The Gemini Review: Features, Fees & More

This in-depth review will uncover Gemini's powerful trading features, advanced security measures, nonpareil user experience, regulatory compliance, and more. Let’s dig in!

Whether you're a seasoned crypto trader or just starting out, this review provides a holistic look at Gemini's offerings.

The Gemini exchange is a privately-owned cryptocurrency powerhouse that operates in the United States, providing both individuals and corporate entities a legal, reliable, and dynamic platform to store, trade, and exchange digital assets. Gemini goes above and beyond, delivering straightforward, balanced, and secure solutions for all your crypto needs. You can confidently buy, sell, and store your crypto assets on a platform that's not just safe but also licensed and compliant.

Gemini has made its mark as a beacon of security in the cryptocurrency exchange landscape. Regular examinations and rigorous cybersecurity audits by the New York State Department of Financial Services (NYSDFS) allow Gemini to operate as a fully accredited New York Trust company. Did you know that Gemini is the first cryptocurrency exchange and custodian to achieve SOC 1 Type 2 and SOC 2 Type 2 accreditation? That's right!

Gemini’s commitment to traditional banking rules ensures that substantial monetary reserves underpin any assets held on the platform. This commitment has fostered a thriving relationship with a New York State-Chartered bank, entrusted to hold the funds of Gemini users.

So, are you ready to uncover all the ins and outs of Gemini? We're about to delve into a comprehensive review of everything you need to know — from trading fees to its robust security features, diverse tradable products, user-friendly interface, and the wide array of trading instruments available. Let's get started!

Gemini’s History

Gemini is the brainchild of the Winklevoss twins, Tyler and Cameron, famous for their legal face-off with Mark Zuckerberg over Facebook. The name 'Gemini' celebrates their status as twins and also nods to their asset holding company, Gemini Space Station.

Since its launch in 2014 and full operation in October 2015, Gemini has been on a roller-coaster ride of growth. It broke new ground, becoming the first licensed Ethereum exchange in the USA, and built a strategic partnership with the Chicago Board Options Exchange (CBOE), which leveraged Gemini for settling Bitcoin futures contracts.

2018 saw the birth of the Gemini Dollar, a stablecoin with its value tied to the US dollar. Plus, Gemini fortified its commitment to safety by securing digital asset insurance to safeguard all crypto assets on its platform. AON, a London-based risk consulting company, brokered this deal with a consortium of global underwriters.

Gemini joined the NFT frenzy in 2019 by acquiring Nifty Gateway, providing a vibrant marketplace for NFTs. It even bagged the title of Best Crypto Exchange in 2019 by the Market Choice Award. In 2020, Gemini and Samsung joined forces, enabling Samsung Blockchain users to transact via the Gemini mobile app (available only in the US and Canada).

Gemini also raised a whopping $400 million in November 2021, valuing the parent company, Gemini Space Station, LLC, at $7.1 billion.

👉 Today, Gemini is a global force with hundreds of employees, billions in annual transactions, and a presence in over 60 countries. It has ventured into Asia, marking its footprint in Hong Kong, Singapore, South Korea, and Japan.

But it's not all smooth sailing. Gemini has faced its share of challenges, including SEC scrutiny and lawsuits. The CFTC filed a suit against Gemini in 2022, alleging misrepresentation of its exchange and futures contracts. In 2023, the SEC charged Gemini with unregistered offer and sale of securities via its Gemini Earn crypto asset lending program, leading to its shutdown. Amidst rumors of a severed relationship with JPMorgan, Gemini reassured its community that their banking relationship remains intact.

But we’re pretty confident that the future is bound to be positive for Gemini, standing strong amidst industry turbulence. Time will surely tell.

Trading Volume

As of now, Gemini Exchange is showing some serious numbers, boasting a 24-hour trading volume of a whopping $5.21 million, earning it a market share of 0.02%, as reported by Coinranking.

Standing tall at the 28th spot among crypto exchanges, Gemini's liquidity is primarily focused on the BTC/USD, ETH/USD, SOL/USD trading pairs. These pairs have clocked in stellar volumes of $2.96 million, $1.05 million, and $135 thousand, respectively.

Available Crypto Assets

When it comes to the variety of supported coins, Gemini Exchange may seem less extensive compared to big players like Coinbase and Binance. As of the latest data from CoinGecko, the platform currently supports 75 coins and offers 100 trading pairs.

The digital asset lineup extends beyond bitcoin (BTC) and ether (ETH), featuring coins such as Zcash (ZEC), Litecoin (LTC), Uniswap (UNI), Gold Pax (PAXG), and Bitcoin Cash (BCH). You'll also find a slew of popular DeFi tokens like Loopring (LRC). Additionally, it hosts a couple of NFT tokens like The Sandbox (SAND) and infrastructure tokens like Skale (SKL) and The Graph (GRT).

Trading Platform Interface

Gemini caters to a diverse array of traders with two distinct versions of its trading platform.

