Stablecoin Explained + Best Stablecoins in Cryptocurrency

Strap in folks, because today we're taking a ride through the fascinating world of stablecoins! These digital currencies are on the cutting edge of crypto adoption, but what exactly are they?

Imagine a cryptocurrency that marries the stability of traditional assets with the cutting-edge world of digital finance. Enter stablecoin — the answer to the wild crypto fluctuations and a crucial player in the realm of decentralized finance (DeFi).

With stablecoins, you can unlock a treasure trove of financial opportunities beyond mere trading. You can lend and borrow using a digital currency that's anchored to real-world assets like the U.S. dollar. Such stability has propelled the likes of Tether and USD Coin to the top of the cryptocurrency charts.

But beware — not all stablecoins are forged alike. Each employs unique techniques to maintain steady value, and their risks differ accordingly. Moreover, regulatory forces continue to cast a watchful eye over the stablecoin landscape.

Ready to set sail on the stablecoin voyage? Equip yourself with essential knowledge to navigate these digital waters safely.

What Is a Stablecoin

Stablecoins represent a unique breed of cryptocurrencies, anchoring their value to other currencies, commodities, or financial instruments. These digital assets strive to offer a solution to the wild price swings of cryptocurrencies, making them more suitable for everyday transactions and lessening the risks associated with volatile investments.

Importance of Stablecoins

While bitcoin continues to reign as the most renowned cryptocurrency, its price volatility often hampers its practical use.

👉 It's not uncommon for bitcoin to experience intraday fluctuations of over 10% in mere hours.

Such volatility can be a boon for traders, yet it transforms ordinary transactions into high-stakes gambles for both buyers and sellers.

To function effectively as a medium of exchange, non-legal tender currencies must maintain relative stability, ensuring short-term purchasing power for those who accept them. In the world of traditional fiat currencies, daily forex trading shifts of even 1% are relatively uncommon.

That’s why stablecoins are so important: they are designed to tackle this volatility issue head-on by employing various strategies to keep their value consistent.

Types of stablecoins

Stablecoins draw their backing from a diverse range of sources, such as fiat currency, other cryptocurrencies, precious metals, and even algorithmic functions.

However, the source of a crypto's backing can influence its risk profile.

👉 For example, a fiat-backed stablecoin may offer greater stability as it's connected to a centralized financial system with an authority figure (such as a central bank) that can intervene and regulate prices during volatile periods. On the other hand, stablecoins not linked to centralized financial systems may experience rapid and significant fluctuations, partly due to the absence of a regulatory body governing the underlying asset. True, some may argue that crypto's essence is independence from centralized finance, making fiat-pegged stablecoins an oxymoron. Fair enough, but it also depends on what you’re after.

Now, let’s talk about each type of stablecoins in more detail below:

- Fiat-backed stablecoins are IOUs—you buy them with dollars or other real money, and can cash them in later. Unlike other cryptos, their value barely budges. But don't think they're foolproof. They're new, risky, and should be invested in cautiously. For instance, Coinbase's USD coin is fiat-backed, always worth $1.

- Crypto-backed stablecoins are tied to volatile crypto assets. To stay steady, they hold more crypto than needed—for every $1 coin, $2 in crypto. If the crypto sinks, the $1 coin is covered. But keep an eye on the underlying crypto! For instance, the DAI coin runs on Ethereum and aims for $1.

- Precious metal-backed stablecoins like gold provide stability and inflation protection. While centralized, gold has long hedged market ups and downs. Example — Digix gold coins let you own gold without the hassle.

- Algorithmic stablecoins aren't backed by anything. Complex algorithms adjust the supply to keep the value around $1. Your share changes, but equals the same value. The AMPL coin uses algorithms to handle shifts in demand.

Stablecoin vs Bitcoin

While bitcoin value can go up or down at any time, a stable coin will always stay the same. This means that you don’t really invest in stablecoins like you do with bitcoin. Instead, you would use a stable coin to keep some of your bitcoin profit from evaporating if you thought that the market was going to experience some turbulence soon.

This allows you to keep your profit safe without having to exit cryptocurrency market. It also means that you can trade much faster and you can keep your day trading profit safer overnight so you can actually sleep instead of worrying about it or cashing out to your country native fiat currency.

How Do Stablecoins Work

As we’ve discovered, stablecoins offer a steadier path in the ever-changing landscape of digital currencies by anchoring their market value to a stable asset. With their tamer price fluctuations, they're better suited for daily transactions and value storage.

👉 However, the key question remains: How do stablecoins maintain their reputed stability? The secret rests in the complex mechanisms governing their pegs and the backing of their value with tangible assets.

Stablecoin's value stability is deeply rooted in the design and governance of its underlying structure. For genuine stability, issuers must commit to issuing and repurchasing stablecoins at the pegged asset's current value while also holding collateral to back the circulating stablecoins, allowing for redemption at any time. The potential risks posed to consumers and markets if stablecoins lack sufficient collateralization are significant concerns for regulators.

Collateralization for stablecoins involves the issuer setting aside ample reserves, such as U.S. dollars or gold, to accommodate potential large-scale customer redemptions. This concept mirrors traditional banks, which must hold enough cash on hand to address potential bank runs.

However, unlike banks, which face strict requirements for cash reserves, the crypto industry lacks such regulations. To mitigate risks, some crypto firms have adopted voluntary "proof of reserves" (PoR). However, a standardized approach, whether industry-led or government-mandated, has yet to be established.

Stablecoin Regulation

Stablecoins started as financial frontier rebels, but their $130 billion stampede has caught the attention of the law. Regulators once dozed as these crypto dollars slipped by — now they scramble to saddle up and rein them in.

But stablecoin rules are a tangled mess of red tape. Some nations ban the use of stablecoins for payments or prevent banks from issuing them, while others propose new regulations, such as requiring substantial cash reserves or limiting issuance to licensed banks only. Following the rules is tough, even for those seeking to obey them. The U.S., Europe, and more are crafting a maze of stablecoin regulations. The European Central Bank has already stated that stablecoin issuers should be subject to "rigorous liquidity requirements" (i.e., substantial cash reserves) and believes it should have veto power over stablecoins in the eurozone.

