Binance Spot vs. Futures: Risk Management

Delve deeper to unravel the differences between Binance’s spot and futures trading and learn robust strategies for managing risks on Binance

What makes futures trading different from spot trading in terms of potential risk and reward?

Binance caters to various trading needs, offering both spot and futures trading options. However, it's crucial to understand the inherent risks these trading methods carry to either boost profit potential or avoid losses.

Let's explore the concept of futures trading and see how it distinguishes itself from spot trading, ensuring everyone is on the same page.

Understanding Crypto Futures vs Spot

Spot trading is a straightforward process, as seen on platforms like Binance, where you can deposit fiat to purchase ether or use litecoin to buy bitcoin.

In contrast, futures trading involves betting on a cryptocurrency's future price, such as bitcoin. It differs from spot trading in terms of risk level, profit potential, and technical considerations like leverage, funding rate, and liquidation price.

👉 For instance, assume you wish to buy BTC (with its current price being 29,414 USDT) and you have 100 USDT in your account. In the spot market, with your 100 USDT, you're able to purchase 0.0034 BTC (100 USDT/29,414 USDT). Conversely, in the Binance futures market, using the same 100 USDT and a maximum leverage of 125X, you could buy as much as 0.424 BTC (12,500 USDT/29,414 USDT). In futures trading, both profits and losses are magnified by leverage. Thus, the risk management profiles for futures and spot trading are distinctly different.

For more in-depth info on the differences between spot and futures, please refer to this comprehensive primer: Spot Trading vs. Futures Trading

