OKX Crypto Exchange Review: Why Choose OKX?

Step into the world of OKX, a premier cryptocurrency exchange with a lot to offer. Read on to discover a treasure trove of insights on the exchange's fee structure, diverse trading products, automated trading, and more.

Welcome to OKX, a vibrant hub for all things crypto! Born in Seychelles in 2017 and rebranded to OKX in 2022, this dynamic exchange offers more than just cryptocurrency trading — it's a playground for derivatives, margin trading, and automated trading too.

One of OKX's standout features? Its very own proprietary blockchain, the Okchain. This game-changing addition has broadened the horizon for users, unlocking access to high-tech features like smart contracts, DeFi services, and cross-chain applications rooted in BTC.

OKX isn't just making waves online — it's expanding across the globe with licenses in Dubai and strategic plans for the Bahamas, Caribbean, Latin America, and Australia. It's even the first client of Komainu Connect, a regulated settlement and custody system that supports 24/7 trading.

OKX kicked off 2023 by boasting the largest clean asset reserves among the big crypto exchanges. Plus, it's already eyeing new territories with branches soon to open in Paris, France, and Turkey.

OKX is more than an exchange — it's an ever-evolving ecosystem that's taking crypto services to new heights around the globe. With a keen eye on cutting-edge technology development and long-term consistency, OKX is setting the bar high in the thrilling world of cryptocurrency trading.

Discover why becoming an OKX account holder could be your next smart move today.

Trading Volumes

The hustle and bustle of a crypto exchange is all about trading volume. It's like a pulse check — a low trading volume? That's a slow heart-rate, a sign of low activity. It's quite the predicament especially when you're ready to close a big position but find yourself stranded, unable to sell at market price due to the exchange's low demand.

Well, not with OKX! With a daily parade of millions of users, liquidity is the least of your worries. CoinGecko, the crypto data maestro, puts OKX's average daily trading volume at a whopping $674 million — now that's some serious action! And let's not forget the jaw-dropping exchange reserves of $9,522,346,299.57. Now, isn't that a number you'd like to be a part of?

Trading Pairs

OKX is a crypto treasure trove, offering a rich selection of 331 coins and 531 trading pairs. The platform showcases a diverse lineup of crypto assets, from the iconic Bitcoin (BTC) and Ethereum (ETH) to Ripple (XRP) and Polkadot (DOT), to name just a few. Each of these can be traded using any instrument available on the platform.

With its vast array of trading pairs, OKX enables users to not only trade digital coins with each other, but also buy and sell them for a diverse range of 93 fiat currencies, such as USD, EUR, and JPY. The platform accommodates a variety of payment methods (in fact 420+), including credit/debit cards, PayPal, and bank transfers, thereby facilitating the purchase of digital assets.

