Seven Questions You Need To Ask Yourself Before Investing In Bitcoin

Unsure about bitcoin, or feeling lost in the sea of crypto-talk? We're here to answer your most pressing questions, demystifying bitcoin's potential bans, risks, rewards, and ultimately helping you decide if it's the right move for you.

Struggling to navigate the bitcoin landscape? From assessing whether Bitcoin is right for you, to debunking myths about potential government bans, we'll dive deep into the world of Bitcoin, unraveling its risks and rewards.

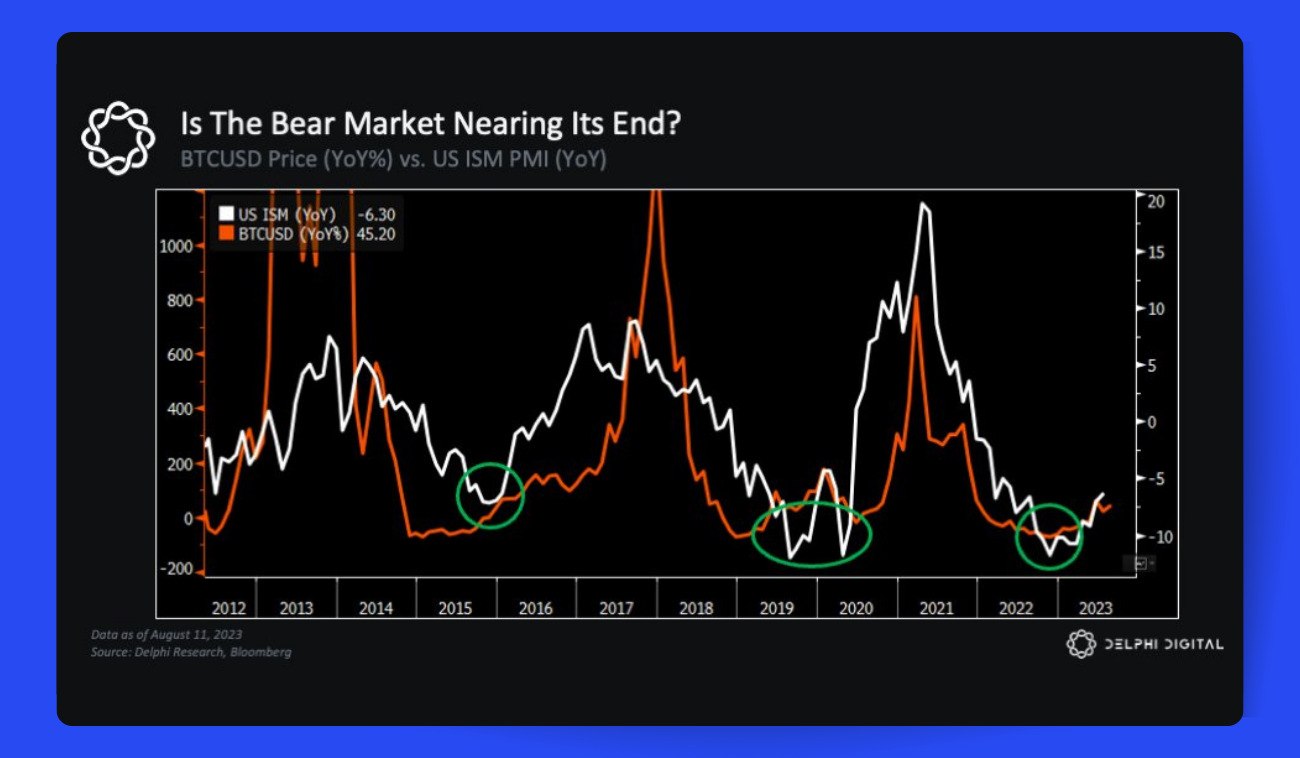

Exciting signs are emerging that could mark the start of a new crypto bull run, according to experts. Several on-chain metrics and charts are exhibiting patterns that have reliably preceded massive crypto market rallies. These cycles tend to follow four-year periods with predictable boom and bust phases.

For example, bitcoin has historically seen an 80% drawdown in the first year, followed by a recovery over two years, culminating in a new all-time high price in the fourth year. Experts note that bitcoin price peaks have typically aligned with peaks in a key U.S. manufacturing index (Pic. 1).

