Automated Trading on Binance: Why Choose Binance

Why not find out today why Binance could be your new best friend in the crypto arena and learn how to give it a firm handshake with Bitsgap?

With a whopping trading volume and an impressive smorgasbord of cryptocurrency trading pairs, Binance caters to millions of users across the globe. Discover today why Binance could be your preferred exchange and learn how to link it with Bitsgap.

Binance, a name that echoes in the corridors of the online cryptocurrency exchange world, was born amidst the crypto frenzy of 2017. Initially, it sprung up in Hong Kong, but regulatory murmurings prompted a reported relocation to Malta in 2018. That said, the exact whereabouts of its headquarters remain a topic of debate, with some suggesting that Binance is somewhat of a digital nomad with no fixed base.

As of September 2023, Binance is a veritable buffet of crypto offerings, flaunting 402 cryptocurrencies, 11 fiat currencies, and 1591 cryptocurrency trading pairs. Its name, a shrewd mashup of 'Bitcoin' and 'finance', encapsulates its core business perfectly. The platform is a bustling hub of activity, renowned for high transaction volumes, thanks to its exhaustive list of trading pairs, encompassing both crypto-to-crypto and crypto-to-fiat combinations.

Among the digital coins jingling in Binance's pocket is its very own Binance Coin (BNB), a versatile token that can be used for things like offsetting trading fees and boosting the efficiency of trading bots.

On Binance, users can either roll up their sleeves for manual trading or sit back and let automated trading tools do the heavy lifting. While some might argue about the pros and cons of each approach on Binance compared to other platforms, it really boils down to individual preferences and experiences. What’s important, however, is that Binance's vast reach and varied offerings mean it plays nicely with almost any trading bot out there.

👉 While Binance does offer proprietary trading bots, many users lean towards trusted third-party platforms like Bitsgap, known for their superior automated trading algorithms.

Unlike some exchanges that limit their services to specific countries or offer a narrow range of services, Binance embraces a more open approach. This strategy has won them a whopping user base of 150 million spanning over 180 countries as of September 2023.

However, it's not all roses and rainbows for Binance. Its U.S. offshoot and co-founder Changpeng "CZ" Zhao have found themselves in the legal crosshairs of regulatory bodies like the SEC and the CFTC. Accusations range from unauthorized operations to offering unregistered securities and contravening commodities laws. The international stage hasn't been much kinder, with regulatory bodies in Australia, Belgium, and Germany adding to Binance's woes.

Despite these regulatory speed bumps, Binance continues to hold its own, and barring any unforeseen black swan events, it should continue to do so. The crypto landscape is ever-changing and evolving, so it's crucial to keep a finger on the pulse and stay informed with news and updates from trusted sources and authorities to stay one step ahead of the pack.

Why Binance Is a Good Fit for Automated Trading

As previously alluded to, the global landscape is dotted with hundreds of cryptocurrency exchanges. Yet, Binance has managed to carve out a unique space for itself as a leading player in this field, thanks to some standout features. Let's dive into a more detailed exploration of these in the sections that follow.

Binance Trading Interface

The world of cryptocurrency trading is a vast mosaic of users, from greenhorns to seasoned traders. In such a heterogeneous environment, it's imperative for a cryptocurrency exchange to cater to the myriad levels of expertise within its user base. Binance has risen to this challenge with aplomb, offering a user interface that's accessible to both neophyte and advanced traders. Its emphasis on user-friendliness ensures that newcomers to cryptocurrency trading can negotiate the platform with ease, aided by straightforward and intuitive tools.

