The Crypto Market's Pulse: How to Take the Crypto Trading Volume's Measure

Dive into our comprehensive guide to learn the art of trading with volume and discover the crucial role it plays in your path to crypto success.

Understanding the currents and eddies of crypto trading volume is what separates the quick-witted traders from those forever chasing ghosts in the dark. Do you have the cunning to follow the volume’s tracks and uncover the clues left behind?

Navigating the complex currents of the crypto market calls for a keen eye on crucial metrics, and trading volume is undoubtedly a lighthouse guiding the course of a trading journey.

The volume tells all — it represents the sum of all cryptocurrency transactions within a designated time frame, acting as a compass to gauge a digital asset's liquidity and vitality in the swirling crypto seas.

Join us as we chart the terrain of crypto trading volume, measure its torrents, and explain how to spot opportune moments and detect troubled waters ahead. Dive in, if you dare.

Cryptocurrency Trading Volume Definition

The crypto trading volume represents the aggregate amount of crypto transacted across exchanges during a given period. In other words, trading volume measures how many market participants are actively buying and selling at any moment and how much they're willing to bet on price movements.

As a pivotal metric in cryptocurrency trading, volume (Pic. 1) is what gives crypto markets their characteristic 24-hour pulse. Its importance stems from the profound influence it exerts on price, both in absolute and relative terms.

👉 A higher trading volume of cryptocurrency results in more equitable pricing. Conversely, low trading volume may signal a lack of market interest as the asking prices of sellers fail to align with the bids of prospective buyers. At the same time, trading volume often surges during significant price fluctuations. For instance, when crypto was in freefall during the 2020 COVID meltdown, trading volume hit an all-time high as investors scrambled to cash out — or swoop in for deals of a lifetime.

How Does Volume Affect Crypto Trading: Why Is Trading Volume Important?

The total trading volume for a specified cryptocurrency directly correlates with its volatility, as the price reflects the equilibrium of opinions between buyers and sellers.

When the purchase and sale volumes are equal, the price remains stable, indicating that market participants possess well-informed opinions about the price — a phenomenon referred to as “market efficiency.” In mature markets characterized by significant volume and efficient price discovery, volatility is minimal. In other words, equal levels of buying and selling lead to stability.

But as we know, stability is rare in crypto — an inherently volatile market subject to outside forces and the whims of every investor, from institutions to speculators. Crypto volume ebbs and flows based on interest in the project, listings on major exchanges, and the spread between buyers and sellers. So analyzing the volume traded for a specific cryptocurrency can provide insight into the community’s belief in the project’s potential and, consequently, crypto’s volatility.

