What Factors Influence the Price of Bitcoin and Altcoins?

What's really driving crypto’s volatility behind the scenes? Read on to uncover the key factors at play in the crypto market, from bitcoin demand to altcoin competition to ETFs.

Cryptocurrency markets are notoriously volatile, with bitcoin's value capable of significant swings, sometimes as much as 5-10% in a single day. Altcoins, the smaller cousins of bitcoin, often experience even greater fluctuations. Ever pondered what drives these dramatic price movements? Our article delves into the myriad of factors that influence the price of bitcoin and altcoins.

As bitcoin’s popularity surges and its acceptance as a payment method expands, understanding the dynamics of its value becomes crucial. Despite its erratic price behavior when paired with fiat currencies like the U.S. dollar or euro, analyzing bitcoin-denominated prices of altcoins can offer a clearer picture by filtering out exchange rate volatility.

Join us as we explore the tangible factors that mold cryptocurrency prices and dissect the reasons behind their volatility. By the end of this article, you'll be equipped with deeper insights into the market forces at play, enabling you to make more informed decisions in the tumultuous world of crypto trading.

What Determines Bitcoin’s Price?

To understand cryptocurrency pricing, we should start with bitcoin — the dominant player whose price shifts impact the broader digital currency market. Grasping the key factors behind bitcoin's valuation provides critical context before exploring the distinct drivers of pricing for alternative cryptocurrencies (altcoins).

As such, the price of bitcoin is determined by several factors, including:

- Supply and demand: Bitcoin has a limited supply of 21 million coins released at a diminishing rate through periodic "halving" events. This capped supply contrasts with fluctuating demand driven by investor enthusiasm, adoption growth, and media attention. When demand rises sharply against fixed supply, bitcoin's price can surge upwards.

- Production costs: The expenses of mining bitcoin influence its price. Mining involves substantial infrastructure, electricity, and computational resources. As bitcoin's mining difficulty rises in line with increased network processing power, production costs also escalate. These changing input costs of creating new bitcoin affect the cryptocurrency's market value.

- Competition from other cryptocurrencies: Although the first and largest cryptocurrency, bitcoin still faces competition from many alternative coins. While bitcoin enjoys early market leadership and the highest valuation, the growing popularity and use of other cryptocurrencies can erode its dominant standing. If adoption of altcoins gains momentum, bitcoin's market share and price could be impacted.

- Regulations: Regulatory developments shape the legislative framework around cryptocurrencies and sway pricing substantially. New regulations can buoy prices by instilling investor confidence and legitimacy. However, restrictive policies that limit cryptocurrency access or use cases can negatively impact valuations. The evolving regulatory landscape carries significant implications for the volatility of bitcoin and altcoin prices alike.

- Media and news: Media narratives and news developments significantly influence public sentiment around bitcoin, affecting demand and pricing. Favorable coverage generates hype and draws in new interest, uplifting bitcoin's value. Meanwhile, negative press sours public perception, depressing demand and deflating prices. Bitcoin's volatile price often aligns closely with the tone of news and media attention given.

So, to sum up, bitcoin's price shifts according to a complex interaction of multiple forces—limited supply contrasted against fluctuating demand, escalating mining expenses, alternative crypto rivalry, an evolving regulatory landscape, and a media narrative that sways public sentiment. The relative influence of each factor varies over time, contributing to the dynamic valuation of bitcoin across different conditions. No single driver dictates bitcoin's price, rather it emerges from the totality of supply/demand, competition, regulation, media buzz, and production costs at any moment.

What Determines Altcoins’ Prices?

In the decades since bitcoin’s inception, the crypto space has exploded to over 5,000 altcoins with diverse applications from governance to data oracles.

However, altcoin prices often move in lockstep with bitcoin, closely mirroring its price swings. This begs the question—why do altcoins follow bitcoin's lead so closely despite having distinct use cases and models?

The core reason altcoins tend to follow bitcoin's price is that altcoin valuations are predominantly benchmarked against bitcoin. Despite competition from thousands of altcoins, bitcoin still accounts for over half of total crypto market capitalization. This dominant position grants bitcoin major sway over the broader market.

