Is the Poloniex Exchange Still a Good Option in 2024?

Dive into the intriguing world of Poloniex, a cryptocurrency exchange that's been through it all: highs, lows, innovations, and controversies. Uncover the compelling story behind this platform, its security measures, KYC policies, fees, and diverse trading options in our comprehensive review.

Whether you're an experienced trader or just starting out, our unbiased review is here to help you decide if Poloniex is the ideal exchange for your crypto trading!

Let's take a closer look at Poloniex, the cryptocurrency exchange that, on the surface, appears to be the perfect match for almost any investor. With its enticing low trading fees and an impressive roster of over 400 cryptocurrencies, it's no wonder this platform catches the eye. Throw in the mix margin trading and cryptocurrency lending, and you might think you've hit the jackpot.

But … Poloniex comes with its fair share of controversies. Intrigued? We thought you might be.

We're here to dissect, analyze, and give you the lowdown on this exchange. Dive right in!

Poloniex History

In the frosty January of 2014, Tristan D’Agosta launched Poloniex in Wilmington, Delaware, and it quickly rose to be one of the larger American cryptocurrency trading platforms. However, a mere two months after its inauguration, Poloniex fell victim to a hack, losing 12.3 percent of its customer's bitcoin holdings. To spread the loss evenly amongst its users, Poloniex's CEO D’Agosta decided to decrease the balance of all users on the exchange by 12.3%. He also pledged that the exchange would keep awarding its users with bonuses to help recoup their losses, and vowed to bolster security measures. One could argue that it was a day late and a dollar short, right?

Fast forward to January 2018, Poloniex found itself amidst another controversy when customers began reporting discrepancies in their account balances. The cause? A glitch which failed to refund customers when they cancelled an incomplete order. The ensuing panic was no small matter, but the issue was soon rectified and all affected customers were fully refunded.

Poloniex's journey took a dramatic turn when it was acquired by Circle, a digital assets and financial service company, in 2018. Post-acquisition, the exchange began showing signs of improvement and started to attract more customers. Both user interface and security saw a significant upgrade, and by late September 2018, Poloniex was the 35th largest cryptocurrency trading platform worldwide by volume. However, as the competition stiffened, Poloniex's market share dwindled and by 2019, it had slipped to the 75th position.

In 2019, after obtaining a Digital Assets Business Act license from Bermuda, Circle announced that Poloniex would shift the business and operations supporting non-U.S. residents to an office in Bermuda. This move came with the promise of expanding the list of tradable instruments for non-U.S. persons. However, in October 2019, Circle announced it was spinning off Poloniex to an Asia-backed investment group called Polo Digital Assets. Despite initial denials, Tron's founder Justin Sun later admitted his involvement.

Poloniex experienced another setback when it halted trading for U.S. residents at the outset of November 2019. Adding to the pile of controversies, an altcoin traded on Poloniex, CLAM, underwent a drastic price collapse in 2019, leading to a massive loss for Bitcoin margin lenders. Poloniex's solution? Borrowing approximately 1,800 BTC from active BTC margin loans, a move that sparked outrage amongst its customers, particularly because a year after the crash, some affected customers had yet to be repaid.

In March 2020, Poloniex stirred the pot once more when it teamed up with Huobi and Binance to reverse a soft fork on Steemit by leveraging their collective voting power from STEEM tokens held by the exchanges. This move resulted in a heated dispute and led to Steemit asserting extraordinary rights to control the STEEM blockchain.

By June 2020, Poloniex, along with Bittrex, was named in a class-action lawsuit filed against Bitfinex and Tether. The suit alleged that these parties had participated in a sophisticated scheme to defraud investors, manipulate markets, and conceal illicit proceeds.

As you can see, Poloniex's journey has been punctuated by a few hiccups, some poor customer reviews, and more than a few controversies. Yet, some users remain loyal to the platform. Maybe give it a whirl and see if it fits your needs. But remember, it's always wise not to put all your eggs in one basket.

Poloniex Trading Volume

Since relocating to Seychelles, Poloniex has seen an uptick in trading volume. The exchange has worked diligently to restore its users' trust, a factor that has played a significant role in demonstrating the deep liquidity available for its listed digital assets.

Thanks to a more relaxed regulatory environment, Poloniex has become increasingly popular among global traders seeking to avoid lengthy and complex Know Your Customer (KYC) processes.