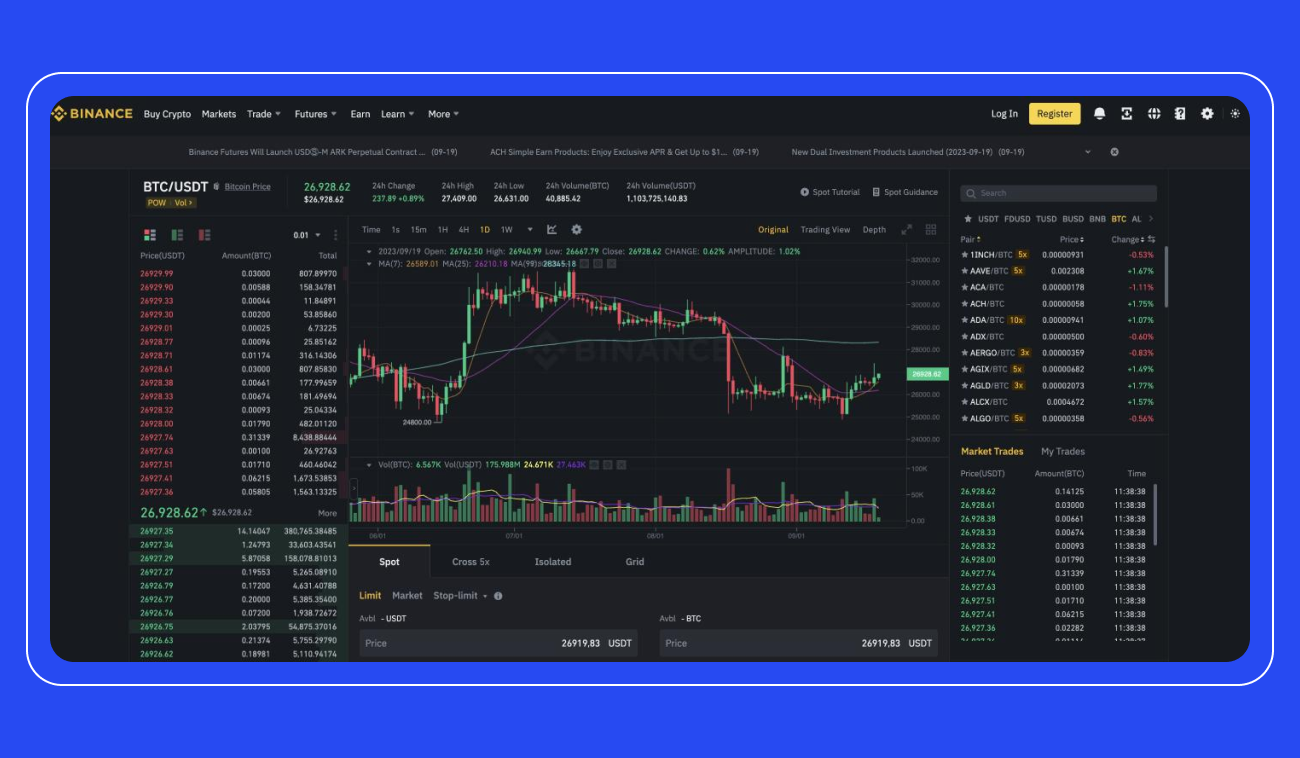

Binance's trading interface (Pic. 1) is a treasure trove of charts and tools designed to guide users on their trading quest. These instruments allow traders to dissect the market, execute trades, and manage their cryptocurrency assets. The toolbox encompasses various order types, including limit order, market order, stop limit order, stop market order, trailing stop order, and One Cancels Other. It also boasts crucial risk management features, such as stop loss and take profit functionalities.

In addition, Binance also has a soft spot for automated trading, extending its appeal to those who prefer to let algorithms do the heavy lifting. All these tools come together to create a versatile platform that lets users buy, hold, and sell their chosen cryptocurrencies in a way that matches their unique trading style and risk level.

Now, keep in mind, the above is just a snapshot of what Binance has to offer. So, before you dive in, make sure to check for the latest updates from Binance itself, because staying informed is always in style.

Why Volumes Matter for Automated Crypto Trading

When it comes to crypto trading, Binance reigns supreme as the king of the exchanges. Its vast userbase generates a whopping $4 billion in average daily volume, dwarfing the paltry $23 million swapped on lesser rivals like Gemini.

For traders and investors, high liquidity is a critical factor as it allows for the purchase or sale of large amounts of assets without drastically influencing the price. Cryptocurrency exchanges like Binance, which consistently show high trading volumes, are often linked with high liquidity. This feature draws a wider range of traders, including those who use trading bots that place more buy and sell orders, thus increasing the exchange's transaction volume.

In the wide world of over 8,000 active cryptocurrencies and more than 600 crypto exchanges, only a few platforms offer a smorgasbord of tokens for trading. And guess who's at the head of the table? Yes, it's Binance, offering a whopping selection of more than 400 different cryptos.

Considering Fees While Using Automated Trading

Choosing a cryptocurrency exchange often comes down to the nitty-gritty of trading fees. Traders are keen on platforms that offer competitive and reasonable fees, a factor that crypto exchanges can't afford to overlook if they want to keep their users happy.

