Smart Contracts Explained: Benefits, Issues & Use Cases

Forget the red tape — smart contracts are the new way deals get done. The future of business is code. Are you on board?

Step into the world of "smart contracts," an ingenious fusion of code and distributed ledger technology that's revolutionizing the way we conduct transactions.

In this article, we unravel the enigma behind smart contracts by exploring their origins, functionalities, and the myriad advantages they bring to the table. But it's not all smooth sailing; we'll also delve into the challenges and legal quandaries that must be addressed before smart contracts can truly reshape the commercial landscape.

Intrigued? Keep reading to discover real-world applications, examples, and the untapped potential of smart contracts.

What Are Smart Contracts?

Smart contracts are self-executing digital agreements that are coded and permanently etched into the blockchain, rendering them both immutable and irreversible.

The raison d'être of smart contracts is to facilitate the automation and execution of agreements, bypassing the need for intermediaries. This enables all parties involved to swiftly confirm the conclusion of a transaction. Moreover, smart contracts possess the ability to orchestrate intricate workflows contingent upon specific conditions.

In the context of a smart contract, "execution" means that the agreement encoded in the contract has been fulfilled. This occurs when all predetermined conditions are satisfied, and the essential actions have been carried out.

Blockchain networks offer a novel advantage: the automation of tasks that once necessitated a third-party intermediary. For instance, a smart contract eliminates the requirement for a bank to manually authorize a money transfer from a client to a contractor. As a result, the normal process of executing a contract takes far less time and money.

Smart Contracts Origin: Back to the Future

In 1994, American computer scientist Nick Szabo first introduced the concept of smart contracts. Szabo, who also conceived the virtual currency "Bit Gold" in 1998, a decade before Bitcoin's debut, has been occasionally speculated to be the enigmatic Satoshi Nakamoto—Bitcoin's anonymous creator, a claim he has refuted.

Szabo characterized smart contracts as digital transaction protocols that fulfill the conditions of a contract. His ambition was to augment the capabilities of electronic transaction methods, such as point-of-sale (POS) systems, within the digital domain.

Smart contracts diverge from traditional contracts in that they lack legal language or explicit terms between parties. Instead, they comprise scripts with conditional statements, functions, module imports, and other programming elements that automate the actions detailed in a contract.

Remarkably, many of Szabo's prognostications materialized in ways that predated blockchain technology. For instance, derivatives trading is predominantly executed via computer networks employing elaborate term structures.

While the advent of Bitcoin in 2009 provided the technical groundwork for smart contracts, it was the Ethereum protocol that truly elevated this technology as a blockchain’s cornerstone.

What Is a Cryptocurrency Smart Contract?

Smart contracts are frequently linked to cryptocurrencies, with Ethereum's implementation of smart contracts widely regarded as a crucial component underpinning decentralized finance (DeFi) and non-fungible token (NFT) applications.

However, numerous blockchains, including Cardano, EOS, and Chainlink, are actively broadening smart contract applications and market share, as well as advancing the underlying technology.