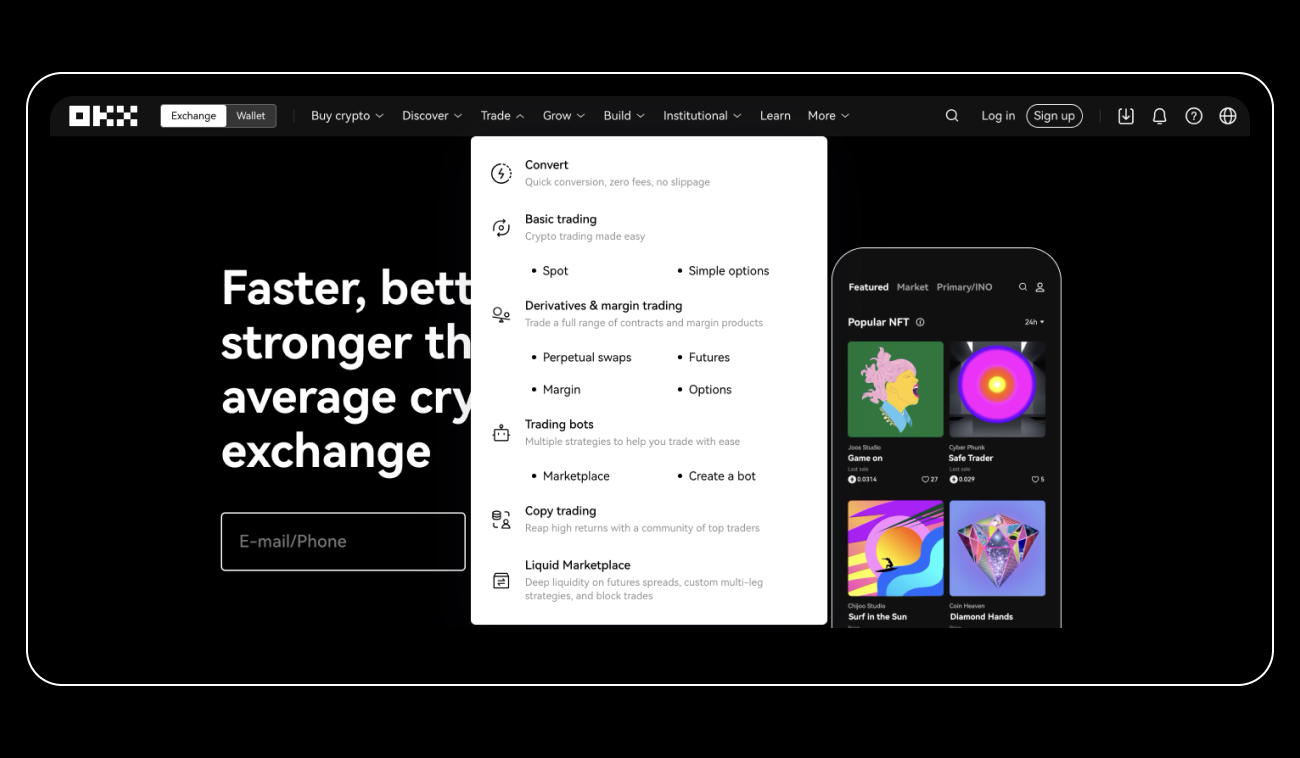

OKX Tradable Products

OKX offers a vast array of tradable products to its users, far beyond just spot trading. The lineup also includes futures, margin trading, perpetual swaps, and options. These products are readily accessible through various trading automation tools, including the Bitsgap trading bots, which can be connected to OKX via API.

The platform is a trader's playground, offering both manual and automatic trading with a staggering leverage of up to 125x for derivatives. And there's more! OKX comes with margin trading, empowering you to short-sell BTC, ETH, and other digital assets with up to 10x leverage. This is like a supercharger for your trading profits, but remember — with great power comes great responsibility. Using leverage can also amplify the risk of waving goodbye to up to 100% of your initial investment.

Currently, you can link your OKX account to Bitsgap for trading on the OKX spot market. But keep your eyes peeled — we’re hard at work to bring the OKX derivatives market connection to the table in the future!

OKX Trading Interface

You can access basic trading features by clicking “Basic Trading” on the homepage (Pic. 1).