While crypto markets have been relatively flat recently, the fundamentals suggest huge potential gains ahead. Factors like ETF approvals, the end of rate hikes, and a major Ethereum upgrade could ignite the markets.

If you've yet to dip your toes into the bitcoin pool, this encouraging news might just nudge you towards taking the plunge. But perhaps you're hesitating, wary of potential bubble bursts, regulatory hurdles, or some other unknowns. Maybe you already own a small slice of bitcoin, but the thought of increasing your stake brings similar apprehensions. If you fall into either of these camps, this article is for you. We tackle the most frequently asked questions about bitcoin, offering concise yet comprehensive responses that aim to help you navigate the decision-making process.

Is Bitcoin a Bubble?

On the question of whether bitcoin is a bubble, the opinions are all over the map. Warren Buffett, famous investor and folksy sage, declared bitcoin worse than rat poison, saying he wouldn’t buy all the bitcoin in the world for $25. Why? Because, unlike businesses selling tangible products or services, bitcoin doesn't generate income for its holders. While he admits that some things, like paintings, can be valuable without traditionally producing value, he insists bitcoin doesn't get to join that club. But Buffet’s old school, right? So no surprise he’s a hater.

On the other end, Jack Dorsey, funky Twitter founder and crypto bro, said nothing was more important than working on bitcoin. As opposed to something else or even other coins, which Dorsey says "don't factor in at all."

So who's right? Is bitcoin a bubble waiting to pop or a gold nugget waiting to be polished? Well, it's as clear as mud. Valuing bitcoin is like trying to nail jelly to a tree — it has a short history and is unlike anything we've seen in the financial world.

While bitcoin’s slowly waking from hibernation, regulators are squinting at crypto more closely, perhaps hinting at its creeping integration into mainstream finance. Meanwhile, the corporate big wigs seem excited, with Mastercard and Visa trying to get in on the action. If stodgy financial companies are chasing bitcoin, it can't be that bubbly...can it?

In the end, your guess is as good as ours! Maybe buy bitcoin without betting the farm. Stick to an amount you can lose without having to swap retirement for a career in fast food. On the other hand, investing a pittance like $50 when bitcoin’s at $20k isn't going to land you on the moon. So, the key is to invest an amount that would make you grin like a Cheshire cat if bitcoin hits $100k overnight. And then, should you sell? Well, that's the million-dollar question, isn't it?

Why Does Bitcoin Have Value?

Bitcoin doesn't cozy up with government authorities or rely on a network of intermediary banks to spread its use. The weight of approving transactions in the Bitcoin network falls on the shoulders of independent nodes in a decentralized network. There's no fiat authority like a government or monetary authority acting as a safety net for risk, and no one to pick up the pieces if a transaction goes belly up.

Cryptocurrency does bear some resemblance to fiat currency though. It's scarce and can't be faked. The only way to create a phony bitcoin would be to pull off a double-spend — that's when a user "spends" or transfers the same bitcoin in two or more separate settings, duplicating the record. But a double-spend is about as likely as finding a unicorn in your backyard.

Anyway, the value of bitcoin is mostly tied to its scarcity. As the supply shrinks, demand for cryptocurrency soars. Investors are fighting tooth and nail for a piece of the profit pie that keeps growing from trading in its limited supply.

Like gold, bitcoin has limited utility. Its underlying technology, blockchain, has been tested as a payment system. It's been particularly effective in making remittances across borders faster and cheaper. Some countries, like El Salvador, are betting on Bitcoin's technology to become a medium for everyday transactions.

Some theorists contend bitcoin has intrinsic value because of the cost of producing one bitcoin. Mining bitcoins isn't a walk in the park — it involves a lot of electricity, which adds significant costs for miners. Economic theory suggests that in a competitive market, the selling price of a product will gravitate towards its marginal cost of production. And it seems that the price of bitcoin tends to follow this trend.

Some monetarists try to value bitcoin like money, using the supply of money, its velocity, and the value of goods produced in an economy. The simplest way to do this would be to look at the current worldwide value of all mediums of exchange and of all stores of value comparable to bitcoin and then calculate the value of bitcoin’s projected percentage. The predominant medium of exchange is government-backed money. In June 2023, the U.S. money supply M1 was worth more than $18 trillion. If we assume this total stays stable, if bitcoin were to achieve 15% of this valuation, its market capitalization in today's money would be about $2.7 trillion. With all 21 million bitcoins in circulation, that would put the price of 1 bitcoin at roughly $128,571.