Risk and Reward in Futures Trading

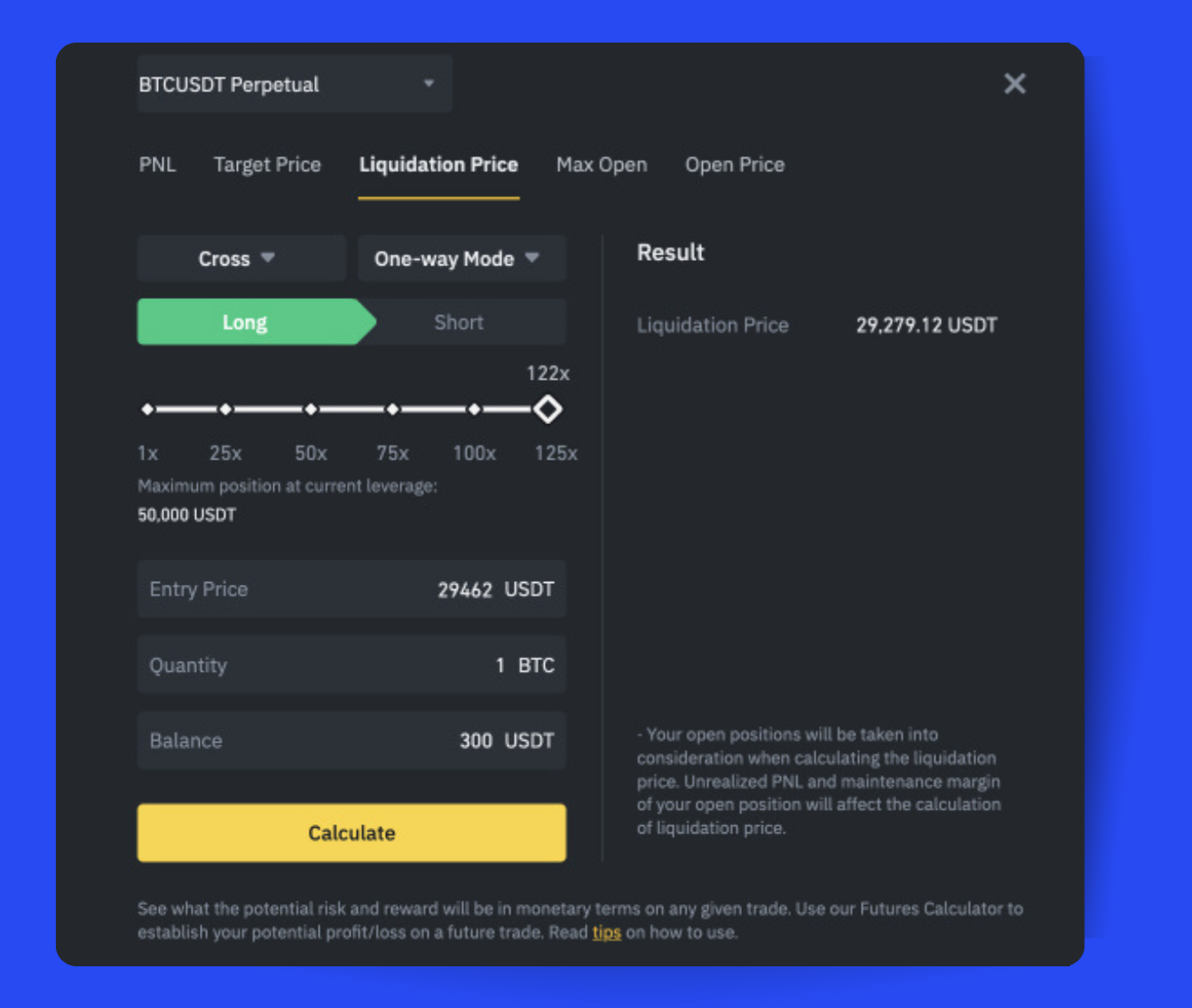

The greater the leverage used, the closer the liquidation price comes to the open price. In the example given (Fig. 1), when you use 125x leverage to take a long position of 1 BTC at 29462.70 USDT, the liquidation price is set at 29,279.82 USDT. This slim margin creates a precarious situation where your position can be automatically closed due to insufficient margin balance, given the high volatility of Bitcoin's price.

Price fluctuations ranging from $50 to $300 within mere seconds are not uncommon in this market. Hence, not only do you need to accurately predict the market's direction, but also the exact timing when it will start to rise, in order to maintain your 125x long position open.

Fig. 1. Calculating spot vs futures rewards and risks.

How to Manage Your Risks When Trading Futures on Binance?

Regardless of whether you prefer spot or futures trading, the ultimate aim remains the same: to generate profit, even when the market is declining (for instance, through such methods as short-selling). Consequently, how effectively you manage risks can significantly influence the distance between your actual results and your intended goal. It's crucial to make use of risk management tools like stop loss orders and to avoid putting all your capital into a single trade.

Let’s explore some of the other risk control strategies that you can employ to manage your tradings risks on Binance (and anywhere else for that matter) more effectively.

