Things to Consider Before Launching Bots on HitBTC: Your Ultimate HitBTC Review

Is HitBTC a pioneer pushing the industry forward or a wizard hiding behind smoke and mirrors?

Step into the realm of HitBTC, one of the pioneering cryptocurrency exchanges launched in 2013. Billed by its creators as the “most advanced Bitcoin exchange,” does it truly live up to this claim? Let's find out.

Originally set up in Chile in 2013 by a group of proficient system analysts and technology experts, HitBTC officially took off in 2014, fueled by $6 million in seed funding from undisclosed angel investors. This pattern of anonymity has raised eyebrows among users worldwide, as the financial backers behind HitBTC remain a mystery.

Despite its secretive origins, HitBTC experienced rapid growth by offering a wide selection of cryptocurrencies backed by ample liquidity. The platform features well-known crypto assets like bitcoin, ether, Dash, as well as lesser-known altcoins that are hard to find on other exchanges.

However, this growth hit a stumbling block when rumors of a potential platform hack began to surface. The team's lack of communication regarding the situation, coupled with increasing grievances about withdrawal issues and subpar customer service, has dented the exchange's trustworthiness.

Today, HitBTC continues expanding its capabilities and services worldwide. Catering to both individual and corporate clients worldwide, it has expanded its footprint by establishing offices in cities such as Rio de Janeiro, Santiago, Hong Kong, Beijing, and Singapore. Yet its early days of anonymous investors, alleged hacks, and unresponsive service still loom over the exchange.

Has anything changed? Is HitBTC safe and legit? Let’s see.

HitBTC Trading Pairs & Crypto Assets on Offer

With over 900 trading pairs across 450+ crypto assets, HitBTC boasts one of the largest cryptocurrency selections of any exchange. While this vast array provides traders access to obscure altcoins not found elsewhere, it also raises concerns. At what point does an exchange begin to list too many thinly-traded or stagnant assets?

HitBTC may benefit from pruning some of these tokens that add little value for the platform or users building portfolios. The sheer number of unknown cryptocurrencies creates confusion, especially for novice traders. More troubling is the large quantity carrying dangerously low trading volumes and illiquid order books. This hampers trading services relying on liquidity for reliable order execution and reasonable spreads.

Offering a variety of assets unseen on other exchanges can be advantageous. However, HitBTC should consider streamlining its trading pairs to reduce clutter, improve liquidity, and enhance the overall trading experience.

HitBTC’s Trading Volumes

Despite having high liquidity, HitBTC lags behind other major crypto exchanges in overall trading volume. HitBTC's reported 24 hour volume is $567 million. Its most traded pair is BTC/USDT at $241 million. However, even with this trading activity, HitBTC only ranks #94 among exchanges listed on CoinMarketCap. Platforms like WhiteBIT, Binance.US, Poloniex, and Crypto.com surpass HitBTC, placing 49th, 45th, 29th, and 16th respectively. So while HitBTC provides substantial liquidity, especially for BTC/USDT, its total volumes are overshadowed by those of competitors.

HitBTC’s Services

HitBTC offers a range of essential trading facilities that cater to the needs of both individual and institutional investors. These include:

