Win on Downtrend With a Fully Revamped DCA Trading Bot

Wholly updated DCA Bot: Fast start in a few clicks, Backtest, and a Shorting strategy to get the most out of the current bearish market.

Take full advantage of the falling market with an updated and redesigned DCA trading bot from Bitsgap. Backtest on historical data, follow the shorting strategy, and more!

Bitsgap welcomes this wonderful holiday season with the all-new DCA bot! We’ve completely redesigned the bot’s interface to ensure your most profitable trading strategy is only three clicks away.

Wait, but the updated interface is not all – we’ve added a shorting strategy and a backtest feature so you can win on a downtrend, test new assumptions, and adjust your settings for more profits.

Discover how you can use all the updated features to your advantage.

What Are the DCA Bot and DCA Trading Strategy?

The DCA trading bot follows the DCA (Dollar Cost Average) trading strategy, where the bot spreads your investment across period purchases and accumulates your position at an average price.

👉 By doing so, the bot minimizes the impact of volatility on your overall purchase and lowers the average price paid per coin.

You’d want to use DCA to build up your portfolio over time and supplement your strategy with indicator-based trading and robust risk management tools.

Newly Revamped and Added Functionality

The newly updated DCA bot has a few powerful additions: redesigned interface, robust manual adjustment settings, backtest, and finally, a shorting strategy! Let’s uncover the features you’re bound to love!

Reimagined Interface

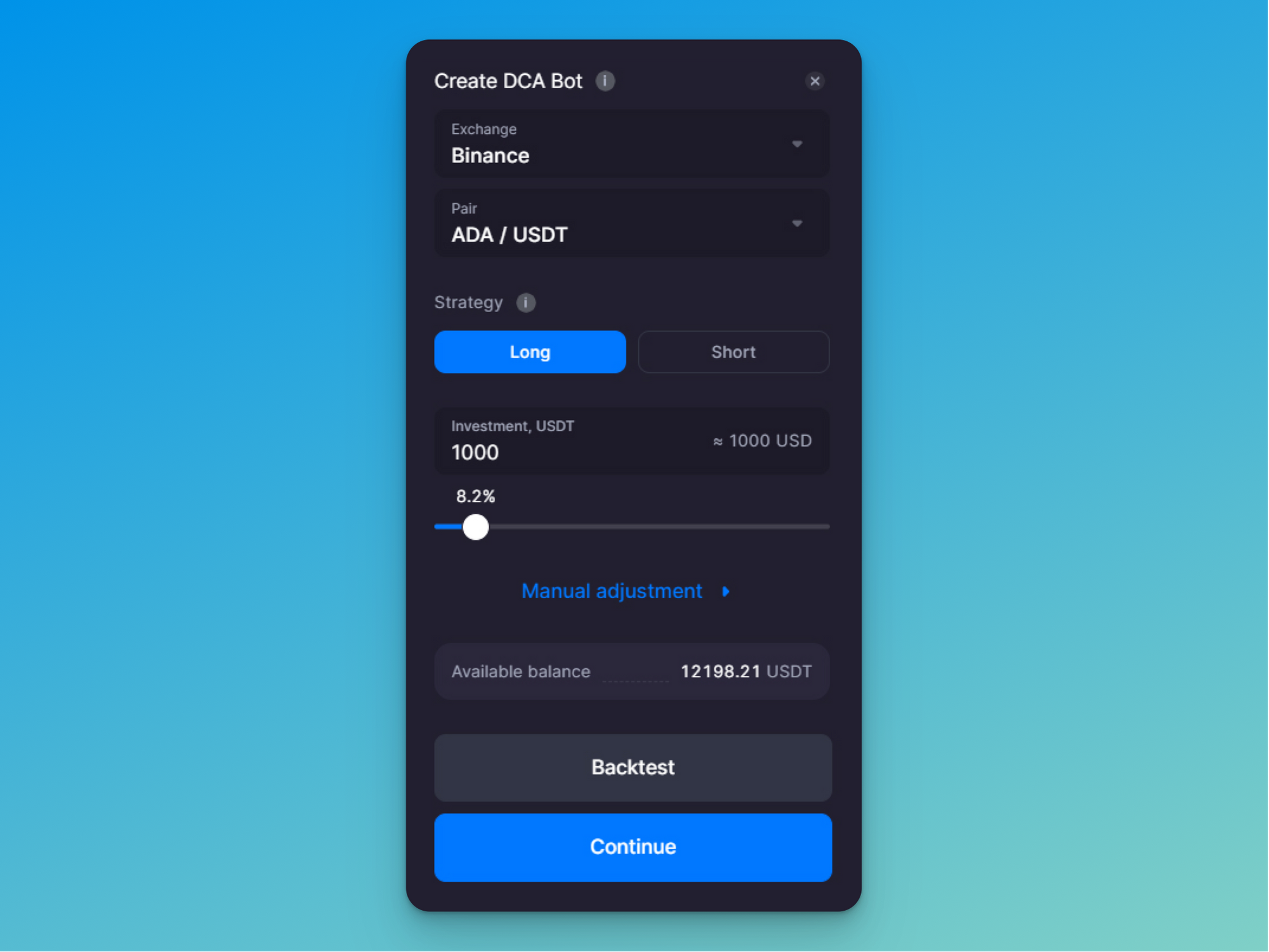

Some of you asked for the ability to launch the bot with profitable default settings in as few clicks as possible. You got it. The new bot launcher (Pic. 1) now comes with an easier, more intuitive interface that allows you to start your bot with as few as three clicks.

