When Is the Best Time to Sell Bitcoin?

Here, we'll explore crucial considerations around timing the treacherous bitcoin market and different approaches to balance your crypto portfolio. But be warned: the second you click that "Sell" button, Satoshi himself will shed a single tear.

Are you sitting on a stash of bitcoin, wondering when to cash in on your digital gold? If so, you may want to keep reading.

The thing is — there's no 'flawless moment' to offload your bitcoins or any other digital assets, because, you know, every trader is a unique snowflake with their own set of ambitions. Some might snatch a quick profit at the slightest market dip, while others are just die-hard HODLers, hanging on for dear life.

So to address your burning question — you should decide to part ways with your crypto based on your master plan and personal wealth objectives.

Pondering over the million-dollar question, "When’s the best time to sell bitcoins and what strategy to use?” Well, brace yourself for enlightenment, because this post has all those answers and more.

Things to Keep in Mind While Selling Bitcoins

Here are some nuggets of wisdom to mull over when you're considering any form of trading. But hold your applause and your thank you notes for this financial 'advice' — it's all just good old common sense, or so you'd think, right?

Be Aware of Bullish and Bearish Trends All the Time

Just like its old-school cousin, the stock market, the cryptocurrency market is a puppet show with strings pulled by all stakeholders — the big fish, the little fish, the HODL believers, and our beloved crypto regulators. The size of your bitcoin wallet or the weight of your influence determines how hard you can tug those strings. A simple tweet from Elon Musk or a new government regulation can send the market spinning, while your average Joe Trader can merely stir a ripple.

And let's not forget, there's no magic crystal ball to accurately gauge the market sentiment. Keeping up with bearish trends can feel like running a marathon uphill. And the bull market isn’t a walk in the park either.

👉 It's a tough pill to swallow seeing others rake in 30-fold returns on their crypto investments, huh? Well, no one ever said crypto trading was a piece of cake, but it's not exactly scaling Everest either.

You can bag some hefty profits if you're eagle-eyed about bullish and bearish signals. For this, you're gonna have to cozy up with crypto charts and stay on top of bitcoin news — Who's putting their chips on Bitcoin? Who tweeted what now? Which government is hopping on the blockchain bandwagon? — and so on.

Market Timing

So, as we've so discussed, there's no magical way to 'time' the market. There's no foolproof answer to the million-dollar question, 'When to sell?' A somewhat sensible strategy is to gradually let go of bits of your position to secure those sweet profits while leaving some on the table for potential price increases. They call this fancy move 'scaling out'.

Imagine this — you sell 10% of your position each time the price climbs 20% higher. Is this the unbeatable strategy, you wonder? Not exactly a slam dunk, but hey, scaling out might just give you a decent profit and fewer sleepless nights.

👉 Let's be real, there's no such thing as an optimal strategy when it comes to trading cryptocurrencies. Different strokes for different folks. So, the strategy that meshes with your personal finance goals is your optimal pick.

Now, here's a fun fact about parabolic markets — you'll probably end up with 40% less cash than you would make at the absolute peak. So, go ahead and realize your gains, especially considering the roller-coaster ride that is the crypto world.

Let's say you invested a grand in bitcoins, and with some solid management, you turned it into a cool $10k. That's a pretty heady feeling of making 10x your initial investment, right? But what if the value of your portfolio tumbles from $10k to $7k. That's a bit of a gut punch, isn't it? But hey, let's flip the script. You can cling to the doom-and-gloom story of “I lost 30% from my $10k high” or you can switch to a more cheerful narrative “I made 7x from the start and I am patting myself on the back!”. Your choice, really.

Don’t Panic and Stick to Your Plan

Ah, the allure of buying or selling crypto on a whim — it's a siren song that'll usually end up lightening your wallet. So, try not to let FOMO push you into a buying frenzy or FUD trick you into dumping all your crypto units.