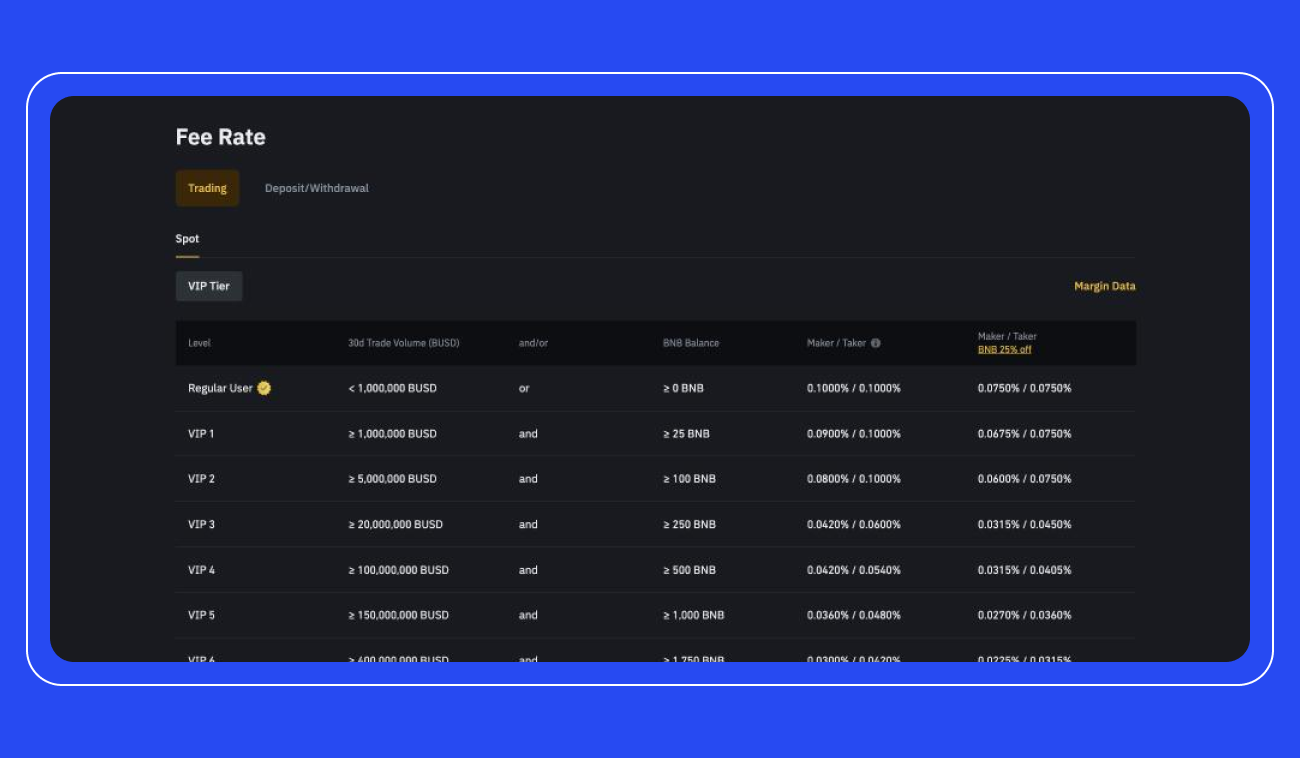

Binance is particularly celebrated for its reasonable fee structure, which keeps luring users its way. As of September 2023, Binance is charging a modest 0.1% on every trade at the Regular User level (Pic. 2). But here's the fun part—traders who choose to pay their trading fees using Binance's own cryptocurrency, BNB, get a sweet deal of a 25% discount on every trade they make on the exchange.

However, a word of caution is due here. Some automated trading tools used on Binance might not consider these fees when calculating trade profits. This could lead to some confusing situations where a trade might seem profitable according to the automated bot, but once the trading fee comes into play, the trader could just be breaking even. Thankfully, trading bot solutions like Bitsgap have taken note of this issue. Bitsgap’s built-in measures prevent traders from placing sell orders that wouldn't yield a net profit after accounting for the trading fees.

