The Only Guide to Order Types You’ll Ever Need

From basic market orders to sophisticated trailing strategies, this is the only guide to crypto order types you'll ever need—whether you're placing your first trade or fine-tuning complex automated systems.

Trading cryptocurrencies effectively requires more than just knowing when to buy and sell—it demands a thorough understanding of different order types and how to use them strategically. Whether you're looking to minimize risks, automate your trading, or execute complex strategies, choosing the right order type can make the difference between a successful trade and a missed opportunity.

Order types are the fundamental building blocks of trading, serving as instructions to exchanges about how you want your trades executed. From basic market orders that execute immediately to sophisticated conditional orders that trigger based on specific market conditions, each order type serves a unique purpose in a trader's toolkit.

In this article, we'll explore the complete spectrum of order types available in cryptocurrency trading. We'll break down their definitions, walk through practical examples, and examine the strategic scenarios where each type shines. By the end, you'll understand how to leverage different order types to enhance your trading precision, manage risks, and potentially improve your trading outcomes.

What Is an Order in Trading?

A crypto order is a set of instructions given to an exchange that specifies how you want to buy or sell a cryptocurrency. Think of it as your formal request to participate in the market under specific conditions that you define. Each crypto order execution follows the parameters you set, whether that's buying Bitcoin immediately at the current price or setting up a conditional purchase that only triggers when certain market conditions are met.

👉 Understanding how orders work is crucial because they're your primary tools for implementing trading strategies and managing risk.

When you place an order, you're essentially telling the exchange three key things:

- The cryptocurrency you want to trade

- Whether you want to buy or sell

- The conditions under which you want the trade to occur

What Are the Types of Crypto Trading Orders?

Trading different types of crypto orders gives you precise control over your market participation. Here are the main categories of crypto order types you'll encounter:

Market Orders

The most straightforward type of crypto order execution, market orders are designed to fill immediately at the best available price. While they guarantee execution, the final price might differ slightly from what you see when placing the order, especially in volatile markets.

Limit Orders

These allow you to set a specific price at which you're willing to buy or sell. Your order will only execute if the market reaches your specified price. Limit orders are essential for traders who want to ensure they don't pay more than their target price when buying or sell for less than their minimum acceptable price.

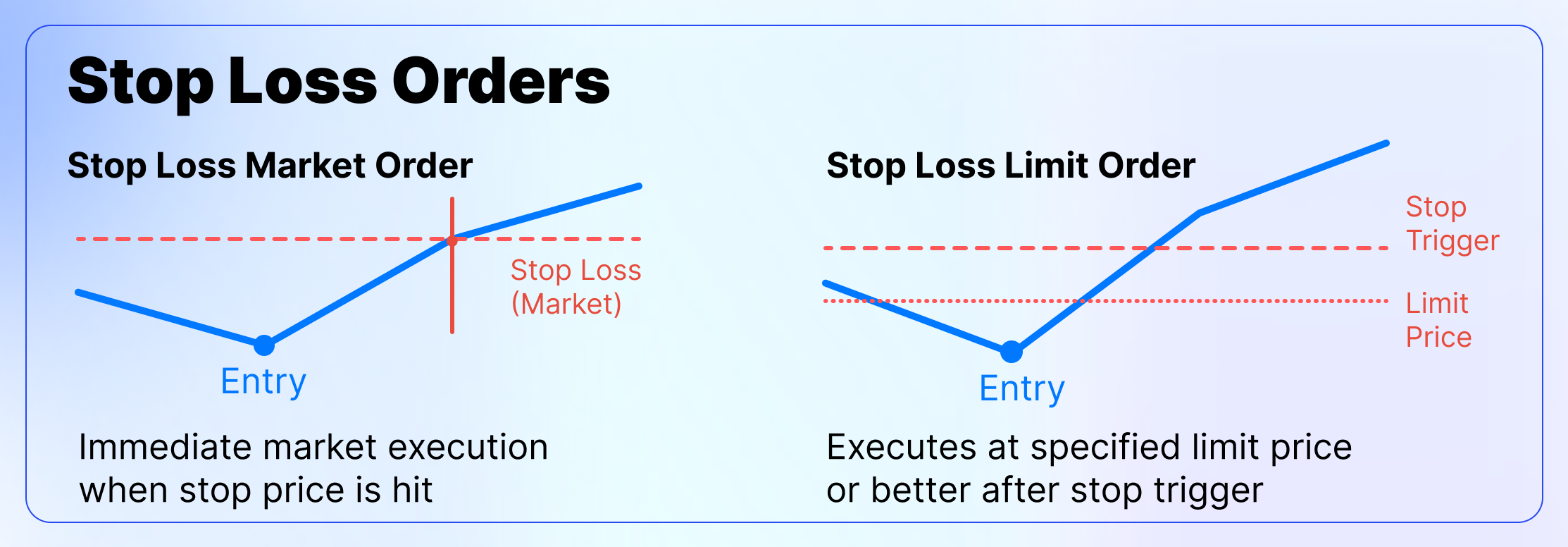

Stop Orders

Also known as stop-loss orders, these are designed to limit your potential losses by automatically triggering a market order when a specific price level is reached. Stop orders crucial for risk management in crypto trading.

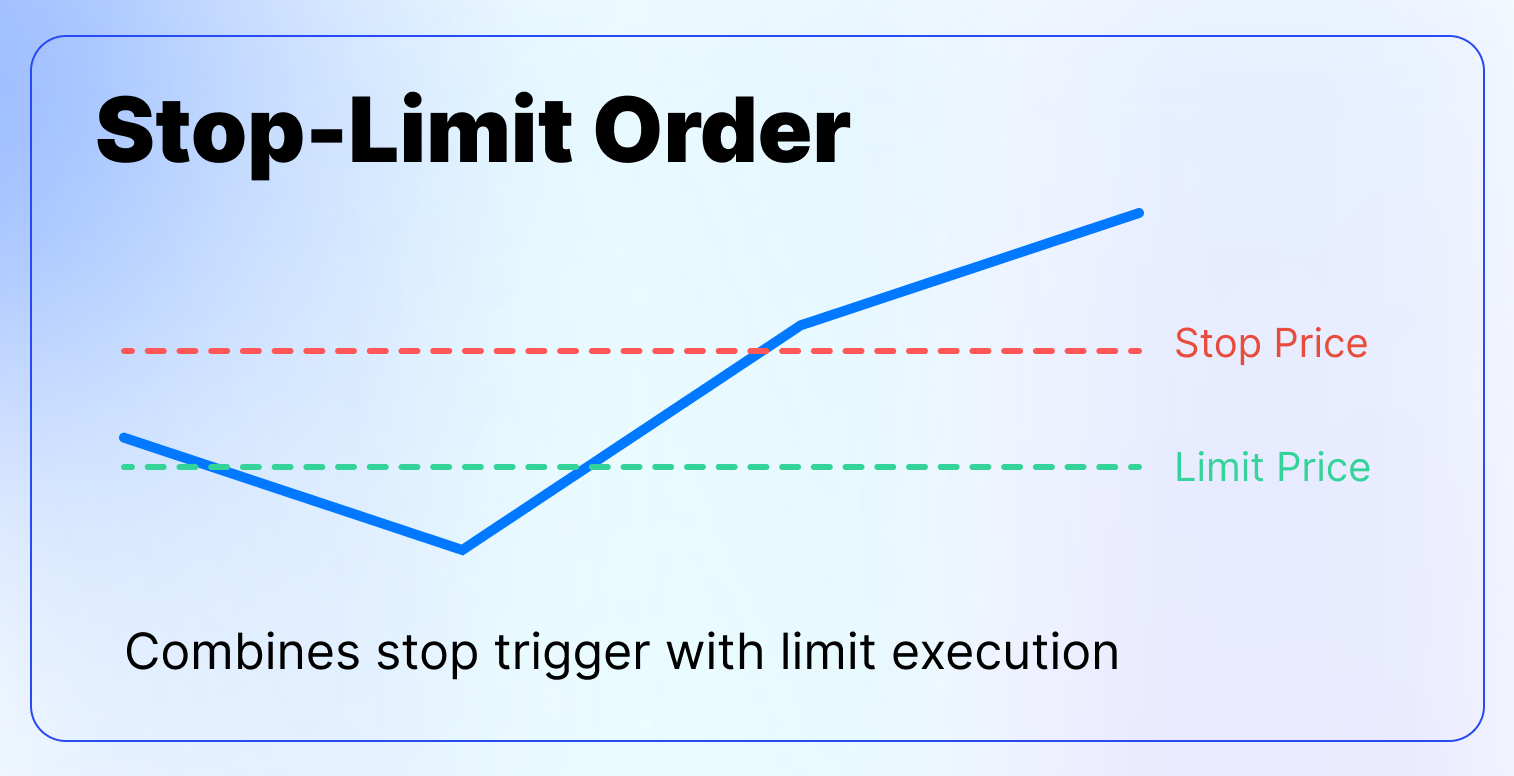

Stop-Limit Orders

Combining features of both stop and limit orders, these orders offer more precise control over your trade execution. They trigger at a specific price (the stop price) but then execute only at your specified limit price or better.

