How to Use Trend Lines in Crypto Trading

From recognizing key levels of support and resistance to timing your entries and exits, trend lines provide a time-tested tool for navigating the volatile crypto markets. Learn the secrets of finding and using trend lines to gain an edge.

By mapping the ebbs and flows of crypto prices on a chart, trend lines can unlock insights into the market's trajectory and help you stay ahead of the curve.

Remember, "the trend is your friend"! Seasoned analysts swear by this mantra, as pinpointing trends is the key to unlocking profitable trades.

With three main trend types at your fingertips, you'll be well-equipped to decipher market direction.

So, join us in this lesson as we shine a spotlight on trend lines.

What Are Trend Lines in Crypto Trading?

Trend lines serve as a tool for recognizing and verifying prevailing trends in the market. By connecting a minimum of two price points on a chart, these lines help pinpoint sloping regions of support and resistance.

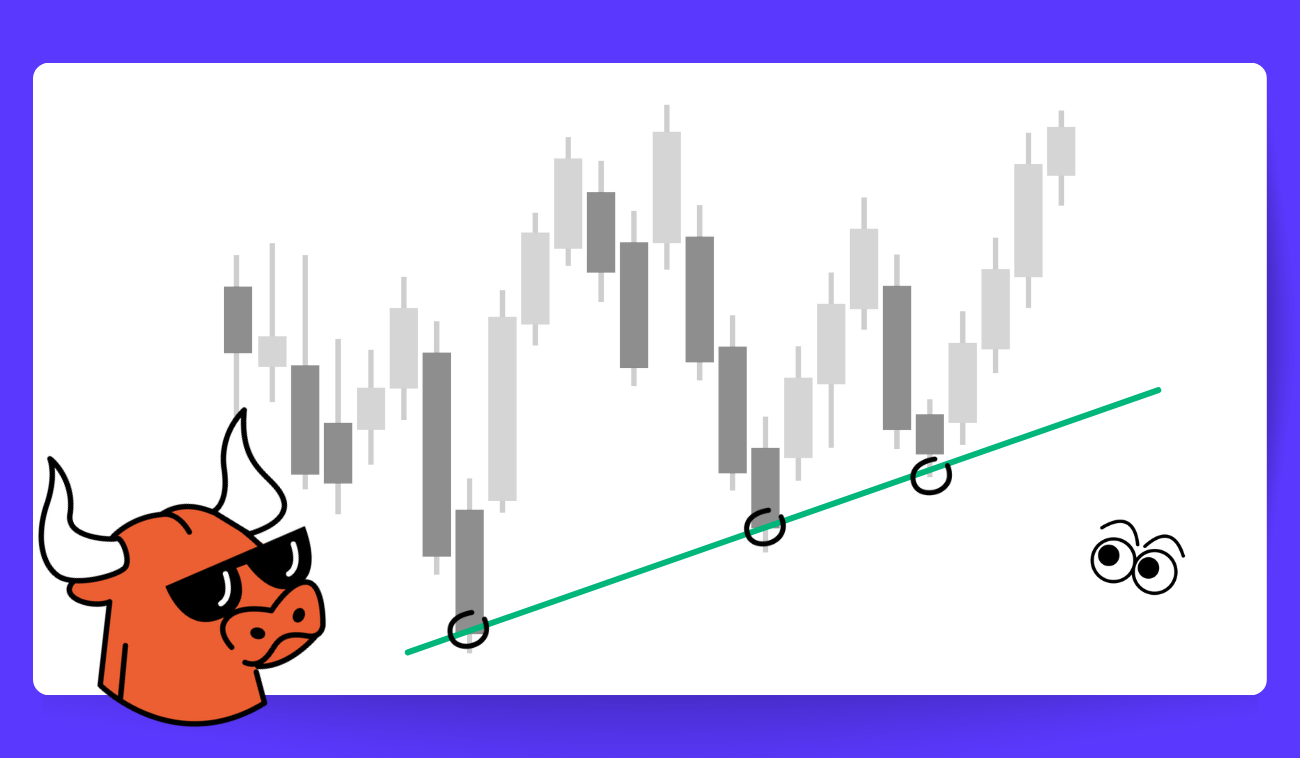

When a line exhibits a positive slope and bolsters price movement, it indicates that net demand is on the rise. A bullish trend persists as long as the price remains above this line.

