Learn How Shorting Crypto With Bitsgap Works

Shorting allows you to profit from a market decline. Learn how you can profit from shorting with the Bitsgap Trading Bots.

Shorting allows you to profit when the market is down. It involves betting against crypto because you expect its price to drop in the future. Learn how shorting crypto works and how to use Bitsgap bots to profit from a downturn.

Investing typically implies benefiting from an asset's price increase and losing when its price drops. However, it’s wrong to assume you can only make money when the market goes up. Thankfully, with shorting, you can leverage the downturn and make it work in your favor.

So, if you think that Bitcoin or any other cryptocurrency will likely go down soon, you can take a shorting position — bet against the crypto — and make money when its price dwindles. But how does it all work? Let’s dive into it.

What Is Shorting?

The fundamental principle of traditional trading is buying low and selling high. Shorting is the opposite of that; put in basic terms, it’s selling high and buying low.

If you suppose the price of an asset will decline, you might want to sell it now and rebuy it later at a lower price. This way, you’ll end up with the same asset but also a price difference that you can safely pocket or use to purchase even more of that asset. Let’s look at an example.

👉 After you’ve discovered General Electric’s (GE) sharp decline in earnings in its annual report, you expect the price of GE’s stock to follow suit and drop. To capitalize on the decline, you borrow 1,500 shares of the stock from your loan department and sell it at $80 per share for $120,000. Luckily, you were right, and the stock plunged to $71. You rebuy 1,500 shares for $106,500, return those shares to your loan department, and pocket the $13,500 difference you’ve made on the sale. Swell, isn’t it?

Broadly speaking, the more the asset price declines, the cheaper it gets to buy it back and the more profit you make.

However, what happens if the price of an asset continues to rise while you’re still holding a shorting position? This is where the risk hides. When it comes to shorting, your profits are capped by the price decline, which can’t go below zero, but the price can potentially rise infinitely.

This regrettable aspect is very important to understand when it comes to shorting. Luckily, multiple hedging mechanisms can help you secure some of your returns and prevent huge losses.

Shorting Types in Traditional Trading

There’s one more facet to shorting that you need to be aware of — types of shorting, which ultimately affect how and where you short.

First, there are spot and derivative shorting (also applicable to crypto trading — more on it later). As the name implies, spot shorting involves taking a short position in the spot market, while derivative shorting — in the futures market.

There are also naked and covered shorts:

- A naked short (unsurprisingly, illegal in the US) involves selling an asset without having or borrowing that asset.

- A covered short involves borrowing an asset from a financial institution and paying a borrow rate on it during the shorting position.

Can Crypto Be Shorted?

While shorting is typically associated with traditional trading in the stock market, shorting Bitcoin and other crypto is entirely possible. The process is similar to the one you’d use for any other asset. Again, when you short, you expect to profit from a decline in the value of a specific cryptocurrency.

Let us talk about how to short bitcoin and other cryptos. Shorting crypto can be done in different ways, including margin, CFD, or futures trading. Read on to learn a bit about each.

Margin Trading

Shorting on margin implies borrowing crypto from an exchange or brokerage with associated interest charges. You use it to purchase another crypto, wait until it drops in value, sell it, and rebuy the cryptocurrency at a lower price.

You then return the borrowed crypto back to the exchange, pay applicable fees, and retain the profit you made on shorting. The exchange backs your position with the margin requirements, which serve as a form of collateral guaranteeing the return of the cryptocurrency.

Using Contracts for Difference (CFD)

CFDs are derivative instruments that allow you to speculate on financial markets without taking direct ownership of the underlying crypto. The contract pays the difference between an asset's opening and closing price. So if you use CFD to short crypto, then a lower price on the close date will net you a profit.

However, you will have to pay for the difference if the opposite is true. Because of the risks associated with CFDs, they have been banned in certain jurisdictions, such as the UK and the US.

Selling Futures or Options

Futures are agreements between two parties to buy and sell an asset at a specific future price on a specific date and time. However, most of the crypto futures are perpetual, meaning they don’t expire.

👉 Thanks to leverage, futures allow you to trade more of each underlying asset without direct ownership. Just like with other instruments, shorting a futures contract means betting against the crypto and anticipating its price decline.

While options are similar derivatives, they have a few important differences that make them relatively low-risk solutions (compared to futures and CFDs). First and foremost, an option gives you the right — but not the obligation — to buy or sell crypto at a set price at an expiration date.

