Ripple Coin Explained: Your Definitive XRP Coin Review

Whether you're a card carrying member of the XRP Army or Ripple skeptic, this no-nonsense guide will give you the unbiased details you need to make up your own mind.

Well, as an objective and trusted source, we're here to finally set the record straight once and for all. We've got the hard facts on Ripple's background, technology, common criticisms, and future price potential.

Let's clear things up right off the bat. A widespread misunderstanding is that Ripple is a cryptocurrency. In fact, Ripple is a payment protocol crafted to cater to the requirements of the financial sector. XRP, on the other hand, is a digital currency specifically engineered for the Ripple system.

👉 Given that XRP consistently holds a place amongst the top five cryptocurrencies by market capitalization, it's hardly surprising you've found your way here ;)

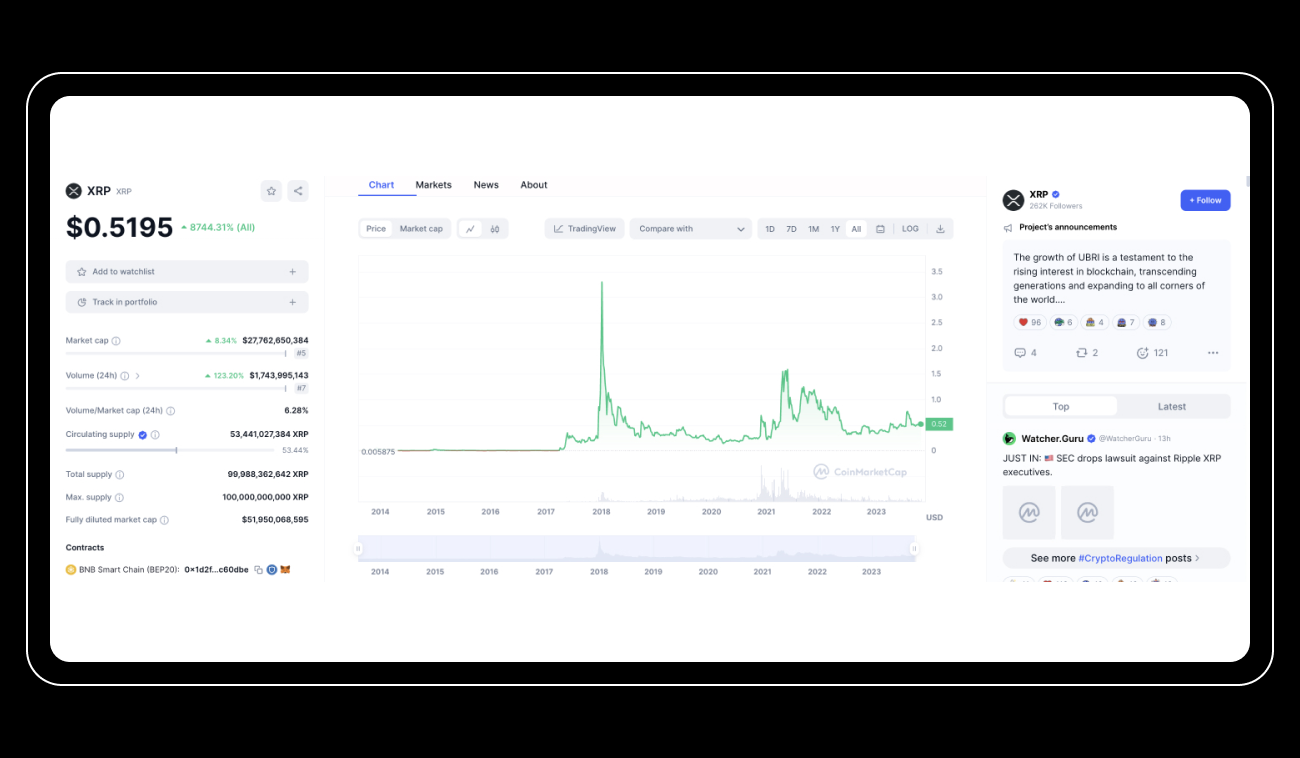

Despite Ripple's promising potential, it has faced some significant hurdles. The most notable was a lawsuit filed by the U.S. Securities and Exchange Commission (SEC) in late 2020. However, the year 2023 marked a turning point as Ripple clinched a monumental victory in its SEC case regarding the XRP cryptocurrency. The court ruled that Ripple did not contravene federal securities laws by selling XRP tokens on public exchanges, a decision that sent waves of excitement across the crypto community and catapulted XRP prices to new heights.