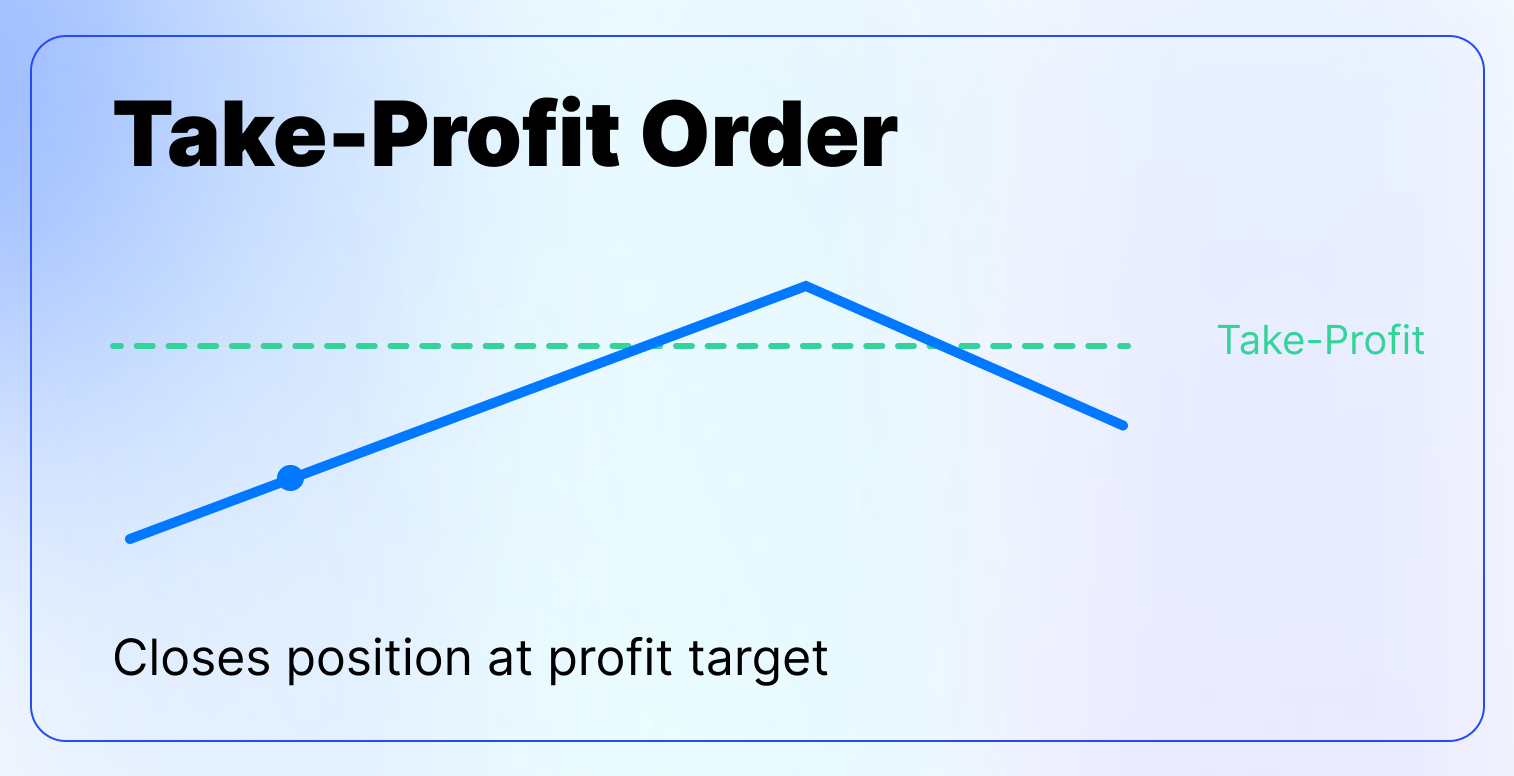

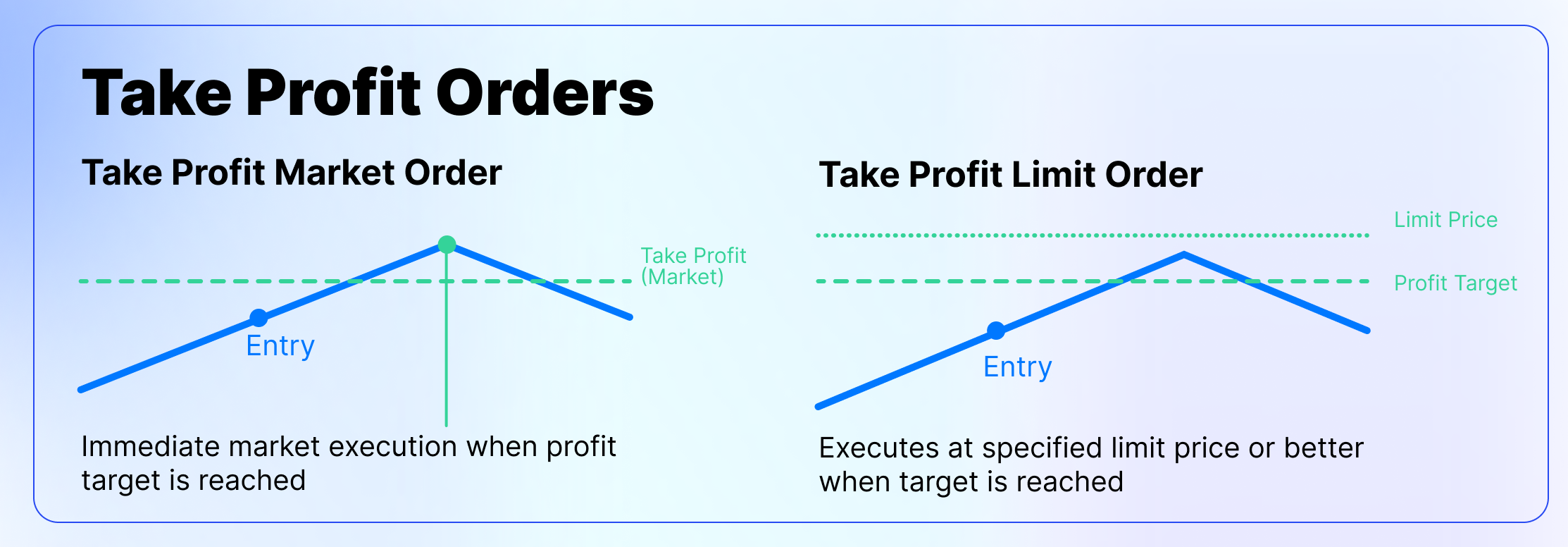

Take-Profit Orders

Take profit orders automatically close your position when the price reaches a predetermined profit target, helping you lock in gains without constantly monitoring the market.

OCO (One-Cancels-Other) Orders

A more sophisticated order type that lets you place two orders simultaneously – when one gets filled, the other automatically cancels. This is particularly useful for setting both stop-loss and take-profit levels at the same time.

Each of these crypto order types serves a specific purpose in your trading strategy, and understanding when to use each one is crucial for effective trading. The key is matching the right order type to your trading objectives, risk tolerance, and market conditions.

Remember that while these are the primary order types, some exchanges may offer additional variations or specialized orders. Always familiarize yourself with the specific features and limitations of the exchange you're using to make the most of their order system.

A Closer Look at Crypto Order Types

Every successful trader needs a thorough understanding of the various order types available at their disposal. While we've briefly covered the main categories above, let's dive deeper into each type of crypto order and explore how they can be used effectively in different trading scenarios.

From the basic market and limit orders that form the foundation of trading to more sophisticated conditional orders, each type serves a specific purpose in your trading toolkit. Let's examine each one in detail, including real-world examples and strategic applications that can help you make more informed trading decisions.

Crypto Market Order

Definition: A market order is an instruction to buy or sell a cryptocurrency immediately at the best available current market price.

Example: If Bitcoin is trading at $42,000, and you place a market buy order for 0.5 BTC, your order will execute immediately at or near $42,000, though the exact price might vary slightly based on available liquidity.

When to Use:

- During periods of low volatility when price slippage is minimal

- When immediate execution is more important than getting a specific price

- If you want to quickly enter or exit a position based on breaking news

- When you're confident about a strong trend and want to enter quickly

- In highly liquid markets where price differences are typically minimal

Crypto Limit Order

Definition: A limit order lets you set a specific price at which you want to buy or sell. The order will only execute if the market reaches your specified price or better.

Example: If Ethereum is trading at $2,500 and you believe it's overvalued, you might set a limit buy order at $2,300. Your order will only execute if ETH drops to $2,300 or lower.

When to Use:

- When you have a specific target price in mind

- In volatile markets where you want price certainty

- For implementing dollar-cost averaging strategies

- When you're not in a rush to execute your trade

- During sideways markets where you want to buy at support or sell at resistance levels

Crypto Stop Limit Order/Crypto Stop Market Order

Definition: A stop limit order combines a stop price (trigger) with a limit price. Once the stop price is reached, it activates a limit order at your specified price. A stop market order, once triggered, executes immediately as a market order.