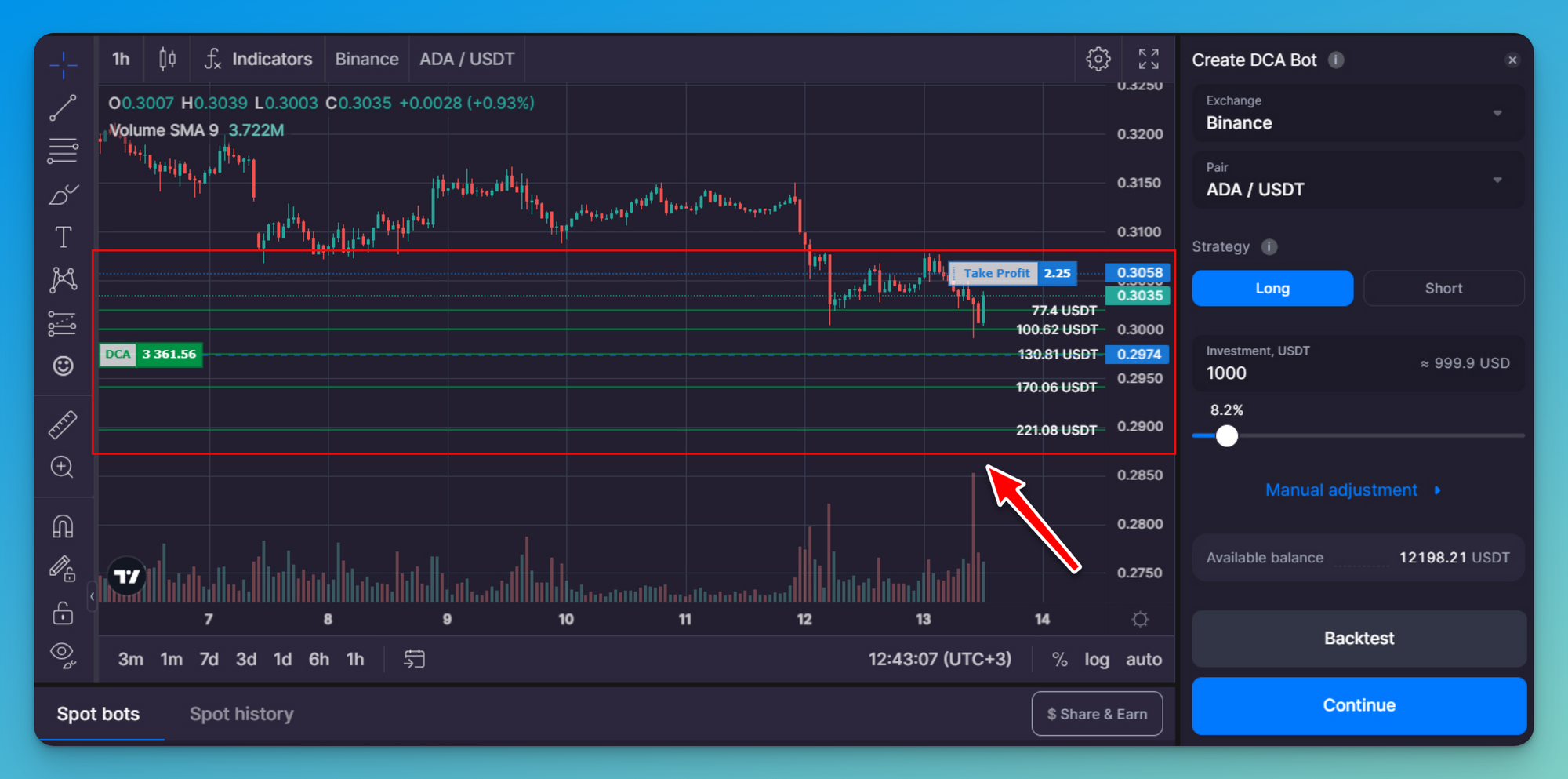

Just choose an exchange, a trading pair, and an amount you’re willing to invest, and that’s it — you’re ready to start your bot and click [Continue]. Your bot will automatically start with a profitable premade strategy that you can examine on the chart to the left of your bot launcher (Pic. 2).

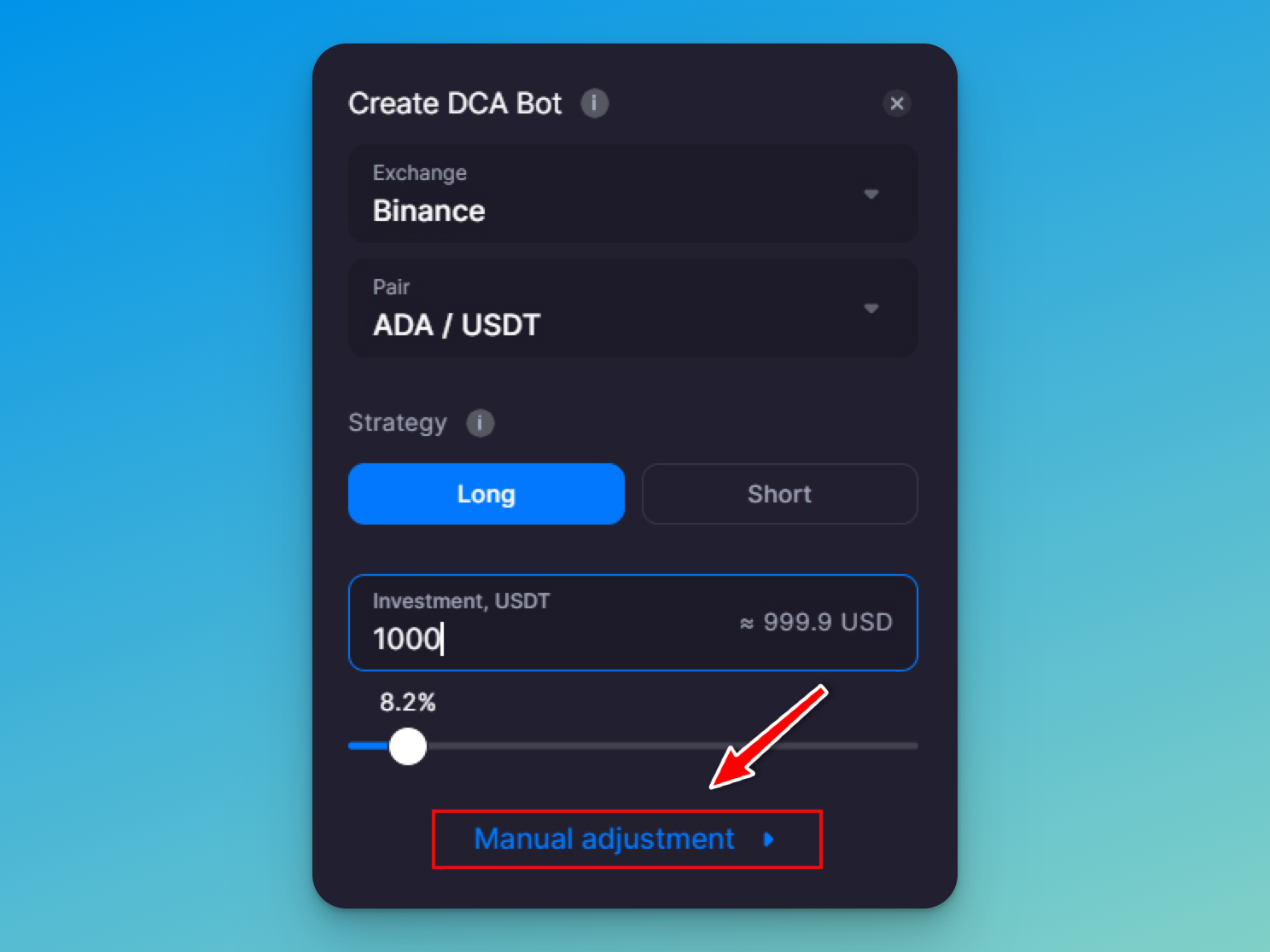

Should you wish to follow a bespoke strategy, there’s [Manual adjustment] for you that now also comes in a more user-friendly interface with equally robust settings.

Manual Adjustment

The [Manual adjustment] function (Pic. 3) allows you to personalize your trading strategy by adjusting the default settings to suit your specific trading agenda. Let’s see what’s under its hood.