One of the biggest bones of contention is bitcoin’s role as a store of value. Bitcoin's utility as a store of value is directly linked to how well it works as a medium of exchange. If bitcoin doesn't make it as a medium of exchange, it won't make the cut as a store of value.

Throughout much of its history, bitcoin’s value has been driven by speculative interest. Bitcoin has shown signs of a bubble with drastic price run-ups and a media frenzy. This is likely to wane as bitcoin sees more mainstream adoption, but the future is unclear.

Problems with cryptocurrency storage and exchange also challenge bitcoin’s utility and transferability.

So, as you can fathom, determining bitcoin’s value is not easy. However, it undeniably carries value, which is expected to escalate as its adoption continues to surge.

Am I investing in a Non-Scalable Cryptocurrency?

Did you know that Bitcoin, our dear digital gold, can only muster a measly 4-7 transactions per second? Now compare that to the payment titan VISA, breezing through tens of thousands of transactions per second like it's a walk in the park. It's enough to make a new investor reconsider bitcoin, right?

But let's not be hasty. Here enters the notorious blockchain trilemma, the ultimate party pooper, stating you can't have your cake and eat it too. In other words, a blockchain network can't be maximally decentralized, perfectly secure, and massively scalable all at once. And this headache isn't solely reserved for blockchain — it's a universal problem for all payment protocols.

Take VISA for example. Yes, it processes a mountain of transactions, but only with 'moderate' security. Bitcoin, on the other hand, valiantly prioritizes decentralization and security, even if it means taking a hit in the speed department.

And let's not forget our beloved traditional banking system, as free from scalability issues as a fish is from climbing trees. Ever sat twiddling your thumbs waiting for an international wire transfer to clear? Banks 'solve' this by cozying up with settlement layers like Paypal, electronic transfers, checks, and the like.

Enter stage right, the Lightning Network: Bitcoin's white knight against its scalability dragon. Instead of painstakingly recording every tiny transaction on the blockchain, the Lightning Network says, 'Hey, let's do countless quick transactions off-chain, and only jot down the final state on the Bitcoin blockchain.' Brilliant, right? It certainly lightens the load on the Bitcoin network, paving the way for more frequent transactions.

And if you're still skeptical, let's just mention that Lightning Labs, the brains behind Bitcoin's Lightning infrastructure, made it to the World Economic Forum's list of top 100 technology pioneers in 2020. Now that's a feather in bitcoin's cap!

Is Bitcoin Too Volatile?

Satoshi Nakamoto, the elusive architect of Bitcoin, aimed for his digital brainchild to be a medium of exchange. Fancy words for something you can use to buy a cup of coffee. Yet, today, bitcoin is paraded around as a 'store of value.' Quite a leap, isn't it? But with its rollercoaster-like volatility, it feels more like trying to fit a square peg into a round hole of time-honored asset classes.

Let's be real. You wouldn't typically stash your emergency fund or your down payment for that dream house in bitcoin. Unless you have a stomach of steel, when a steady return in the near future is what you're after, bitcoin is hardly the first name on the roster.

Nevertheless, bitcoin is often hailed as an 'emerging store of value.' With under 15 candles on its birthday cake, the digital currency still has room to grow. For bitcoin to truly become a reliable store of value, it needs to calm down a bit. This tranquil state usually involves an exciting mix of uphill climbs and inevitable downhill tumbles. If bitcoin ever manages to hit the $2.5 trillion market cap jackpot, with a more diverse crowd of holders, its wild price swings may finally take a chill pill.

Will Governments Ban Bitcoin?

Oh, governments and their love-hate relationship with bitcoin. Some of them have already “banned” it, but let's take a moment to remember that gold, of all the things, was also a no-no in the U.S. from 1933 to 1975. Yes, the shiny stuff that's been a symbol of wealth since forever.

Now, bitcoin is doing its own version of the moonwalk straight into the mainstream. And as it waltzes in, the idea of banning it is starting to look as likely as banning the internet.

Here's why bitcoin is not just knocking but kicking the door down to mainstream acceptance:

- Bitcoin's lording over a cool $555 billion in market capitalization like it's no big deal.

- The IRS, in a move that probably made some bureaucrats' heads spin, labeled crypto as a 'commodity' for tax purposes.