HitBTC Trading Platform

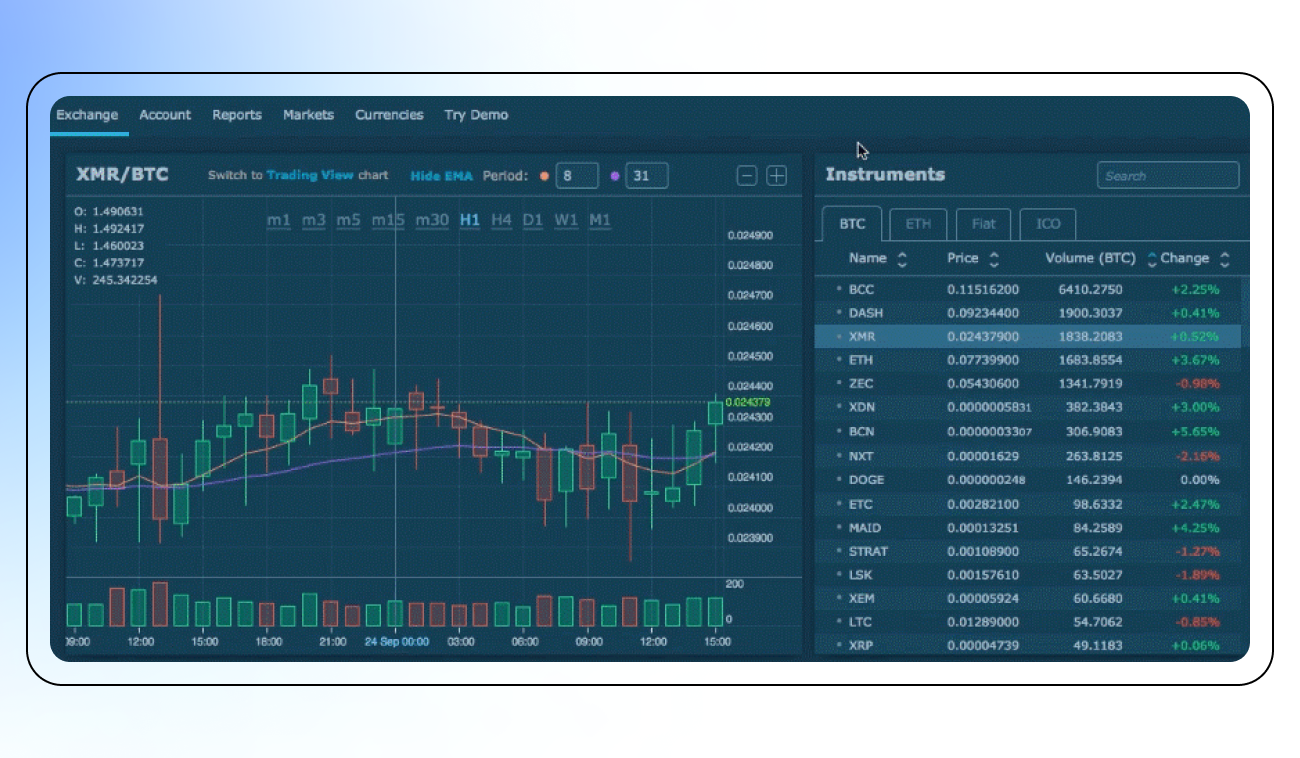

HitBTC's main offering is its trading platform, which provides comprehensive tools, a user-friendly interface, and a demo mode for traders.

For full automation though, traders need third-party services like Bitsgap since HitBTC only enables manual trading. It does offer smart orders to partially automate, along with various order types — limit, market, stop, good-til-canceled, immediate-or-cancel, fill-or-kill, and more. But worry not because HitBTC has crafted a highly robust API that stands out in the market for its speed, reliability, and its specific design catering to algorithmic trading. So, you’re in good hands when it comes to interfacing with third-parties via APIs.

Overall, trading on HitBTC is smooth and responsive thanks to its order execution engine. Users who prefer personally managing trades will find it a pleasant experience.

Also, unlike many exchanges, HitBTC retains the TrollBox community chat feature alongside its trading screens, which certainly adds a bit of a social flair to trading.

All these elements come together to create a comprehensive and welcoming trading environment on HitBTC.

Over The Counter (OTC) Trading

HitBTC proudly presents a bespoke Over-The-Counter (OTC) trading experience, perfect for those eager to conduct high-volume transactions without dipping into public order books. This service is incredibly versatile, accommodating transactions starting from a modest sum of just 10 dollars, and soaring to limitless heights. To ensure your trading journey is as smooth as possible, HitBTC provides a protective shield and an extra layer of security, keeping you safe from any sudden price swings in the asset market while you're making your move.

Token Listing

HitBTC offers an easy-to-navigate process for coin listing, turning it into a bustling hub for low-capped alts and fresh cryptocurrencies. Budding crypto projects can conveniently locate a request form on the website to initiate their integration into the platform. Applications are meticulously reviewed, and feedback is provided within a ten-day working period.

Margin & Futures Trading

HitBTC provides the ability for cryptocurrency margin trading with leverage up to 10x, and futures trading with leverage up to 100x. These options offer the opportunity to potentially increase your profits through the use of borrowed capital. Although this type of trading carries a higher level of risk, if you correctly identify market trends, it could significantly enhance your potential gains.

