Why and How to Diversify Cryptocurrency Trading Portfolio

The crypto market promises thrilling rewards, but riding the rollercoaster on a single coin can lead to a stomach-churning drop. Secure your financial future by mastering the art of crypto portfolio diversification.

The cryptocurrency market is exciting, offering potentially high rewards, but it's also incredibly volatile. Putting all your eggs in one basket, or in this case, one coin, can expose you to significant risk. That's where diversification comes in. Just like with traditional investing, diversifying your crypto portfolio is key to mitigating risk and maximizing your chances of long-term success.

In this article, we'll explore the concept of portfolio diversification, its implications, and the best strategies for diversifying your crypto portfolio. Along the way, we'll unveil valuable tools that can assist you on your journey and showcase how Bitsgap can empower you to build and manage a resilient and profitable crypto portfolio.

What Is Portfolio Diversification?

Portfolio diversification is a strategy used by investors to spread their investments across various assets, sectors, or geographical locations to reduce risk. The fundamental idea behind diversification is that a well-balanced portfolio will, on average, yield higher returns and pose lower risk than any individual investment found within the portfolio. By holding a mix of assets, investors can mitigate the adverse effects of volatility in any single investment.

Understanding Portfolio Diversification

At its core, portfolio diversification involves allocating investments across different asset classes, such as stocks, bonds, real estate, and commodities. The goal is to create a portfolio that includes a variety of investments that will react differently to the same market event. For instance, when the stock market is performing poorly, bonds or real estate might perform better, thereby cushioning the overall impact on the portfolio.

Diversification can be achieved in several ways:

- Asset Allocation: Distributing investments among different asset classes.

- Sector Diversification: Investing in various sectors like technology, healthcare, finance, etc.

- Geographic Diversification: Investing in different countries or regions to spread risk associated with any single country's economy.

What Does a Diversified Crypto Portfolio Look Like?

A diversified crypto portfolio follows the same principles as traditional diversification but within the realm of cryptocurrencies. Given the volatile nature of cryptocurrencies, diversification within this asset class is crucial.

A well-diversified crypto portfolio might include:

- Large-cap Cryptocurrencies: These are well-established and have a large market capitalization, such as Bitcoin (BTC) and Ethereum (ETH).

- Mid-cap Cryptocurrencies: These are emerging cryptocurrencies with significant growth potential but higher risk than large-caps, such as Cardano (ADA) or Polkadot (DOT).

- Small-cap Cryptocurrencies: These are newer and smaller cryptocurrencies with high growth potential but also high risk, such as Chainlink (LINK) or VeChain (VET).

- Stablecoins: Cryptocurrencies like Tether (USDT) or USD Coin (USDC) that are pegged to a stable asset like the US Dollar, providing stability within a volatile market.

- Blockchain Projects: Investing in specific blockchain projects or platforms that offer unique technologies or solutions, such as DeFi (Decentralized Finance) protocols or NFT (Non-Fungible Token) platforms.

We’ll take a look at diversified crypto portfolio examples in more detail in later sections.

Differences Between a Diversified Crypto Portfolio and Other Asset Portfolios

While the principle of diversification remains consistent across different types of portfolios, the specific strategies and considerations can differ. Here’s how a diversified crypto portfolio differs from a diversified stock portfolio or other asset portfolios:

Volatility and Risk

- Crypto Portfolio: Cryptocurrencies are known for their extreme volatility and higher risk compared to traditional assets. A diversified crypto portfolio must account for this by including stablecoins or assets that can provide a hedge against market swings.

- Stock Portfolio: Stocks generally exhibit lower volatility than cryptocurrencies, though they can still fluctuate significantly. Diversification within stocks often involves a mix of growth stocks, value stocks, and dividend-paying stocks.

Market Maturity

- Crypto Portfolio: The cryptocurrency market is relatively young and rapidly evolving, with new projects and technologies emerging frequently. This presents both higher risk and higher potential rewards.

- Stock Portfolio: The stock market is more mature and regulated, with established companies and historical data that can guide investment decisions.

Asset Types

- Crypto Portfolio: Diversification can include a variety of digital assets like utility tokens, security tokens, stablecoins, and different blockchain projects.

- Stock Portfolio: Diversification typically involves stocks from various sectors, bonds, mutual funds, ETFs, and possibly real estate or commodities.