Example: You buy BTC at $40,000 and set a stop-limit order with a stop price at $38,000 and a limit price at $37,800. If BTC falls to $38,000, a limit order activates, attempting to sell at $37,800 or better.

When to Use:

- When you want more control over your exit price during downward movements

- In liquid markets where you can afford to risk non-execution

- For protecting profits while allowing for some price wiggle room

- When trading volatile assets where precise exit points matter

- During trending markets where you want to ride the trend but protect gains

Crypto Stop Loss Limit/Stop-Loss Market Order

Definition: A stop-loss order automatically closes your position when the price reaches a specified loss level. The limit version allows you to set a minimum acceptable price, while the market version executes immediately once triggered.

Example: You buy Solana at $100 and set a stop-loss market order at $90. If the price falls to $90, your position automatically closes at the best available price.

When to Use:

- As a risk management tool for all positions

- When trading with leverage to prevent liquidation

- During periods of high volatility to protect capital

- When you can't actively monitor your positions

- For emotional discipline in sticking to your risk management plan

Crypto Take Profit Limit/Take-Profit Market Order

Definition: A take-profit order automatically closes your position when the price reaches your profit target. The limit version ensures a minimum profitable price, while the market version executes immediately at the market price.

Example: You buy Cardano at $0.50 and set a take-profit limit order at $0.75. When the price reaches $0.75, your position will close only at $0.75 or better.

When to Use:

- When you have a clear profit target based on technical analysis

- For locking in profits while you're away from the market

- In ranging markets where prices tend to reverse at certain levels

- As part of a broader risk management strategy

- When you want to avoid the temptation of holding too long out of greed

For all these order types, it's crucial to consider:

- Market liquidity

- Volatility levels

- Your overall trading strategy

- Risk tolerance

- Time commitment to monitoring positions

Crypto Fill or Kill (FOK) Order

Definition: A Fill or Kill (FOK) order must be executed immediately and completely filled at the specified price, or it will be automatically canceled. There's no partial filling – it's either all or nothing.

Example: You want to buy exactly 2 BTC at $42,000. If the market can't immediately fill your entire 2 BTC order at that price (perhaps only 1.5 BTC is available), the order is automatically canceled instead of partially filling.

When to Use:

- When you need to buy or sell a specific quantity as a single unit

- In situations where partial fills would disrupt your strategy

- When executing large orders where partial fills could lead to increased costs

- If you're implementing a strategy that requires precise position sizing

- When trading less liquid altcoins where fragmented execution could be disadvantageous

Crypto Good 'til Canceled (gtc) Order

Definition: A Good 'til Canceled order remains active until either it's executed or manually canceled by the trader. Unlike orders that expire at the end of the trading day, GTC orders persist until you decide to remove them.

Example: You set a GTC limit buy order for ETH at $2,200 while it's trading at $2,500. The order remains active for weeks until either ETH drops to your target price or you cancel it manually.

When to Use:

- For long-term price targets that might take time to reach

- When implementing patient entry or exit strategies

- In ranging markets where you want to catch specific price levels

- For dollar-cost averaging strategies over extended periods

- When you want to set and forget orders for extended periods

Crypto Iceberg Order

Definition: An iceberg order is a large order that's split into smaller portions to hide the true order size. Only a small portion is visible to the market at any time, while the rest remains "underwater."

Example: You want to sell 100 BTC but don't want to spook the market. You create an iceberg order that displays only 5 BTC at a time. As each 5 BTC portion is filled, another automatically becomes visible.

When to Use:

- When trading large positions that might move the market

- To minimize price impact on significant orders

- When you want to accumulate or distribute large positions discreetly

- In markets where showing your full position might disadvantage you

- For institutional-size trades that need to be executed carefully

Crypto Bracket Order

Definition: A bracket order is a combination of orders that includes an initial entry order along with two exit orders: a take-profit order and a stop-loss order. Once the entry order fills, both exit orders are automatically activated.

Example: You set a bracket order to:

- Buy BTC at $41,000 (entry)

- Set a take-profit at $43,000 (profit target)

- Place a stop-loss at $40,000 (risk management) Once your entry order fills, both exit orders are automatically placed.

When to Use:

- When you want to automate your entire trade management

- For implementing a structured risk management strategy

- When you can't actively monitor your positions

- In volatile markets where quick reactions are necessary

- For maintaining emotional discipline by pre-setting exits

- When trading multiple positions simultaneously

- For swing trading strategies where you want to define risk/reward upfront

Crypto OCO Order

An OCO order combines two orders where the execution of one automatically cancels the other. It allows you to place two conditional orders simultaneously, typically with different price targets, and when one is triggered, the other is automatically canceled.

Example: You buy ETH at $2,400 and set an OCO order with:

- A take-profit order at $2,800

- A stop-loss order at $2,200 If either price is reached, that order executes and the other is automatically canceled.

When to Use:

- When you want to set both profit targets and stop losses simultaneously

- In volatile markets where price could move significantly in either direction

- For breakout trading strategies where you're unsure of direction

- When you want to secure profits while maintaining downside protection

- For swing trading where you need automated exit management

- During periods when you can't actively monitor the market

Crypto TWAP Order

Definition: A TWAP order automatically breaks down a large order into smaller pieces and executes them at regular time intervals over a specified period. The goal is to achieve an average execution price close to the time-weighted average price of the asset.

Example: You need to buy 100 BTC but want to spread the purchase over 4 hours. A TWAP order might split this into 24 orders (one every 10 minutes) of roughly 4.17 BTC each, helping to average out the price and reduce market impact.

When to Use:

- When executing large orders that could impact market price

- For institutional-grade trading requiring price averaging

- When you want to minimize slippage on significant positions

- In markets where liquidity varies throughout the day

- For implementing systematic trading strategies

- When you need to report execution prices relative to TWAP benchmarks

- For accumulating positions over time with minimal market impact

Crypto Scaled Order

Definition: A scaled order automatically splits your order into multiple smaller orders at different price levels. It can be scaled in (buying more as price drops or selling more as price rises) or scaled out (gradually taking profits or cutting losses).

Example: You want to invest $100,000 in BTC with a scaled-in approach:

- 25% at $42,000

- 25% at $41,500

- 25% at $41,000

- 25% at $40,500

Or for selling:

- 20% at $43,000

- 30% at $44,000

- 50% at $45,000

When to Use:

- For implementing dollar-cost averaging strategies

- When accumulating positions in volatile markets

- For taking profits systematically as price rises

- During trending markets to build or exit positions gradually

- When you want to automate a pyramiding strategy

- In ranging markets where you want to buy dips or sell rallies

- For reducing emotional decision-making in position management

Trailing Orders

Trailing order types automatically adjust based on market price movements, helping traders lock in profits or limit losses while allowing positions to run in favorable directions. Let's examine each type in detail:

Trailing Stop Limit/Trailing Stop Market

Definition: A trailing stop order follows the price at a fixed distance or percentage when the market moves in your favor, but stays fixed when the market moves against you. The 'limit' version allows you to set a specific execution price range, while the 'market' version executes immediately when triggered.

Example: You buy BTC at $42,000 and set a trailing stop at 5% ($2,100):

- If BTC rises to $45,000, your stop moves up to $42,750 (5% below)

- If BTC reaches $47,000, your stop adjusts to $44,650

- If BTC then falls to $44,650, your order triggers

- With a limit version, you might set the limit price 1% below the trigger price

- With a market version, it executes at best available price when triggered

When to Use:

- During strong uptrends to maximize profits

- When you want to let profits run while protecting gains

- In volatile markets where you need dynamic risk management

- For longer-term positions where you want automated profit protection

- When you're unsure about the exact exit point but want to protect profits

Trailing Stop Loss

Definition: Similar to a regular trailing stop, but specifically designed to prevent losses while allowing for maximum upside. It follows the price upward and maintains a fixed distance or percentage below the highest price reached.

Example: You buy ETH at $2,400 with a 10% trailing stop loss:

- As ETH rises to $2,800, your stop loss moves up to $2,520

- If ETH reaches $3,000, your stop loss adjusts to $2,700

- If ETH drops to $2,700, your position closes automatically

- The position closes at market price, protecting you from further losses

When to Use:

- As a core risk management tool for any position

- When trading volatile assets where price can reverse quickly

- For swing trading where you want to protect unrealized gains

- During strong trends where you want to maximize potential upside

- When you can't actively monitor your positions

- For automated portfolio protection

Trailing Take Profit

Definition: A trailing take profit order follows the price as it moves against your position by a fixed amount or percentage, allowing you to potentially capture more profit if the price continues moving favorably before reversal.