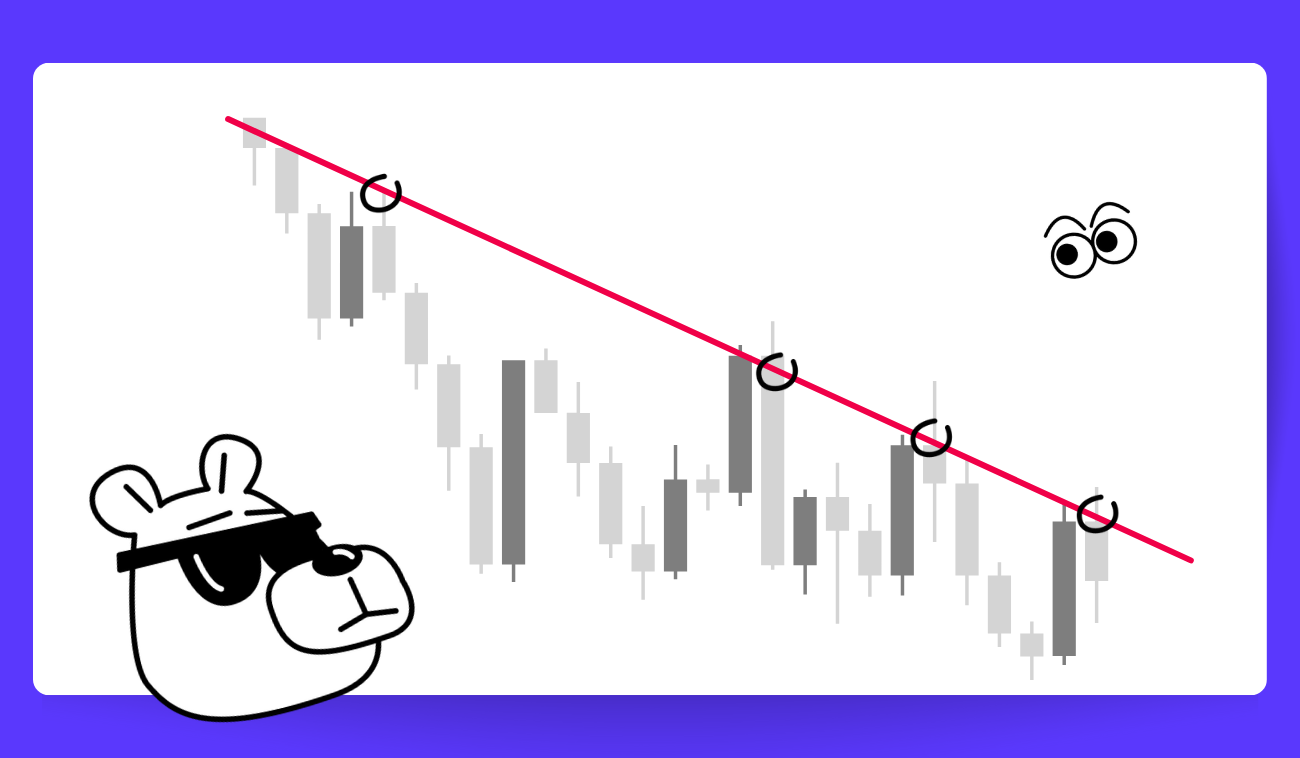

Conversely, lines with a negative slope that hinder price movement suggest that the net supply is increasing, and a bearish trend continues as long as the price stays below this line.