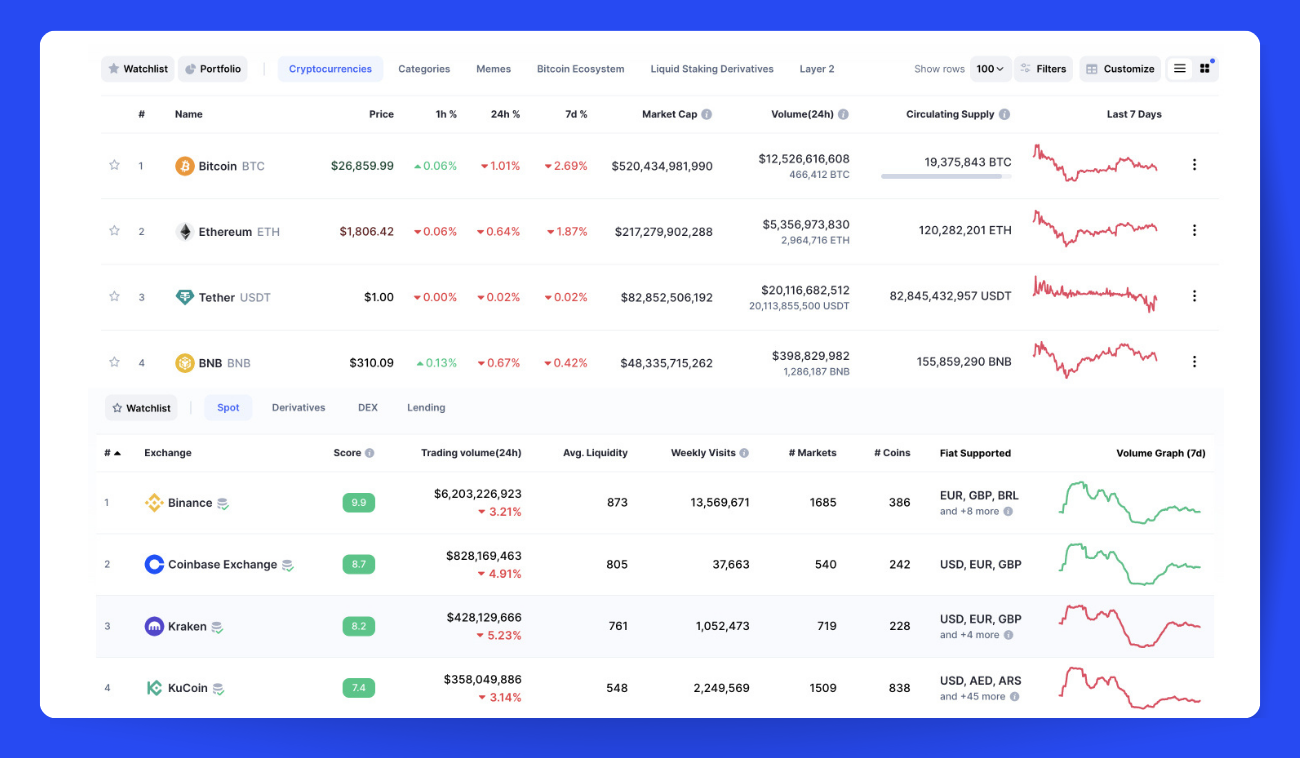

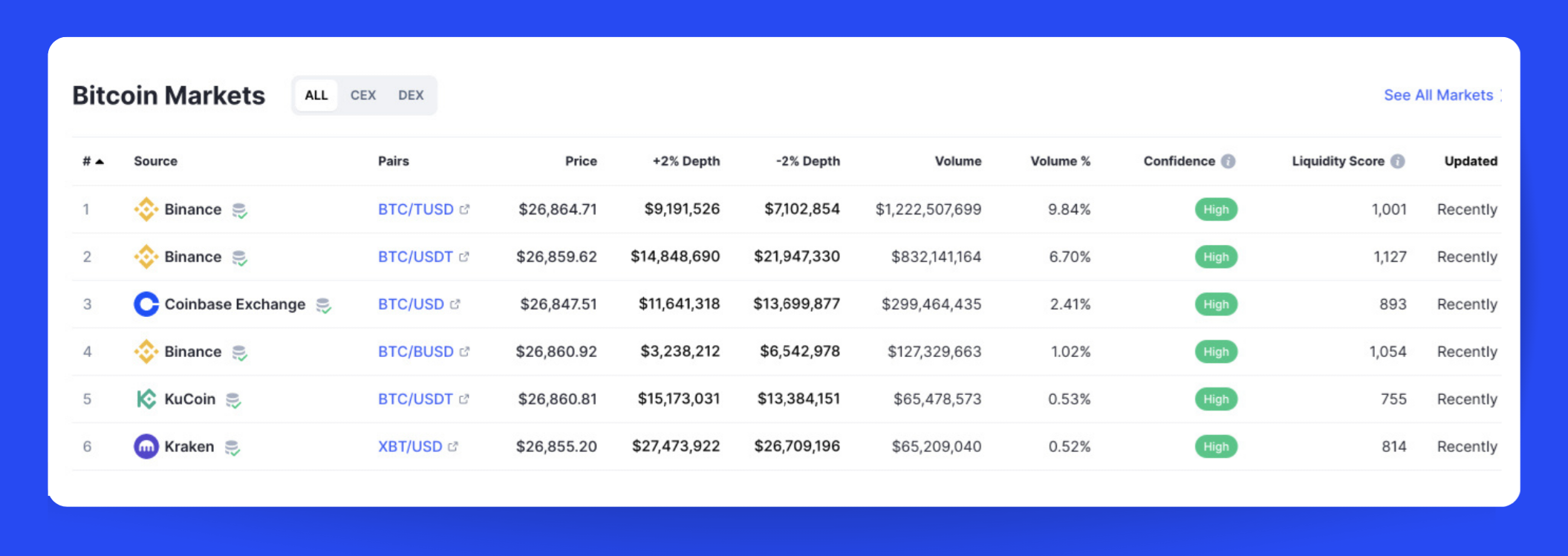

Sites like CoinMarketCap provide historical volume data and "liquidity scores" for each crypto on each exchange (Pic. 2). A high liquidity score means less slippage and impact on price when you buy or sell. For obscure coins on tiny exchanges, the lack of volume means any trade can send prices into a tailspin. But that same lack of volume creates openings for arbitrage, where the coin is cheap on one exchange but fetches a premium on another.

👉 While cryptocurrency volume is akin to liquidity, the two are not identical. Volume represents the aggregate of completed trades, while liquidity refers to the amount available for trading at a specific price.

So, to sum up, volume serves as a crucial indicator for traders when forecasting the future profitability of cryptocurrencies, potential price direction, and volatility:

- An increased volume of transactions ensures fair pricing and eliminates the possibility of distorted prices. Conversely, low cryptocurrency exchange volumes signal inefficiencies and minimal trades, as sellers' asking prices do not align with potential buyers' bids (Pic. 3).

- Traders also use trading volume to try and get a stronger sense of the momentum behind a trend. If there are big swings in price along with high levels of trading volume, that may suggest the price move is strong and valid. On the other hand, if a price shift occurs with little change in trading volume, that could signal the trend underlying the move is weak.

- Price levels that have historically seen very high trading volume can also provide clues for traders about the optimal points to enter or exit a trade. Usually, a rising market is accompanied by rising volume, showing ongoing buyer interest to keep pushing prices up. Rising volume in a declining market may show increasing selling pressure.

