Smart Tips on Sending and Receiving Coins Safely

Don't let your crypto coin flip turn into a coin flop! Unearth the secrets to safe and secure crypto transfers in our latest guide.

Ensuring transaction security is paramount in cryptocurrency. In this piece, we'll explore the available methods for transferring funds and examine typical errors made by users.

Isn't it great how we can zap money across the internet using crypto wallets? But, alas, it's not all rainbows and unicorns. The web's dark corners are teeming with unsavory characters scheming fraudulent investments and peddling fake wares.

And then there's the 'no take-backsies' rule of cryptocurrency. Once a transaction is confirmed by the network, it becomes nearly impossible to reverse. That's blockchain for you. There are some exceptions, of course, when smart contracts are involved or when some genius has built a dispute resolution mechanism into a protocol. But, let's face it, those are rare gems in the wild west of crypto.

So, here's the mantra: Be careful, double-check before you click 'send,' keep your wallets secure, and protect your private keys. Because if some online villain gets their grubby hands on your keys, your crypto could vanish faster than a cookie in a kindergarten.

In this article, we're going on a joyride through popular token networks and sharing some survival tactics for crypto transfers. Buckle up, it's a wild ride in the crypto universe where your wits are your best co-pilot.

Choosing the Right Blockchain Network for Transactions: Renowned Token Networks

Did you know that nearly 95% of all assets traded on crypto exchanges are digital tokens living on a myriad of blockchains?

Let's do a quick roll call of some of these blockchain protocols that are the talk of the cryptoverse:

- OMNI: Think of it as an extra layer that allows users to craft tokens on the Bitcoin (BTC) blockchain. Despite BTC being its homegrown token, OMNI doesn't see much action due to its turtle-paced transaction speed and hefty fees.

- ERC20: This protocol, a native of the Ethereum blockchain with Ethereum (ETH) as its home token, is currently the belle of the ball in the digital tokens' universe.

- TRC20: It's the frugal individual's best friend, with its pocket-friendly transaction fees, especially when it comes to sending and receiving USDT. The native token here is TRX.

- BEP2: This is the brainchild of the Binance chain, with BNB strutting around as its native token.

- BEP20: This protocol is the offspring of the Binance Smart Chain. It's a social butterfly, compatible with both BEP2 and ERC20. While all fees are paid in BNB, it's a bit of a rebel and doesn't have an official native token.

BEP20 was engineered to facilitate a swift and smooth token migration from other blockchains. It's the bargain hunter's dream boasting some of the lowest transaction fees in the market. But its close ties to the Binance ecosystem can lead to a bit of head-scratching for users trying to withdraw tokens to external wallets.

Beyond digital tokens, there are also tokenized assets, like Tether, that are backed by fiat currencies or tangible assets. These digital assets can have their feet in multiple blockchains at the same time.

The striking similarity of wallet address formats across different blockchains often sends users into a tizzy. For example, Ethereum and Binance Smart Chain protocols share the same address format, forcing users to specify the network they want to use for a transaction.

Some popular wallets, such as MetaMask or Trust Wallet, play nicely with both ERC20 and BEP20 protocols. They're also the forgiving sort, allowing for token recovery even if a wrong network was used, as long as the wallet addresses in ERC20 and BEP20 are mirror images of each other.

Why Networks Matter?

It's a recurring nightmare in the crypto world: selecting the wrong network when pulling assets from a centralized exchange to an external address. This misstep is more common than you might think, and it's not a pleasant one.

Those who frequent Binance may stumble into this pitfall more often, given the plethora of tokens from various blockchains listed on the exchange.