Regulatory Environment

- Crypto Portfolio: The regulatory environment for cryptocurrencies is still developing, leading to potential uncertainties and changes that can impact investments.

- Stock Portfolio: The stock market operates under well-established regulatory frameworks, providing a level of stability and predictability.

Here’s a table that summarizes these key differences for easy reference:

Fig. 1. Key differences between different types of portfolios.

Whether dealing with traditional assets like stocks and bonds or the more volatile realm of cryptocurrencies, the goal remains the same: to create a balanced portfolio that can withstand market fluctuations.

Why to Diversify Crypto Portfolio?: Advantages & Disadvantages

As mentioned, diversifying a crypto portfolio is essential for managing the inherent risks associated with the volatile nature of the cryptocurrency market. While the potential for high returns is a significant attraction, the extreme price fluctuations can lead to substantial losses if investments are not properly diversified. Below, we explore the reasons for diversification, along with its advantages and disadvantages.

Reasons to Diversify a Crypto Portfolio

- Risk Management: The primary reason for diversification is to reduce risk. By spreading investments across various cryptocurrencies and blockchain projects, investors can minimize the impact of a poor-performing asset on their overall portfolio.

- Maximizing Returns: Diversification increases the chances of capturing high returns from different sectors and projects within the cryptocurrency space. While some assets may underperform, others might deliver substantial gains, balancing the overall portfolio performance.

- Exposure to Innovation: The crypto market is teeming with innovative projects and technologies. Diversifying allows investors to gain exposure to a wide array of opportunities, from decentralized finance (DeFi) to non-fungible tokens (NFTs) and beyond.

- Hedging Against Volatility: Cryptocurrencies are known for their volatility. Including stablecoins or assets with lower volatility in a portfolio can provide a buffer against market downturns, ensuring some level of stability.

Benefits & Challenges of Crypto Portfolio Diversification

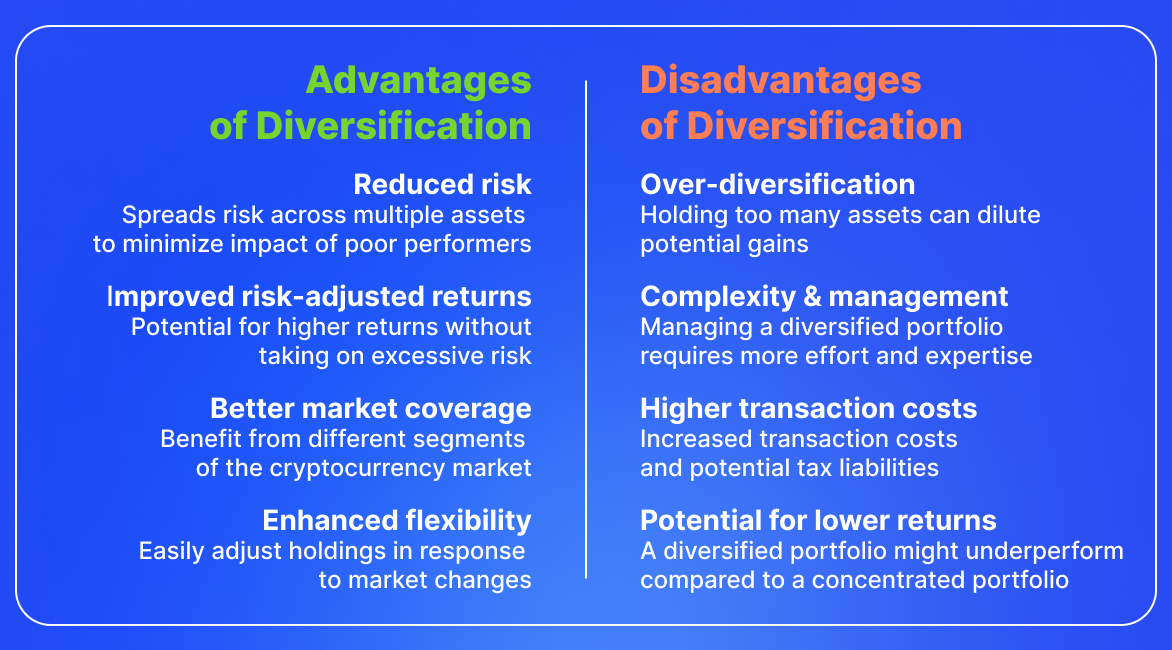

Advantages of Diversification

- Reduced Risk: Diversification helps in spreading risk across multiple assets. If one cryptocurrency performs poorly, the loss can be offset by gains in other investments.

