Thrills and Spills of Crypto Market Volatility: Navigating Market Swells and Crashes

The crypto markets are wild and whipsawing. Want to ride the bulls and beat the bears like a pro? Read on to learn the secrets of crypto volatility and how savvy traders surf this digital wave.

Fasten your seatbelts as we explore the thrills and chills of crypto market volatility! While it’s a gripping adventure, it’s not without bumps in the road!

Cryptocurrencies have taken the world by storm, igniting a whirlwind of excitement and curiosity around the globe. When it comes to the adrenaline-pumping, heart-stopping twists and turns of the crypto market, we're playing in a league of its own. Embrace the rollercoaster or dread the drop, volatility is the lifeblood of this digital gold rush, and mastering it could be your ticket to success.

As the thirst for understanding the unpredictable nature of cryptocurrency swells, we're here to quench it. In this article, we'll try to unravel the mysteries of crypto market volatility and arm you with valuable insights to conquer the tumultuous tides.

What Is Cryptocurrency Market Volatility?

Volatility measures how dramatically an asset's price rockets and plummets over time. The wilder the ride, the riskier the investment—but also the greater the chance of scoring huge wins or losses.

Crypto is considered the Formula One of volatility, with the potential for massive highs and lows in a split second. The stock market has its own degree of drama, from relatively stable blue-chip stocks to notoriously unpredictable penny stocks. By comparison, the bond market seems downright boring, with prices that drift along on a slow but steady path over the long run.

👉 By tracking volatility of an asset, you can start to predict how much your investment might soar—or plummet—over time.

If you've got the guts to handle the volatility, the crypto markets are your playground. Sharp, sudden price moves are simply the price of an admission ticket to this high-stakes game of crypto.

Market Volatility vs Liquidity

Liquidity means cash is flowing and deals are getting done. When markets are liquid, traders can execute their orders in a snap. Liquidity depends on how many traders there are and how much they're buying and selling.

Volatility is what happens when liquidity dries up—prices start swinging wildly because even small trades can tip the scales. Illiquid markets move fast, so profits and losses pile up in a hurry. That's why small-cap assets can be so lucrative yet so hair-raising.

👉 If you're looking to play it safer, stick with massive markets where liquidity is always high and volatility is muted. But for thrill-seekers with a taste for chaos, spectral gains from illiquid assets might be worth a rollercoaster ride.

Market Volatility Example

Jimmy was a thrill-seeker always on the hunt for his next adrenaline rush. He found it in a tiny cryptocurrency known for wild price swings that could generate monster profits—or crush you into dust.

The token’s value bounced around from cents to nothing and back again, turning each trade into a heartbeat-pounding adventure. Jimmy watched the chart for a few days as the price whipped up and down and finally decided it was time to jump on for a ride.

Jimmy bought 10,000 tokens at a penny each. By day's end, a surge of trading had kicked the price up to two cents. Jimmy's gamble had just doubled his money! He leapt off the rollercoaster with a grin, his pockets bursting with profit.

👉 But Jimmy knew his success was pure luck. If the market had veered the other way, his pennies would have disappeared as quickly as they came. Volatility is a fickle friend—fun when it's on your side, brutal when it's not.

Why Is Crypto Market so Volatile?

A flurry of recent studies have explored dozens of possible factors influencing crypto’s volatility, from market sentiment to the economy to global finance. But the results are all over the map, with no clear answer as to what matters most.

One of the latest studies dove into 22 potential drivers of bitcoin volatility between 2010 and 2020, examining five groups of potential explanatory factors: (i) the bitcoin environment, (ii) market sentiment, (iii) financial markets, (iv) macroeconomic conditions, and (v) policy and market uncertainty.

While the impact of each factor shifted over time, a few stood out as consistently significant, namely the bitcoin Google trends, total circulation, S&P 500 index, and US consumer confidence.

The other factors seemed mostly irrelevant, showing little meaningful effect on bitcoin's choppy price action. While Google trends exhibited a positive impact on volatility, total circulation, US consumer confidence, and the S&P 500 index had a negative effect, with the latter found particularly significant over the last months of the sample.

Since altcoins greatly depend on bitcoin, it makes sense to extrapolate the above findings to the rest of the market.

From our own observations, crypto market fluctuations are often stirred by the news of the day, which whips sentiment into frothy optimism or gloomy pessimism. Naturally, good news ignites enthusiasm and sends prices rocketing skyward, while bad news sparks fear and starts a sell-off stampede. Once the herd is on the move, momentum builds as traders pile in, afraid to miss out on gains or desperate to escape losses.

Sometimes, there are more devious forces at work manipulating the markets. Especially in small markets where a little money goes a long way, you should be wary of falling victim to manipulated hype. It can be hard to tell whether hype is real or manufactured in the heat of the moment, so it’s best to step back and ask yourself what's really driving the latest price swing and if you should join the herd.