As per CoinGecko, Poloniex boasts an average daily trading volume surpassing $139 million (and a normalized volume of $63 million), securing it a respectable 63rd position among cryptocurrency exchanges. The most actively traded pair on Poloniex is BTC/USDT, with a 24-hour volume of $34 million. Compared to other cryptocurrency exchanges, Poloniex's liquidity might seem insufficient for the so-called "crypto whales" who are interested in sizeable trades. Therefore, before deploying trading bots on Poloniex, ensure that the exchange provides ample liquidity for smooth bot operations on your selected trading pairs.

Poloniex Trading Pairs

With a whopping 400+ cryptocurrencies on offer, Poloniex boasts one of the most extensive portfolios among the big-league exchanges. And if you're feeling a little daring, why not dip into some of the more volatile currencies? Baby Dogecoin, Dogelon, and Dogs of Elon are all on the menu. Poloniex also offers a tantalizing cocktail of well-backed utility tokens and the more obscure currencies, ensuring there's something for everyone. And let's not forget Poloniex's cozy relationship with Tron (TRX) currency. Hold and use Tron, and you might just find yourself enjoying some lovely discounted fees.

If you're considering funding a Poloniex account with traditional money, you can kick things off with Poloniex's straightforward cryptocurrency exchange platform, Simplex. This user-friendly system enables you to effortlessly trade currency using a bank account, debit card, or credit card. However, keep in mind that if you transact using a debit or credit card, you will incur a 3.5% fee ($10 minimum) that goes to the card processor. Additionally, you may have to shoulder an extra spread fee.

Poloniex Tradable Products

Alongside your standard spot trading, Poloniex has a veritable smorgasbord of other services. These include margin trading, a cross-margin mode with 3x leverage, futures trading with a leverage of up to 100x, AI strategy trading, staking, lending, an NFT marketplace, and token sales via LaunchBase.

Speaking of lending, Poloniex has a brilliant scheme where you can play the benevolent lender by renting out your crypto assets (a whopping 39!) to other users. Not only do you give a helping hand, but you also get a nice little interest on top of your lending. You get to call the shots on rates, durations, and other loan terms.

Then there's Poloniex's LaunchBase, also known as the IEO section. This little gem enables traders to get a head start on new projects, allowing you to invest in Initial Exchange Offerings (IEOs) before they hit the big time in the crypto space.

So, whether you're an active trader or a passive investor, Poloniex seems to have something to cater to everyone's taste!

