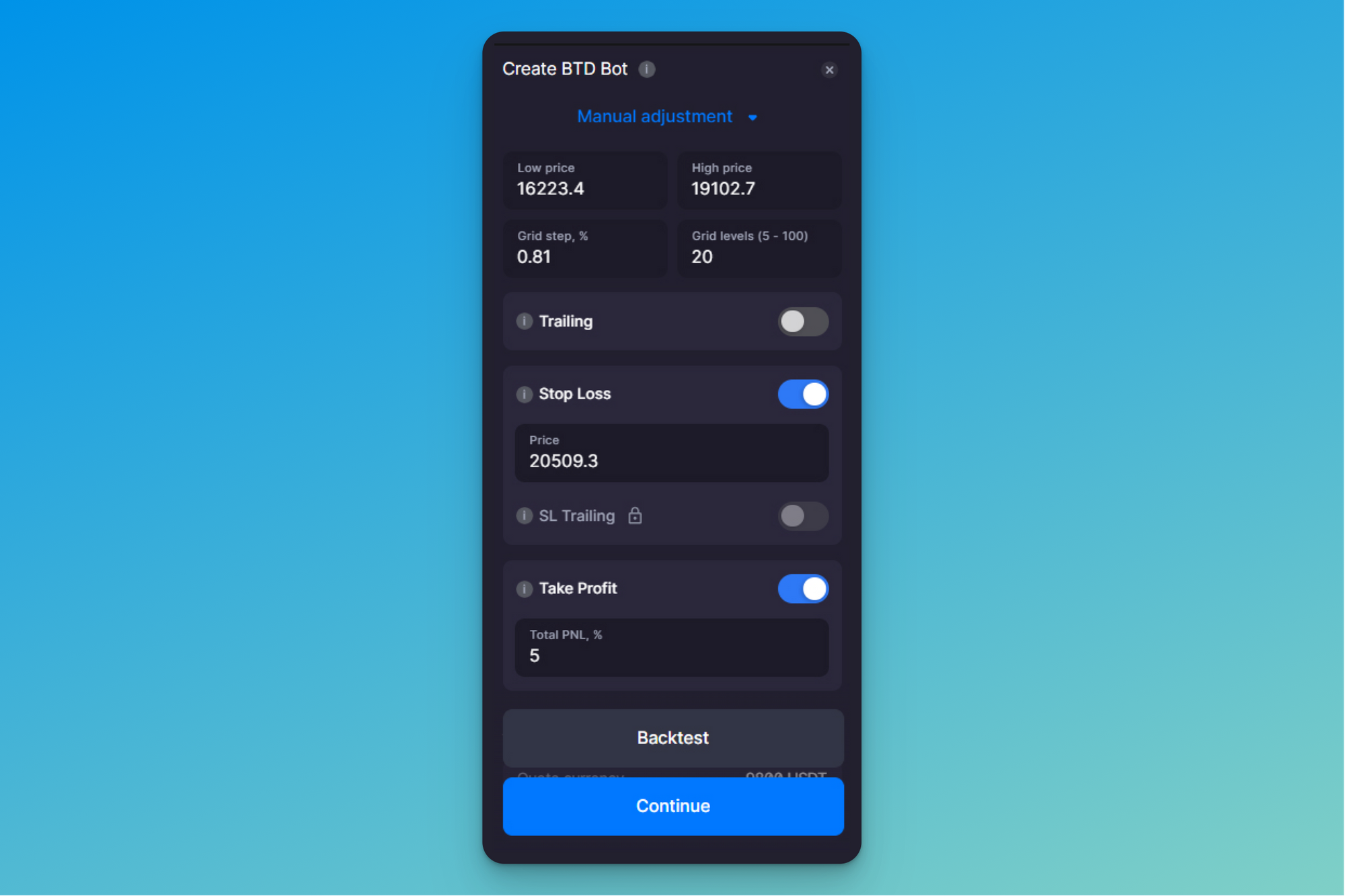

The [Manual adjustment] section has several settings you can tamper with to fine-tune your Buy the Dip strategy (Pic. 4).

