HODLing Explained: The Power of Patience in Crypto Trading

Of all the wild lingo in crypto, “HODL” reigns supreme. But what exactly does HODL mean? When should you HODL and when should you fold? Read on for the full scoop on HODLing your way to the moon!

The “HODL”—an endearing typo-turned-mantra that has cemented itself into the crypto-lexicon. If you’re still wondering what this HODL business is all about, rest assured you’ve come to the right place.

HODL — ostensibly simple yet profound strategy — has fueled many success stories in the turbulent world of cryptocurrency trading. While weak hands fold at the first sign of plummeting charts, stalwart hodlers cling to their digital assets with diamond-studded gloves.

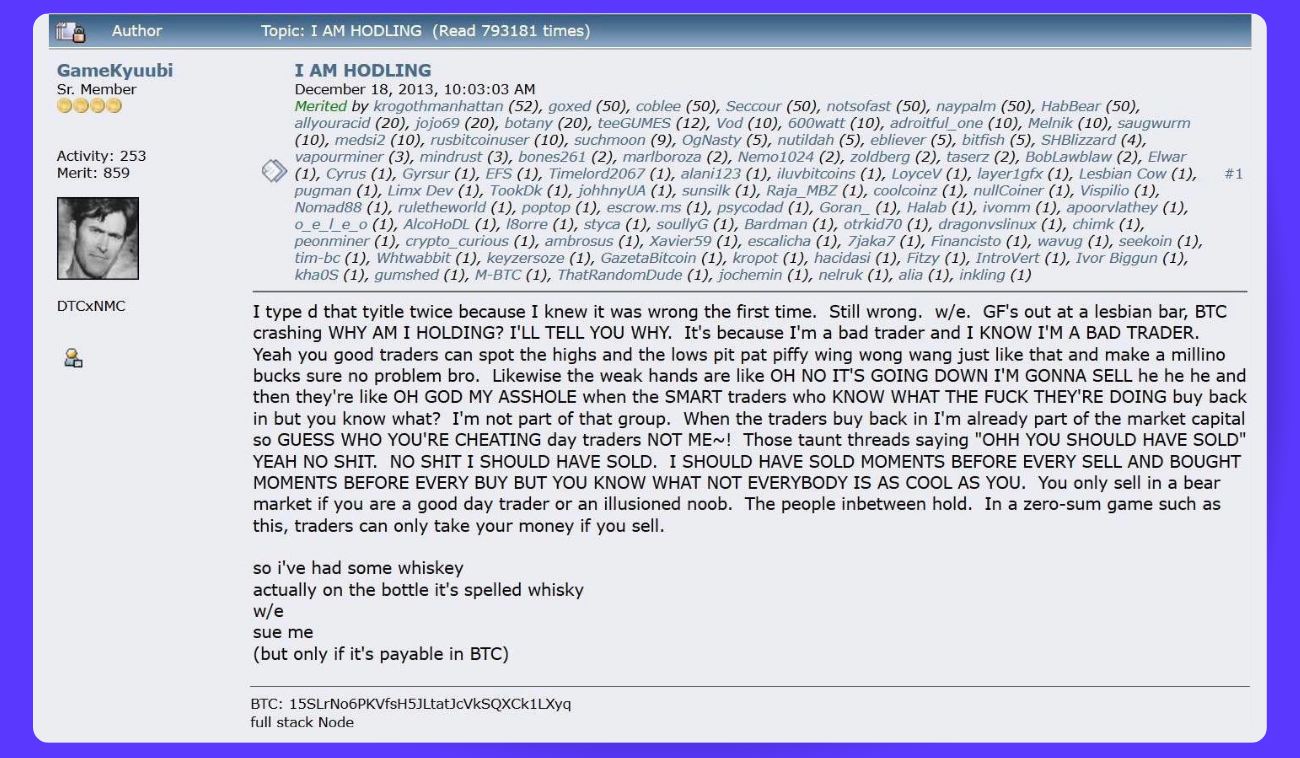

Way back in the ancient era of 2013, a visionary Bitcointalk user named GameKyuubi accidentally engineered an investment revolution. In a moment of candid self-reflection, GameKyuubi admitted to his fellow forumers that while he may be a terrible trader, he was determined to "HODL" onto his bitcoin through ups and downs. His serendipitous typo and dedication in the face of volatility resonated with many and soon "HODL" became a rallying cry.

