Everything You Need to Know about Bitcoin & Crypto Options

Want to unlock the secrets of the crypto options market? Learn the ins and outs, the strategies, and the risk-reward balance in this detailed primer.

Dive in as we unpack the thrilling world of cryptocurrency options trading! Explore the mechanics, learn the strategies, and weigh the risks against rewards to master this dynamic market.

Each year, we see a flurry of brilliant new tools designed to help investors like you make the most out of every opportunity that comes your way. One such shiny tool in your investing toolbox is crypto, or, more specifically, bitcoin options.

At its core, options, which are part of a unique club known as 'derivatives,' are like special contracts that grant the holder the right (but not the obligation) to buy or sell an asset at a set price and date. The interesting thing about options is that they're dependent on the value of other financial instruments, such as cash, bonds, and even other derivatives. It's a bit like how your happiness might depend on the amount of chocolate in your pantry (or maybe that's just us).

Sure, the concept can seem a little head-spinning at first, but here's the bottom line: Options can be a profitable secret weapon in your investing arsenal. So let's dive in and unravel all their mysteries. Buckle up, because it's going to be an enlightening ride!

What Are Bitcoin Options?

Well, great news is that Bitcoin options are pretty much like a twin to traditional options trading.

These magical contracts give traders the right (but not the duty) to buy or sell bitcoin at a fixed price when the contract ends. It's like having a reservation at a restaurant — you can choose to go, but you don't have to.

👉 Now, you might be thinking, "Bitcoin Options sound like some high-tech Wall Street stuff!" But, options trading isn't as new (or as scary) as you might think. It's actually an old-school idea that dates back to ancient Greece, where folks speculated on olive harvests. And this practice wasn't just limited to Greece, either. The Japanese were up to something similar with the Dojima Rice Exchange.

In the world of options trading, there are two main characters: the Holder and the Writer (no, we're not talking about a pen and a notebook!). The Holder is the buyer of the contract, kind of like someone holding a golden ticket to buy or sell bitcoin. On the other hand, the Writer is the one selling this golden ticket. The Writer takes on the obligation to buy or sell bitcoin if the Holder decides to use their ticket, and in return, they get a premium. It's like selling a promise for a fee.

So, there you have it! Still confused? Let’s dig a little deeper.

How Crypto Options Work?

Cryptocurrency options basically come in two flavors:

- American Style: With this style, you can exercise the contract at any moment before the expiry date.

- European Style: For this one, you can only exercise the contract when it expires.

Even though European options can only be exercised at the end, you can still trade them or sell them early if you want.

