Building Your Defense with Cryptocurrency Hedging Strategies

With cryptocurrency prices subject to wild fluctuations, protecting your investments is crucial. This article will explain multiple hedging strategies you can use to minimize risk and safeguard your crypto assets.

Want to protect your cryptocurrency investments from market fluctuations? This article decodes the enigma of hedging in cryptocurrency, offering you an arsenal of strategies to ensure your digital wealth remains secure.

Cryptocurrency trading, as thrilling as it might be, is not without its perils. The storm of market downturns is as inevitable as the changing seasons. As a crypto navigator, the challenge lies in safeguarding your digital treasure from these tempests, and this is where the compass of crypto hedging strategies may guide you.

But what on earth is hedging? How do you apply these risk-shielding tactics to the crypto seas? And is this so-called hedging truly a bulletproof vest against risks?

If these queries have you scratching your head, fear not. You've just docked at the right harbor. This article will unfurl the map to hedging, and chart out crypto hedging strategies you can effortlessly set sail with.

What Is Hedging?

Hedging is a tactical game plan adopted by individuals and establishment alike, aimed at cushioning possible financial blows that might puncture an investment.

👉 Think of it like this: Imagine you own a beautiful home in an area known to be a hotbed for wildfires. Naturally, your instinct would be to safeguard this valuable property from the fiery fury of a potential blaze. The solution? Fire insurance.

This same protective concept translates beautifully into the arena of finance and cryptocurrencies. Hedging is essentially the act of investing in a financial fire extinguisher, designed to dampen the heat of adverse price movements in an asset.

Intriguingly, 'hedging' can be a bit of a chameleon in the financial world. For some, it serves as a catch-all phrase for every conceivable risk management shield that can be deployed for assets. For others, it has a more precise definition, referring specifically to the strategic move of entering a position that's predicted to zig when an existing position zags.

👉 For instance, consider a trader who's gone long on ETH but wants an armor against a potential short-term market slide. This trader could employ derivative trading tools that stand to gain profits if their ETH decides to take a downhill journey in value.

In this article, our spotlight will be trained specifically on the latter interpretation of hedging. However, it's essential to remember that 'hedging' can also encompass a whole spectrum of other risk management maneuvers, which we've previously delved into in our comprehensive risk management guide. Feel free to leisurely browse through that resource here.

How Does Hedging Work?

Hedging in the crypto realm mirrors its counterpart in the traditional financial markets. It's all about playing a strategic game where you stake a claim in a correlated asset that is predicted to trend in the opposite direction as the initial position.

Hedging, although it comes in diverse flavors, typically follows this pattern:

- Lay down your primary position: You kick off with an existing stance on a particular asset, say bitcoin or ether. Either you possess it or are exposed to its price moves.

- Spot the stumbling blocks: Next, you need to spot the potential banana peels on the trading floor. For instance, for a bitcoin owner, the stumbling block could be the risk of the asset's price taking a nosedive.

- Counter with a complementary move: You can sidestep the identified risk by embracing a counter stance in a related instrument expected to swing in the opposite direction of your primary move.

👉 Remember, the aim of this hedging isn't to steal the limelight and make a profit, but to maintain your balance and shield against potential falls. The gains from your countermove should ideally help you recover from any missteps in your primary move.

However, it's crucial to note that flawless routines are rare in the hedging world. Also, like pretty much anything in trading, hedging often carries a price tag, so you need to weigh the cost against the potential benefit of your hedging routine.

Crypto Hedging Techniques

This article presents you with a menu of several hedging strategies you can feast on in the crypto markets. However, remember that the availability of these delicacies may vary based on your location, so it's paramount to ensure that your hedging tactics align with the rule book of your local regulations.

Each strategy carries its own flavor of risks and costs, so make sure you understand their recipes before you decide to take a bite.

Using Stablecoins for Hedging

Stablecoins are a special breed of cryptocurrencies that have their value tethered to a cache of assets, usually a traditional "fiat" currency. If you sense storm clouds brewing over the market, you may want to transform a portion of your turbulent crypto assets into these calm, steady stablecoins. Although this move won't let you ride the wave of a market surge, it will offer you a safe harbor against the stormy seas of a market downturn. If you want to learn more about stablecoins, please refer to this piece: Stablecoins Explained.

Short Selling in Cryptocurrency Markets

Certain platforms grant the option of short selling. In this strategic move, you can borrow a cryptocurrency, sell it into the market, and then repurchase it at a later stage to return it. If the market price takes a downward plunge — just as you predicted — you would pocket a profit.