- Improved Risk-Adjusted Returns: A well-diversified portfolio can achieve better risk-adjusted returns, meaning investors can potentially earn higher returns without taking on excessive risk.

- Better Market Coverage: Diversification allows investors to benefit from different segments of the cryptocurrency market, ensuring they do not miss out on potential growth areas.

- Enhanced Flexibility: With a diversified portfolio, investors can more easily adjust their holdings in response to market changes, new opportunities, or personal financial goals.

Disadvantages of Diversification

- Over-Diversification: While diversification reduces risk, over-diversification can dilute potential gains. Holding too many assets can make it difficult to achieve significant returns from any single investment.

- Complexity and Management: Managing a diversified portfolio requires more effort and expertise. Investors need to stay informed about multiple assets, monitor market trends, and make timely adjustments.

- Higher Transaction Costs: Diversifying across numerous cryptocurrencies can lead to increased transaction costs, including trading fees and potentially higher tax liabilities.

- Potential for Lower Returns: If not managed properly, a diversified portfolio might underperform compared to a more concentrated portfolio focused on high-performing assets.

Diversifying a crypto portfolio is a crucial strategy for managing risk and maximizing potential returns in the highly volatile cryptocurrency market. It provides exposure to various innovative projects and helps hedge against market downturns. However, investors must be mindful of the potential downsides, such as over-diversification and increased complexity.

Ultimately, the goal is to find a balance that aligns with individual risk tolerance, investment goals, and market conditions. By carefully selecting a mix of assets and continuously monitoring their performance, investors can navigate the dynamic world of cryptocurrencies with greater confidence and resilience.

How to Diversify Crypto Portfolio: Ways to Diversify Portfolio

Below, we outline how to diversify a crypto portfolio and provide practical examples of diversified portfolios, explaining why they work.

Ways to Diversify a Crypto Portfolio

- Invest in Different Types of Cryptocurrencies

- Large-cap Cryptocurrencies: These are well-established cryptocurrencies with large market capitalizations, such as Bitcoin (BTC) and Ethereum (ETH). They tend to be more stable and are often considered safer investments.

- Mid-cap Cryptocurrencies: These have significant growth potential but come with higher risk. Examples include Cardano (ADA) and Polkadot (DOT).

- Small-cap Cryptocurrencies: These are newer and smaller cryptocurrencies that can offer high returns but are also the riskiest. Examples include Chainlink (LINK) and VeChain (VET).

- Include Stablecoins: Stablecoins like Tether (USDT) and USD Coin (USDC) are pegged to stable assets such as the US Dollar. They provide stability and can act as a hedge against market volatility.

- Diversify Across Sectors

- DeFi (Decentralized Finance): Invest in projects like Uniswap (UNI) and Aave (AAVE) that are revolutionizing financial services through blockchain technology.

- NFT (Non-Fungible Tokens): Projects like Enjin Coin (ENJ) and Decentraland (MANA) are leading the way in the NFT space, offering unique opportunities for investment.

- Infrastructure Projects: Cryptocurrencies that support the blockchain infrastructure, such as Chainlink (LINK) for oracles and Filecoin (FIL) for decentralized storage.

- Geographic Diversification: Investing in cryptocurrencies that are popular in different regions can help mitigate risks associated with regulatory changes in a specific country. For example, considering projects that have strong support in Asia, Europe, or North America.

- Staking and Yield Farming: Participate in staking or yield farming to earn rewards on your investments. This involves locking up your cryptocurrencies in a wallet to support network operations or providing liquidity to DeFi protocols in exchange for interest or tokens.