Politicians join the posse too. U.S. senators demand audits. Others want bank rules. Congress proposes guidelines but can’t corral votes.

Regulators scrutinize stablecoins closely as they grow and could disrupt finance. A global rules group says “systemically important” stablecoins—the big troublemakers—need a short leash.

Headlines and hype don’t help. Tether cleaned up reporting after years of dust-ups. Paxos faced trouble for its stablecoins. Even star student Circle’s USDC briefly stumbled after the collapse of Silicon Valley Bank, where Circle had over $3 billion on deposit.

Why the chaos? Stablecoins seem simple but hide complexities in reserves, risks, and reporting. And as banks like JPMorgan adopt the idea with “deposit tokens,” consensus remains elusive.

Stablecoin Adoption

The journey towards stablecoin adoption by Web2 businesses faces a few challenges, such as regulation, consumer adoption, and streamlining on- and off-ramping processes.

👉 Imagine the immense potential unlocked when converting between stablecoins and fiat currencies becomes seamless — it would revolutionize real-world applications.

Progress in regulation is already happening in Europe and the US, but a universally agreed-upon definition of stablecoins would sweep away the fog of uncertainty, empowering organizations to confidently embrace this groundbreaking technology.

Moreover, a cultural transformation is required to dispel consumer confusion. As people gain a deeper understanding of digital assets and blockchain, their confidence will soar.

👉 It's crucial to appreciate that we are pioneers in this space, and the rising user CAGR is a promising sign of an unstoppable trend. As more use cases emerge and the user experience enhances, the momentum will only grow stronger.

After all, the true power of technology lies in its ability to solve real-world problems. Stablecoins are poised to tackle numerous banking system challenges, making them a compelling choice for businesses ready to take their first steps into this uncharted territory.

How to Get Stablecoins

When you buy stablecoins through an exchange, it may be considered a taxable event depending on your jurisdiction's tax laws. Using cryptocurrencies like ether as collateral to obtain a loan in stablecoins is an alternative that might not trigger a taxable event.

However, when borrowing against your crypto holdings, you can usually only borrow a percentage (e.g., 50-60%) of your collateral's value. You need to be cautious about price fluctuations, as a significant drop in the value of your collateral might lead to liquidation, forcing you to sell at a loss. To avoid this, you can either add more collateral to your position or repay a portion of your loan.

👉 Please note that tax laws and regulations differ between countries and jurisdictions. Always consult a tax professional or financial advisor for accurate information about your specific situation.

Looking to dive into the stablecoin sea at centralized exchanges? Set sail with Bitsgap, the all-in-one treasure map that unites 15+ top exchanges under one 'X' marks the spot! Get ready to be dazzled by snazzy charting instruments, and don't forget the cherry-on-top widgets like the legendary Technicals.

Ready to trade like a true captain? Choose between real trading, a demo voyage, or let automated trading bots take the wheel in both spot and futures markets.

Join the jolly crew of 500K traders, where regular booty, contests, and a friendly shipmate community are just a button away. Arrrr, click me hearties!

Stablecoin Examples + Best Stablecoins in Cryptocurrency

Now let's look at some examples of stablecoins, as well as stablecoin gems worth knowing about:

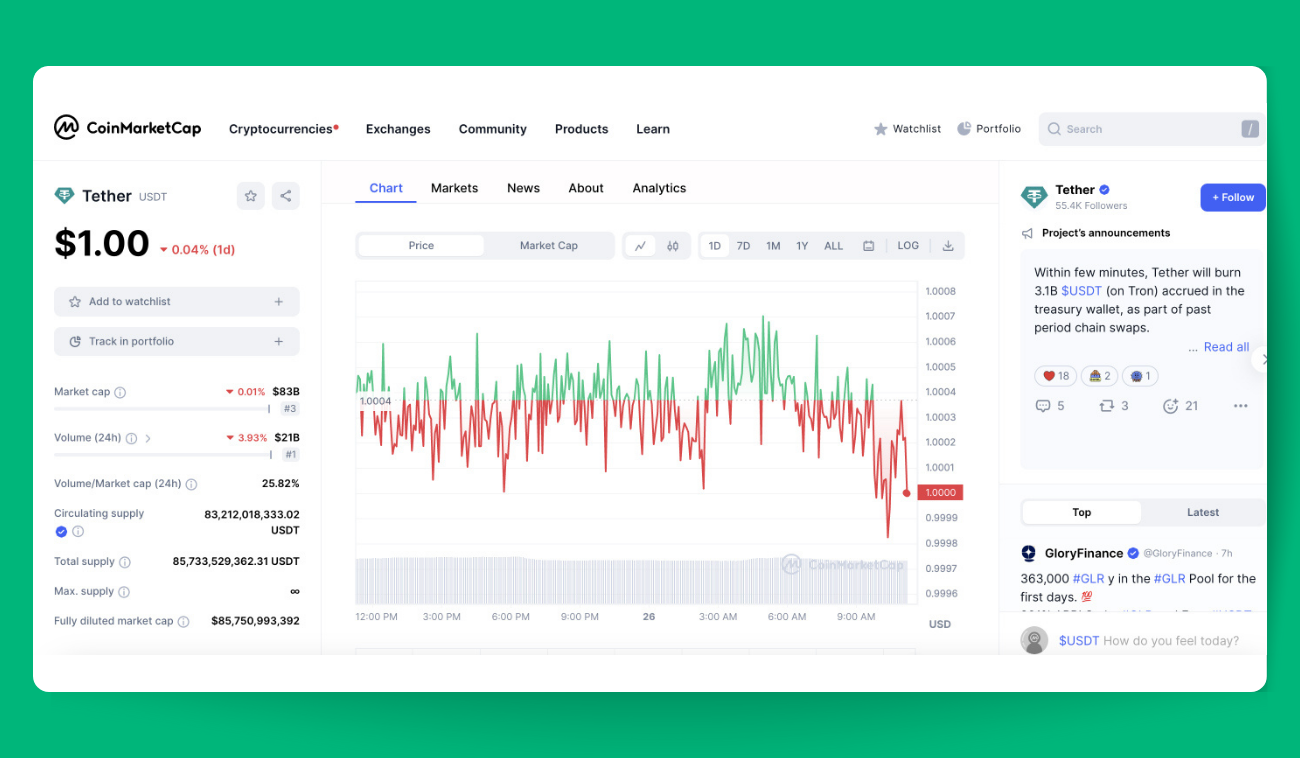

Tether: USDT Stablecoin

The stablecoin Tether (Pic. 1) allows cryptocurrency traders to anchor their portfolios to the stability of the U.S. dollar. For every USDT, the popular stablecoin token issued by Tether, there is supposedly one U.S. dollar held in reserve to back its value. This 1:1 peg means USDT can be redeemed for dollars at any time, providing a steady shelter from the volatility of crypto markets.