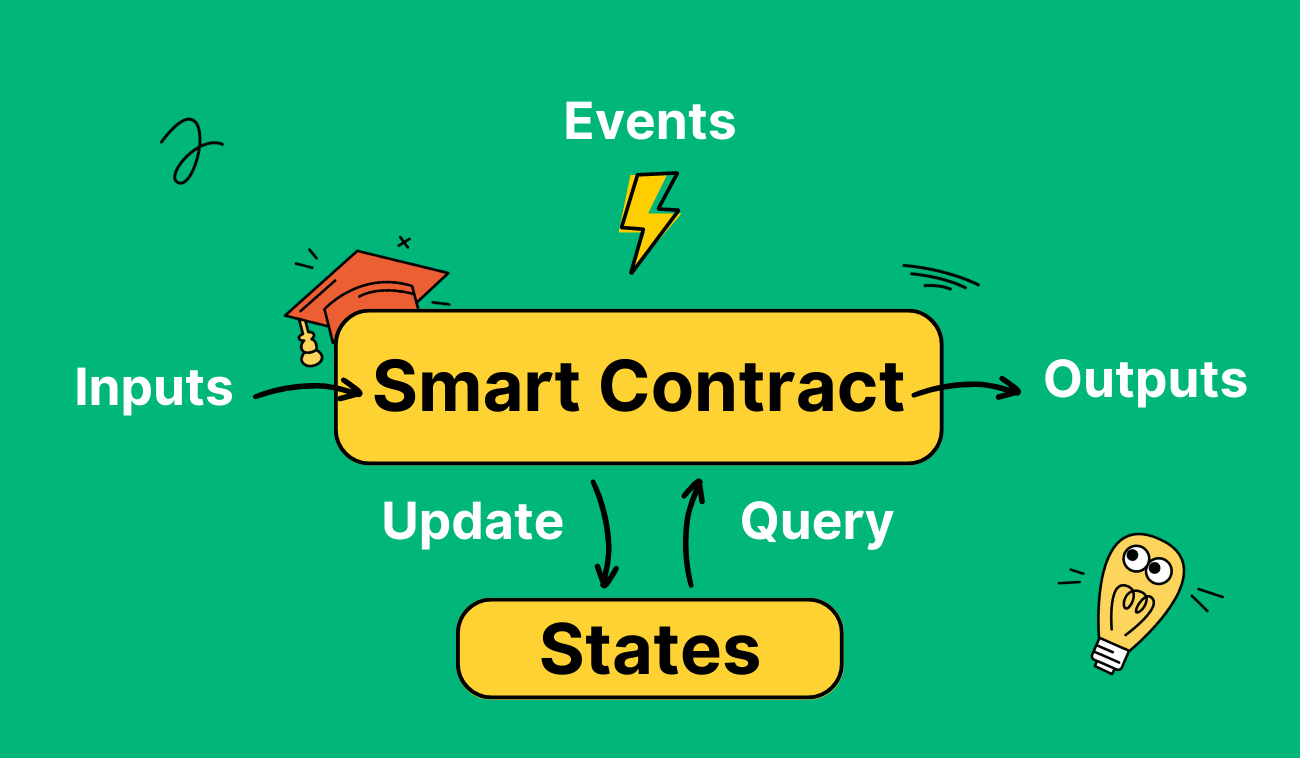

👉 Ethereum.org offers this description of a smart contract: “A smart contract is a program that operates on the Ethereum blockchain. It comprises a set of code (functions) and data (state) located at a particular address within the Ethereum blockchain.”

How Smart Contracts Work

Smart contracts operate through straightforward "if/when...then..." statements encoded within the blockchain. When a network of computers verifies that predetermined conditions have been satisfied, these statements trigger specific actions, such as disbursing funds to relevant parties or sending notifications. Upon completion, the transaction is recorded on the blockchain, rendering it unalterable and visible only to authorized parties.

A smart contract can encompass numerous clauses to ensure all parties are confident in the task's satisfactory completion. To establish the contract's terms, participants must decide on the representation of transactions and their data on the blockchain, concur on the rules governing the "if/when...then..." statements, examine all potential exceptions, and devise a framework for resolving disputes.

A developer then codes the smart contract. However, many organizations using blockchain for business purposes now offer templates, web interfaces, and other tools to simplify the process.

Smart Contract Use Cases: What Can Smart Contracts Do?

Smart contracts have the capacity to execute various agreements, making them suitable for a wide range of applications in numerous industries, including real estate transactions, stock and commodity trading, lending, corporate governance, supply chain management, dispute resolution, and healthcare, among others.

A detailed example of using smart contracts for supply chain management is provided on IBM's website. IBM describes its collaboration with the company Sonoco to track the transportation of temperature-sensitive medicines. Using IBM's Blockchain Transparent Supply solution and smart contracts, the Pharma Portal platform monitors the location and temperature of pharmaceuticals as they move through the supply chain.

A potential use case for smart contracts is the tokenization of digital identities, which would allow secure storage and controlled sharing of personal information. Users could selectively share data on social media and with banks, maintaining privacy while receiving benefits. Social media platforms would not control data; users could create smart contracts to exchange chosen information and get paid directly. In banking, users could share specific documents needed for transactions like loan applications without risking data exploitation by third parties.