The Basic Gemini exchange, with its sleek design and straightforward interface, is perfect for beginners and those traders who prefer to 'HODL'. It offers streamlined features such as setting up regular buys, price alerts, and a 24-hour portfolio value with percentage changes, all at a quick glance.

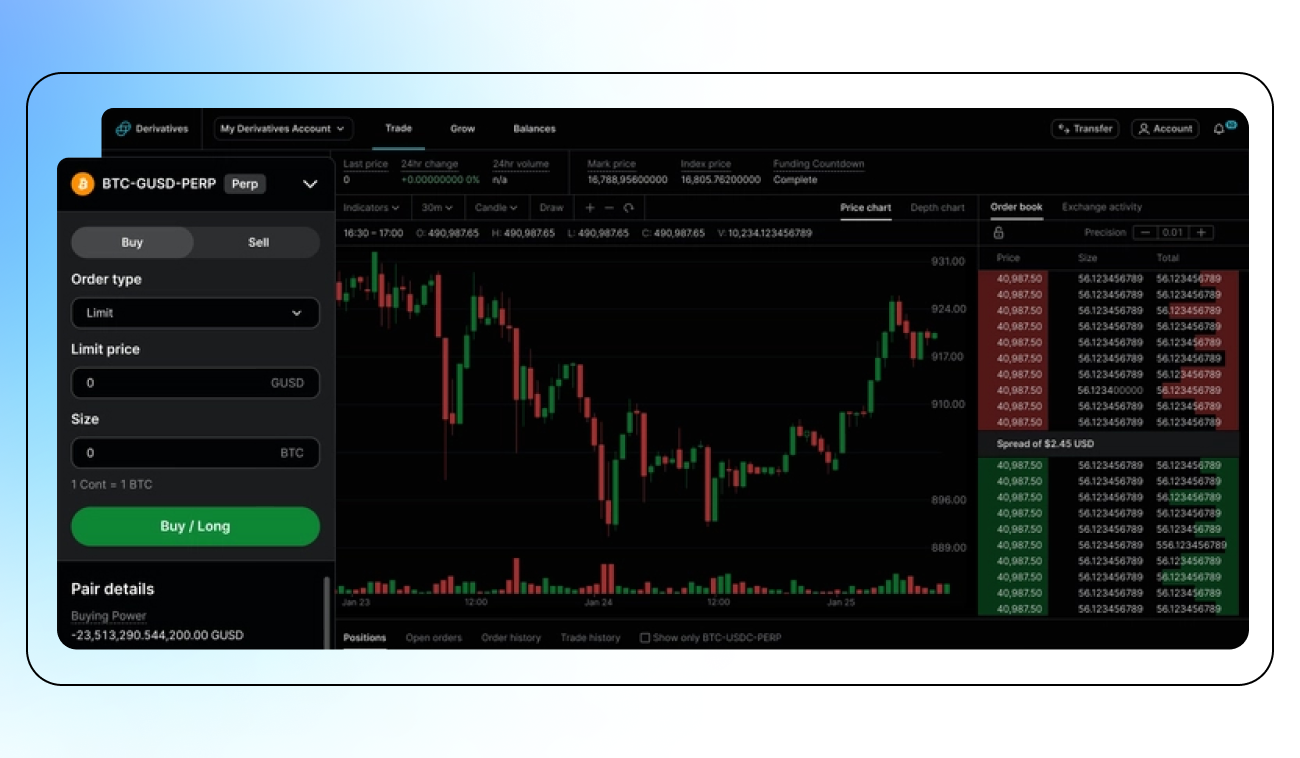

On the other hand, the ActiveTrader interface is specially designed for more seasoned crypto traders seeking a high-performance platform. It promises an exceptional trading experience with a myriad of advanced features. These include crypto derivative trading, a range of order types, and sophisticated charting tools. The platform offers central limit order books, dynamic maker-taker fees, and multiple order execution options. Traders can utilize various order types such as market/limit, alongside a plethora of limit order types like Immediate or Cancel (IOC), Fill or Kill (FOK), Maker or Cancel (MOC), and Indication of Interest (IOI), as well as stop limit orders.

Other Services Available on Gemini

Originally, the Winklevoss twins laid the foundation of Gemini as an exchange primarily for institutional traders, with a substantial focus on bitcoin. This institutional-oriented approach is perhaps why Gemini doesn't incorporate a built-in bot trader, as many institutional investors often employ custom software. However, the platform has since evolved, broadening its service offerings to cater to traders of all kinds.

- With the Gemini Card, you can spend your crypto anywhere in the world where Mastercard is accepted. You can also earn rewards in bitcoin, ethereum, or any of the 40+ other cryptos currently supported on Gemini. What's unique about this card is that your crypto rewards are deposited into your Gemini account the moment you make a transaction, not at the end of the month. Additional perks include no foreign transaction fees and no exchange fees when acquiring your crypto rewards.

- Gemini provides derivatives for non-US clients in selected jurisdictions worldwide (excluding the US, UK, or EU). These include perpetual contracts with a maximum leverage of 100x, and futures and options trading coming soon.