As Steve Bumbera, COO of Many Worlds Token, explains, "1 Tether should always be exchangeable for $1, regardless of market conditions." This reliability has fueled Tether's rise to become one of the largest cryptocurrencies by market cap and the most heavily traded crypto, surpassing even bitcoin and ether.

Tether's model is simple. When users deposit dollars, Tether issues them an equal amount of USDT. When they redeem USDT, Tether destroys those tokens and returns their dollars. This process, at least in theory, underpins Tether's stable value and its popularity as a tool for entering and exiting volatile crypto positions.

While recent events dented confidence in the stability of some stablecoins, Tether has so far maintained its peg. However, Tether has long faced questions about whether it truly holds enough dollar reserves to redeem all USDT, and its disclosures have been inconsistent. Most experts agree Tether is not fully backed but see little imminent risk to its peg.

Tether operates on multiple blockchains, including Bitcoin, Ethereum, TRON, and Liquid. Despite lingering transparency concerns, Tether remains the stablecoin of choice for traders seeking shelter from crypto's stormy seas.

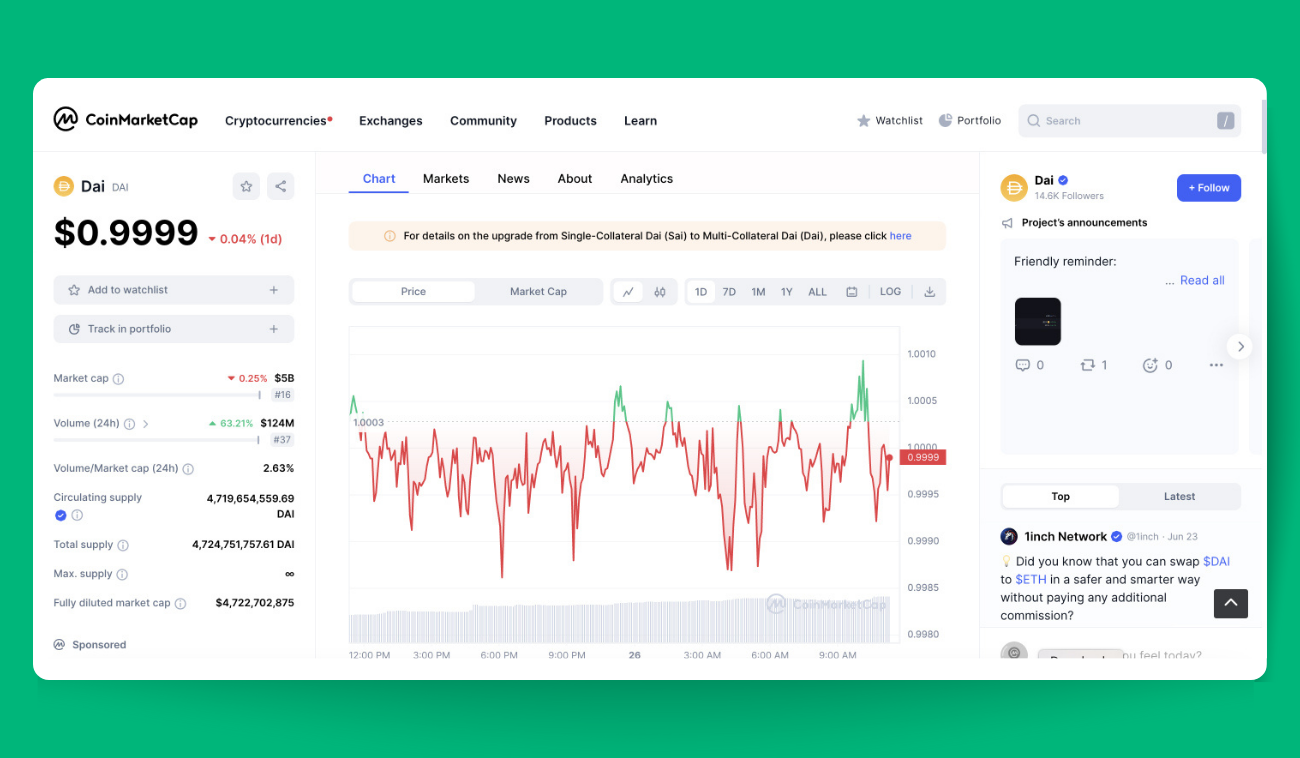

DAI: DAI Stablecoin

Dai (Pic. 2) is the pioneer of decentralized stablecoins, and it's changing what stability means in crypto. Unlike rigid fiat-backed coins like USDT, Dai moves with the sway of its collateral, mainly ether. And that's a feature, not a bug.

Dai is minted by locking collateral, primarily ether, but also other cryptocurrencies, into smart contracts. For every $1 of Dai, $1.50 or more of collateral is staked. This overcollateralization protects Dai holders even when volatility strikes, allowing Dai to weather crashes that could break a strictly fiat-pegged stablecoin.

But there's no requirement to hold ether when you buy Dai. Once minted, Dai freely circulates. Traders love Dai because it's a decentralized hedge against volatility that's backed by some of crypto's most liquid assets, not an opaque fiat war chest. One stablecoin to rule them all? With a massive market cap ($4B at the time of writing) that reflects the circulating supply and market dynamics, Dai is certainly making a case.