Today, hodlers refuse to part with their crypto no matter what heights or depths the markets may reach. For those wondering what the difference is between trading and hodling or why a simple wordplay has sparked an entire subculture, read on to unfold the engaging story of HODL! Spice up your crypto vocab and maybe even find the inspiration to become a hodler yourself.

What Is HODL?

So what exactly is this captivating concept of HODL?

Crypto pioneers, in a stroke of brilliance, retrofitted HODL as an acronym for “Hold On for Dear Life”. This mantra is a reassuring call for fledgling crypto investors not to panic in the face of plummeting prices and sell at a loss.

The HODL motto acknowledges that while trading may be tempting, it requires skills that novices have yet to master. Volatility is the price we pay for excitement! However, not all are ready for the treacherous crypto seas, instead preferring to weather the storms on the sidelines. And who can blame them? After all, bitcoin was built as an incorruptible digital gold with turbulence as a feature, not a bug!

👉 According to Bitfarms’ mining mogul Ben Gagnon, HODL is more a state of mind than an investment tactic. “HODL is the realization that while there are fortunes to be made trading short-term ups and downs, there are also fortunes easily lost.”

Additionally, HODL can refer to the HODL token on Binance's Smart Chain. The token's purpose is to incentivize investors for hodling, or holding onto, their tokens. HODL functions as a yield farming and DeFi token, allowing your tokens to accrue interest. This interest stems from HODL investors who opt to sell their tokens, at which point a small 'tax' is levied.

Periodically, HODL token investors receive rewards in the form of Binance Coin (BNB) tokens. The HODL token also contributes liquidity to the crypto markets, potentially generating additional rewards for investors.

Why HODL instead of Hold?

There are a few reasons why "HODL" has become more popular than simply saying "hold."

As mentioned, it started as a typo that caught on. The original 2013 Bitcointalk post (Pic. 1) that popularized "HODL" was titled "I AM HODLING". The typo was unintentional, but it gave the phrase a memorable quality that resonated with the crypto community.

Its self-deprecating humor and ability to convey passion and determination in the face of volatility tapped into the crypto community's sense of humor and values.

Lastly, the phrase's acronym, "Hold On for Dear Life," succinctly captures the spirit and intent behind the hold ethos, which resonates with the crypto community and reinforces its popularity.

HODL vs Day Trade Cryptocurrency

Day trading and hodling are two very different crypto investment strategies. Day trading involves buying and selling assets on the same day, often within minutes or hours, to profit from short-term price swings. It requires extensive technical analysis, fast decision-making, and constant monitoring. While risky, day trading can yield high rewards, especially in volatile crypto markets. However, it demands a lot of time, skill, and emotional discipline.

Hodling, on the other hand, is a simple long-term strategy where investors buy crypto and hold it for years while avoiding reacting to short-term volatility. Hodlers believe in the long-term potential of assets like bitcoin and are unconcerned by temporary price crashes. This “buy and hold” approach reduces emotion and the risks of buying high and selling low.

While hodling seems straightforward, choosing which crypto to buy and hold requires research, as many assets won’t survive long-term. Dollar Cost Averaging, or making regular small buys over time, is a popular hodling technique as it removes emotion and volatility from the process. The key is determining how much crypto to accumulate and sticking to the plan.

👉 Did you know that Bitsgap has a DCA crypto trading bot that can automate the Dollar Cost Averaging strategy? Dollar Cost Averaging, or DCA, means splitting your investment into periodic buys, allowing you to get a better average price over time. You automatically buy small amounts, whether the market is up or down, high or low. This smooths out the peaks and valleys and gives you more control in an out-of-control space. Bitsgap’s DCA bot is like having a tireless cyborg trader at your disposal, programmed to execute your master plan with clockwork precision. The bot repeatedly buys or sells at set intervals, minimizing the impact of the market's volatility on your portfolio. It carries out your wishes regardless of turbulence, emotionless and unhindered by greed or fear. Giddyup!