Example: You short SOL at $100 with a 7% trailing take profit:

- If SOL drops to $90, your take profit level sets at $96.30

- If SOL continues to $85, your take profit adjusts to $91

- If SOL then rises to $91, your position closes with profit

- The trailing mechanism helps capture maximum downside movement

When to Use:

- In trending markets where you expect price continuation

- When you want to maximize profit potential while ensuring gains

- For volatile assets where price movements are substantial

- In momentum-driven markets

- When you want to automate profit-taking without fixed targets

- For day trading strategies where capturing maximum moves is crucial

Key Considerations for All Trailing Orders:

- Parameter Setting:

- Distance/percentage should reflect market volatility

- Too tight: frequent premature exits

- Too wide: potentially giving back too much profit

- Market Conditions:

- Works best in trending markets

- May trigger frequently in choppy markets

- Consider liquidity for optimal execution

- Technical Aspects:

- Requires stable platform connection

- Some exchanges may update trailing points at different intervals

- Consider exchange processing time for adjustments

- Strategic Implementation:

- Can be combined with other order types

- Consider using multiple trailing orders at different distances

- Factor in trading fees when setting trailing distances

- Risk Management:

- Always test with smaller positions first

- Understand how orders behave during extreme volatility

- Have backup plans for technical failures

Comparative Table of Crypto Order Types & Other Considerations

Here's a comprehensive comparison table of all discussed crypto order types:

Fig. 1. Comparative table of order types.

Key Decision Factors When Choosing Order Types

Selecting the right order type is crucial for trading success. Here's a detailed breakdown of the key factors to consider:

Market Conditions

The cryptocurrency market's dynamic nature demands a nuanced understanding of how different market conditions influence your trading decisions. Your choice of order type can mean the difference between a successful trade and a missed opportunity or unnecessary loss. Every market condition presents its own challenges and opportunities, requiring traders to adapt their order strategies accordingly.

👉 The interplay between volatility, liquidity, and trend strength creates unique trading environments that demand specific approaches to order execution.

Understanding these relationships helps you select the most appropriate order type for any given market situation, ultimately improving your trading effectiveness and risk management. Let's examine how each of these market conditions impacts your order selection strategy, starting with one of the most critical factors: volatility.

Volatility Level

The market's volatility significantly influences your order choice, acting as a primary factor in determining how and when to execute trades. In cryptocurrency markets, volatility levels can shift dramatically within minutes, transforming a relatively calm market into a turbulent environment where prices swing wildly and execution becomes challenging.

During periods of high volatility, when Bitcoin might move thousands of dollars within hours or even minutes, market orders become particularly risky. What you see as an entry price might differ substantially from your actual execution price, a phenomenon known as slippage. For instance, attempting to buy Bitcoin at $40,000 during high volatility might result in an actual purchase at $40,500 or higher, immediately putting your trade at a disadvantage.

This increased volatility also affects stop-limit orders differently than stop-market orders. While a stop-limit order provides price protection, it risks not executing at all if the market gaps through your limit price. Imagine setting a stop-limit sell order with a stop at $39,000 and a limit at $38,900—in highly volatile conditions, the price might gap down to $38,500, leaving your order unfilled and your position exposed to further losses.

Conversely, in periods of low volatility, when price movements are more predictable and spreads are tighter, limit orders become more reliable tools. You can place orders closer to the current market price with higher confidence of execution. Trailing stops can be set tighter, allowing you to protect profits more effectively without getting stopped out by normal market noise.

👉 The impact of volatility extends to position sizing and order structuring as well. High volatility periods often require smaller position sizes and wider stops to accommodate larger price swings. A stop-loss that might typically be set 2% away in calm markets might need to be 4-5% away during volatile periods to avoid premature execution.

Traders must also consider the timing of their orders during volatile periods. Large orders might need to be broken down into smaller chunks using tools like TWAP (Time-Weighted Average Price) orders or iceberg orders to minimize market impact and achieve better average execution prices. This becomes particularly crucial when volatility coincides with lower liquidity, as often happens during major market events or news releases.

For systematic traders and investors building positions, volatility levels should influence their scaling strategies. In low volatility environments, positions can be built with tighter price increments between orders. However, during high volatility, these increments should be widened to account for larger price swings, potentially using a combination of limit orders at various price levels to catch sharp moves in either direction.

Understanding and adapting to market volatility is fundamental to successful trading. It requires constant monitoring and adjustment of your order strategies to match current market conditions, ensuring your execution aligns with your trading objectives while maintaining appropriate risk management.

Below is the summary of the above, along with relevant examples for easy reference:

- High Volatility Markets: During periods of high volatility, such as major market news or crypto events:

Market Orders and Slippage:

- Example: If BTC is showing $40,000 but moving $500 every minute, your market buy might execute at $40,500 or higher

- Risk: The higher the volatility, the larger the potential slippage

- Solution: Break larger orders into smaller chunks or use limit orders when possible

Stop Limit Execution Risks:

- Scenario: Setting a stop-limit sell at $39,000 with a limit at $38,900

- Problem: Price might gap down to $38,800, skipping your limit price entirely

- Result: Order remains unfilled while price continues falling

- Mitigation: Consider using stop-market orders for critical exits

Trailing Stop Considerations:

- Traditional Setting: 2% trailing stop might be too tight

- Volatile Adjustment: Consider 4-5% or higher depending on average price swings

- Example: A $40,000 BTC price with 5% trailing stop sets initial stop at $38,000

- Benefit: Reduces premature stopouts while maintaining protection

Bracket Order Strategy:

- Implementation: Set wider stops and take-profit levels

- Example: Instead of 3% stops, use 5-7% in volatile conditions

- Protection: Combines stop-loss and take-profit in one order

- Advantage: Automated risk management in fast-moving markets

- Low Volatility Markets

Limit Order Reliability:

- Precision: Prices move more predictably

- Example: Setting buy limits at $39,950 when BTC trades at $40,000

- Success Rate: Higher fill probability due to smaller price movements

- Strategy: Can set tighter limit prices to capture small movements

Tighter Trailing Stops:

- Setting: Can use 1-2% trailing stops effectively

- Example: $40,000 BTC with 1.5% trail = $39,400 initial stop

- Benefit: Captures more profit in smaller moves

- Risk Management: Less likely to be stopped out by normal market noise

TWAP Execution:

- Timing: More predictable execution prices

- Example: Buying $100,000 worth of BTC over 4 hours

- Result: More consistent average price

- Advantage: Reduced impact on market price

Scaled Order Benefits:

- Implementation: Can use tighter price intervals

- Example: Building a position with 4 orders, each 0.5% apart

- Effectiveness: Higher likelihood of all orders filling

- Strategy: Better for systematic position building

Liquidity Availability

Market liquidity fundamentally shapes how orders behave and execute in cryptocurrency markets, directly influencing both the choice of order type and execution strategy. Unlike traditional markets, crypto liquidity can vary dramatically across exchanges and time zones, creating unique challenges and opportunities for traders.

👉 Understanding order book depth becomes crucial in assessing liquidity. For instance, while Bitcoin might show a price of $40,000, the available liquidity might only support a few hundred thousand dollars worth of trades near that price before causing significant slippage. This "real" liquidity often differs substantially from what surface-level volume figures suggest.

In highly liquid market conditions, typically seen in major trading pairs like BTC/USD during peak hours: Market orders become more reliable and predictable. A $100,000 BTC purchase might only move the price by 0.1% or less, making immediate execution more viable. Spreads remain tight, often just a few basis points, allowing for more precise entry and exit points. Large positions can be built or unwound without significant market impact, and standard limit orders become highly effective tools for price improvement.

However, in less liquid conditions, such as during Asian trading hours or with smaller altcoins: Simple market orders can become dangerous, potentially causing price slippage of several percent. A $50,000 market buy that might barely move BTC could cause a 5-10% price spike in a less liquid altcoin. This scenario demands more sophisticated order types and execution strategies.

The implications for order selection become particularly important:

- For Large Orders:

Iceberg orders become essential tools, allowing traders to hide the true size of their positions while gradually executing in chunks. Without this approach, showing a large order in an illiquid market can cause other traders to front-run the position or move the market adversely. A trader looking to buy $1 million worth of crypto might show only $10,000-$20,000 at a time to maintain price stability.

TWAP strategies gain importance, spreading large orders over time to minimize market impact. For example, a significant position might be built over several hours or even days, with algorithms tracking volume patterns to optimize execution timing.

- For Regular Trading:

Fill-or-Kill (FOK) orders become more relevant in less liquid markets, ensuring that partial fills don't leave traders with suboptimal position sizes. A trader needing exactly 1 BTC might prefer their order to cancel entirely rather than fill only 0.7 BTC if full size isn't available at their desired price.

Limit orders take precedence over market orders, as they provide price protection in environments where the next available price might be significantly different from the last traded price. Smart traders often place limits slightly away from the current market to capture price improvements during liquidity gaps.

Time of day considerations become crucial for liquidity analysis: Peak trading hours typically offer the best liquidity, allowing for larger orders and more aggressive execution strategies. Off-peak hours require more patience and often wider spreads between bid and ask prices, necessitating different order types and execution approaches.

Cross-exchange liquidity also plays a vital role: Major exchanges might show different prices during low liquidity periods, creating arbitrage opportunities but also execution risks. Traders need to consider not just the liquidity on their chosen exchange but also the broader market liquidity landscape.