How Can Crypto Market Volatility Be Measured?

When traders talk about volatility, they usually mean how wildly an asset's price has swung in the recent past, implying “historical volatility.” “Implied volatility,” on the other hand, aims to predict future price moves — an imperfect art, though it powers tools like the Cboe Volatility Index or "fear index" that gauges market volatility for the next 30 days.

There are a couple ways to measure volatility. Beta compares an asset's volatility to the overall market, typically the S&P 500. The standard deviation shows how far an asset's price has strayed from its average.

For example, bitcoin's daily volatility measures how much its price diverges from the opening price each day. It's calculated as the standard deviation of bitcoin's price changes.

- First, sample bitcoin's price at points throughout the day (say, N samples).

- Calculate (Opening Price - Price at Sample Point)^2 for each sample.

- Add up all those results to get ∑(Opening Price - Price at Sample Point)^2.

- Divide that by N to get the variance, ∑(Opening Price - Price at Sample Point)^2 /N.

Bitcoin's daily volatility is the square root of that variance. For annualized volatility, multiply the daily result by the square root of 365. For monthly, use the square root of 31, and so on.

The fear index and other implied volatility tools try to peer into the future, for better or worse. And although history has its limits in markets where sentiment shifts on a dime, without the past as a guide, the future is only guesswork.

Crypto Market Volatility Index

Due to unprecedented demand for more accurate tools to gauge crypto price volatility, devs at COTI created the Cryptocurrency Volatility Index, or CVI, a decentralized tool. Along with the CVI, COTI also launched a decentralized exchange where traders can go long or short on volatility by trading the index. The CVI is a crypto version of the VIX (The S&P 500 Volatility Index), which estimates volatility in the stock market over the next 30 days based on options prices.

The CVI index measures the implied volatility for the entire crypto market for the next 30 days using the Black-Scholes options pricing model. It generates a score from 0 to 200, where 200 means maximum volatility and 0 means the lowest. A higher CVI means bigger risks—but also bigger potential rewards.

👉 Of course, the CVI isn't infallible. Implied volatility only reflects traders' expectations, which could be wrong. But as a gauge of market sentiment, the CVI provides insight into the crypto world's view of what's to come.