- Sharp reversals in price direction, exhaustion moves, and dramatic shifts in trend are frequently accompanied by a spike in volume, since these tend to be times when the greatest number of buyers and sellers are active in the market.

How Crypto Trading Volume Is Calculated and Measured

Trading volume represents the total quantity of units exchanged in a particular market within a specified time frame.

For instance, if Jimmy sells John 5 ETH at 1,800 USD apiece, the transaction volume could be either 9000 USD or 5 ETH, depending on the chosen denomination for trading volume.

Trading Volume Example

Having had a close eye on a particular cryptocurrency token for some time, Jimmy noticed an emerging pattern. The trading volume was steadily building up, and for Jimmy, this was the sign to join the ride. He jumped in and bought it at a good price. Within a few days, the volume exploded for the token, and the price shot up.

Jimmy watched the chart eagerly and noticed the trading volume was dropping off again. He had a hunch that the token price couldn't be sustained with the volumes drying up like that. So he sold to lock in his gains. It turned out Jimmy's instincts were right — within a week, the price of the token started tanking due to a lack of demand.

By keenly observing the trading volumes, Jimmy was able to ride the wave up and get out before the downturn, preserving his profits.

How to Analyze Trading Volume

The total trading volume of a cryptocurrency can give useful insights into how actively it is traded and how efficient its market is. The relative volume, meaning how much volume accompanies price changes, can provide clues about where the price may be heading.

To start analyzing the figures, you first need to locate the volume on the chart on your trading platform. On Bitsgap, a crypto trading platform with a full suite of manual and automated trading tools, it’s very easy to do.