Practical Examples of Diversified Portfolios

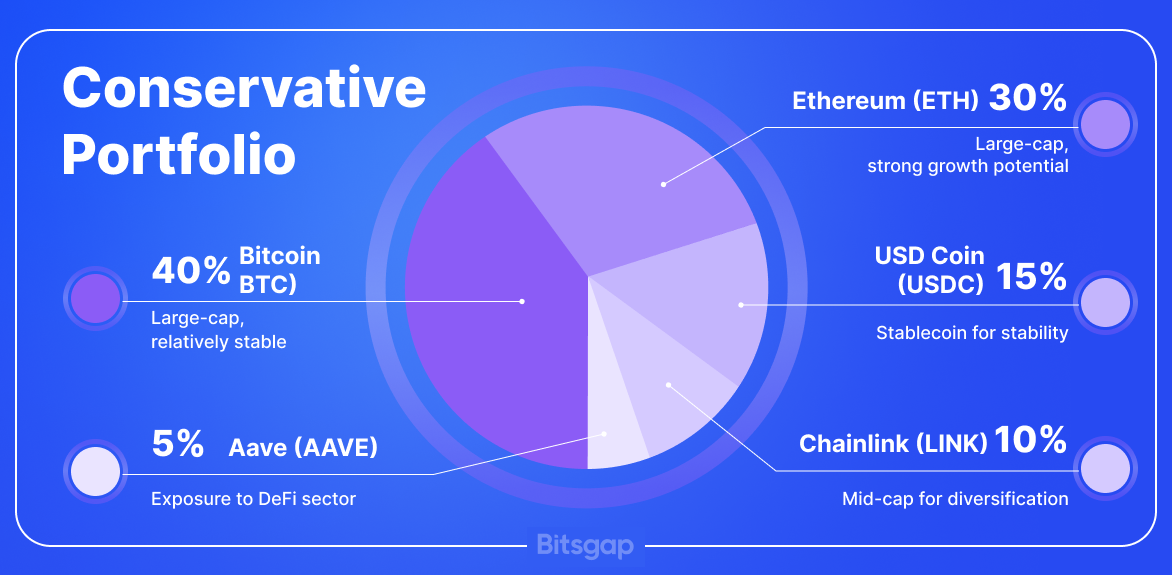

Example 1: Conservative Portfolio

- 40% Bitcoin (BTC): Large-cap, relatively stable.

- 30% Ethereum (ETH): Large-cap, strong growth potential.

- 15% USD Coin (USDC): Stablecoin for stability.

- 10% Chainlink (LINK): Mid-cap for diversification.

- 5% Aave (AAVE): Exposure to DeFi sector.

Why It Works: This conservative portfolio prioritizes stability and lower risk by heavily weighting large-cap cryptocurrencies and including a stablecoin. It still captures growth potential through mid-cap and DeFi investments.

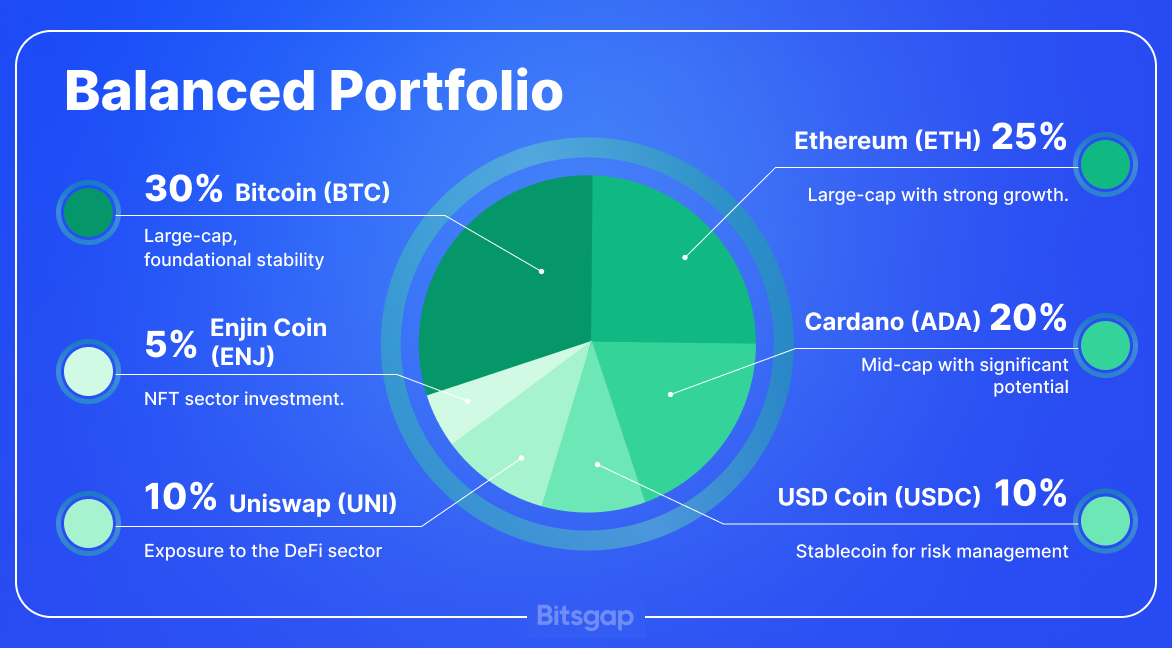

Example 2: Balanced Portfolio

- 30% Bitcoin (BTC): Large-cap, foundational stability.