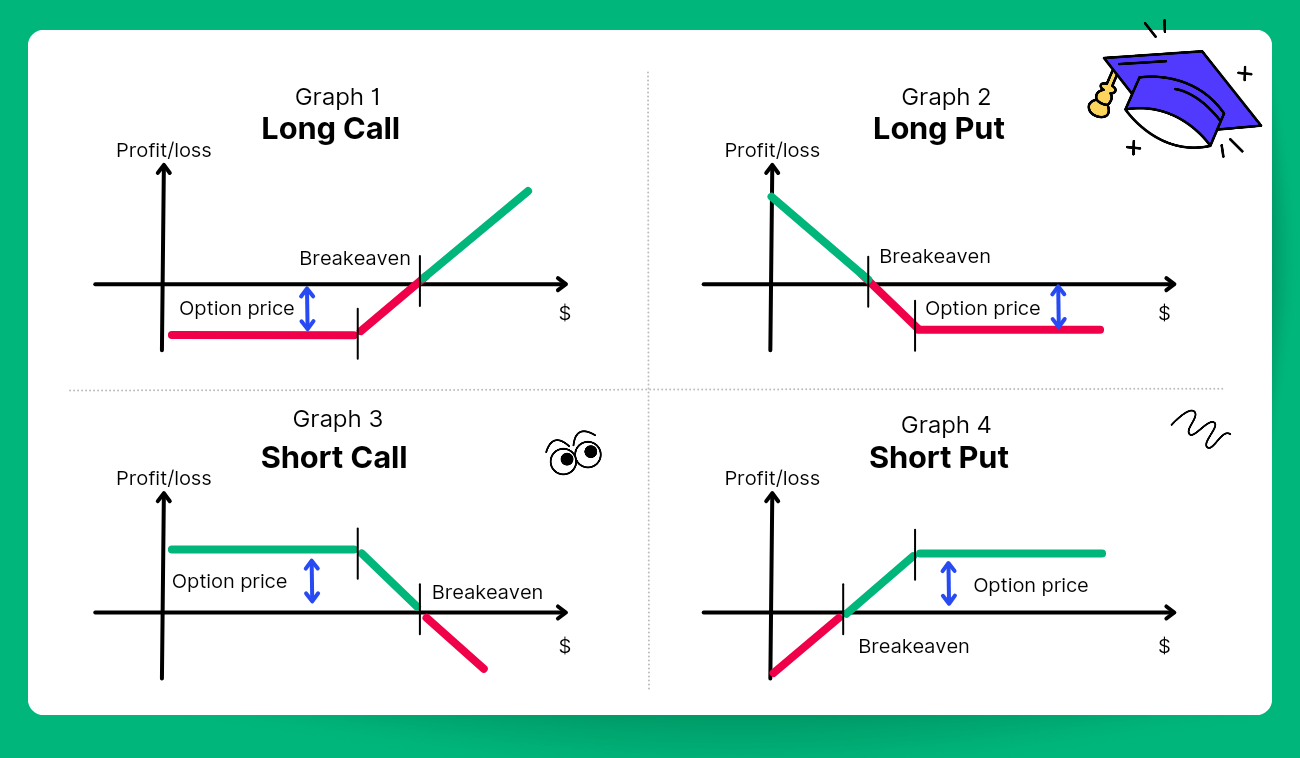

And there are two types of options:

- Call: This gives you the right to buy the asset.

- Put: This gives you the right to sell the asset.

Here's how it works: An options seller makes the call and put options contracts. Each contract has an expiration date and a "strike price," which is the price you get to buy or sell the asset at when the contract ends (or before the end if it's an American style option).

The contracts are then listed on a crypto options exchange. Sometimes, you can even place an order on the exchange and the options seller can sell into it.

The price you pay for an option is called a "premium," kind of like insurance. For example, if you buy a put option, you're doing it to protect yourself if the price of the asset falls below the strike price.

The premium's price depends on a few things like how much time is left on the contract, how much the asset's price is expected to change, interest rates, and the current price of the asset.

The current price of the asset is super important when figuring out how much an option's premium costs:

- In the money (ITM): For a call, it's when the strike price is lower than the current price. For a put, it's when the strike is higher than the current price.

- At the money (ATM): For both a call and a put, it's when the strike equals the current price.

- Out of the money (OTM): For a call, it's when the strike price is higher than the current price. For a put, it's when the strike is lower than the current price.

Let's say, at the beginning of January, one bitcoin is priced at $20,000. Alice has a hunch that by the end of February, the price will jump up. Acting on her hunch, she decides to buy 5 European-style call options with a strike price of $22,000, paying a premium of 0.001 bitcoin per contract, which expires at the end of February.

0.001 bitcoin at a price of $20,000 translates to $20 when Alice buys the call options. So, she ends up paying a total premium of 5 x $20, which equals $100.

Each contract allows Alice to buy 0.2 of a bitcoin at $22,000 per coin. This means Alice can buy one bitcoin at $22,000 when the contract expires at the end of February (since 5 x 0.2 equals 1).

By the time the contract expires, bitcoin’s price has climbed to $26,000. Alice decides to exercise her call option, making a neat profit of $4,000 (26,000 - 22,000 equals 4,000). After deducting her premium, Alice's net profit is $3,900.

But if bitcoin’s price is just $19,000 at the end of February, Alice won't exercise her call option because it's 'out of the money'. In this case, Alice's loss is just what she paid for the call premium.

A Few More Scary Options Terms to Be Aware of

Ah, well, before we get to the juicy bits, let's get comfy with a few more terms linked to options. This way, you won't be left scratching your head when you come across them on an exchange or some such good old place.

The Greeks

The Greeks help you understand the factors that shape the price of an option. The Greeks determine how much you'll shell out to open an options contract or how much you'll pocket from selling one.

Let's meet the five members of the Greek family:

- Delta measures how much the price of an option moves when there's a change in bitcoin's price. Think of it as the option's sensitivity to bitcoin's price changes.

- Gamma shows how much the option's delta changes when bitcoin's price moves a notch. It's like a measure of Delta's own sensitivity.

