Cryptocurrency Scalp Trading for Beginners: How to Scalp Trade Crypto

The scalping high-speed trading style can generate profits faster than any other, for better or worse. But do you have the nerve for it? Read on to explore the turbulent world of crypto scalping and whether you should try it too.

Cryptocurrencies are famed for their rollercoaster-like volatility. While this might spook some traders, it opens up a treasure trove of thrilling scalping opportunities for those with the skills, tools, and speed to seize them. Can you too become part of the elite scalper brigade, or is this game not worth the candle?

Over the years, the trading world has concocted a smorgasbord of strategies and tactics, letting traders profit in ways that suit their tastes. Eager crypto traders were quick to adopt these techniques for their own gain, blending strategies along the way to reap better rewards. Among those is scalping, a trading strategy much-beloved by some with roots predating the cryptocurrency era.

In this article, we delve deeper into scalping, explore its associated strategies, and unveil how scalpers rake in profits. Plus, we'll guide you through crypto scalping strategies and empower you to become an ace crypto scalper with a straightforward framework. Don't miss out!

What Is Crypto Scalp Trading?

Scalping is a subset of day trading that thrives on the thrill of the chase — making numerous small gains from minor daily price fluctuations.

👉 In the frenzied realm of crypto, prices flit and flutter from one moment to the next. While most traders get distracted by the bigger swings, scalpers zero in on these small, capricious movements. They buy and sell in a flash, netting modest gains that add up in a hurry as they move on to the next opportunity.

A scalp trade typically refers to an order with a duration of less than 30 minutes, executed on a 1-minute or 5-minute time frame. The primary goal of this strategy is to minimize possible risks by enforcing a stringent stop-loss policy while seeking to capture any profits.

Crypto’s inherent volatility makes it an auspicious playground for scalping. However, not everyone has the stomach or reflexes to become a scalper.

To be successful at scalping requires several key attributes:

- The mental fortitude and composure to handle the ups and downs.

- The quick thinking and fast reaction times to open and close positions rapidly.

- The ability to rigorously follow a strict set of trading rules.

- Access to funding, especially borrowed funds (leverage), to take on positions.

- Advanced automated tools, such as scalp trading algorithms, to execute trades swiftly and systematically.

Scalp Trading vs Swing Trading

Luckily, there is a wide range of trading strategies for traders to select from based on their preferences and strengths. Scalping and swing trading represent just two options on the menu.

While scalping is for adrenaline junkies and twitchy finger folks who thrive on high-speed action and constant movement, swing trading is more laid back for those who prefer a slower groove and less screen time.

For scalpers, even the littlest price wiggle is an opportunity to make a buck, so they’re glued to the 1-minute charts, waiting to pounce. Liquidity and low fees are must-haves for these frequent fliers. Impatience is a virtue for scalpers — they’re outta there as soon as the money starts rolling in. Scalping will give you lots of mini heart attacks, but it can be rewarding if you’ve got the stomach, tools, and skills for it.

Swing traders are more chill. They spot an overall trend, jump on, and enjoy the ride for a few days or weeks. They check in when they can, set a profit target, then head off to live their lives until it’s time to bank the gains. Swing traders rely on patience and planning, reviewing daily and weekly charts to find coins on the upswing before the crowd jumps in. Their style works great for part-timers who can’t constantly monitor the markets. Overnight positions don’t cause swing traders to lose sleep — they’re willing to wait for their payday.

Each trading style comes with its own unique blend of risks and rewards. There's no one-size-fits-all strategy, so consider your skills, temperament, time commitment, account size, trading experience, and risk tolerance when choosing your crypto trading groove.

Scalping vs Day Trading

As mentioned, day trading involves the act of purchasing and selling assets within a single day. Consequently, scalping, which avoids holding trades overnight, falls under the umbrella of day trading.

Yet, a scalper is notably more energetic and executes a higher number of trades throughout the day. This is because their primary goal is to accumulate small, recurring profits.

