Digital Money 2.0: Distinguishing Stablecoins from Tokenized Deposits

As digital money evolves, three players are battling for dominance: stablecoins, tokenized deposits, and deposit tokens. Each promises to revolutionize finance, but their approaches couldn't be more different.

The rapid evolution of digital payment systems has brought forth two distinct yet often confused financial instruments: stablecoins and tokenized deposits. As the financial sector increasingly embraces blockchain technology and digital assets, understanding the fundamental differences between these two forms of digital money has become crucial for investors, regulators, and financial institutions alike.

For traditional banks exploring digital innovation, fintech companies developing new payment solutions, and policymakers crafting regulatory frameworks, the distinction between stablecoins and tokenized deposits carries significant implications for risk management, regulatory compliance, and business strategy. Moreover, as retail investors and consumers face an expanding array of digital payment options, clarity on these instruments' underlying mechanisms and guarantees becomes essential for making informed financial decisions.

In this article, we'll examine both stablecoins and tokenized deposits in detail, exploring their unique characteristics, operational mechanisms, and the key differences that set them apart. Our analysis will help readers navigate this complex landscape and better understand the role each instrument plays in the broader digital financial ecosystem.

What Are Stablecoins?

Stablecoins are digital assets designed to maintain a stable value by pegging themselves to another asset or basket of assets. Unlike their volatile cousins such as Bitcoin or Ethereum, stablecoins aim to provide the best of both worlds: the stability of traditional currencies combined with the efficiency and accessibility of blockchain technology.

👉 The most common type of stablecoins are those pegged to fiat currencies, typically the US dollar. USDC and USDT, for instance, target a constant 1:1 ratio with the dollar. To maintain this peg, stablecoin issuers employ various backing mechanisms. Some, like USDC, claim to hold equivalent amounts of cash and short-term U.S. Treasury bonds in reserve. Others might use more complex collateralization methods, including cryptocurrencies or algorithmic mechanisms.

However, stablecoins aren't without their controversies. The collapse of TerraUSD in 2022 served as a stark reminder that not all stability mechanisms are created equal. This event prompted renewed scrutiny of stablecoin reserves and highlighted the importance of transparency in their backing arrangements.

What Are Tokenized Deposits?

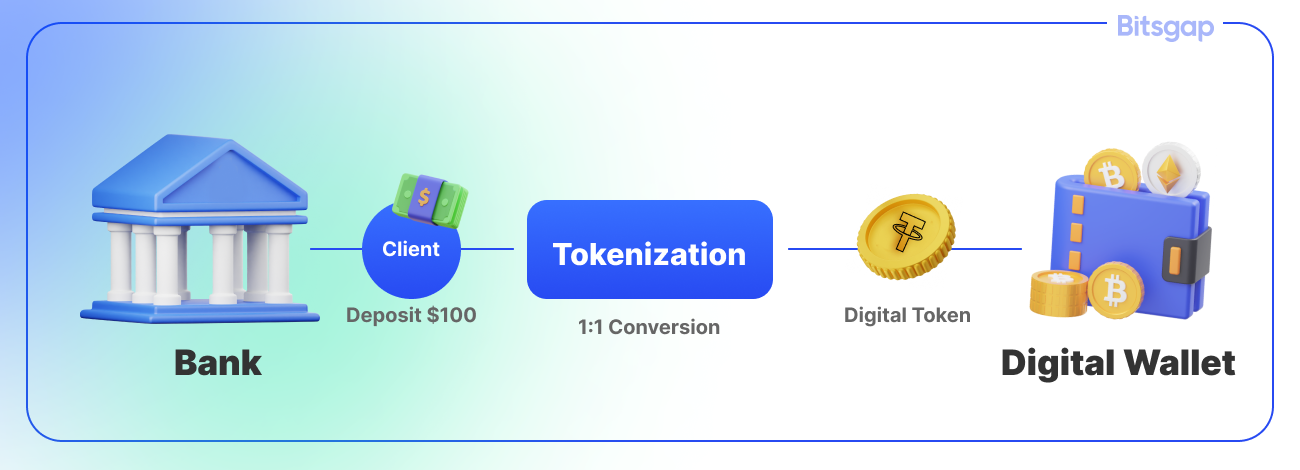

Tokenized deposits represent a different approach to digital money—one that keeps one foot firmly planted in the traditional banking system. These are essentially traditional bank deposits that have been "wrapped" in a digital token, making them compatible with blockchain technology while retaining their status as regulated bank liabilities.

