User Success Story #5: Precision Trading: Dissecting a 55% Gain on $YGG with Bitsgap

In GameFi trading, every second counts. Discover how one savvy trader turned market volatility into a golden opportunity, netting a staggering 55% profit on $YGG in just 64 hours using Bitsgap's DCA Futures Bot.

Welcome to the fifth installment of our "Bitsgap Wins" series, where we shine a spotlight on the achievements of our traders and share their invaluable insights throughinterviews. These stories showcase the diverse strategies and impressive results our users have attained using Bitsgap's powerful trading tools.

In this edition, we're excited to present a fascinating case study featuring a skilled trader who leveraged our DCA Futures Bot to secure a 55% profit on $YGG in just 64 hours. This success story not only demonstrates the potential of our platform but also offers a wealth of knowledge for both novice and experienced traders alike.

Before we dive into the details of this GameFi-focused trade, we encourage you to explore our previous editions in the "Bitsgap Wins" series:

- User Success Story #4: Riding the Downtrend: A Trader's 40% Win Using Bitsgap's DCA Strategy

- User Success Story #3: How One Trader Turned PENDLE Futures into an 82.95% Windfall

- User Success Story #2: How One Trader Navigated Volatility to a 43% Gain with DYM in 26 Hours

- User Success Story #1: How a Savvy Trader Scored 158% Profit with Bitsgap's COMBO Futures Bot

Now, let's delve into the story of our featured trader and uncover the strategy behind their impressive $YGG trade.

Success Story # 5. GameFi Gains: 55% Profit on $YGG in 64 Hours with DCA Futures Bot

👉 Story originally published here.