Only those who mint Dai, by staking collateral in Collateralized Debt Positions, need to monitor its value and the price of the underlying assets. If the value of your collateral falls too low, your position can be liquidated. But for most, Dai acts like any other cryptocurrency — hold it, trade it, spend it. Its soft peg to $1 USD has remained relatively stable near $1 since its launch.

In a world of fiat-backed coins and algorithmic stablecoins grasping at stability, Dai nimbly proves that crypto-collateral and decentralization are ideal ballasts.

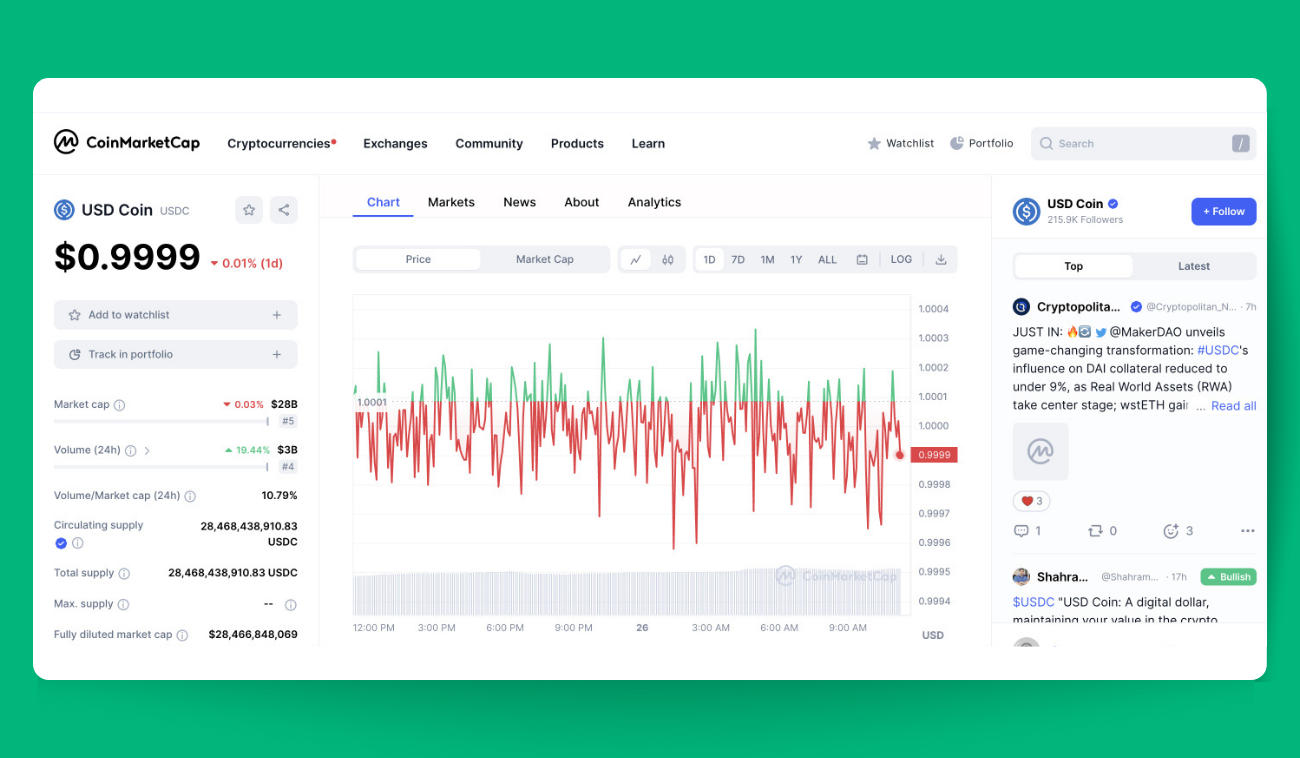

USD Coin: USDC Stablecoin

USDC (Pic. 3) is angling to be the regulated standard in stablecoins. Backed 1:1 by dollars and short-term U.S. Treasuries, USDC delivers stability you can trust, courtesy of fintech Circle. As CEO Jeremy Allaire said, "USDC stands for the idea that you can have an open global payment system that still has real accountability and trust."

But on March 11th, 2023 USDC rattled this trust by depegging to $0.90. Rumors sparked a bank run on Circle's reserves at Silicon Valley Bank, forcing the sale of assets to meet redemptions. The liquidity crunch proved temporary, but it highlighted the risks of centralized stablecoins and dependence on legacy banks.

According to Circle, USDC holds $3.3 billion at SVB, 77% in Treasuries. The remaining 23% in cash at other banks kept USDC afloat. But as customers rushed SVB, doubt shook the peg. The incident shows stability requires liquidity and trust — in the system, its overseers, and their controls.

Regulated and audited, USDC should inspire confidence. Yet one bank hiccup destabilized it, proving regulations alone don't negate risk. After all, a stablecoin is only as strong as its reserves, and as liquid as access allows.