- Theta is all about time. It measures an option's "time decay," or how much the option's value erodes as time passes. If Theta is low, the expiration date is far off. But if Theta is high, the expiration date is getting close.

- Vega watches how changes in the volatility of bitcoin's price affect an option. It tells you how much the option's premium changes when volatility ticks up or down by 1%. Since bitcoin is quite a roller-coaster ride, Vega plays a big part in setting option prices.

- Rho looks at how changes in interest rates affect an option's price. It's like a weather vane for the winds of financial policy.

So there you have it, a friendly introduction to the Greeks!

Naked Call and Put Crypto Options

In options trading, when we say "going naked", we're referring to a situation where you assume an options position without owning a corresponding position in the underlying asset, or what we call a "covered" position.

For example, if you sell a call option but don't own the asset, it's like you're making a wager that the price will go down. On the other hand, if you sell a put option without owning the asset, you're essentially betting that the price will go up.

Selling naked calls (which give buyers the right to buy) and puts (which give buyers the right to sell) can be a bit of a high-wire act and could end up costing you a lot.

Usually, the person selling the option would own the underlying asset as a kind of safety net in case the price takes a turn for the worse. Let's illustrate this with a story:

Let's get back to our previous example with Alice and assume the trader who created the options contract decided to buy one bitcoin at the time they created the contract, which cost them $20,000. After the contract expired and bitcoin’s price had increased to $26,000, the options seller would've ended up making a profit of $1,900:

- Profit from bitcoin price: $6,000 (they bought in at $20,000 per bitcoin, and the price is now $26,000.)

- Loss on option: -$4,000 (because the options seller has to sell Alice the $26,000 bitcoin at the strike price of $22,000.)

- Gain from premium: $100. Hence, (6,000 - 4,000) + 100 equals 2,100. If the options seller simply held onto their bitcoin, they would've made a gain of $6,000.

Now, let's imagine that the options seller decided not to buy one bitcoin when they created the call contract. Upon expiry, they would’ve had to buy one bitcoin at $26,000 to fulfill the contract, which would result in a loss of $3,900:

- Loss on option: -$4,000 (the options seller has to buy one bitcoin at the settlement price of $26,000 and sell it for $22,000.)

- Gain from premium: $100.

- Hence, -4,000 + 100 equals -3,900.

So, you might ask, why would anyone want to sell naked call and put options? The main draw is that the options seller doesn't have to invest any capital upfront. And remember, there are three potential outcomes for any options trade:

- The price of bitcoin moves in the buyer's favor and the options seller loses money.

- The price of bitcoin stays the same, so the buyer decides not to exercise the contract.

- The price of bitcoin moves against the buyer, so they decide not to exercise the contract.

In two out of these three scenarios, the options seller could end up winning. The seller just needs to balance the risks, taking into account bitcoin’s volatility, against the potential to earn premiums without having to invest any upfront capital to cover the call and put options they've created.

Comparing Bitcoin Options to Traditional Options

The key differences between trading good old traditional options and crypto options boil down to two main things. First, the crypto market never sleeps! It's up and running 24/7, unlike the conventional financial markets that operate Monday to Friday from 9:30 a.m. to 4 p.m. ET. Second, the crypto world is typically a wilder ride, with prices often jumping up and down more frequently and dramatically.

Now, you might be thinking, "Why would I want all that volatility?" Well, the silver lining to this roller coaster is the potential for bigger returns. If you're a savvy trader and you've got your predictions on point, that larger gap between the strike price and the settlement price at expiry could mean a bigger payday for you.

What Are Crypto Options Trading Platforms?

Bitcoin options can be traded on traditional securities exchanges such as the Chicago Mercantile Exchange (CME), as well as on specific cryptocurrency trading platforms like