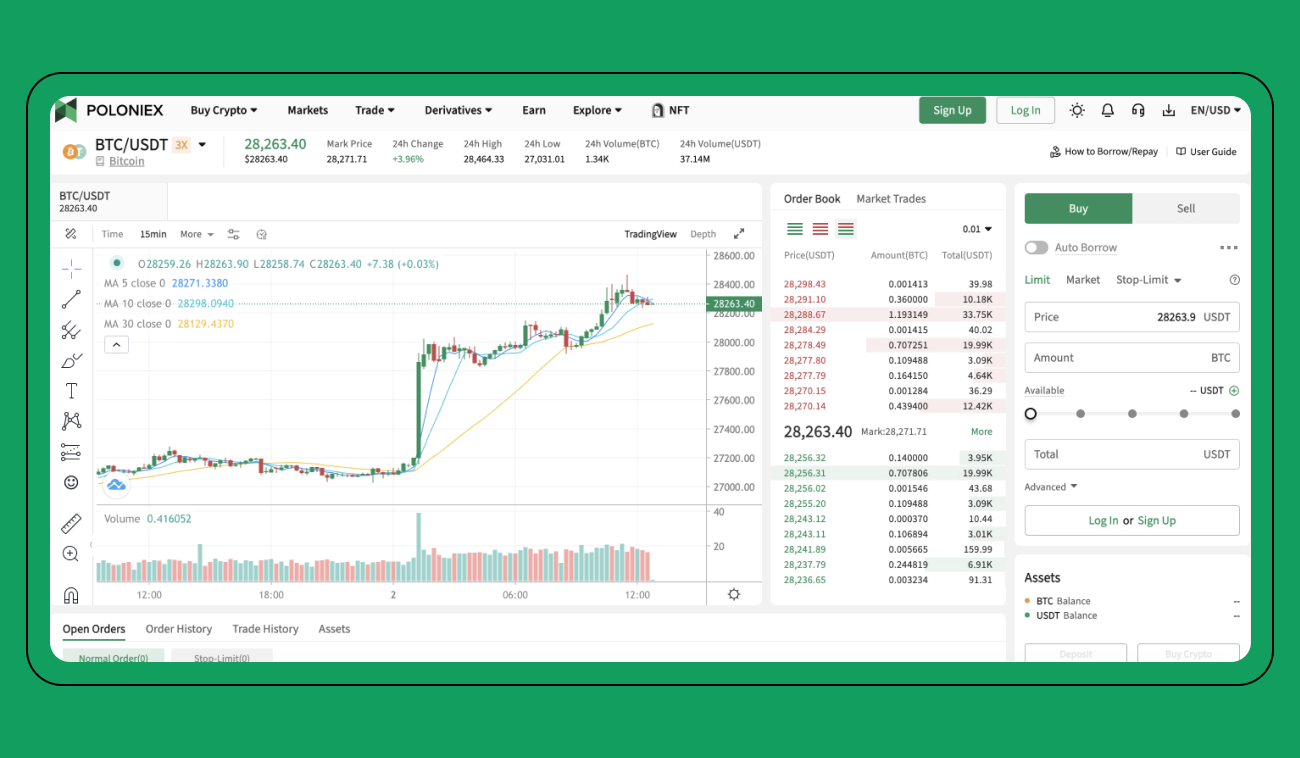

Poloniex Trading Interface

Poloniex's trading platform comes packed with an array of features. Picture an interactive chart, bristling with a cornucopia of indicators, the open order book, a record of recent trades, your active orders, and a straightforward trading form. For those seasoned sailors with experience in cryptocurrency, charting a course through the Poloniex trading platform will feel like a walk in the park.

Poloniex keeps things neat and tidy with their order types, offering just Market, Limit, Stop Limit, and Stop Market. You won't find any of those highfalutin order types here. But don’t let that deter you. If you're itching to add a touch of sophistication to your orders, Poloniex plays nicely with advanced trading platforms like Bitsgap. Simply connect Poloniex via APIs to Bitsgap and jazz up your orders with trailing and hedging features to your heart's content.

But Poloniex isn't just about web trading. The Poloniex mobile app, a nifty little gem with high praise on both the App Store and Google Play, is like having a personal trading deck in your pocket. The app mirrors most of the features from the web platform, making it your go-to crypto companion.