Now, the brainiac way to play is to always set a stop loss order each time you dive into the market or use a TWAP order to distribute your funds over time and volume (don't worry, we'll get into the nitty-gritty of this later in the blog). This way, if the price takes a nosedive below your designated limit, your position will shut down pronto and shield you from more losses.

Feeling the FOMO creeping in? Resist the urge to go all-in. You can gradually up your risk exposure as the market slowly climbs (via TWAP or GRID trading — both available on Bitsgap, btw). As the market soars, you can start offloading units (#1 market timing strategy, folks).

Be Careful with Leverage

Leveraged trading is like trading on steroids — you boost your trading firepower by borrowing funds from a broker, using a small security deposit (your initial margin). This multiplication trick is known as 'leverage'.

So, for instance, a 20X leverage trade lets you play with 20 times the value of your starting investment. Sounds fun, right?

Those potential gains might set your heart racing. But hold your horses — when the price of your shiny new asset starts to tumble, your initial margin can evaporate faster than a snowball in the Sahara. This means that if the market turns tail and runs in the opposite direction, you could be staring at a loss 20x bigger than in a regular trade.

So tread carefully when dabbling in leverage. It's wise to have stop loss and take profit orders as your safety net to curb the potential risks in leverage.

Short Selling the Crypto

Short selling (or shorting, if you want to sound hip) — it's all about selling borrowed cryptocurrency units with the hope of buying them back at a lower price, returning them to the lender, and pocketing the difference. This is the go-to move when you're feeling bearish about a cryptocurrency.

Let's say you're not feeling too bullish about bitcoin, and you decide to borrow 1 BTC unit and sell it at the current price of $25,000. Voila, you're now 1 BTC short. Your bearish prediction proves to be spot on, and bitcoin dips to $22,000. You snap up 1 BTC at $22,000, return it to the lender, and walk away with a tidy profit of $3,000 (minus the interest, of course).

Shorting can be a lucrative game in a bearish market. But if you're trying to short sell in a bull market to cash in on short-term dips, tread carefully. You could be looking at major losses if the price decides to skyrocket instead.

Automated Trading Strategies

Then there’s automated trading, the beast you’ve probably heard of multiple times, where you can teach a bot to do the hard work for you.