This windfall can serve as a financial cushion, softening the blow of losses from other investments.

On other platforms, such as Bitsgap, you can short (either manually or with bots) whatever assets you hold, without reverting to borrowing.

If you want to learn more about short selling, please refer to these two articles: Ultimate Guide to Shorting and Shorting with Bitsgap.

Portfolio Diversification with Digital Assets

Possessing a diversified portfolio can be the simplest and most fail-safe route for traders aiming to shave off potential losses in the volatile crypto market. Diversification essentially means spreading your investments across various crypto assets rather than staking all your funds on a single cryptocurrency.

In a diversified portfolio, each asset serves as a safety net for the others. Consequently, when one asset's price tumbles, the overall impact is softened compared to the scenario where a trader plunges all their funds into a single asset.

A well-rounded strategy typically involves seeding funds into investments that don't march in lockstep. The most favorable situation would entail a trader sprinkling their investments across a selection of unrelated or non-correlated assets.

In a portfolio exclusively dedicated to crypto, diversification might mean holding a blend of large-cap coins like bitcoin (BTC) and ether (ETH), coupled with altcoins. The large caps provide a sturdy counterbalance to the higher risks associated with altcoins, while the altcoins themselves hold the potential for sky-high returns.

However, it's worth noting that most cryptos tend to shadow bitcoin's movements closely; when bitcoin takes a dive, the rest often follow suit. Therefore, crafting a fully diversified portfolio solely out of crypto might require some strategic finesse.

Cryptocurrency Insurance Products

Unlike government-backed fiat currencies like the U.S. dollar and euro, cryptocurrencies lack any official backing or built-in protections against theft or loss. For example, FDIC insurance protects traditional bank accounts up to $250,000, but there is no comparable safety net for cryptocurrencies.

The insurance industry is still in the early stages of developing robust, affordable policies to reimburse individuals for lost crypto assets. According to ZenGo, the main problem with existing crypto insurance is that it is not comprehensive enough. To fully protect all their crypto holdings, individuals need to combine multiple policies — one for private key loss, another for smart contract risks, and possibly a third in case their wallet provider fails.

Some insurers offer limited coverage for crypto theft, but only under specific circumstances. These policies often exclude direct hardware damage or loss, third party transfers, and blockchain disruptions or failures. To achieve more complete protection, you would likely need to buy several separate insurance policies.

Hedging Cryptocurrency Risk with Derivatives

Hedging strategies frequently employ the financial wizardry of tools known as derivatives.

These contracts, established between two parties, mirror the price of an underlying asset. Derivatives give investors the opportunity to participate in the price fluctuations of an asset without owning the asset itself.

For those embarking on the cryptocurrency adventure, this indirect exposure can be a treasure as it erases the quest for a secure storage solution. Hedging derivatives are nothing more than contracts between two parties that yield a bounty based on the price moves of an underlying asset — neither party ever needs to lay hands on the actual treasure. From the first twirl of the trade to the final bow of settlement, no real crypto changes hands.

Futures and options are the two most frequently used derivatives for hedging crypto trading positions. Both allow investors to ride the wave, reaping benefits when an underlying asset's price ascends, or to surf the downturn, profiting when it descends. They typically hold the power to buy or sell a specific asset at a predetermined price on a set future date.

Let’s explore those two in the next few sections.

Crypto Futures and Options for Hedging

Futures Market

Bitcoin futures contracts made their official debut in traditional financial markets in 2017, with the Chicago Board Options Exchange (Cboe) and the Chicago Mercantile Exchange (CME) being the pioneers. This development opened up a new chapter for institutional investors, enabling them to officially short-sell bitcoin for the first time.

One of the key advantages of Bitcoin futures trading is that it doesn't require owning the underlying asset, bitcoin, to gain exposure to its price movements.