If this crypto project piques your interest, we've compiled a comprehensive overview of its journey, how it operates, and an evaluation of whether investing in XRP is a wise move.

What Is Ripple?

Ripple is a payment settlement system and currency exchange network capable of processing transactions globally. It functions as a trusted middleman between parties, ensuring transactions zip through correctly with quick confirmations.

👉 Whether it's fiat currencies, crypto, or even real gold, Ripple exchanges it all with minimal fees.

While banks sluggishly move money and charge outrageous fees, Ripple offers a better way. Its speedy network deducts just 0.00001 XRP per transaction — a tiny fraction of what the old guard demands.

By harnessing blockchain's potential, Ripple is paving the way for the future of global, low-cost transfers.

History of Ripple

Ripple's origins date back to 2004, when software developer Ryan Fugger founded RipplePay, a system aimed at enabling individuals to generate credit within their own communities. This marks Ripple as a unique crypto project that even precedes Bitcoin, although it didn't start as a cryptocurrency.

In 2011, programmer Jed McCaleb began developing the XRP cryptocurrency and its associated blockchain. By 2012, McCaleb had assembled a team, secured investors, and convinced Fugger to merge his RipplePay network into the project, resulting in Fugger handing over control. The company and the XRP cryptocurrency were officially launched in 2012, initially under the name NewCoin, subsequently rebranded to OpenCoin, and ultimately named Ripple.

Over the years, Ripple has formed alliances with several financial institutions. In 2019 alone, over 300 financial institutions in over 45 countries were utilizing its RippleNet payment network, a significant endorsement for prospective investors.

However, Ripple encountered a significant hurdle on December 22, 2020, when the SEC charged it with selling $1.3 billion in unregistered securities through its XRP cryptocurrency. Ripple vigorously contested this, maintaining that XRP isn't a security. In a landmark ruling in 2023, U.S. District Judge Analisa Torres declared that Ripple Labs Inc had not violated federal securities laws. This precedent-setting decision, a first for a cryptocurrency company in a U.S. SEC case, propelled Ripple's price up by 75% within two days.

👉 For those curious about Ripple's future, keeping a finger on the pulse of the latest crypto news will keep you well informed.

How Ripple Works

RippleNet is designed to revolutionize the banking world by offering swifter, more economical, and more convenient cross-border transactions for banks. It's an exciting alternative to the traditional SWIFT system that most banks currently rely on.

Ripple brings a heap of advantages to the table when it comes to international transactions, such as a lightning-fast speed and astoundingly low transaction fees. Moreover, it can be a game-changer as a bridge currency. This means financial institutions have a cheaper way to exchange currencies — they can simply hold XRP instead of a multitude of fiat currencies.

At the heart of Ripple, like all cryptocurrencies, is its trusty blockchain. This provides a rock-solid, immutable record of transactions. The XRP Ledger (XRPL), Ripple's very own blockchain or electronic ledger, diligently keeps track of all transaction data such as accounts, balances, and transfers. This blockchain is cryptographically secured with key pairs, and only the holder of private keys can authorize transactions. However, Ripple's similarities with Bitcoin and other cryptocurrencies largely stop there.

Ripple doesn't just go with the flow — it waves goodbye to Proof-of-Work or Proof-of-Stake network consensus protocols. Instead, it employs a majority-based consensus method known as the Ripple Protocol Consensus Algorithm (RPCA). This allows a majority of validators — servers specifically set up to actively participate in consensus — to agree on a set of transactions for a ledger entry.

Once they reach an agreement, the ledger entry is validated, written to the blockchain, and its content is set in stone.

While Ripple provides a recommended list of around 35 validators, each node in the network has the freedom to choose its own validators. This unique list, known as a Unique Node List (UNL), adds a dash of individuality to each node.

Each validator proposes what they believe to be the correct block containing new transactions. They dynamically compare blocks or ledger entries every 3 to 6 seconds, and if an 80% majority of validator nodes agree on the transactions and their order, voila! Consensus is achieved, and the block is added to the XRPL.

However, if there's a disagreement and 80% of validators don't see eye to eye, each validator tweaks their proposals to match the other trusted validators on their UNLs. This could go on for several rounds until they finally reach a consensus.