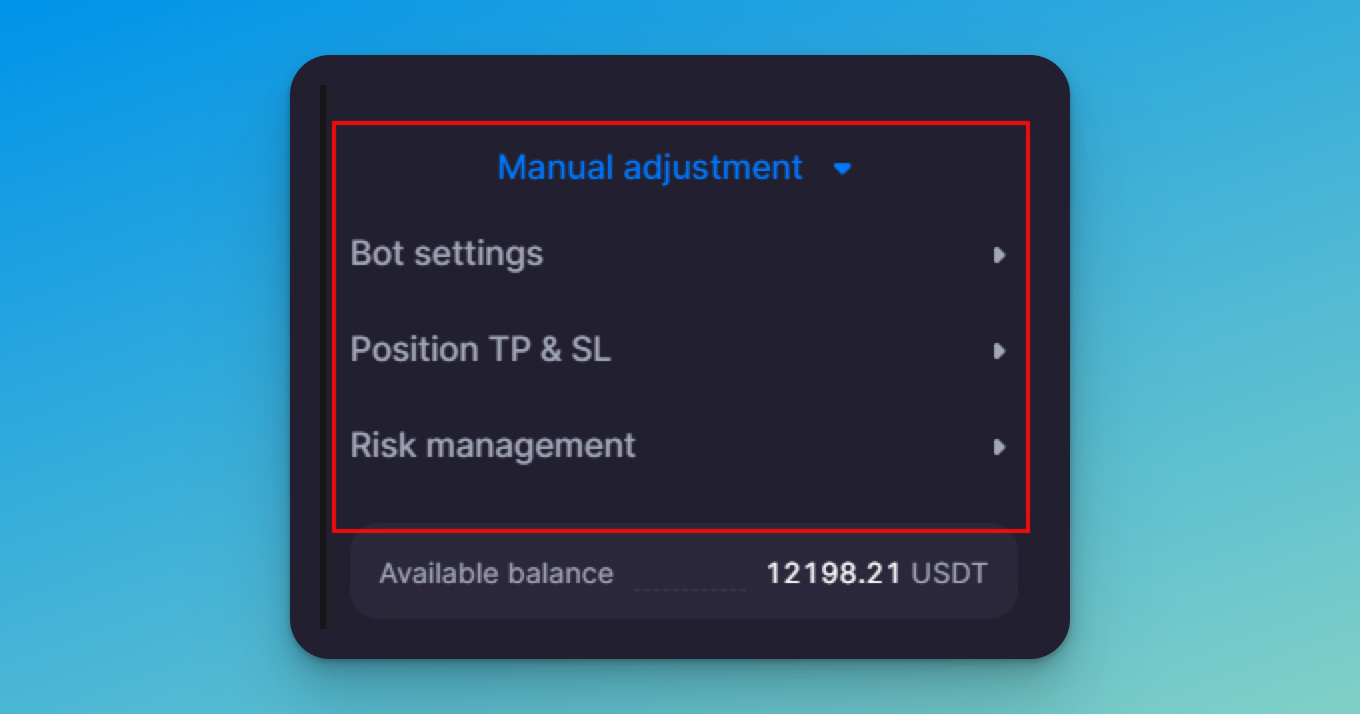

[Manual adjustment] has three sections (Pic. 4):

- Bot settings,

- Position TP&SL,

- Risk Management.

The [Bot settings] section includes the conditions for starting the bot (either immediately or by indicator signals) and allocating the investment amount between the base order and the averaging grid.

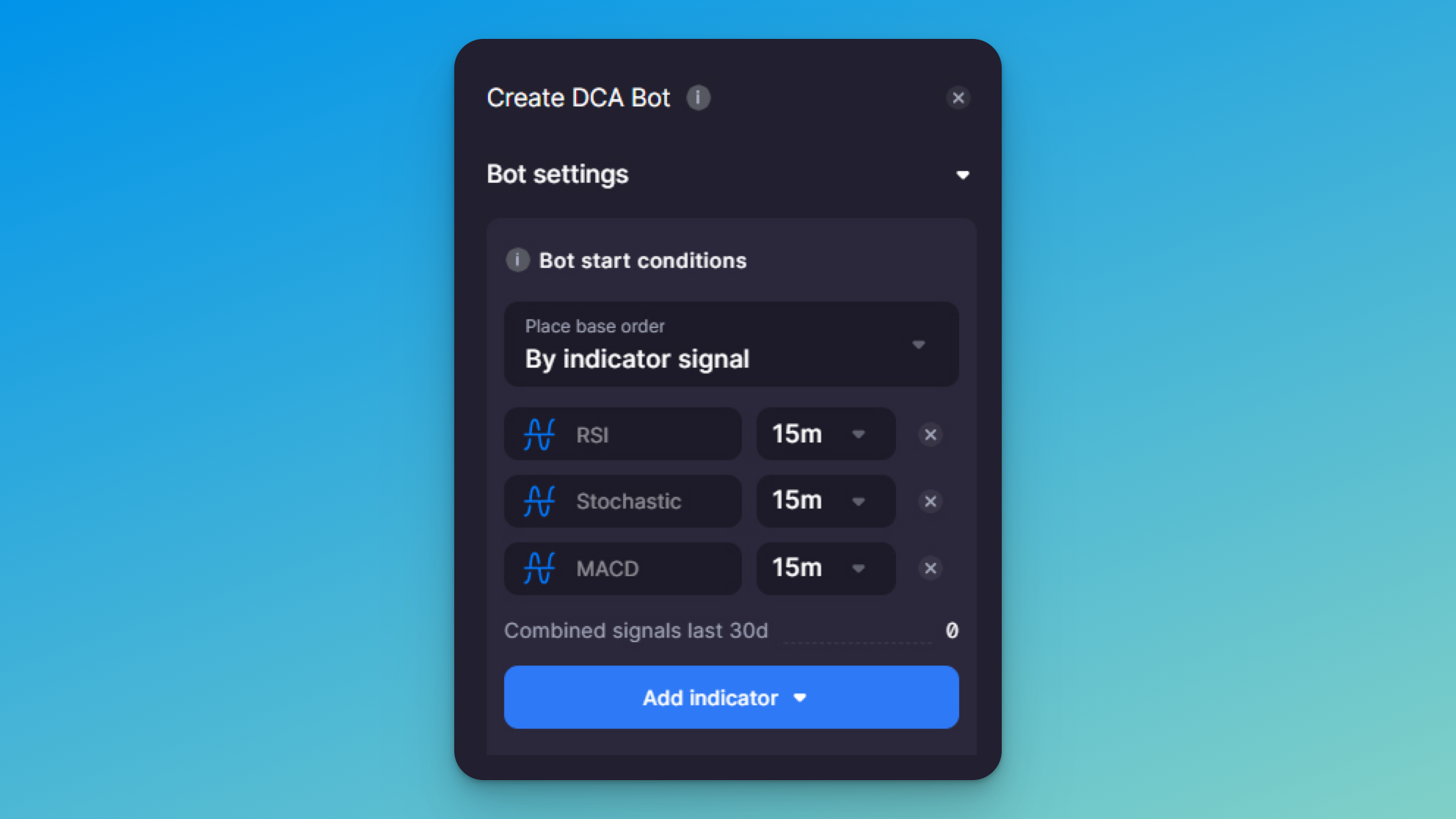

If you want to enter trades following indicator signals, specify so in the [Place base order] conditions. There, switch from [Immediately] to [By indicator signal] and choose up to six indicators you want your bot to follow (Pic. 5).