👉 Consider JPMorgan's JPM Coin as an example. When a client deposits funds, the bank issues digital tokens representing those deposits, which can then be used for instant payments and settlements within JPMorgan's network. Unlike stablecoins, these tokens are direct claims on the bank and benefit from the same regulatory protections as regular deposits, including deposit insurance (up to applicable limits).

The key innovation here lies in how tokenized deposits bridge the traditional and digital financial worlds. They enable banks to offer their clients the speed and programmability of blockchain technology while maintaining the familiar security and regulatory framework of conventional banking. For instance, a corporate client could use tokenized deposits to automate complex payment flows through smart contracts while keeping their funds within the regulated banking system.

What makes tokenized deposits particularly interesting is their potential to transform institutional finance. Major banks are exploring their use for everything from real-time cross-border payments to automated treasury management. Goldman Sachs and other financial institutions have been conducting trials with tokenized deposits, suggesting that this technology could become a significant part of the future financial infrastructure.

Pros and Cons of Each System: Advantages & Risks of Stablecoins & Tokenized Deposits

Here's a thoughtful analysis of the advantages and risks of each system:

Stablecoins

Advantages:

- 24/7 global accessibility without traditional banking hours or geographic restrictions

- Near-instant settlement of transactions, particularly valuable for cross-border transfers

- Programmability through smart contracts enabling automated financial operations

- Lower transaction costs compared to traditional international wire transfers

- Enhanced privacy as some transactions can be conducted without direct bank involvement

- Greater financial inclusion for the unbanked population who can access basic financial services through mobile devices

Risks:

- Counterparty risk if the issuer fails to maintain adequate reserves

- Potential for "bank runs" if many holders try to redeem simultaneously

- Regulatory uncertainty as frameworks continue to evolve

- Risk of depegging from their target value, as seen in historical cases

- Cybersecurity threats including smart contract vulnerabilities

- Concentration risk when major stablecoins are controlled by a few entities

- Questions about reserve quality and transparency

Tokenized Deposits

Advantages:

- Full regulatory compliance and oversight from day one

- Protection through existing deposit insurance schemes (like FDIC in the US)

- Integration with existing banking infrastructure and services

- Clear regulatory status as bank liabilities

- Built-in KYC/AML compliance through bank accounts

- Direct connection to fiat currency system

- Institutional trust from being issued by regulated banks

Risks:

- Limited accessibility as users typically need a bank account

- Dependence on the issuing bank's operational hours for certain functions

- Potential for technical issues during the tokenization process

- Higher costs due to regulatory compliance requirements

- Limited interoperability between different banks' systems

- Concentration of control within traditional banking system

- Potential for system-wide issues if major banks face technical problems

- May be less innovative due to regulatory constraints

The choice between stablecoins and tokenized deposits often depends on specific use cases. Businesses requiring high regulatory certainty might prefer tokenized deposits, while those prioritizing accessibility and programmability might lean toward stablecoins. Understanding these tradeoffs is crucial for making informed decisions about which system better suits particular needs.