Risk management adaptation becomes essential: Position sizes need to be adjusted based on available liquidity. A position that might be easy to exit in liquid conditions could become trapped in less liquid markets. Stop losses might need to be set wider in less liquid conditions to account for larger spreads and potential slippage during execution.

Current Trend Strength

Trend strength plays a pivotal role in order selection and execution strategy, as the market's directional momentum significantly impacts how different order types perform. Understanding and adapting to trend conditions can mean the difference between capturing profitable moves and getting caught in false breakouts or reversals.

Strong Trending Markets

In strongly trending markets, whether bullish or bearish, order execution requires a different approach than ranging markets. When Bitcoin shows clear directional movement, such as during a bull run from $35,000 to $45,000 over several days, certain order types become particularly effective.

Trailing stops become powerful tools in these conditions. Instead of fixed stop-losses, traders can use trailing stops to protect profits while letting winners run. For example, in a strong uptrend, a 5% trailing stop would continuously move up with the price, allowing traders to capture the majority of the trend while automatically protecting gains. If Bitcoin rises from $40,000 to $45,000, the trailing stop would move from $38,000 to $42,750, ensuring profitable exits even if the trend eventually reverses.

Scaled entries also work well in strong trends, particularly during pullbacks. Rather than trying to pick a perfect entry point, traders can build positions gradually:

- A primary position during the initial trend confirmation

- Adding during shallow retracements

- Final portions on momentum continuation

For instance, during a strong uptrend, a trader might:

- Enter 40% of their position on the trend break

- Add 30% on the first pullback to support

- Complete the position with 30% on trend continuation

Break-Even Stop Management:

Once a trend develops and shows profit, break-even stop adjustments become crucial. A trade entered at $40,000 with an initial stop at $38,000 might have its stop raised to the entry price after reaching a 2R profit ($44,000). This ensures that even if the trend reverses, the trade won't result in a loss.

Ranging/Sideways Markets

When markets lack strong directional movement, different order types take precedence. In these conditions, where price oscillates between support and resistance levels, OCO (One-Cancels-Other) orders become particularly valuable.

For example, if Bitcoin is ranging between $39,000 and $41,000:

- Traders can set buy orders near support with two exit scenarios

- A take-profit order at resistance

- A stop-loss below support

- Whichever triggers first cancels the other

Limit orders at support and resistance levels become more reliable in ranging markets. Unlike trending conditions where price might break through levels with momentum, ranging markets tend to respect these boundaries more consistently. A trader might place:

- Buy limits near $39,000 (support)

- Sell limits near $41,000 (resistance)

- Multiple orders at slight increments around these levels

Bracket Order Application:

Bracket orders work differently in trending versus ranging markets:

In Trends:

Consider a strong Bitcoin uptrend: setting stops too tight might result in premature exits during healthy pullbacks that are characteristic of even the strongest trends. A bracket order in this environment might set the stop-loss 5-7% below entry, rather than the typical 2-3% used in more stable conditions. The take-profit levels similarly need adjustment, often extending further to capture the trending momentum. Rather than targeting a fixed 2:1 reward-to-risk ratio, traders might set multiple take-profit levels - perhaps closing 30% of the position at 2:1, another 30% at 3:1, and leaving the remainder to ride the trend with a trailing stop.

This flexible approach in trending markets allows for maximum profit capture while still maintaining risk management principles. For instance, if you enter Bitcoin at $40,000 during an uptrend, your bracket order might include:

- Initial stop at $38,000 (5% buffer)

- First take-profit at $44,000 (30% of position)

- Second take-profit at $46,000 (30% of position)

- Trailing stop on remaining 40% starting at $42,000

In Ranges:

Ranging markets demand a more conservative bracket order structure. When Bitcoin oscillates between clear support and resistance levels, bracket orders should be configured to capitalize on these predictable boundaries. The stops can be tighter as price movement is more contained, often sitting just beyond the established range limits. Take-profit orders are precisely placed at known resistance levels, and positions are typically closed in full when targets are hit, as the probability of continued movement beyond range boundaries is lower.

For example, in a range-bound market where Bitcoin moves between $39,000 and $41,000, a bracket order for a long position might look like:

- Entry at $39,200 (near support)

- Stop-loss at $38,800 (just below range)

- Take-profit at $40,800 (near resistance)

- Full position exit on target hit

This more rigid structure in ranging markets helps maintain discipline and prevents the common mistake of holding positions too long in hopes of a breakout. The key is recognizing that ranging markets require a different profit expectation and risk management approach than trending conditions.

The success of bracket orders in either market condition relies heavily on accurate market assessment and appropriate parameter setting. Regular monitoring and adjustment of these parameters ensure the bracket order structure remains aligned with current market conditions and trading objectives.

Trading Goals

In this section, we'll explore how your trading goals influence order selection across three critical dimensions: time sensitivity—how quickly you need to execute; price sensitivity—how important achieving a specific price point is; and position size—how the scale of your trade affects your execution strategy. Each of these factors plays a vital role in determining the most effective approach to entering and exiting positions in the cryptocurrency market.

Time Sensitivity

The urgency of trade execution fundamentally shapes your order selection strategy. Time sensitivity in crypto trading represents a critical balance between optimal price execution and the necessity of entering or exiting positions within specific timeframes.

High-Time Sensitivity Scenarios

When immediate execution becomes paramount, trading strategies must adapt to prioritize speed over perfect price execution. Consider a situation where Bitcoin breaks a major technical level with strong volume—waiting for the perfect entry price might mean missing the move entirely.

In breaking news scenarios, such as regulatory announcements or major market developments, the need for quick execution often outweighs price considerations. For instance, if a major country announces crypto-friendly regulations, the market might move thousands of dollars in minutes. Here, a market order, despite potential slippage, might be more advantageous than waiting for a limit order to fill.

Technical breakouts present another time-sensitive scenario. When Bitcoin breaks above a long-term resistance level, traders often need to act quickly to capture the momentum. A trader waiting for a pullback to enter might watch the market continue higher without providing an entry opportunity.

For these scenarios, the order execution hierarchy typically follows:

- Market orders for immediate entry or exit

- Stop market orders for breakout confirmation

- Fill-or-Kill orders when specific size is crucial

Risk management in high-time-sensitivity situations often means accepting wider spreads and potential slippage as a cost of necessary quick execution. However, this doesn't mean abandoning price consciousness entirely. Consider breaking larger orders into several quick pieces rather than one large market order, potentially reducing overall slippage while maintaining execution speed.

Low Time Sensitivity Scenarios

When time pressure diminishes, traders can implement more sophisticated and price-sensitive strategies. Long-term position building, for example, benefits from patient execution and strategic order placement.

Consider a fund implementing a monthly Bitcoin accumulation strategy. With no immediate execution pressure, they can utilize:

- Limit orders at key technical levels

- Time-sliced orders across trading sessions

- Scaled entries during market dips

Good-til-Canceled (GTC) orders become particularly valuable in these scenarios, allowing traders to set and forget orders at desired levels without constant monitoring. For instance, a trader might place multiple GTC buy orders below the market, ready to catch any significant dips while focusing on other opportunities.

The luxury of time allows for more sophisticated average price optimization. Rather than accepting market prices, traders can:

- Use TWAP orders to spread execution across time periods

- Implement iceberg orders for larger positions

- Set multiple limit orders at different price points

Price Sensitivity

The importance of achieving specific price points fundamentally shapes your order execution strategy. In cryptocurrency markets, where prices can move significantly in short periods, understanding when and how to prioritize price precision over other factors becomes crucial for trading success.

High Price Sensitivity Scenarios

When precise execution prices become critical, such as trading near key technical levels or managing tight profit margins, your order strategy must prioritize price over speed. Consider a trader identifying a key resistance level at $40,000 for Bitcoin – even a $100 difference in entry price could significantly impact the trade's risk-reward ratio.

Limit orders become essential tools in these situations. Rather than accepting market prices, traders can:

- Set exact execution prices

- Maintain discipline in entry and exit points

- Avoid paying the spread in volatile conditions

For larger positions requiring price precision, TWAP (Time-Weighted Average Price) orders prove particularly valuable. A fund looking to acquire $10 million worth of Bitcoin might structure their buying to achieve a price close to the day's average, reducing the impact of short-term price swings. This methodical approach helps:

- Minimize market impact

- Achieve better average entry prices

- Reduce the risk of significantly moving the market

Iceberg orders serve a crucial role when price sensitivity meets large position sizes. By showing only a small portion of a large order, traders can:

- Prevent other market participants from front-running

- Maintain price stability during accumulation

- Execute large orders without telegraphing their intentions

Lower Price Sensitivity Scenarios

When immediate execution takes precedence over exact price points, such as during strong trend moves or breaking news, different order types become more appropriate. Market orders, despite potential slippage, might be justified when:

- Capturing a decisive market move

- Executing emergency risk management

- Taking advantage of sudden opportunities

Stop market orders prioritize position protection over exact exit prices. A trader might use these when:

- Protecting profits in a volatile market

- Implementing risk management strategies

- Needing guaranteed execution during market stress

Trailing stops offer a balance between price sensitivity and trend following. They allow traders to:

- Protect profits automatically

- Stay in trending moves longer

- Adjust protection levels dynamically with price movement

Position Size

Position size dramatically influences how orders behave in the cryptocurrency market, often determining not just which order types to use, but how to structure and sequence them. From small retail trades to large institutional positions, the size of your trade fundamentally shapes your execution approach.