Bitcoin's role as a reserve currency on major crypto exchanges also influences altcoin pricing. When bitcoin outflows increase from the largest trading platforms (meaning investors are moving their bitcoin to private wallets), it’s often seen as a bullish sign. The perception is that investors are opting for long-term holding (or "HODLing") rather than selling. This expectation of a pending bitcoin upcycle generates market-wide confidence that can lift other cryptocurrency prices.

Bitcoin is also commonly used as an intermediary for converting fiat currency to cryptocurrencies (and vice versa). Thus, when bitcoin is bullish, it can increase the fiat influx into the crypto market as a whole, potentially benefiting altcoins.

Finally, a potential bull run can create enthusiasm that spills over to the broader altcoin market. This is partly due to new or casual investors entering the market through bitcoin and then diversifying into altcoins, as well as a general increase in market liquidity and trading volume.

However, there are also instances when bitcoin's price declines while altcoins rally. Savvy investors may shift funds from bitcoin into promising altcoins showing momentum.

Likewise, if bitcoin enjoys a solo bull run, investors can pivot back to ride the wave. This dynamic reveals an interplay where money flows between bitcoin and altcoins based on their relative outlooks.

Why Is Crypto Going Up?

In early 2024, bitcoin surpassed $40K as overall crypto market capitalization hit $1.88 trillion by February. This rise occurred as anticipation built for regulatory approval of cryptocurrency exchange-traded funds, which was granted earlier that year.

The two largest cryptocurrencies, bitcoin and ether, showed impressive stability in kicking off 2024 with modest gains. This unforeseen crypto rally raises questions—what's driving the upward trajectory and how should investors respond?

The cryptocurrency market experienced a shift in sentiment from fear to neutrality and then to greed over the past month. Positive factors like inflation-fighting strategies and a falling dollar index initially boosted morale. However, looking more broadly, the recovery signs in the crypto market appear modest so far for major cryptocurrencies like bitcoin and ether. Previous tightening of fiscal policy and interest rate hikes in the U.S., along with new inflation data, have put cryptocurrency investors in a difficult position. Still, the crypto market now seems to be rallying, building momentum for a potential significant upward move.

The cryptocurrency market has faced strong headwinds, dealing with the impacts of SEC actions against Binance and overall global inflation. But easing inflation and other international developments have somewhat slowed the decline in bitcoin and cryptocurrencies like Dogecoin, BNB, and Solana.

The U.S. Federal Reserve's decision to hold interest rates steady in June, pausing its streak of rate hikes, boosted the dollar but increased volatility in U.S. treasuries, potentially spurring interest in riskier assets like cryptocurrencies. The Fed's June pause was to evaluate how its aggressive tightening affects inflation.

Currently, the global crypto market cap remains strong at $1.87 trillion. The market has shown modest upticks previously due to easing macroeconomic pressures, driving a rally in cryptocurrency prices. This was influenced by Fed interest rate policies, growing confidence in decentralized finance to avoid a recession, and substantial backing from these factors, fostering a positive 2023 outlook.

There is also anticipation that monetary policies could become more favorable towards BTC and digital currencies, potentially swaying strict regulators.

Moreover, banks' significant bond losses and liquidity crises have prompted the Fed to moderate rate hikes, a key driver of the recent crypto market uptick. The current U.S. interest rate is 5.25%.

Historically, high inflation has reduced demand for risky cryptocurrencies, as higher rates typically lower their appeal. After a tough 2022, the second half of 2023 saw cryptocurrencies start recovering from massive global uncertainties and the FTX collapse, which had severely impacted the markets.

In addition to bitcoin’s resurgence and the crypto market's strong rebound, a recent setback occurred when Binance's CEO admitted violating U.S. anti-money laundering regulations as part of a $4.3 billion settlement, one of the largest in U.S. corporate history, concluding a long-standing crypto exchange investigation.

Finally, the introduction of spot bitcoin exchange-traded funds (ETFs) have influenced cryptocurrency market prices and might have potentially broader market significance.

Below is an analysis of how bitcoin ETFs have affected the market so far, followed by expectations for the future:

How Bitcoin ETFs Affected the Market So Far:

- Increased accessibility: The approval of bitcoin ETFs has made it easier for the average investor to gain exposure to bitcoin without the complexities of managing private keys or directly purchasing and storing the cryptocurrency.