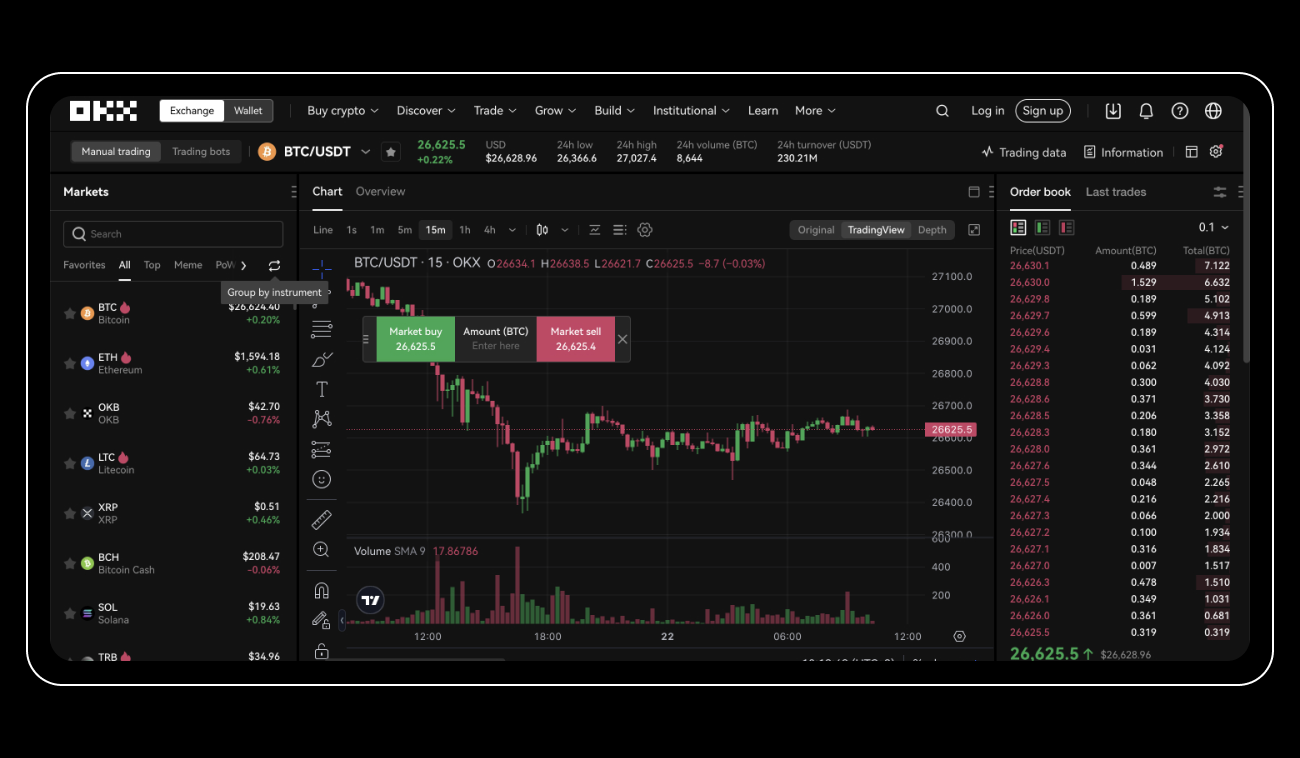

Upon navigating there, you will discover all the necessary tools for trading crypto from your portfolio. This includes charts, the order book, and all the essential information required to facilitate the exchange of digital assets within the OKX ecosystem (Pic. 2).

At the heart of your screen, you'll find a large window displaying charts that offer an array of indicators and analytical tools. The list of available trading pairs is tucked away in a dropdown menu on the left side of the screen, while the trade order window is conveniently situated on the right. All open positions are neatly arrayed at the bottom of the screen.

There's also the option to toggle between the default OKX charts and the Trading View charts, widely recognized for their sleek and informative design, akin to those used with Bitsgap trading bots.

OKX is renowned for its substantial selection of order types. These include Limit and Advanced Limit (Fill or Kill, Post Only, Immediate or Cancel), Market, SL/TP, Trigger, Trailing stop, and 'Slicing' bot orders like Iceberg, TWAP.

The Iceberg order, quite an exclusive feature on OKX, is designed with high-volume traders in mind. To mitigate the effect of slippage, the Iceberg order slices a large position into multiple orders, placing them according to the predetermined parameters.