Withdrawal Fees

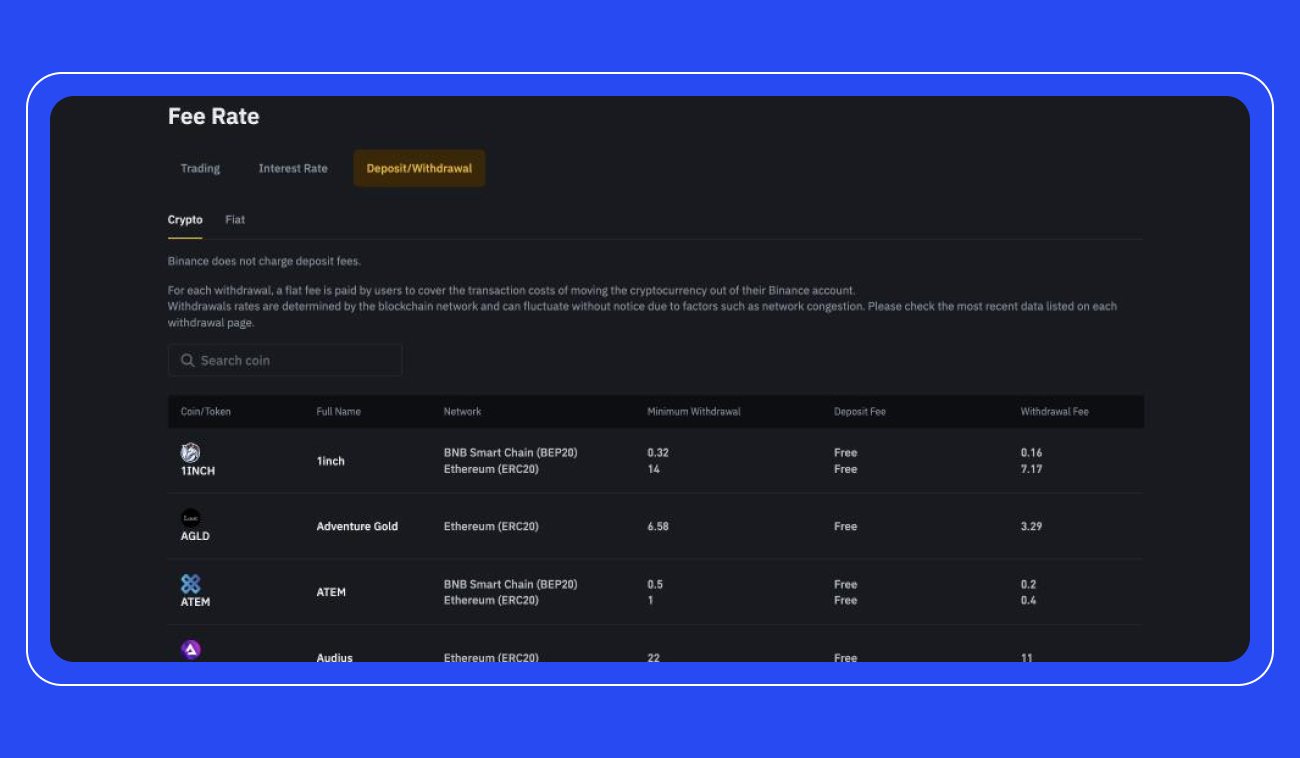

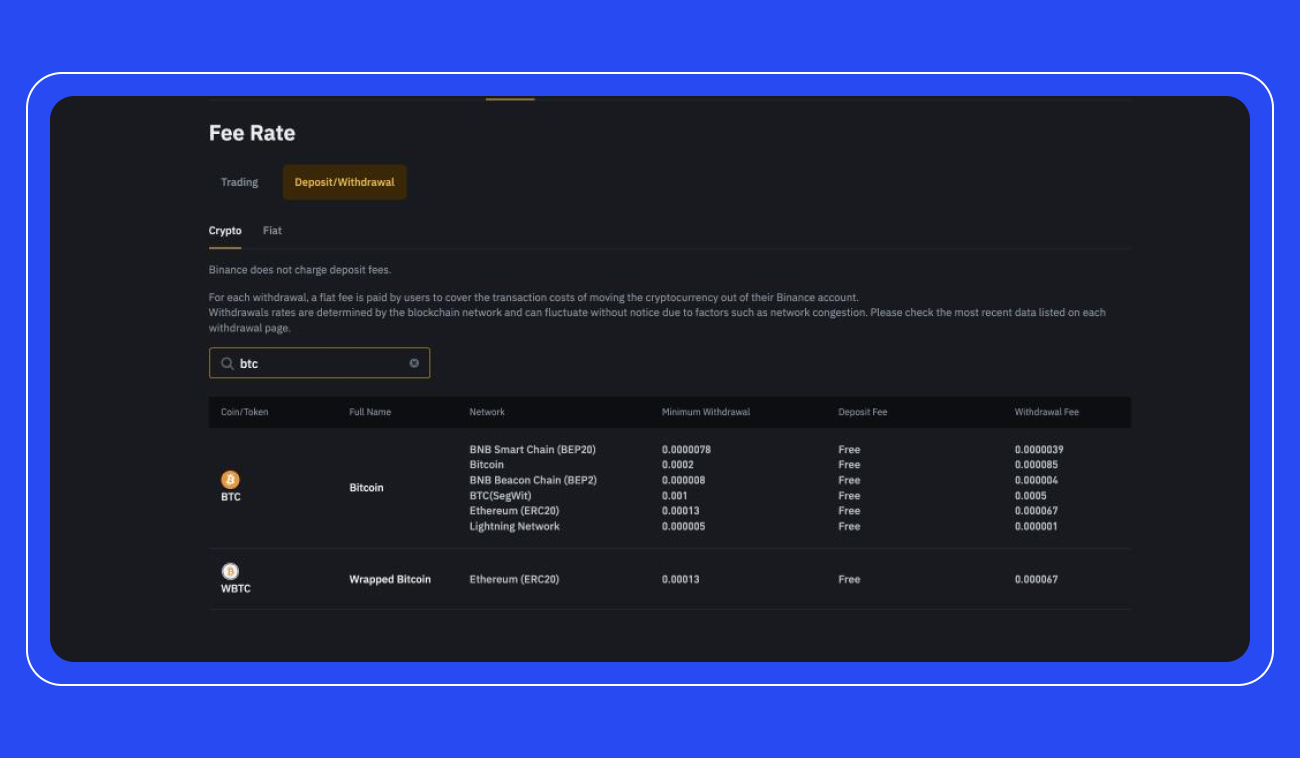

Binance is quite a sport, charging zero fees for deposits. However, when it comes to withdrawals, things get a little different. Each withdrawal carries a fixed fee, which users have to pay to cover the costs of shifting the cryptocurrency from their Binance account to elsewhere. The catch here is that these withdrawal rates aren't static (Pic. 3) — they're determined by the blockchain network and can change without warning due to factors like network congestion. So, it's always a good idea to check the latest rates on Binance's fees page before you make a withdrawal.

It's notable that Binance has set its BTC withdrawal fee at 0.001 BTC and has also stipulated a minimum withdrawal amount, which is 0.002 BTC.