- High initial volumes: The ETFs experienced significant trading volumes in the initial days, indicating strong interest and demand from investors.

- Asset shift: There has been a notable shift of assets from other cryptocurrency investment vehicles, such as the Grayscale Bitcoin Trust (GBTC), to these newly approved ETFs, suggesting investor preference for the ETF structure.

- Asset under management growth: BlackRock's iShares Bitcoin Trust crossed over $1 billion in assets under management shortly after launch, demonstrating robust investor appetite.

- Diversification: Financial experts cited in the document suggest that bitcoin can help spread risk in an investment portfolio, potentially improving diversification and return profiles.

- Inflation hedge perception: Bitcoin is seen as a potential tool against inflation, providing a "safe-haven asset" that may preserve or even increase value over time, relative to traditional fiat currencies.

Expectations for the Future Regarding Cryptocurrency Prices:

- Market legitimization: The rise of bitcoin ETFs could legitimize cryptocurrencies further as an asset class, potentially leading to increased adoption and investment, which could support higher prices.

- Portfolio integration: As bitcoin becomes more integrated into traditional investment strategies, such as the classic 60/40 portfolio, demand could rise, influencing prices positively.

- New financial products: The ETF structure allows for the creation of new financial products, such as futures and options, which could lead to more sophisticated investment strategies involving cryptocurrencies.

- Potential risks: The document notes that investors should be aware of changing characteristics, including correlation with other assets and the potential for increased volatility, which could impact prices.

- Impact of management fees: While the management fees for ETFs are considered small relative to bitcoin's volatility, they could influence investor returns and long-term holding decisions.

- Evolution of bitcoin's characteristics: As bitcoin matures as an asset class, its characteristics could evolve, impacting its role in diversification, store-of-value, and correlation with other assets, which all have implications for prices.

- Wider financial system influence: Over the next five to ten years, crypto ETFs are expected to become a significant part of investment portfolios, which could increase bitcoin's influence and potentially stabilize its price.

The launch of bitcoin ETFs has generated more interest, liquidity, and opportunities for diversification among investors. While early signs have been positive, the future relationship between cryptocurrency prices and ETFs remains uncertain. It will depend on variables like adoption, regulations, market sentiment, and the asset class evolution of bitcoin and other cryptocurrencies. Investors should remember that crypto markets are highly volatile. Therefore, exposure should align with an investor's individual risk appetite and objectives. Overall, bitcoin ETFs have increased accessibility but cryptocurrencies are still risky assets with unpredictable price movements.

Conclusion

The pricing of cryptocurrencies is a complex interplay of many factors, with bitcoin as the dominant market leader. Bitcoin's own price is determined by the balance of its limited supply and fluctuating demand, the real costs of mining, competition from altcoins, evolving regulations, and prevailing narratives. These dynamics directly impact bitcoin's value and set the tone for the broader crypto market.

For altcoins, despite their unique use cases, their prices often correlate with bitcoin's movements given its massive presence. Bitcoin serves as a valuation benchmark, reserve asset, and fiat on-ramp, so its price signals influence investor sentiment, liquidity, and altcoin prices.

However, altcoins can detach from bitcoin's trajectory when presenting compelling utility or shifting market favor, demonstrating the intricate and fluid nature of the crypto ecosystem. Here, investor behavior, technological progress, and macro conditions all play roles.

In summary, cryptocurrency pricing is a nuanced web with bitcoin at the center. Yet each distinct component—be it an altcoin, regulation, or news—can uniquely alter the whole fabric in complex and unpredictable ways.

For those interested in trading cryptocurrencies like bitcoin and altcoins to profit from price volatility, Bitsgap offers an aggregated crypto trading platform connecting 15+ exchanges to enable easy manual arbitrage. Plus, you get awesome features like automation tools, killer charts and analytics, and more. The best part is you can test drive Bitsgap free for 7 days.

FAQs

What Are Cryptocoin Values?

Cryptocoin values, or cryptocurrency valuations, reflect their current market prices as dictated by supply and demand forces. Similar to fiat currencies or commodities, a coin's value represents the equilibrium point between what buyers are willing to pay and sellers will accept at any moment. Cryptocurrency prices are highly dynamic as they respond to influences like market sentiment, technological innovations, regulatory actions, and shifts in the coin's utility or adoption. The complex interplay of these factors means the value of a cryptocurrency is constantly adjusting based on the balance of market conditions.