- 25% Ethereum (ETH): Large-cap with strong growth.

- 20% Cardano (ADA): Mid-cap with significant potential.

- 10% USD Coin (USDC): Stablecoin for risk management.

- 10% Uniswap (UNI): Exposure to the DeFi sector.

- 5% Enjin Coin (ENJ): NFT sector investment.

Why It Works: This balanced portfolio offers a mix of stability and growth. It includes a healthy portion of large-cap cryptocurrencies, a stablecoin for security, and allocations to mid-cap and sector-specific investments for diversification.

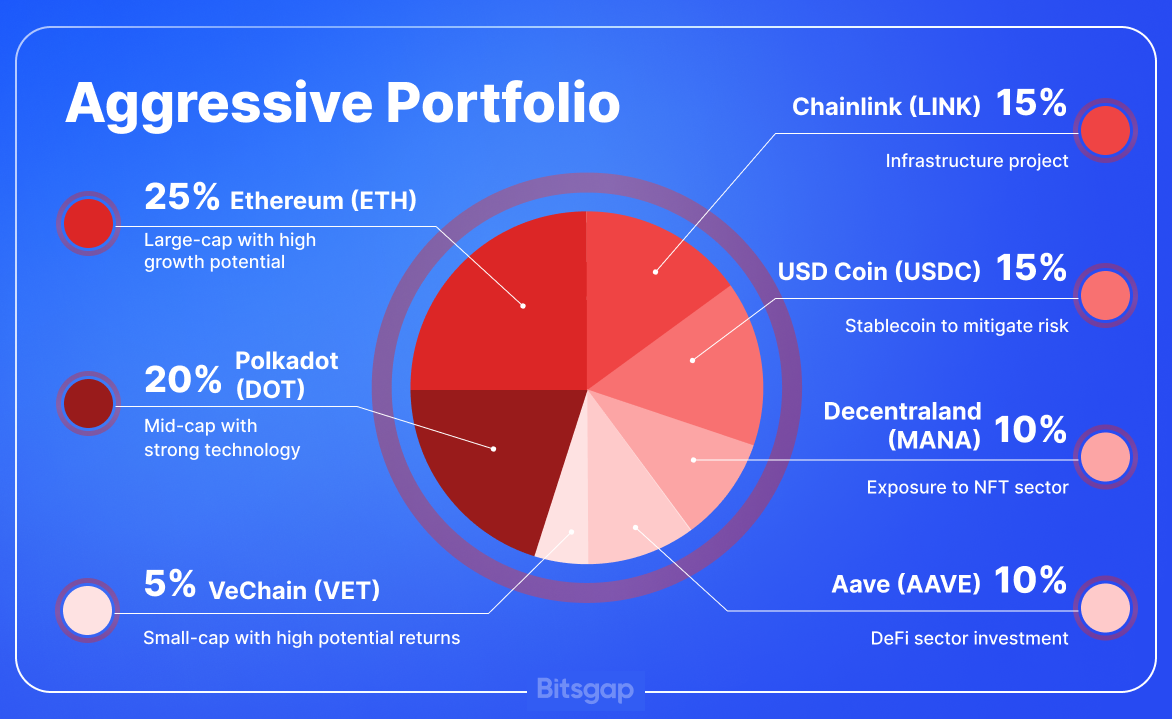

Example 3: Aggressive Portfolio

- 25% Ethereum (ETH): Large-cap with high growth potential.

- 20% Polkadot (DOT): Mid-cap with strong technology.

- 15% Chainlink (LINK): Infrastructure project.

- 15% USD Coin (USDC): Stablecoin to mitigate risk.

- 10% Decentraland (MANA): Exposure to NFT sector.

- 10% Aave (AAVE): DeFi sector investment.

- 5% VeChain (VET): Small-cap with high potential returns.

Why It Works: This aggressive portfolio focuses on higher risk and higher reward opportunities. It includes a variety of mid-cap and small-cap cryptocurrencies, stablecoin for some stability, and significant exposure to emerging sectors like DeFi and NFTs.