How to Scalp Trade Crypto

The underlying assumption of scalping is that most assets will complete the initial stage of a movement, but their subsequent direction is uncertain. Some assets may stall after the first stage, while others continue to advance.

Scalpers aim to accumulate as many small profits as possible, which contrasts with the "let your profits run" approach that seeks to maximize gains by increasing the size of winning trades. Scalping achieves results by boosting the number of winning trades while sacrificing the size of the wins.

A trader with a longer timeframe might still achieve positive results by winning only half, or fewer, of their trades, as long as the wins are significantly larger than the losses. In contrast, a successful stock scalper will have a higher ratio of winning to losing trades while maintaining profits roughly equal to or slightly larger than losses.

The main principles of scalping include:

- Limited exposure reduces risk: Minimizing market exposure decreases the likelihood of encountering unfavorable events.

- Smaller moves are more attainable: Larger imbalances between supply and demand are necessary to justify more significant price changes. For instance, it's easier for an asset to move $0.01 than $1.

- Smaller moves occur more frequently than larger ones: Even in relatively calm markets, there are numerous small movements for a scalper to exploit.

When it comes to spreads, scalpers aim to profit from changes in an asset's bid-ask spread by seeking narrower spreads. In normal trading conditions, the spread between the bid and the ask is steady (as supply and demand for assets are balanced), allowing for consistent profits.

Scalping can be used either as a primary or auxiliary trading strategy. So while a dedicated scalper will execute numerous trades daily, possibly in the hundreds, an occasional scalper may use it once in a while during choppy or range-bound markets or incorporate scalping through the "umbrella" concept. The “umbrella” method implies initiating a position for a longer time-frame trade and, as the trade progresses, identifying new setups in a shorter time frame that align with the main trade's direction, entering and exiting these trades based on scalping principles.

👉 The volatility of the cryptocurrency market is beneficial for scalp trading, as frequent price fluctuations create numerous opportunities. However, many traders prefer scalping bitcoin due to its balance between volatility and dependability. When opting for scalp trading in the crypto sphere and selecting altcoins, ensure that the coins you pick have high liquidity.

Scalp Trading Indicators

There is no universal formula for choosing the ideal indicators for scalping cryptocurrencies. The optimal indicators for each scalper will depend on their specific objectives, trading style, and appetite for risk.

That said, certain indicators are popular among cryptocurrency scalpers. For example, the Moving Average Convergence Divergence, or MACD, indicator helps traders spot shifts in the market's momentum. The Relative Strength Index, or RSI, is also commonly used to determine when the market is overbought or oversold.

For those new to scalping cryptocurrencies, the best approach is to test out different indicators to find the combination that fits you best. What works well for one scalper may not suit another. It is a process of experimentation to determine which indicators gel with your trading goals and risk limits.

We’ll look into some of those indicators below when discussing various scalp trading strategies.

Crypto Scalping Techniques Based on Indicators

Even if you use scalping bots, you’ll still need to have a solid strategy.

Here are some of the most profitable crypto scalp trading strategies based on the well-known indicators:

Moving Average (MA)

Moving averages are popular indicators for good reason. They provide a simple visual representation of the average price trend over a given time period. A single moving average line offers a broad overview of the current market situation. Adding multiple moving average lines creates a useful set of tools for identifying trends and potential reversals.

For example, a basic strategy uses two moving averages with periods of 20 and 200. When the 20 and 200 moving averages converge or cross, it signals a trend reversal. When they diverge or move apart, it indicates a strong trend and opportunities for scalpers to make trades while short-term price movements are more predictable.

A "moving average ribbon" strategy uses three moving averages — typically with periods of 5, 8 and 13 (Pic. 1). When the 5 and 8 moving averages converge and cross over the 13 moving average, it points to a strong reversal. When all three moving averages cross, it triggers a buy or sell signal depending on the direction they are moving.