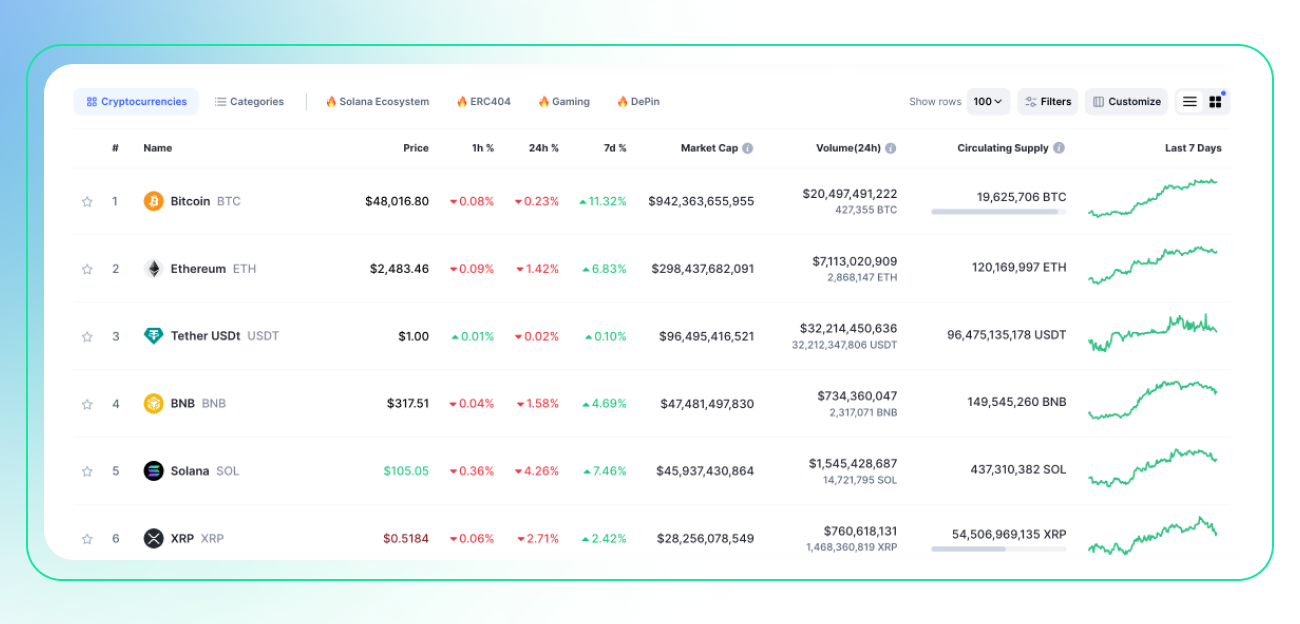

A cryptocurrency's value can also be measured through its market capitalization. This metric is calculated by taking the current market price and multiplying it by the total circulating supply of coins. Market capitalization indicates the overall valuation of a cryptocurrency in dollar terms, allowing for comparison between different cryptocurrencies based on their relative market size and dominance. It provides a snapshot of a coin's aggregate worth on the open market at any given time.

What Are Cryptocurrencies Quotes, and Where Could You Look Them Up?

Cryptocurrency quotes refer to the latest prices at which coins can be bought or sold, typically presented in currency pairs. These pairs show the amount of fiat currency (like USD) needed to purchase one unit of the cryptocurrency, or vice versa.

Quotes can be found on:

- Cryptocurrency exchanges like Coinbase and Binance, which display real-time trade prices and order book data.

- Financial news websites like CoinDesk and CoinTelegraph, offering market quotes and analysis.

- Aggregators like CoinMarketCap that compile prices across exchanges into average quotes, alongside data on market capitalization and trading volumes.

- Mobile apps dedicated to tracking crypto prices in real-time, some with extra features like portfolios and price alerts.

When checking quotes, note that prices can vary slightly across exchanges due to differences in liquidity and volumes. The quotes provide up-to-date snapshots of the market rate at which cryptocurrencies can be exchanged.