What’s the Difference Between Stablecoins & Tokenized Deposits

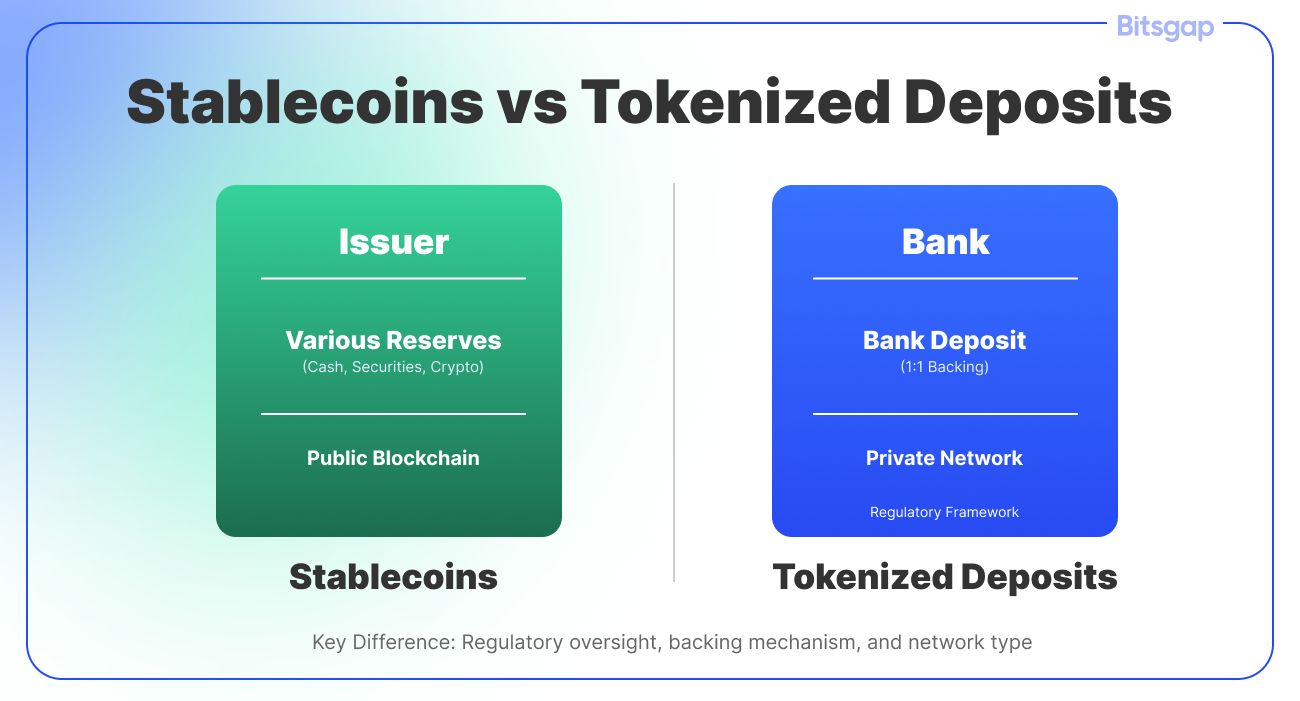

While both stablecoins and tokenized deposits represent digital forms of money, they differ fundamentally in their design, operational mechanisms, and regulatory status. Let's examine these differences across multiple dimensions:

Legal Status and Regulatory Framework

Tokenized deposits are straightforward bank liabilities, falling under existing banking regulations and benefiting from established legal frameworks. They represent a direct claim on a regulated financial institution, just like traditional bank deposits. In contrast, stablecoins operate in a more ambiguous regulatory space. While recent regulatory initiatives aim to bring clarity, stablecoins' legal status varies significantly across jurisdictions, creating uncertainty for issuers and users alike.

Backing and Collateralization

The backing mechanism represents perhaps the most crucial distinction. Tokenized deposits are backed one-to-one by actual bank deposits, which themselves are backed by the bank's assets and regulatory capital requirements. The backing is transparent and subject to regular regulatory scrutiny. Stablecoins, however, employ various backing mechanisms – from claimed full reserve backing with cash and short-term government securities (like USDC) to more complex arrangements involving cryptocurrencies or algorithmic mechanisms. The quality and verifiability of these reserves can vary significantly.