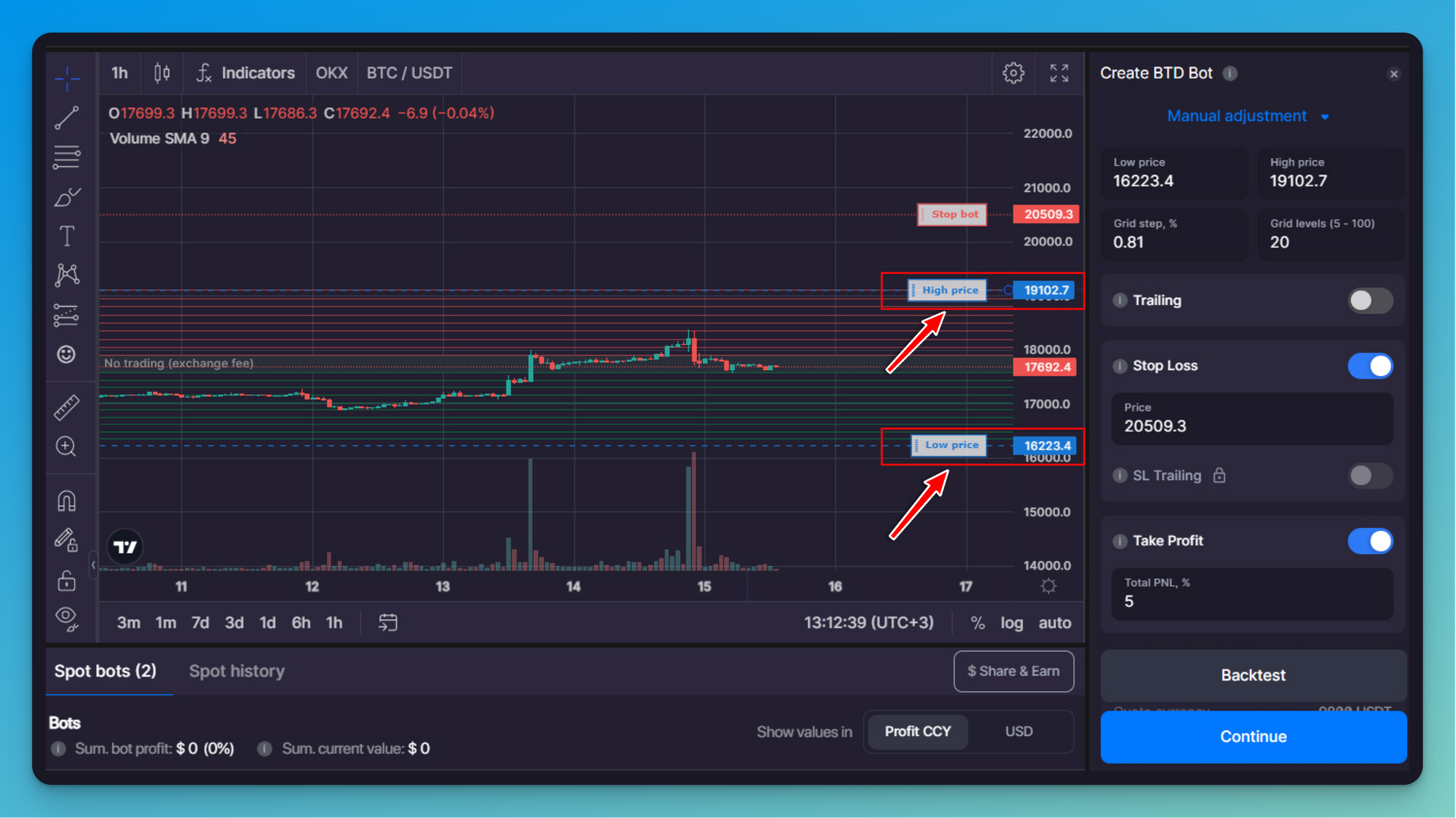

So, what can you change? Firstly, it’s the grid’s high and low price levels, which you can either adjust manually in the bot setting’s window or drag and drop on the chart to the desired price (Pic. 5).

Then, you can set the grid steps and grid levels interchangeably as one setting changes the other. And finally, it’s Trailing, Stop Loss, and Take Profit.

Stop Loss closes the bot if the market moves against you, in this case — if the coin price rises. If the price reaches a specified SL level, the bot buys the base currency back with all the left quote currency and stops further trading.

If SL can be specified with a concrete price, Take Profit, on the contrary, should be defined in a percentage of the total profit and loss (P&L).

👉 If you enable Trailing, the grid will automatically move down as the price decreases. With the enabled Stop Loss, Trailing will also dynamically follow the grid.

When you’re done adjusting your settings, you can also backtest them on historical data and see how the bot would have performed if it had started up to 30 days in the past.

Whenever you’re ready, click [Continue] to launch the bot and earn coins while the dip lasts.

Summary: Why BTD From Bitsgap?

The BTD bot is a perfect tool to accumulate more coins in a falling market at a lower average cost, build your coin portfolio, and capitalize on the price difference when the market rebounds.

Moreover, with a newly revamped BTD, you can start your bot in as few as three clicks because Bitsgap has done all the hard work for you already. All you have to do is click start, sit back, and relax!

And by the way, on the Advanced and Pro plans, you can set up as many as 5 to 25 GRID bots but an unlimited amount of BTDs when the market’s down to build up and diversify your coin portfolio. An opportunity not to miss!

Ready to start trading? Head on to the Bitsgap platform now!