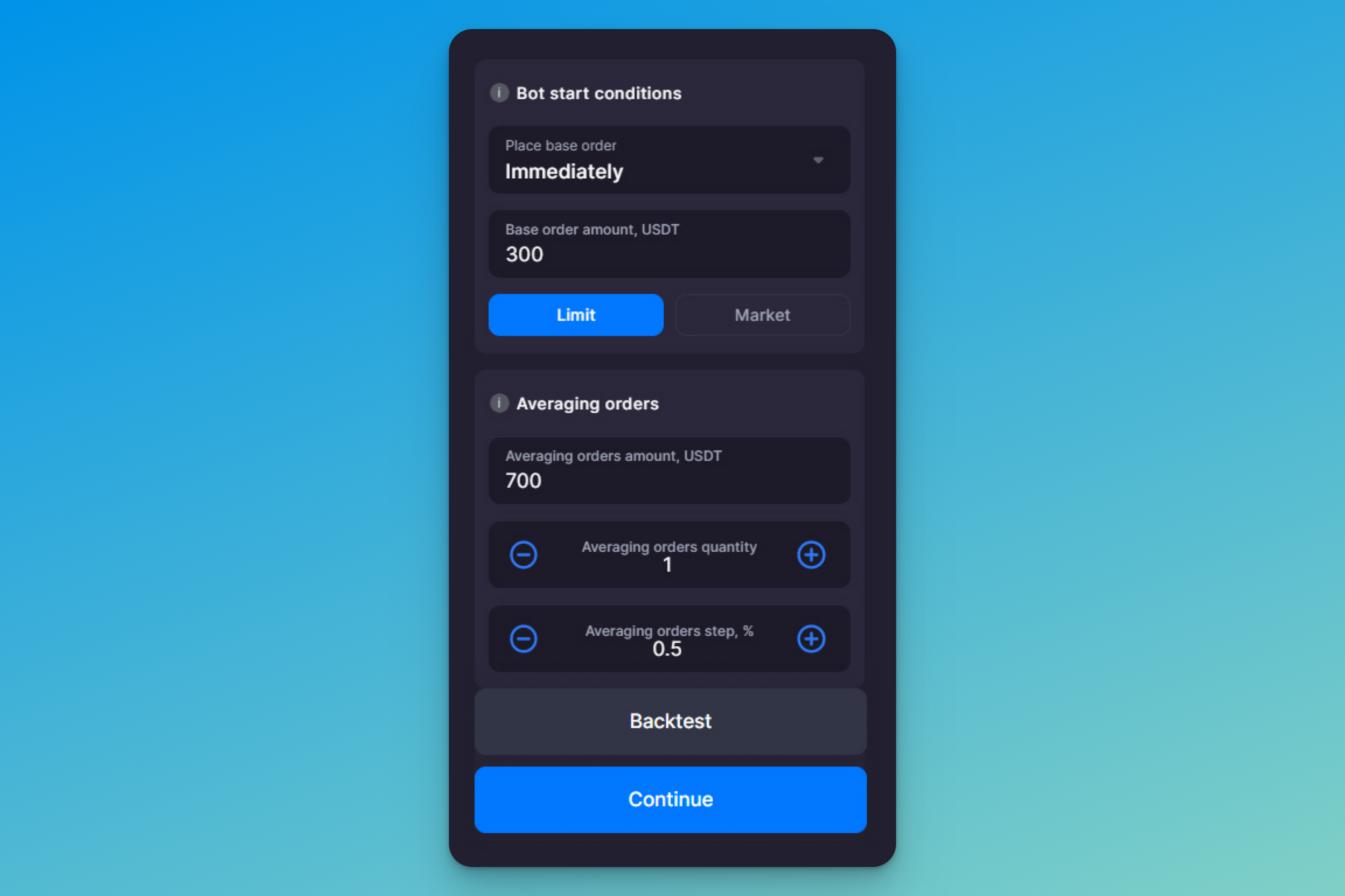

A little further down below, you can adjust the size of your initial position (base order amount), choose the order type (market or limit), and tamper with averaging order settings (Pic. 6).

Under [Averaging orders], you can adjust the amount of investment distributed among the averaging orders, the number of such orders, and their step (or distance between average orders in %).

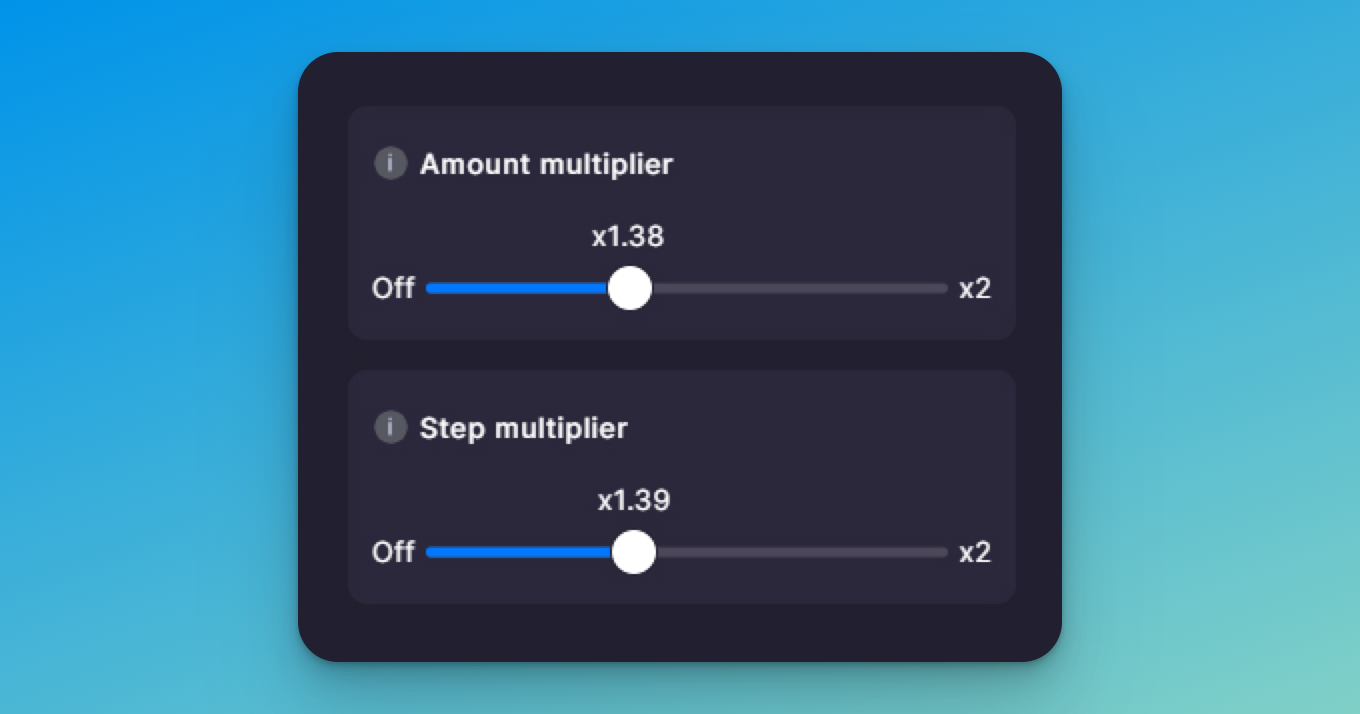

Further down, you can also tweak both amount and step multipliers (Pic. 7).

As the name suggests, the amount multiplier increases the size of each subsequent averaging order by x times you specify. On the other hand, the step multiplier expands the grid of averaging orders with increasing intervals to make fewer trades as the price moves against the first order.