The simplicity yet effectiveness of moving averages explains their widespread popularity. Scalpers can use multiple moving average strategies to identify when to enter and exit positions to profit from short-term price fluctuations.

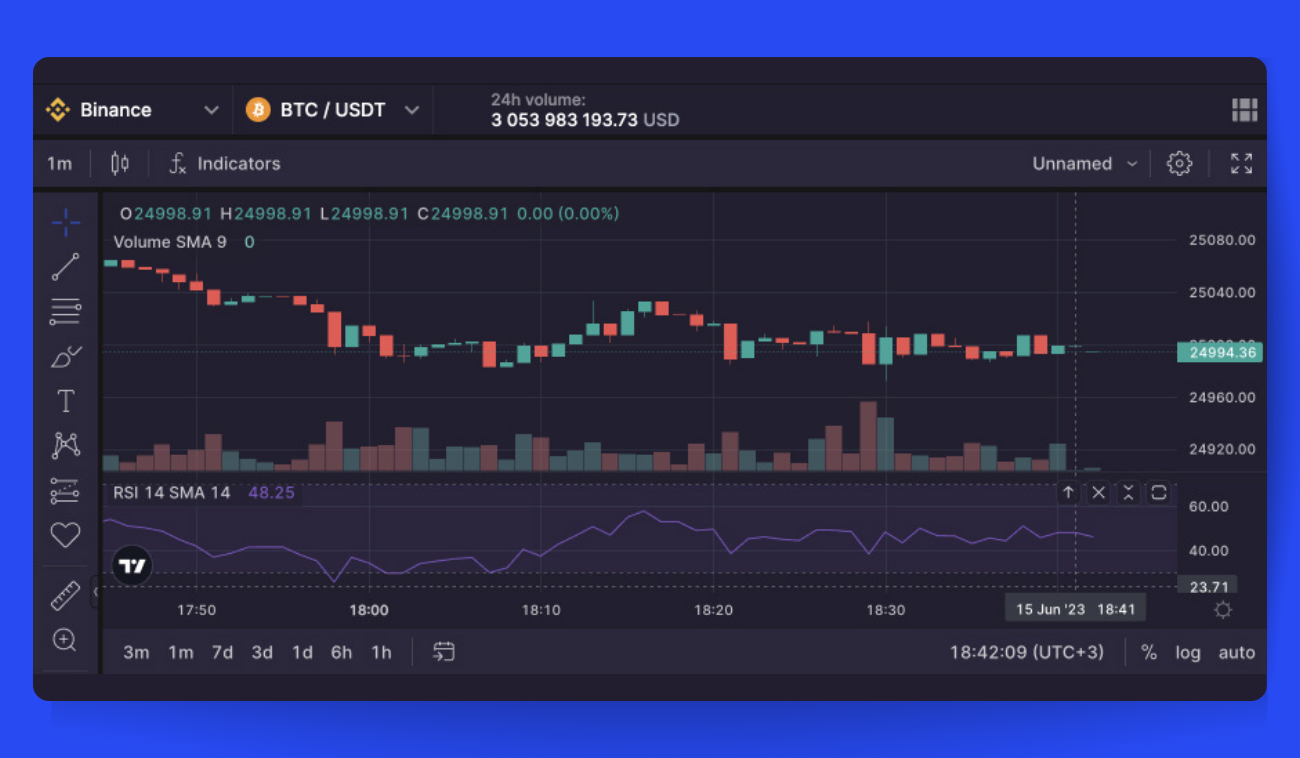

RSI-based strategies

The Relative Strength Index, or RSI (Pic.2), is an indicator that measures the strength of a trend and highlights when reversals are more probable. When combined with moving averages like the 3SMA, the RSI provides additional insight and can strengthen trading signals.