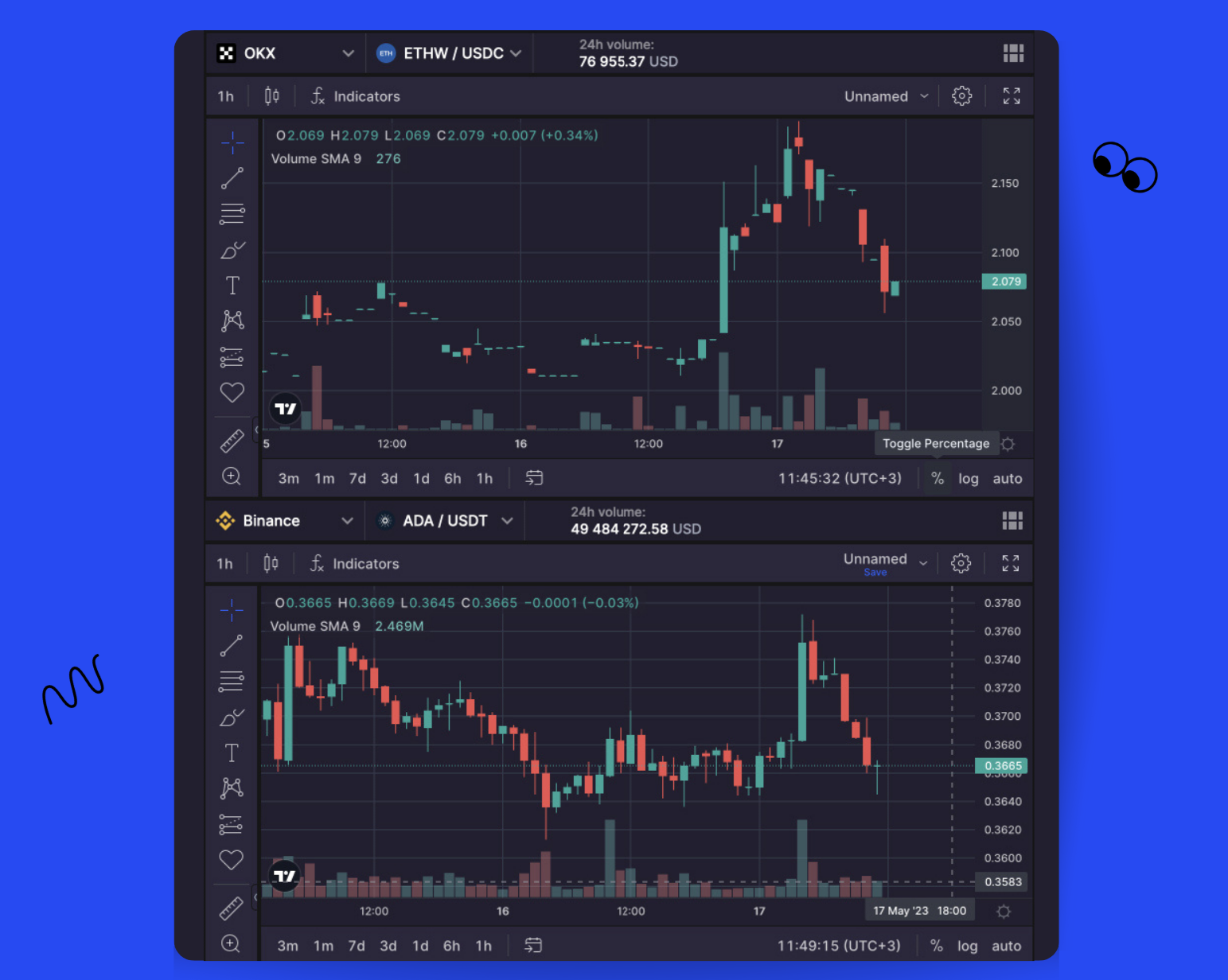

Click on the [Trading] tab in the terminal, select an exchange and a trading pair, click on the [Indicator] icon, and choose [Volume] from the drop-down menu of available options (Pic. 4):

The image above (Pic. 3) shows that there are several volume indicators you can use and analyze. We will discuss some of those in more detail later. For now, let's focus on the basic [Volume] indicator, which displays a bar chart at the bottom of the chart (Pic. 5):

The volume bars match the same time period as the candlesticks on the chart. Taller bars indicate higher volume. Green bars signify that the price rose during that period, while red bars show that the price fell.

By observing volume patterns on the chart, you can get a sense of how eager buyers or sellers are. Rising volume along with rising prices suggests strong buying pressure, which may indicate higher prices are on the horizon. Falling volume as prices decline signals weakening selling pressure, which could mean a reversal is coming.

Typically, however, before looking at volume bars and figures, you’d do a basic tech analysis to identify the overall direction a cryptocurrency is heading.