As long as fewer than 20% of trusted validators are faulty, the consensus can roll on smoothly. However, confirming an invalid transaction would require over 80% of trusted validators to collude. If more than 20% but less than 80% of trusted validators are faulty, the network hits the brakes.

👉 Confused? In the following video, David Schwartz, the Chief Cryptographer at Ripple, demystifies 'Consensus' in a way that's easy to grasp. He also delves into the inspiration behind his ingenious design of the XRP Ledger to function on Consensus, rather than the traditional Proof-of-Work.

Ripple & XRP Consensus vs. Proof-of-Work.

Ripple is truly reinventing the wheel when it comes to cross-border transactions, and it's thrilling to be part of this journey, don’t you think?

What Is XRP?

XRP is a digital currency that powers the XRP Ledger. You can snap it up as an investment, use it as a coin to barter for other digital currencies, or employ it to fuel transactions on the Ripple network. But here's the kicker: even though many folks refer to XRP as Ripple, it's vital to highlight that XRP is an open-source digital asset that stands independently from Ripple, a technology company. Thanks to its speedy, efficient, eco-friendly, and rapid delivery, XRP is the shining star in Ripple's suite of solutions, helping customers stay on the right side of compliance.

In a departure from most cryptocurrencies, XRP is pre-mined with a cap of 100 billion tokens. The distribution of this vast supply took three well-planned steps:

- Ripple, the birthplace of XRP, was the proud recipient of 80 billion XRP tokens. To make sure the supply of XRP stays steady, the company stashed 55 billion of the token in an escrow account, as safe as houses.

- The remaining 20 billion XRP found a home with Ripple's co-founders and the core team. Talk about a welcome gift!

- The rest of the XRP is unveiled at a rate of less than 1 billion monthly, with the original reveal schedule set for 55 months.

The founding idea behind XRP was refreshingly straightforward, envisaged as a peer-to-peer trust network. Ripple champions XRP as a more efficient, cost-cutting, and energy-saving digital asset that can zip through transactions in a flash and consume less energy than some other cryptocurrencies. Impressive, right?

Primarily, XRP is designed to be a settlement layer that greases the wheel for transactions within the Ripple network. It's been traded far and wide as a cryptocurrency and is up for grabs on a host of exchanges, including futures, options, swap exchanges, spot exchanges, custodian exchanges, and non-custodian exchanges.

Ripple’s Advantages and Disadvantages

Ripple has a whole bunch of awesome perks:

- Lightning-fast settlement: Ripple's transaction confirmations are super quick, generally wrapped up in four to five seconds.

- Dirt-cheap fees: The cost of performing a transaction on the Ripple network is just 0.0001 XRP, which at current rates, is less than a fraction of a penny.

- Versatile exchange network: The Ripple network is not some one-trick pony. It doesn't just process transactions using XRP, but can also handle other fiat currencies, cryptocurrencies, and even commodities.

- Big Fish love it: Ripple isn't just for small fry. Large enterprises can use Ripple as a transaction platform too. Institutions like Santander, Axis Bank, and Yes Bank are already on this bandwagon. It's clear as day that Ripple's already got a foot in the door when it comes to larger institutional market adoption.

But hold your horses! Ripple has some downsides:

- Centralization city: One of the big draws of cryptocurrencies is their decentralized nature, taking the power away from big banks and governments. But Ripple? It's as centralized as they come, which is a bit of a party pooper.

- Ripple Labs is the puppet master: Unlike other cryptocurrencies that are steadily released through mining, Ripple Labs pulls the strings when it comes to releasing coins. This means Ripple Labs holds the power to influence the value of XRP, deciding when and how many tokens to set free.

- Regulatory drama: Last year, the U.S. Securities and Exchange Commission (SEC) threw a wrench in the works by filing a lawsuit against Ripple. And guess what? Ripple beat them at their own game. But you know, just like that one guest who overstays at a party, the aroma of the incident just didn't seem to fade away. Get the hint?

Ripple Use Cases and Applications

XRP can be used just like any other digital currency, either for making transactions or as a prospective investment. Moreover, the Ripple network can be employed to carry out other kinds of transactions, such as currency exchanges.

Moreover, below you’ll find a few glimpses into the world of possibilities with XRP:

- Cross-border payments: Say goodbye to slow and expensive international transactions! Thanks to XRP, cross-border payments are now lightning-fast and won't burn a hole in your pocket.