- Through Gemini's Staking feature (up to 6.06% APR), you can engage in the blockchain ecosystem and receive staking rewards on your crypto. Once you've set up a Gemini account, you can purchase any amount of crypto assets supported by Gemini Staking, transfer them immediately for staking, and begin earning rewards. There's no minimum crypto amount required for staking on Gemini, and no transfer or redemption fees. Gemini's fee is taken directly from your accrued staking rewards.

- Gemini Institutional, with over $2.3 billion in institutional assets, also provides big players with services such as Custody, eOTC, and Staking.

- The Gemini Wallet offers a secure space for you to tuck away your assets. You have the choice between Gemini's insured hot wallet or its institutional-grade cold storage system.

- Highly praised by users on both Apple's App Store and Google's Play Store, Gemini’s mobile apps are your pocket-sized powerhouses that faithfully replicate many of the features and functions from the Gemini desktop site. So, wherever you are, whatever you're doing, you can tap into Gemini's world of services with just a touch.

However, it's important to note that, unlike some other exchanges, Gemini does not currently offer margin trading services.

Gemini Trading Fees

Gemini offers an array of fee structures, tailored to suit the product you're using and your level of usage. And compared to other exchanges, they are on the heavier side.

Now, Gemini is kind enough not to charge transaction fees for deposits from U.S. bank accounts or wire transfers — although, your bank might sneakily do so. But! If you're using a debit card for purchases, the fee rockets to a hefty 3.49%, and who knows, other fees might just pop up.

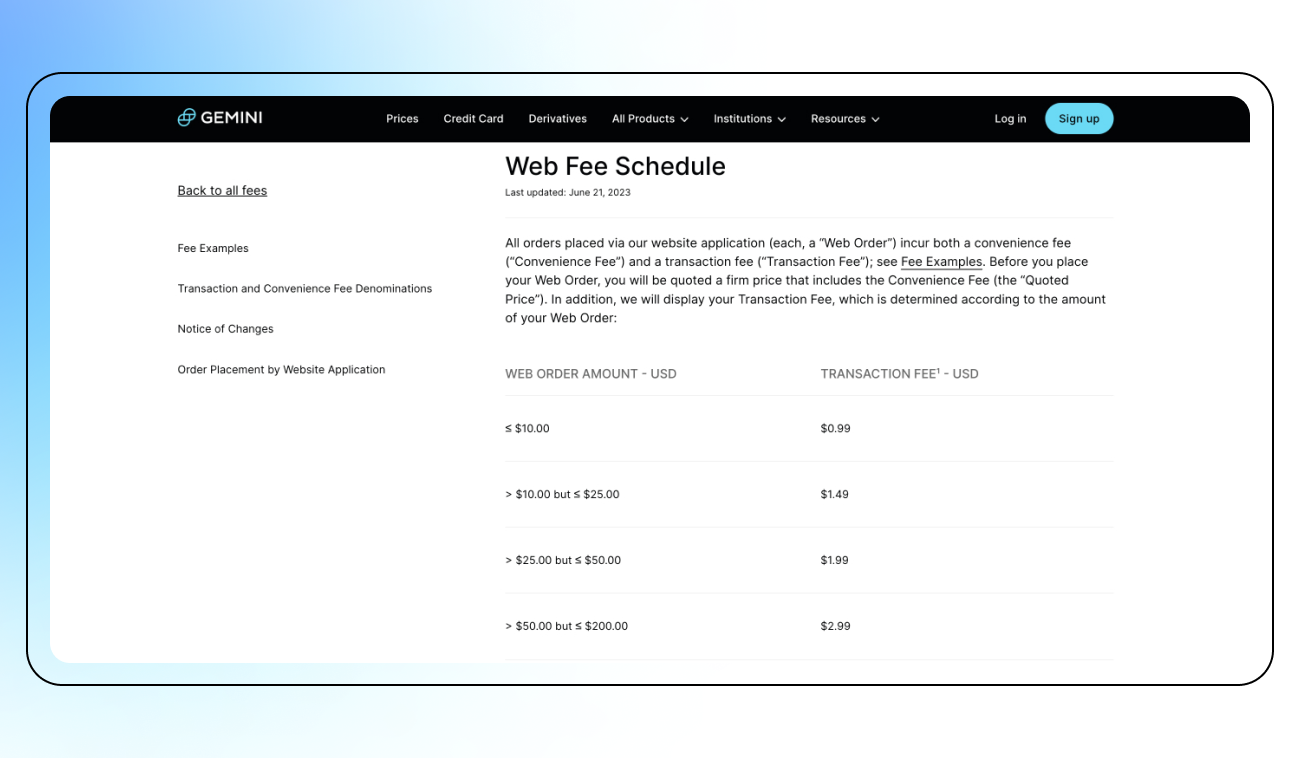

For traders using the mobile and web app, Gemini adds a flat 0.5% above the current trading price, a charge they've dubbed their "convenience fee". Gemini also levies a transaction fee, à la Coinbase style, based on the amount traded. You're looking at a tiered flat fee up to $200, and anything above that will cost you a cool 1.49%.

