User Success Story #3: How One Trader Turned PENDLE Futures into an 82.95% Windfall

In this Bitsgap success story, a trader achieved an impressive 82.95% profit using a PENDLE DCA Futures bot. The case study reveals how combining technical analysis with social media insights led to this remarkable trading triumph.

Welcome to the third installment of our "Bitsgap Wins" series, where we showcase inspiring user success stories from our community. In this edition, we delve into another remarkable trading journey that demonstrates the power of strategic bot configuration and market insight.

For those who haven't caught up with our previous editions, you can explore the first two user success stories by clicking here [link 1] and here [link 2].

Today, we're excited to present a case study featuring a PENDLE Futures bot that achieved an impressive 82.95% profit using Bitsgap's DCA (Dollar Cost Averaging) strategy. This success story not only highlights the effectiveness of our tools but also provides a glimpse into the thought process of a savvy trader who combines technical analysis with social media insights.

Success Story # 3. DCA Your Way to 82.95% Profit: A PENDLE Futures Bot Case Study

👉 Story originally published here.

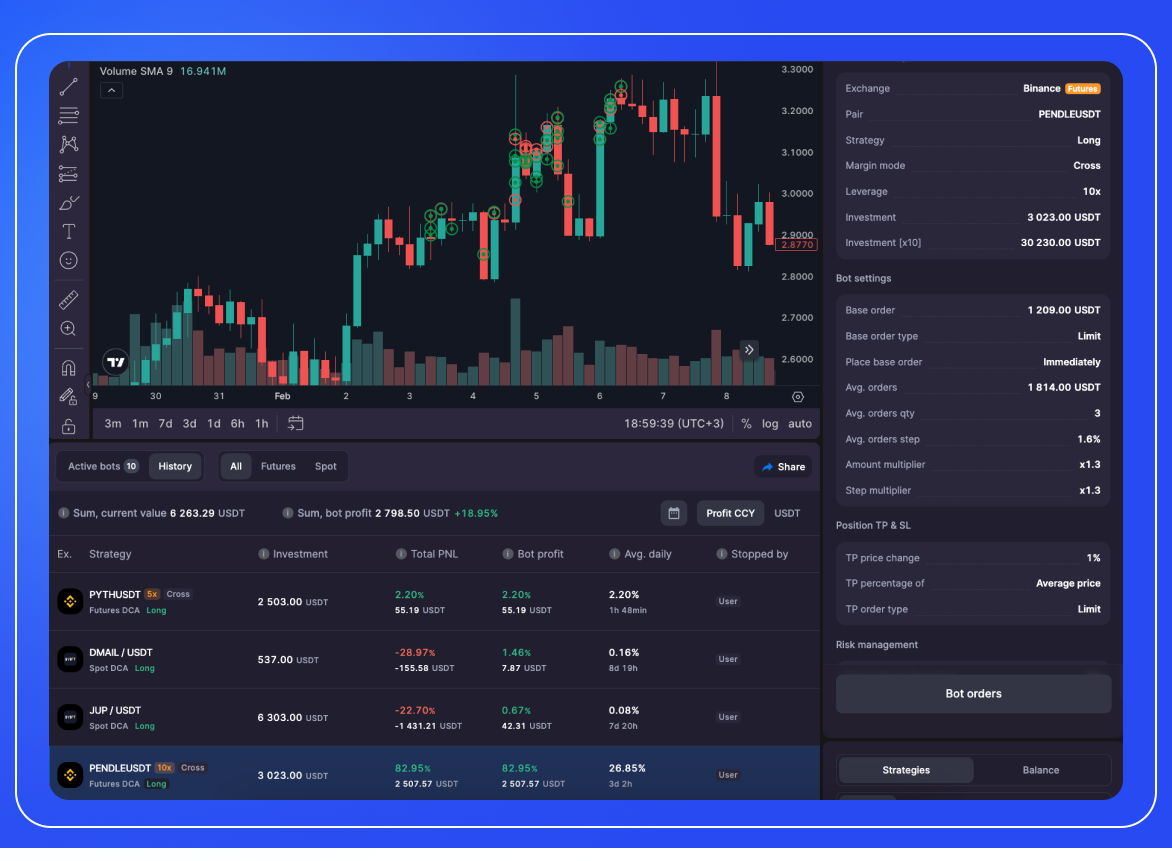

This featured trader also used Bitsgap's DCA Futures Bot but with the following precise parameters:

- Base order: 1,209.00 USDT

- Base order type: Limit

- Place base order: Immediately

- Avg. orders: 1,814.00 USDT

- Avg. orders qty: 3

- Avg. orders step: 1.6%

- Amount multiplier: x1.3

- Step multiplier: x1.3

This configuration shows a calculated approach to trading PENDLE, using a moderate base order with three averaging orders. The 1.6% step and multipliers of 1.3 for both amount and step indicate a strategy designed to capitalize on volatile price movements while managing risk.

Strategy Insights: Simplicity Meets Social Listening

When asked about their trading approach, our community member revealed a strategy that combines traditional technical analysis with modern social media insights:

"💎 I focus on some pretty straightforward factors: trend movement, Twitter activity, and so on."

This approach highlights the importance of not just watching the charts, but also keeping a finger on the pulse of social media sentiment. In the fast-moving world of crypto, Twitter can often be a leading indicator of market movements.

Timeframe Management: Riding the Wave

Our trader also shared insights into their timeframe management strategy:

"💎 I analyze how long I'll keep the bot running; usually, trends last anywhere from a few hours to a few days. And if I want to hold a position longer, I make use of the trailing up feature."

This flexible approach to trade duration demonstrates an understanding that different trends have different lifespans. By adjusting the bot's runtime and utilizing features like trailing stop, the trader can maximize gains while protecting profits.

The PENDLE Trade: Capitalizing on Momentum

For this particular trade, our community member based their decision on two key factors:

"In this trade, the idea was based on a strong trend from earlier and increasing volume."

This insight reveals a strategy of momentum trading—identifying and capitalizing on assets that are already showing strong upward movement and increasing interest from other traders (as indicated by rising volume).

👉 Key takeaways from this trader's approach include:

- Utilize advanced tools like Bitsgap's DCA Futures Bot to execute strategies

- Pay attention to both technical indicators (trends, volume) and social media sentiment

- Be flexible with trade durations, adapting to the lifespan of each trend

- Use features like trailing stops to protect profits in longer-term trades

- Look for assets with strong existing momentum and increasing trader interest

Conclusion: Your Turn to Shine with Bitsgap

This success story is more than just numbers—it's a testament to the power of combining smart tools with market insight. Our featured trader's journey with PENDLE futures demonstrates how Bitsgap's DCA Futures Bot can be a game-changer when used strategically.

We love celebrating our users' wins! Your success is our success, and stories like these inspire both our team and the wider trading community. If you've had a great experience with Bitsgap, we want to hear about it:

- Join the conversation: Telegram Chat Group

- Connect with Arthur K

- Email us: marketing@bitsgap.com

Your story could be the inspiration someone else needs to take their trading to the next level. Let's make it happen!

Ready to write your own success story? There's no better time to start than now. Try Bitsgap bots today and see for yourself how they perform in the market.