- Remittances: For all the hardworking migrants out there, XRP could be your new best friend, helping to send money home swiftly and affordably.

- Micropayments: Who needs credit card companies when you have XRP? With this game-changer, micropayments are now possible and easier than ever, opening up a world of opportunities for pay-per-view content or microtransactions.

- Peer-to-peer lending: Say hello to frictionless lending! XRP could completely revamp peer-to-peer lending, making it possible to borrow and lend money without the fuss of going through a bank.

- Insurance: Insurance payouts could be as fast as a cheetah and as smooth as silk with XRP.

- Smart contracts: Finally, XRP could be used to create and execute smart contracts, the self-fulfilling prophecies of the business world that come into effect when certain conditions are met.

XRP Price Prediction

Pitched as bitcoin's rival on the crypto pitch, XRP has been embraced by various communities like a rockstar, leading to a meteoric rise in its value. The real fireworks happened during the crypto bull market from 2017 to early 2018, when XRP skyrocketed to an eye-popping all-time high of $3.40. That's a jaw-dropping, 53,435% leap from its humble price of $0.006531 at the dawn of 2017. Sure, it has had its fair share of roller coaster rides since then, but it has firmly held its turf as a heavyweight coin in terms of market capitalization, currently lounging at the fifth spot on the cap table.

Now, here's where XRP struts its unique style. Unlike the majority of cryptocurrencies that charge a transaction fee, XRP marches to its own beat. It doesn't ask for a transaction fee. Instead, it does a little vanishing act by burning a teensy-weensy part of the XRP, making it a deflationary asset.

Yes, being a deflationary asset means XRP's supply could theoretically go the way of the dodo and hit zero. But don't hold your breath – at its current burn rate, it would take a cool 70,000 years for that to happen! And even if it looked like we were heading for a grand XRP extinction event, never fear – the validators can step in and tweak the transaction costs and prices through a voting system, as long as all the boxes are ticked. Talk about having a backup plan, right?

XRP Price Prediction 2025-2030

Frankly, the rumor mill has been buzzing for some time with speculation about a potential initial public offering (IPO) for Ripple. But as of now, there's not a peep from the official channels confirming such a plan.

That doesn't stop the ever-vigilant community, however, who are turning over every rock in their quest for some shred of evidence pointing to an IPO.

Recently, a new theory has popped up like a jack-in-the-box. Ripple posted a job ad for a Shareholder Communications Senior Manager and some folks put two and two together and … they see it as the starting gun for an IPO race.

This, of course, has kicked up a fresh question in the dust: Could XRP’s price shoot up to a whopping $10 if Ripple were to go public?

The potential aftermath of an IPO on XRP's price could swing like a pendulum.

- On the sunny side, a successful IPO could put a feather in Ripple's cap and rake in a hefty capital. This could be poured into broadening their services, fueling the engines of research and development, or championing the adoption of the XRP ledger.

- But every coin has two sides. The flip side? It might scatter Ripple's focus, leading them to pour funds into areas that aren't exactly XRP's BFF.

Honestly, we're charting new waters here. The crypto industry is still a baby. The only major IPO by a crypto-centric company in the U.S. was Coinbase, and they don't have their own coin. Their stock performance was a glorious rocket ride to the moon... until the market took a nosedive.

So, while it's possible that XRP could hit the $10 jackpot in a bullish market and with a victorious Ripple IPO, it's wise to remember that its price is likely to dance to the tune of the overall market performance. It's like trying to predict the weather—you never really know until you step outside.

Should You Buy Ripple?

Whether you're a fan or a skeptic, there's no denying XRP's standing in the crypto world.

The recent semi-resolution with the SEC might just inject some momentum into XRP's stride. This legal tangle has heavily influenced XRP's performance, with the crypto community and investors keeping a hawk-eye on the unfolding drama. But let's be honest, the future path for XRP remains as clear as a foggy day.

Ultimately, there are just two possible scenarios, aren’t there? Both a bearish and bullish outcome hinge on a plethora of factors. The recent court ruling, seemingly in XRP's favor, has sent positive ripples through its price. However, a trend back to the base price before the ruling suggests the market isn't quite ready to celebrate yet. Whether the price will hold its ground or do a nosedive, only time will tell.