👉 It is common for the price to retest a sloping trend line multiple times before eventually breaking through, signaling a potential trend reversal.

The more points that can be connected, the more robust the trend line becomes.

While different analysts may connect different types of price points at varying intervals, all trend lines eventually break.

Types of Trend Lines

Trend lines come in three flavors: uptrends, downtrends, and sideways.

- Uptrend lines slope upward, connecting a series of higher lows that show demand outpacing supply and propelling prices higher.

- Downtrend lines slope downward, joining a series of lower highs, indicating supply is overcoming demand and pushing prices lower.

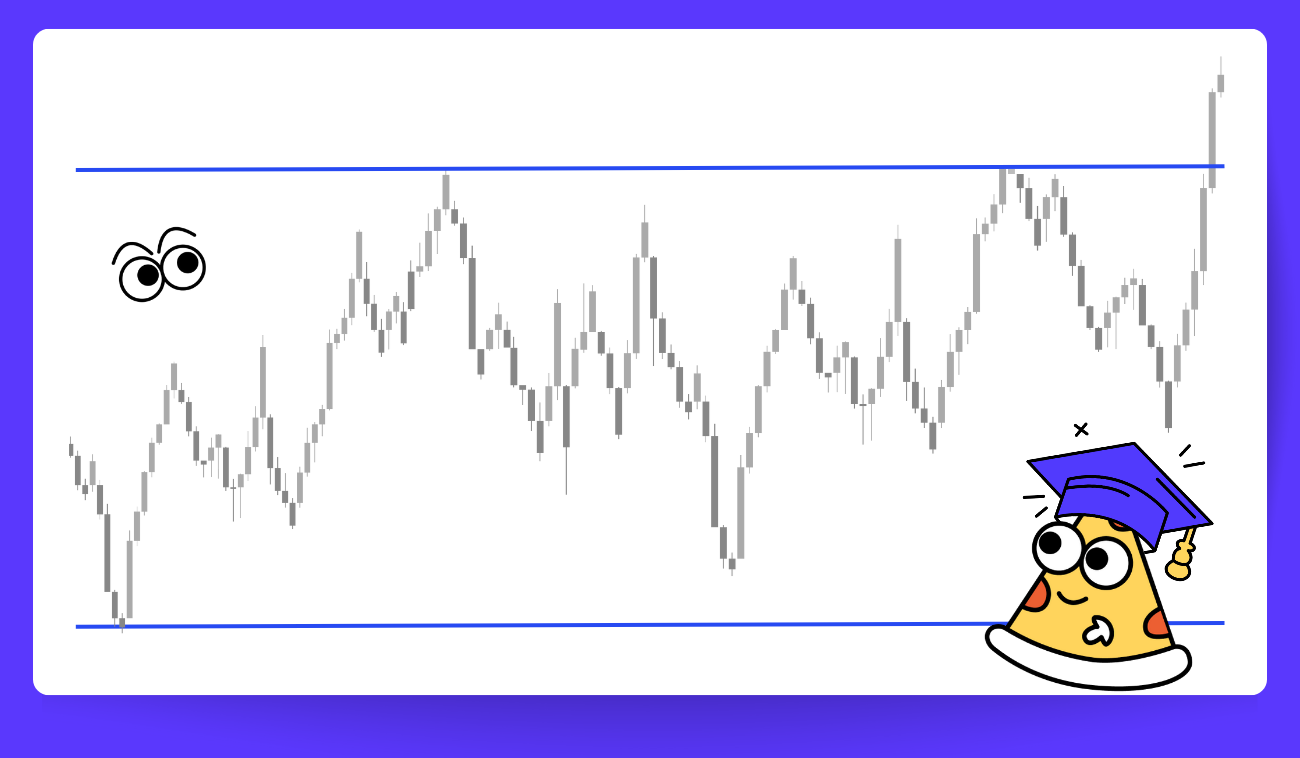

- Sideways or horizontal trend lines are flat, representing an equilibrium where bulls and bears are locked in a stalemate.