Automated Trading on HitBTC

HitBTC proudly claims to be the first platform in the market to offer robust and speedy REST, WebSocket, and FIX API for automated bots. However, it's important to note that the exchange itself doesn't offer any built-in trading automation but instead ensures a reliable connection with third-party algorithmic trading service providers, rather than creating its own solution.

While some users might see the absence of integrated automated trading features as a drawback, pairing a trusted third-party trading software like Bitsgap with an exchange through a stable API connection can potentially offer superior functionalities compared to any in-house bot developed within an exchange.

Moreover, Bitsgap gives you an increadible opportunity to validate this claim yourself with a generous week-long trial that grants complete access to all the premium features the platform has to offer. This includes GRID, DCA, and BTD bots for HitBTC, superior charting instruments, paper trading mode, smart trading functionalities, and portfolio management. It's an exciting chance to explore the world of automated trading! Why not start now?

HitBTC Jurisdiction

HitBTC is accessible from anywhere around the globe, with the exception of a few regions: the United States, Syria, Sudan, Cuba, Crimea, and North Korea.

HitBTC Trading Fees

HitBTC employs a flexible trading fee matrix for its upgraded accounts. This system benefits active traders who maintain a positive token balance by offering them reduced trading fees.

These trading fees are determined by two factors: the user's trading volume in the last 30 days, converted into BTC, and the user's average token balance over the past 30 days, calculated based on the daily balance at 00:00 UTC. The trading amount is converted at the time of the transaction.