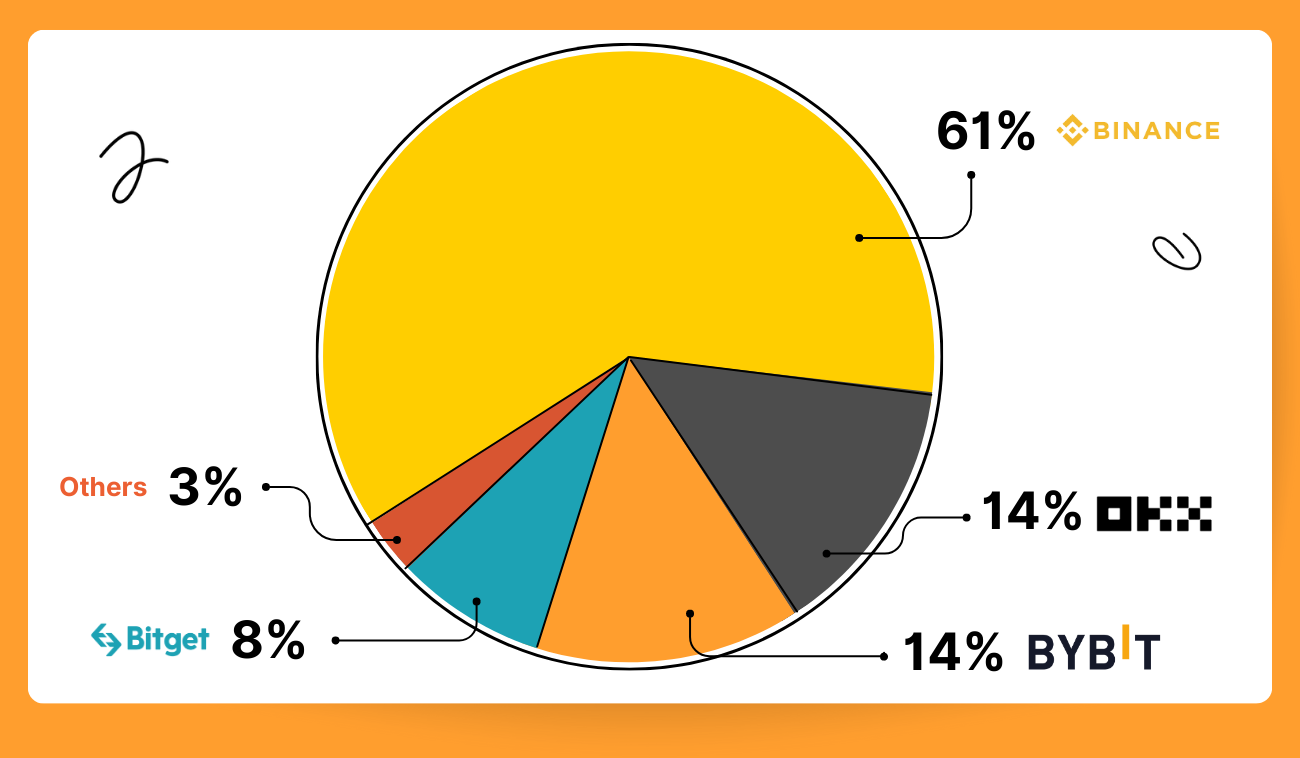

Even though Cboe halted its Bitcoin futures in 2019 due to a lack of liquidity and interest, other platforms such as CME and Bekkt continue to provide this service. Additionally, there are several other platforms, including Binance, OKX, and KuCoin (Pic. 1), where investors can trade perpetual futures. Therefore, there is no dearth of opportunities for those interested in crypto futures trading.

Bitcoin futures on CME are cash-settled, meaning that at the end of the contract, the investor receives cash instead of actual bitcoin. This approach negates the need for traders and investors to manage blockchain wallets with intricate security measures.