The larger market dynamics also pose potential hurdles. A big sell-off in the cryptocurrency market could put a damper on XRP's value. And then there's the question of XRP's role in Ripple's cross-border payment system. Is the currency merely a bystander, or does it play a vital role in the system's operation? The fact is, even if XRP is used for settling payments, its value doesn't influence the system's operation, as settlements are done in fiat, offering little incentive for positive price action.

So, what's the takeaway?

We'd advise a conservative approach, allocating no more than 10-20% of your portfolio to XRP. But at the end of the day, the ball is in your court, mate.

👉 Disclaimer: While we don't specifically endorse any single cryptocurrency, like Ripple or others, we're here to empower you with knowledge. If you're considering an investment, always remember to seek expert financial counsel and go ahead only when you're comfortable with the risk.

How Do You Buy Ripple?

Ready to dip your toes in Ripple's XRP cryptocurrency? Kickstart your journey by creating an account on an exchange that supports it. Once done, you can purchase XRP using any payment methods endorsed by the exchange.

Now, here's where the game gets exciting.

By integrating your exchange accounts (you can add as many as 17!) with Bitsgap, you unlock the potential to trade across all these platforms using a single, user-friendly interface.

But that's not all — Bitsgap also equips you with advanced trading tools that most exchanges can't boast of, potentially amplifying your odds of successful trades and attractive returns. From automated trading bots like DCA, GRID, BTD, COMBO, and DCA Futures to savvy trading features like trailing and hedging, Bitsgap has got you covered! These tools are designed to help you maximise your profits and keep losses at bay.

Intrigued?

Sign up for a one-week trial today and experience the Bitsgap advantage for yourself!

Bottom Line: Is XRP a Good Investment?

Though the overall sentiment for XRP seems to have swung towards the positive, the journey to the $1 mark appears to be quite the uphill climb. XRP did enjoy a brief price surge in mid-July, but fast-forward to now, and it's back to its summer starting line.

Adding to the drama, a slew of blockchain competitors have emerged, boasting speedier and more economical transactions than XRP. To thicken the plot, some of XRP's early allies have jumped ship, presumably due to the legal storm from the SEC case. This leaves XRP on shaky ground, more exposed than ever to fresh rivals.

However, it's not all doom and gloom for XRP. It could ride the wave of certain macro trends in the international payment sphere, such as de-dollarization and the introduction of new central bank digital currencies (CBDCs). If XRP manages to weave itself into various de-dollarization and CBDC initiatives worldwide, it could be a game-changer for its long-term growth.

But let's not get ahead of ourselves. Unless a miracle occurs, we envisage XRP carving out a niche in the financial services industry, with a focus on areas like cross-border remittances. As for its place in your investment portfolio, consider a conservative long-term hold of maybe 10-20% or even less. But if you're game for some short-term volatility, it's all systems go!

FAQs

Where Can I Get XRP News?

The most effective method for staying up-to-date with all the latest XRP news is by using crypto aggregator sites such as CoinMarketCap. You can check out their dedicated News sections for the most recent developments. Another superb resource is CoinGecko; simply select the XRP coin and look for the 'XRP Latest News' section. Other notable websites you should consider monitoring include Cointelegraph, CoinDesk, Decrypt, and The Block. Simply search for "Ripple" or "XRP" to find the latest news related to your search query.

What Is the Best Source for Ripple News 1 Hour?

NewsNow is a great resource for Ripple News 1 Hour. Otherwise, you can Google search “Ripple latest news” and browse through Google News top stories.

What Is Your XRP Price Prediction After Lawsuit?

Despite the unwavering optimism of XRP's steadfast fans, we'd be rather taken aback if XRP were to soar beyond the $1 milestone, let alone hit the $10 mark following the elusive IPO. Crypto, as we know, is a world where traditional rules often take a back seat, favoring instead the thrill of unprecedented price movements.

As we witness the making of history, these erratic patterns are still evolving, potentially setting the stage for future analyses and predictions. Perhaps a decade from now, we might have cracked the code of predicting crypto trends. But for now, we reckon it's largely a game of prevailing market sentiment.

The rollercoaster ride of XRP's price post-SEC decision is a case in point. The price surged with the good news, only to tumble down, ultimately settling back to its pre-news levels. So, in essence, tread carefully and don't go putting all your eggs in the XRP basket.

As for exponential growth? We're skeptical, unless Ripple pulls a rabbit out of its hat or manages to leverage emerging macro trends like CBDC and de-dollarization to its advantage. So, keep your popcorn ready as we watch this space!