Because you can choose not to sell your put options, for example, you can limit your losses to the price you paid for putting options on sale. Also, at some exchanges, you can buy and sell options before expiration, which obviously allows for greater flexibility.

Why Is Short Selling Crypto the Best Trading Strategy in the Current Market?

While shorting might sound counterintuitive (especially to long-term investors), in fact, it is one of the best strategies for the current market. These are a few main reasons:

- The market is down. And while prices go down, there are plenty of opportunities to sell now and buy at a bargain later.

- You can protect your long positions with shorting — yes, that’s true. For example, having a long position on Bitcoin, you might feel it’s overbought, and its price will soon decline. Instead of selling your BTC now, you might want to open a shorting position to hedge against your current holdings. This way, if Bitcoin’s price declines, you won’t lose as much money.

- Shorting can be used as a short-term speculative trade. For example, you notice that many coins have recently depreciated in value, but you believe that their price decline can be exploited later when the market rebounds.

You may want to sell your current holdings and rebuy them a bit later when you think the price has reached the bottom. A couple of weeks later, you sell coins at a higher price and pocket the returns.

You can also streamline the whole process with automated trading tools, such as Bitsgap’s, and let bots do all the hard work for you — keep track of prices and buy/sell at the most opportune time.

How to Short Crypto with Bitsgap Bots

Bitsgap has a few shorting instruments that can not only automate the whole shorting business but also make it a superbly profitable venture! Let’s talk about each in more detail below.

Short with the DCA Bot

The DCA shorting bot follows the DCA (Dollar Cost Averaging) trading strategy and divides your investment into periodic sell orders to get a better average price. This approach minimizes the impact of volatility on your overall position and maximizes your returns.

👉 You’d want to use the DCA bot if you want to cycle your trading, follow technical signals, or supplement your shorting position with effective risk management tools. Currently, the bot accumulates profits in the base currency, but later, you’ll be able to choose the quote currency too. So stay tuned for updates.

Below, we’ll explain how you open a shorting position with the DCA bot. It’s important to note that unlike traditional shorting, where you can borrow money from an exchange to short, in Bitsgap, you’ll need to have a sufficient amount of the base currency to open a position. If you don’t have it, you’ll need to buy the base currency manually, go back to the bot launcher, and start it again.