- MicroStrategy (MSTR, not MTSR — easy mistake) and Square (SQ) are strutting around with huge bitcoin portfolios. They're not alone though. A whole bunch of public and private companies, along with investment funds, are also riding the bitcoin wave.

- Big-name investors like Cathie Woods, Paul Tudor Jones, and Stanley Druckenmiller aren't just dipping their toes in the bitcoin pool, they've done the cannonball.

- Fidelity and a bunch of other big-name companies are running institutional-grade custodian services for bitcoin, making sure your digital gold is safe and sound.

- PayPal, not wanting to miss out on the party, announced it would let U.S. customers buy, sell, and hold bitcoin and other major crypto units on its platform in 2021.

- Even federally regulated banks in the U.S. have been given the green light to provide cryptocurrency custody services by the Office of the Comptroller of the Currency (OCC).

So, considering all this, banning bitcoin in major capital markets like the U.S., Europe, or Japan would be about as easy as reversing a river. The level of bitcoin adoption among legal frameworks, institutions, and companies is too deeply entrenched. But hey, stranger things have happened, right?

I am Anon with Bitcoin, Right?

Errm … no.

Even though bitcoin transactions appear to be a jumble of characters that look like a cat walked on your keyboard, they are trackable and identifiable. Thing is — these seemingly nonsensical strings are your public addresses, and they're on display for every transaction you make.

You see, if you're careless enough to post your address anywhere public, it can be tied back to your real-world persona. Even if you're not that reckless, simply reusing the same address could end up leaving a trail of breadcrumbs a half-decent analyst can follow straight back to you.

They'll just look at transaction times, amounts, and regularity and tie it to other data like receipts, exchange records, or shipped items.

For the sake of privacy and security, it's common practice to use a new address for each transaction. Most modern wallet software does just that. But don't be fooled, even this doesn't make you a digital ghost.

Thanks to some nifty blockchain explorers and analytical tools, single transaction addresses have been linked to their owners. This has proven handy for investigating thefts (looking at you, Mt. Gox and Bitcoinica), but could potentially unmask anyone.

So, let's be honest, calling bitcoin "anonymous" is like calling a zebra a horse. It's more accurate to say bitcoin is "pseudonymous". Think of it like a weird email address or online handle. It may not be your name, but someone out there could potentially connect the dots to the real you.

Oh, and Where to Buy, Trade, and Store Bitcoin?

If you've got a hankering to buy bitcoin, your first step is to find an exchange or platform that trades in digital gold. Payment methods are as varied as a box of chocolates — credit card, debit card, bank transfer, or Paypal. For a more local flavor, you can use Bitcoin.com Local or Bitcoin Teller Machines, the digital cousins of cash ATMs scattered across the globe.

Bitcoin.com provides a handy list of current online exchanges and brokers who deal in bitcoins. Now, selling your bitcoins is a whole other ball game, but it's pretty similar to buying. You can hawk your bitcoin online, in person, or with Local Bitcoin if you want to channel your inner James Bond.

Making bitcoin payments is a breeze with a wallet app and addresses. You can make transactions from your desktop or smartphone, whether it's with an individual, a merchant, or an exchange. Addresses can be used in number form, as a QR code, or contactless technology. Plus, transacting with bitcoin offers lower fees than any known remittance provider or credit card service. No bank, state, or third party can beat that!

Once you've got your hands on some bitcoins, you're free to trade them on the same exchanges where you bought them. And if you want to level up, you can link your exchange accounts to Bitsgap. The platform lets you trade on all your linked exchanges from one interface. It also offers extra tools like smart orders, hedging/trailing features, and automated crypto trading bots that can long, short bitcoin in the spot and futures market. These bots are relentless, weathering whatever storm the market throws at them and steadily growing your holdings.

But remember, storing your bitcoins is as important as storing your grandma's secret cookie recipe. Lose your keys, and you're saying goodbye to your bitcoins. If you're keen to learn more about storing crypto, check out our dedicated wallet blog posts here and here.

The Bottom Line

Here's a novel idea: treat bitcoin like — wait for it — any other investment! Shocking, right? Dive into that analysis of risks, rewards, the rollercoaster ride of bullish and bearish cycles, and don't forget to measure your risk tolerance. You know, just in case bitcoin decides to take another moonshot or nosedive. Make sure your financial goals are in the mix too. We wouldn't want bitcoin to rain on your retirement parade, would we?