Observing and acting on the RSI is relatively straightforward — when the RSI declines to 30 or lower, it indicates a good opportunity to buy; conversely, when the RSI rises to 70 or higher, it may signal a good time to sell. These RSI signals can be reinforced by moving average crossovers, allowing for even more reliable forecasts.

👉 Of course, it goes without saying that scalpers should not rely on any one indicator alone. Applying multiple indicators, especially those that provide confirmation of trading signals, helps to avoid false alarms and improve the accuracy of predictions.

The RSI and moving averages are two indicators that work well together. They measure different aspects of the market, with the RSI determining overbought and oversold levels and moving averages spotting trend changes.

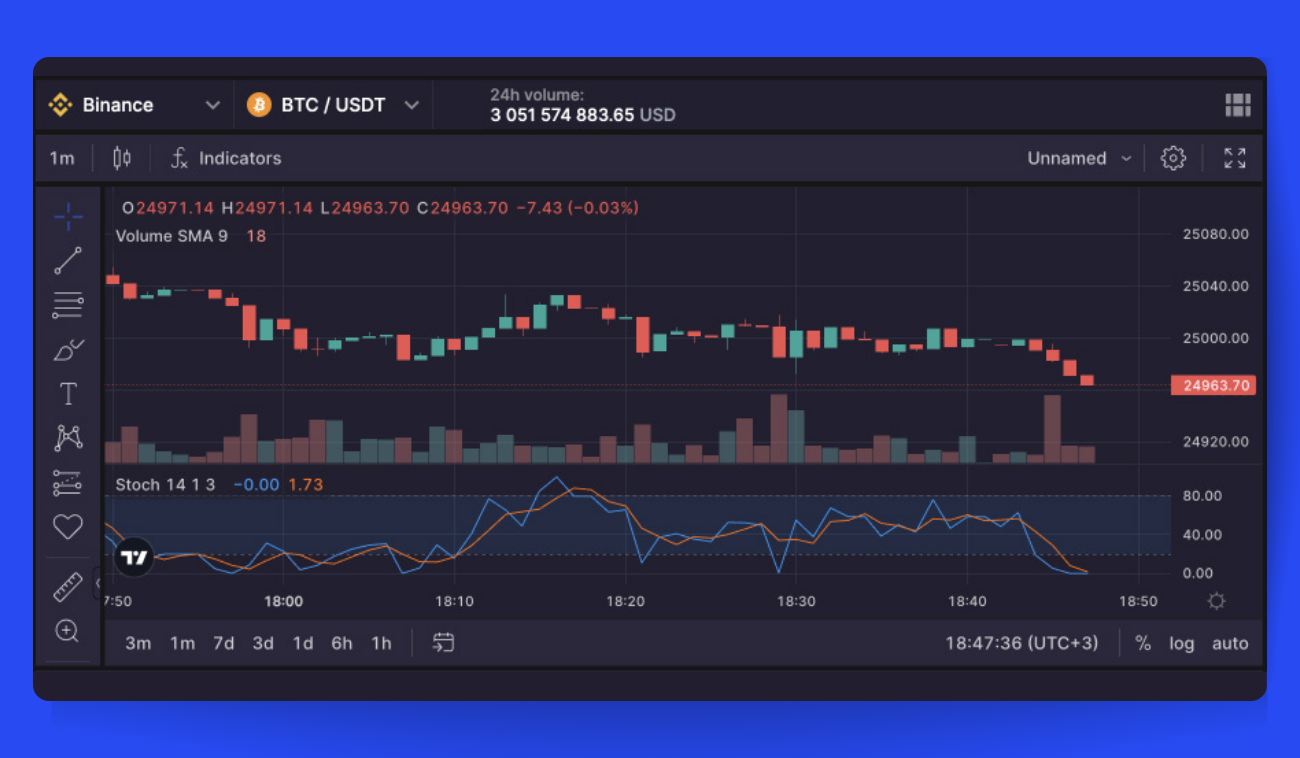

Stochastic Oscillator

The Stochastic Oscillator (SO) is a handy tool to determine when an asset's price trend may be about to switch directions (Pic. 3). It works by comparing the current price of an asset to its average price over a set time period.