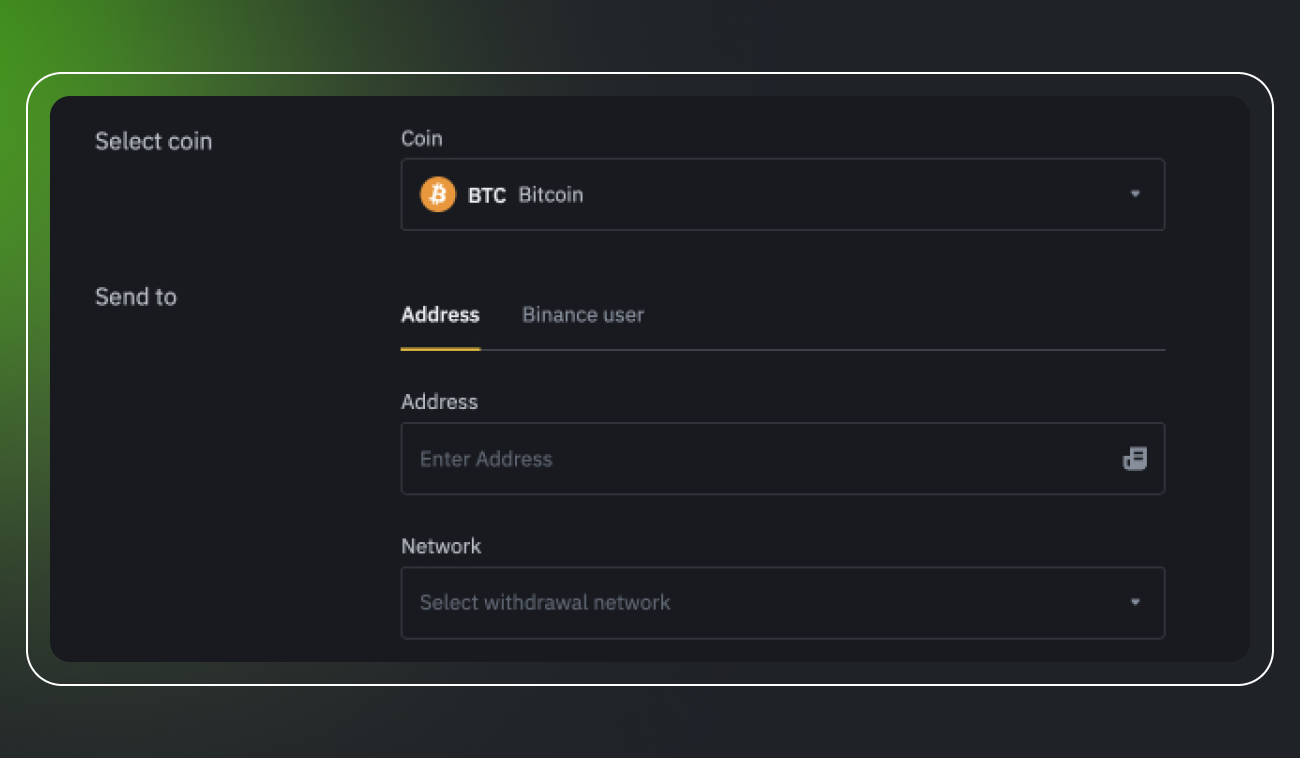

The sequence typically goes like this: users select the cryptocurrency they plan to yank from the exchange, followed by the transaction network. This is where the unseasoned users often trip up, as they tend to go for the network with the lightest transaction fees.

The disparity in transaction fees between networks can indeed be striking. However, most crypto exchanges these days have automatic checks in place to stop users from sending funds into the abyss of incompatible networks. For example, they'll block attempts to send ETH via the BEP2 or TRC20 networks.

Likewise, ERC20 tokens won't travel via the TRC20 network, no matter how alluring the transaction fees may look. If a user somehow gets such transactions through, the tokens will vanish into thin air, never making it to the destination wallet. And unlike the u-turns in the centralized banking system, there are no backsies in the blockchain universe.

Here's a golden rule to ensure your transactions don't go off the rails: Stick to the native network of the recipient’s address when making transactions.

Imagine this scenario: When you're sending fiat money through a bank transfer, the recipient needs to give you the correct bank details. If any of this information is off, the funds will take a detour away from the recipient's account. In the same vein, in the cryptocurrency world, choosing the right network for transactions is key.

5 Common Mistakes When Withdrawing Crypto

When you're pulling crypto from an exchange or moving it to a different wallet, keep an eye out for these classic missteps:

- Picking the wrong network: Before you hit the transfer button, figure out which networks your recipient's wallet can handle. Match this with your sending options, and then, and only then, opt for the one with the slimmest transaction fees.

