Benefits Of Holding And Trading Crypto Exchange Tokens

Uncover the thrilling benefits of trading and holding exchange-based tokens in this comprehensive dive.

A well-balanced portfolio with cryptocurrency exchange tokens offers dividends, discounts, and airdrops.

Over 23,000 cryptocurrencies are vying for their own slice of the market. Crypto exchange tokens, the primary utility tokens distributed within a specific cryptocurrency exchange's ecosystem, provide users with exclusive discounts and attractive perks like refunds, per-token dividends, and more.

Let's get pumped about some prime exchange token examples and see the myriad advantages of HODLing and trading those tokens:

- Binance Coin (BNB)

- KuCoin Token (KCS)

- Crypto.com Coin (CRO)

Binance Coin: BNB

About BNB

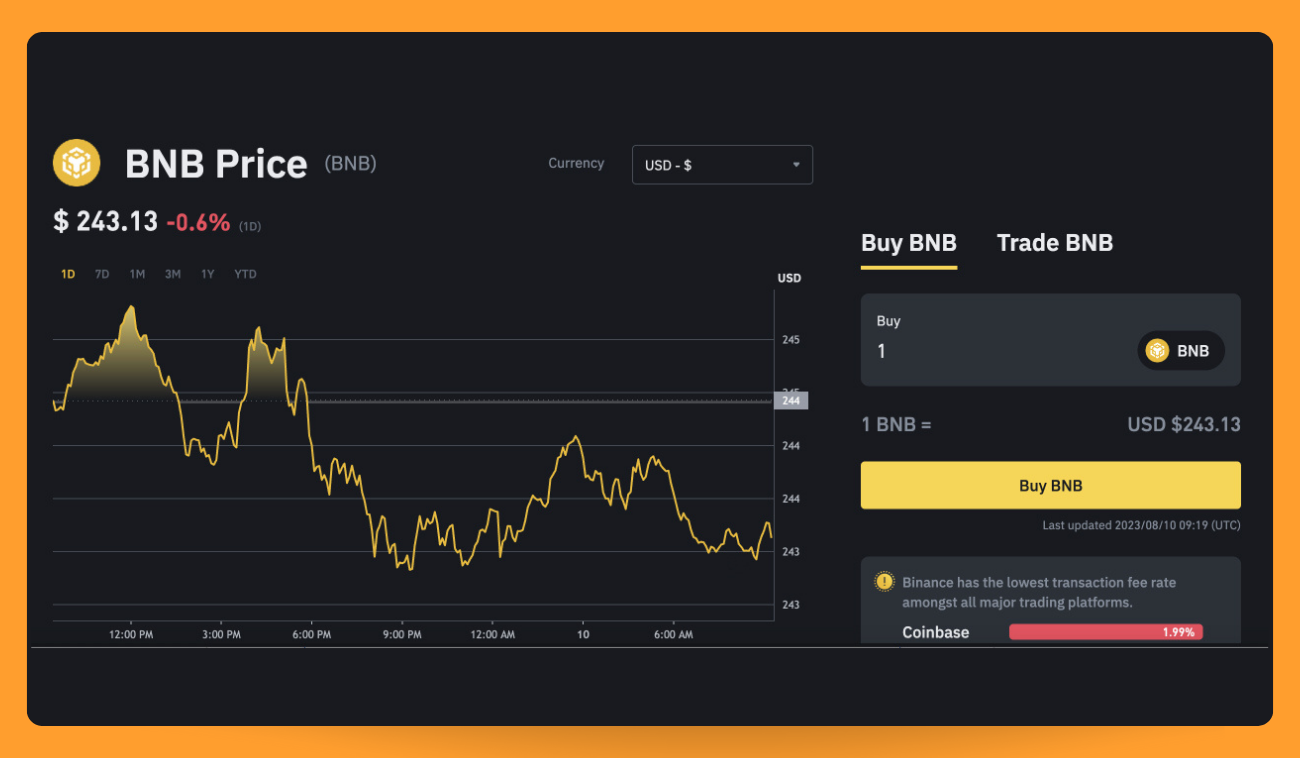

BNB (Pic. 1), the cryptocurrency fueling the Binance exchange, offers a versatile way to trade and offset fees within the platform. This formidable token also operates as the powerhouse behind the BNB Chain ecosystem, carving out a niche as one of the most widely used utility tokens globally.