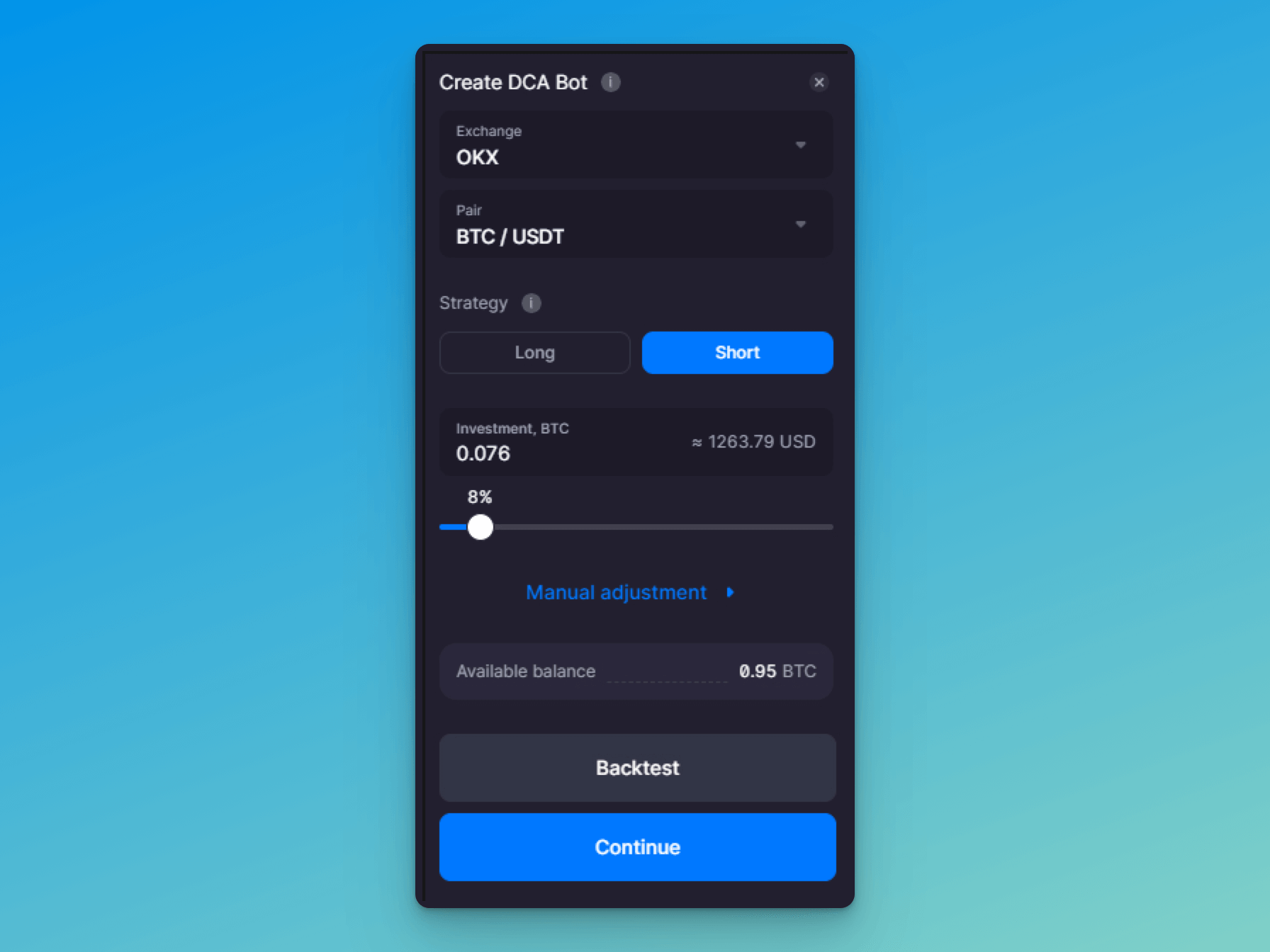

As soon as you have enough base currency, you’re ready to roll. Click [Start new bot] at the top of the interface, then choose the DCA bot from the available options. In the bot settings menu, choose an exchange, a trading pair, and click [Short] under [Strategy] (Pic. 1).

If you click [Continue] now, your bot will immediately start with profitable default settings. Should you wish to follow a particular trading strategy, you’re welcome to customize your settings in [Manual adjustment].

This section has a plethora of different settings combined into three main groups: [Bot settings], [Position TP&SL], and [Risk management].

For example, in [Bot settings], you can choose indicators (if you want to start your trades based on indicator signals) and the amount of your base and averaging orders. In [Position TP&SL], you can specify your Take Profit and Stop Loss.

In [Risk management], you can further hedge your position with target profit (or max tolerated loss) in percentage from your investment and set max/min prices at which the bot won’t open trades.

