11 Crypto Day Trading FAQs Answered

Learn about day trading by following the answers to eleven frequently asked questions about the strategy.

Some traders prefer the tried-and-true HODL. But what if you want to make and secure profits more quickly? If so, you may be interested in trying a crypto ‘day trading’ approach.

Cryptocurrency trading is an exciting area that many people are keen to master. There are, of course, many different ways to do it. Some people prefer the long-hold approach, while others choose to secure profits quickly.

This article will concentrate on the second, quicker path to making money, better known as crypto day trading. Have questions about crypto day trading? Here, you’ll have all the answers!

What Is Crypto Day Trading and How Does It Work?

Cryptocurrency day trading is a short-term, high-risk trading strategy where you enter and exit positions multiple times over a single day. Exactly how many trades you want to make is up to you, but ideally, you’ll be looking for small price bumps that allow you to sell for a profit. These may not seem like much at first, but in the long run, they can add up to substantial profits.

Is Crypto Day Trading Profitable?

Day trading can be very profitable. It’s not unusual to see a particular crypto asset spiking through the roof on the same day. All you have to do is to be informed, vigilant, and stress-resistant.

👉Ultimately, profitability greatly depends on your individual investment goals and trading style.

Since day trading is risky, it requires a deeper understanding of the market, fast decision-making, and execution. To increase your chances of profit, you may want to use additional tools that can help you gauge market timing more accurately.

How and Where Can You Start Day Trading?

Getting started with day trading cryptocurrencies is relatively simple — choose an exchange, find an asset you like, make a purchase, and then flip it for profit by the end of the day.

👉 By using Bitsgap, a crypto exchange aggregator and the best crypto trading platform online, you can connect to multiple exchanges.

This gives you easy access to your favorite exchanges and plenty of additional tools, including smart orders, trading bots, and risk management instruments, which can be critical for successful day trading.

What Is the Best Crypto Day Trading Strategy?

Since there are several crypto day trading strategies, you may want to try a couple, a combination, or all of them to see what works best for you. You may find out that you’re better at scalping or arbitrage. Alternatively, you may come up with a different strategy entirely that incorporates a bit of everything. In short, experiment!

In the meantime, let’s go over the best crypto trading strategies and talk a bit about each.

- High-frequency trading is a trading approach that takes advantage of price changes that occur in seconds. Since dozens of orders per second are beyond human capability, investors use trading bots to take advantage of minute price swings automatically. The bot follows any given trading logic, monitors the market, and executes trades continuously as long as it’s connected to an exchange.

- Scalping is a trading strategy that aims to reap small profits from a large number of trades. As such, scalping capitalizes on growing trading volume, slight price fluctuations, and short time frames. Because time is key, most scalpers also use crypto trading bots to enhance the trading frequency and maximize results.

- Arbitrage is a trading strategy that involves buying and selling crypto at different exchanges to capitalize on the spread (the difference between buy/sell prices). For instance, if you know that BTC sells at a price 20% higher in South Korea than in the US, you may want to buy BTC in the US, sell it in Korea, and pocket the difference.

- Range trading is a strategy that assumes that crypto prices fluctuate within a certain range over a specific period. As such, the strategy is heavily dependent on the concept of support and resistance. Price movements outside the range signal abnormal price behavior and can be used as triggers to enter/exit a position. The idea is to buy when the price touches support and sell when it reaches resistance.

What Are the Best Indicators for Crypto Day Trading?

For a day trader, keeping an eye on technical analysis is very important. A few indicators can be beneficial in estimating the right time to enter and exit:

- Moving Averages (MAs) are technical indicators that smooth out price data by creating a constantly updated average for a specific period like 20 minutes, ten days, and so on. MAs can be used as standalone indicators to identify trend direction or form the basis for other technical indicators like the moving average convergence divergence (MACD). The most commonly used MAs include simple, exponential, weighted, triangular, and variable MAs.

- Relative Strength Index (RSI) is a momentum indicator that measures the speed and magnitude of an asset’s recent price changes to determine if it’s over/undervalued. Moreover, RSI can identify assets bound for a trend reversal or corrective pullback in price.

- Bollinger Bands (BB) is a technical analysis tool that comprises a set of trendlines – an upper, middle, and lower band. The upper and lower bands are two standard deviations, both positive and negative, from the middle band, which is a 20-day simple moving average (SMA). BB is used to generate oversold or overbought signals. This way, if an asset’s price touches the upper band, it’s overbought, and vice versa.