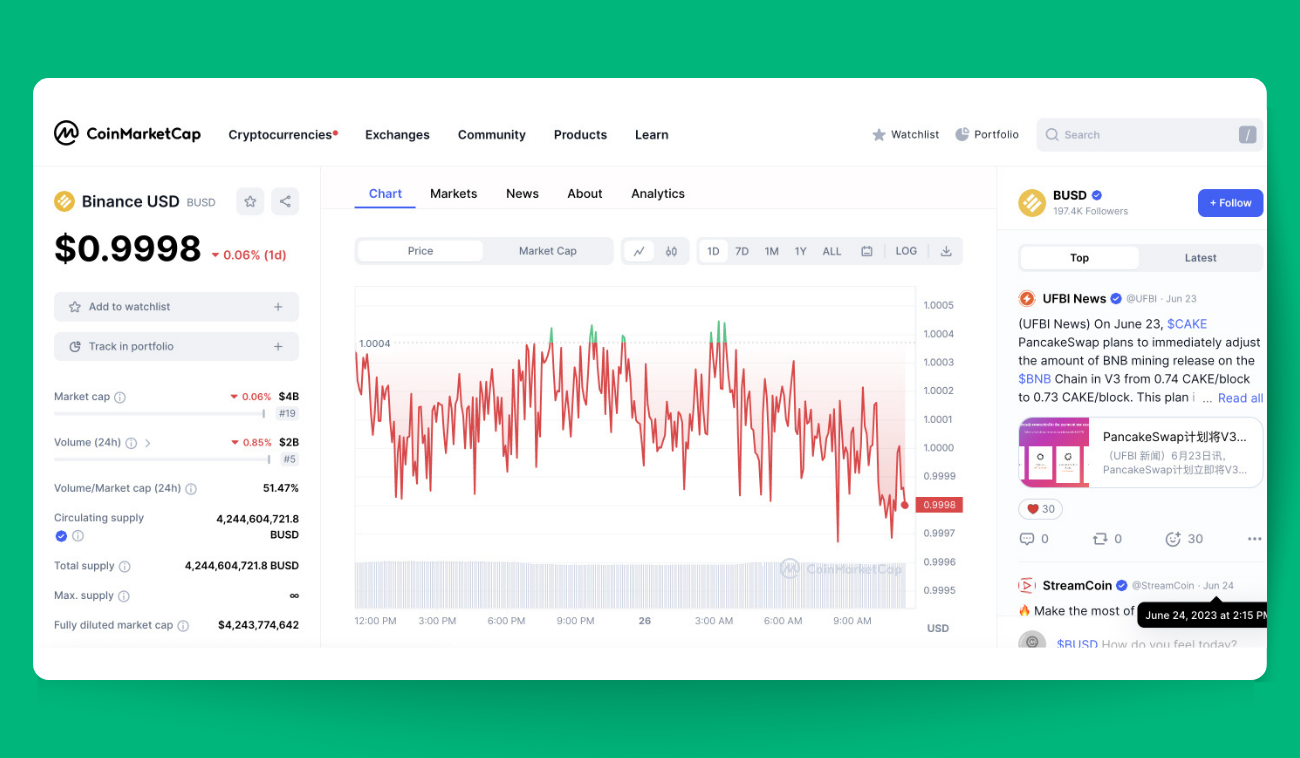

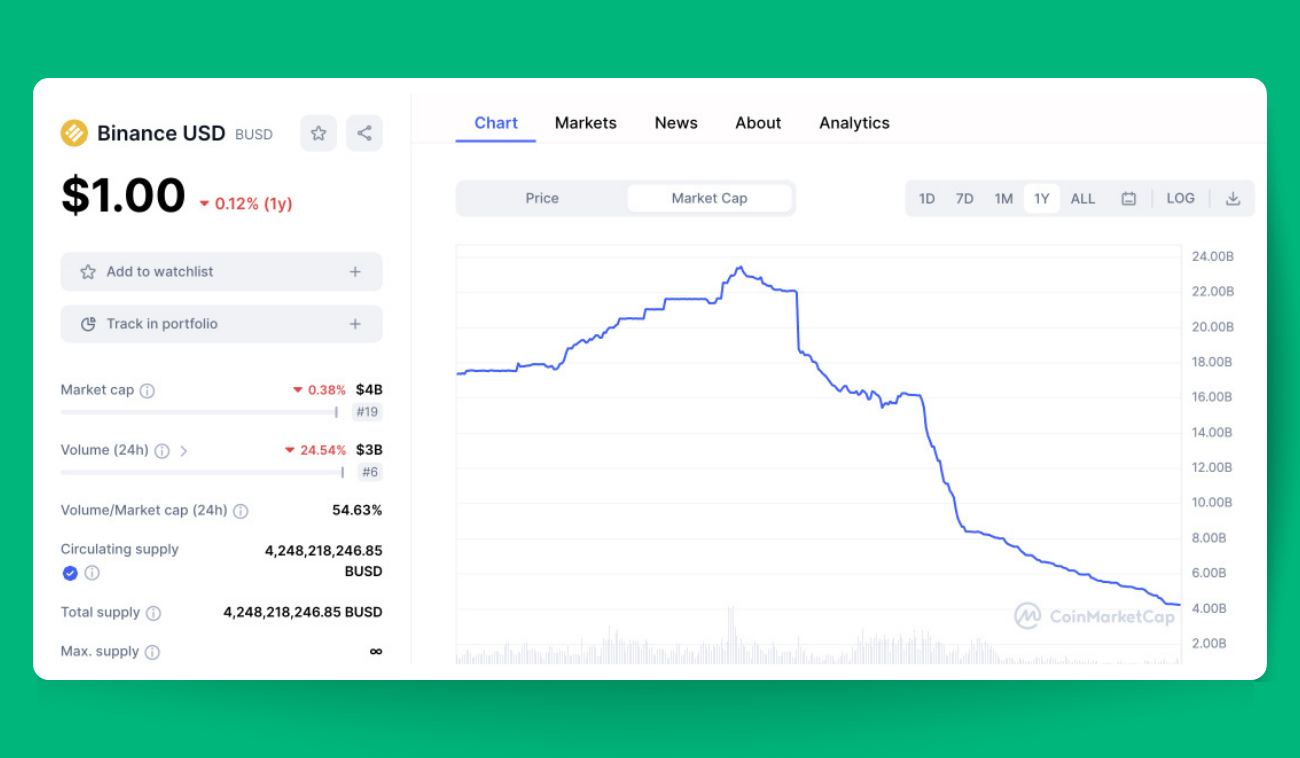

Binance USD: BUSD Stablecoin

The once high-flying BUSD stablecoin (Pic. 4) has rapidly fallen from grace. In just a few months, BUSD lost billions of dollars in market cap to $4.3B (Pic. 5). Long gone are the heady days of December 2022, when BUSD's market cap peaked at $23 billion.

BUSD's decline mirrors the mounting troubles of its issuer, Binance, the world's largest crypto exchange. Last November, the collapse of FTX sent shockwaves through crypto, and a December report suggested the DOJ had Binance in its sights. The one-two punch rattled BUSD, proving that no stablecoin, however trusted, is immune from the perception of its backers.