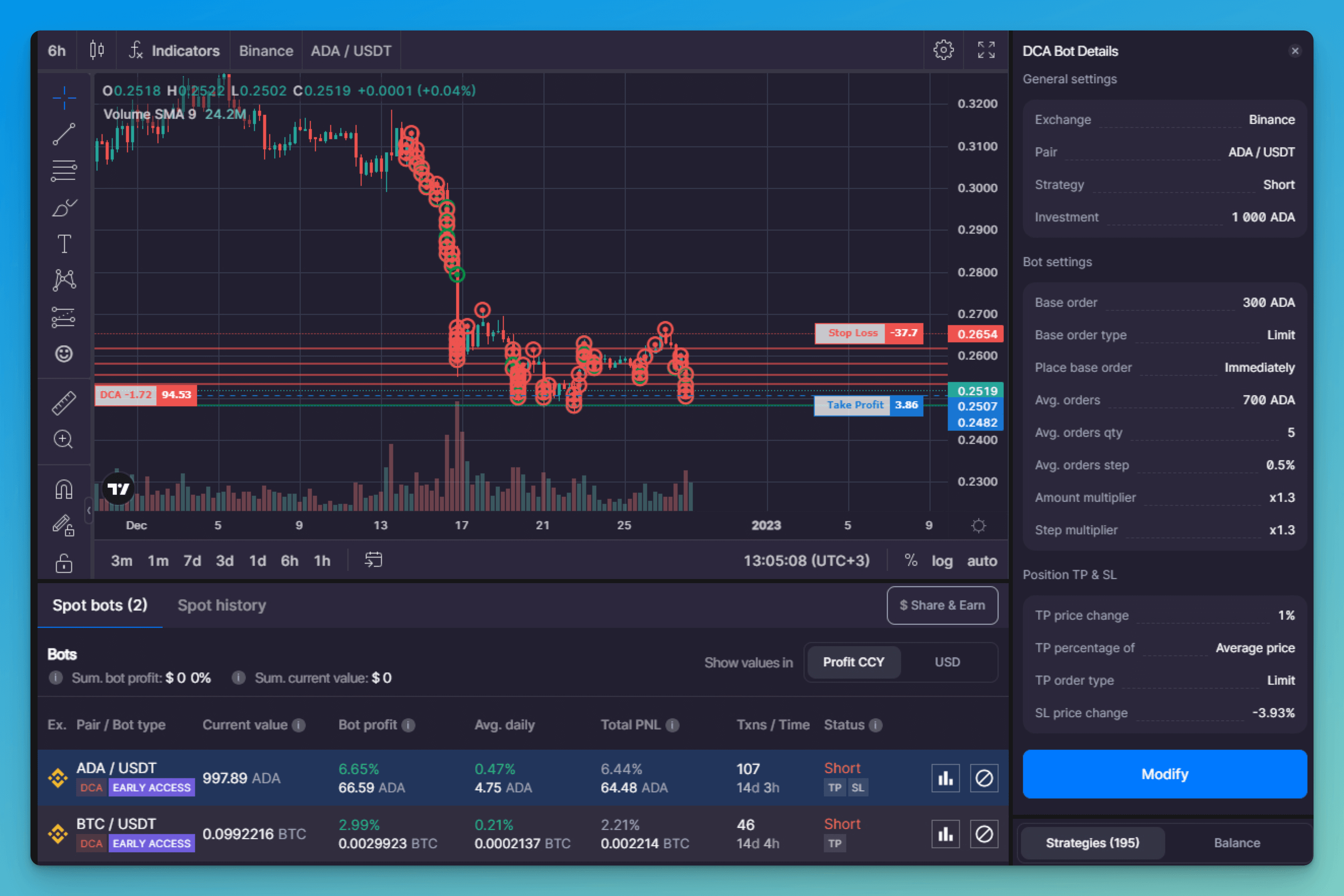

Let’s look at the DCA shorting bot that’s been started 14 days ago and managed to earn 6.65% so far (Pic. 2).

As you can see, the market has been particularly conducive to our shorting position — the price has been falling, allowing the bot to purchase around 4.75 ADA on average daily and make a profit of almost 67 ADA for half a month.

Having started an averaging grid at a much higher price, the bot followed the downtrend market and readjusted to keep profiting and accumulating the base currency.

To learn more about the DCA bot, head to our Help Center or read this article.

To start winning on a downtrend, go to the Bitsgap terminal and start your DCA shorting bot today!

Short the Futures With the COMBO Bot

Bitsgap’s COMBO bot is the futures bot that combines DCA and GRID strategies to profit from both rising and falling markets. While the GRID allows the bot to generate returns on every market movement, DCA optimizes the average price of a position. The automated trailing of the Stop Loss follows the trend and secures generated returns.