OKX Trading Fees

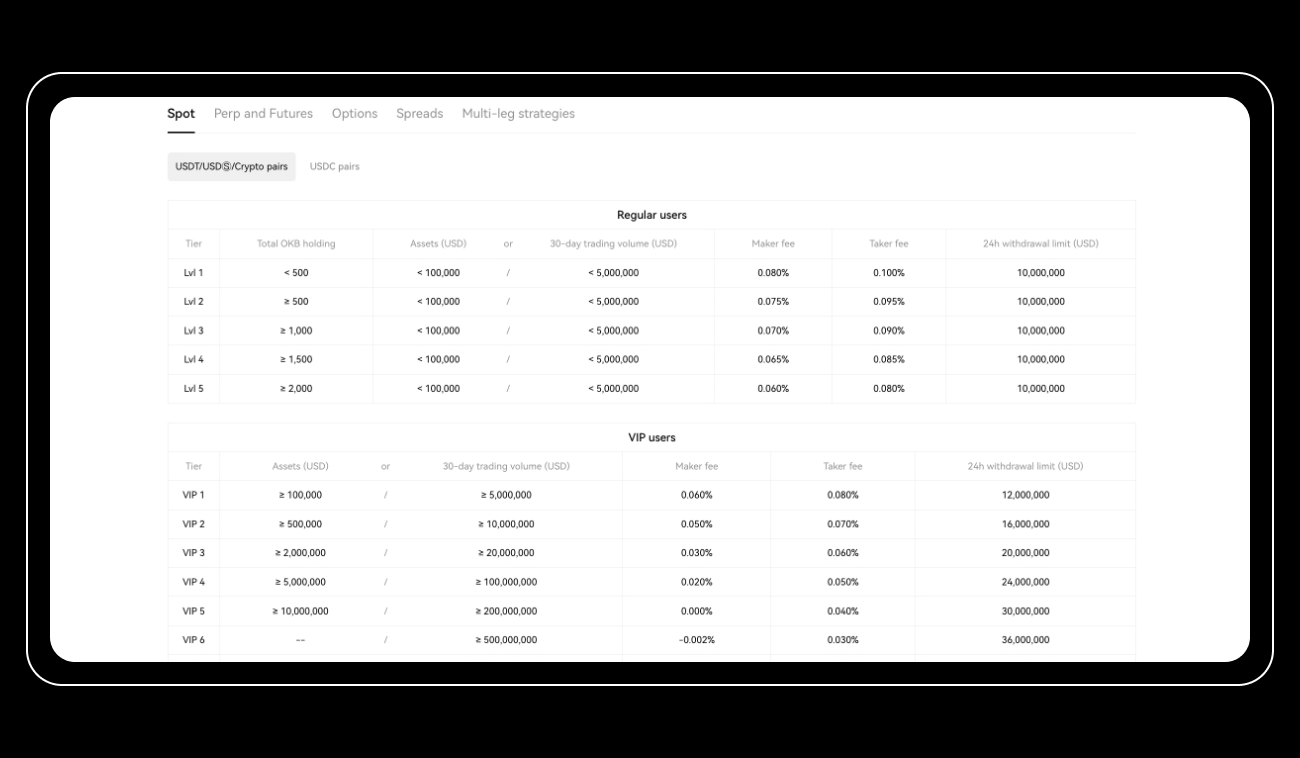

OKX truly rolls out the red carpet when it comes to trading fees, offering a tailored experience for both regular and VIP users. Regular users' tiers are cleverly dictated by their total OKB holdings, while VIP users get the star treatment with daily refreshed tiers decided by 30-day trading volumes and daily asset balances.

Now, here's where the magic happens: if users hit the target for different fee tier conditions, spanning across spot trading volume, total trading volume of perpetual and futures contracts (USDT-margined, USDC-margined, and crypto-margined), options trading volume, spread trading volume, and total assets, they get to bask in the fee discount of the highest tier they qualify for.

So picture this: If a user has a 30-day spot trading volume of 10,000,000 USD (making them a VIP 2); a 30-day total trading volume of perpetual and futures contracts (USDT-margined, USDC-margined, and crypto-margined) at a whopping 200,000,000 USD (earning them VIP 3 status); a 30-day options trading volume of 5,000,000 USD (ranking them as a VIP 1); a 30-day spreads trading volume of 150,000,000 USD (which lands them at VIP 2); and total assets for the day at a cool 5,000,000 USD (pushing them up to VIP 4), then they'll be living the dream, enjoying the fee discounts of a VIP 4 user across all markets!