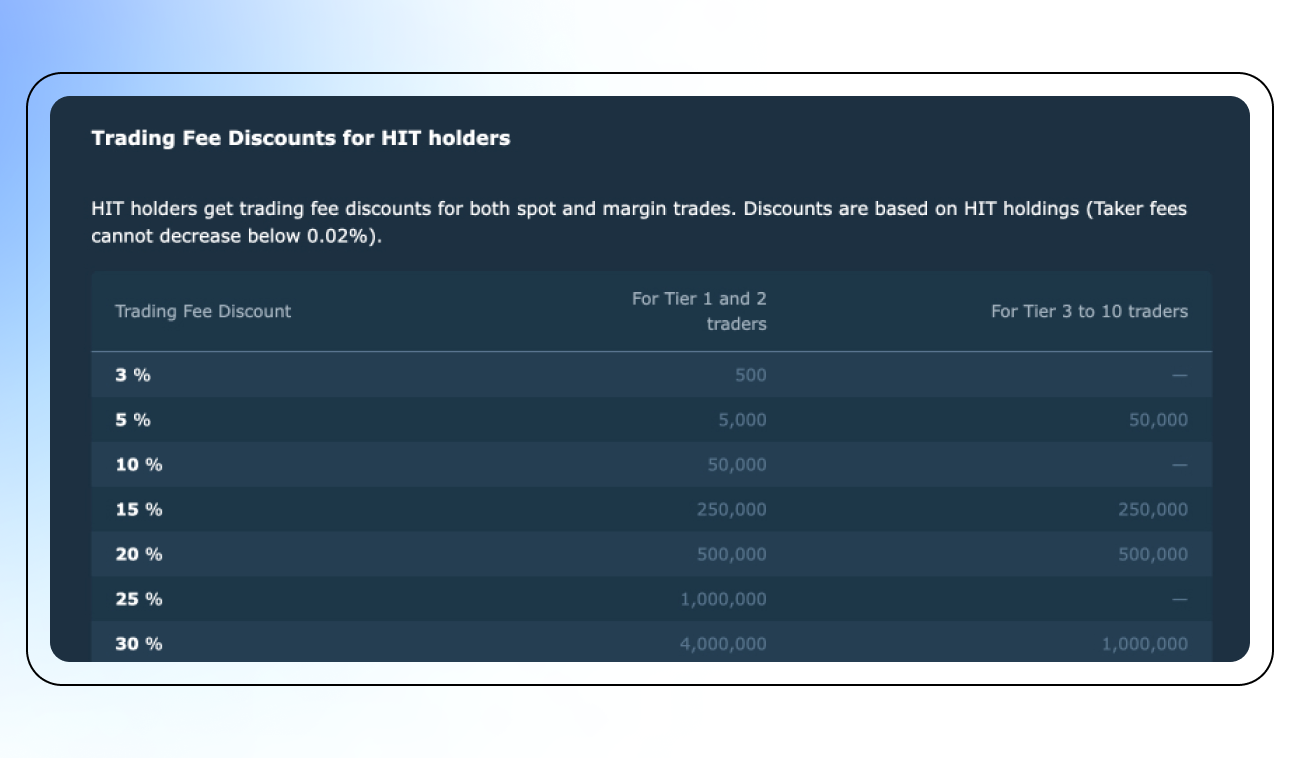

Holders of HIT tokens are also eligible for trading fee reductions for both spot and margin transactions. The discounts are calculated based on the quantity of HIT tokens held, with the taker fees not going below a minimum of 0.02%.

Security Features

HitBTC offers users several security measures including:

- Whitelist for wallet addresses

- 2FA authentication via apps or physical Yubikey

- Active session monitoring with instant termination capability

- Automatic logout after a period of inactivity

- Email notifications for new IP logins

- KYC/AML compliance for large withdrawals

However, HitBTC does not provide transparency into their internal security practices for protecting user funds and data within the exchange system itself. Unlike some exchanges, they do not detail their cold storage policies, encryption standards, or other technical safeguards. So while HitBTC gives users security tools, how they secure assets internally remains unclear.

Know Your Customer (KYC) Policy

HitBTC does not require identity verification to start trading or make deposits. However, passing KYC provides additional benefits like lower fees, higher limits, and enhanced services. According to HitBTC, their streamlined verification process only takes a few minutes to complete.

HitBTC Concerns: Is HitBTC Worth It?

Several criticisms and concerns have been raised about HitBTC, including issues with customer service, difficulties with withdrawals, lack of transparency, account freezes, and disappearing funds.

A common issue reported is poor customer service response times to user problems. Others have struggled to withdraw their assets from the exchange in a timely manner. Some users have had accounts abruptly frozen or suspended without explanation. Most concerning are reports of funds mysteriously vanishing from accounts.

Overall, HitBTC users cite lack of support responsiveness, withdrawal delays, opaque policies on frozen accounts, and unexplained missing assets as major problems. The exchange has room to improve on communication, support, and transparency in handling these types of complaints.

So, whether or not HitBTC is worthwhile is a matter of personal judgment. Given HitBTC's impressive APIs, it may be worth experimenting with tools like Bitsgap and conducting occasional trades, particularly for coins that aren't accessible on other platforms. However, in general, it might be wiser to choose an exchange with a stronger reputation, more positive reviews, and a more comprehensive security policy.

Connecting Bitsgap to HitBTC

Here’s how you connect Bitsgap to HitBTC:

- Begin by signing into your HitBTC account or creating a new one if you don't have one already.