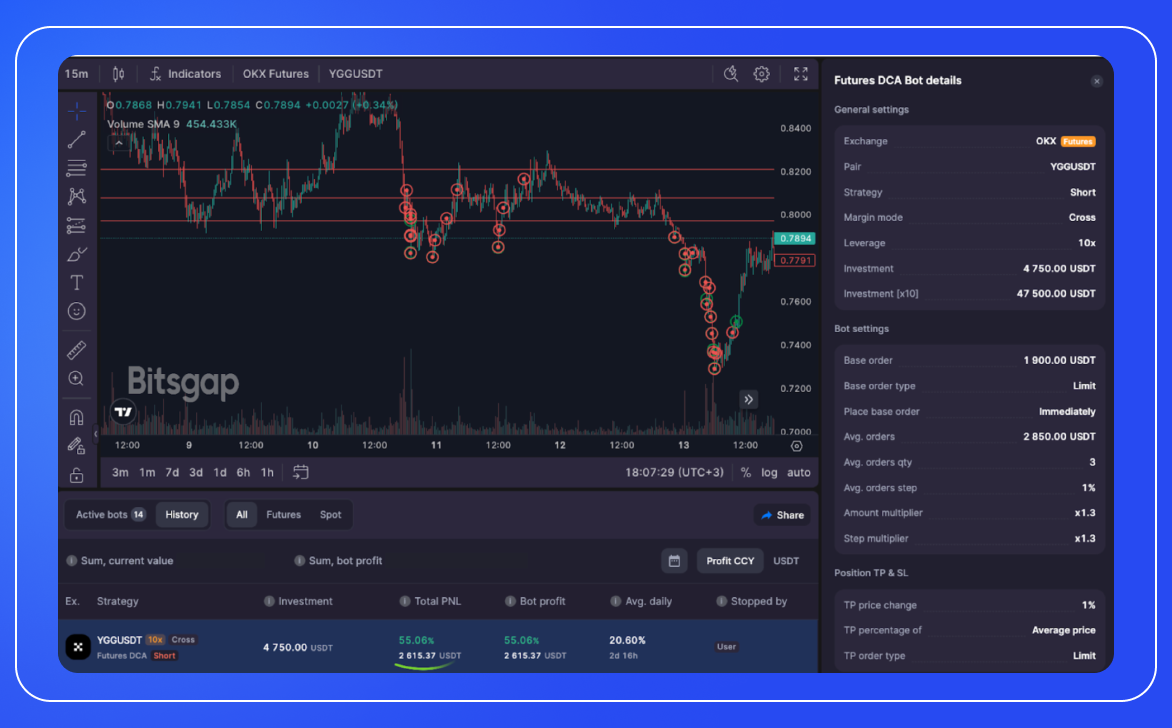

This featured trader also used Bitsgap's DCA Futures Bot, but with the following parameters for this GameFi short trade:

- Base order: 1,900.00 USDT

- Base order type: Limit

- Place base order: Immediately

- Avg. orders: 2,850.00 USDT

- Avg. orders qty: 3

- Avg. orders step: 1%

- Amount multiplier: x1.3

- Step multiplier: x1.3

- TP price change: 1%

This configuration shows a calculated approach to shorting in the volatile GameFi sector, using averaged positions and a tight take-profit to capitalize on short-term price movements.

Strategy Insights: Building Positions for Medium-Term Gains

When asked about their overall strategy and bot preferences, our trader revealed:

"In my strategy, I mostly follow the principle of building up positions. I trade medium-term, accumulating assets and redistributing them into BTC and ETH. My favorite bots are GRID and DCA Futures."

This approach highlights a focus on gradual position building and asset redistribution, with a preference for the stability of major cryptocurrencies.

The YGG Trade: Timing the Entry

Our trader provided specific insights into the YGG trade:

"In this particular trade, if you take a look at the initial drop, you'll notice the price made a 0.5 correction from the impulse. I frequently enter a trade on such movements. Confirmation for the deal could come from a decrease in volume or a weak impulse followed by a slowdown in growth. Here, I've observed both these patterns, so I entered a DCA Short."

This detailed analysis demonstrates a keen eye for technical indicators and market behavior, showing how experienced traders can spot opportunities in price movements and volume trends.

Market Outlook: Meme Coins and Tech Projects

When asked about current market conditions and potential trading opportunities, our trader shared:

"You know, I reckon the rise will be in meme coins, and to a lesser extent, in tech projects. Among the list of interesting coins for trading: $JASMY, $BONK, $PONKE, $MXM, and $PERCLE. Also, I'm anticipating a rise from ETH and AI tokens: $AKT, $TAO, $ORAI, $FORT, $AGI. Many tokens still have a not-so-big market cap and are hovering around resistance zones from previous local highs."

This outlook reveals a focus on both the meme coin phenomenon and emerging tech projects, particularly in the AI sector. The trader's attention to market cap and resistance levels shows a strategic approach to identifying potential breakout candidates.

👉 Key takeaways from this trader's approach include:

- Use DCA strategies to capitalize on short-term price movements in volatile sectors like GameFi

- Pay close attention to technical indicators like price corrections and volume for trade entries

- Balance short-term trades with a medium-term strategy of accumulating and redistributing assets

- Stay attuned to emerging trends in the market, including meme coins and tech projects

- Consider market cap and resistance levels when identifying potential trading opportunities

Conclusion

This installment of "Bitsgap Wins" showcases the power of strategic trading combined with cutting-edge tools. Our featured trader's success with the $YGG trade exemplifies how Bitsgap's DCA Futures Bot can be leveraged to capitalize on short-term market movements while maintaining a broader medium-term strategy.

Your story could be the next inspiration for fellow traders. We invite you to share your Bitsgap experiences and insights:

- Share your insights in our Telegram Chat Group

- Reach out directly to Arthur K to discuss your trading experience

- Send your story to marketing@bitsgap.com

By sharing your journey, you not only contribute to the growing knowledge base of our community but also inspire others to explore new strategies and push the boundaries of their trading potential. Remember, every trade is a learning opportunity, and your unique perspective could be the key to unlocking someone else's success.