OKX Fees for the Spot Market

The fee structure at OKX is bifurcated into maker and taker fees (Pic. 3). Kicking off at 0.08% for makers and 0.1% for takers for users holding fewer than 500 OKB tokens on the exchange, these fees offer the potential to be whittled down to just 0.06% for makers and 0.08% for takers. The key? Users need to claim and hold a minimum of 2,000 OKB tokens in their OKX wallet.

As mentioned above, the fee policy for VIP clients is primarily shaped by a combination of various factors, with the spotlight shining on their 30-day trading volume.

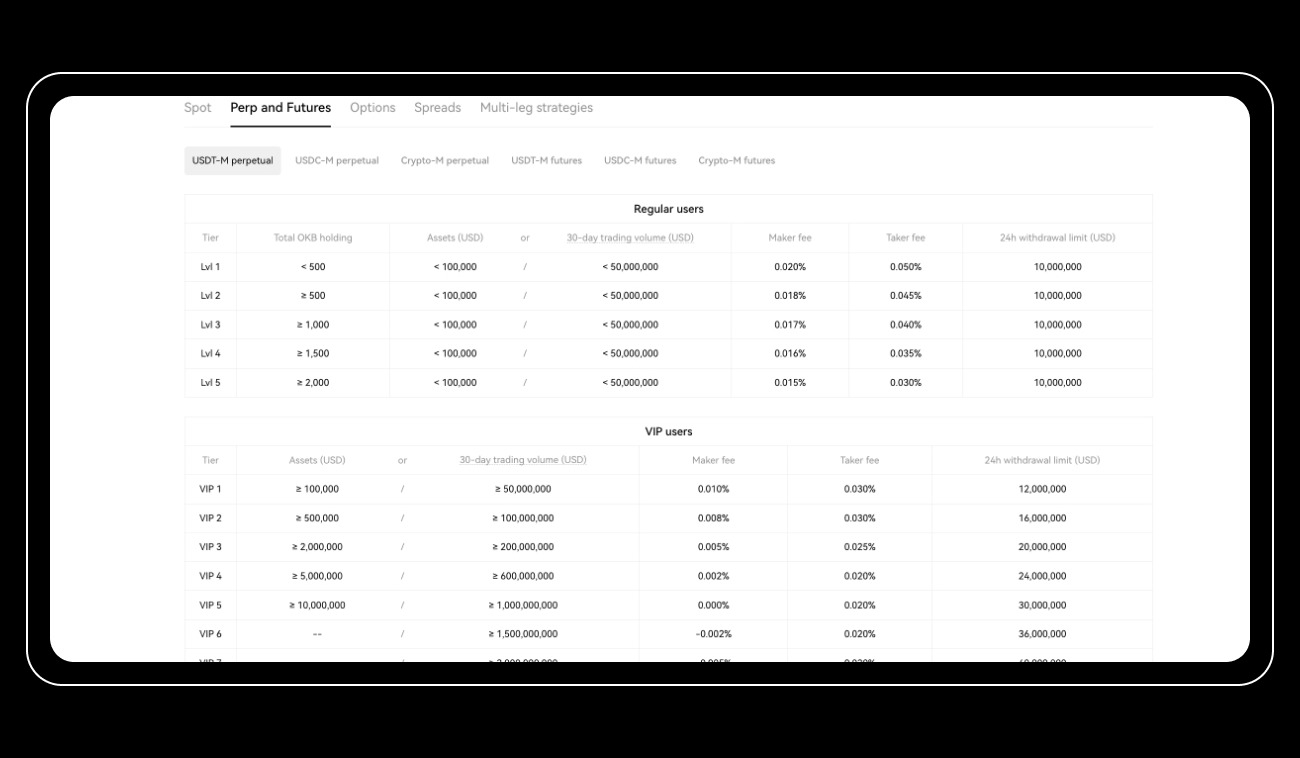

OKX Fees for the Futures and Perpetual Market

Starting rates for OKX trading fees in the crypto derivatives market are pegged at 0.02% for maker orders and 0.05% for taker orders. However, for those users with a more substantial holding of OKB tokens, these fees have the potential to be cut down to 0.015% for makers and 0.03% for takers.