BUSD launched in 2019, a collaboration between Binance and Paxos, which issues the coin. Paxos handled regulations, Binance provided the brand, and for a time the partnership prospered. But Paxos also faced obstacles, including a Wells notice from the SEC alleging BUSD was an unregistered security. The ensuing NYDFS investigation froze BUSD issuance, showing the risks of centralized oversight and tethering any stablecoin to a single entity.

For BUSD, the path ahead is fraught. Its close ties to Binance mean its stability depends on rebuilding trust in the exchange, even as regulators circle. And while Paxos stewards the coin, it relies fully on Binance's brand and liquidity. This centralized model and shared fate highlight the need for stablecoins to diversify — their backing, issuers, blockchains, and regulatory regimes.

BUSD may yet rise again. But its precipitous fall stands as a lesson in how quickly the tides of trust and perception can turn.

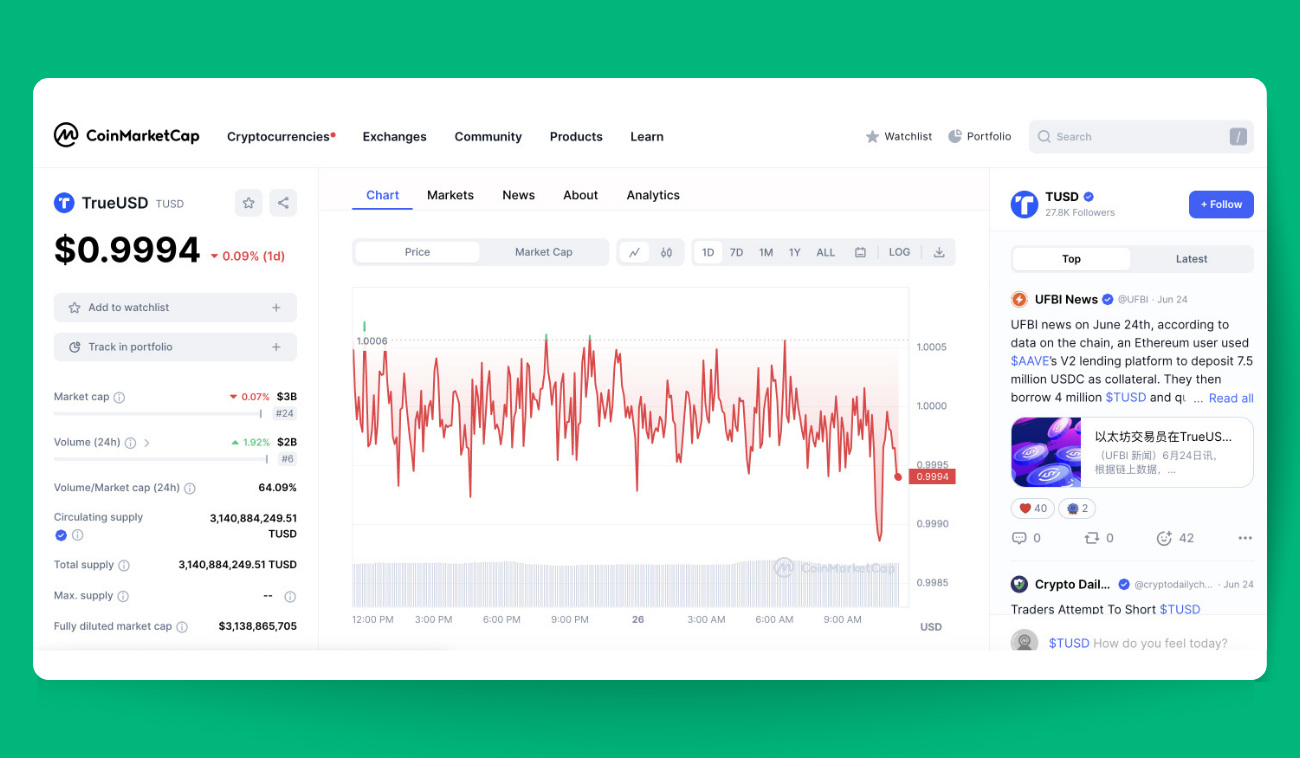

True USD: TUSD Stablecoin

TrueUSD (TUSD) (Pic. 6) is a top-five stablecoin by market cap, designed to remain pegged to the US dollar. Each TUSD token is backed by US dollars held in trust companies' bank accounts. The TrustToken platform allows TUSD tokens to be minted or redeemed at a 1:1 ratio with USD.

Launched by TrustToken in 2018, TUSD was later sold to a mysterious China-based company, Techteryx, in December 2020. Though marketed as transparent, the lack of information about Techteryx raises concerns. Additionally, the company maintains connections to Tron founder Justin Sun and Alameda Research.

TrueUSD claims to be transparent through an on-chain mint/lock protocol in partnership with Chainlink. However, its relationship with Techteryx, a non-US-based company, and the use of a third-party auditor that doesn't directly audit the reserves undermine its transparency claims.

TUSD is also considered centralized, as users must complete KYC and AML documentation before buying or redeeming tokens, and the TrueUSD team can freeze accounts or confiscate tokens if they believe terms or regulations have been violated — powers that make some in the crypto community uncomfortable.