As shown in Pic. 1, an uptrend line starts low and ascends higher, linking two or more rising price floors.

In contrast, a downtrend line in Pic. 2 begins high and descends lower, joining two or more falling price ceilings.

The key is that uptrend lines connect the lowest lows, while downtrend lines connect the highest highs.

Horizontal trend lines, true to their name, remain level, connecting a series of highs and lows at roughly the same price (Pic. 3). While prices may fluctuate up and down, the overall trend is sideways. Horizontal trends present challenges as the market is stuck in neutral, with no clear victor between buyers and sellers.

How Do Trend Lines Work?

Trend lines are a popular technical analysis technique to spot and validate price trends. By joining important price points on a chart, trend lines provide insights into the direction and momentum of market moves.

While trend lines require some manual work compared to most indicators, which appear on charts automatically as if by magic, tools like the Bitsgap platform make drawing trend lines directly on live charts easy.

Trend lines generally identify resistance and support levels for an asset. This means tracing one line above the price and one below to pinpoint the levels where the price often bounces. This methodology usually offers a solid basis for determining the best buy or sell points.

Trend lines are created by connecting either swing highs or swing lows to ascertain the trend's bias and predict future price movements.

Connecting higher highs and higher lows indicates an uptrend, demonstrating that buyers have control and that prices are likely to keep rising. Linking lower highs and lower lows signifies a downtrend, suggesting that sellers are in control and prices may continue to fall.