The genesis of BNB dates back to an Initial Coin Offering (ICO) that spanned from June 26th to July 3rd, 2017 — a mere 11-day period before the Binance Exchange commenced trading operations. The introductory price was set at 2,700 BNB for 1 ETH or 20,000 BNB for 1 BTC. It's important to note that despite its ICO origins, holding BNB does not equate to a stake in Binance's profits or any form of investment in Binance.

BNB's functionality extends across a myriad of applications within the BNB Chain ecosystem and beyond. Initially introduced as an ERC-20 token on the Ethereum blockchain, BNB has since transitioned to its dedicated BNB Chain. Even though the initial total supply was capped at 200 million coins, this supply is consistently being trimmed through regular coin burns, thereby creating a deflationary effect.

BNB Regulatory Controversy

Despite its lofty ambitions and grand potential, BNB coin has managed to find itself in the thick of quite a number of regulatory disputes. There's nothing quite like a little scandal, right?

On an unassuming June 5, 2023, the United States Securities and Exchange Commission (SEC) decided to spice things up by filing a lawsuit against crypto exchange Binance, Binance.US's operating company, and the illustrious Binance founder and CEO Changpeng "CZ" Zhao. The accusations? Oh, just a few minor federal securities law infractions. Apparently, Binance, Binance.US, and CZ have been distributing unregistered securities to the public in the form of BNB tokens and the Binance-linked BUSD stablecoin. As if that wasn’t enough, they also accused Binance's staking service of violating securities law.

This U.S. legal kerfuffle quickly became a contagion, with legal repercussions rippling across borders leading to the French playing cops, the Dutch playing hard to get with licensing, and the Australians deciding they wanted in on the regulatory probe action too. Amidst all this, our dear CZ brushes off the departure of key legal and compliance executives like it's a mere hiccup in the grand scheme of things.

What seems to be conveniently ignored in this melodrama is the precarious position of Binance.com, which appears to be teetering on the brink of a confidence crisis and a dramatic plummet in the price of BNB. Observers whisper that Binance might have over-inflated the token's price, and the law of gravity insists what goes up must come down.

See, Binance woos its customers with a 25% discount on spot transaction commissions and a 10% discount on futures if they use BNB. It further flatters them into holding large amounts of BNB in their accounts with the promise of substantial commission markdowns. Additionally, Binance plays hard-to-get by 'burning' coins each quarter, thereby permanently shrinking the pool of BNB. These are not the coins from the open market, mind you, but tokens tucked away in its balance sheet or in the pockets of the founding team. Since its birth in 2017, Binance has torched a whopping 45 million BNB, almost a quarter of the initial 200 million lot.

This 'push and pull' tactic has caused BNB's price to skyrocket in a manner that would even make a space shuttle blush. From a humble 15 cents each during the 2017 ICO, BNB shot up to a staggering $623 in November of that year, boasting an intimidating market cap of over $100 billion. This 4,000-fold leap over four years left even Bitcoin's 20-fold gain eating dust.

However, after the CFTC lawsuit (a sort of curtain-raiser for the SEC charges), BNB hit a rough patch. From a comfy $348 on April 16, it tumbled down to a less comfortable $227 on June 12, before clawing back to $237 the next day, spurred by an unexpected consumer price index report. Despite shedding 31% over two months, BNB still struts around with a monstrous valuation of $37 billion – just for a little perspective, that's 71% of the value of General Motors.