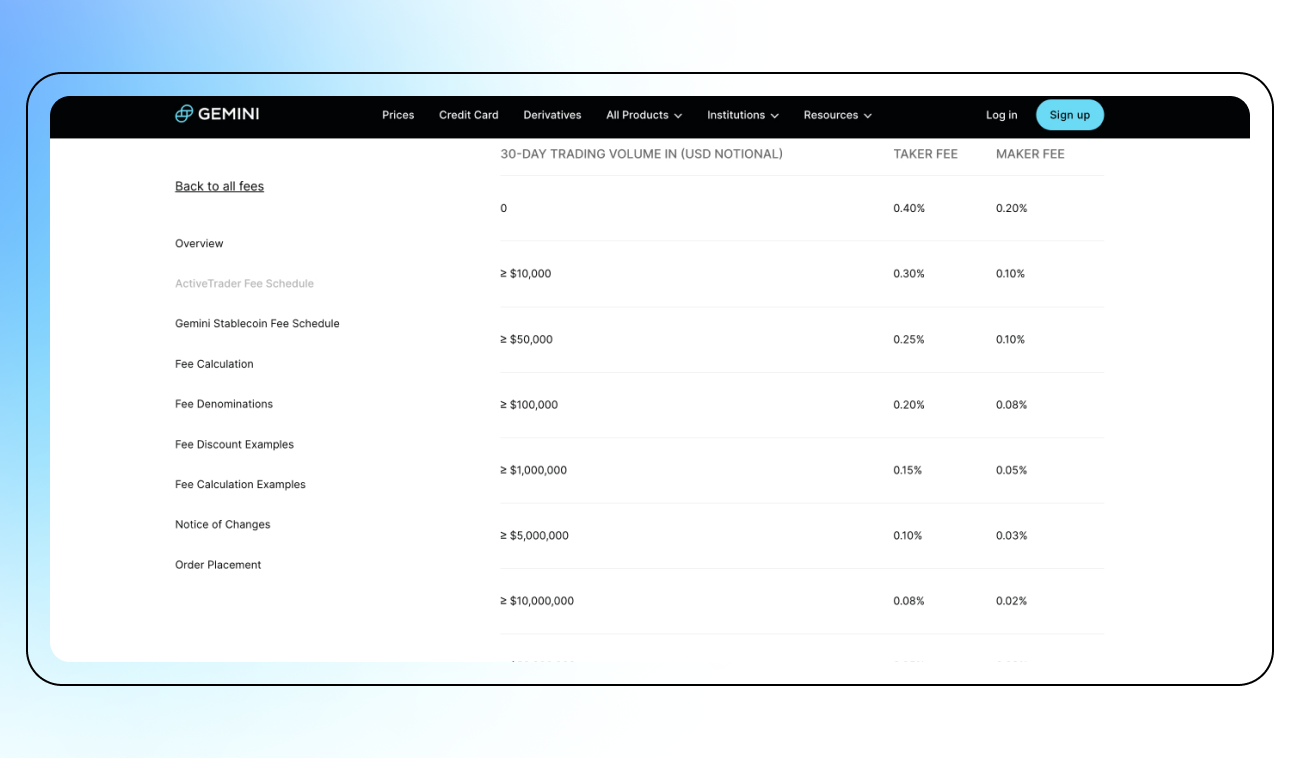

For the serious, high-volume crypto traders among you, Gemini has a whole different rate buffet based on the 30-day dollar volume of trades on its ActiveTrader platform. The rates also depend on the liquidity of the asset at the time of purchase. If it's readily available, you're slapped with a "taker" fee, but if your order is left waiting for a buyer, you get hit with a "maker" fee. They even offer an "auction" option for selling blocks of cryptocurrency at a maximum buy price or minimum sell price.

And the cherry on top? In 2022, Gemini decided to abandon ship on a feature that previously gave it an edge over competitors — free withdrawals of cryptocurrency. Depending on the cryptocurrency, the fees for withdrawal vary, but say goodbye to your 0.0001 BTC every time you withdraw bitcoin.

Gemini’s Security Features

Gemini, ever the model exchange, diligently adheres to regulatory compliance, acquiring all necessary licenses for seamless operation. Now, don't get too excited—the Federal Deposit Insurance Corporation (FDIC) insurance on the exchange doesn't cover cryptocurrencies, just fiat. But fear not! Gemini skillfully shields your digital assets with layers upon layers of security measures.

They've crafted a top-tier security program that's all about conjuring up innovative solutions to keep you and your assets safe and sound. And in the spirit of openness, they've poured a ton of resources into maintaining transparency about their security stance. This includes third-party security assessments like SOC2 Type 2, ISO 27001, and annual penetration testing.

Most of the cryptocurrencies are tucked away offline in cold storage, scattered safely across the globe. Meanwhile, a small portion is kept on hand to ensure liquidity on the exchange at all times. New accounts can't escape two-factor authentication, and multi-signature schemes are woven in to avoid single points of failure.