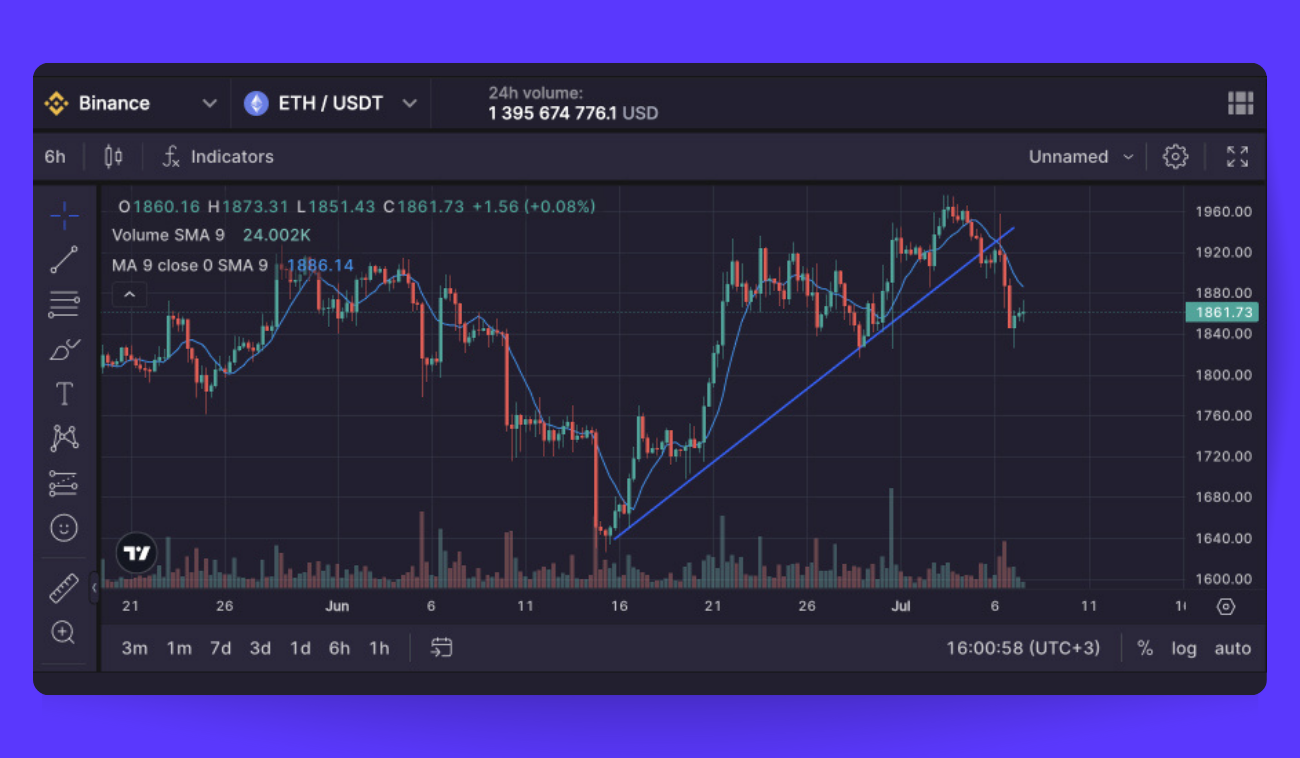

As the price nears an uptrend line, it often presents a buying opportunity, as the line may once again serve as support and push the price higher. Conversely, when the price approaches a downtrend line, it may provide an opportunity to sell short, as the line could act as resistance and initiate a further downward movement. However, since trend lines eventually break, traders should always utilize stop-loss orders.

👉 By identifying whether bulls or bears hold the reins, trend lines aid in spotting high-probability trading setups, maximizing profits, and minimizing losses in turbulent markets.

How to Read Crypto Trend Lines

Trend lines trace the path of a trend's brief pauses, revealing where the market tested the prevailing forces of supply and demand before resuming the trend. By extending trend lines into the future, you can forecast critical price levels ahead. As long as trend lines remain unbroken, the trend continues.

While useful for any data, trend lines are most commonly applied to price charts. They provide insights into the tug-of-war between buyers and sellers in the market. Uptrend lines show demand winning out, with buyers propelling prices higher. Downtrend lines indicate supply overcoming demand, as sellers drive prices lower.

👉 However, trading volume must also be considered. If volume is decreasing or low, a price rise could falsely signal strengthening demand.

As mentioned, trend lines also pinpoint support and resistance levels, two of the most vital concepts in technical analysis. Uptrend line support shows the price floor below which buyers are likely to step in. Downtrend line resistance indicates the price ceiling where sellers will probably emerge.

When support or resistance fails, the trend often reverses. If an uptrend line breaks down, the rally is over. If a downtrend line breaks up, the decline has ended. The market's balance of power has shifted (Pic. 4):

👉 Please keep in mind that technical analysis is a subjective enterprise, with many ways to draw trend lines. For the best results, combine multiple techniques and also consider fundamentals.

Can Trend Lines Be Used for Cryptocurrency Predictions?

Trend lines can indeed offer a glimpse into the future. While no tool can predict price moves with perfect accuracy, trend lines help spot the current trend, locate support and resistance levels, and detect potential turning points.

For the best forecasts, use trend lines alongside other indicators like moving averages, RSI, MACD, and candlestick patterns. Fundamental analysis also provides crucial context for understanding market forces and fueling smarter predictions.

Trend Line Example

Jimmy wanted to know if his favorite crypto was poised to pop or drop. He logged into his Bitsgap account to do some trend line analysis.

Over the past month, Jimmy carefully traced the crypto's ups and downs, connecting the dots to map its jagged path. Three solid uptrend lines emerged, signaling the crypto had rallied higher each time it hit those levels. The trend seemed ripe to repeat.

With a hunch prices were primed to pump again, Jimmy bought in. Just a few hours later, his crypto climbed right along the uptrend line once more. Jimmy's trend line analysis was spot on — and so were his profits.

With a win under his belt, Jimmy was hungry for another. He waited for the next chance to catch his crypto surging off support and ride the rise. When his crypto pulled back to retest the trend line, Jimmy bought back in, betting it was a springboard to send prices soaring again.