KYC on OKX

In line with the growing trend of stringent Know Your Customer (KYC) policies across crypto exchanges, OKX isn't an exception, having established its own KYC procedures.

The rationale behind this verification process is to uphold the safety of the exchange, curb fraudulent activities, and deter other illegal actions. Post completion of your account verification, the doors to trading, depositing, and withdrawing are opened.

You are required to furnish basic information such as your full name, date of birth, ID number, and proof of address. Further, you'll need to provide selfies and valid government-issued IDs, which could be passports and driving licenses.

OKX Jurisdiction

As of 2023, OKX's extensive crypto services are accessible to users spanning North America, Europe, Asia, Australia, and Africa, with some exceptions due to regional regulations. Countries including Australia and France enjoy full access to OKX, allowing residents to effortlessly engage in trading, buying, and selling cryptocurrencies through various trading modes. Conversely, locations such as the United Kingdom and Hong Kong are restricted to derivatives trading and have limited platform access.

Although OKX has cast its net wide, there are a few spots where it's off-limits. These include Hong Kong, Cuba, Iran, North Korea, Crimea, Malaysia, Singapore, Syria, the United States of America and all its territories (like Puerto Rico, American Samoa, Guam, Northern Mariana Island, and the US Virgin Islands such as St. Croix, St. John, and St. Thomas), the Bahamas, Canada, the Netherlands, the United Kingdom, Bangladesh, Bolivia, Donetsk, Luhansk, and Malta.

Automated Trading on OKX

OKX offers a multitude of choices for automated trading, including grid bots, signal bots, DCA, arbitrage, and slicing bots. Additionally, there's a trading bot marketplace where OKX traders can share their spot grid, futures grid, DCA, smart portfolio, and recurring buy bots. This means regular users can effortlessly adopt the parameters of top-notch strategies!

But wait, there's more! You can also link your OKX to a third-party platform like Bitsgap and unlock a world of opportunities when it comes to smart and automated trading. Bitsgap comes equipped with powerful DCA and GRID bots for OKX, ready to supercharge your trading strategy.

How Do I Connect My Trading Bots to OKX?