This simple yet ingenious indicator has two lines that represent threshold values of 20 and 80. When the lines cross and go above 80, it means the price has likely climbed too high too fast and is due for a correction. So traders see this as an opportunity to sell before the price drop.

On the flip side, when the lines intersect below 20, it means the price has probably fallen too far too quickly. Savvy traders recognize this as a chance to buy before the price bounces back up again.

The Stochastic Oscillator helps identify these potential inflection points by showing when an asset's price may have become overbought or oversold relative to its recent norm. While not foolproof, when used properly it can provide valuable insights into market psychology and help scalpers spot reversals in short-term price trends.

SAR or Stop and Reversal

The parabolic indicator, also known as the Stop and Reversal (SAR), adds an engaging visual element to charts when combined with moving averages (Pic. 4).

By displaying the market's current direction through strategically placed dots, it helps decipher trends more easily. Dots positioned below the price bars signal a bullish trend, while those above the bars indicate a bearish movement.

Although the SAR doesn't form the core of a trading strategy, it's a valuable enhancement to graphical arsenal, making trend analysis more captivating and accessible.

Cryptocurrency Scalping Strategies

If you’re looking for general scalping strategies, then take your pick:

- Range trading focuses on the price range—the difference between an asset's high and low prices within a specific time frame. Traders can place both long and short positions depending on the situation, buying at support levels and selling at resistance levels. Limit orders are useful for long positions.

- Price action trading requires closely monitoring price movements and reacting quickly. Traders look for patterns and clues to determine when and how to trade. This fast-paced style demands strong analytical and reaction skills.

- Arbitrage traders buy and sell the same asset simultaneously on different exchanges to take advantage of price differences. With crypto’s volatility, arbitrage opportunities frequently pop up for scalpers.

- Bid-ask spread strategy revolves around the difference between the asking and bid prices. Open a position at the bid or ask price and close it immediately after the price shifts slightly in your favor. Spreads can be wide (with inflated asking prices and low bidding prices) or narrow (with low asking prices and high bids), depending on market conditions.

- Margin trading allows you to trade small asset price movements while amplifying profits with borrowed leverage. It demands exceptional skill, as mistakes can be more costly than with other strategies. Not all crypto exchanges support margin trading, and the conditions can vary significantly among those that do. Conduct thorough research if you're considering margin trading.

Crypto Scalping Tips

If you're seeking additional advice, here are some more tips to consider:

- Steer clear of low-volume altcoins, as they pose challenges for scalpers.

- Devise a plan and remain committed to it.

- Establish a reliable exit strategy.

- For security, refrain from allocating all your funds to a single trade.

- Account for fees in your trading calculations.

- Employ appropriate technical indicators to guide your decisions.

Pros and Cons of Scalp Trading Bots

Scalping bots offer some useful benefits to traders:

- Speed: Bots react instantly to signals and place orders right away, according to your settings. In a fast-paced market, this quick response time is key.

- 24/7 operation: Bots don't sleep so they can keep scalping around the clock. You can make money even when you're resting by automating the process.

- No emotions: Bots don't get anxious, distressed or impatient. They execute trades systematically without hesitation or unnecessary delay. This removes the possibility of human error caused by emotions.

However, scalping bots also have some downsides to consider:

- Lack of flexibility: Some bots just follow a template and can't adapt to changing market conditions on their own. They don't have the ability to fully analyze the situation which could lead to losses.

- Absence of intuition: While lack of emotions is good in some ways, it also means the bot will keep trading even after a string of losses. A human trader might decide to stop trading for the day after losing too much, then reassess and modify their strategy.