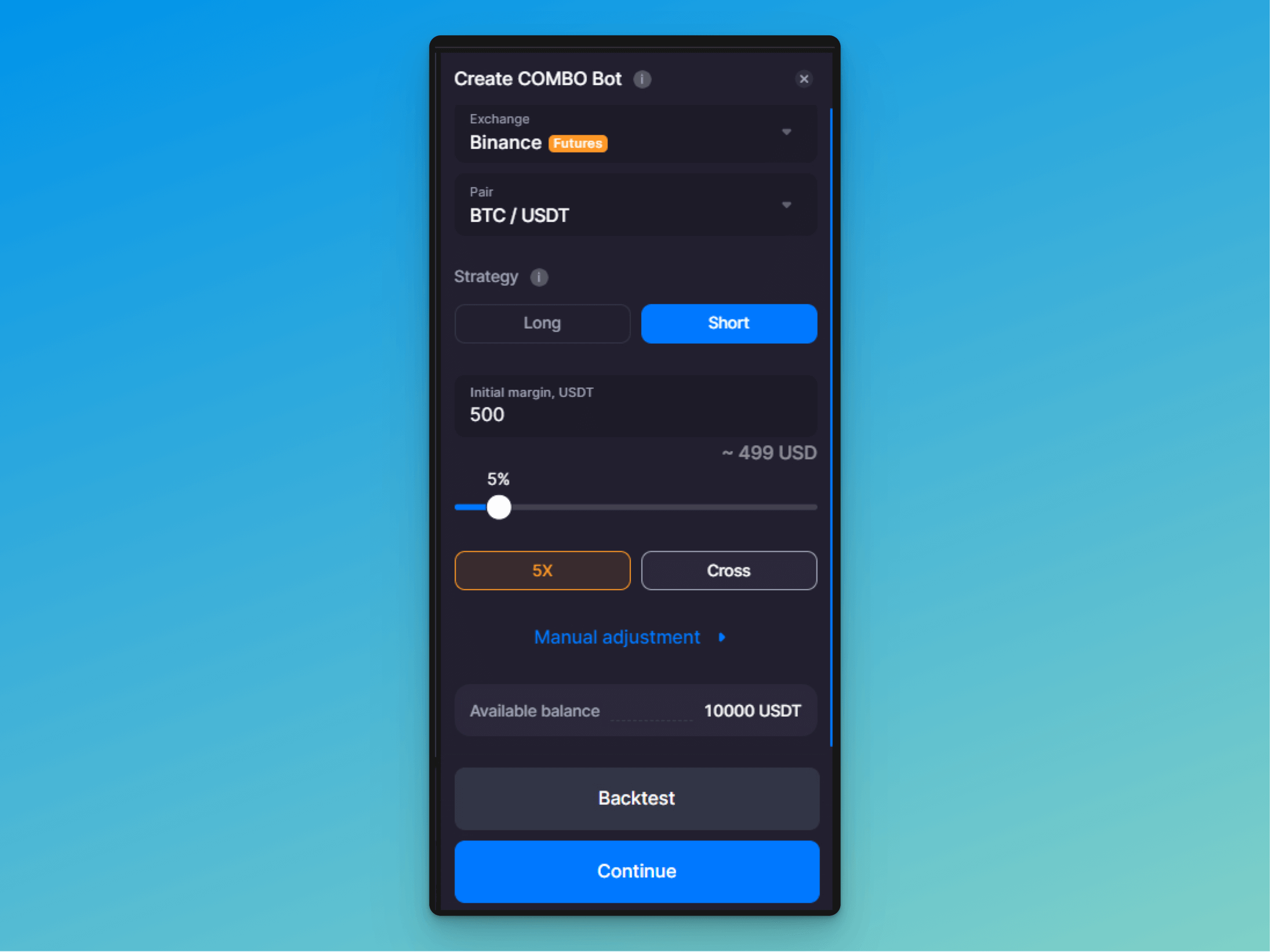

To start your COMBO bot, click on [Start new bot] at the top of the terminal and choose COMBO bot from the list of options. In the bot settings menu, choose an exchange, a trading pair, an initial margin, leverage, and click [Short] under [Strategy] (Pic. 3).

If you click [Continue] now, your bot will start with profitable default settings (the DCA and grid step of 0.33% and a total of 30 levels).

You can adjust the default settings of your COMBO bot by clicking on [Manual adjustment]. There, you can alter the step percentage and a number of (grid+DCA) levels and set up Take Profit and Stop Loss.

When your bot starts, it will use 50% of your initial investment multiplied by the leverage to open your short position. The remaining 50% will be allocated between DCA (sell) and GRID (buy) orders.

To learn more about how the COMBO bot works, please refer to this article on our blog or Help Center.