- Overlooking MEMO: Some networks ask for a bit more information like MEMO, Tag, or Payment ID along with the wallet address. This is a common ask for BEP2 network transactions or when you're dealing with XRP, XLM, or XMR. While some might let you file a Tag/MEMO Recovery request, don't bank on a refund.

- Shipping the wrong coin: Some networks have wallet addresses that look like long-lost twins, which can bewilder users and up the odds of dispatching the wrong coin. For instance, a user might mistakenly send Bitcoin Cash (BCH) to a Bitcoin wallet address or the other way around, resulting in a funds fiasco.

- Depositing phantom assets: Some users have a habit of depositing crypto straight from their wallets using saved data. This can land users in hot water if they send coins to an exchange, not realizing the token has become a ghost, risking their coins' disappearance.

- Turning a blind eye to transaction fees: When pulling funds, the commission generally comes out of the transfer amount, leaving the recipient with a lighter load. This can throw a wrench in things, especially if the user aims to send a specific sum.

Binance stands out as one of the handful of crypto exchanges that let users tap into its own blockchain, Binance Smart Chain (BSC)/BEP20, to shift and stash tokens. BSC gives users the green light to store ERC-20 tokens as BEP-20 tokens, potentially chipping away at fees and speeding up transactions within the exchange's ecosystem.

When moving tokens to external wallets, make sure you're steering clear of any network that begins with BEP. Even though some users have managed to retrieve their tokens, most blockchain transactions are a one-way street. Sending crypto via the wrong network or to an incorrect address will likely result in the transferred assets going MIA.

FAQs

How Do I Send Crypto Safely?

Sending crypto safely involves several stages. Your roadmap starts with checking wallet addresses twice — always give them a second look. A slip of the finger could send your crypto into the void. Some wallets even let you scan a QR code for the recipient's address. Your network and the recipient's wallet need to be on speaking terms too. Sending ERC20 tokens on a TRC20 network, for instance, is a big no-no. So, always make sure your networks are friendly with each other before setting off. If you're sending the digital equivalent of a king's ransom, consider a test run with a pittance. Once you've confirmed that the small amount made it safely, you can unleash the full treasure. Also, remember that some transactions want more than just the basics. They might ask for a MEMO, a Tag, or a Payment ID. Finally, before hitting that big, tempting 'confirm' button, make sure everything checks out. Once you've hit confirm, there's no going back.

Since your device is the vehicle for this journey, make sure it's in top condition with a good antivirus program, updated software, and a strict no-clicking-on-weird-links policy. If you're moving amounts of crypto that would make a dragon envious, think about a hardware wallet. It's like a secret hideaway for your private keys, offline and away from prying eyes. There are plenty of crypto pirates out there. Don't share your private keys or mnemonic phrases. And be wary of anyone asking for them. They're probably not your friends.

Remember, safe crypto transfers are all about vigilance. Double-check everything before you confirm. A tiny error can lead to a big, irreversible loss.

How Do I Receive Crypto Safely?

Receiving crypto safely demands careful execution that also involves several steps, beginning with getting your address right. Always hand out the correct wallet address to whoever is sending you the crypto. Make sure the address you provide is a match for the intended crypto. For instance, if you're expecting Ethereum, a Bitcoin address won't do you much good. After you've copied your wallet address, give it a once-over to ensure it's accurate. Crafty malware can switch copied addresses behind your back, so double-checking is a wise move. Then confirm that your wallet can cozy up to the type of cryptocurrency you're receiving. Not all wallets play nicely with all cryptocurrencies. If you're sent a coin that your wallet gives the cold shoulder, you could lose your funds. Finally, once the sender puts the transaction into motion, ask them for the transaction ID (also known as a txid or hash). You can use this ID to follow the transaction's progress on a blockchain explorer and confirm when it's wrapped up.