Institutional Framework

Tokenized deposits exist within the traditional banking system, issued by regulated financial institutions with established risk management frameworks, capital requirements, and operational procedures. This institutional framework provides a clear chain of responsibility and accountability. Stablecoins, particularly those issued by non-bank entities, operate outside this traditional framework. While this allows for innovation, it also means less institutional oversight and potentially higher operational risks.

Redemption and Settlement

The redemption process for tokenized deposits is straightforward – they can be converted back to traditional bank deposits through the issuing bank's established procedures. Settlement finality is guaranteed through the banking system's legal framework. Stablecoin redemption processes can be more variable, depending on the issuer's policies and the specific stablecoin design. Some stablecoins may have redemption restrictions or fees, and settlement finality might be less clearly defined.

Technical Infrastructure

Stablecoins typically operate on public blockchain networks, offering greater interoperability with other digital assets and decentralized finance (DeFi) applications. This makes them more versatile for cryptocurrency trading and blockchain-based financial services. Tokenized deposits often use private or permissioned blockchain networks, prioritizing security and regulatory compliance over interoperability with the broader crypto ecosystem.

Access and Usability

Stablecoins offer broader accessibility—anyone with a digital wallet can hold and transfer them, regardless of their banking status. This makes them particularly valuable for financial inclusion and cross-border transactions. Tokenized deposits typically require users to have a banking relationship with the issuing institution, limiting their accessibility but providing stronger customer protections and compliance controls.

Risk Profile

The risk profiles of these instruments differ significantly. Tokenized deposits carry traditional bank counterparty risk, mitigated by regulatory oversight and deposit insurance. Stablecoins face additional risks, including technology risks, market risks (potential depegging), and operational risks related to their backing mechanisms. The concentration of risk also differs – tokenized deposits spread risk across the regulated banking system, while stablecoin risk may be concentrated in a few large issuers.

Innovation Potential

Stablecoins generally offer greater flexibility for financial innovation, particularly in decentralized finance applications and programmable money. Their design allows for easier integration with smart contracts and blockchain-based applications. Tokenized deposits, while more constrained by regulatory requirements, provide a bridge between traditional banking and blockchain technology, enabling innovation within a regulated framework.

Market Dynamics

The market behavior of these instruments can differ significantly. Stablecoins are more susceptible to market sentiment and can experience pressure on their pegs during periods of crypto market stress. Tokenized deposits, being direct bank liabilities, typically maintain their value more consistently but may be affected by traditional banking sector risks.

Future Evolution

The future development paths of these instruments are likely to diverge. Tokenized deposits are evolving within the established banking framework, focusing on institutional use cases and integration with existing financial infrastructure. Stablecoins are developing more dynamically, with ongoing experimentation in design, backing mechanisms, and use cases, particularly in decentralized finance.

Understanding these differences is crucial for stakeholders across the financial system—from regulators and financial institutions to developers and end-users. As the digital asset ecosystem continues to evolve, both instruments are likely to find their own niches, serving different needs in the financial landscape. The choice between them will depend on specific use cases, regulatory requirements, and risk preferences.

Fig. 1. Stablecoins vs Tokenized deposts.