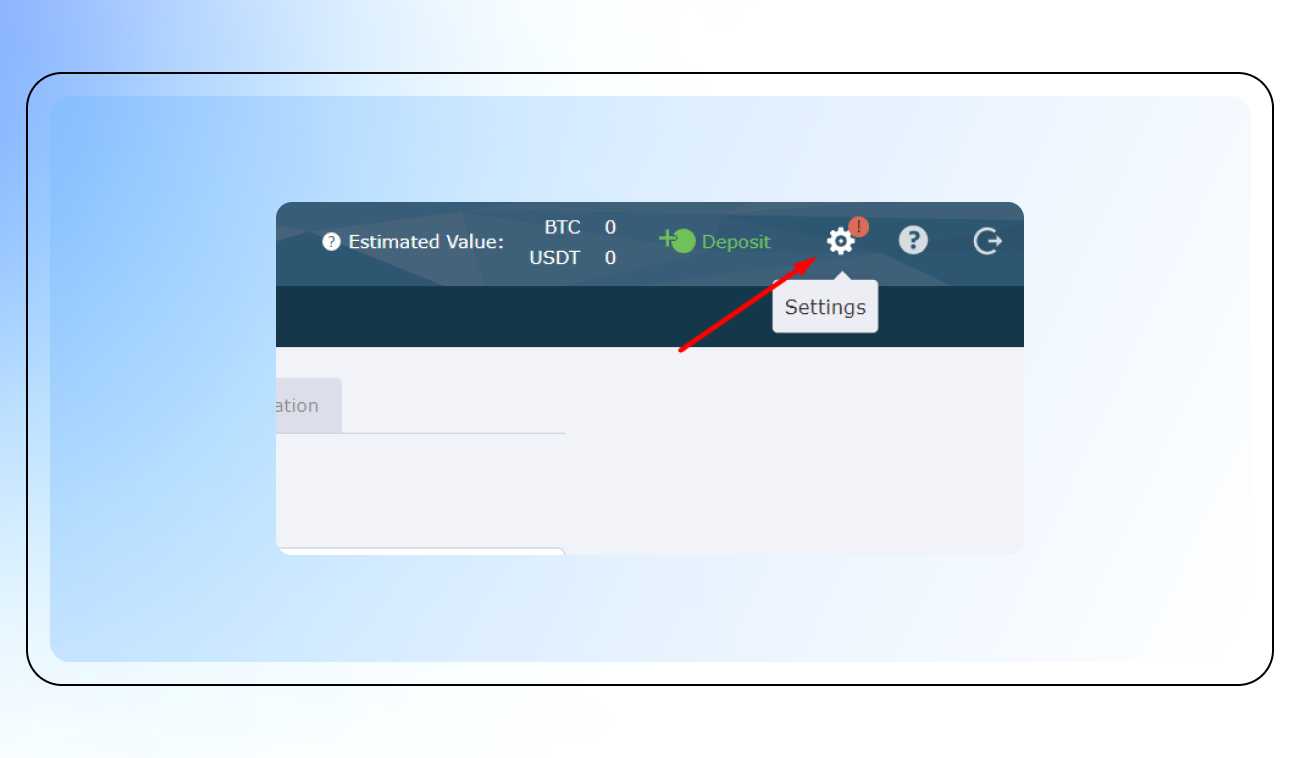

- Once you're logged in, head over to your account settings (found in the top-right corner) and click on the [Settings] icon.