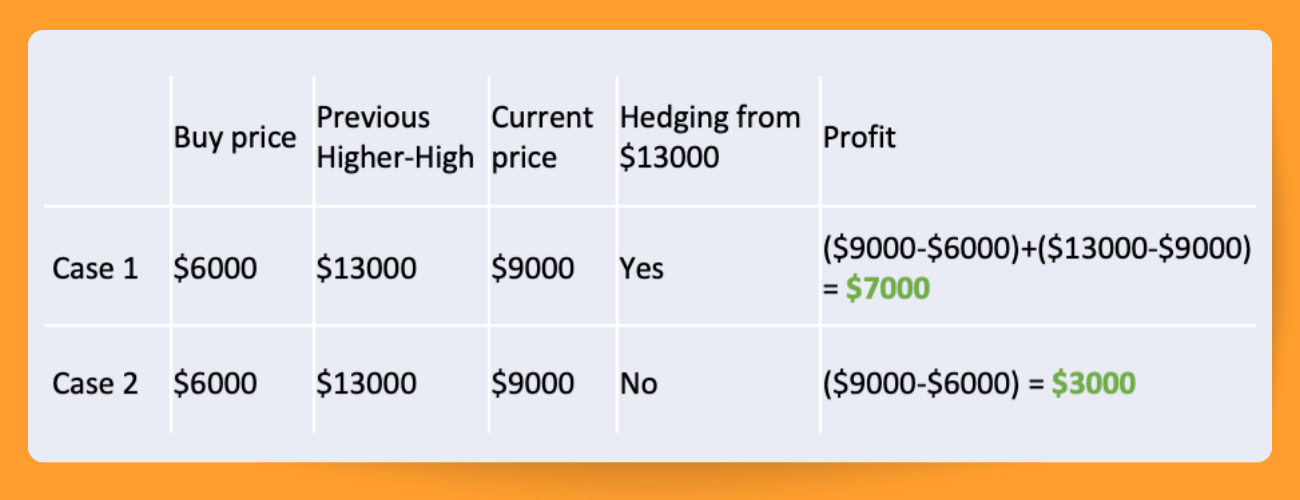

Another significant advantage of Bitcoin futures is their utility for hedging long positions in a declining market. For instance, if you purchased one bitcoin at $6,000 and its price has now escalated to $13,000 but is at risk of falling to $10,000 due to market pressure, you could open a short position on futures contracts equivalent to one bitcoin. This action effectively shields your long position from a price drop by 100%, allowing you to profit from the falling prices.

Consider two scenarios (Pic. 2): one involves short selling from $13,000 as the price begins to decline, and the other is a simple HODLING strategy from $6,000 to the current market price without any hedging. In the first scenario, shorting the market from $13,000 to $9,000 with a futures contract equivalent to one bitcoin results in a $4,000 profit, which counterbalances the bitcoin price drop, thereby safeguarding the initial profit made from $6,000.

However, keep in mind that this is a simplified example of hedging. Other factors such as daily fees, leverage, storage risks, and technical issues should also be considered.

Options Market

The Bitcoin options market is a relatively recent development in comparison to the futures market. Deribit has been a key provider of options contracts through its online platform, with other entities like LedgerX, Bakkt, OKX, and CME also offering options trading desks.

Options contracts primarily aim to give traders and investors the right, without obligation, to buy or sell a predetermined amount of bitcoin at a specified date. Given bitcoin's extreme volatility, options prices are usually high, making them mainly accessible to seasoned market participants. A significant benefit of options trading is its cost-efficiency due to leverage. Let's illustrate this with a real example from Deribit:

Instead of purchasing bitcoin worth $10,000 right away, you can buy an option contract for only $838. This contract gives you the right to buy one bitcoin at a $10,000 price (strike price) on the settlement date, in this case, June 26, 2020. Assume that on the expiration date, the BTC price rises to $15,000. You will secure a profit of $4,162 ($15,000-$10,000-$838). To get the ROI ratio, divide the return on investment, i.e., $4,162 by the total investment ($838+$10,000), and multiply by 100% to get a percentage, which equals 38.4% ROI. Now let's compare this ROI with that of a typical spot trade.

If you bought bitcoin worth $10,000 on the spot market and then sold it for $15,000, the return is $5,000. To get the ROI, divide the $5,000 return by the $10,000 investment, which gives you an ROI of 50%. However, the risk in an options strategy is limited to losing $838, while in spot trading, you are exposed to unlimited losses due to market volatility. Can you see the difference?

Both professional traders and portfolio managers use options for speculative and hedging purposes. The above example illustrates a simple Call option strategy. A Put option strategy is also available, which is useful as a hedging tool in a declining market.

For this strategy to be profitable, the price of bitcoin must fall significantly below the strike price before the expiration date. Suppose you bought a Put option for $1,000 with a strike price of $10,000, and by the expiration date, the price had dropped to $5,000. In this scenario, the profit is $4000 ($10,000-$5,000-$1,000). You exercised your right to sell BTC for $10,000 when the current market price is 50% lower ($5,000).

If you were HODLING one bitcoin, the profit generated by your Put option compensates for bitcoin's price drop from $10,000 to $5,000. This is what hedging is all about!

Automated trading

Finally, one of the easiest and most affordable hedging strategies is algorithmic hedging for digital currencies.

👉 Picture this: the world of automated trading, a frontier where high-frequency trading bots whizz around the market making trades at lightning speed, turning a profit no matter which way the market winds blow.

One of the biggest advantages of Bitsgap's automated bots is that they allow you to have your fingers in the market pie at all times. If the base currency price starts to take a nosedive, the profits stacked up by your bot will form a safety net, cushioning the fall in value.