- Fibonacci Retracement levels stem from the Fibonacci sequence and represent horizontal lines with the associated percentages of 23.6%, 38.2%, 61.8%, and 78.6%. Those lines are used to determine possible support and resistance levels and trend-trading entry points.

- Stochastic Oscillator is a momentum indicator that compares a particular closing price of an asset to a range of its prices over time. Like many others, it aims to generate overbought or oversold trading signals. Stochastic Oscillators can be fast or slow. Because some traders believe fast stochastic to be overly responsive to price changes, the general preference is to use slow stochastic for day trading.

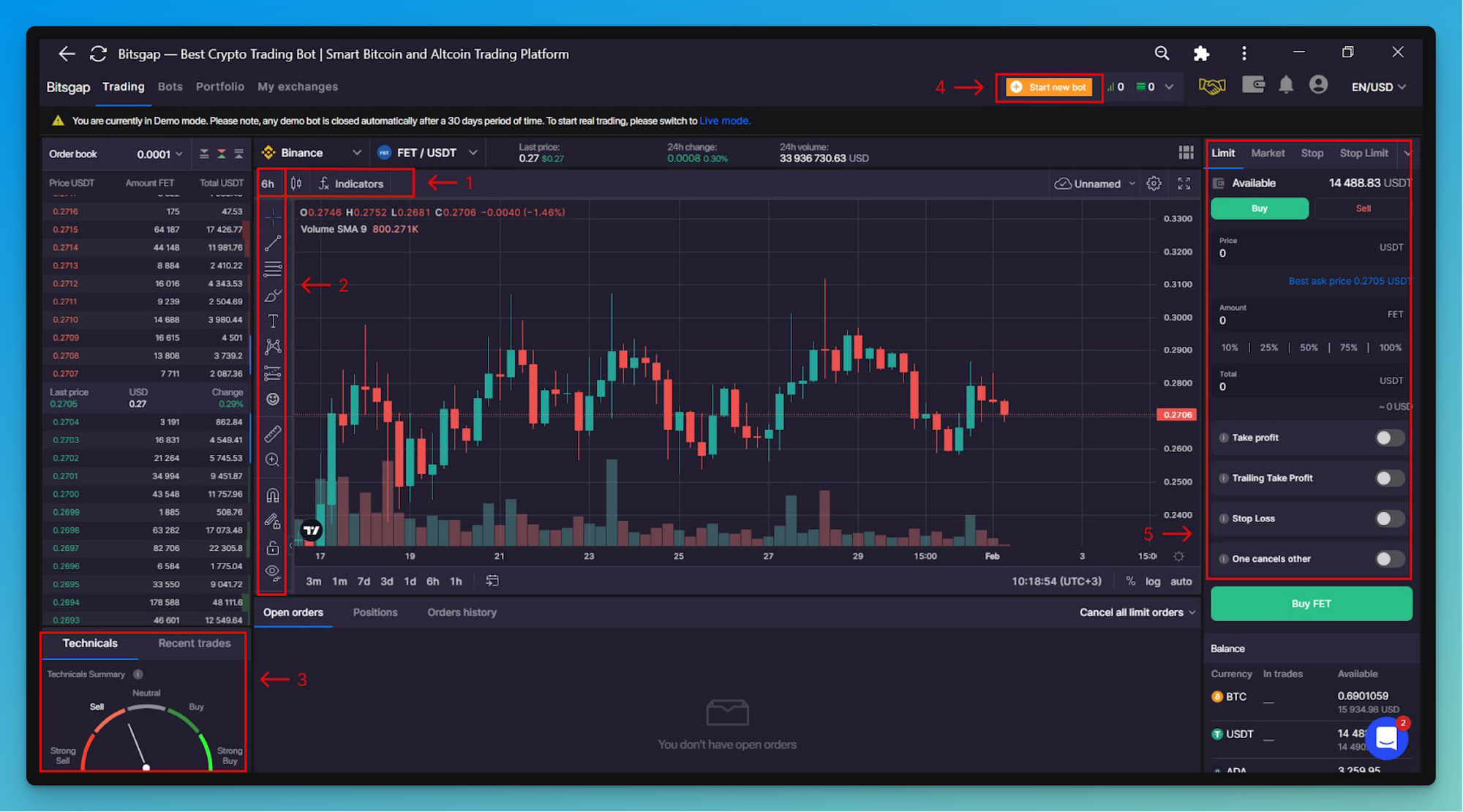

The good news is that most of the above indicators and many others are available in the Bitsgap terminal.

👉 Here’s a handy tip — in day trading, you can use practically any indicator simply by adjusting its time frame.