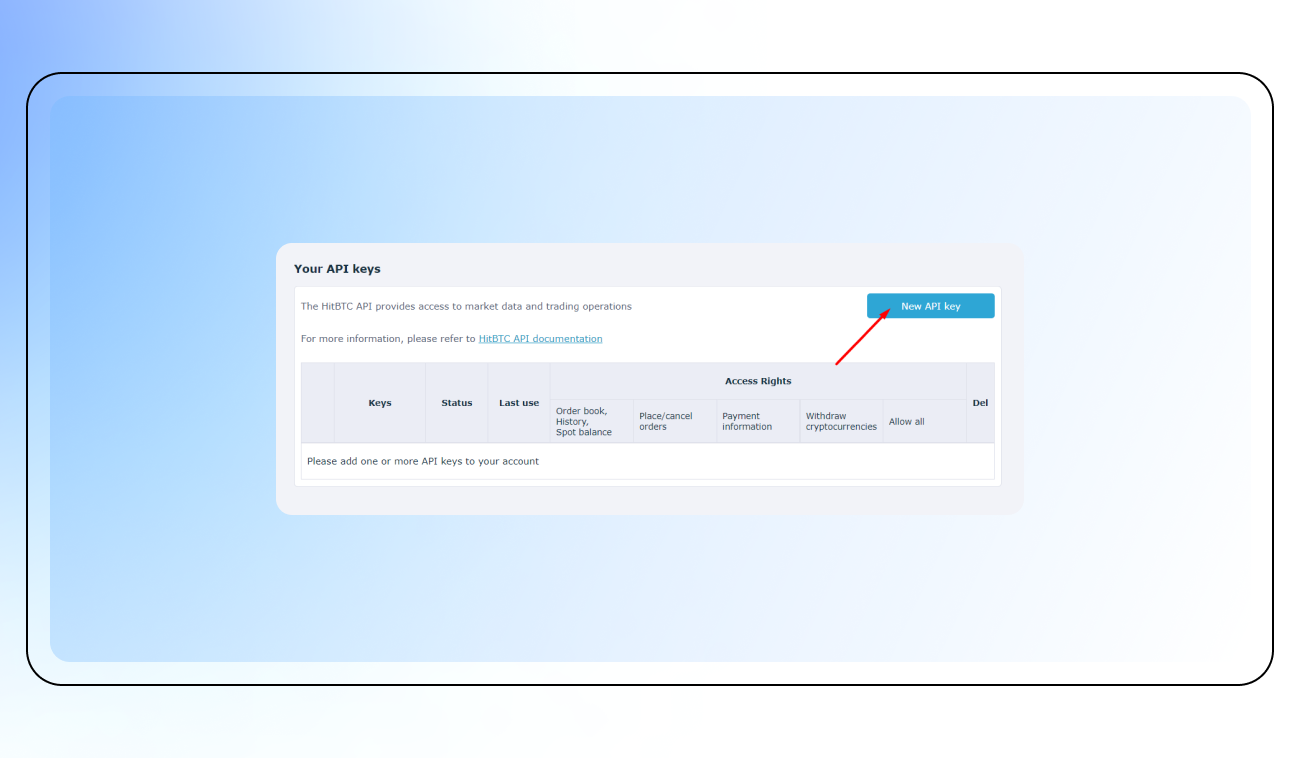

- Look for the [API keys] tab in the top menu and select it.

- Click on the [New API key] button to create a new API key.

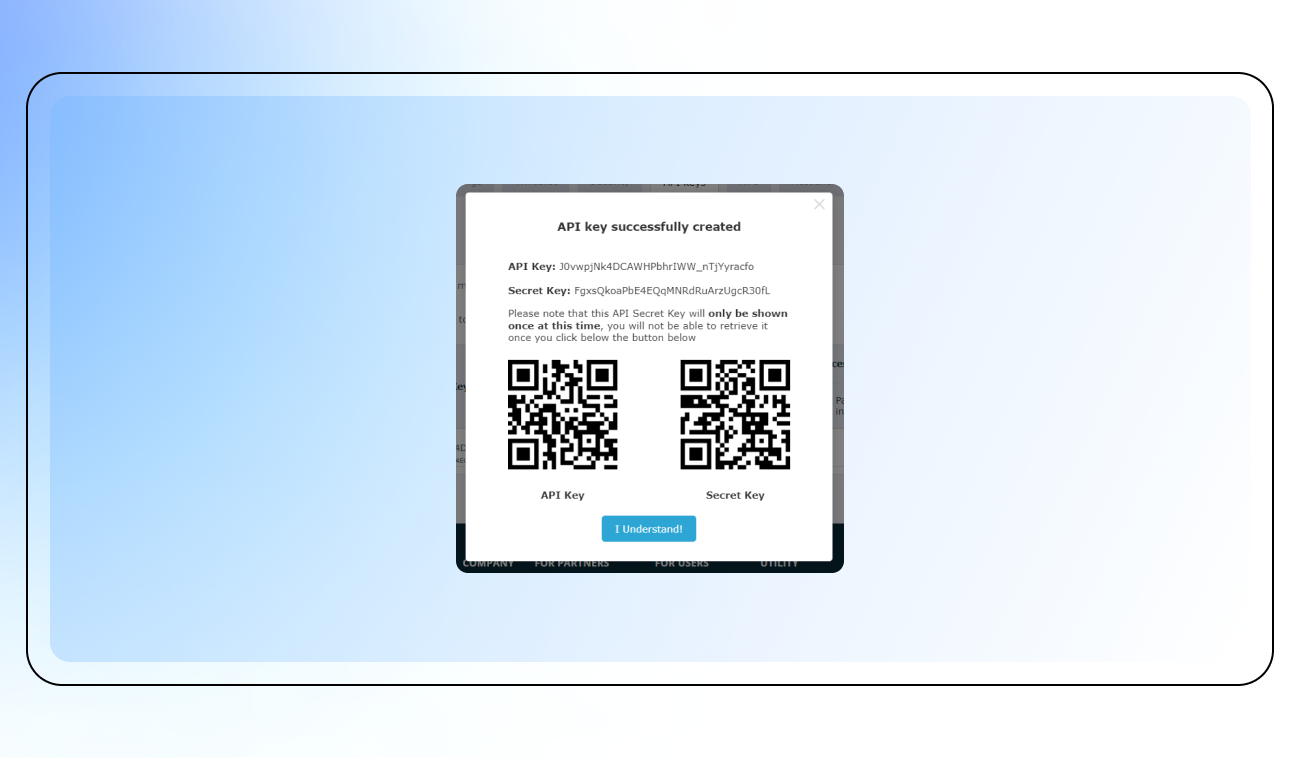

- Congrats! You've successfully created your HitBTC trading key. Now, ensure you safely store your API key and Secret key before adding them to Bitsgap.