Tokenized Deposits vs Deposit Tokens

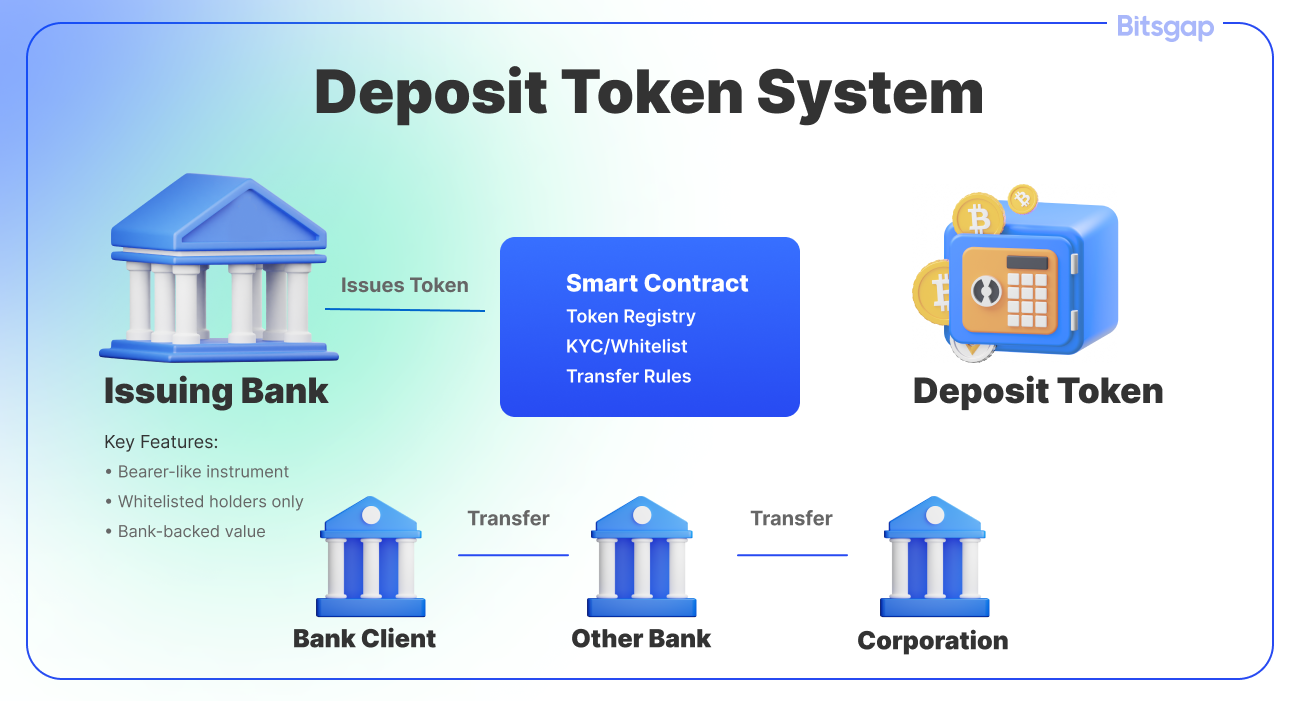

While tokenized deposits and deposit tokens may sound similar, these instruments serve different purposes and operate in fundamentally different ways.

As previously discussed, tokenized deposits represent a more conservative approach, firmly rooted in traditional banking relationships. They are essentially digital versions of conventional bank deposits, operating within the established banking framework. When a client holds a tokenized deposit, they must maintain a direct relationship with their bank, just as they would with a regular deposit account. These deposits operate primarily on private, permissioned blockchains controlled by the issuing banks, with transactions and settlements occurring through existing banking infrastructure.

In contrast, deposit tokens represent a more innovative and flexible approach. They function more like bearer instruments, allowing for broader circulation beyond the traditional banking relationship. The key innovation here is that individuals or entities who aren't direct clients of the issuing bank can potentially hold and transfer these tokens. This opens up new possibilities for financial inclusion and cross-platform functionality, though it also raises important regulatory questions.

The settlement process highlights another crucial difference between these instruments. Tokenized deposits typically rely on traditional interbank settlement systems, often requiring central bank money for final settlement. This maintains the existing hierarchy of the banking system but can limit the speed and flexibility of transactions. Deposit tokens, however, might enable new settlement mechanisms that don't necessarily require traditional central bank settlement, potentially offering more efficient transfer processes.

👉 From a regulatory perspective, tokenized deposits operate within well-established frameworks, subject to existing banking regulations and oversight. They fit neatly into current compliance systems and benefit from regulatory clarity. Deposit tokens, while promising greater flexibility, face more regulatory uncertainty. Questions remain about how ownership should be recorded, what KYC requirements should apply, and how these instruments fit within existing financial regulations.