BNB Trading and Holding Perks

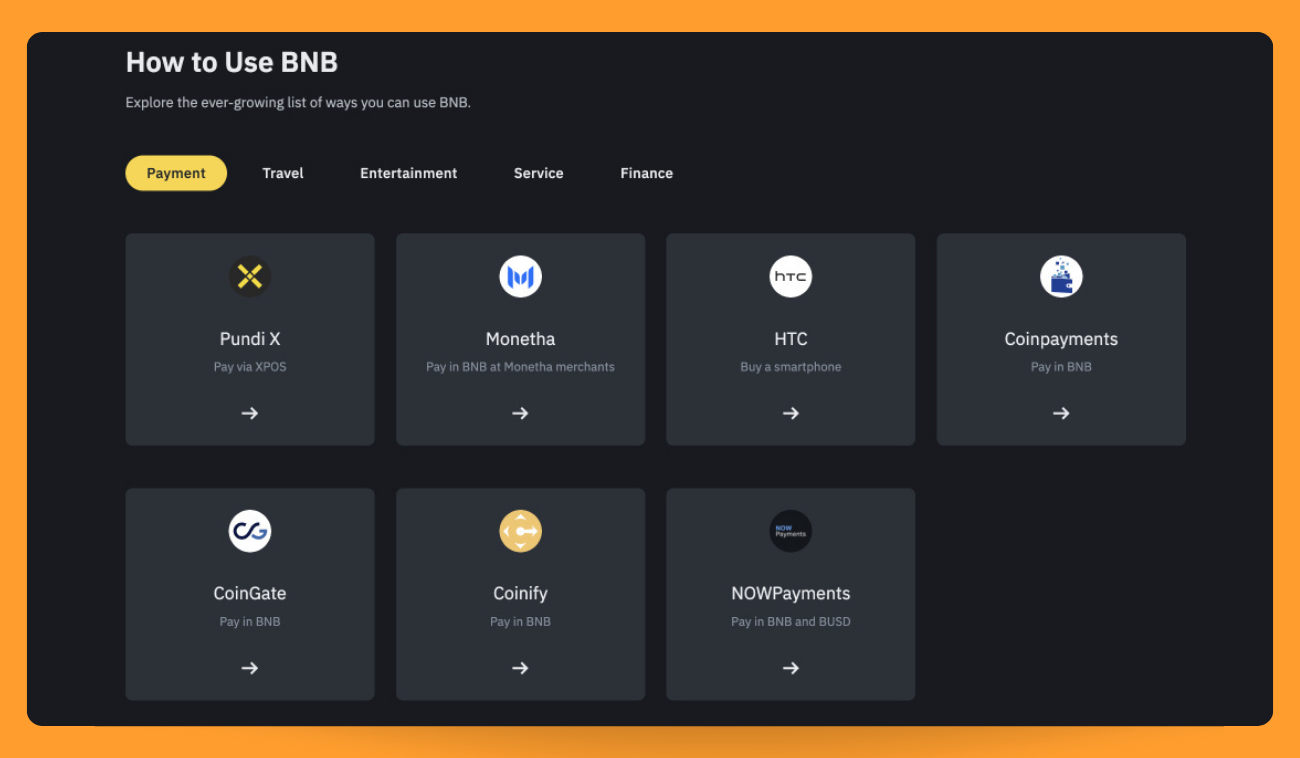

- Reduced Transaction Fees

One of the primary advantages (Pic. 2) of wielding Binance Coin for transactions is the tantalizing prospect of reduced transaction fees. Binance typically imposes a 0.1% fee for every trade executed on its platform.

However, here's the twist — if you choose to settle the transaction fees using Binance Coin, you are eligible for a discount of up to 25%. This nifty little perk can significantly slash your transaction fees, thereby making Binance Coin an attractive proposition for traders looking to cut costs.

- Accelerated Transaction Speeds

Yet another feather in Binance Coin's cap is its swift transaction speeds. Binance Coin operates on the Binance Smart Chain, a speedier and more affordable cousin of the Ethereum blockchain.

This implies that transactions carried out using Binance Coin are processed at a much quicker pace compared to those executed via Ethereum.