Gemini’s Know Your Customer Policy (KYC)

Gemini insists on a verification procedure as an integral part of setting up and using a personal account, as it doesn't entertain anonymous trading. This holds true even when using third-party trading bots for Gemini. While platforms like Bitsgap don't ask for ID verification, Gemini's Know Your Customer (KYC) policy does.

As part of the registration process, Gemini needs to gather a few details: your full legal name, date of birth, address, phone number, social security number, and email. To be fully verified and to be able to withdraw from the exchange, you also need to provide additional documentation. Here's the rundown:

- If you're a U.S. resident, you need a valid passport or driver's license.

- If you're an international resident, Gemini requests at least two government-issued documents depending on your country of residence. These could be a valid passport, a driver’s license, or a national identity card.

- If you're a Canadian resident, you need to provide a valid passport, driver’s license, and social insurance number.

And to put the icing on the security cake, Gemini enforces 2-factor authentication (2FA) for all users. This is to confirm your phone number and guard against risks related to number-hijacking. So, although it might feel like a bit of a hoop-jumping exercise, it's all in the name of security and compliance.

Automated Trading on Gemini

Gemini may not have a built-in crypto trading bot as a development priority right now, but no worries! If you're looking to set up an auto trader, there are third-party solutions ready to step into the spotlight.

Enter Bitsgap, an automated trading platform that's your all-in-one hub for cryptocurrency trading. It's like trading on rocket fuel, offering the advantages of automated trading coupled with a sleek interface, the ability to place a broad array of smart orders, and manage crypto assets across 17 different exchanges.

👉 With its speed, reliability, and impressive returns, Bitsgap is the reigning champion as the best trading bot for Gemini.

Setting up a connection between Bitsgap trading bot and Gemini exchange is a breeze with API keys. This opens up a world of opportunities for customers to use Bitsgap's exclusive trading bots or even create custom bots to carry out automated trades for them.

What bots on offer, you ask? Plenty:

Wanna take this baby for a spin? Bitsgap's letting you test drive the bot for Gemini for a whole week — for FREE! Get your need-for-speed thrills!

Gemini Automated Trading Tips

Here are some tips for automated trading on Gemini:

- DYOR: Initially, you must conduct comprehensive research on all automated trading systems compatible with the Gemini exchange. Delve into numerous reviews on social channels and relevant review platforms, scrutinize security protocols, and examine the variety of bots available.

- Practice: Once you've linked your Gemini account to the third-party automation software, it's essential to get acquainted with how your chosen bot operates, ideally within a demo mode setting. Familiarize yourself with its features, decision-making process, and strategic approach. The deeper your understanding of your bot, the more effectively you can utilize it.

- Start small: If you're a newcomer to automated trading, it's advisable to commence with a modest investment. This approach provides a learning opportunity with minimum risk.

- Monitor: Despite the automated nature of your bot, it's crucial to keep a close watch on its activities. Monitor its trades and ensure it's operating as expected.

- Use risk management tools: Always mitigate risks and use key risk management features like stop loss and take profit to safeguard against substantial losses and lock in profits.

- Backtest: Most bots offer a backtesting feature using historical data, giving you insights into how your strategy might have fared in the past and enabling future strategy adjustments.

- Keep an eye on the market: Staying abreast of market trends and news allows for timely strategy tweaks.

- Stay safe: Lastly, prioritize security—keep your API keys secure, don't share them, and always use 2-factor authentication for added protection.

How to Automate Trading on Gemini: Connect Gemini to Bitsgap

Ready for a step-by-step journey to connect your Gemini account to Bitsgap? Then let’s get started!