Now, when it comes to security, treat your wallet like a digital fortress. Ramp up the safety measures, such as two-factor authentication, and never share your private keys or recovery phrases. They're yours and yours alone. Consistently update your wallet software to the newest version. It's like a regular check-up that can keep you safe from the lurking vulnerabilities that hackers love to exploit. Watch out for scams that tempt you with the promise of unlocking or claiming larger crypto amounts if you send some first. They're known as "giveaway scams" and are as sketchy as they sound. Finally, if you're handling significant amounts of crypto, think about using a hardware wallet. These gadgets keep your private keys offline and add an extra layer of security.

In the end, receiving crypto safely comes down to caution, careful checking, and supreme wallet security.

What Are Some Renowned Crypto Wallets?

Navigating the sea of crypto wallets can be tricky, but there are a few beacons of reliability out there, each boasting a unique blend of features, security protocols, and user experiences. Top dogs in the field include the likes of Ledger, Trezor, Metamask, Trust Wallet, Exodus, Coinbase Wallet, and MyEtherWallet (MEW), to name but a few. For a deep dive into the wide world of crypto wallets, we've got a couple of resource-rich reads waiting for you: 'Crypto Wallets Unzipped' and 'The Fabulous Five of Hardware Wallets'. Do give them a glance for a full scoop on the topic.

Can You Recommend a Read on Blockchain Transactions?

Absolutely, we can help with that! In fact, we've got a stellar piece that delves deep into the subject. For a thorough understanding of blockchain transactions, swing by and take a look at our article, 'Demystifying Blockchain Transactions: A Guide to Bitcoin Transactions'.

What Are Some Digital Wallet Safety Practices?

Securing your digital wallet is paramount in keeping a firm grip on your cryptocurrencies. Here's a rundown of essential practices to bolster your digital wallet's safety:

- Private keys: Your private keys should be exactly that — private. Share them with no one, even if they claim to be part of the wallet's support team. This secret code is your sole gateway to access and manage your assets.

- Two-factor authentication (2FA): Activate 2FA on all accounts associated with your crypto transactions. This security measure boosts protection by demanding not just your password, but also a second factor, such as a one-time code sent to your phone.

- Wi-Fi: Steer clear of public Wi-Fi when dealing with your digital wallet. Cybercriminals could intercept data on insecure networks. Opt for a secure, private internet connection instead.

- Hardware Wallets: For those holding substantial crypto amounts, a hardware wallet is a smart choice. These gadgets keep your private keys offline, reducing the risk of online hacking.

- Backup: Regularly backing up your digital wallet ensures you can retrieve your assets if your device goes missing or gets stolen. Keep these backups in various secure places.

- Software updates: Regularly refresh your wallet software. Updates often come with improved security features and safeguard against new threats.

- Phishing: Keep an eye out for phishing scams. These deceitful attempts to access your wallet often masquerade as a trusted service. Always verify email addresses, website URLs, and message content for authenticity.

- Multi-signature: Some wallets offer a multi-signature feature, which requires the green light from several individuals before a transaction goes through. This can add an extra layer of asset security.

- Address verification: Always give the address a second look before sending or receiving funds. A minor typo could lead to irreversible fund loss.

- Keep Holdings Under Wraps: Avoid broadcasting the amount of cryptocurrency you possess. This info could paint a target on your back for hackers.

By adhering to these safety measures, you can significantly decrease the odds of losing access to your cryptocurrencies due to hacking, phishing, or a simple case of human error.

What Are Some Safe Crypto Exchanges?

There's a multitude of trustworthy and secure cryptocurrency exchanges where you can purchase, sell, and trade digital assets. Some of the most acclaimed include Coinbase, Binance, Kraken, and Gemini. We recommend checking out our comprehensive guide: 'Top Crypto Exchanges' for an in-depth understanding.

Ever wished you could juggle all these exchanges from one snazzy interface? Well, your wish is Bitsgap's command. Not only can you trade on all your linked exchanges in one fell swoop, but you also get a boatload of features that most exchanges can't hold a candle to.

We’re talking smart trading options with hedging and trailing, automated crypto trading bots with default strategies that are more profitable than a leprechaun's pot of gold, and customization options that would make a Swiss Army knife blush.

Give it a whirl, and prepare to be dazzled!