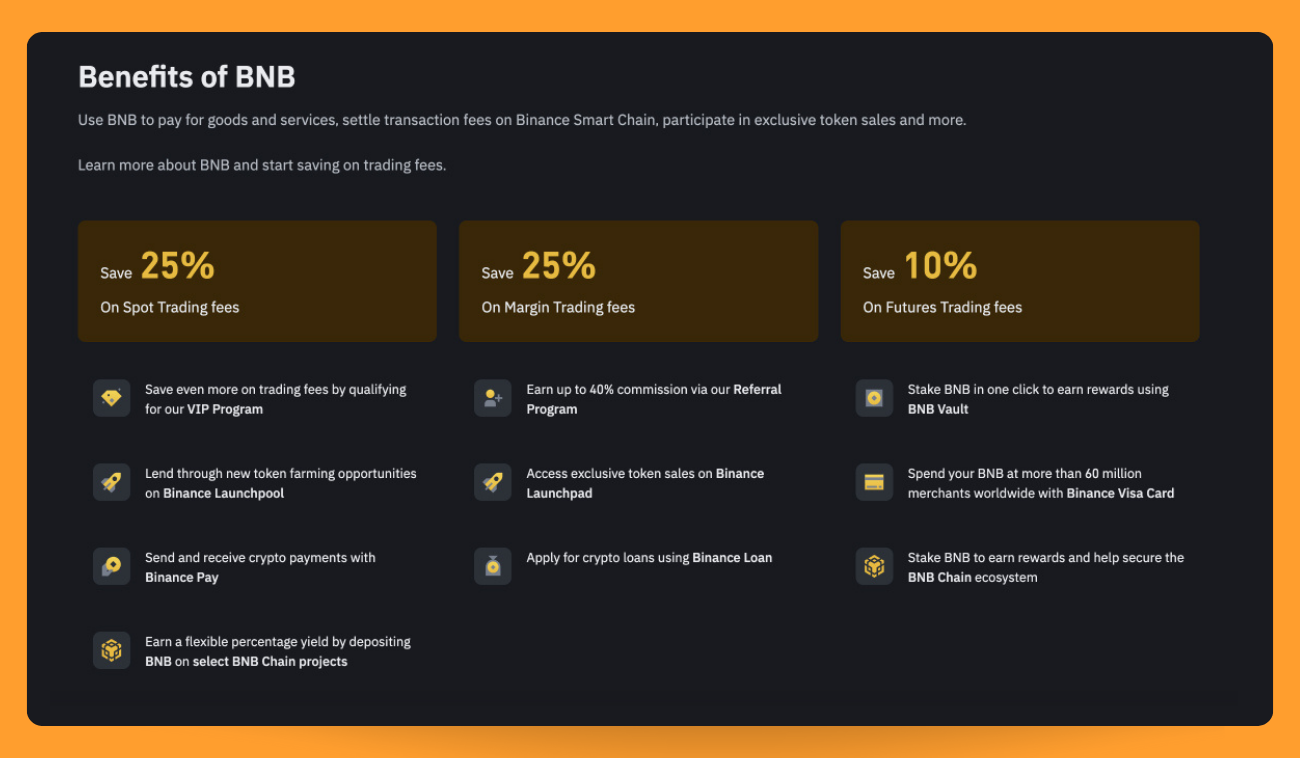

- Versatile Range of Applications

Binance Coin boasts a versatile range of applications (Pic. 3). Apart from settling transaction fees on the Binance exchange, it can also be used to purchase goods and services on other platforms that welcome Binance Coin.

What's more, Binance Coin can be wielded to participate in token sales and to foot the bill for the listing of new cryptocurrencies on the Binance exchange.