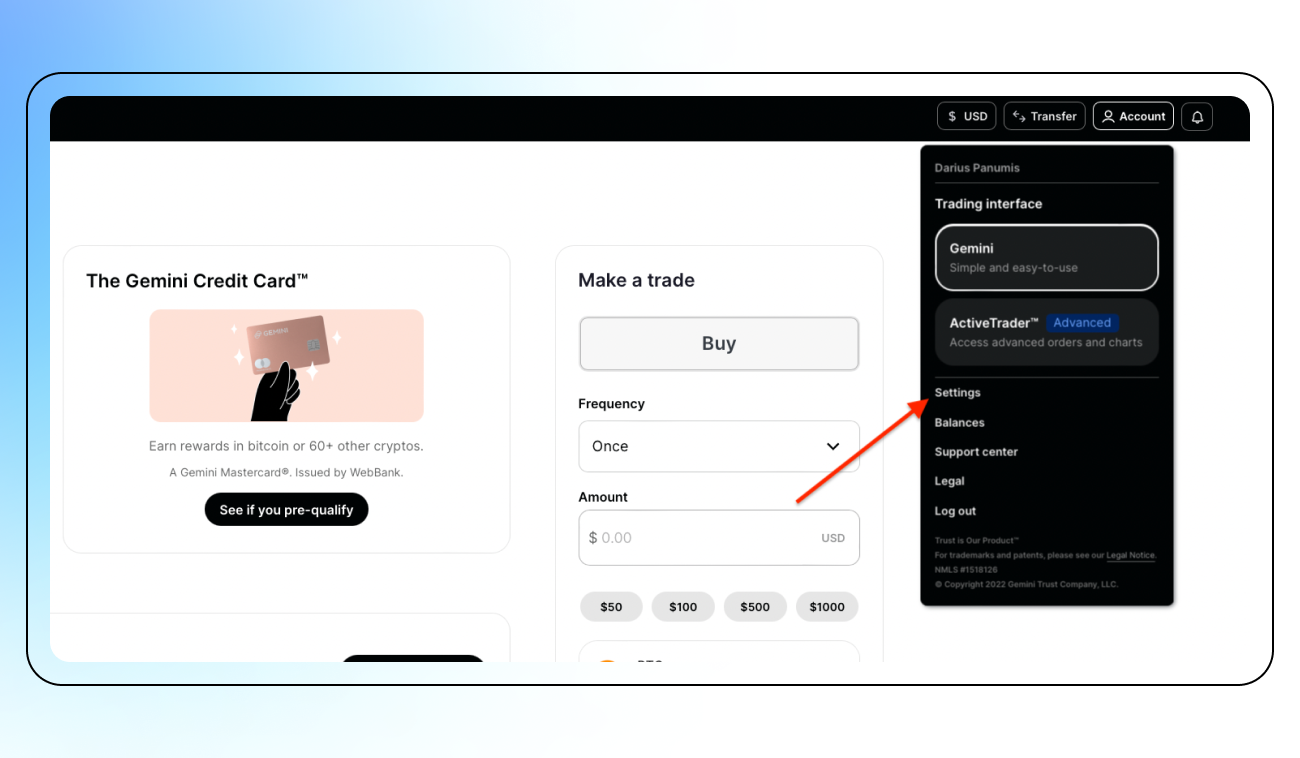

- Start by logging into your Gemini account. If you don't have one yet, go ahead and create a new one. Once you're logged in, head to the top right-hand corner of the page and click on [Account].

- Next, steer your mouse towards the [Settings] page.

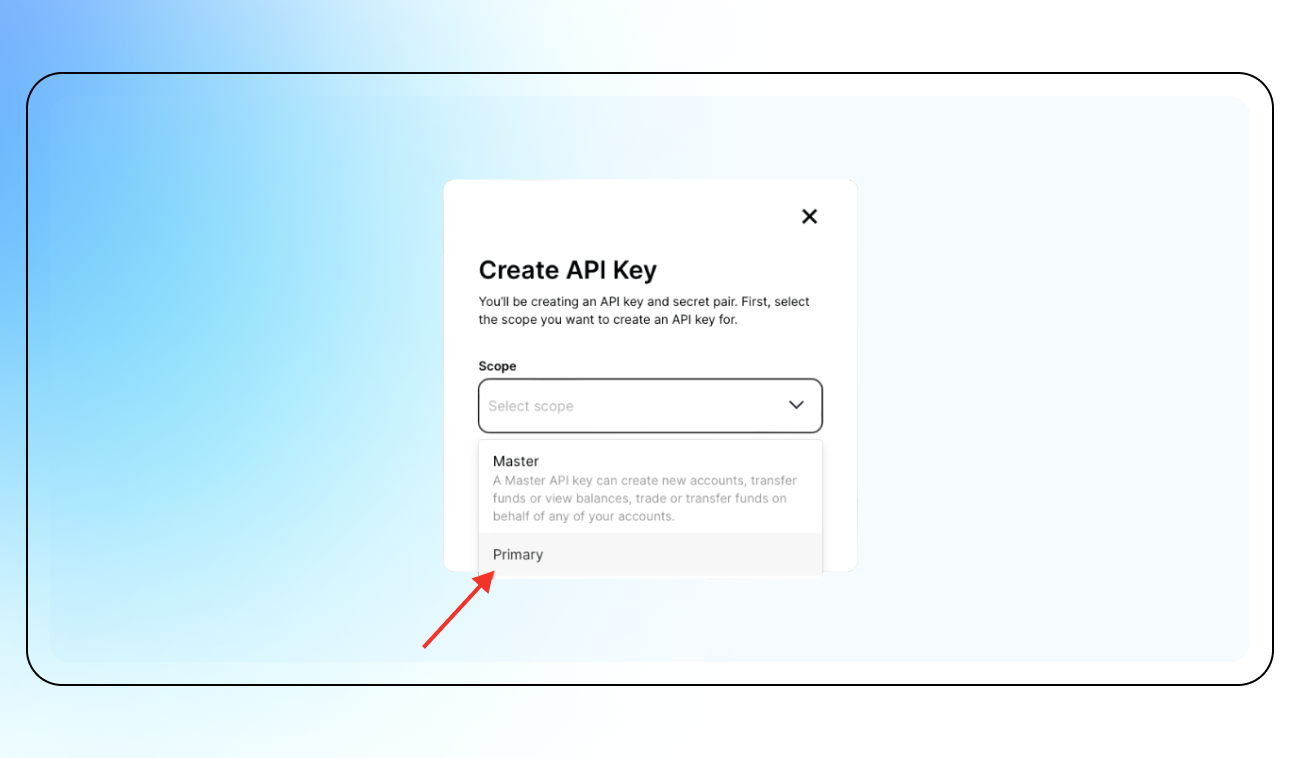

- Click on [Create API key] and you're on your way to tweaking your API info. To successfully set up your API key, select a primary account. Name your API key something memorable so you know it's linked to your Bitsgap account.