Cryptocurrency Smart Contract Example

Smart contracts are essential for decentralized applications (dApps), serving as a key aspect of blockchain development. If a single smart contract typically handles one transaction type based on "if-then" conditions, dApps often combine multiple smart contracts for advanced functionality. From finance to gaming and media, these trusty smart contracts serve diverse purposes, reducing the burden of administrative tasks.

For example, Chainlink provides a decentralized "oracle" system that securely validates external data so that smart contracts can access data feeds, APIs, and payments. In blockchain terms, an oracle is a source of outside information for smart contracts on the ledger.

Chainlink enhances the security of data feeds by using similar consensus methods as those that validate transactions. Since smart contracts require inputs from various sources to work properly, Chainlink connects to APIs to verify transactions from banks, Visa, PayPal, and other financial institutions.

Oracles are essential for smart contracts to interact with the outside world beyond their own blockchain. This is especially important for permissioned blockchains, allowing smart contracts to respond to changes like interest rate shifts or stock price movements.

👉 Imagine a smart contract that automatically pays your bills each month. It would need an oracle to supply data on your latest utility charges, rent payment amount, etc. Or think of a smart contract managing a blockchain-based lending fund. It relies on oracles providing live data on interest rates, allowing it to adjust borrowing terms immediately based on the latest market conditions.

The key is that oracles expand the capabilities of smart contracts by giving them eyes and ears outside their limited blockchain environment. With oracles and smart contracts working together, decentralized applications have the potential to eventually handle many of the automated tasks currently performed by centralized companies. But with blockchain, individuals and communities will remain in control of an open, transparent, and secure system.

Benefits of Smart Contracts

The majority of conventional digital contracts involve two parties who are unfamiliar with each other, which introduces the possibility that either participant will not fulfill their obligations.

To address this counterparty risk, digital contracts are frequently managed and executed by larger, centralized institutions, such as banks, that can enforce the contract terms. These digital contracts may be directly between an individual and a large corporation, or they may involve a large corporation serving as a trusted intermediary between two parties. While this arrangement allows for the existence of many contracts that would otherwise not take on such risks, it also results in a situation where centralized institutions wield disproportionate power over the agreements.

Smart contracts provide several enhancements over traditional digital contracts.

- Security: By operating the contract on a decentralized blockchain infrastructure, there is no single point of failure to exploit, no centralized intermediary to corrupt, and no means for either party or a central administrator to manipulate the outcome.

- Reliability: The contract logic undergoes redundant processing and verification by a decentralized network of nodes, offering robust resistance to tampering, high uptime, and precise execution guarantees.

- Fairness: Utilizing a decentralized network to host and enforce the agreement's terms reduces the potential for a profit-seeking middleman to exploit their privileged position and extract value.

- Efficiency: Automating the backend processes of the agreement — such as escrow, maintenance, execution, and settlement — eliminates the need for either party to wait for manual data entry, the other party to meet their obligations, or an intermediary to complete the transaction.

Smart Contract Issues

While smart contracts represent an exciting advancement, they are not without shortcomings. It is crucial to understand that these contracts and the underlying blockchain technology are created by humans, making them prone to human mistakes.

👉 The infamous attack on Ethereum's decentralized autonomous organization (DAO) in 2016 served as evidence that coding errors can occasionally result in security breaches. The attackers exploited a flaw in the fundraising smart contract, siphoning funds from the project.

Additionally, the absence of clear regulations regarding smart contracts poses another challenge. Although the notion of a secure, efficient transfer of funds is attractive, matters such as taxation and governmental oversight must be addressed.

One limitation of smart contracts lies in their inability to access data from sources outside the blockchain network. This issue arises because many real-world applications depend on external data to trigger or execute contract provisions. As discussed above, oracles redress this issue but they also have their limitations.

As the adoption of blockchain technology and smart contracts increases, concerns about scalability and network congestion remain. These factors can impact the system's performance and dependability, particularly during periods of high demand.