KuCoin Token: KCS

About KuCoin Token

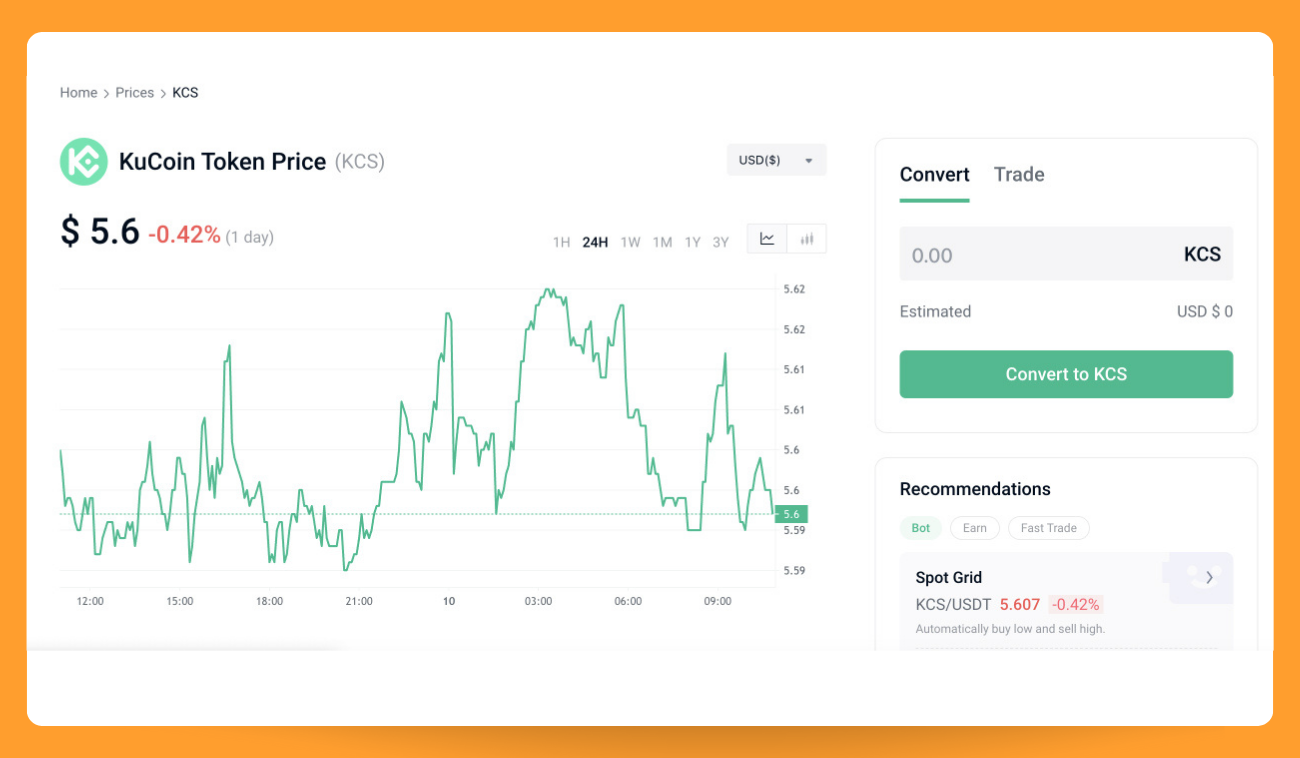

Launched as an ERC-20 token on the Ethereum network in 2017, the KuCoin Token (Pic. 4) was originally conceived as a tool for profit-sharing between KuCoin and its users, with the aim of enhancing the trading experience on the platform.

Beginning as a utility token used for settling trading fees and gaining access to exclusive campaigns within the KuCoin exchange, KCS has evolved into the linchpin of the entire KuCoin ecosystem.

Parallel to the rapid expansion of KuCoin, KCS set a new record high on December 1, 2021, skyrocketing to $28.8. This was followed by the release of the KCS white paper and the direct burn of 20 million KCS on March 31, 2022, which expedited the deflationary process of KCS.

Despite significant hikes in its past trajectory, KCS, owing to the inherent volatility of the crypto sphere and customary market fluctuations, is currently trading at $5.6.

KCS Benefits & Use Cases

Here's a rundown of the key applications (Pic. 5) of KuCoin Token (KCS):

- Discounts on trading fees at KuCoin exchange

Holders of the KuCoin token are treated to exclusive discounts on trading fees and other related expenses within the KuCoin exchange. The discount rate is determined by the quantity of KCS tokens owned by the user. Moreover, KCS holders can leverage the KuCoin Token to cover transaction fees and avail a 20% discount.

- Exclusive entry to KuCoin Spotlight/BurningDrop

Ownership of KCS tokens paves the way for exclusive access to initial token offerings from emerging projects featured on KuCoin Spotlight/BurningDrop.

- Daily KCS bonus

Developers and holders who possess at least 6 KCS are entitled to a daily bonus derived from 50% of KuCoin's trading fee revenues. Consequently, the size of your bonus hinges on your holding volumes and the cumulative trading fee revenue generated by KuCoin.

- Fuel for transactions in KuCoin Community Chain (KCC) network

The KCS coin doubles up as the native currency in the KCC network, enabling users to pay transaction fees or gas fees within this public chain.