Looking toward the future, both approaches are likely to influence how digital money evolves. The industry is moving toward unified ledger concepts that might combine elements of both systems. We're seeing increasing focus on programmability and smart contract integration, with both tokenized deposits and deposit tokens exploring ways to incorporate these features while maintaining their distinct characteristics.

The impact on the broader financial system could be significant. These innovations might reshape traditional banking relationships, influence how institutions handle digital assets, and potentially transform cross-border payment systems. They could also affect how monetary policy is transmitted through the financial system, particularly as these instruments become more widely adopted.

For financial institutions, the choice between implementing tokenized deposits or deposit tokens often depends on their strategic objectives:

- Banks focused on serving existing clients within traditional frameworks might prefer tokenized deposits

- Those seeking to innovate and reach new markets might lean toward deposit tokens

- Some may implement both, serving different market segments and use cases

The evolution of these instruments reflects a broader trend in finance: the challenge of balancing innovation with stability, accessibility with security, and efficiency with regulatory compliance.

Conclusion

The evolution of digital money through tokenized deposits, deposit tokens, and stablecoins represents a fascinating transformation in how we think about and use money in the digital age. Throughout this article, we've explored how these innovations are reshaping the financial landscape, each offering unique approaches to bringing traditional banking assets and stable value into the digital realm.

Traditional banking is being revolutionized by these technologies, with tokenized deposits providing a bridge between conventional banking and digital innovation, while deposit tokens push the boundaries further by offering greater flexibility and potential for broader financial inclusion. Meanwhile, stablecoins have emerged as a crucial component of the digital asset ecosystem, offering stability and liquidity in crypto markets through various backing mechanisms, from fiat-backed solutions like USDC and USDT to more complex crypto-collateralized systems.

The contrast between these approaches is particularly illuminating. While tokenized deposits and deposit tokens maintain direct connections to the traditional banking system, stablecoins have carved out their own niche, often operating independently of traditional financial institutions while still maintaining price stability through different collateralization methods. The success and challenges of stablecoins, including the dramatic events like Terra's collapse, have provided valuable lessons about the importance of robust backing mechanisms and transparent governance in digital money systems.

Looking ahead, these innovations could have far-reaching implications for the future of money. We're likely to see increased integration between traditional banking systems and blockchain technology, potentially leading to faster, more efficient financial transactions while maintaining necessary regulatory oversight. The development of these technologies, along with the evolution of stablecoins under frameworks like Europe's MiCAR, could facilitate better cross-border payments, reduce transaction costs, and enable new forms of financial services that we haven't yet imagined.

However, this is just the beginning of the journey. As we navigate this evolving landscape, it's crucial to stay informed about the latest developments in blockchain technology, decentralized finance, and digital assets. The financial world is becoming increasingly interconnected with Web3 technologies, creating new opportunities for both individuals and institutions.

If you're interested in exploring more about how technology is reshaping finance and the digital world, we invite you to browse through other fascinating articles on the Bitsgap blog, including:

- "Web3 and Crypto Trading Bots: How Does Decentralization Affect Automated Trading?"

- "Smart Contract Trading on Decentralized Platforms: A New Stage of Automation?"

- "How Web3 Is Reshaping the Creator Economy"

- "Best Crypto Memes 2024"

- "Web3 Roadmap to the Future of Decentralized Internet"

For those looking to actively participate in the cryptocurrency markets, consider exploring Bitsgap, a comprehensive platform that brings together over 15 centralized exchanges under one roof. Bitsgap offers essential tools for modern crypto trading, including automated trading strategies, smart order types, sophisticated portfolio management, and an AI Assistant to help guide your trading decisions.

Join us in shaping the future of finance—explore more articles on our blog and sign up for 7-day free trial on the PRO plan to trade crypto with advanced tools like never before.