As you can see, diversifying a crypto portfolio involves strategically spreading investments across different types of cryptocurrencies, sectors, and regions to manage risk and enhance potential returns. Each example portfolio we’ve described above offers a different approach to diversification, catering to varying risk appetites and investment goals.

Tools for Crypto Portfolio Diversification

There are various tools available that can help you achieve effective diversification, monitor your assets, and manage your portfolio efficiently. Below, we explore different types of tools and offer examples for each.

Portfolio Trackers

Example: Delta

Portfolio trackers are essential for monitoring your crypto investments across various exchanges and wallets. Delta is a popular app that allows you to track your portfolio's performance in real time. It provides detailed analytics, price alerts, and insights into your holdings, helping you make informed decisions. With Delta, you can easily monitor the diversification of your assets and adjust your strategy as needed.

Rebalancing Tools

Example: Shrimpy

Rebalancing tools help maintain your desired asset allocation by periodically buying and selling assets to align with your target distribution. Shrimpy is a powerful rebalancing tool that automates this process. It supports multiple exchanges and allows you to set specific rebalancing strategies, such as periodic or threshold-based rebalancing. By keeping your portfolio balanced, Shrimpy helps mitigate risk and optimize returns over time.

Research and Analysis Platforms

Example: CoinGecko

Staying informed about the latest market trends and developments is crucial for effective portfolio management. CoinGecko is a comprehensive research and analysis platform that provides detailed information on thousands of cryptocurrencies, including price data, market cap, trading volume, and more. It also offers insights into market sentiment, upcoming events, and blockchain metrics, helping you make informed decisions about diversifying your portfolio.

DeFi Platforms

Example: Yearn Finance

Decentralized Finance (DeFi) platforms offer various financial products and services that can enhance your portfolio diversification. Yearn Finance is a leading DeFi platform that automates yield farming strategies to maximize returns on your crypto assets. By participating in Yearn Finance's vaults, you can diversify your portfolio into different DeFi protocols and earn passive income from interest and rewards.

Staking and Yield Farming Tools

Example: Aave

Aave is a prominent DeFi protocol that allows users to lend and borrow cryptocurrencies. Through its staking and yield farming features, you can earn interest on your crypto holdings by providing liquidity to the platform. Aave supports a wide range of assets and offers various yield farming opportunities, allowing you to diversify your income streams. By staking your assets in Aave, you can earn attractive rewards while contributing to the platform's liquidity.

Tax Reporting Software

Example: CoinTracker

Managing taxes on your crypto investments can be complex, especially with a diversified portfolio. CoinTracker is a tax reporting software that simplifies this process by tracking your transactions across multiple exchanges and wallets. It provides detailed tax reports, helping you stay compliant with tax regulations and accurately report your crypto earnings.

Trading Bots & AI

Example: Bitsgap

Crypto trading bots, like the Bitsgap, use algorithms to automate trading strategies. These bots can analyze market trends, execute trades, and manage your portfolio 24/7. In the next section, we'll dive deeper into Bitsgap's cutting-edge AI Assistant, exploring how this innovative tool can effortlessly elevate your portfolio diversification strategy.