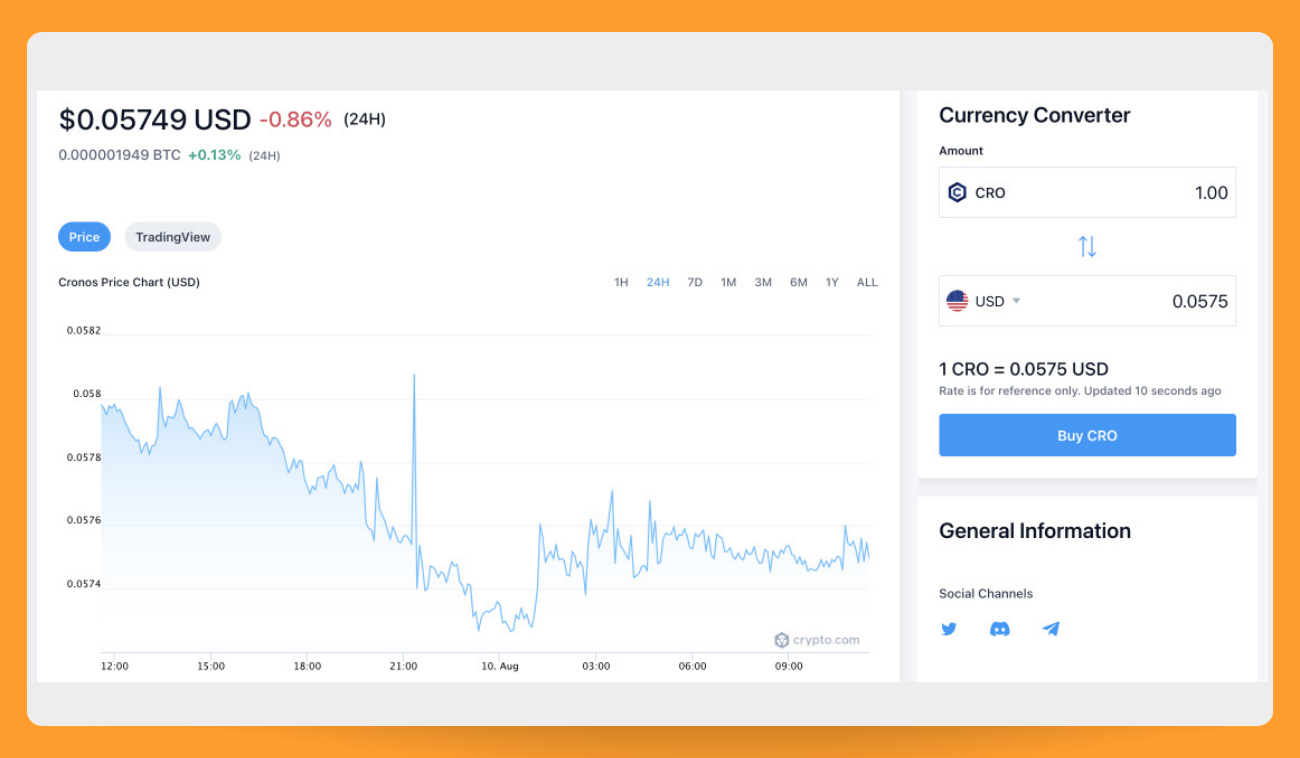

Crypto.com Coin: CRO

About CRO

Cronos is a Layer 1 blockchain network that aligns with Ethereum's protocols, and is constructed using the Cosmos SDK. It has the backing of Crypto.com, Crypto.org, alongside various app developers and partners within its ecosystem.

CRO, the inherent token of the Cronos network and an ERC-20 entity on the Ethereum blockchain, has a total circulation of 30 billion units. Ownership of CRO offers users a range of benefits within the Crypto.com ecosystem. Some of these advantages include reduced trading costs on Crypto.com and the opportunity to acquire a Crypto.com Visa Card that comes with a variety of perks.