Crypto Market Volatility Chart

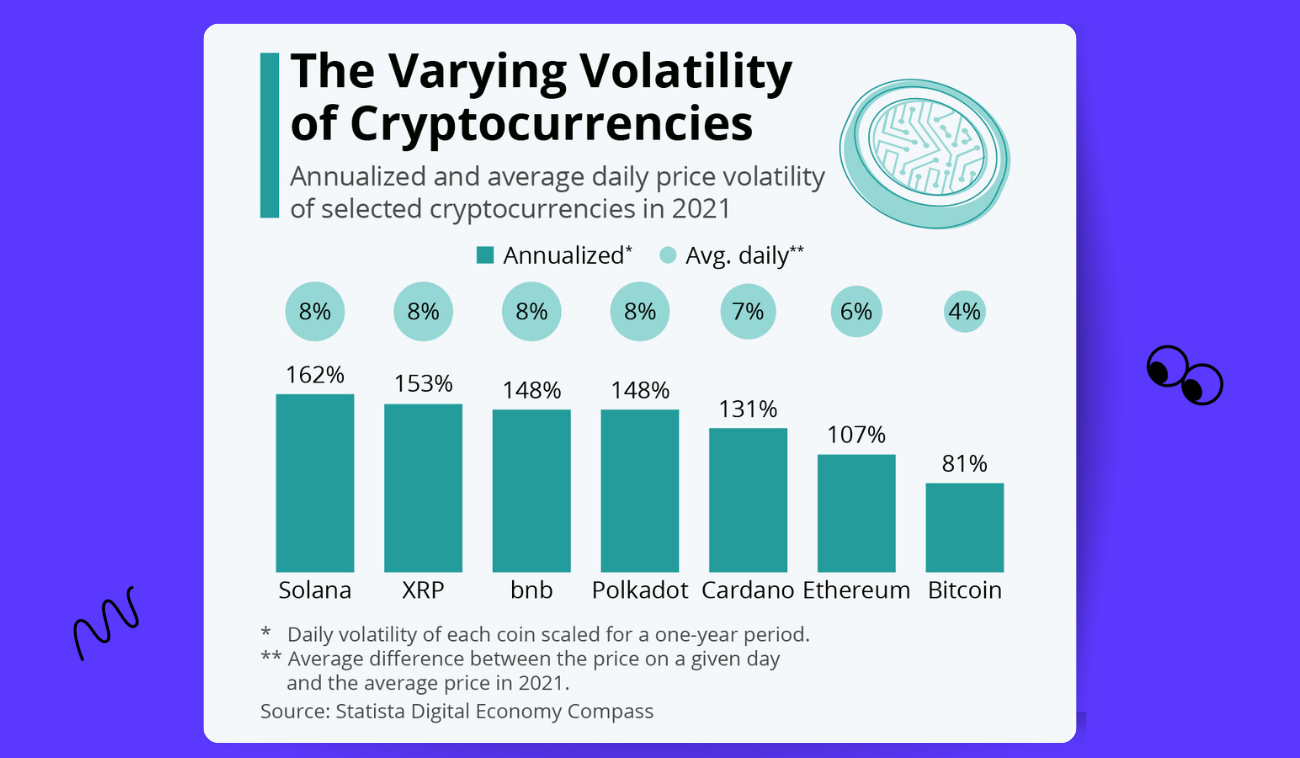

Crypto prices soar and crash unpredictably, keeping the market on a rollercoaster ride. Bitcoin is no exception, with huge price fluctuations that fuel hype and headlines. Yet Statista found that compared to other major cryptocurrencies, bitcoin's volatility was the mildest (Pic. 1). Bitcoin's annualized volatility was 81% last year, meaning its price changed by an average of 4% each day. That's half the volatility of Solana, the most volatile crypto studied.

If you’re hunting for the highest volatility crypto, Yahoo Finance Most Volatile Crypto chart (Pic. 2) serves the purpose. It tracks the crypto market's wildest rides — the coins with the biggest price swings over the past 20 days based on their standard deviation during that period.

Conversely, for the most violent gyrations, go to coinmarketcap.com and sort your coins by price change.

What Effect Does Cryptocurrency Market Volatility Have?

Crypto market volatility is a Janus-faced beast, surely — wild price swings can stir euphoria and panic in equal measure. For traders, volatility is an opportunity — the chance to win big or lose fast. But too many ups and downs scare ordinary investors and undermine mainstream appeal.

When prices soar to new highs, FOMO — fear of missing out — sets in. Speculators rush into the market, dreaming of effortless riches as prices skyrocket. But parabolic rises inevitably reverse, and the higher the highs, the steeper the drop. Bear markets bring dreams of wealth crashing down, leaving the wreckage of novice traders in their wake.

Of course, every market needs corrections to remain healthy. Bears clear out speculators and weak hands, transferring coins to believers who endure. But too much volatility — enormous bull runs followed by devastating bears — makes crypto notoriously difficult for most ordinary investors to stomach.

The crypto faithful argue that volatility will settle as the market matures. Wiser, more seasoned traders will prevail. Institutional investors will stabilize prices. Maybe so, but thus far, crypto remains a volatile rollercoaster.

Volatility sustains traders, the lifeblood of liquid markets. But too much of it threatens long-term growth. For crypto to truly go mainstream, volatility must be tamed — without losing what makes the space uniquely attractive. This is the paradox of crypto: volatility is an essential yet existential threat. And so an asset class of almost unimaginable potential remains confined to the fringes, awaiting stability that may dull its shine yet harness its power at last.

How to Predict Crypto Market Volatility?

Predicting crypto volatility is hard, but attentive traders spot clues to market shifts before volatility strikes or subsides. Bitcoin is crypto's bellwether. Its price action foretells whether volatility lies ahead or calmer seas may come. If Bitcoin soars or plummets, the rest of the market follows. So Bitcoin is the first indicator for traders bracing for turbulence or opportunity.

News and hype also drive volatility. Rumors on social media, new regulations, exchange outages — anything could spark a price spike or drop. Stay up-to-date on crypto's latest developments to anticipate how markets may react.

Look for strong or weakening support levels, where buyer demand is high or low. As prices approach support, see if it holds or cracks. Breaking through suggests further downside; holding steady, a bounce may come. The stronger the support, the larger the potential price move in either direction.