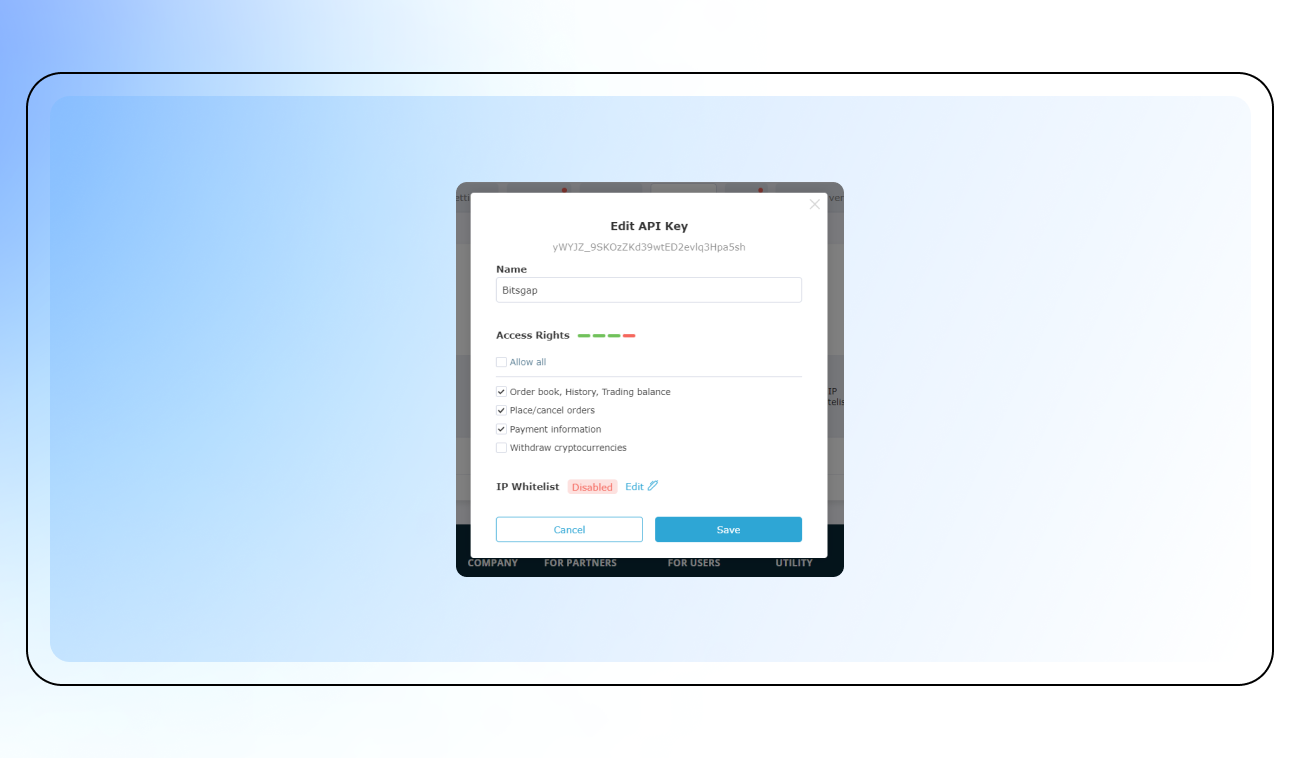

- You need to modify the restrictions on your API key so that the Bitsgap platform can manage your trading activity on your HitBTC account. Please set the permissions as outlined below:

- After setting these, click [Save].