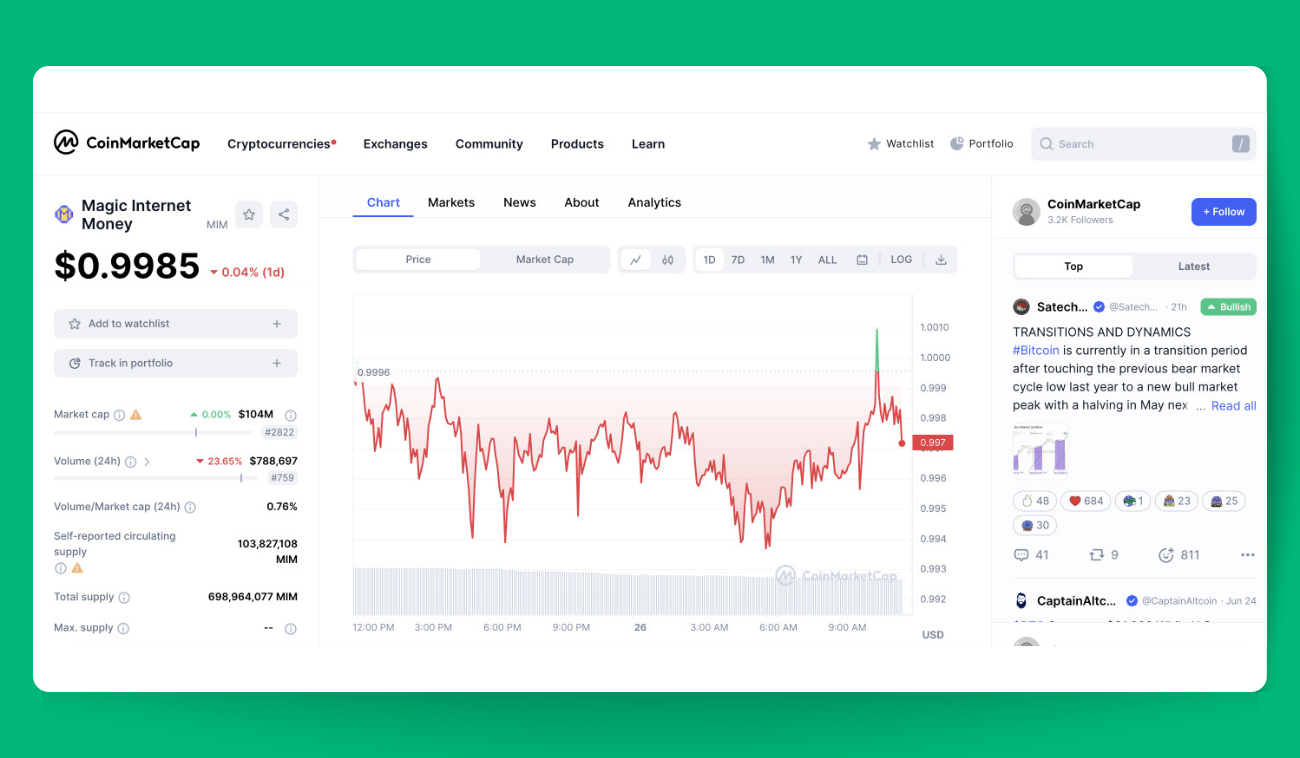

Magic Internet Money: MIM Stablecoin

Abracadabra Money, a DeFi crypto lending platform, lets you leverage your interest-bearing assets as collateral for stablecoin loans called Magic Internet Money (MIM) (Pic. 7). What sets Abracadabra apart? It's their unique use of collateralized interest-bearing tokens (ibTKNs) to mint MIM loans on a multi-chain platform.

ibTKNs, a type of liquidity provider token, grow in value over time. They can be cryptocurrencies like ether, USDT, or USDC deposited in farming pools like Yearn.Finance. Abracadabra's multi-chain nature means MIM coins can move across various blockchains.

Traditional DeFi lending platforms require users to deposit a liquid asset, such as USDT, to receive illiquid interest-bearing tokens like yUSDT. In contrast, Abracadabra allows users to deposit illiquid tokens (ibTKNs) as collateral for liquid MIM loans, making yield farming positions more flexible.

As with any DeFi platform, there are pros and cons. Abracadabra boasts adjustable risk tolerance levels, compatibility with multiple chains, no pesky hosting costs, and the power to use otherwise dormant, illiquid tokens. However, it may not be beginner-friendly, has potential smart contract risks and liquidations lurking in the shadows.

Abracadabra uses two tokens: MIM and SPELL. MIM is a yield-bearing stablecoin, minted in exchange for interest-bearing asset deposits. It's available on multiple blockchains like Avalanche, Arbitrum, Fantom, Ethereum, and Binance Smart Chain. SPELL, the native Ethereum token for governance and incentives, is used for voting and rewarding liquidity providers.

To wrap it up, Abracadabra Money seems confidently poised to shake the DeFi landscape, opening a portal to DeFi 2.0. After all, this platform unlocks the hidden potential of interest-bearing tokens, which would otherwise lie dormant. Users can now transform their lending platform "receipts" into collateral for loans, all while their original stablecoins accumulate at an annual rate. With a mere 0.8% yearly fee, users can reclaim 90% of their liquid assets.