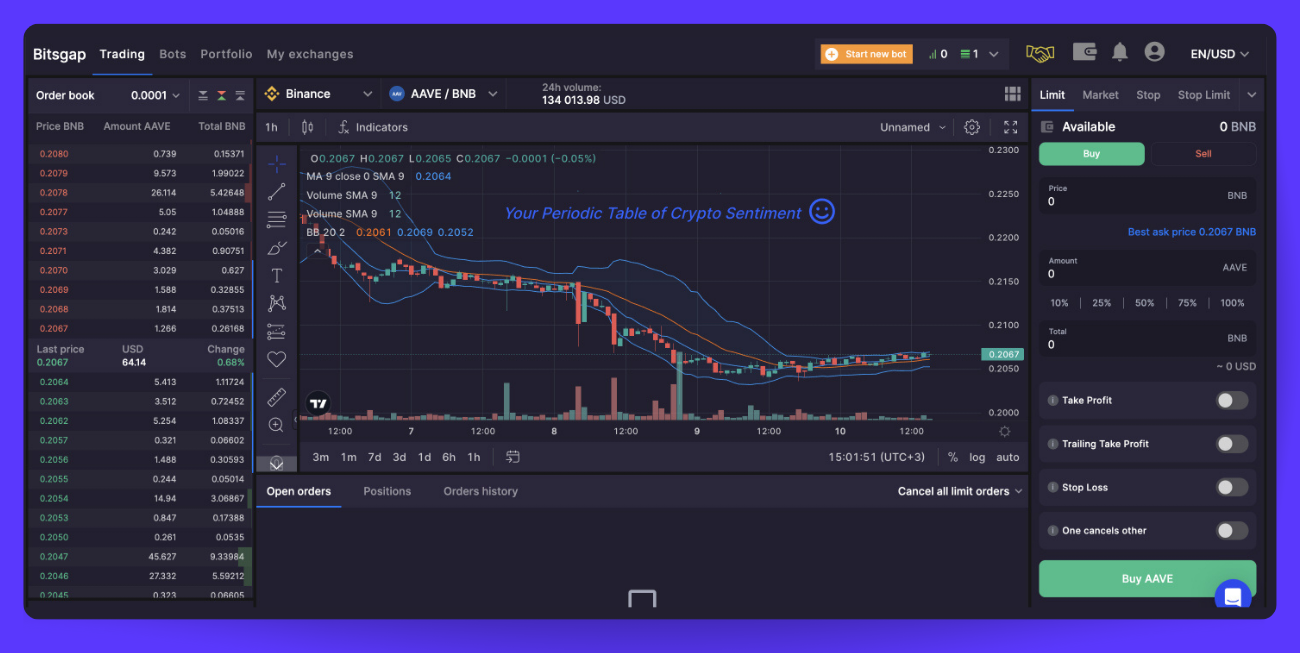

Technical analysis helps forecast volatility. And Bitsgap offers plenty of tools for you to do your tech homework before striking gold.

Bitsgap’s long-term partnership with TradingView is a match made in heaven. Combined, we offer a robust platform for technical analysis to identify opportunities in an instant and automation to seize them systematically (Pic. 3).

TradingView supplies interactive charts with many indicators, timeframes, and drawing tools, with the ability to customize the charts to your heart’s content and share insights with others. Bitsgap, on the other hand, offers automation for acting on your analysis. You can use smart orders like Scaled or TWAP, hedge your bets, seize lucrative trades with trailing, or launch trading bots like GRID, DCA, or COMBO to automate your strategy. Suffice to say, these tools go beyond what most exchanges provide for trading!

Bitsgap’s in-house Technicals Widget is another awesome addition to any trader’s toolkit. The widget aggregates signals from dozens of indicators to identify trading opportunities at a glance. You can finally see when markets are overbought, oversold, or poised to reverse without checking each indicator separately.

To put it simply, Bitsgap unites the science of analysis with the automation to prosper from it, helping intuition become profit at last.

FAQs

Why Is Market Volatility Important?

Crypto volatility is essential for traders to understand because it determines risk and potential reward. Volatile assets like crypto can swing wildly in value, soaring high or dropping fast. This makes them risky but offers big opportunities.

Traditionally, investors reduce risk through diversification and balancing volatile with stable assets. But crypto is an entirely new asset class and far more volatile than stocks. Bitcoin, the largest crypto, is seeing volatility decline over time as volume and institutional adoption rise. Smaller cryptos with little volume tend to be the most volatile.

So understanding the ups and downs as well as diversifying your portfolio can help you time the market and avoid unnecessary risks.

Is Market Volatility Good or Bad?

Crypto volatility is a double-edged sword. On the one hand, massive price swings attract interest and enable huge gains. Without volatility, crypto would never have captured mainstream attention or turned early believers into millionaires.

But volatility also means risk — the possibility of devastating losses. As an investor, your job is to leverage volatility for opportunity while avoiding getting crushed.

When Will Crypto Market Volatility End?

Crypto volatility won't end anytime soon. For markets to stabilize for good, they need stringent regulation and mass adoption — so far, crypto boasts of neither. Besides, many swear by volatility and won’t trade it for a lukewarm and humdrum stock market, believing that volatility in crypto is a feature, not a bug. So, ending volatility could fulfill crypto's promise but also undermine its purpose.

The future depends on balancing regulation, adoption, liquidity, and decentralization — a precarious act that could make or break this asset class. After all, unfettered crypto lets traders experiment, for better or worse, and big price moves mean big opportunities to win big. Why end volatility when fortune favors the bold?