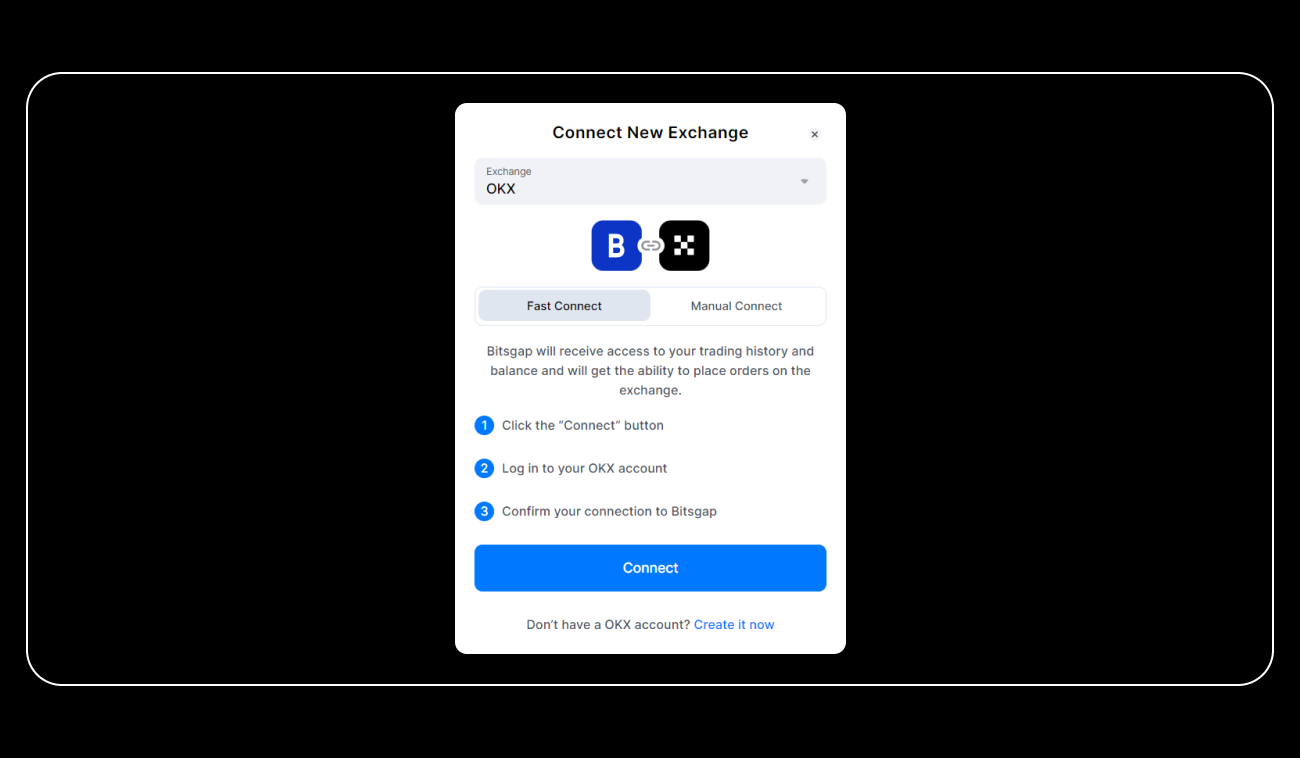

If you're looking to link your OKX exchange account with Bitsgap, you're in luck! Thanks to FAST API, it's a breeze. OKX Fast API is an OKX API component leveraging the OAuth 2.0 protocol for user authentication and authorization. It's like a shortcut to authorize specific account permissions, generate API keys, and auto-connect them to Bitsgap. It means you can start enjoying Bitsgap's services without the manual hassle of creating API keys. And worry not, it's secure — all freshly minted API keys are sent to Bitsgap in an encrypted form. Now, let's get you set up with an API key through these easy steps:

- Head over to Bitsgap: Log into your Bitsgap account, navigate to the [My Exchanges] page, and hit the [Add new exchange] button to proceed.

- Pick ‘OKX’ and [Fast Connect]: From the list, select ‘OKX’ and opt for [Fast Connect]. Take a quick look at the following steps, then hit [Connect].