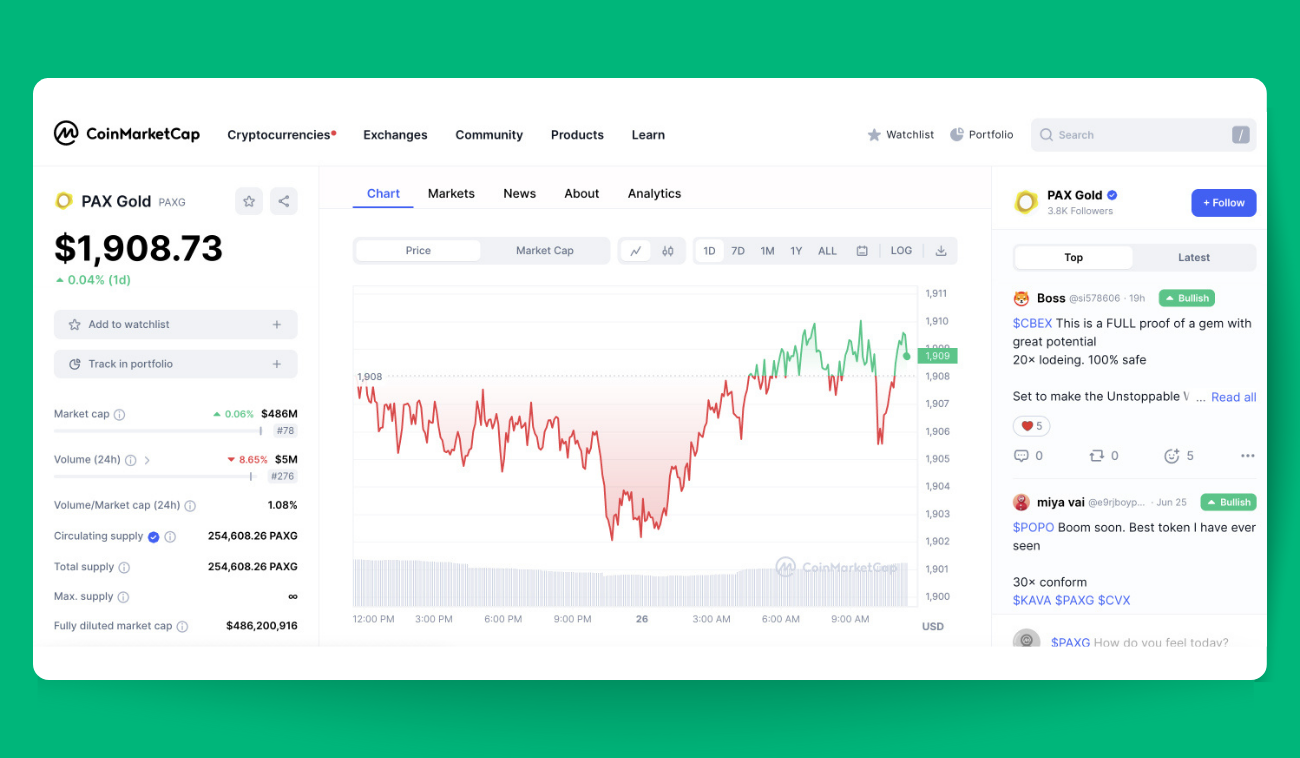

Pax Gold: PAXG Stablecoin

Gold is a time-tested store of value, but it can be a hassle to own and trade. Investors struggle with buying, storing, and selling physical gold. Gold bars are hard to divide, risky to store, and illiquid.

Paxos solved these problems with Paxos Gold (PAXG) (Pic. 8), a digital token backed 1:1 by gold bars in their vaults. Each PAXG represents an ounce of gold, providing the benefits of gold ownership without the hassle.

Paxos uses blockchain to improve how gold is distributed, stored, and owned. As a decentralized digital asset, PAXG is resilient against attacks or theft. It offers gold's value without complications like storage, transport, and theft risks.

Instead of trading gold derivatives like futures or ETFs, which lack physical gold backing, PAXG provides a secure alternative. These traditional methods are simply speculations on gold prices without owning real gold. While convenient to trade, they lack gold's store of value. Unlike derivatives, PAXG is backed 1:1 by gold, so you own real gold. And unlike gold futures, PAXG has no settlement risk.

The gold backing PAXG is registered to token holders. You can see details like serial number, weight, and purity for your gold bar on Paxos' website. PAXG in Paxos accounts offer the same details and more.

Allocated gold, like PAXG, is safer than unallocated gold or self-storage. Paxos buys and vaults gold for PAXG, and you own that gold. Unallocated gold risks the provider using your money without buying gold. If they go bust, you likely lose your investment.

Initially, you could only buy PAXG on Paxos' site or itBit exchange. Now available on Kraken, Binance, and more, PAXG provides new ways to earn interest not possible with physical gold. Nexo, Crypto.com and BlockFi offer up to 8% APY on deposited PAXG, using it as collateral for loans.

A couple of years ago, Paxos announced its integration with PayPal to offer crypto services to PayPal’s clients. However, PayPal paused the stablecoin plans earlier this year, as regulators scrutinised crypto and investigated Paxos. Although Paxos' stablecoin was unaffected, Paxos had to stop issuing BUSD.

FAQs

Why Do We Need to Use Stablecoins?

Stablecoins are significant for a couple of crucial reasons. Firstly, for merchants to accept crypto confidently, they need stability. Without it, the fluctuating value of volatile coins could obliterate their narrow profit margins. Stablecoins provide a protective layer, safeguarding their earnings from erratic market movements.

Secondly, stability is essential for maintaining value. For investors, stablecoins serve as a secure refuge during turbulent market conditions. They offer a place to park funds without entirely withdrawing from crypto. When the financial waters get rough, stablecoins become the crypto safe harbors, allowing you to anchor down until the storm subsides.

How Do Stablecoins Make Money?

Stablecoin companies, whether centralized or decentralized, have unique business models and revenue streams.

Centralized stablecoins, like Tether, USDC, Paxos Standard, and Gemini dollar, hold reserve assets off-chain and are managed by a central authority. They generate revenue through short-term lending and investing, similar to how banks lend out customers' savings. Centralized stablecoins also charge issuance and redemption fees, albeit small, for creating or redeeming stablecoins.

On the other hand, decentralized stablecoins hold reserve assets on-chain using cryptocurrencies and smart contracts, addressing transparency concerns. They issue additional cryptocurrencies for governance and revenue sharing, such as MakerDao's MKR token, which grants rights to interest on collateral. The interest, or stability fee, is paid in MKR tokens and later burned, reducing supply and potentially increasing the token's value. Decentralized autonomous organizations (DAOs) can vote to issue more tokens to reward key contributors.

In a nutshell, stablecoin companies generate revenue through lending, investing, and fees in the case of centralized stablecoins, while decentralized stablecoins focus on governance, revenue sharing, and incentives for their communities.

What Issues Are Connected with Stablecoins?

Stablecoins face unique challenges compared to other cryptos. One is "counterparty risk"—whether the groups holding their reserves actually have the money they claim. For example, Tether often faces questions on truly having $1 for each USDT coin.

In the worst case, the reserves backing a stablecoin may not redeem every coin, shaking trust.

Cryptos aim to ditch middlemen who control and can halt funds. Yet some stablecoins have reintroduced this ability. The USDC coin, for instance, can freeze payments for illegal activity. In 2020, USDC issuer Circle froze $100,000 at law enforcement's request.

Stablecoins also face recent regulatory challenges. The SEC's wide-ranging crypto crackdown has faced backlash, but their shot across the bow of Binance USD could offer clues on where regulators draw the line for stablecoins.