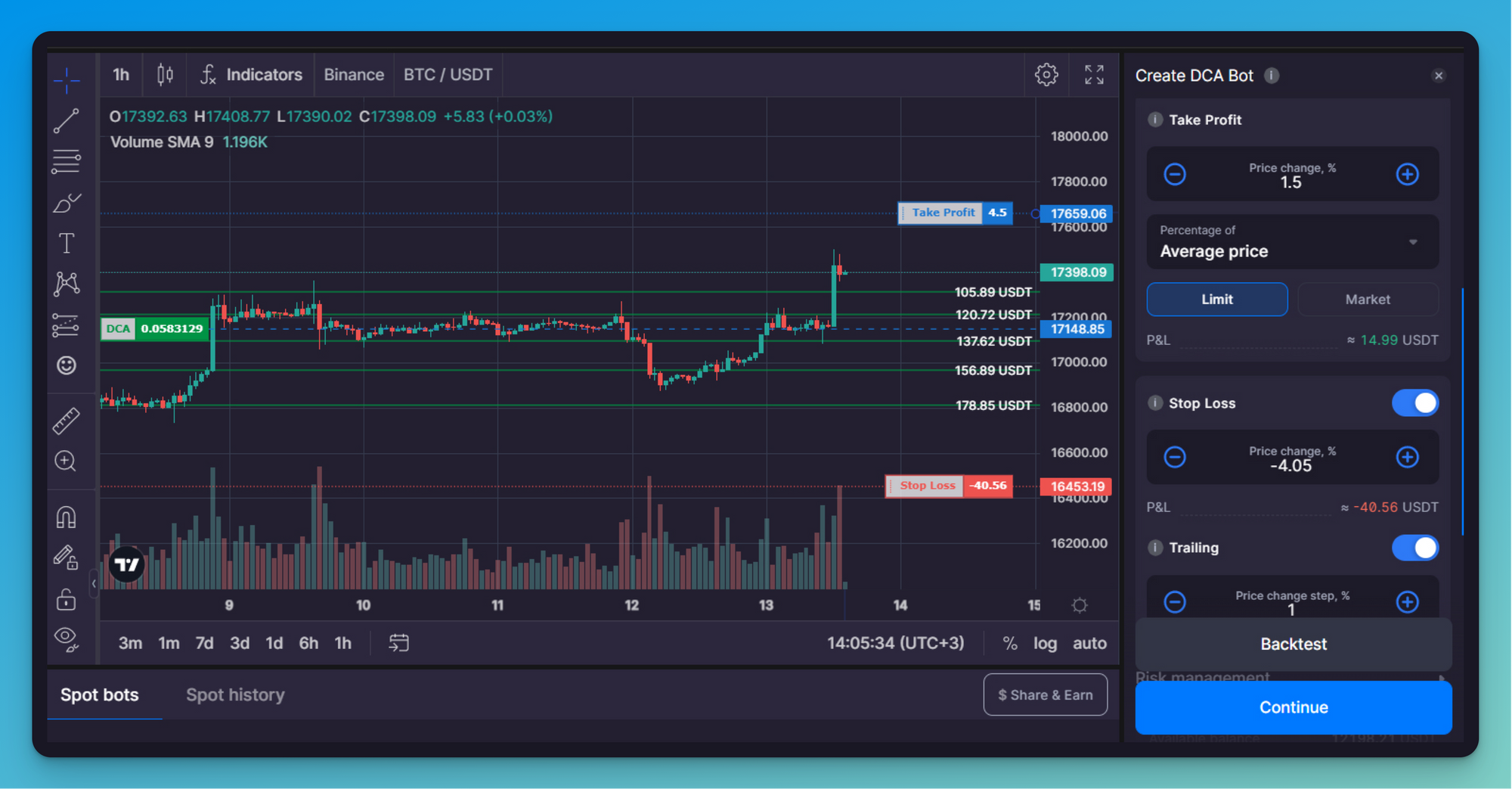

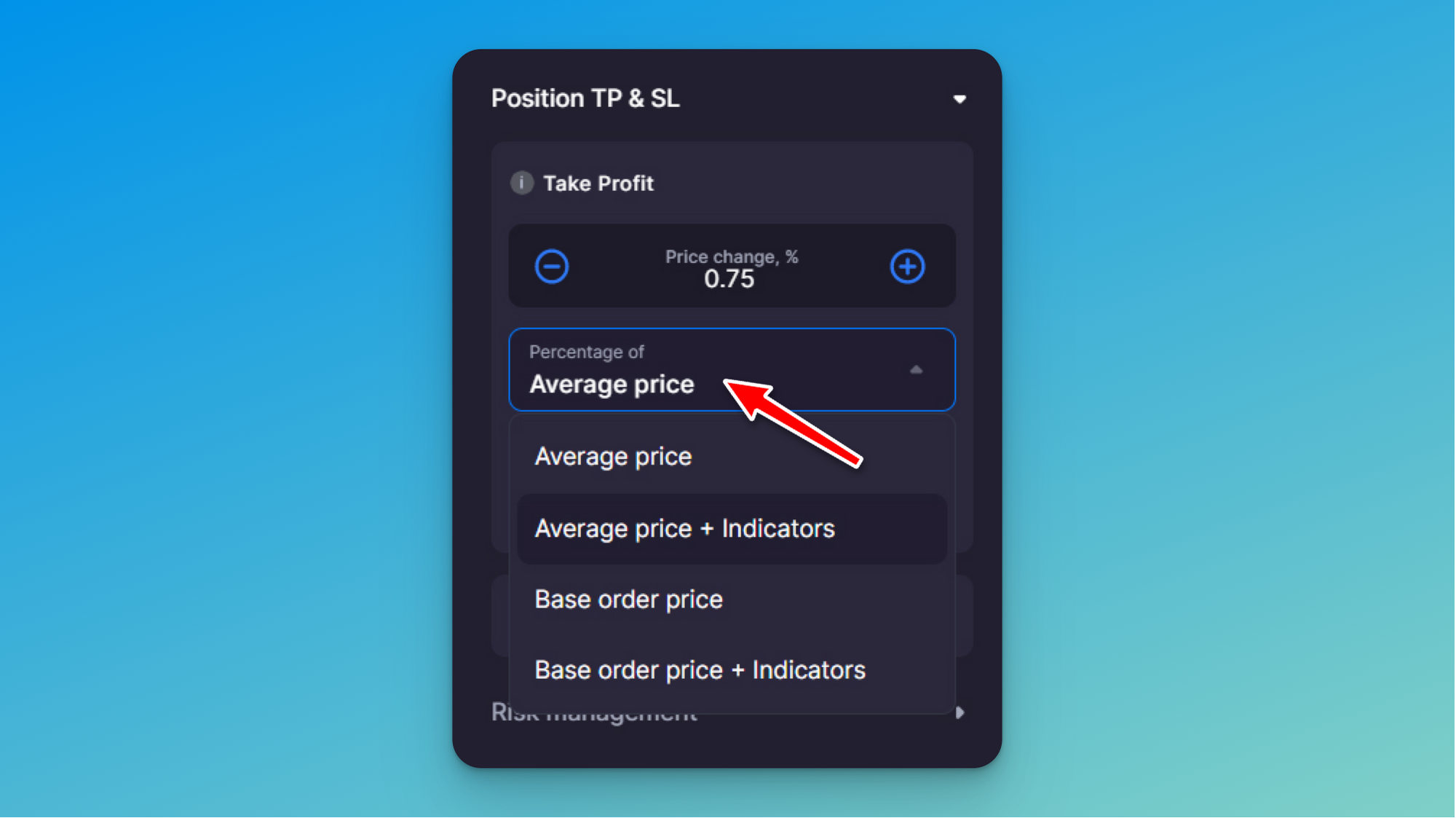

Under [Position TP&SL] (Pic. 8), you can specify the conditions for both Take Profit and Stop Loss to minimize potential losses and secure returns.

When you adjust the Take Profit settings, you determine the conditions for bot closure and the percentage of price change to fix the profit. The percentage of Take Profit can be calculated in four different ways, which you can check and select in the [Percentage of] section (Pic. 9).

For example, should you choose [Average price], the bot will calculate the TP percentage from the maximum weighted average price of the position. Suppose you choose [Base order price + Indicators]. In that case, the bot will calculate the minimum profit level from the base order price and close the trading cycle following an indicator signal of your choice.

On the other hand, the bot continuously calculates the Stop Loss percentage on the maximum weighted average position price. It closes the trading cycle by placing and executing a market buy/sell order, depending on your position (Long/Short).

👉 You can also select [Trailing] to give a bit of leeway and flexibility for Stop Loss so your bot can change the SL position every time the price changes by X% (that you can specify in the [Price change step, %] section).