- Need for oversight: Scalping bots require control and supervision. They can't be left unattended for long because they lack the judgment to determine when to stop trading on their own. Monitoring is necessary to achieve the best results and avoid disasters.

Overall, with the right oversight and settings adjustments by an astute trader, scalping bots can be very effective. But they still need human guidance to reach their full potential while avoiding major pitfalls. Close management and modification based on performance and market conditions are key.

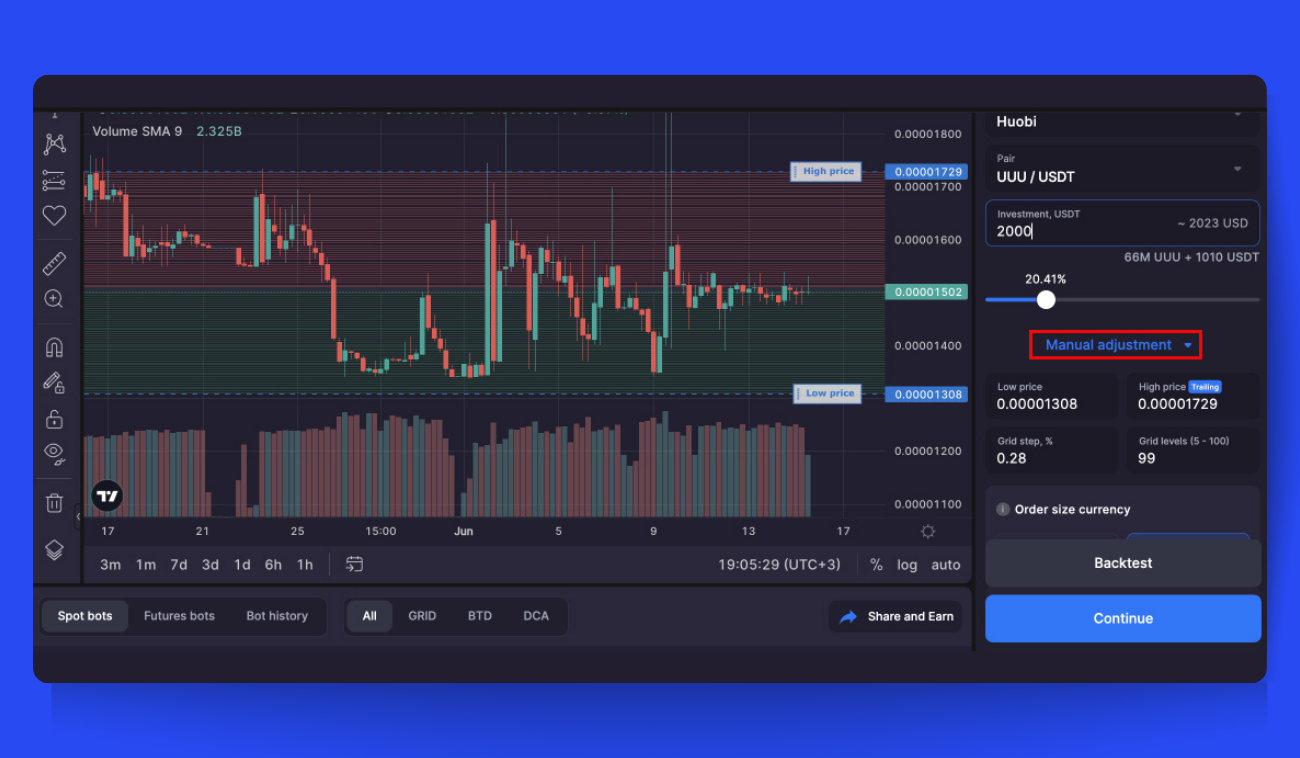

Scalp with Bitsgap’s GRID Bot

For those in the dark, the GRID strategy is a widely-used approach in crypto and forex trading that involves placing delayed limit buy and sell orders at predefined price intervals. The chosen price range is divided into multiple levels, forming a grid filled with orders—hence the name.