👉 Fortunately, Bitsgap provides plenty of tech analysis tools — from charting instruments to drawing tools to the Technicals widget, which tracks dozens of indicators and oscillators.

After you’ve done with your preliminary technicals, you can perform volume analysis to confirm or reject what the trend seems to show. If both the trend and volume are positive, it could be a buy signal. For cryptocurrencies you already own, volume acts as a health check to verify promising developments or warn of potential negative reversals.

A few basic rules of thumb are:

- If contemplating investing in a particular crypto, positive volume is a sign of strength.

- If considering buying but volume is negative, it is best to wait or look at other options.

- Owning a cryptocurrency with a positive trend and volume: keep holding.

- Owning a cryptocurrency with a positive trend but diminishing volume: watch closely and be ready to sell if the trend starts to reverse.

Unfortunately, market noise has a tendency to sway volume indicators. So, don't emphasize volume too much if you're investing long-term. However, volume indicators can quickly detect changes in investor sentiment, allowing you to get in or out early before the crowd catches on. For active short-term traders, volume analysis is critical.

Crypto Trading Volume Indicators

Some of the most commonly used indicators related to the trading volume study are: On Balance Volume (OBV) and Money Flow Index (MFI), both available on Bitsgap (Pic. 6).

- On Balance Volume (OBV)

On Balance Volume (OBV) is a user-friendly measure to assess how shifts in volume relate to price changes.

The idea behind OBV is that not all trading volume is created equal. OBV distinguishes between "smart money” —- institutional investors like mutual funds — and ordinary retail investors. When the smart money starts buying what the little guy is selling, volume rises even if the price stays flat. But soon, all that buying pressure pushes the price up. At that point, the big players lock in profits and sell, while the small fry buy in hopes of more gains.

OBV shows this dynamic on a chart, but the actual OBV number itself doesn't really matter.

OBV is cumulative, starting from an arbitrary point in time, so its absolute value depends entirely on when you start measuring. What's important is the trend of OBV — whether it's rising, falling, or flatlining. The slope of the OBV line tells the real story. If OBV is heading higher, it means the smart money is buying. If it's dropping, the smart money is selling. And if it's moving sideways, the big players are undecided — so retail investors should watch out, because once they do jump in, prices are likely to move fast.

- The Money Flow Index (MFI)

The Money Flow Index (MFI) is a handy volume-based indicator that evaluates whether the market is too hot or too cold. Running on a scale of 0-100, MFI is similar to the Relative Strength Index (RSI), but instead of using just price, it also incorporates volume data.

When MFI values soar above 80, it might imply a price reversal due to extreme buying volume. On the flip side, a value of 20 or lower could suggest excessive selling volume and oversold conditions.

One of the best ways to use the MFI is to spot divergences. A divergence happens when the MFI goes in the opposite direction of the actual price. This can signal a reversal in the trend.

For example, say a coin’s price keeps climbing higher but MFI starts falling from a very high level, like above 80. This divergence suggests the price may be about to reverse. Or the opposite — MFI starts turning up from a very low point, like below 20, even as the price keeps falling. This could mean an upside reversal is coming.

How Does Trading Volume Affect Crypto Price

Trading volume plays one of the most crucial roles in shaping crypto prices. When fresh money pours into a coin, its price pumps as people rush in to buy. But when money drains out, the price tumbles as panic sellers race to exit. Volume and liquidity are the fuel that power these price moves.

Below are a few observations to keep in mind when it comes to volume and prices in crypto:

- Heavy buying volumes will push prices higher, but for the upward momentum to continue, buying volumes need to remain strong.

- Rising prices on declining volumes can indicate that the upward move is running out of steam. Falling prices on low volumes similarly suggest a potential trend reversal.

- Sometimes large spikes in volume mark the end of a price trend, known as exhaustion. When latecomers pile in as a move peaks, this can use up remaining buy or sell orders, signaling the trend's end.

- Volume tends to go wild during price crashes. For instance, when the bear wakes up and drags prices down, some investors start fleeing, selling in panic, while others scoop up coins on the cheap. This battle between fear and greed causes volume to explode.