Large Positions

Managing large positions requires sophisticated execution strategies to avoid significant market impact. Imagine trying to buy $5 million worth of Bitcoin in a market where the average hourly volume might be $20 million – careless execution could move the market substantially against you.

Iceberg orders become essential tools for large position building. Rather than showing your full intention to the market, you might:

- Display only 1-2% of total position size

- Automatically replenish visible orders after fills

- Adjust visible size based on market reaction

For example, when building a 100 BTC position, you might:

- Show only 2 BTC orders at a time

- Replenish automatically after each fill

- Monitor price impact and adjust if necessary

- Vary visible size based on available liquidity

TWAP strategies help distribute large orders over time, reducing market impact. A $10 million position might be built over several hours or even days:

- Divide the total size into smaller time-weighted chunks

- Execute systematically during optimal liquidity windows

- Adjust execution speed based on market conditions

- Monitor and adapt to changing volume patterns

Position Scaling Strategies

For substantial positions, scaled entry and exit strategies become crucial:

- Break the total position into multiple tranches

- Use different price levels for each portion

- Vary size based on market conditions and technical levels

Real-world implementation might look like:

- 20% at market for initial position

- 30% on first minor pullback

- 30% at key support levels

- 20% held for significant dips

Smaller Positions

Smaller positions offer more flexibility in execution, allowing for:

- Direct market orders when needed

- Single-level limit orders

- Straightforward stop-loss implementation

However, this doesn't mean overlooking execution quality. Even with smaller sizes, traders should consider:

- Spread costs relative to position size

- Timing of entries and exits

- Fee impact on overall profitability

Risk Management

When executing trades in the volatile cryptocurrency market, robust risk management becomes the cornerstone of sustainable trading. Your approach to risk management fundamentally determines which order types to use and how to structure them effectively.

Maximum Acceptable Loss

The concept of maximum acceptable loss forms the foundation of risk management, establishing clear boundaries for every trade. This isn't just about setting stop-losses; it's about comprehensively understanding and limiting potential downside.

Position-Level Risk Management: When entering a trade, your maximum acceptable loss should:

- Define exact dollar or percentage risk per trade

- Consider total portfolio exposure

- Account for market volatility

- Set appropriate position sizing

For example, with a $100,000 trading account:

- Maximum 1% risk per trade = $1,000 risk tolerance

- In Bitcoin trading at $40,000:

- If using a $1,000 stop, position size = 2.5 BTC

- If market is highly volatile, reduce position size

- Consider scaling in to reduce entry risk

Implementation Strategies:

Hard Stop-Loss Orders: These represent your non-negotiable exit points. Unlike mental stops, hard stops provide automated protection, crucial when:

- Trading multiple positions

- Operating in volatile markets

- Managing emotional discipline

- Dealing with platform or internet issues

Bracket Orders: Combining entry, stop-loss, and take-profit levels in a single order provides comprehensive trade management. This approach:

- Ensures stops are placed immediately upon entry

- Removes emotional decision-making

- Maintains consistent risk-reward ratios

- Automates both protection and profit-taking

OCO (One-Cancels-Other) Orders: Particularly valuable for risk management as they allow:

- Simultaneous stop-loss and take-profit orders

- Automatic cancellation of remaining order when one triggers

- Clear definition of risk and reward parameters

Practical Risk Management Examples

Consider a Bitcoin trade with the following parameters:

- Entry at $40,000

- Maximum acceptable loss of $1,000

- Target profit of $3,000

- Account size $100,000

Order Structure:

- Initial Entry Phase:

- Split entry into two parts

- 50% at market around $40,000

- 50% limit order at $39,800

- Protection Setup:

- Hard stop at $39,000 (2.5% below entry)

- Trailing stop activated after $41,000

- Break-even stop after $42,000

- Profit Management:

- First target: 30% at $41,500

- Second target: 40% at $42,500

- Final 30% with trailing stop

This structure ensures:

- Defined maximum loss

- Opportunity for better average entry

- Progressive profit protection

- Potential for capturing extended moves

Profit Targets

Your approach to profit targets can significantly impact overall trading success, requiring a careful balance between capturing gains and maximizing market opportunities. Understanding when to use fixed versus flexible profit targets becomes crucial in volatile crypto markets.

Fixed Profit Goals

Fixed profit targets provide clear, predefined exit points for trades, removing emotional decision-making from the equation. This structured approach becomes particularly valuable in ranging markets or when trading specific technical setups.

Take Profit Limits: When implementing fixed targets, consider multiple factors:

- Technical resistance levels

- Risk-reward ratios

- Historical price reaction points

- Volume profile nodes

For example, in a Bitcoin trade entered at $40,000: First Target: $41,000 (1:1 risk-reward)

- Exit 40% of position

- Move stop to break-even

- Lock in initial profits

Second Target: $42,000 (2:1 risk-reward)

- Exit another 40%

- Tighten stops on remainder

- Secure substantial gain

Final Target: $43,000 (3:1 risk-reward)

- Exit remaining 20%

- Complete trade cycle

- Maximize probable gains

Bracket Order Implementation: These orders excel at executing fixed profit strategies by:

- Setting all exits upon entry

- Maintaining trading discipline

- Removing emotional interference

- Ensuring systematic profit taking

Example Structure: Entry: Long Bitcoin at $40,000

- Stop-loss: $39,000 (-2.5%)

- Target 1: $41,000 (+2.5%)

- Target 2: $42,000 (+5%)

- Target 3: $43,000 (+7.5%)

Flexible Profit Taking

Markets don't always respect fixed levels, and trending conditions often require more dynamic approaches to profit taking. Flexible strategies allow traders to adapt to market conditions and potentially capture larger moves.

Trailing Take Profits: These dynamic exits adjust with price movement, particularly valuable in strong trends. Consider:

- Initial trailing distance (often wider)

- Adjustment criteria

- Profit lock-in levels

Example Implementation: Starting Position: Long Bitcoin at $40,000

- Initial trail: 5% below highs

- Tighten to 3% after 10% profit

- Final trail 2% after 15% profit

This might play out as:

- Price reaches $44,000 (+10%)

- Trail tightens to 3% ($42,680 stop)

- Price hits $46,000 (+15%)

- Final 2% trail ($45,080 stop)

Scaled Exit Strategy: This approach combines elements of both fixed and flexible profit-taking:

- Multiple exit levels

- Percentage-based scaling

- Technical level integration

Progressive Exit Example: Entry at $40,000:

- 25% at +5% ($42,000)

- 25% at +10% ($44,000)

- 25% at +15% ($46,000)

- Final 25% with trailing stop

Automation Needs

The complexity of cryptocurrency markets, combined with their 24/7 nature, makes automation a crucial consideration in order execution strategy. Understanding when and how to implement automated trading solutions can significantly impact trading success and operational efficiency.

Fully Automated Requirements

At its core, trading automation aims to remove emotional decision-making and ensure consistent strategy execution. Consider a typical scenario: you've identified a promising Bitcoin setup, but it might trigger while you're sleeping, or the exit conditions could emerge during a meeting. This is where comprehensive automation becomes invaluable.

Bracket order automation forms the foundation of most automated trading systems. Rather than manually managing each aspect of a trade, a well-structured bracket order handles the entire lifecycle automatically. For instance, if you're trading Bitcoin with a specific strategy, your automated system might manage a complete trade sequence: entering at predetermined levels, adjusting stops as the position moves into profit, and executing exits according to your predetermined rules.

A practical example might look like this: You set up an automated trade to buy Bitcoin at $40,000. The system calculates position size based on your risk parameters – say, 1% of your trading capital. Once triggered, it immediately places protective stops and take-profit orders. As the position moves in your favor, the system automatically adjusts these levels. If Bitcoin rises 2%, it might move your stop to break-even. At 5% profit, it could start implementing a trailing stop mechanism.

The sophistication of trailing stop automation particularly demonstrates the power of automated trading. Instead of manually tracking price movements and adjusting stops, your system continuously monitors price action and updates protection levels in real-time. This becomes especially crucial in volatile crypto markets where prices can move significantly in minutes. Your trailing stop might start at 5% during the initial position phase, automatically tighten to 3% after capturing some profit, and further adjust to 2% as the position becomes more profitable.

Risk management automation represents another critical component. Your system must constantly monitor position sizes, account balance, and overall exposure. For example, if you're running multiple correlated crypto positions, the system should understand these relationships and adjust position sizes accordingly. It should prevent overexposure to similar assets and maintain your predetermined risk parameters across your entire portfolio.