Bitsgap’s GRID bot follows this approach, generating profits on any market movement. The bot’s grids are interchangeable, with the bot creating a new sell order above the executed price for each completed buy order, and vice versa, while the platform manages all your trades behind the scenes.

When configuring a new GRID bot, the [Manual adjustment] (Pic. 5) section lets you customize its settings and tailor your trading strategy, including scalping.

By default, the system sets the lower and upper limits of the trading range at a 50:50 ratio relative to the current price. The orders above the current price are your initial sell orders, while those below are your buy orders. This ratio changes as the price fluctuates within your grid. You can manually set the range according to your strategy by entering values in the "Low Price" and "High Price" fields or adjusting the levels on the chart.

Pretty much every other setting you see in [Manual adjustment] can be tampered with to suit your particular needs — grid step, grid levels, order size currency, hedging mechanisms, and so forth.

If you’re looking to literally “grid” the chart and squeeze profit from every twitch of the market, simply shrink the spacing between your rows. Choosing a smaller grid step will automatically multiply your grid levels, filling trades more frequently. By cinching your grid tight, you cultivate a sea of buys and sells that capture even the most infinitesimal movements. Each time the price stirs, a new order will awaken to catch it.

Bitcoin vs Altcoin Scalp Trading

Bitcoin swings less wildly than most altcoins, so while profits may be more modest, they are also more dependable. The king of crypto lumbers where altcoins sprint, with less chance of sudden jumps or drops. In contrast, altcoins often display highly erratic volatility. If you're not careful, you could potentially fail to recover your profits. To succeed, it's essential to make informed decisions.

Bottom Line

Day traders seeking thrills and profits should explore the strategy of scalping. Scalping involves riding the market's waves to pound out many small wins that compound into substantial gains over time.

With scalping, traders dip in and out of positions in the blink of an eye to profit from brief price moves. Exposure to the market lasts only seconds, with traders entering and exiting multiple times a day. It's not for the faint of heart but can be very rewarding.

Scalping works well as either a primary tactic or a supplement to other day trading strategies. The keys to success are strict risk management, quick reaction times, the right tools, and tolerance for frequent trading.

If you’re scalp-curious, be prepared for a wild ride!

FAQs

What Is Scalping Cryptocurrency?

Cryptocurrency scalping is a high-risk, high-reward day trading strategy. It involves buying and selling crypto tokens rapidly to profit from small price changes. Scalpers jump in and out of positions in minutes, seeking to squeeze gains from the market's constant fluctuations.

Is Scalping Trading Profitable?

Scalping can be very profitable when done right but also perilous. Cryptocurrency prices are notoriously volatile, so scalpers must act fast and choose wisely. Catch the wave at the wrong time, and your portfolio could end up shipwrecked. This aggressive trading style demands skill, discipline and tolerance for risk.

Is Scalp Trading Legal?

Yes, scalp trading is perfectly legal. However, it can also be abused for fraud, as the SEC has warned.

Scalping involves rapidly buying and selling assets to capitalize on brief price fluctuations. Skilled scalpers pound out many small wins from volatility that compound into big gains.

When done properly and ethically, scalping is a legitimate tactic.

What Scalp Trading Books Can You Recommend?

Those are some of the leading books on scalp trading strategies, techniques and systems:

- A Beginner's Guide to Day Trading Online (2nd edition) by Toni Turner offers an excellent primer on day trading for newcomers, including an introduction to scalp trading.

- High-Probability Trading by Marcel Link provides a range of trading strategies tailored for various market environments. Among these strategies is guidance on scalp trading

- Day Trading and Swing Trading the Currency Market by Kathy Lien provides extensive guidance on trading strategies tailored for different market environments. While the book covers forex trading broadly, it includes specific insight into scalping techniques along with other short-term approaches.

Also, check out Al Brook’s price action series; it might be worth it.