Use Available Binance Risk Calculation Tooling

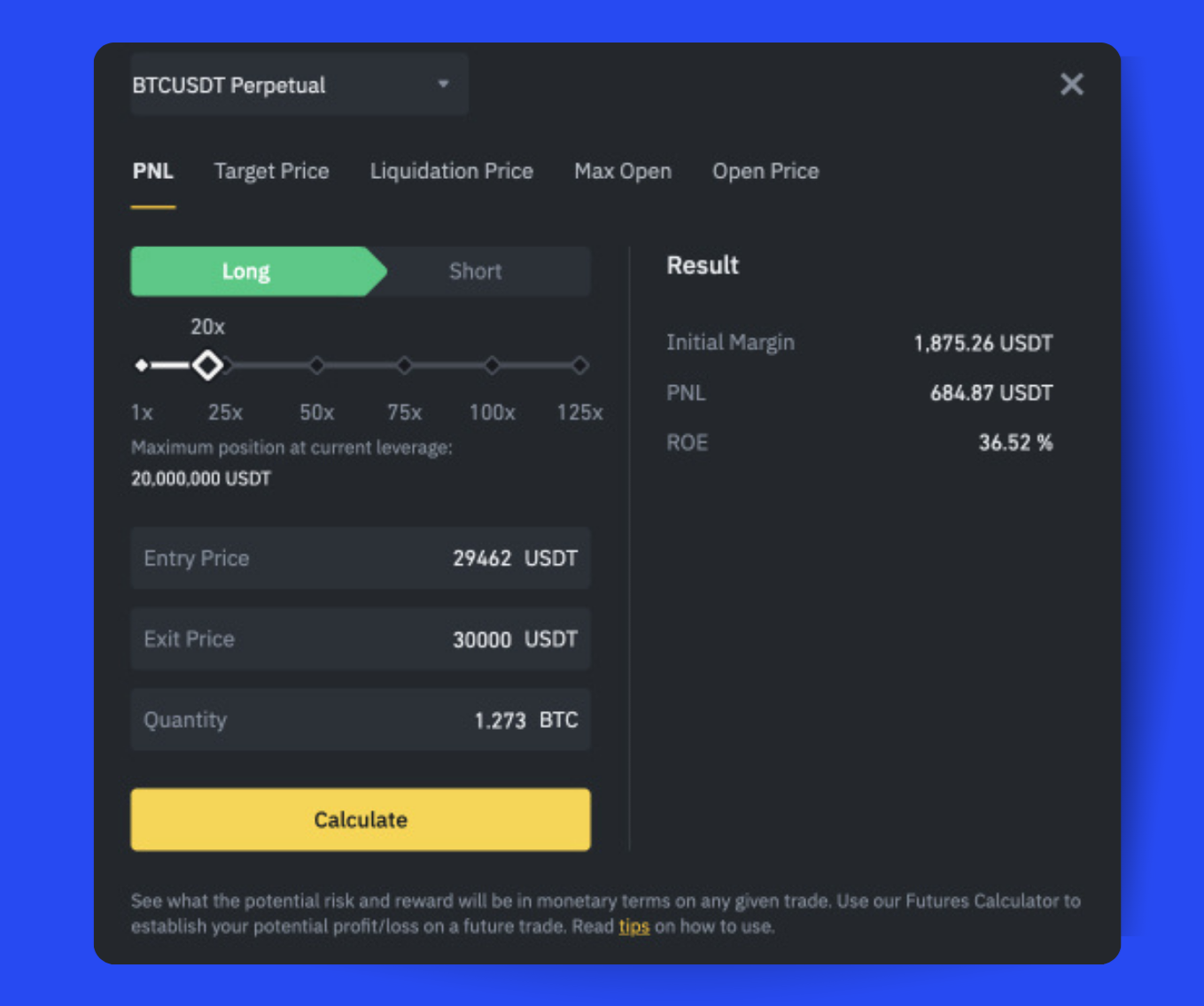

You can use the integrated calculator on Binance to determine the necessary initial margin (Pic. 1) for your intended trade size, as well as the liquidation price (Pic. 2).

The initial margin is the minimum balance required to sustain a leveraged position. On the other hand, the liquidation price refers to the price point at which a futures contract will automatically be closed if you can't meet the maintenance margin due to insufficient funds to cover a loss.

Wanna learn more about the Binance Futures Calculator? Here’s your video guide from Binance:

The workings of the Binance calculator.

Don’t Blindly Take Positions

In futures trading, you have the opportunity to choose between a short or a long position. Going short means you're anticipating market prices to drop, or perhaps you're looking to hedge against this possibility. On the other hand, going long is your way of expressing optimism about the market, hoping for prices to rise.

Your decision to go short or long should not be made lightly. It should be supported by careful technical and fundamental analysis. To help you make more informed decisions, we’d suggest checking out some articles that provide valuable knowledge about cryptocurrency market analysis. They're just a click away and could really enhance your understanding of the market:

Maximize the Use of Different Order Types

Binance's futures trading platform offers a variety of order types to facilitate a seamless trading experience.

With limit orders, you can go short or long at a price you set or one that's even better. When you place a market order, it's executed at the current market price. And with a stop limit order, your order gets filled once the price you've specified is reached.

It's worth noting that market makers are charged lower fees for adding liquidity to the market, while takers, who remove liquidity, incur slightly higher fees. Thankfully, Binance boasts one of the lowest trading fees in the market, which can be further reduced if you use Binance native token BNB (25% off on spot and 10% off on futures trading).