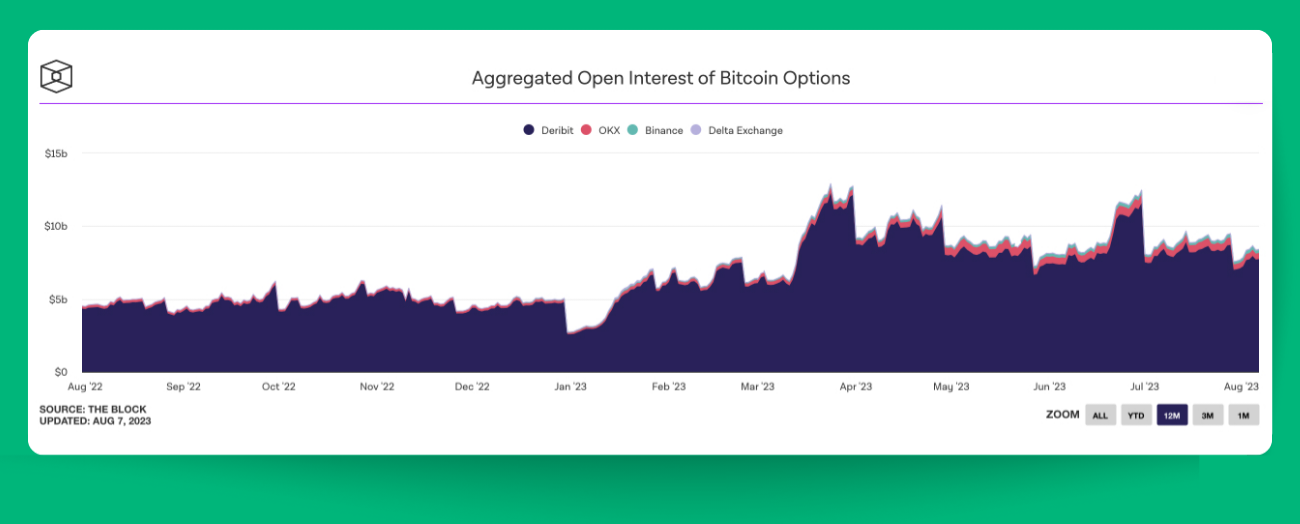

The Block illustrates (see Pic. 2) that Deribit takes the crown in the realm of Bitcoin options trading volume, leaving Delta Exchange in the runner-up spot. During the heat of July 2023, Deribit claimed a substantial share of the arena, trading a whopping $16.4 billion out of the total bull run of $20.37 billion. On the other side of the aisle, Delta Exchange made a respectable showing, trading options valued at $2.76 billion.

A glance at the aggregated open interest in Bitcoin options (Pic. 3) reveals increasing liquidity, indicative of a maturing market. Open interest is actually a measure of the estimated notional value of all active options positions, or in simpler terms, the total dollar value of contracts outstanding that are destined to be fulfilled in BTC. This measure is noticeably swelling, and the growing buzz surrounding Bitcoin options suggests a burgeoning crowd of market participants, both speculators and hedgers, who are diving into these intriguing waters.

How to Trade Crypto Options

As mentioned, several exchanges offer Bitcoin options, and each employs a unique approach to contract allocation.

For instance, on certain cryptocurrency exchanges, an options contract is maintained directly between the customer and the exchange. To engage in an options contract, the user selects the volume of Bitcoin they want to base their options contract on, which in turn establishes the premium. The trade is conducted between the user and the exchange via a software program. If the user's losses exceed a certain limit, a liquidation process is initiated to curtail further losses, with the premium being the only loss incurred.

On other platforms, a user "authors" a contract and waits for another user to match this contract by ordering a similarly termed contract. The exchange supervises this transaction, levying a fee to ensure fair play.

Bottom Line

Bitcoin Options trading presents a significant benefit — it allows investors to tap into the potential profits without the high-risk exposure that comes with purchasing the underlying bitcoin outright.

In this arena, traders pay a premium to engage in trading, but crucially, they're not compelled to either buy or sell the contract at its expiration. If you're a trader and your predictions are aligning with the price movement, you can sell the contract profitably ahead of time.

A careful analysis of trading graphs and price history, using technical indicators, can guide your future speculation decisions. If your experience and the trading signals suggest with reasonable certainty a potential price increase or decrease in bitcoin, then put or call options could be your next move.

Are You In For Trading Some Crypto?

Oh, the thrill of crypto trading! If that's your sole focus (rather than dabbling in options), we've got something that will make your heart race — Bitsgap! This dynamic platform brings together up to 17 exchanges under one roof. Yes, you heard it right! You can access the titans of the crypto world like Binance, Crypto.com, Bybit, Bitget, OKX, and Kucoin, all in one place!