Now, if you want to avoid getting seasick from bitcoin’s wild volatility, here's a tip: manage your position. It's like taming a wild horse; you don't need to jump on and off it every second. In fact, it's probably better if you don't. So, instead of trading bitcoin like it's a hot potato, hold your horses, take a step back, and just let it ride.

FAQs

Is Bitcoin Right for Me?

Truth be told, crypto investment isn't a game for the faint-hearted. You need to be in a solid financial spot, with a healthy appetite for risk. If the idea of potentially losing your investment doesn’t make you break into a cold sweat, you might just be bitcoin material.

Deciding to invest? Don't put all your eggs in the bitcoin basket. You'll want to keep a diversified portfolio to spread the risk around. A good rule of thumb? Keep your risky ventures, like bitcoin, to a lively but sensible 10% of your portfolio.

What Are the Things to Know before Investing in Bitcoin?

The thrill of the crypto market's volatility may have investors chewing their nails to the quick, but it's unlikely to slow the cryptocurrency express. Yet, if you're pondering whether to jump on board, remember a few key points.

First, cryptocurrencies are as unregulated and decentralized as a rock band at a retirement home. Sure, this wild independence makes the crypto market alluring, but it's also a bit like dancing on the edge of a volcano. Because cryptocurrencies aren't leashed by any central authority, they're a ripe playground for scams and fraud.

Secondly, even the big boys of the crypto world, bitcoin and ether, have seen significant chunks of their values evaporate due to their extreme volatility. However, as bitcoin starts to rub shoulders with the mainstream, we're hoping things might settle down a smidgen.

Looking to invest? Then you'll need a trustworthy crypto exchange and wallet service, a safe haven for your precious crypto funds. With the surge in popularity of cryptocurrencies, new crypto exchanges and wallet services are popping up faster than mushrooms after rain. Choosing the right one can feel as overwhelming as trying to find a single grain of sand on a beach.

While you might not always remember where you put your car keys, you absolutely must remember and protect your private keys. The crypto experts recommend using a hardware wallet. It's like a digital Fort Knox for your funds, no internet connection required, making it less tempting for cyber attackers.

And before you part with your hard-earned cash for some shiny new cryptocurrencies, do your homework. Look into how your government is regulating digital assets. With 2024 shaping up to be the year of increased regulations, future crypto users should be as careful about crypto tax regulations as a cat is around a bathtub full of water.

What Are Bitcoin Investment Pros & Cons?

Born in 2009, bitcoin’s still wet behind the ears, and just like a teenager, it comes with its own set of myths and misunderstandings. Understanding the pros and cons of bitcoin can help you decide whether it's the right kind of gamble for your investment portfolio.

One of the major plus points of Bitcoin is its passport-free access to the world. Bitcoin is accepted by an ever-growing list of vendors, making buying goods and services in foreign lands easier and cheaper than ever. Also, bitcoin gives individuals the power to be their own bank. There's no need to lean on a banking institution, bind yourself with legal documents, or depend on a solitary entity to assert full ownership of your assets. Moreover, bitcoin’s not just outshone, but completely outclassed its runner-up, the NASDAQ 100, by a magnitude that's hard to fathom. Even those who have thrown a few spare coins at bitcoin have seen returns that would make Midas green with envy. As expected, bitcoin's meteoric ascent has paved the way for a plethora of bitcoin success stories.

Sure, bitcoin's list of pros could probably stretch from here to the moon, and back. It's chock-full of potential and promise, no doubt about it. But let's not kid ourselves, the list of cons? It's just as lengthy.

Bitcoin's volatility is high when compared to more stable assets like real estate. This is par for the course with any rapidly growing asset and, while it's been a blessing for nimble traders, it can give long-term investors a case of the jitters. Despite the spotlight thrown on bitcoin by major global media platforms, a sizeable chunk of the population remains oblivious to its existence or its transformative power. After all, getting your head around bitcoin can be a steep climb, potentially overwhelming for novices in the investment world. Also, Bitcoin's proof-of-work consensus model relies on energy consumption to ensure network security, and while the trend is shifting towards more miners adopting renewable energy, this environmental consciousness wasn't a major concern during Bitcoin's infancy. Finally, bitcoin’s transactions per second leave much to be desired, which means other blockchains (like, say, Solana or Avalanche) may prove superior for differing use cases.