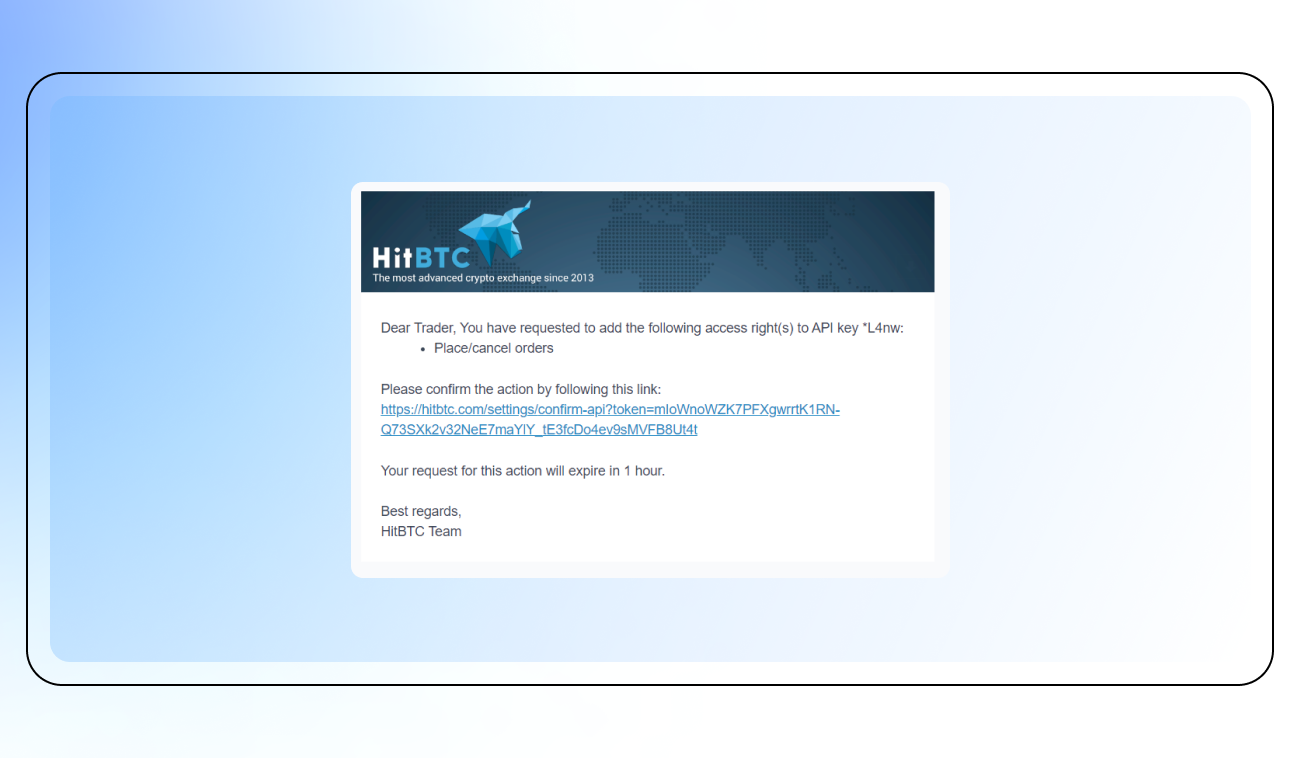

- Next, you'll need to enter the 2FA code from your Authenticator app to continue with API creation. Once you've entered the code, hit [Confirm].

- Check your email for a message from HitBTC. Open it and follow the confirmation link to allow the Place/cancel orders permission for your key.

- Log into your Bitsgap account and head to the [My Exchanges] page. Click on [Add new exchange].

- A pop-up will appear where you need to select HitBTC. This will open a window where you can add your API key and Secret key. After entering these details, click [Connect].

- If all the steps have been followed correctly, you'll see HitBTC appear in your list of connected exchanges, showing a Connected status and the trading balance available on your account.

Bottom Line

While its API capabilities and unique coin offerings hold advantages for programmatic traders, HitBTC's opaque policies, mixed reviews, and lack of transparency outweigh the benefits for most. Traders are better off opting for an exchange with a more trustworthy track record and robust protections.

Occasional API-driven trades on HitBTC to access rare coins could make sense. But it's wise to choose alternative platforms as your primary exchange rather than rely heavily on HitBTC given its shortcomings.

FAQs

How to Use HitBTC API for Trading Bots?

Harnessing the HitBTC API for trading bots encompasses several steps, including the creation of an API key and its subsequent integration with your bot. Initially, you'll need to create an API key on HitBTC, adjust the permissions of the API Key, and then fuse the API Key with your trading bot. Once the API key is successfully integrated, your bot should be capable of interacting with your HitBTC account. It's crucial to remember that your API key and Secret key must remain confidential. Furthermore, verify that the trading bot platform you're using is trustworthy and secure. It's always a good practice to test your trading strategies with minimal amounts before dedicating significant funds.