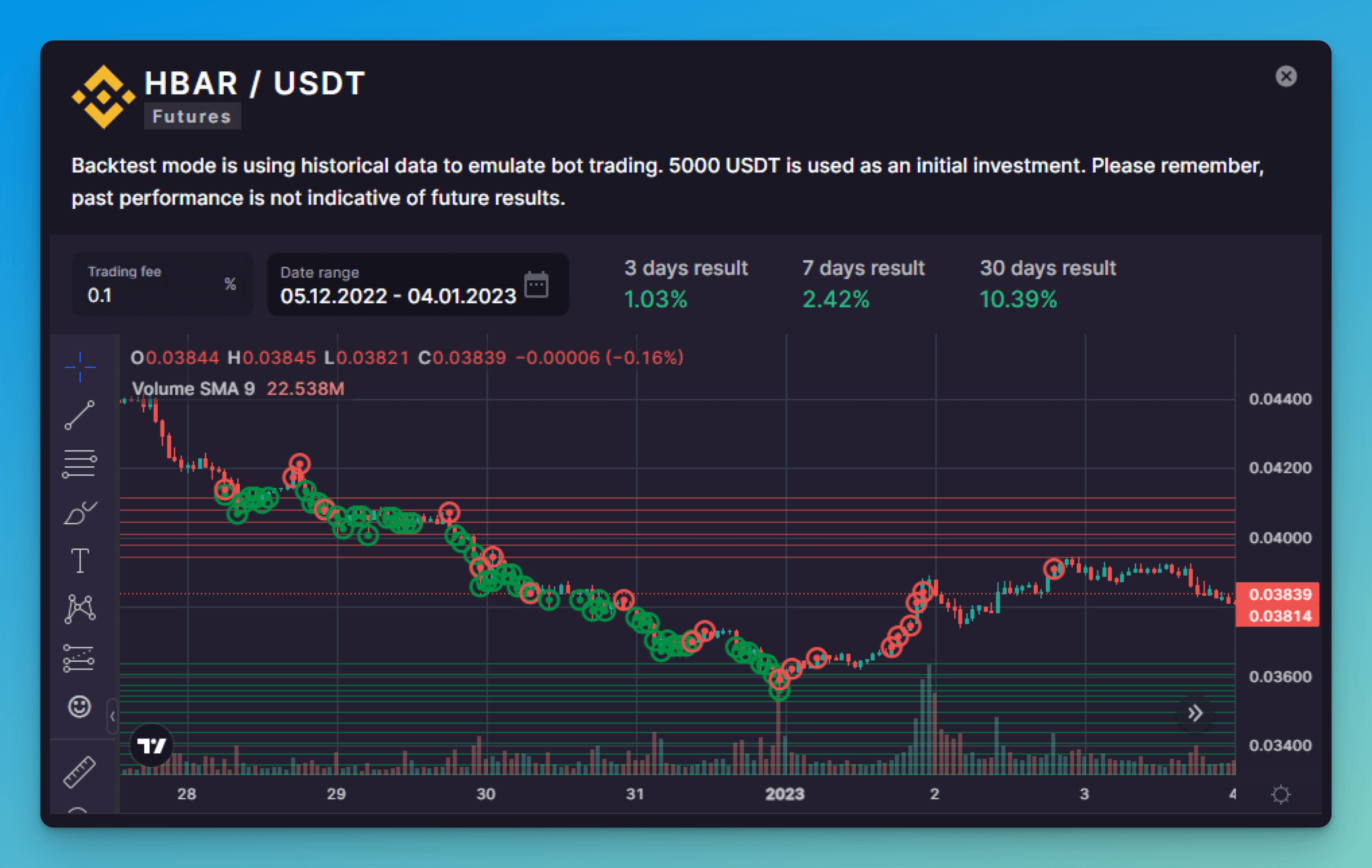

Let’s see how the bot would have performed with HBAR/USDT trading pair if it was started 30 days ago (Pic. 4). Since the price of HBAR has been falling last month, the bot could have accumulated a decent HBAR portfolio and made 10.39% in profit.

Buy the Dip With the BTD Bot

While the Buy the Dip (BTD) bot is not exactly a shorting bot, it works similarly — it purchases coins after they’ve fallen in price, thereby – buying into the dip. If you want to increase your coin portfolio (or base currency) when its price decreases, then the BTD bot can be a good option to consider.

👉 Dip buying also averages the cost of owning your coin portfolio because the bot purchases coins in higher quantity as its price dips deeper.

So, let’s see how to start and navigate BTD. To launch BTD, click on [Start new bot] at the top of the Bitsgap interface and select BTD. Choose your trading pair, an exchange, and an investment, and either click [Continue] to start the bot with profitable default settings or click on [Manual adjustment] if you want to tamper with the bot’s settings.