The technical infrastructure supporting these automated systems requires careful consideration. Reliability becomes paramount – a system failure during a crucial market move could be costly. This necessitates:

Robust server architecture with redundant connections, ensuring continuous operation even if primary systems fail. Think of it as having multiple backup generators for your house – you never want to lose power at a critical moment.

Comprehensive error handling protocols that can manage unexpected situations. What happens if an exchange becomes unreachable? How does the system handle partial fills or rejected orders? These scenarios must be thoroughly planned for and tested.

Regular system checks become essential, much like maintenance on a high-performance vehicle. Your automation system should constantly verify positions, confirm order statuses, and ensure all risk parameters remain within acceptable bounds.

The integration of market condition monitoring adds another layer of sophistication. Your system should understand when market conditions change and adapt accordingly. During high volatility periods, it might widen stops or reduce position sizes automatically. In low liquidity conditions, it could adjust execution strategies to prevent slippage.

Manual Management Capability

While automation handles many aspects of trading, the human element remains crucial in cryptocurrency markets. Manual management provides flexibility and judgment that automated systems can't fully replicate, especially in unique market conditions or when dealing with unexpected events.

Basic Limit Order Management

The art of manual limit order placement requires a deep understanding of market dynamics and price action. Imagine watching Bitcoin approach a major support level at $39,000. While an automated system might place orders based on predetermined rules, a manual trader can assess the quality of the approach – the volume, the momentum, the market sentiment – and adjust their limit orders accordingly.

Consider this scenario: You notice Bitcoin pulling back to support with declining volume and oversold indicators. Rather than placing a single limit order, you might layer your entries:

- A primary order slightly above the support level to catch any quick reversal

- Secondary orders at and slightly below support to take advantage of any brief wicks

- A final order below support for potential stop hunts or liquidation wicks

This nuanced approach allows you to read and react to market conditions in real-time, something automated systems might miss.

Market Order Execution

Manual market order execution becomes particularly valuable during breaking news events or significant market developments. For instance, imagine a major positive regulatory announcement hits the market. While automated systems might stick to predetermined rules, a manual trader can:

Assess the significance of the news immediately and determine if quick execution is warranted. They can evaluate whether the news justifies paying the spread and potential slippage to enter quickly, or if waiting for a pullback makes more sense.

Monitor order book depth and volume in real-time, choosing the optimal moment to execute. Perhaps they notice large buy orders stacking up, suggesting strong momentum, or see significant resistance ahead that might warrant patience.

Pre-Execution Market Analysis

The human edge in manual trading often comes from pre-trade analysis. Before placing any orders, experienced traders develop a comprehensive market view:

They examine multiple timeframes to understand the broader context. Is this a counter-trend trade in a larger uptrend? Are we approaching significant weekly or monthly levels? This multi-dimensional analysis informs both entry timing and order type selection.

Volume analysis becomes more nuanced under manual management. Traders can distinguish between genuine buying pressure and potential manipulation, adjusting their execution strategy accordingly. They might notice subtle shifts in buying or selling pressure that automated systems wouldn't recognize as significant.

Monitoring and Adjustment

Manual monitoring allows for flexible response to changing market conditions. For example, if you're holding a profitable Bitcoin position and notice increasing selling pressure or bearish divergences on momentum indicators, you might:

- Tighten stops more aggressively than an automated system would

- Take partial profits earlier than planned

- Adjust your position size based on changing risk perception

This dynamic risk management approach considers factors that might be difficult to program into automated systems, such as:

- Correlation with traditional markets during major economic events

- Sudden changes in market sentiment on social media

- Emerging technical patterns that don't fit standard definitions

Real-Time Decision Making

Perhaps the greatest advantage of manual management lies in real-time decision making during uncertain market conditions. Consider a situation where Bitcoin approaches a critical technical level with unusual volume patterns. A human trader can:

- Evaluate the quality of price action, not just the levels themselves. They might notice that while price is holding above support, the bounces are becoming weaker, suggesting potential failure.

- Assess market depth changes in real time, noticing if large orders suddenly appear or disappear, potentially signaling institutional activity.

This human judgment factor becomes particularly valuable during market stress periods or when dealing with irregular market behavior that might confuse automated systems.

Hybrid Automation Considerations

The most effective trading approaches often combine the precision of automation with the adaptability of human judgment. This hybrid approach leverages the strengths of both systems while mitigating their respective weaknesses in the dynamic crypto market environment.

Platform Integration and Infrastructure

Think of your trading infrastructure as a modern aircraft cockpit – while many functions are automated, the pilot maintains crucial decision-making control. In crypto trading, this means establishing a robust technical foundation that supports both automated and manual interventions.

For instance, a sophisticated trading setup might include multiple layers:

- Primary trading platform for automated execution

- Secondary platforms for manual oversight and intervention

- Real-time monitoring systems for market conditions

- Emergency override capabilities for unusual situations

Consider a practical scenario: You're running an automated Bitcoin trading strategy during a major market event. Your system continues executing its predetermined rules, but you notice unusual market behavior. Through your monitoring dashboard, you can quickly assess the situation and, if necessary, modify or override automated orders while maintaining risk parameters.

Risk Control Framework

Risk management in a hybrid system requires careful orchestration between automated rules and human oversight. Imagine your automated system trading multiple crypto pairs simultaneously. While it manages standard risk parameters, you might manually adjust these based on broader market conditions:

During high-correlation events (like a major stock market selloff affecting crypto), you could:

- Reduce position sizes across automated strategies

- Widen stops temporarily

- Adjust entry criteria to account for increased volatility

The system continues executing trades, but with modified parameters that reflect your market assessment.

Monitoring and Alert Systems

Effective hybrid trading relies heavily on comprehensive monitoring solutions. Your system should act like an early warning radar, alerting you to situations that require human attention while handling routine operations automatically. This might include:

Performance Monitoring:

- Real-time profit/loss tracking

- Execution quality analysis

- Risk parameter compliance

- Pattern recognition for potential issues

For example, if your automated system starts experiencing unusual slippage or rejection rates, you receive immediate alerts allowing you to investigate and potentially switch to manual execution until conditions normalize.

Emergency Protocols

Perhaps the most critical aspect of hybrid systems is their ability to handle unexpected situations. Like a nuclear power plant's safety systems, your trading infrastructure should have clear protocols for various scenarios:

- Connection failures

- Exchange API issues

- Unusual market volatility

- Liquidity crises

- System performance degradation

Take a flash crash scenario: Your automated system might hit predetermined circuit breakers, automatically reducing exposure while alerting you to take manual control. This gives you the flexibility to assess the situation and decide whether to resume automated trading or continue manually.

Documentation and Analysis

A hybrid approach requires meticulous record-keeping of both automated and manual decisions. This documentation serves multiple purposes:

- Strategy refinement

- Risk assessment

- Performance evaluation

- System improvement

Think of it as a flight recorder for your trading operation, providing valuable insights for future optimization.

Continuous Improvement Cycle

The beauty of a hybrid system lies in its ability to evolve. Through careful analysis of both automated and manual trading results, you can:

- Identify patterns that could be automated

- Recognize situations requiring human judgment

- Refine risk parameters

- Optimize execution strategies

For instance, if you notice your manual interventions during certain market conditions consistently improve results, you might incorporate these insights into your automated rules while maintaining override capability for exceptional circumstances.