Customer Support

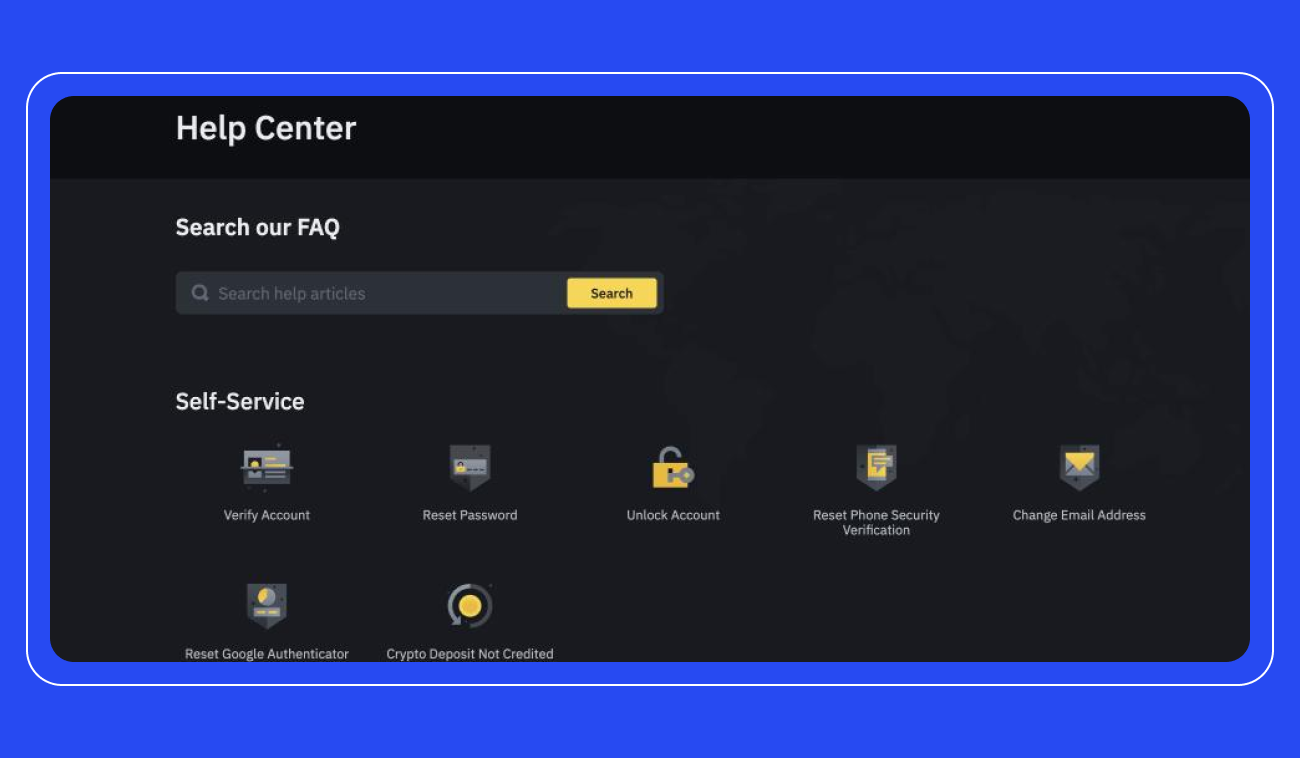

Crypto exchanges serve as a lifeline for users when they encounter hiccups, and the efficiency of this support can significantly bolster user trust in the platforms where they execute their trades.

Live customer support on Binance might feel a bit sluggish, as it primarily handles support tickets through online forms available on its platform. With thousands of users raising concerns each day, Binance's customer support team can get swamped. They typically respond to reported issues via email, but unfortunately Binance does not offer a dedicated phone line for customer complaints.

But hey, there's a silver lining! Binance users can take a deep dive into its Frequently Asked Questions section on the hunt for some golden answers. And to make this treasure hunt a breeze, Binance provides a handy chat bot. Plus, Binance's YouTube channel is a goldmine of handy videos for newbies to learn the ropes of basic features, internal and external automated trading tools, smart orders, and more.

Security policy

Binance, a titan in the cryptocurrency exchange world, takes security seriously. In the unfortunate event of a system crash or sneaky hackers swiping assets or funds, Binance has its users' backs with the SAFU — a whopping $1 billion fund ready to compensate users.

Binance also encrypts data from end to end, keeping an eagle eye on user activity, and hitting the pause button on withdrawals if it smells something fishy.

It also strictly adheres to KYC/AML policies and goes the extra mile to shield against spiteful attacks.

Additionally, Binance’s a big fan of the double-layer security protocol known as Two-Factor Authentication (2FA), giving users an extra shield against unauthorized access or hacking attempts. 2FA also comes in handy when hooking up third-party trading bots to Binance. It makes sure no withdrawals happen without the user's green light, pushing account security up a notch.

Know Your Customer (KYC) Policy

This is a routine security procedure that most exchanges, including Binance, have in their playbook. New users to Binance are typically asked to verify their accounts by supplying a personal document. So during this verification dance, they need to present a government-issued ID, such as a passport or driver's license, and also their residential address.

Once a user completes this verification process, their account graduates to a higher level, freeing them from certain trading and withdrawal limit chains. So, to unlock all the goodies and services Binance offers, users need to cross the verification finish line.

Binance also asks users to keep a tight hold on their mobile numbers used during sign up. If they ever need to change the number because of a lost or stolen device, Binance requires them to go through the account verification process from square one.

How to create an API key on Binance?

Not every crypto exchange is warm and welcoming, allowing users to rope in trading bots on their accounts.

So, what's a trader to do, eager to embrace the future with automated trading? The quest leads to exchanges that roll out the red carpet for trading bots. And voila! The Binance trading platform, in all its glory, graciously allows users to hop over to third-party platforms like Bitsgap, bringing their accounts along via APIs. Want to know the secret passage to do it swiftly? Read on!