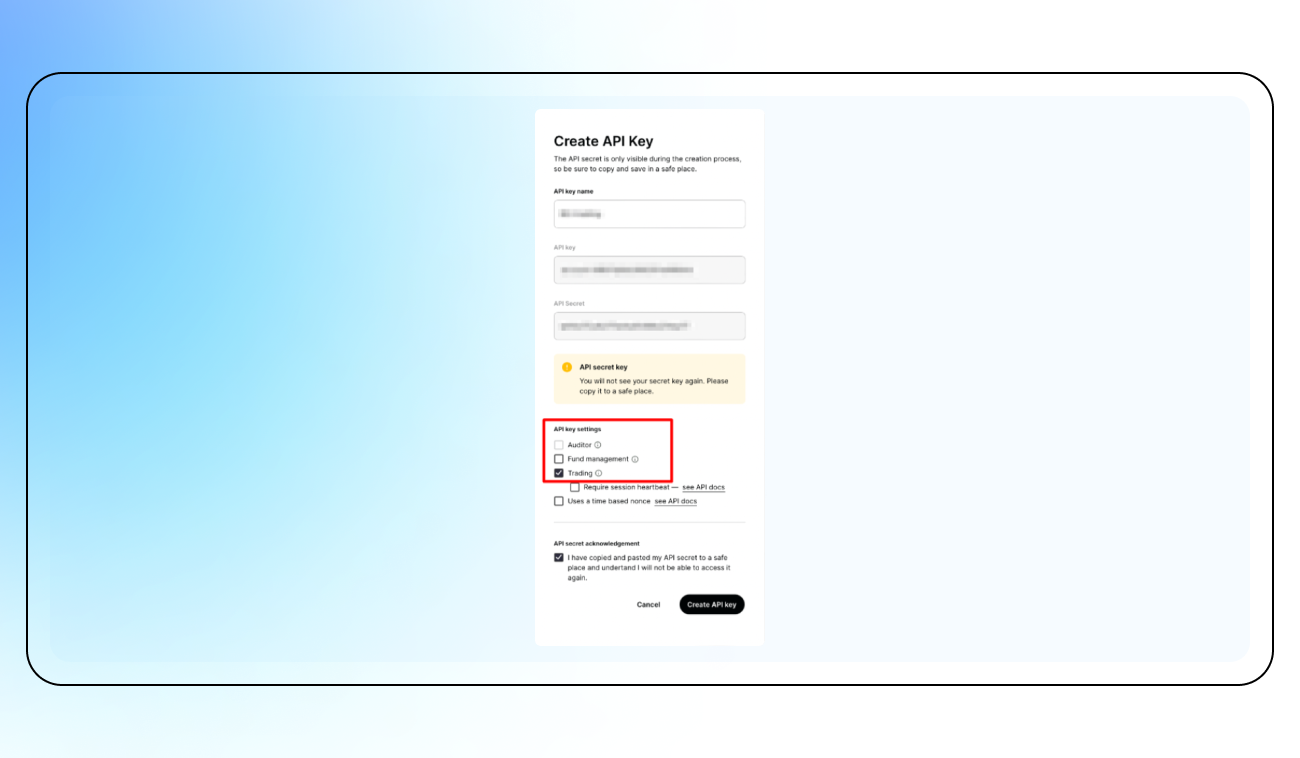

- Now, it's time to adjust your permissions as shown in the example below. These permissions will enable us to read your history, current balance, and execute trades on your exchange account.

Here's the list of permissions you'll need: - Auditor off

- Fund Management off

- Trading on

- Once you've saved both API and Secret keys, hit [Create API key].