Trend lines revealed the path of least resistance for Jimmy's crypto was up, up and away. By determining the trend and forecasting key levels it might reach, trend lines gave Jimmy an edge. While the future was uncertain, the odds seemed stacked in favor of this uptrend continuing - at least until the trend line finally broke.

For crypto traders like Jimmy, trend lines offer a high-probability glimpse into the future. They don't predict moves with perfect accuracy but show which way prices are most apt to head next based on the recent trend.

What Indicators Can Be Used to Calculate the Trend Lines?

Trend lines aren't calculated using specific indicators. Instead, you get to draw them yourself on a price chart by connecting important price points like swing highs or swing lows.

However, you can use other technical indicators alongside trend lines to make your market trend analysis even more meaningful.

Here are some popular indicators you might find helpful:

- Moving Averages: Simple moving averages (SMA) or exponential moving averages (EMA) are great for spotting the overall trend direction. If the price is chilling above a moving average, you might have an uptrend on your hands. If it's hanging out below the moving average, you could be looking at a downtrend.

- Moving Average Convergence Divergence (MACD): The MACD is like your own personal momentum radar, showing you changes in the strength, direction, and duration of a trend by comparing two moving averages of an asset's price.

- Relative Strength Index (RSI): The RSI is a nifty momentum oscillator that measures the speed and change of price movements. It's perfect for identifying overbought or oversold conditions and possibly spotting trend reversal points.

- Average Directional Index (ADX): Want to know how strong a trend is? The ADX has your back, measuring the strength of a trend without worrying about its direction. A high ADX value means a strong trend, while a low value suggests a weak or non-existent one.

- Bollinger Bands: These bands are made up of a moving average with two standard deviation bands above and below it. They help you identify periods of high and low volatility, as well as potential trend reversals.

- Parabolic SAR: The Parabolic SAR is a time and price-based indicator that shows potential trend reversal points by plotting cute little dots above or below the price chart.

👉 Remember, no single indicator or tool can give you the full picture of the market. So, make sure to use a mix of technical indicators, trend lines, and fundamental analysis to make the best decisions and stay ahead of the game.

Drawing Trend Lines in Cryptocurrency: How to Draw Cryptocurrency Trend Lines

Drawing trend lines in cryptocurrency trading follows the same principles as drawing trend lines in traditional financial markets. The basics are fairly simple:

- Select a time frame: Do you want to round up short-term strays as a day trader or wrangle long-term beasts as an investor? Choose your time frame — minutes to months — based on your trading strategy and goals.

- Select a charting tool: Saddle up with a charting tool like TradingView, Coinigy, Bitsgap, or a native charting tool within your chosen cryptocurrency exchange.

- Plot the price data: Get a candlestick chart to see the open, high, low, and close prices for your chosen cryptocoin over time.

- Identify significant highs and lows: Look for major turning points on the price chart, such as swing highs (peaks) and swing lows (troughs). These points represent areas where the market has shown a significant change in direction.

- Draw the trend line: Connect at least two of the biggest lows to draw an uptrend line that'll act as your support. Connect two meaningful highs to get a downtrend line that'll be your resistance. The more dots you can connect, the better.

- See if your line holds: If the price keeps respecting that trend line, it gets stronger. But if it busts through, you may need to redraw your line or prepare to reverse course.

- Adjust the trend line over time: As new data becomes available, you may need to extend or adjust the trend line. Make sure to continue using the same method to maintain consistency in your analysis.

It's essential to practice drawing trend lines and use them in conjunction with other technical analysis tools to get a more accurate picture of the market's direction.

Trend Lines Practice in Demo Mode

If you’re interested in gaining some hands-on experience with cryptocurrency trend lines without jeopardizing your funds, Bitsgap offers excellent demo modes for both futures and spot markets! This allows you to sketch directly on the live chart and carry out simulated trades in real time, all without the risk of financial loss.