Furthermore, smart contracts are self-executing and non-negotiable, which can be a disadvantage if unforeseen events necessitate changes to the contract terms.

Smart Contract Platforms

Platforms for smart contracts enable the facilitation, verification, and enforcement of these digital agreements. They supply the blockchain infrastructure necessary for smart contracts, deliver programming and testing services for smart contracts, and host their deployment and execution. Beyond the smart contract itself, these platforms integrate the inputs and outputs of the contracts into the blockchain. Notable examples include Ethereum, Hyperledger Fabric, Waves, Solana, Stellar, Algorand, Polkadot, Tron, Chainlink, and BNB Chain.

How to Create a Smart Contract

Suppose you decide to code and deploy a smart contract on the Ethereum network. Then the first thing you need to do is learn a smart contract programming language like Solidity or Vyper and have enough ether to pay for the deployment transaction fees. Please be mindful of smart contract costs, which are significantly higher than for a simple transfer.

Once you write a smart contract in Solidity or Vyper, the code needs to be compiled into bytecodes that can be interpreted by the Ethereum Virtual Machine (EVM). The compiled smart contracts are public on the blockchain and can interact with each other, allowing for complex composable applications. Smart contracts themselves cannot access off-chain data directly but this can be overcome using oracles. Another limitation is the maximum smart contract size of 24 KB.

Regrettably, delving into the intricate coding specifics is beyond the scope of this article. Nevertheless, if you're eager to learn, the following resources will serve as comprehensive guides:

- Introduction to Smart Contracts on Ethereum

- Comprehensive Ethererum development tutorials

- OpenZeppelin Contracts: Library for secure smart contract development. It offers pre-built and audited smart contracts like ERC20, ERC721, etc.

- DappSys: Provides safe, simple and flexible building blocks for smart contracts.

Smart Contract without Blockchain

The ledger plays a crucial role in managing smart contracts, as it handles the storage of essential information required for their operation. Without the ledger, smart contracts would be unable to function effectively.

Smart Contract vs dApp

Smart contracts serve as the foundation for many blockchain operations, including dApps. This means that dApps function due to the presence of smart contracts. Conversely, without an interface, smart contracts are inaccessible to general users. dApps provide this interface, making it easy to interact with smart contracts with just a click. No programming knowledge is required to use a dApp, simplifying access to smart contracts.

How Does All This Relate to Bitsgap?

You may ask how Bitsgap comes into the picture. Well, see, as one of the largest crypto aggregators and trading platforms on the internet, Bitsgap enables you to trade cryptocurrencies across 15 leading centralized exchanges.

If you've been seeking a visually appealing, highly efficient trading platform that consolidates major exchanges in one place, Bitsgap is your solution. With an array of smart trading and automation tools, charting instruments, and portfolio management features, you'll be well-equipped to trade and grow your crypto holdings!

If you start today, you’ll receive a week-long free trial on the PRO plan, so don’t miss your chance to trade with the best bots online!

FAQs

When and Where Is a Smart Contract Executed?

A smart contract is carried out on a blockchain network once its predetermined requirements have been fulfilled. The execution occurs across numerous nodes in the decentralized network, which allows for consensus and verification of the contract's results.

The official point of execution of a smart contract is the moment when the transaction is recorded on the blockchain. After a smart contract executes, all the nodes in the network update their ledgers to reflect the new state. Once a transaction or record has been added to the blockchain, it cannot be changed — it can only be appended with new transactions.

Can a Smart Contract Be Changed or Deleted?

After submitting your contract, it cannot be altered, as any changes would compromise the agreement between the parties involved. If a modification to a smart contract is truly necessary, you will typically need to adjust the interactions between other smart contracts. In essence, this involves creating a new smart contract that carries out the desired functions while considering the existing actions of the original contract.

Can a Smart Contract Be Hacked?

All software, including cryptocurrency smart contracts, can contain bugs. The potential for exploits always exists, and inadequate code auditing can lead to severe consequences. Additionally, developers may intentionally insert malicious code, so it's important to exercise caution when deciding which smart contracts to trust.