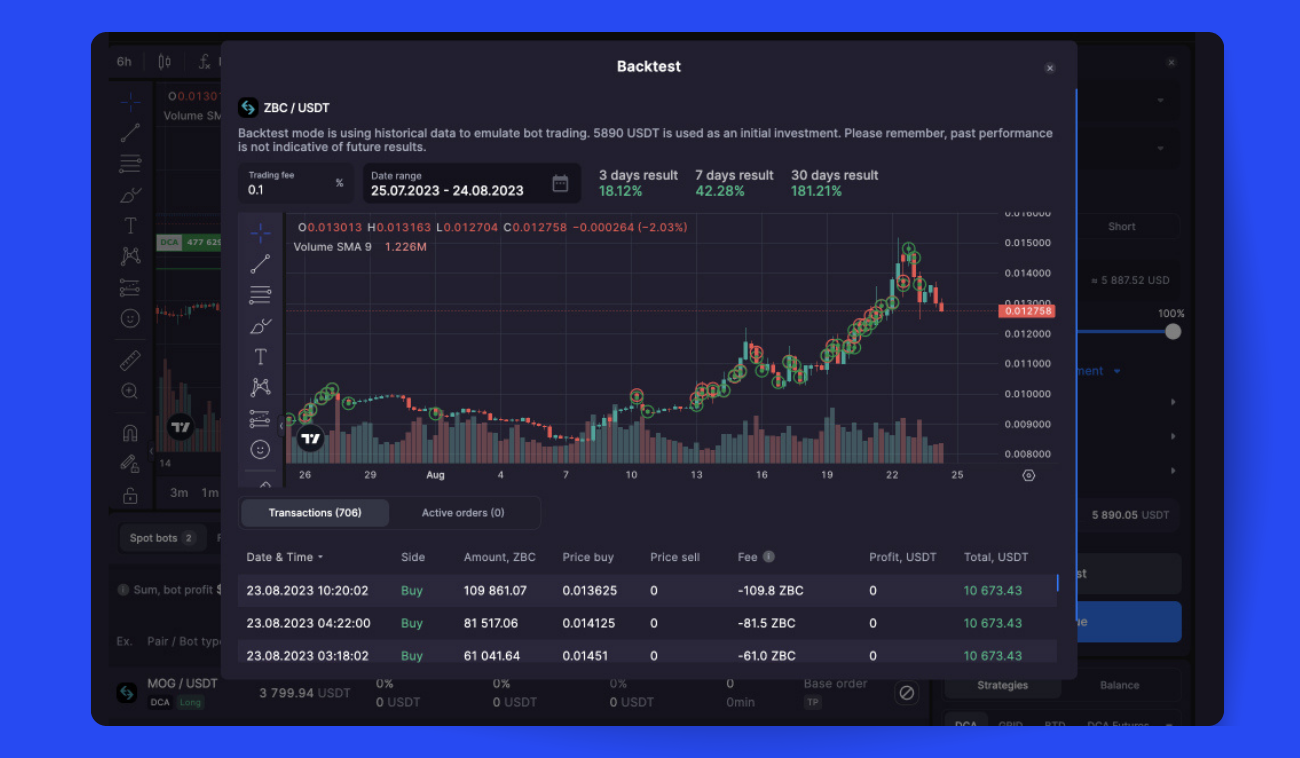

Take Bitsgap, for example. We have GRID, DCA, and BTD bots tailored for sideways, rising, and falling markets. In other words, no matter where the market wind decides to blow, Bitsgap is ready to roll with the punches. The built-in algorithm makes trades like a pro, all based on a set of trading rules you define.

To spotlight GRID bots, these clever machines are always on the prowl, hunting for chances to buy low and sell high with each price swing, regardless of the market phase. There's a whole menu of high-yield and low-risk strategies to choose from. It all boils down to striking a balance between risk and return. High-yield strategies are like riding a rollercoaster with 2x the usual volatility, thanks to the fluctuations in both base and quote currencies.

For instance, you can tweak the bot to trade AAVE/BTC, which means you're racking up returns in BTCs. Now, picture this — the prices of both AAVE and BTC surge relative to USDT, and you're looking at a multiplier effect.

But let's cut to the chase, shall we? You're practically chomping at the bit to take Bitsgap for a spin, aren't you? Well, go ahead, sign up for a week's trial and strap in for a joyride!

Top 3 Risk Management Tools and Principles

Whether you're short selling, leverage trading, or crypto-botting, a solid risk management strategy could be your knight in shining armor, saving you from losses. With that in mind, let's dive into some of the key risk management tools.

Stop Loss

A stop loss order is like your own personal financial bodyguard — it's an advanced order that steps in to automatically close your position if the price of your crypto asset takes a nosedive below your specified limit, shielding you from further losses. Imagine you've just splurged $1000 on BTC. You've decided you can stomach a loss of $100 on this venture, and not a penny more. In this case, you can set up a stop-loss order that will hustle to sell your BTC stash the minute the value of your investment dips below $900.

Take Profit

A take profit order is like your personal wealth genie — it wraps up your position once it hits your preset profit threshold, saving you the headache of keeping an eye on your portfolio round the clock. Now, setting your profit level is a bit of an art — aim too low and you might find yourself shortchanged if the price decides to skydive higher than your forecast. On the other hand, a well-placed profit level can swoop in and save the day, rescuing you from losses if the market decides to pull a stunt and plummet after a spike.