What Tools Can Be Used for Day Trading at Bitsgap?

With Bitsgap, you have all the tools you need to start day trading cryptocurrencies. So look no further.

For starters, if you prefer manual trading, you can use a wide range of available smart orders and risk management tools such as Stop Loss & Take Profit.

For those interested in automated trading, Bitsgap has a handful of fantastic options:

- GRID Bot follows the GRID strategy and divides your chosen price range into multiple levels, thereby creating a grid of buy and sell orders. The lower the grid step, the more levels and orders you’ll have, causing the bot to respond to even tiny price fluctuations. You can start the bot with only a handful of clicks to follow a profitable default strategy or modify your bot however you like it. Read more about the GRID bot here.

- DCA Bot follows the DCA strategy and divides your investment into periodic purchases or sales depending on your position, either long or short. Such distribution allows you to reduce the impact of volatility on your overall position. You’d want to use the DCA bot if you want to supplement your trading with powerful risk management mechanisms and trading signals. Like the GRID bot, DCA can be started in a few clicks or modified for a personalized strategy. Read more about the DCA bot here.

👉 The platform can also automatically analyze your bot’s trading performance to give you insight into the profits and losses so that you can adjust your strategy accordingly.

Bitsgap offers plenty of charting instruments and a special Technicals widget. The widget combines and averages the signals from multiple indicators to give one composite signal – buy (strong buy), sell (strong sell), or neutral. This is super handy for spotting potentially favorable opportunities.

Finally, if you’re not yet ready to play with real money, you can also use the Demo mode to practice your skills without exposing yourself to any risk. To switch to the Demo mode, just click on the [My account] icon on the top right of the interface and toggle [Demo] mode on.

Can I Start Day Trading Crypto with Only 100 Dollars?

One of the best things about cryptocurrency is that you can begin trading with nearly any amount of money. Crypto coins and tokens are not required to be held in full amounts, which means you can trade with even a very small investment.

If you prefer to hold entire tokens or coins, you can look to smaller market cap assets that are more in your price range. There are hundreds of promising projects that are still very affordable.

Is Day Trading Cryptocurrency Worth It?

Day trading is a skill, just like anything else. If you take the time to learn how it’s done, then it can be a very lucrative hobby or even a full-time job. Of course, this means you’ll need to be willing to learn how the process works and be prepared for losses.

👉 Nobody wins on every trade, but the goal is more wins than losses. Good traders know how to assess risks and don’t bet the farm on a single trade.

Cryptocurrency Day Trading vs. Swing Trading vs. HODL

Crypto day traders enter and exit positions several times within 24 hours. These traders usually seek small gains on day-to-day trading activity that add to significant profits over time.

A swing trader is generally looking for a bit larger cashout target. These traders may hold on to assets for several weeks or months to take advantage of news or relevant market action, which could result in significantly bigger profits.

A trader who plans to ‘HODL’ intends to make a large sum of money on one trade after perhaps a couple of years or more. If you believe in a project’s potential and are not interested in chasing short-term profits, then this is the method for you.

How Is Day Trading Taxed?

Day trading will be taxed at a higher rate than buying and holding. This is because the tax rate differs for assets held for less than a year.

In general, your crypto profits may be subject to income tax and capital gains tax. Since the IRS rules on crypto tax are constantly changing, talk to your local tax office to find out what you owe to the government.

What Are the Good and Bad of Crypto Day Trading?

Day trading can be an excellent way to make short-term profits and add to your portfolio. Even investors who are typically only interested in long-term holding can use cryptocurrency day trading to easily double the size of their holdings while they wait for long-term gains.

👉 These daily fluctuations may seem small, but they can add up to many extra coins or profits over a few months.

Of course, you can’t expect every trade to be a winner! Everyone makes a bad move occasionally, and if you don’t know how to manage your risk properly, it can be a costly mistake. There is also the risk of exiting a position just in time for a bigger run. Missing out on larger gains by chasing smaller profits can be a painful experience, but it’s a risk day traders take.

Conclusion

As we’ve discussed, crypto day trading is a high-risk trading strategy that involves the frequent purchase and sale of cryptocurrency. To be a successful day trader, you need to be well-informed about the market, have a solid trading strategy, and use additional tools like technical analysis and automated trading instruments.

Day trading or not, Bitsgap has everything you need to become a successful trader — access to more than 15 exchanges, exceptional security, technical analysis tools, a range of trading bots, and various hedging mechanisms.

Ready to start day trading with Bitsgap? Head to the platform now!