The Binance Fast API is a subsystem of Binance API that utilizes the OAuth 2.0 protocol for user authentication and authorization. It lets you kickstart your journey with Bitsgap services, bypassing the manual creation of API keys. And rest assured, it's secure— all API keys generated are sent to Bitsgap in an encrypted format. To set up an API key, follow these steps:

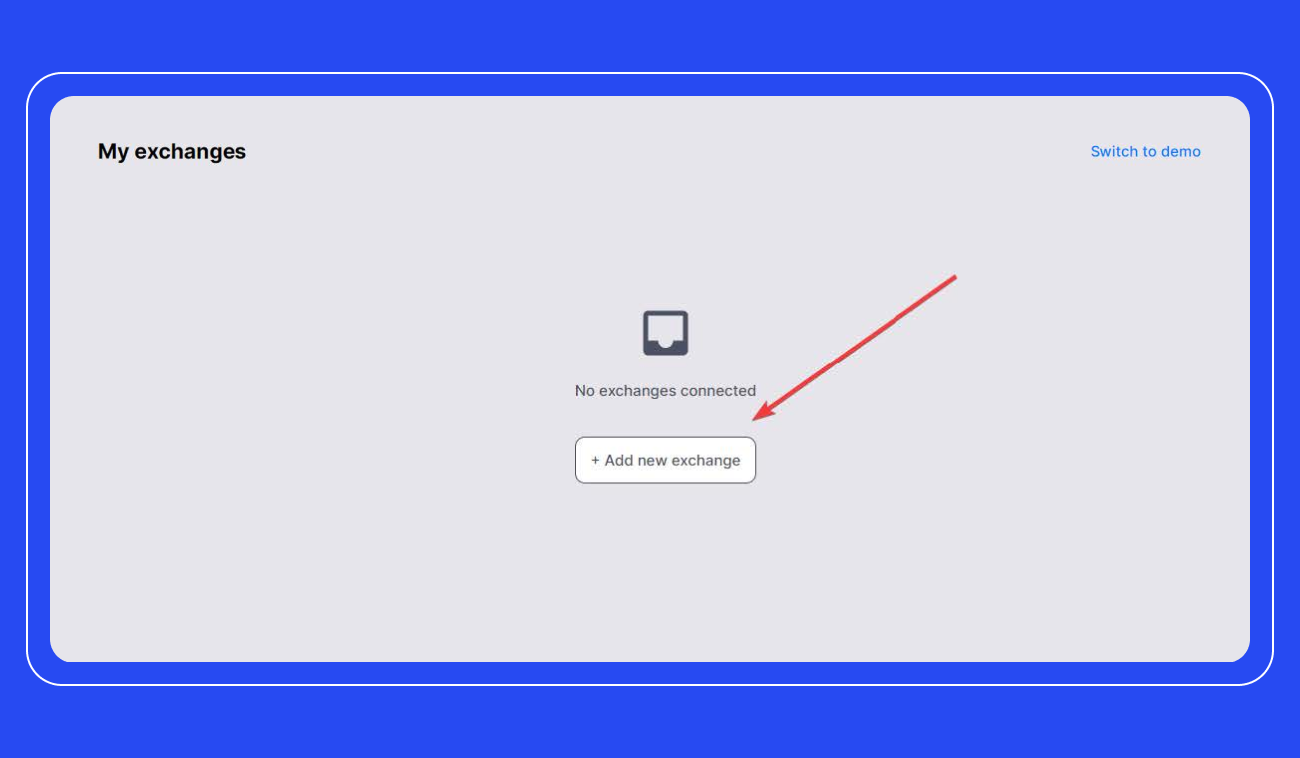

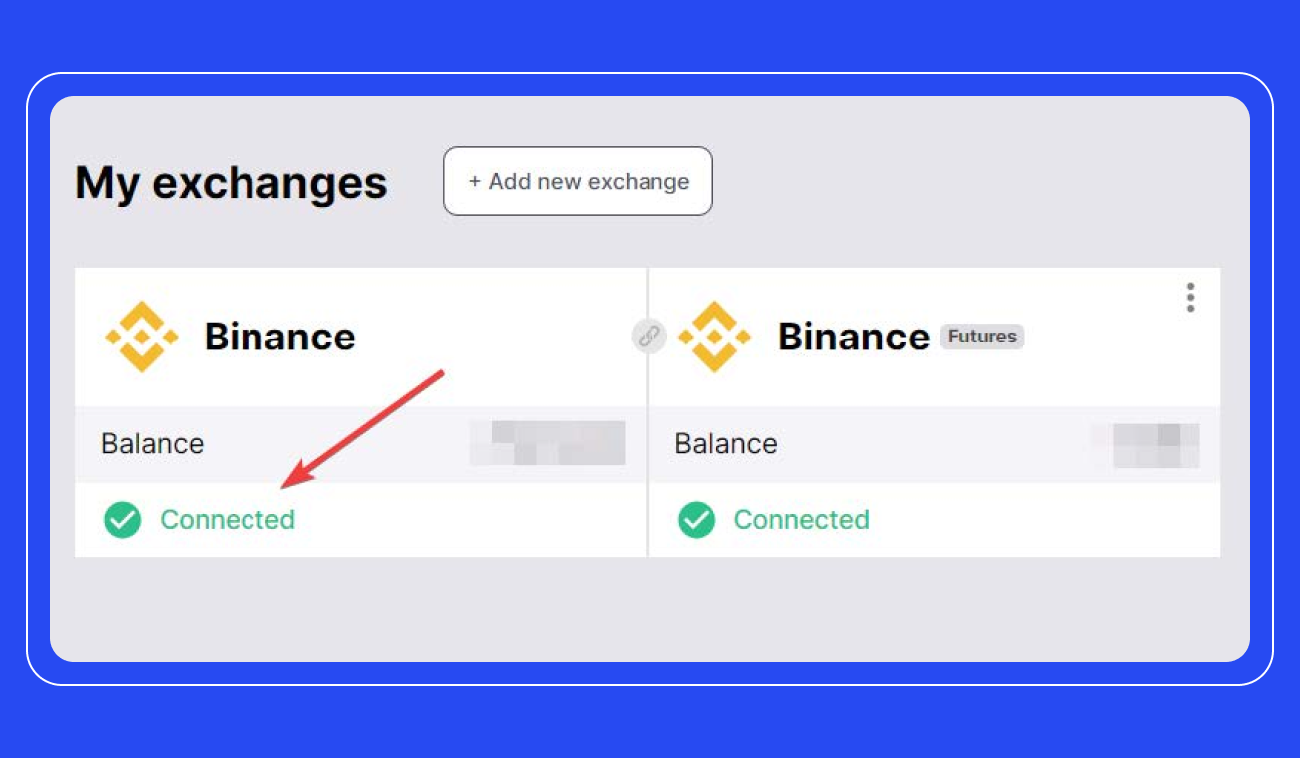

- Navigate to Bitsgap > [My Exchanges] Page

Log into your Bitsgap account, head over to the [My Exchanges] page, and then hit the [Add new exchange] button to proceed.

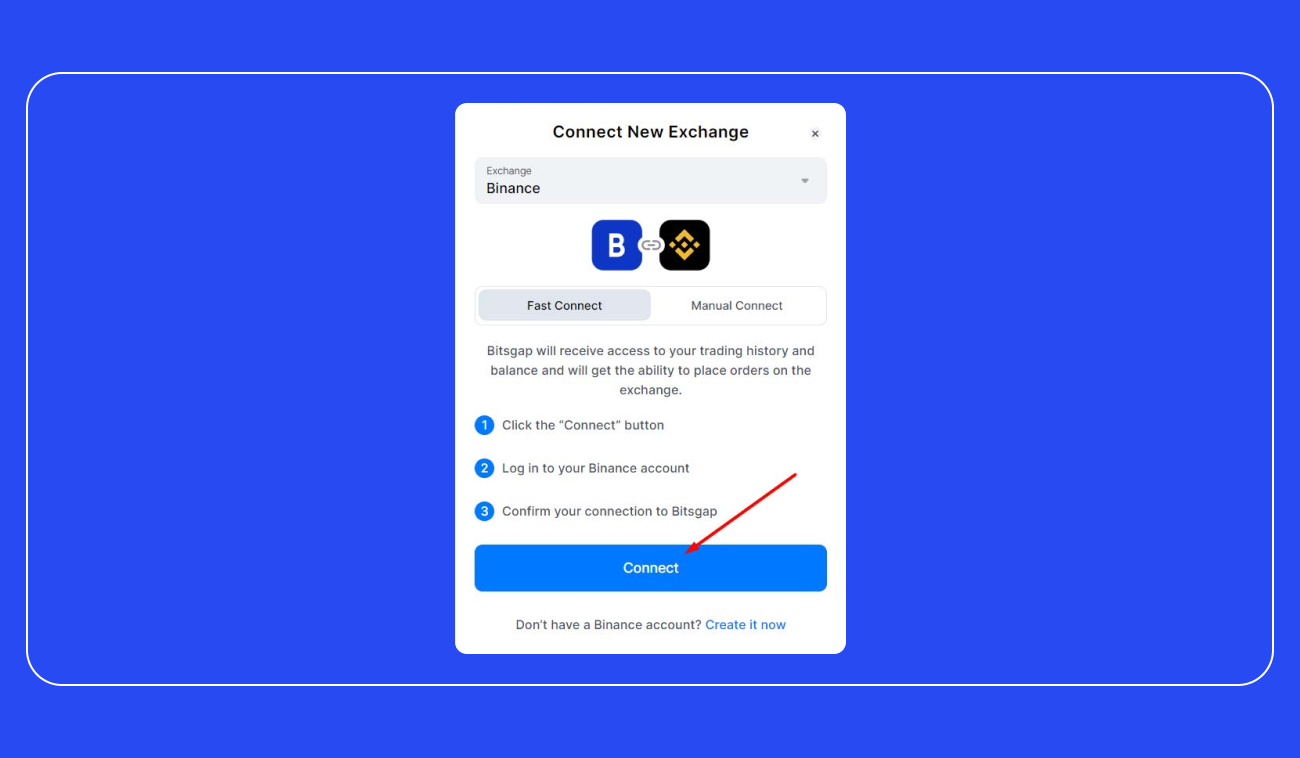

- Pick Binance from the dropdown and opt for Fast Connect

Peruse the subsequent steps and then hit [Connect].