Do Not Put All Your Eggs in One Basket

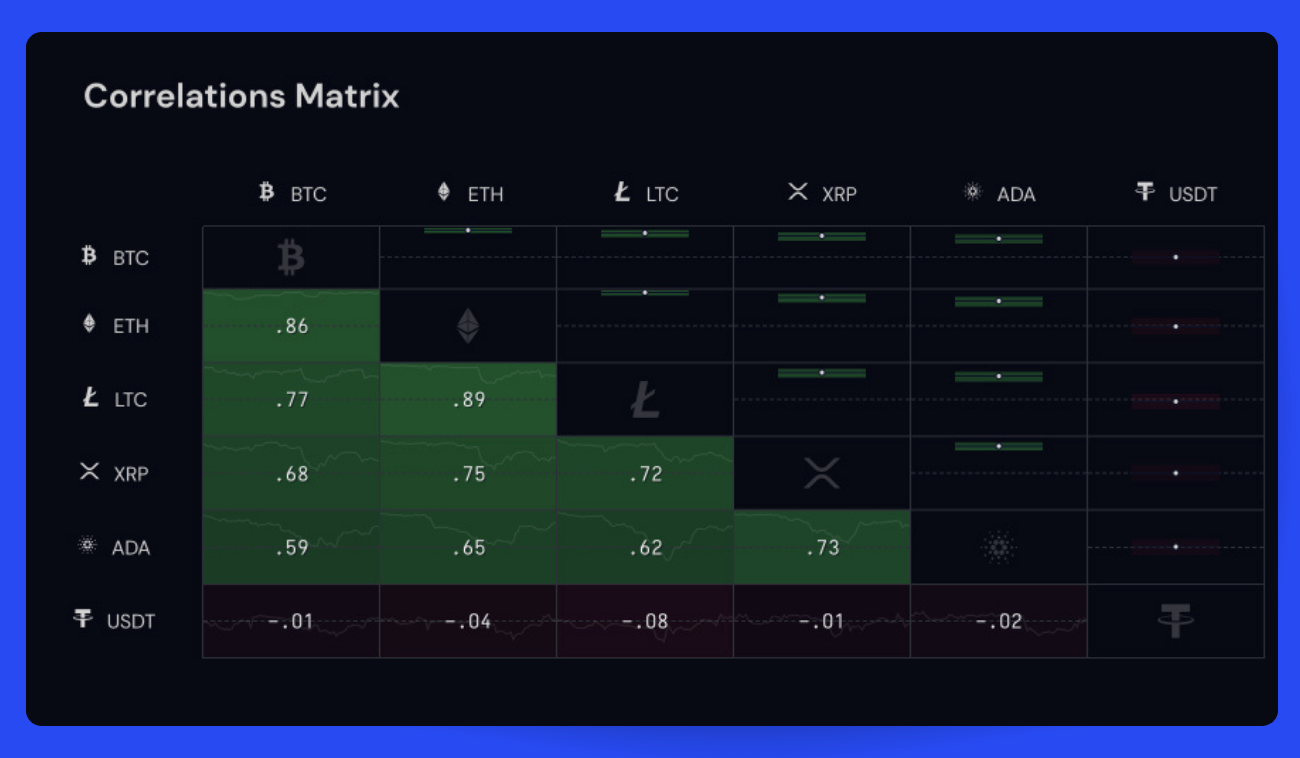

Sure, the crypto-verse can be a wild rollercoaster ride, but don't expect all your crypto assets to plunge headlong at the same time. For example, let's say you've got five crypto assets tucked away in your portfolio. Even if two of them decide to slack off and rack up losses, the other three can step up to the plate and pick up the slack. That's the beauty of diversifying your crypto portfolio — it's like a financial safety net. So, it's a smart move to spread your eggs across different crypto baskets to soften the blow in this unpredictable market.

Most cryptocurrencies out there have a knack for mirroring bitcoin's volatility. They're like bitcoin's shadow, moving in sync with it. So, if bitcoin decides to leap up by 10%, these cryptocurrencies might hitch a ride and climb by 5% or even 20%. On the flip side, if bitcoin dives by 10%, these cryptos might follow suit and plummet by 5% or 20%. So when you're building your portfolio, make sure to pick those assets that match your taste for volatility. You can use TradingView as your personal financial compass to compare assets.