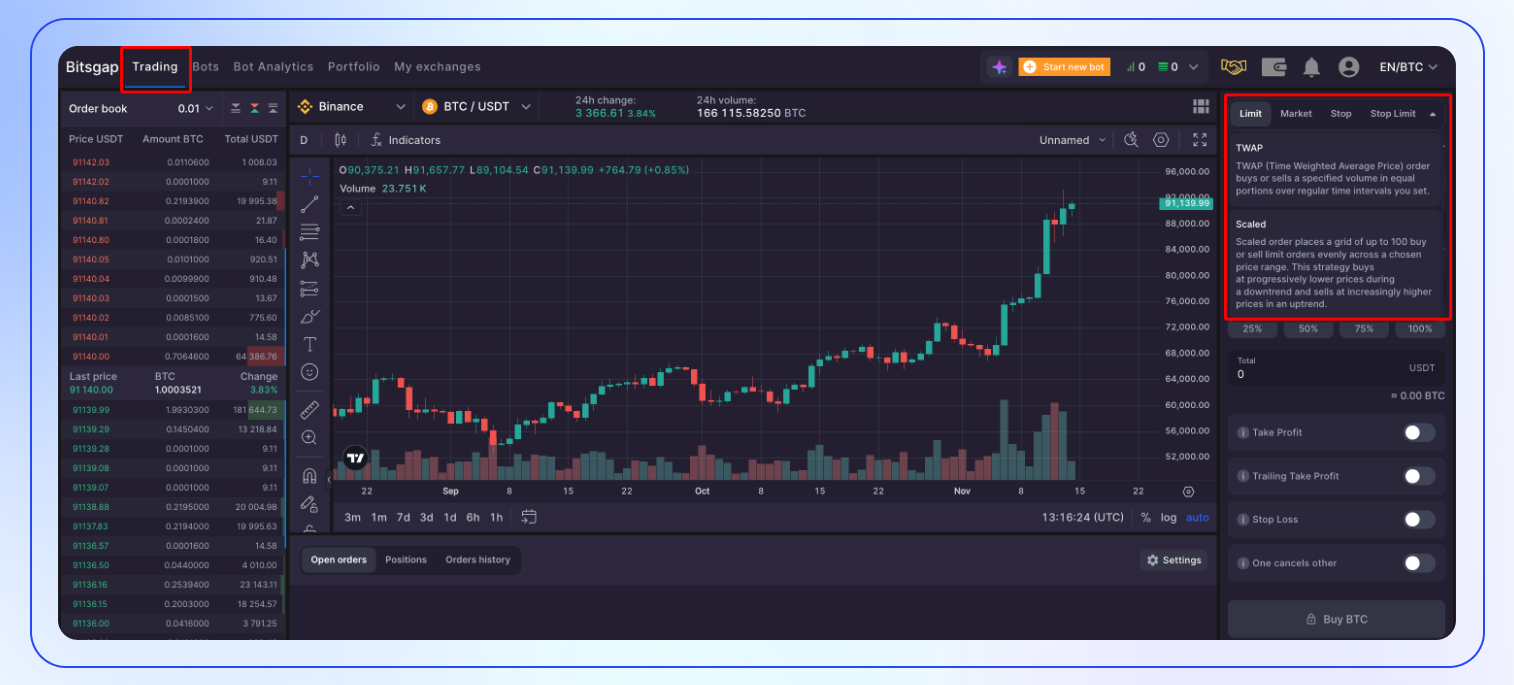

Bitsgap’s Smart Trading Platform & Smart Order Types

For traders seeking to implement the sophisticated order types and strategies we've discussed, Bitsgap offers a comprehensive solution that combines advanced trading capabilities with powerful automation features. This platform integrates seamlessly with over 15 leading centralized exchanges, providing a unified trading experience through its smart trading terminal.

Key Features and Capabilities

Bitsgap's smart trading terminal stands out by offering extensive order type functionality, including sophisticated condition management that can transform basic orders into smart, adaptive trades. The platform combines spot and futures automation with comprehensive portfolio management, providing actionable analytics to inform your trading decisions.

Getting Started with Smart Orders

Setting up advanced orders on Bitsgap is straightforward yet powerful. After logging into your account, navigate to the Trading section where you'll find a full suite of order types and customization options. The platform allows you to:

- Select from multiple exchanges and trading pairs

- Configure advanced order parameters

- Implement trailing stops and take-profit strategies

- Set up sophisticated stop-loss mechanisms

- Create conditional orders based on market behavior

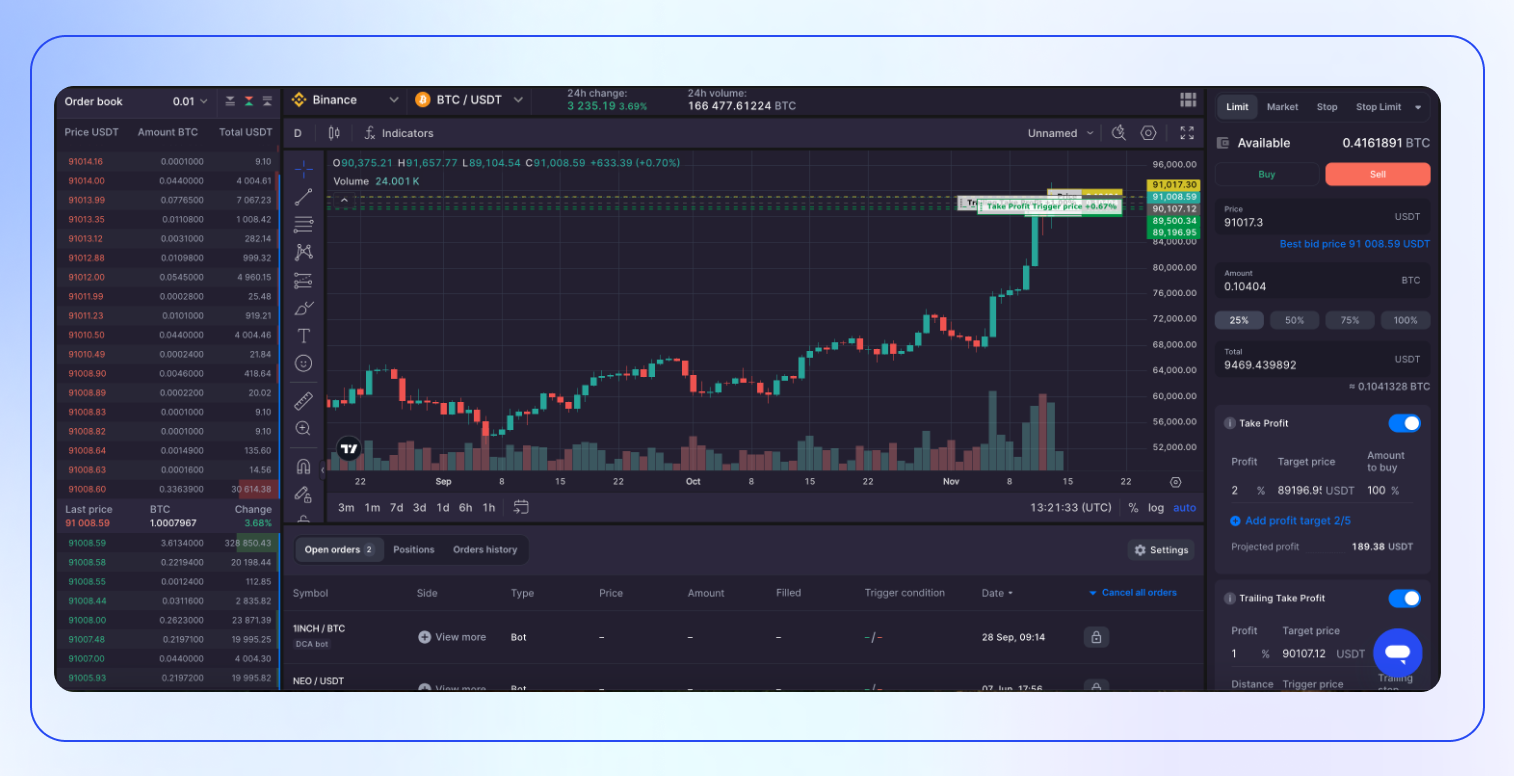

Order Management and Modification

Active trade management becomes intuitive through Bitsgap's interface. Monitor your positions and open orders through dedicated tabs, where you can:

- View all active orders in real-time

- Modify existing smart orders through the edit interface

- Adjust take-profit and stop-loss levels dynamically

- Fine-tune trailing parameters based on market conditions

The platform's edit panel provides flexibility in managing your trades, allowing you to adjust trigger prices and percentages for various order components. This dynamic approach ensures your trading strategies can evolve with changing market conditions.

Practical Implementation

Consider a scenario where you're implementing a complex Bitcoin trading strategy. Through Bitsgap, you could:

- Set up a scaled entry using multiple smart orders

- Configure trailing take-profits to maximize gains in trending markets

- Implement dynamic stop-losses that adjust with market volatility

- Monitor and modify all components from a single interface

This integrated approach to trading automation, combined with comprehensive risk management tools, provides traders with the capabilities needed to execute sophisticated strategies effectively in today's cryptocurrency markets.

Conclusion

Throughout this comprehensive guide, we've explored order types and their strategic applications. From basic market and limit orders to sophisticated trailing stops and OCO combinations, each order type serves as a vital tool in a trader's arsenal, offering unique advantages for different market conditions and trading objectives.

We've learned that successful trading isn't just about knowing these order types; it's about understanding when and how to use them effectively. Whether you're managing risk with stop-losses, capturing profits with take-profit orders, or implementing complex strategies using bracket orders, the key lies in matching your order selection to:

- Current market conditions and volatility

- Your specific trading goals

- Position size requirements

- Risk management parameters

- Time and price sensitivity

The complexity of modern crypto markets demands a sophisticated approach to order execution. While understanding these order types is crucial, implementing them effectively requires robust tools and platforms that can handle both automated and manual trading needs.

Ready to put these order types and strategies into practice? Bitsgap offers a comprehensive trading platform that brings all these sophisticated order types and more under one roof. With its smart trading terminal, you can:

- Access advanced order types discussed in this guide

- Implement complex trading strategies with ease

- Connect to over 15 leading cryptocurrency exchanges

- Manage your portfolio with actionable analytics

- Automate your trading strategies effectively

Start your trading journey with Bitsgap's 7-day free trial and experience the power of professional-grade trading tools. Whether you're a beginner looking to implement basic strategies or an advanced trader seeking sophisticated order combinations, Bitsgap provides the infrastructure and features needed to execute your trading plans effectively.

Remember, successful trading is a journey of continuous learning and adaptation. Take advantage of these tools and order types to develop and refine your trading strategy, always keeping risk management at the forefront of your decision-making process.

Ready to give it a go? Try Bitsgap free for 7 days and discover how professional trading tools can transform your trading experience.