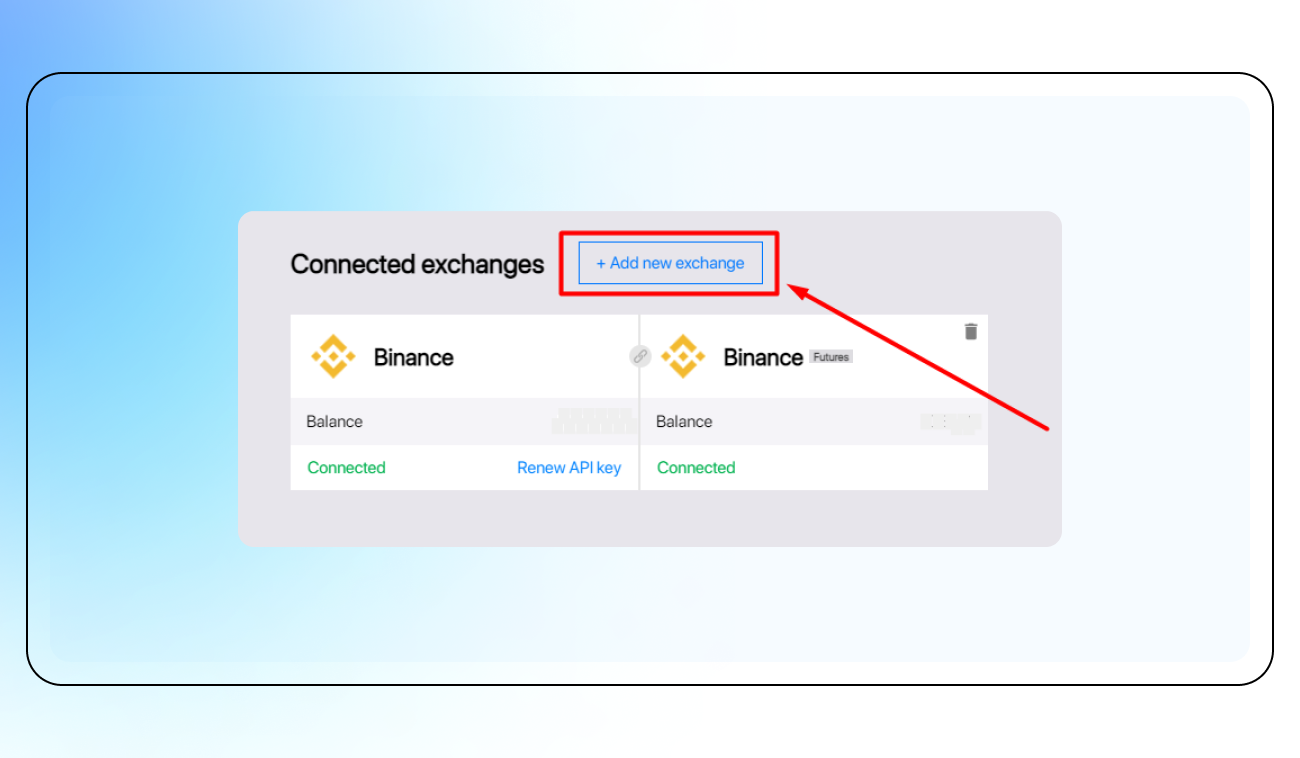

Congratulations! Your Gemini trading key is now created and ready to be hooked up to our platform! But before you do, make sure to save your API key and Secret key in a secure place. - Now, log into your Bitsgap account and go to the My Exchanges page. Here you'll find an option to connect your Gemini account. Just click on [Add Exchange].

- A pop-up window will appear, from which you need to select Gemini, input your Gemini API key and Secret key. Once you've done that, click [Connect].

Time for a Connection Check! If all steps have been followed correctly, you'll see Gemini appear in the list of your connected exchanges showing a Connected status and the trading balance available on your account.

And there you have it! You're all set to start trading on Bitsgap with your Gemini account. Happy trading!

Bottom Line

If you're on the hunt for a secure, intuitive platform for all your cryptocurrency buying, selling, and trading needs, look no further than Gemini! Gemini's interface is a joy to navigate, and its straightforward buy/sell form is a beginner's dream.

Looking for something more advanced? Not to worry, as Gemini's ActiveTrader platform is a veritable treasure trove, packed with sophisticated charting tools and a variety of order types to suit your every need.

Sure, Gemini's fee structure might seem a bit more intricate than some other top platforms, but let's not forget: transparency is key. Gemini is upfront about its fees, so you're not going to find any unexpected costs lurking in the shadows.

So, whether you're just dipping your toes into the vast ocean of crypto or you're a seasoned trader with a wealth of experience, Gemini could be your perfect match.

FAQs

How to Use Gemini API for Trading Bots?

Here's a step-by-step guide to setting up any trading bot with the Gemini API:

- Log into your Gemini account and head over to the API settings page. Look for the [Create a New API Key] button and click it! You'll be asked to select permissions for this key. After your key is created, safely store the API key and Secret key in a secure place.

- Log into your trading bot and find your way to the settings or exchange connections page. You'll come across an option to add a new exchange. Spot and select Gemini, then input your API key and Secret key.

- With your bot now connected to Gemini, the fun part begins — you can tailor the bot to your trading style! Depending on the bot you're using, you could set a variety of trading strategies, craft your own risk management rules, and tweak other settings to your liking.

- Once you've fine-tuned your bot, it's showtime! Your bot will take the stage and automatically execute trades on Gemini, following the rules and strategies you've set.

Never forget the golden rules of trading: it comes with risks. Never risk more than you're comfortable losing, and always do your homework before embarking on a trading journey. Happy trading!