Let's take the DATA/BTC cryptocurrency pair as an exemplar (or any other pair for that matter). Imagine you took the plunge, bought DATA, and decided to HODL it without the aid of an automated bot. Without the bot, there's no one to play the market swings, selling high and buying low with your purchased DATA to accumulate profits in BTC. If the price of DATA suddenly drops, you’ll be looking at a negative ROI. But, if you had your automated bot ON, the profits it generated would counterbalance the drop in DATA's price. And as the DATA price starts to climb back up, reaching for its previous highs, with the base currency appreciating and your bot continuing to churn out profits, you'll find yourself back in the green with a positive ROI before long.

Oh, and by the way — if you've been on the hunt for a top-notch automated trading platform, your search ends here. Welcome to Bitsgap, a home for world-class trading bots that have garnered a massive following. With over 3.7 million bots initiated and a staggering $300B in trading volume in 2022 alone, our bots have given jaw-dropping returns!

The dazzling lineup includes the star performers: GRID, DCA, BTD, COMBO, and our newest member, DCA Futures!

But Bitsgap's capabilities extend far beyond just trading bots! Think state-of-the-art security, amazing community, and an unmatched affiliate program, laden with massive rewards and prizes!

Impressive, isn't it? You’re welcome to join the party too!

Conclusion

In the illustrations above, we've made the assumption that our traders have deftly entered into a hedging trade right at the pivotal moment when the trend takes a turn. But life, especially in the volatile cryptocurrency world, is rarely so perfect. The price could very well march in the opposite direction, leaving the trader to shoulder a loss. When it comes to options hedging, this cost comes in the form of the contract purchase. For futures hedging, the price of the gamble is increased market exposure as the asset price veers off course, manifesting as an unrealized loss.

Among those options, automated trading shines the brightest. Why? Well, picture a tireless trader, working around the clock for you, seven days a week, accumulating profits whether the market is on an upward climb or a downward spiral. The key emphasis here is — no matter the market. See? When the price takes a tumble, your automated bot transforms into a protective shield, hedging your investments. And when the price is on a meteoric rise, it morphs into a relentless money-making machine.

If you're venturing into the realm of automated trading, set your sights on Bitsgap. Each bot in our arsenal is armed with a suite of risk management tools like Stop Loss, Take Profit, as well as trailing and pump and dump safeguards. These features are designed to not only enrich your trading adventure and juice up your returns, but also act as a shield against unforeseen losses. Give it a whirl and experience the Bitsgap difference for yourself!

FAQs

Can You Hedge Cryptocurrency?

Yes, it is possible to hedge cryptocurrency. Cryptocurrency hedging involves making trades or using financial products to offset potential losses from price fluctuations. The goal of hedging is to minimize risk in your cryptocurrency investments. However, hedging itself carries risks and costs, so thorough research is required.

What Are Some Hedging Strategies?

Some common hedging strategies include:

- Diversifying your cryptocurrency portfolio across different assets instead of just one coin. This spreads out risk.

- Using stablecoins, which are designed to have minimal price volatility. They can act as a hedge against volatility.

- Trading derivatives like futures and options that allow you to bet on price movements without buying the underlying asset.

- Short selling by borrowing then selling coins you think will drop in value. If the price does fall, you buy them back cheaper and profit.

- Getting insurance against theft or hacking on crypto exchanges. This protects against losses.

What Is Bitcoin Hedging Strategy?

Bitcoin hedging tactics serve as a shield for your bitcoin investment against possible drops in value. Let's examine some of the prevalent methods used for hedging in bitcoin:

- Use futures contracts to lock in a selling price for bitcoin at a future date. This protects against price drops.

- Buy put options to sell bitcoin at a set price if the market dips below that price. Puts act as insurance.

- Short sell bitcoin if you think prices will fall. You profit when prices go down. However, potential losses are unlimited if prices rise.

- Diversify into other crypto assets besides bitcoin to reduce risk exposure to bitcoin's volatility.

- Convert bitcoin holdings to stablecoins like Tether when expecting bitcoin prices to fall. Stablecoins aim to maintain a steady value.

The key is finding the right balance of hedging strategies aligned with your risk tolerance and investment goals. Work with a financial advisor for guidance.

What Is Correlation-Based Crypto Hedging?

Correlation refers to how closely two cryptocurrencies move in price together. A high positive correlation means their prices tend to rise and fall together. A negative correlation means they tend to move in opposite directions. Hedging with correlations involves buying cryptocurrencies with negative or low correlations to ones you already own. If prices fall in your core cryptocurrency holding, the price of the uncorrelated asset may rise to offset the losses. For example, if bitcoin drops in price, your holdings in a negatively correlated altcoin like Monero may increase, balancing out the bitcoin loss. This diversification across assets with low correlations can reduce overall portfolio risk and volatility.