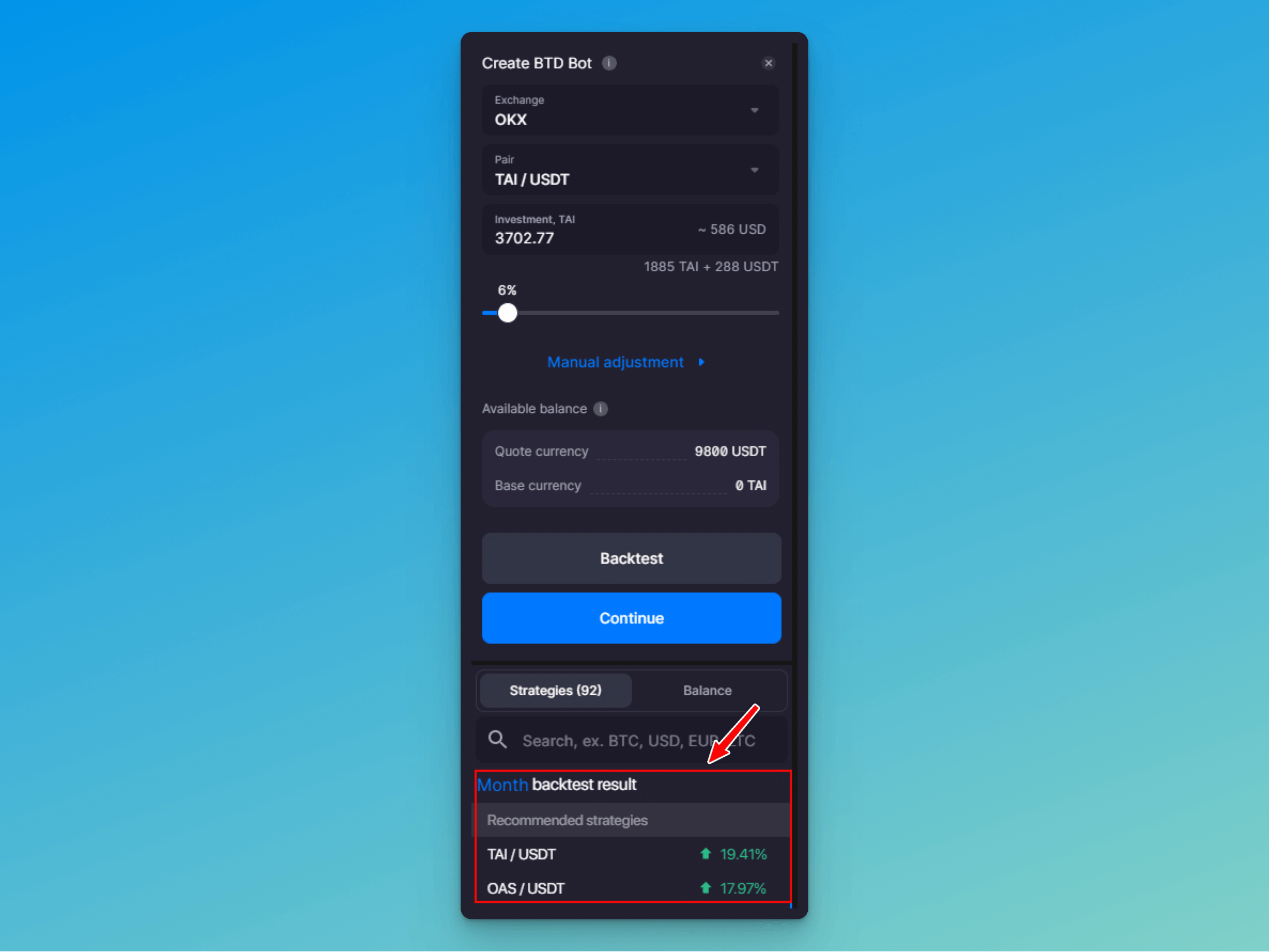

You can also take a look at the profitable strategy suggestions below the settings that are based on a 30-day backtest of the indicated trading pairs (Pic. 5).