Bottom line

While cryptocurrency prices are volatile and difficult to predict, trading volume can offer important clues. Volume confirms what the price trend suggests but also warns when cracks are emerging. For cryptocurrency swing traders trying to stay ahead of major moves, volume is an invaluable radar system guiding decisions to buy, sell or stand aside.

Overall, rising volume accompanying a price rise suggests the uptrend is strong and may continue. But if volume starts fading even as the price keeps climbing, it often means the trend is running out of gas and a reversal may be looming. The opposite holds true in a downtrend. Volume fading during a price drop can signal the selloff may be exhausting itself, pointing to an opportunity to buy at a relative low before an uptick.

Volume extremes also highlight high-probability turning points. A volume spike after a long period of muted activity often flags an explosive move is coming, in either direction. These are moments when being properly positioned means the difference between missing out and catching a major swing.

The bottom line is, while long-term crypto investors may pay little heed to volume, for swing traders it provides an early warning system that makes all the difference.

For those interested in trading crypto and using technical analysis to find entry and exit points, Bitsgap offers an all-in-one platform with advanced tools for both in-depth market analysis and trading. Bitsgap aggregates data from multiple exchanges, providing smart trading options as well as automated bots so you can remain active in the market and capitalize on both short and long-term opportunities 24/7.

FAQs

What Is Abnormal Trading Volume?

Traders often say that "volume comes before price." This means major price moves are usually preceded by a sustained rise in trading volume. There is frequently an intense battle between bulls and bears at key support or resistance levels as each side tries to hold the line. This battle can go on for minutes or hours with little effect on price. But while price may barely budge, volume steadily builds as the opposing forces square off.

By closely watching Level 2 order flow data, traders can spot these volume ramp-ups even when price stays flat. The gathering volume signals the pressure is mounting — and a powerful breakout is likely coming soon. The more advance notice traders have, the better their chances to profit from the move.

Abnormal volume alerts can also highlight these coiling spring setups before the break. As volume starts spiking abnormally, pay very close attention to price action. A breakout may be imminent, and being ready to act fast separates those who capitalize from those left behind.

Often, the longer and more intense the volume buildup, the more powerful the resulting move will be once the price breaks free. All that pent-up energy explodes, fueling a trend that can last for days or weeks. The traders who detected the volume clues ahead of time and positioned themselves properly are able to ride a major piece of this move. By contrast, those surprised by the breakout end up chasing, buying the top, or selling the bottom.

Is High Trading Volume Good or Bad?

In general, higher trading volume is positive for cryptocurrencies. Greater volume typically means more stability and liquidity, allowing for easier trading and less price slippage. However, lower-volume altcoins can often see bigger price swings, creating more opportunities for large gains.

Healthy volume growth is good. It shows increasing interest and participation in a crypto, fueling steady price appreciation over time. But artificially inflated volumes sparked by hype alone should raise red flags. These hype-fueled rallies are unsustainable, and the asset risks crashing back down once the hype dies off and volume dries up.

Higher volume also makes it easier to buy and sell without significantly moving the price - your trades have less market impact. With lower-volume altcoins, even small trades can produce a ripple effect, causing the price to swing wildly. While this volatility opens the door for huge upside, it also increases the chance of big losses if a trade goes against you.

The ideal scenario is finding an emerging crypto with solid fundamentals and technology, indicating the potential for real, long-term mainstream adoption. If trading volume in this crypto starts rising over time along with the price, it suggests a growing base of committed investors who believe in the project's future. This “natural” growth in volume and price is sustainable and less risky than a hype-fueled pump and dump.

Why Does Trading Volume Decrease?

Trading volume tends to fall when investors lose optimism about a particular investment or the entire market. This can cause them to pull money out of the cryptocurrency market, decreasing overall trading activity.

If you notice trading volume regularly declining for your investments, you may need to take proactive steps to protect your capital. Consider options like moving some funds to more stable investments or even short selling assets that may lose value due to low volumes.

In essence, dwindling volume can be a warning sign of shrinking demand that precedes price drops. Taking appropriate actions like reducing risk exposures or hedging your positions in response to such a trend can help minimize potential losses before prices start to decline substantially.