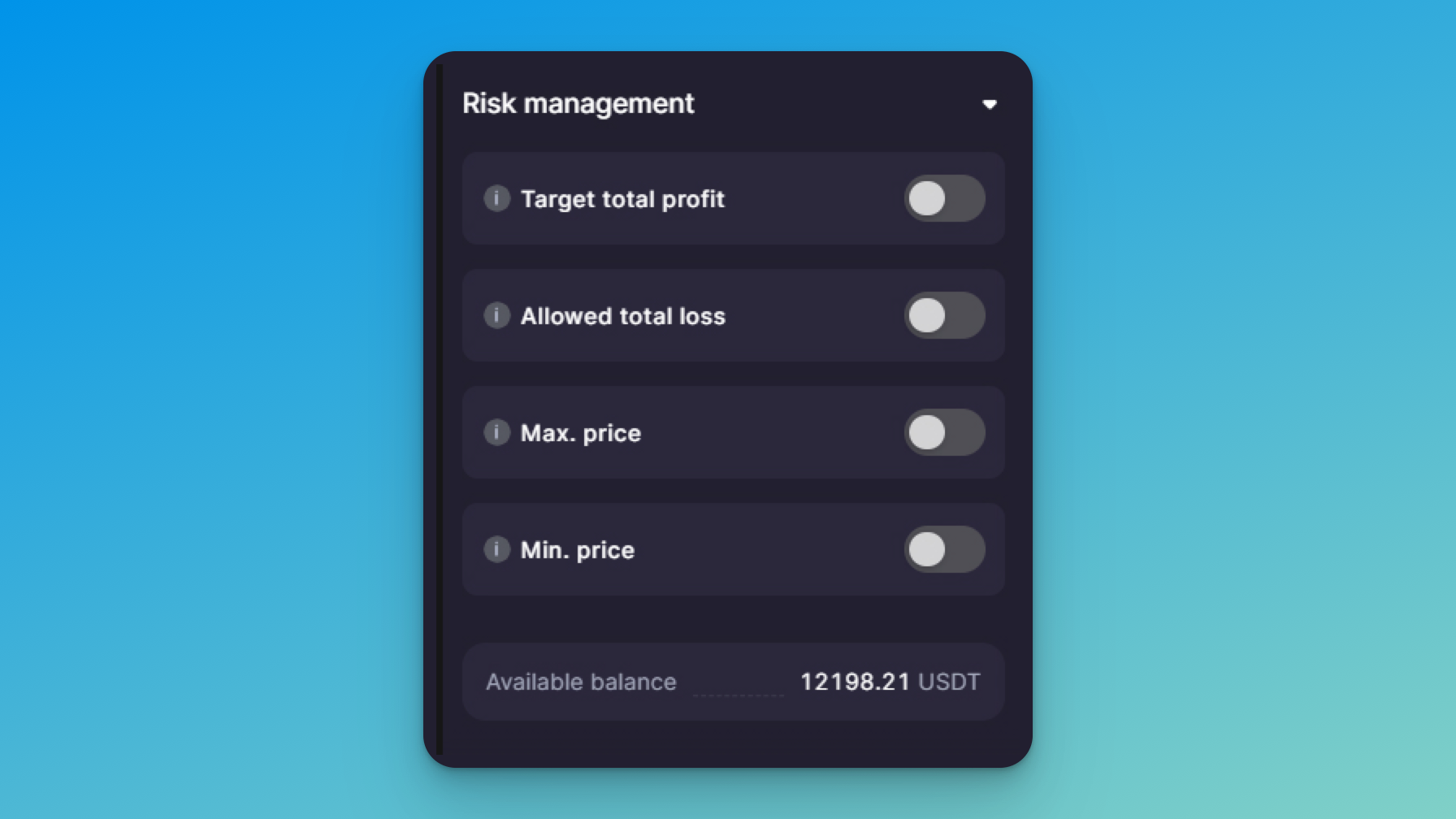

Finally, in the [Risk management] section (Pic. 10), you can specify even more conditions for bot closure and further adjust your risk tolerance level.

For example, in [Target total profit] and [Allowed total loss], you can define the profit or loss (in the percentage from the original investment) at which you’d like to close your bot, even if it never reaches your TP price specified in the earlier section.

You can also determine the maximum and minimum coin prices (in [Max. price] and [Min. price] sections) to avoid buying at the tip and selling at the dip or both. To learn more about [Manual adjustment] and all the settings you can change there, head to the Help Center for a comprehensive review of the section.

Backtest

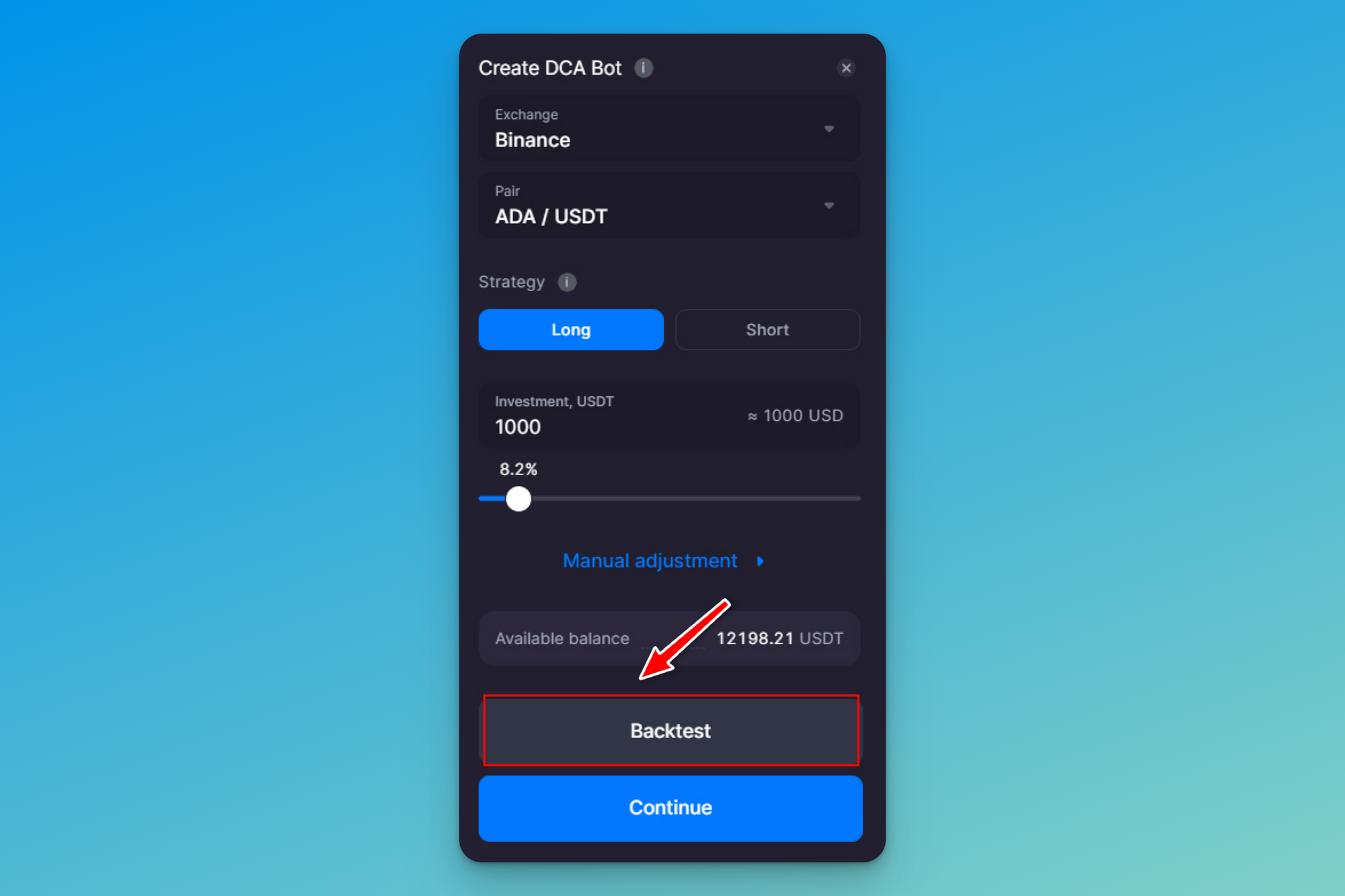

Meet the DCA Backtest feature, the new kid on the block. It’ll allow you to evaluate your bot’s performance with selected settings based on historical data.