CRO Use Cases, Benefits, and Perks

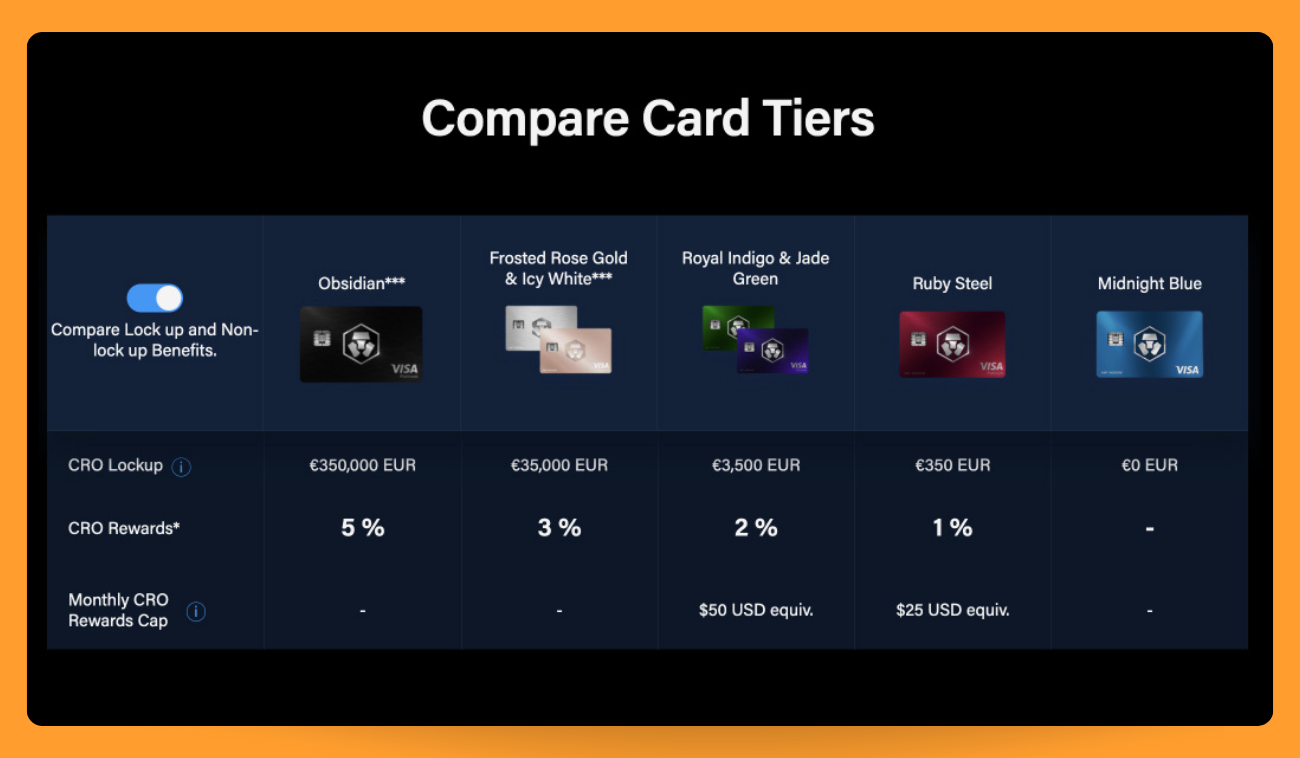

- Visa cards

Crypto.com's VISA debit card (Pic. 7) is likely the most appealing part of their ecosystem, originally being the main feature promoted in their ICO. The card comes in five tiers, where staking more CRO tokens in the Crypto.com app unlocks increasing benefits.

The base tier is free for all users but has the fewest perks. The top tier requires a massive $400,000 USD stake in CRO and builds on the rewards of each lower level while adding exclusive advantages. Essentially, the higher the tier through staking CRO, the more debit card bonuses you can access, making this a prime incentive to acquire and hold the token.

- E-commerce

Crypto.com provides you with a payment wallet called Crypto.com Pay that lets you make purchases using cryptocurrencies.

This feature enables you to pay for retail items with over 30 different digital currencies, including CRO.

Numerous retailers now accept Crypto.com Pay as a valid payment method. For example, you can use it at Travala, an online travel booking site, and Shopping.io, a platform for buying from brands like Amazon and eBay.

Another way you can use the Crypto.com token is to recharge your mobile airtime through Crypto.com Pay. Launched in 2020, this lets you purchase airtime in over 100 countries using BTC, CRO, XRP, ETH, and LTC. However, topping up with CRO tokens gives you 2.5% to 5% cashback. You can access the airtime payment tool through the Pay icon in the Crypto.com App.

You can also use CRO tokens to buy gift cards through the Crypto.com App. The app offers gift cards for numerous services, including food, taxis, groceries, gaming, fashion, telecoms, entertainment, hotels, airlines, gas stations, and retailers.

- Peer-to-peer lending

You can take advantage of Crypto.com's lending and borrowing service to secure loans against your crypto holdings, similar to how traditional banks work.

Using the Credit feature, you can collateralize your cryptocurrencies and receive loan payouts in stablecoins like USDT, TUSD, PAX, and USDC. You can borrow up to 50% of the value of the crypto you put up as collateral. If you have CRO tokens, you can use them as collateral to obtain stablecoins. As a lender, you can supply assets to the platform and earn up to 8% annual interest on your capital.