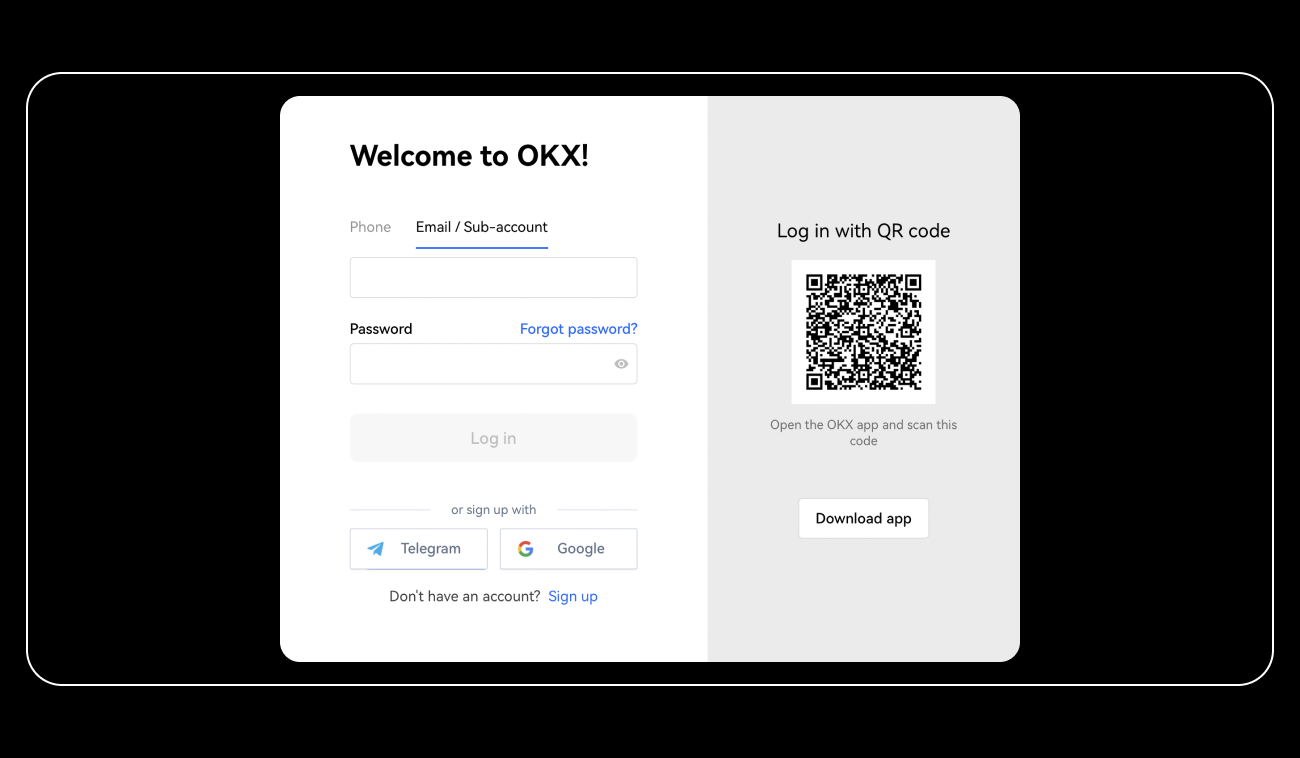

- Authorize the permissions: You'll be taken to the OKX website where you'll see the account permissions we're requesting. To link your OKX account to Bitsgap, punch in your OKX account details and click the 'Log in' button.

- Check the connection: Post successful authorization and API creation, you'll be auto-redirected to the [My exchanges] page on Bitsgap. Your API key will be automatically created and added. If you've followed these steps to a T, OKX should appear in your list of connected exchanges with a [Connected] status, and your trading balance will be visible on your account. Let the trading begin!

Bottom Line

OKX stands as a premier cryptocurrency exchange, earning the trust of millions of users worldwide. It provides a seamless and user-friendly platform for crypto enthusiasts of all skill levels, from novices to experts, to buy, hold, and trade a wide array of popular cryptocurrencies at competitive rates. By linking your OKX account to Bitsgap, you can enhance your trading experience by utilising top-notch crypto trading tools. These include intelligent order capabilities and advanced trading bots for GRID and DCA strategies. Why not connect now and start your trading journey with Bitsgap today?

FAQs

What Are OKX Exchange Features?

OKX exchange boasts several significant features that stand out. These include:

- Competitive low trading fees, of 0.10% or less for most transactions.

- High-yield staking opportunities.

- The convenience of purchasing cryptocurrency using a card, bank account, or digital wallet.

- A broad selection of cryptocurrency trading pairs.

- High trading volumes and liquidity for optimal trading conditions.

- The availability of derivatives, margin, and spot trading.

Nevertheless, it's important to note that the exchange is currently not accessible to users residing in the United States.

What’s OKX Security?

OKX adheres to industry-standard security protocols, including the employment of cold storage for the majority of customer assets. In addition, it provides supplementary features like the option to establish a withdrawal password and set anti-phishing codes.