Bottom Line

Even if you're the most bullish bull in the china shop, remember that cryptocurrency trading is a bit like dancing on a tightrope. There's no golden rule that states a crypto asset can't stumble and fall by 80%, and then decide to take a long nap right there for years. Yes, even the top dogs in the crypto world can take a giant leap off the cliff and stay at rock bottom for a good while.

But fear not, with some sharp analysis and savvy risk management strategies, you can still manage to wring out profits from a bearish market (short selling, anyone?). Just one word of advice — don't let your emotions dictate your trading moves. Keep your head cool and your actions guided by careful analysis and solid strategies.

FAQs

When to Take Profit on Bitcoin?

Knowing when to cash in your chips on bitcoin is like trying to figure out the final season of a long-running TV show. It's personal and depends on a bunch of stuff like your financial dreams, how much risk makes you sweat, your game plan, and the mood swings of the market. Here are some strategies that might just help:

- Target price: Think of a price at which you'd want to sell some or all of your bitcoin, kind of like setting a personal finish line. This could be based on the profit you'd like to see or a price you've dreamt up for bitcoin.

- Percentage gain: Decide to celebrate and take profit after your investment has bloated by a certain percentage. For instance, you might want to sell if your bitcoin stash grows by a cool 20% or a whopping 70%.

- Regular intervals: Some investors play it like clockwork, taking profits at set intervals like monthly, quarterly, or annually. It's like steadily munching on your chips instead of gulping them all down at once, helping lock in gains and reducing exposure to future rollercoaster rides.

- Market signals: Keep an eye out for signs that the market is getting a makeover. For instance, if there are whispers of a bear market on the horizon, it could be a good time to pocket some profits.

But remember, timing the market perfectly is like catching lightning in a bottle. It's often smarter to take profits bit by bit rather than in one big swoop, helping you weather those price swings. And don't forget to do your homework or chat with a financial advisor before making any blockbuster investment moves.

Where to Find Bitcoin Sell Signals?

If you're the kind who loves to roll up their sleeves and get their hands dirty, you can cook up those bitcoin signals right in your own kitchen. Heck, you could even set up a shop if you're successful and cash in on all the sweat and tears you're undoubtedly going to shed over this venture. To whip up these signals, you'll need to play detective with bitcoin price charts and indicators like RSI, MACD, moving averages, and what not, stay on top of bitcoin news like a hawk, religiously follow major bitcoin forums, groups, channels, and threads, get chummy with trading algos if you've got the knack for it, and keep a hawk-eye on order books. Sounds like a ton of work, right? But don't fret, there's a shortcut — just subscribe or follow bitcoin sell/buy signal groups, which are as common as cats on the internet.

Here's a handy list of some crypto trading signals providers, ready to help you reach your investment goals without breaking a sweat: Fat Pig Signals, Binance Killers, Sublime Traders, CoinCodeCap, Jacob Crypto Bury, Crypto Inner Circle, and Wolf of Trading. Just do a Google search to check those out.

What Should Be My Bitcoin Investment Exit Strategy?

Just like planning an epic road trip, you need to know your final destination before hitting the gas. So, what's your endgame here? Do you dream of long-term gains, or are you after the thrill of quick wins? Knowing your goals is the compass that'll guide you when it's time to say adios to your investment.

Now, no strategy is set in stone. The crypto market is as unpredictable as the weather forecast. So, keep your strategy under regular review, ensuring it's still singing in harmony with your financial goals and the market's latest moves.

One golden rule — don't let your feelings drive your decisions. The market might be on a rollercoaster ride, but that doesn't mean you should be. Stick to your plan, set take profit - stop losses, hedge your bets, and diversify.