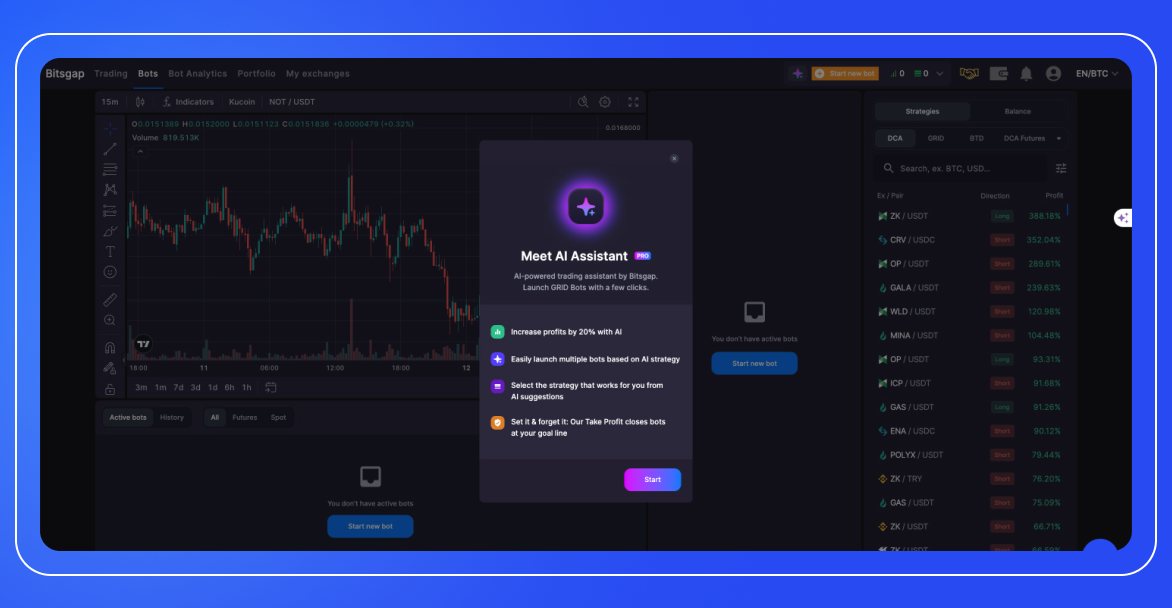

Introducing Bitsgap AI Assistant

Now, on Bitsgap, you can diversify your portfolio by buying/selling assets manually, with automated trading bots, or using a cutting-edge AI assistant.

The Bitsgap AI Assistant is designed to simplify cryptocurrency trading, especially for newcomers and those looking for a helping hand with developing effective strategies. It takes the guesswork out of setting up trading bots by analyzing your assets and recommending personalized GRID Bot configurations.

Here's how it works:

- Analysis and Recommendation: The AI Assistant analyzes your available exchange balance and, using algorithms developed and tested over 7 years, generates a list of personalized GRID Bot strategy recommendations. These strategies focus on USDT trading pairs.

- Customization: You choose the exchange, the total investment amount (or a percentage of your balance), and your preferred investment term (short, mid, or long). Each term is associated with a risk profile (aggressive, moderate, conservative), influencing the bot's settings. The AI then suggests a diversified portfolio of bots across different trading pairs to mitigate risk.

- Backtesting: Before deploying your bots, you can run a backtest to see how the recommended strategy would have performed historically. This helps you evaluate its potential effectiveness and make adjustments if needed.

- Launch and Manage: Once you're satisfied, you can launch your AI-powered bot portfolio with a single click. The bots run independently, and you can monitor their performance, modify settings, or close them individually at any time.

Getting Started:

- Click on the "Start new bot" button.

- Select "AI assistant" in the pop-up window.

- Follow the on-screen instructions to customize your strategy, review the settings, and launch your bots.

Pic. 9. Customizing your AI Assistant.

How Bitsgap AI Assistant Helps with Diversification:

- Automated Portfolio Creation: Instead of manually selecting trading pairs and configuring multiple bots, the AI Assistant does the heavy lifting for you, creating a diversified portfolio based on your risk tolerance and investment goals.

- Multi-Pair Strategies: The AI recommends strategies that involve multiple USDT trading pairs, spreading your risk across different assets and potentially capturing gains from various market movements.

- Backtesting for Confidence: Backtesting allows you to assess the historical performance of the AI's recommendations, giving you more confidence in the diversification strategy before committing your funds.

In a nutshell, the Bitsgap AI Assistant acts as your personal crypto trading co-pilot, simplifying the process of building and managing a diversified portfolio of GRID Bots, making it easier to navigate the exciting but often complex world of cryptocurrency trading.

Conclusion

The turbulent waters of cryptocurrency investment requires a steady hand and a strategic mind. As we've discovered, diversification is your compass and life vest, guiding you towards a more secure and potentially profitable journey. It's about strategically spreading your risk by investing in a variety of digital assets, ensuring that the fate of your entire portfolio doesn't hinge on the performance of a single coin.

Remember, diversification isn't a one-time action but an ongoing process. Regularly assess your portfolio's balance, keeping your risk tolerance and investment goals in mind. Fortunately, you don't have to chart these waters alone. Tools like index funds and staking platforms can simplify the diversification process, while portfolio trackers help you monitor your investments' performance.

And for a truly intelligent co-captain, consider the Bitsgap AI Assistant. This powerful tool leverages years of market data and sophisticated algorithms to recommend personalized, diversified GRID Bot strategies. It's like having an expert strategist by your side, helping you navigate the complexities of crypto trading and potentially maximizing your returns.