Demo is a great way to refine your technical analysis and indicator skills without parting with your capital. Once you feel prepared to transition to actual trading, you can effortlessly make the switch and begin investing with real money.

Other Cool TA and Other Features on Bitsgap

In addition to the demo mode on Bitsgap, there's a treasure trove of fascinating features waiting to be explored, including an array of charting tools, smart trading options (featuring trailing and hedging capabilities), and trading bots designed to optimize your returns while minimizing undesirable risks in both spot and futures markets. To dive deeper into fantastic automated tools, take a look at the following guides:

So, why wait? Embark on your trading journey and experience the magic for yourself:

FAQs

What Are Crypto Trend Lines?

Trend lines are lines plotted on price charts to ascertain the trajectory of a specific trend. They are created by linking the extreme points of the trend in question. Generally, when prices consistently rise, the trendline exhibits an upward slant. Conversely, if the market experiences selloffs, the trendline will display a downward incline.

How to Identify Trends in Crypto Trading?

Identifying trends in crypto trading involves the systematic analysis of price movements and patterns.

Firstly, you need to get acquainted with the three primary trend categories: uptrends (bullish), downtrends (bearish), and sideways trends (consolidation).

Then you need to delve into the charts and examine various time frames (hourly, daily, weekly) for a well-rounded perspective of the market.

If you spot any particular drift either up or down, connect higher lows or lower highs to arrive at a current trend and possible support or resistance points.

To assist you in confirming or refuting your conclusions from sketching, deploy simple or exponential moving averages (e.g., 50-day, 100-day, or 200-day) to filter out price fluctuations and pinpoint trend direction.

You may also want to throw the RSI, MACD, or Bollinger Bands into the mix for deeper insights into market trends and potential reversals.

How to Use Trend Lines in Crypto Trading?

Trend lines provide a visual guide to where the market may offer support or hit resistance. Using them can help you make savvy trading choices.

First, figure out if the market is feeling bullish (prices rising), bearish (prices dropping) or undecided (prices wandering sideways).

Choose a time frame that suits your trading style, whether you're in it for the quick bucks or the long haul.

Connect the dots between recent price peaks for an uptrend or price dips for a downtrend. The more times the line is touched, the more reliable it is. These lines act like barriers — in an uptrend, the line holds up prices as support, while in a downtrend it blocks further rises like resistance.

If prices burst through the trend line, it may signal a change in direction or weakening trend, so recheck your positions. Trend lines alone don't tell the whole story, so compare them to other tools like moving averages, RSi, MACD, or Fibonacci levels.

Developing an eye for accurate trend lines takes practice. Your lines may differ from another trader's, so find an approach that works for you.

What Is Cryptocurrency Trend Analysis?

Cryptocurrency trend analysis is like playing detective with crypto price data and market behavior. It's all about examining the past to predict the future and make smarter trading or investment choices. There are two main ways to do this: technical analysis and fundamental analysis.

Technical analysis involves studying price charts, trading volume, and technical indicators. The idea is that what happened in the past can give us clues about what's coming next. To crack the code, you can use nifty tools like trend lines, moving averages, support and resistance levels, and fancy-sounding oscillators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD).

Fundamental analysis, in contrast, is more like playing crypto detective by digging into the real-world factors that give a cryptocurrency its value. You'll investigate the technology behind the digital coin, the team and community backing it, market demand, regulations, and other juicy details that can impact its long-term success and adoption.

For accurate trend analysis, it’s important to combine those two.

What’s Better — Trend Lines or Moving Averages?

While both moving averages and trend lines are useful for identifying trends in cryptocurrency, the moving average is generally more effective. This is due to its ability to eliminate anomalies and present a truer average. On the other hand, trend lines are more straightforward for visualizing patterns over extended periods.

It is advisable to employ both methods. Begin by establishing a trend line and then use the moving averages indicator to validate your hypothesis. To assess the strength of the support for your anticipated trend, you can also combine this with the RSI.