But wait, there's more! Bitsgap doesn't just connect you to exchanges; it supercharges your trading with an array of powerful tools. Smart orders, crypto trading bots, and more await you on this platform, ready to propel your trading to stratospheric levels.

So why wait? Dive in, explore, and experience the power of Bitsgap for yourself.

FAQs

What Are Some Advanced Crypto Options Trading Techniques?

There are several advanced options strategies that can help you navigate the turbulent waters of risk while simultaneously raising the sails of potential profit:

- Straddle strategy: Picture being on a seesaw, unsure of which way it will tip. This is the essence of the Straddle strategy. It's for times when you anticipate a substantial price swing in a cryptocurrency, but the direction is uncertain. By purchasing both a call and a put option with identical strike prices and expiration dates, you can profit from significant price movement in either direction.

- Strangle strategy: Just like the Straddle strategy, the Strangle strategy is used when you're expecting a big price shift but are unsure of its direction. The difference? The call and put options you buy have different strike prices. This makes the Strangle a cheaper strategy than the Straddle, but it demands a more significant price movement to turn a profit.

- Covered call strategy: Imagine owning a golden goose (the underlying cryptocurrency) and selling golden eggs (call options). While this strategy earns you premium income from selling the eggs, it does limit your potential profit should the golden goose (cryptocurrency's price) skyrocket.

- Protective put strategy: This strategy is akin to buying an insurance policy for your cryptocurrency. By purchasing a put option, you protect yourself against possible price drops. If the price does dip, the put option's value rises, balancing the loss from the cryptocurrency you own.

- Bull spread strategy: Picture yourself as a bull charging forward, expecting a moderate rise in a cryptocurrency's price. This strategy involves buying a call option and selling another call with a higher strike price. Your profit is the difference between the strike prices, subtracting the cost of the options.

- Bear spread strategy: This is the inverse of the bull spread strategy. If you're expecting a moderate price drop, you're in bear territory. Here, you buy a put option and sell another put with a lower strike price. Your profit is again the difference between the strike prices, minus the cost of the options.

It's important to keep in mind that trading is akin to sailing in a storm; it always carries risks. These strategies are best employed by seasoned traders who are comfortable with their understanding of potential outcomes and the level of risk they're assuming.

How Do I Trade Crypto Options in the USA?

Your first step would be to find a cryptocurrency exchange that operates in the USA and offers options trading. Not all exchanges offer options trading, and even fewer may offer it in the USA due to regulatory oversight. Some popular exchanges offering options trading include Deribit and LedgerX. Make sure the exchange you choose complies with US regulations.

What Are the Benefits of Trading Digital Asset Options?

Let's explore why crypto options trading might be an attractive choice:

- Capped risk: One of the main attractions of options trading is that your potential loss is confined to the premium you paid for the option, thereby limiting your risk.

- Hedging abilities: Options can serve as a protective shield against the ever-changing tides of market volatility, helping to safeguard your investment portfolio.

- Flexible nature: Options are a versatile instrument, offering the freedom to select various strike prices and expiration dates. They enable you to adapt to different market scenarios, whether you predict a bull or bear market. Moreover, options facilitate the execution of numerous non-directional strategies through the combination of different option strike prices.

- Leverage opportunities: Options trading can make you feel like a giant in the market, controlling a substantial value of underlying assets with a relatively small investment. This leverage can lead to significant returns if you can accurately predict the market's direction.

- Diversification potential: With options, you can spread their wings, diversifying your portfolios, and thereby reducing risks.

What Are the Risks Associated with Cryptocurrency Options?

However, crypto options trading is not without its pitfalls:

- High volatility: Cryptocurrencies are notorious for their rollercoaster-like price movements. This high level of volatility can spell uncertainty when you face substantial price fluctuations.

- Regulatory deficiency: In contrast to traditional markets, the crypto market operates in a largely unregulated space. This lack of regulation can leave you vulnerable to potential fraud or other forms of misconduct.

- Limited liquidity: Some crypto options markets may suffer from liquidity constraints, potentially making it challenging for you to execute trades or exit positions at your preferred price.

- Complex nature: Options trading is not a simple game. It demands a significant level of knowledge and experience, which may not be suitable for everyone.

- Counterparty risk: There's always a chance in trading that the other party may not meet their commitments. This counterparty risk can lead to losses if the counterparty fails to fulfill their obligations.