👉 Backtest will help you understand how your bot’s settings are likely to affect your trading results and optimize them to achieve better returns.

To launch Backtest after you’ve finished your bot’s setup, click on the [Backtest] button in the bot’s launcher (Pic. 11).

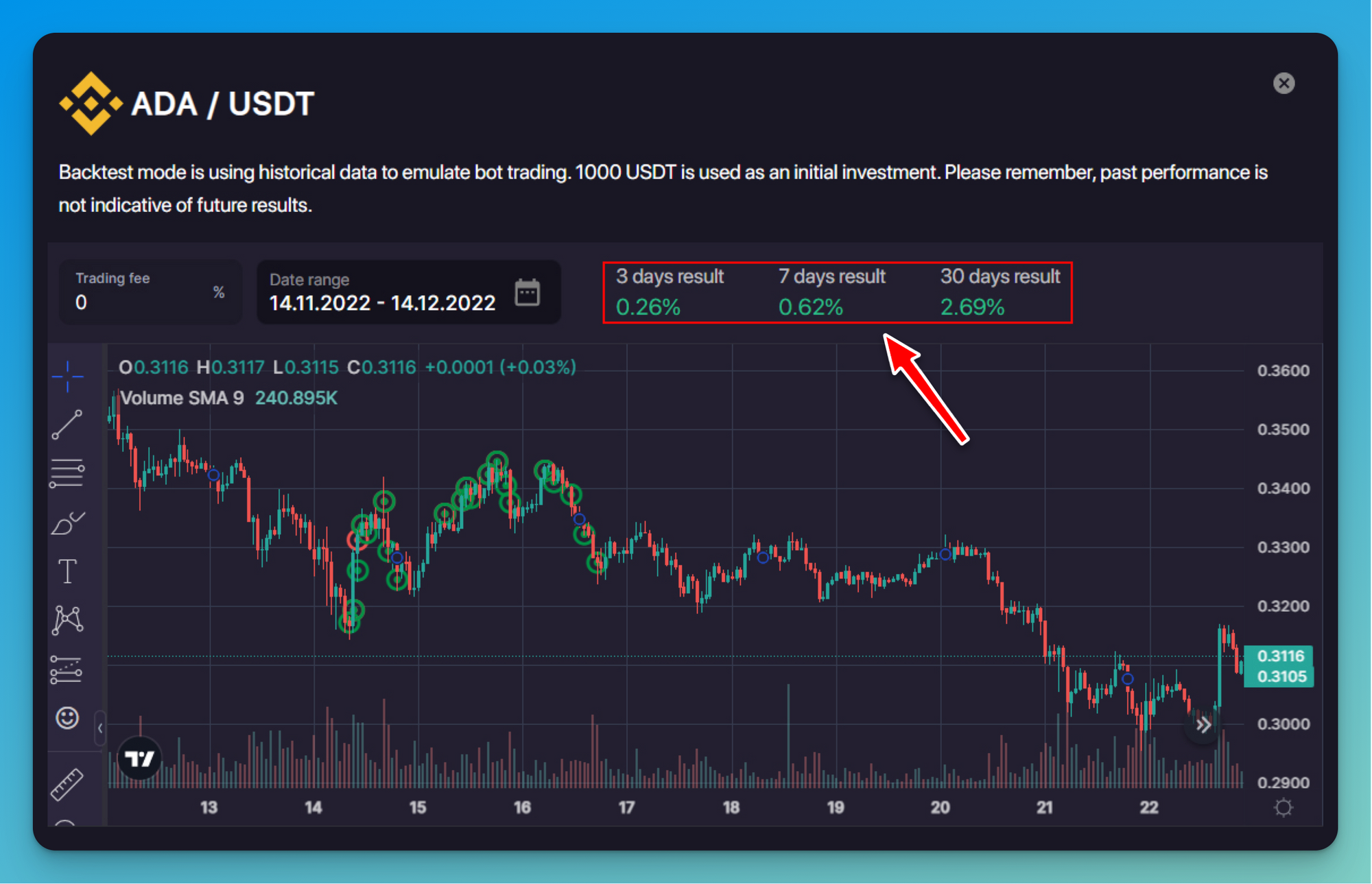

In the Backtest window that follows, you’ll see the calculated results of your bot’s performance with the current settings for the past 30 days (by default), like so (Pic. 12):

Using the built-in calendar, you can change the testing period from 30 days to any other time frame by selecting the dates in the [Date range] window. If you don’t like the Backtest results, you can always go back to the bot launcher, adjust settings, and test them until you’re satisfied with the expected returns.

👉 The main idea behind backtesting is that any strategy that played out well in the past will most likely perform just as well in the future.

While it has a few apparent shortfalls, like the inability to predict future volatility or account for black swan events, backtesting can become a powerful assessment tool that can help you develop a more sound, profitable trading strategy.

Shorting Strategy

Finally, we’ve added the much-anticipated shorting strategy to the DCA bot — Moreover, it can also be launched with default settings, customized, and backtested!

Shorting is an invaluable strategy in a downtrend market as it allows you to sell your coins and rebuy them at a lower price. This way, your bot will accumulate the base currency and make a series of sell orders in red above the coin’s current price.

This is a fantastic opportunity to accumulate your coin portfolio at a reasonable average price for a later sale. That’s because, in the bear market, you can easily earn more coins for the same amount of money as their price falls.

👉 Suppose, you have 0.05 BTC. You might sell it at 885.7 USDT and buy back the same amount later when its price drops to 750 USDT. You’ll still have 0.05 BTC but also 135.7 USDT which you can use to buy even more bitcoin. As of now, the shorting DCA bot makes profit in the base currency, but in the future, you will be able to choose the quote currency too.