👉 Another bot that’s perfect for hodling is BTD. When crypto doomsday hits and the herd stampedes for the exits in a selling frenzy, the BTD bot springs into action. As weak hands unload at any price, Bistgap’s BTD starts greedily gobbling up coins at a discount. The further the price falls, the more ferociously it buys. So let the market crash and burn while you emerge from the ashes with a trove of coins at clearance sale prices.

HODLing Pros and Cons

As with every strategy, holding has its pros and cons. Let’s go over each in detail.

Benefits of HODLing

The hodl strategy offers crypto investors the possibility of decent gains without the hassle. By buying and holding for the long haul, you can achieve the following perks:

- Peace of mind. Hodling frees you from constantly checking charts or stressing over short-term price swings. You know you're in it for the long game, so daily volatility won't phase you.

- Massive upside potential. Hodling even for just a few years has historically led to returns of well over 1000% in crypto. No other asset class offers the possibility of such enormous gains in such a short time. If you had bought and hodled Bitcoin for just 15 months from 2020 to 2021, you could have turned $5,500 into $65,000 — a 1100% return!

- Defer taxes. By hodling for over a year, you can qualify for long-term capital gains tax rates which are lower than short-term rates. You keep more of your profit and your money stays invested and working for you.

- Minimize emotions. Hodling helps you avoid reacting to FOMO or FUD. You have a multi-year time horizon, so you don't make rash buys or panic sells. You know short-term volatility won't impact your long-term success.

- Build wealth faster. With the potential for huge returns and tax benefits over time, hodling crypto may create wealth at a speed unmatched by any other investment. Your money compounds much quicker when you have four-figure percentage returns!

While hodling means waiting and avoiding temptation, the long-term rewards of doing so can be well worth it.

Dangers of HODLing

Despite offering impressive gains over the long haul, holding can also be challenging:

- Hodling crypto through bearish times requires grit and determination as doubt and despair threaten to crack your resolve. But diamond hands are forged under intense pressure. There’s no walkaround for keeping your emotions in check. It's equally important to have sufficient capital at your disposal to cater to unforeseen liquidity needs or forced sales.

- While hodling can be a smart investment strategy, it's not entirely risk-free. Established cryptocurrencies like bitcoin and ether may seem like stalwart investments, but their short history doesn't guarantee their long-term value. Additionally, cryptocurrency regulation and future mass adoption remain uncertain, making digital assets less reliable investments.

- Long-term hodling also comes with a higher security risk. You must become adept at wielding the self-custody and privacy tools at your command to fend off the ever-present specter of cyber theft and hacking. Losing access to private keys, which are essential to asset protection, is a prevalent risk that should not be taken lightly.

It's worth noting that day trading and hodling are not mutually exclusive investment strategies. Many investors combine both to grow their portfolios. Ultimately, it's essential to weigh the pros and cons of each strategy and determine what works best for your investment goals.

Which Coins Are Fine to HODL?

Before anchoring your investment to a coin for hodling, it's crucial to thoroughly assess its potential. A prime HODL-worthy coin boasts a remarkable use case and a limited enough supply to ensure its value ascends over time.

Embracing the hodling mindset demands unwavering dedication and steadfast belief in your chosen coin. While behemoth market cap coins may offer a more stable voyage, the daring act of hodling a smaller market cap asset could yield a greater treasure trove of profits.

Where to HODL Coins

Hodling requires diligent attention to your storage choices. Whenever feasible, seek out a hardware wallet to securely harbor your precious crypto coins. These cold storage options provide a safer haven than hot wallets found on desktops or mobile phones, making them the preferred choice for steadfast hodlers.

For those unacquainted with the world of wallets, here’s our dedicated, comprehensive primer: Cryptowallets Explained.

When to Stop HODL

There are those who pledge eternal allegiance to hodling, but without letting go, profits will remain but a distant dream. It's wise to cease hodling when the moment feels just right. Establishing a profit target can be a prudent strategy, and even with unwavering faith in the currency's future, it's generally advisable to liquidate a portion to reap the rewards.