In essence, Crypto.com gives you familiar lending and borrowing options tailored to crypto assets. This allows you to unlock the value of your holdings or profit from supplying capital to other users.

- Earn with staking

You can stake CRO by delegating your tokens to a trusted validator node. These validators help secure the Cronos blockchain by verifying transactions, in return getting CRO block rewards when new blocks are added every 5-6 seconds.

The validators share these CRO rewards with the token holders who delegated to them. So by staking your CRO with validators, you earn a portion of the rewards they receive for securing the network. The more CRO you stake, the higher your potential rewards.

Staking provides an easy way to put your idle CRO to work and gain benefits just for contributing to the health of the Cronos chain.

- NFTs

Crypto.com has expanded into the booming NFT market as well. In 2021, it launched an NFT marketplace where you can buy and sell different NFTs using currencies like CRO. The marketplace aims to provide the fastest and easiest way to purchase NFTs and supports transactions with over 30 tokens. With NFTs gaining immense popularity, Crypto.com's marketplace offers you a straightforward platform to get involved in this new segment of the crypto world.

Where to Trade BNB, KCS, CRO, and Other Exchange-Based Tokens?

You can trade a wide array of exchange-based tokens like BNB, KCS, CRO, and many more on their respective exchanges or any other platform that supports these cryptocurrencies. And guess what? By linking your exchange accounts to Bitsgap, you can leverage additional trading tools to maximize the benefits from these currencies.

But that's not all! With Bitsgap, you can consolidate as many as 17 crypto exchanges, including big names like Binance, KuCoin, and Crypto.com, all under one roof! Beyond bringing all your exchanges together, Bitsgap offers a smart trading terminal with advanced order options such as TWAP, Scaled, OCO, and multiple hedging and trailing features.

And here's the kicker — Bitsgap features automation bots, which are truly the crown jewel of the platform. You can take advantage of DCA, BTD, GRID bots for the spot market, and DCA Futures and COMBO bots for the futures market.

So, are you ready to jump in and explore these features for yourself? We're thrilled to welcome you aboard!

Bottom Line

Just like any other asset, cryptocurrencies are subject to heart-pumping volatility. But don't let that deter you — with great risk comes great reward.

To really strike crypto gold, you've got to get strategic. Forget staring mindlessly at charts all day — it's time to put on your thinking cap. Focus on crypto’s utility, analyze its tokenomics, and study price patterns.

When it comes to utility, cryptocurrency exchanges have a clear advantage. Why? Because crypto exchanges are essential no matter which way the winds blow. As the gateway to trading, they provide liquidity that oils the entire crypto machine.

So go ahead, delve into those charts, understand the utility, and you could be on your way to reaping decent returns.

FAQs

What Are Exchange-Based Tokens?

Crypto exchanges often issue their own tokens, known as exchange-based tokens. These tokens serve as a type of utility token with unique uses within the exchange's ecosystem, such as facilitating funding for platform maintenance and enhancement, providing voting rights to token holders, offering discounted transaction fees, and granting access to exclusive coin offerings, among other benefits.

Many exchanges, particularly Centralized Exchanges (CEX), have their own native tokens, which can be beneficial to own. Notable examples of these tokens include Binance's BNB, OKX's OKB, Kucoin's KCS, Huobi's HT, Gate.io's GT, and Crypto.com’s CRO, among others.

Is Holding Crypto Exchange Tokens a Good Idea?

Exchange-issued crypto tokens, often referred to as "exchange tokens," might be among the most valuable digital assets available. These tokens can offer various benefits to their holders, such as trading fee discounts, making them similar to utility tokens like airline miles. However, unlike airline miles, exchange tokens can be freely traded across multiple platforms. For traders, the benefits of holding these tokens can be substantial, including potential savings on fees, rebates, early access to token sales on the platform, voting rights, and earning rewards through staking and yield farming, among others.

Despite their benefits, it's important to note that exchange tokens are not equivalent to owning shares in the company and usually do not provide governance rights over the exchange. Nevertheless, the market dynamics of exchange tokens often mirror those of equity markets. Their value is largely driven by the belief in the success of the exchange - the idea being that as exchange activity grows, so too will the demand for its native token, making it a valuable asset to hold.