Be Cautious with Leverage

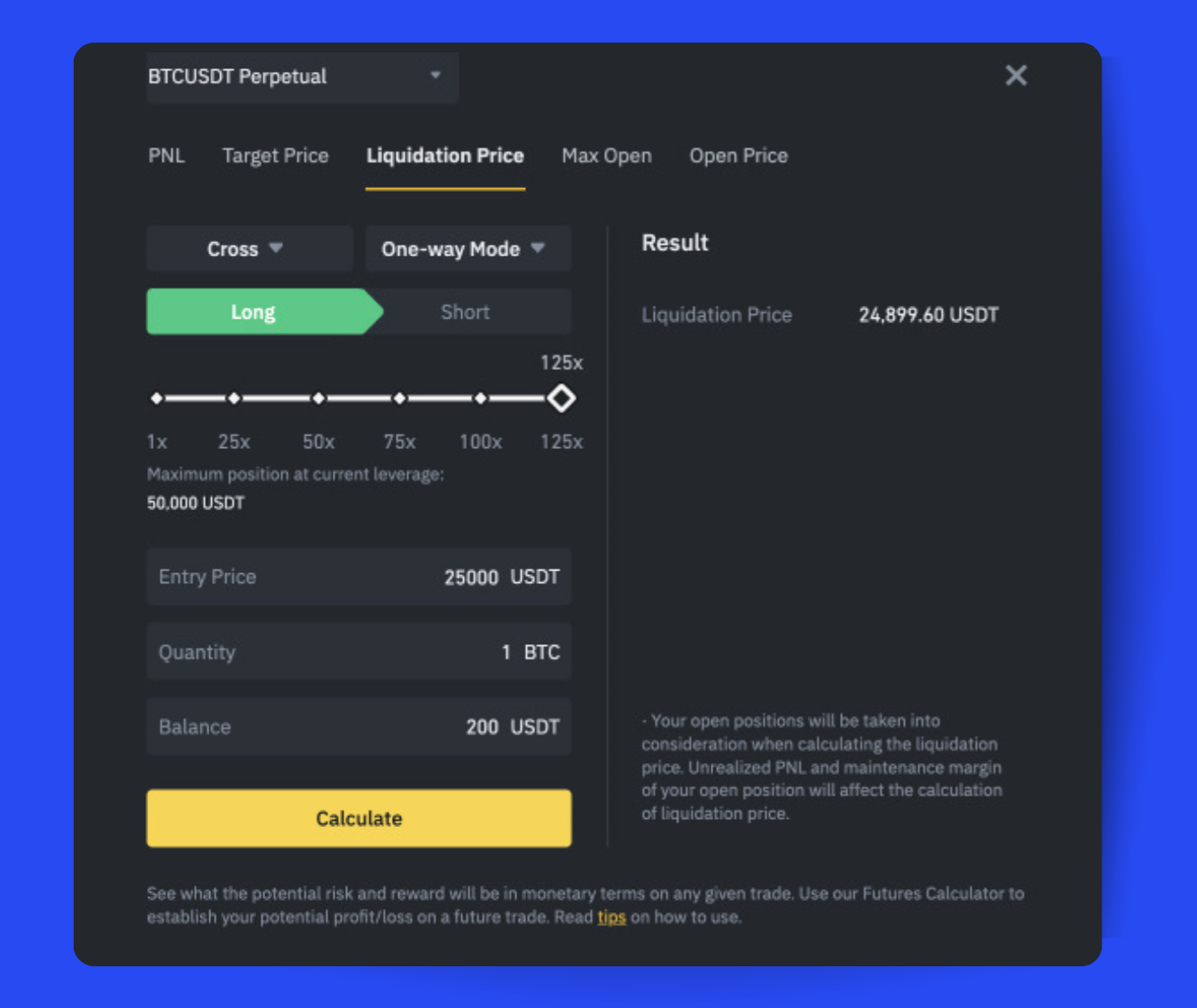

Binance futures provides a leverage option of up to 125X. While higher leverage can amplify your profits, it also escalates the risks and brings the liquidation price much closer to the open price. Hence, it's crucial to tread cautiously when using leverage.

For instance, if you open a long spot position with 1 BTC valued at $25,000 and the price declines by 20% to $18,750, your loss would be $6,250. However, with a 125X leverage, your initial margin needed to enter a trade of 1 BTC would be just $200 ($25,000 / 125). To manage the potential losses, automatic liquidation would be initiated at $24,899.60 USDT, effectively closing the position to prevent losses from exceeding your capacity to bear (Pic. 3):

Careful Planning of Positions on Binance Futures

- Before initiating a long or short position, validate the precision of your technical analysis. Ensure that you're at ease with interpreting selected indicators and data across various timeframes. The pace of futures trading greatly exceeds that of spot trading, necessitating quick decision-making based on the information at hand.

- Determine the level of leverage you intend to use as it will preset your initial margin and liquidation price. This decision should align with your technical analysis and the potential risks you've identified beforehand.

- Choose the type of order for opening your position. This could be an immediate entry (market) or one that's deferred until the price reaches a certain point (limit).

- Establish a realistic target price to manage your risk-reward ratio, and safeguard your potential profits by planning ahead.

- Be aware of your liquidation price and make adjustments as needed to avoid your position getting closed during local trend reversals.

- Decide on the initial margin that you can afford to maintain your position. Bear in mind that these funds will keep your position open as long as you wish or as long as the market permits. Any losses incurred, as well as leverage fees, will be deducted from your initial margin.

Diversification of Trading Strategies

Think about using Bitsgap’s automated strategies for both the spot and futures markets.

Bitsgap has several trading bots for Binance:

- GRID Trading Bot uses the acclaimed GRID trading strategy, a popular choice among both forex and crypto traders across the globe. Imagine a grid, each cell bristling with limit buy and sell orders, carefully placed within defined price ranges. That's what this bot does. The beauty of the GRID trading bot lies in its versatility. It's a pro at churning out profits from both rising and falling market movements, making it a real MVP in swing markets.