This tactic achieves a dual purpose. Firstly, it enables you to withdraw some capital as a safety net in case the asset's value takes a nosedive— a realistic possibility, particularly if your coin has recently skyrocketed in value. Secondly, should the value descend, you'll be left with liberated capital. This newfound wealth could potentially secure you double the number of coins you initially held.

HODL vs SODL

SODL stands in stark contrast to HODL. When the atmosphere around bitcoin turns bleak, you may encounter this term more frequently. Choosing between hodling and sodling is an individual decision. If funds are urgently needed, it might be wise to avoid taking risks.

On the other hand, if the money isn't required immediately, the potential rewards for hodling could be significantly higher. Keep in mind that it's not a binary choice, and one could opt to sell a portion of their holdings while continuing to HODL a respectable amount of coins.

GRID Bot vs HODL

GRID and HODL are two different strategies used in cryptocurrency trading.

The GRID strategy is a widely employed tactic in both crypto and forex trading. It operates by placing deferred limit buy and sell orders at predetermined price intervals. The selected price range is divided into multiple levels, giving rise to a grid teeming with orders—hence the name GRID strategy.

👉 If you’re looking for a reliable GRID bot, then Bitsgap’s GRID bot is your best bet. Bitsgap’s GRID bot faithfully follows the GRID trading strategy and sets up a grid of buy and sell orders at predetermined price levels for you automatically, continuously generating profits from market fluctuations even when you're not at your computer. The grids are highly adaptable; for every completed buy order, the bot will generate a new sell order above the executed price, and the opposite holds true as well.

On the other hand, hodling is a long-term investment strategy where investors buy and hold onto a cryptocurrency for an extended period of time, regardless of short-term price movements. The goal of hodling is to benefit from the potential long-term growth of the cryptocurrency.

Both have their advantages and disadvantages, and the choice between those strategies will depend on your personal investment goals, risk tolerance, and trading experience.

Bottom Line: HODL Like a Boss

Although bitcoin has been in existence since 2009, its long-term track record pales in comparison to stocks, bonds, real estate, and other assets. Some detractors contend that HODL culture's unwavering obstinacy and insular nature resemble a "cult," rendering the community impervious to any legitimate critiques of bitcoin as an investment or currency. Nevertheless, if the predictions of Bitcoin enthusiasts come to fruition and BTC ultimately emerges as the world's universal digital currency and preferred long-term store of value, those who have steadfastly HODL'd will undoubtedly reap the rewards. Who would have the last laugh, then?

FAQs

What Does HODL Mean?

HODL, an acronym encapsulating the sentiment "hold on for dear life," traces its origin to a typo in a Bitcointalk post penned by a crypto enthusiast. The term has since become synonymous with weathering the tumultuous rollercoaster of the cryptocurrency market, regardless of the ferocity of price fluctuations. Over time, the typo evolved into a meme and is now a common refrain used to discourage selling. However, it is important to consider whether this advice is always sound, as while some individuals have gained significant profits by HODLing, others have learned the hard way that it may not always be the best strategy.

Bitcoin or Altcoins to HODL?

The decision about which cryptocurrency asset to HODL is entirely yours. While bitcoin is a popular choice due to its status as the original cryptocurrency and established longevity, there are numerous other viable options available. Ether, Ripple, Cardano, Polkadot, or Monero, for example, are highly esteemed and widely utilized within the cryptocurrency landscape, making them potential candidates for hodling as well.

Should I HODL or Trade?

The decision to HODL or trade ultimately depends on your individual goals, risk tolerance, and investment strategy.

HODLing is a long-term approach where you hold onto your cryptocurrencies through the market's ups and downs, believing they will appreciate over time. This strategy demands patience, resilience in the face of volatility, and a strong conviction in the underlying technology and potential of the digital assets.

Trading, on the other hand, involves actively buying and selling cryptocurrencies to capitalize on short-term price fluctuations. This approach requires a deeper understanding of market trends, technical analysis, and a willingness to devote time to monitoring the market.