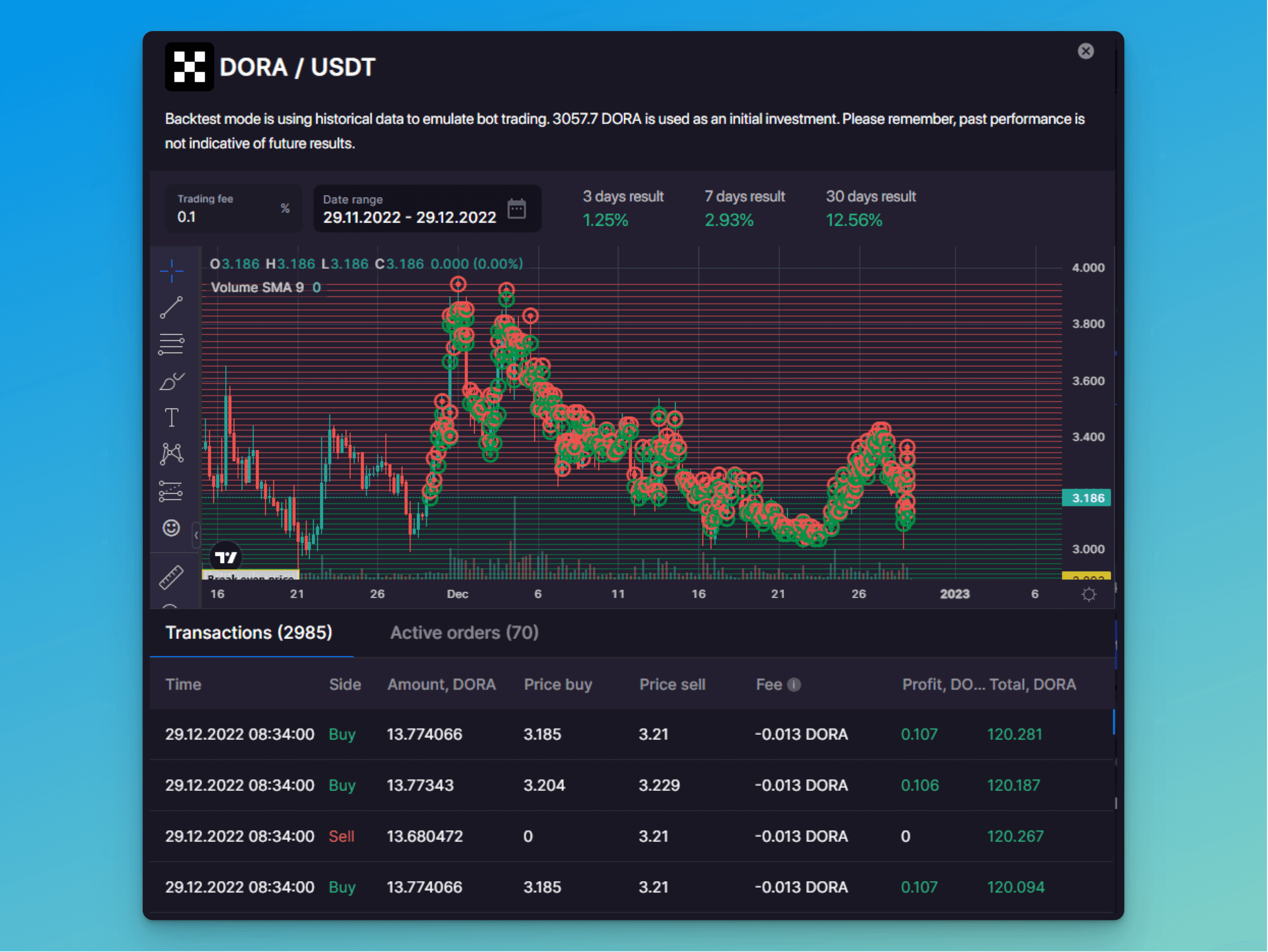

Let’s look at the backtest results of one of the suggested strategies — DORA/USDT (Pic. 6):

As you can see, for the past 30 days, the bot had multiple opportunities to buy into the dip as the DORA price was plunging. Should the bot have started 30 days ago, it could have reaped 12.56% profit.

Can You Short Bitcoin or Other Crypto With the BTD bot?

No, technically, the answer is no. When you’re buying the dip, you’re essentially taking a long position on a coin because you expect the price to rise in the future. Unlike in shorting, when you sell high to buy low.

👉 However, similarly, in BTD, you accumulate your coin portfolio by speculating on a short-term price decline. BTD offers a fantastic opportunity to quickly amass coins for a later dump when the price spikes up or for an infinite HODL.

Want to learn more about BTD? Check out our articles on the blog or Help Center. Can’t wait to start trading? Head to the platform now!

Bottom Line: Shorting Bitcoin & Altcoins

Shorting is a powerful strategy that can help you take advantage of the falling market and capitalize on a price decline. However, manual shorting can become extremely complicated, which makes some traders wary of venturing into that territory.

Thankfully, algorithmic trading bots from Bitsgap allow you not only to automate your shorting but also to take advantage of powerful in-built tools like profitable strategy suggestions that make shorting easier and more accessible.

Want to try shorting? You’re welcome! Do it with the DCA and COMBO bots today!