- BTD Trading Bot deploys the Buy the Dip trading strategy, strategically accumulating cryptocurrencies as their prices dwindle. Picture this: a market in a downtrend, with coin prices dipping. This is where the BTD Trading Bot shines, seeing it as a golden opportunity to snatch up coins at bargain prices. It's like a grand sale in the crypto market, and the BTD Bot is your personal shopper!

- DCA for spot is a maestro of the Dollar Cost Averaging (DCA) strategy that spreads your investments across routine purchases (or sales), enabling the bot to capture a more beneficial average price for your position while softening the blows of market volatility.

- DCA Futures Trading Bot is a master strategist that purchases or sells coins in tiny, regular doses, keeping your investment ship steady even amidst the stormy seas of market volatility. Where the spot market bot is the marathon runner, the DCA Futures bot is the sprinter, engineered for high-speed, high-reward ventures within the futures market.

- COMBO for futures masterfully blends both DCA (Dollar Cost Averaging) and GRID trading strategies. Designed to pluck profits from the futures market, it's a marvel of ingenuity, leveraging its unique capabilities to churn out profits at a blistering rate that's 1,000% faster.

Given that the majority of cryptocurrencies have a high correlation with Bitcoin, diversifying assets in the traditional sense can be challenging. However, you can achieve diversification through different trading strategies such as automated trading, manual spot trading, and futures trading for both hedging purposes and speculation.

Intrigued? Subscribe for a week-long trial and see for yourself!

Still confused? Peruse the below materials at your leisure to learn more about Bitsgap, Binance, and crypto trading in general.

- Spot Trading vs Futures Trading in Crypto

- The Ultimate Guide to Trading on Binance Futures

- How Does a Crypto Bot Work

- How to Run a Bot on Binance

- Trading Futures Risk Free with Bitsgap’s Demo Mode

- COMBO Trading Bot: Profiting from Binance Futures

- DCA Futures: Your New Binance Futures Whiz

- Decoding Crypto Technical Analysis

- The Art of Filtering: Your Guide to Crypto Fundamentals

Summary

Futures trading, while offering a potentially lucrative return compared to spot trading, is akin to dancing on a tightrope. It demands the utmost care and caution. Remember to arm yourself with rigorous risk management measures, weave a tapestry of varied trading strategies, and never underestimate the power of the stop loss for protection against market downturns.

FAQs

What Is Binance Spot Trading?

Binance spot trading is the most basic form of trading on the platform. When you buy or sell a cryptocurrency in the spot market, you're buying or selling it "on the spot" at its current market price.

What Is Binance Futures Trading?

Binance Futures is a high-octane feature on the renowned Binance platform that allows savvy traders to deploy tools like leverage and short selling to wrestle profits out of the tumultuous cryptocurrency price movements. Instead of traditional spot trading, where you directly snap up or offload your cryptocurrency, you deal in futures contracts. Binance offers two types of futures contracts — perpetual futures with no predetermined end or expiry date and quarterly futures contracts that expire after three months. Yes, the potential rewards can be sizeable, but the scale can tip the other way too, plummeting you into substantial losses. So before diving in, understand the risks and how to manage them effectively.

What Are Crypto Leverage Trading Risks?

Leverage essentially allows you to borrow capital from exchanges to increase your buying power. While this can increase potential profits, it also dramatically increases your risks if the market moves against your position because borrowed capital must be repaid regardless of your trading outcomes. Your account can face margin calls and liquidation if your balance drops below the minimums required to maintain open leveraged positions. Additionally, technical issues on trading platforms can limit your ability to manage leveraged positions. So it’s important to understand leverage trading and its inherent risks before trying your hands on it. Considering all the ins and outs, we recommend leverage trading only for experienced traders.

What Is Binance Margin Trading?

Binance Margin Trading is a service provided by the cryptocurrency exchange Binance that allows users to borrow funds to trade larger amounts of cryptocurrencies. It's a method that can enhance potential profits, but also potential losses. Users can leverage their trades, increasing their buying power from 3x to up to 10x. Binance offers two types of margin modes: Isolated Margin and Cross Margin, which use different methods for calculating collateral. However, if the market turns unfavorable and the account value falls below the margin maintenance level, Binance may liquidate your position to cover the loan. Due to its high-risk nature, a thorough understanding of margin trading's mechanics and risks is crucial before getting started.

What’s The Biggest Binance Futures Leverage?

Binance Futures allows users to trade with leverage up to 125x on certain contracts, such as Bitcoin (BTC) and Ethereum (ETH) futures. This means that for every dollar of your own money, you can borrow up to $125 from Binance to trade.