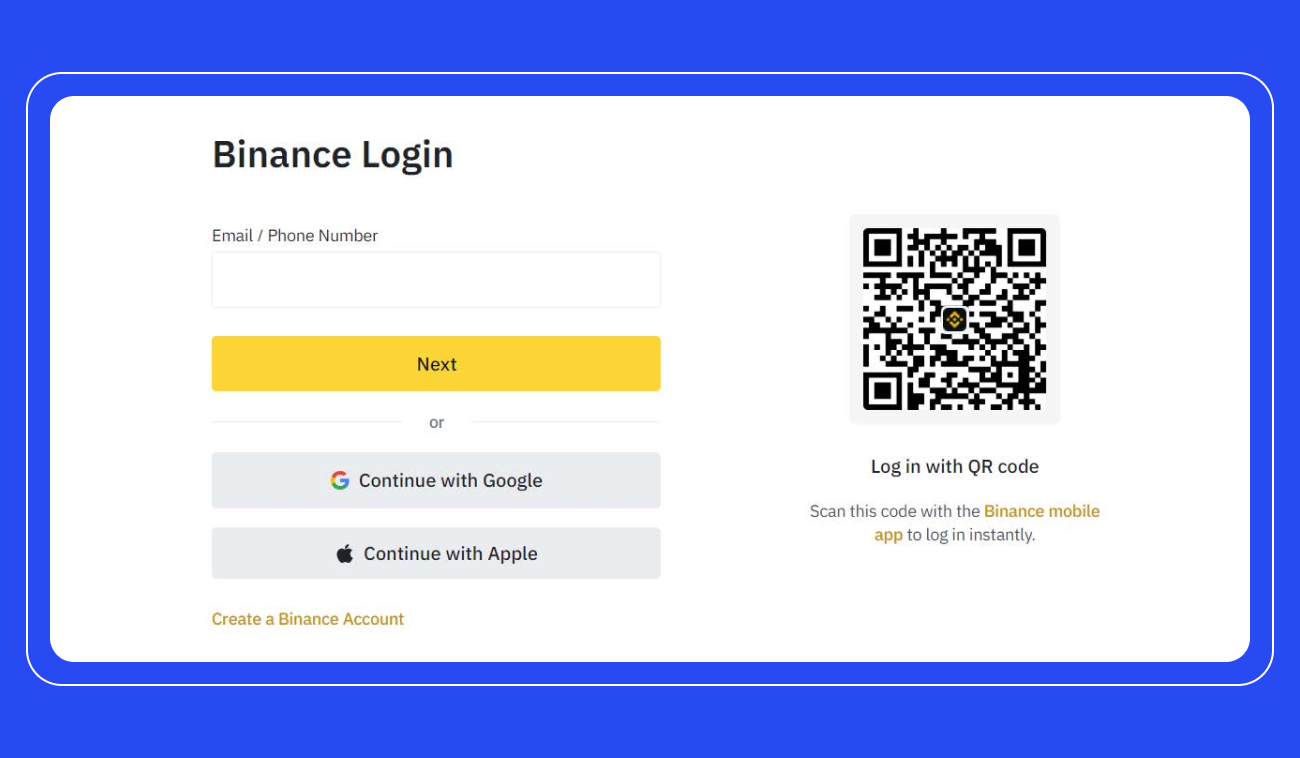

- Sign into your Binance account

You'll be directed to the Binance website, where you can log into your exchange profile.

- Verification of Connection

Upon successful authorization, you'll be automatically rerouted to the [My exchanges] page on Bitsgap. The API key will be generated and added automatically.

If all steps are executed correctly, you'll find Binance added to your roster of connected exchanges, marked with the "Connected" status, and your trading balance will be visible on your account.

Bottom Line

Wrapping things up, the crypto powerhouse known as Binance, born amidst the 2017 blockchain bonanza, now parades an eye-popping variety of 402 cryptocurrencies and 1591 crypto trading pairs as of our current year, 2023. Touting its very own Binance Coin (BNB) and a smorgasbord of trading pairs, it's become a veritable carnival of trading activity, attracting a whopping 150 million users from all corners of the globe. Sure, it's had a few run-ins with regulators here, there, and just about everywhere, but Binance holds its ground in the ever-twisting plot of the crypto universe.

FAQs

What Is Binance API Trading?

Binance API trading is the process that involves leveraging Binance's Application Programming Interface (API) to enable automated trading on the Binance platform. An API functions as a software go-between that facilitates interaction between two applications. In this specific scenario, it permits your personalized trading program to interface directly with the Binance trading platform. As an illustration, you might decide to link a third-party trading application to Binance, thereby using the capabilities of that third-party tool while conducting trades on the Binance exchange.

What Is Binance Bot Trading?

Binance Bot Trading refers to employing automated programs, commonly referred to as bots, to carry out trading activities on the Binance cryptocurrency exchange platform. These trading bots are engineered to engage with cryptocurrency exchanges directly, perform market data analysis, execute trades, and implement strategies continuously. The utilization of trading bots provided by Binance itself is an option, or you could integrate a third-party application with Binance through the use of APIs.

What Are Binance Trading Strategies?

Binance trading strategies refer to the tactics or methods employed by traders while purchasing and selling cryptocurrencies on the Binance platform. The choice of strategy can greatly differ depending on a trader's objectives, willingness to take risks, and preferred trading approach. Some commonly adopted Binance trading strategies include day trading, swing trading, scalping, holding (also known as 'HODLing'), dollar-cost averaging (DCA), and grid trading.