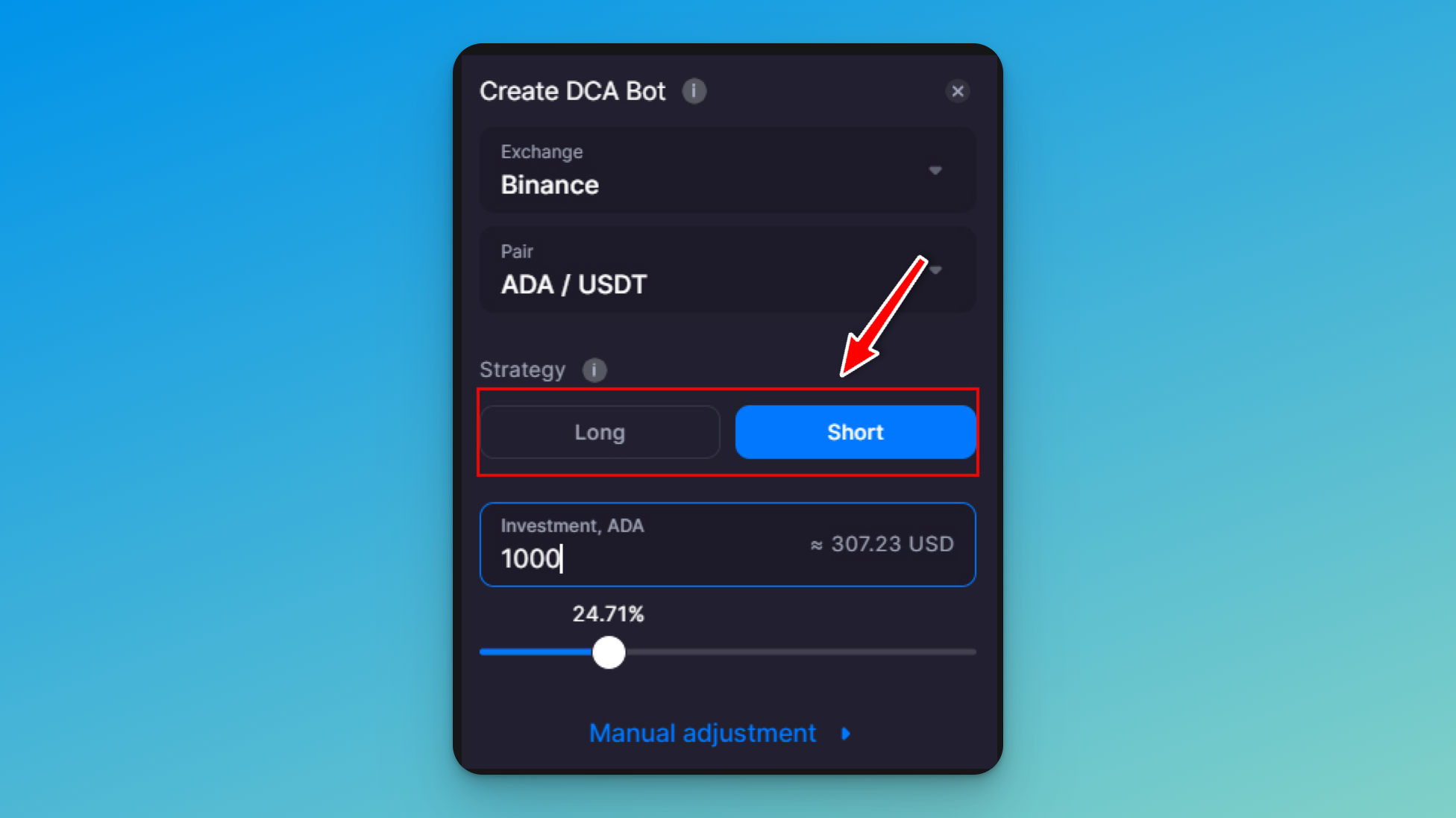

To launch the shorting DCA bot, switch from a Long strategy to a Short one in the bot launcher (Pic. 13):

Just like with a Long position, you can either start your bot with default settings or adjust them using the [Manual adjustment] menu. Check the section on [Manual adjustment] above or head to Help Center for more info on the custom bot settings.

Unlike the Long strategy, your shorting TP&SL will take the reverse positions — TP at the bottom and SL at the top (Pic. 14):

This way, your SL ends up above the price when you entered the trade and TP below. As soon your bot reaches the TP level, it will close (pending other conditions like indicator signals if you choose them) and buy the base currency at the TP price.

To learn more about the DCA’ short’ settings, please visit the Help Center.

Benefits of Trading with the DCA Bot

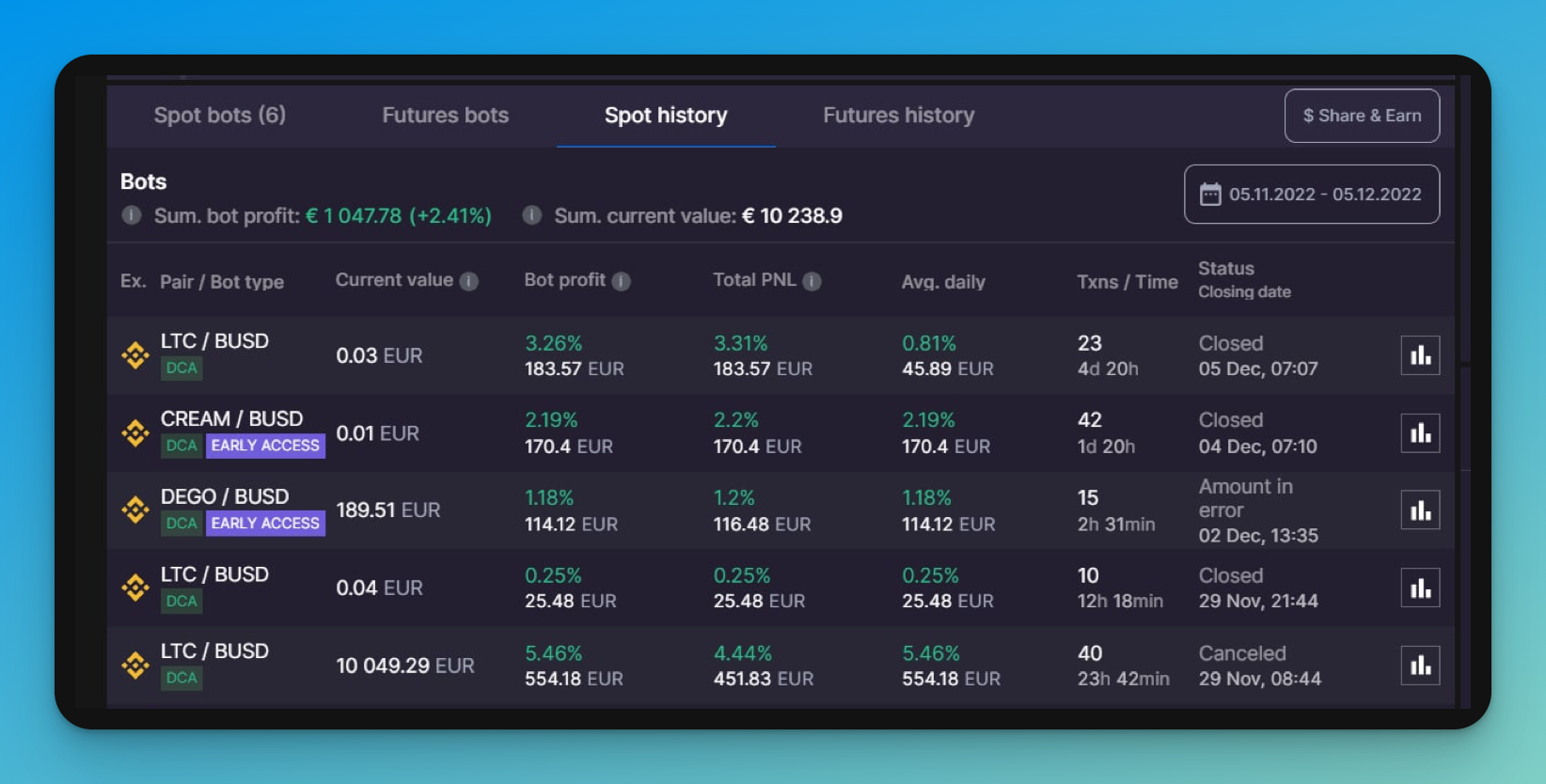

Before we outline a few major benefits of trading with the DCA bot from Bitsgap, let’s have a look at the following bot results (Pic. 15):

As you can see, a Bitsgapian jumped in early to test all revamped bots while they were still running in beta and didn’t miss a chance to make some money in the meantime.

You can do that, too - start trading with the DCA bot today and check the Early Access section from time to time to take advantage of new releases!

Now, why trade with the DCA bot?

- The DCA bot from Bitsgap is straightforward to set up and use. With the default settings and redesigned interface, it’s now easier than ever.

- You can set up as many as 10 DCA trading bots on all Bitsgap plans, which start as low as $23 a month — a relatively small investment considering very high potential returns.

- The DCA bot can now follow a shorting strategy, an indispensable trading addition in a falling market, and a fantastic opportunity to build a coin portfolio.

- The DCA bot can now be backtested and fine-tuned to achieve even better trading results.

While it’s been hard to condense a few months of hard work into a single article, we’ve tried our best so you can have a better idea of what’s been happening at Bistap and how much the DCA bot has changed.

Ready to win on a downtrend and harness the power of the DCA bot? Let’s start now!