Poloniex Trading Fees

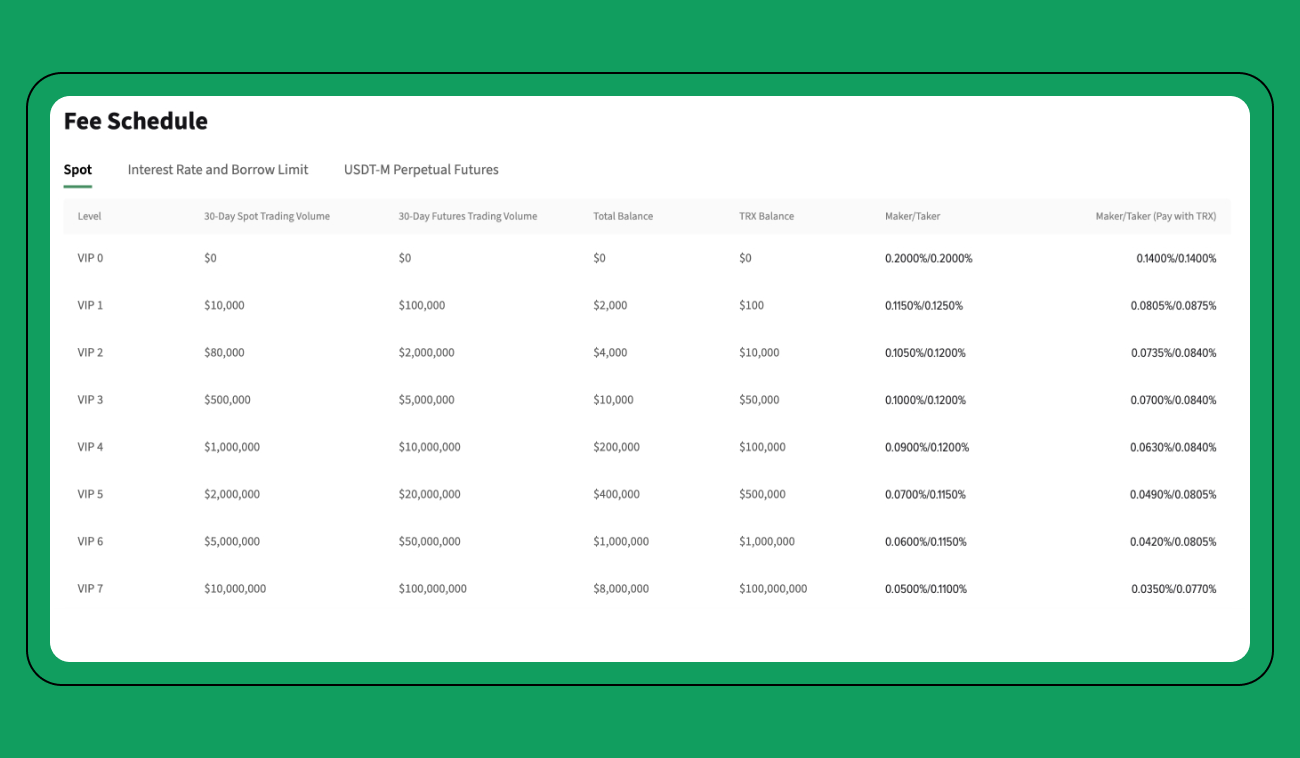

The trading fees at Poloniex are a breath of fresh air in the crypto landscape, and should definitely be on your radar while investing in cryptocurrency:

- Spot: The journey begins at 0.2% for novices, gradually decreasing as your monthly trading volume escalates.

- Futures: For both Market Makers and Takers, the fees are set at 0.0150% and 0.0500%, respectively.

- Deposit: Cryptocurrency deposits come free of charge. However, for fiat deposits, Simplex (a third-party provider) imposes a 3.5% fee, and Poloniex adds on an extra 0.75% fee.

- Withdrawal: Every withdrawal carries a nominal fee intended to offset the cost of gas.

As depicted in the above image (Pic. 2), Poloniex offers you the golden ticket to reduced fee tiers. Here's how you can grab this opportunity:

- Keep a healthy stash of TRON (worth $100 or more),

- Trade more than $10,000 in volume over a 30-day period.

Moreover, opting for TRON as your go-to payment method can unlock further significant discounts.

KYC on Poloniex

Poloniex offers a flexible approach to KYC with optional verification, split into two tiers. Each tier comes with its own requirements and perks, including different withdrawal and trading limits.

Level 1 requires just an email address and password, which, once verified, grants you unlimited trading and deposits, plus a daily withdrawal limit of $10,000. You can even dabble in lending! However, you won't have access to margin trading or Poloniex's Launchbase products at this level. And a word of caution — if you forget your login details, account recovery might be a bit tricky.

Upgrading to Level 2 unlocks the full suite of Poloniex's trading products and services, but this comes with a daily withdrawal ceiling of $500,000. For this level, you'll need to provide:

- A government-issued ID, driver's license, or another valid document

- Your residential address

- Proof of address

- A valid phone number

- Date of birth

- A selfie

For those looking for an even more enhanced experience, there's the option to apply for VIP status or a Poloniex Plus account. These provide additional benefits and higher limits.

Poloniex Jurisdiction

Poloniex's reach extends to most corners of the globe, but there are a few exceptions. At the time of writing, the following countries unfortunately cannot avail of Poloniex's services:

Afghanistan, Burma, Mainland China, Crimea, Cuba, Democratic Republic of Congo, Iran, Iraq, Ivory Coast, Lebanon, Libya, Mali, North Korea, Palestine, Somalia, Sudan, Syrian Arab Republic, Yemen, Zimbabwe, the United States (and all US Territories).

Automated Trading on Poloniex

Poloniex now serves up a trio of tantalizing automated trading options: GRID, copy, and AI-based automated trading. Yet, the excitement doesn't stop there! You can further supercharge your trading experience by integrating advanced platforms like Bitsgap with Poloniex via APIs.

Bitsgap's automated trading is truly top-tier, offering an unrivaled service that's tough to beat. Are you a trader who'd rather kick back and let trading bots do the heavy lifting? Then you're in luck! Bitsgap is bridging the gap with its stellar services that go beyond just algorithmic trading, to include portfolio management, a demo trading mode, and a plethora of other handy features.

For Poloniex users, Bitsgap rolls out advanced order features and automated trading bots for the spot market like GRID, DCA, and BTD. You’re welcome to try them now and see for yourself!

And here's the kicker: Bitsgap offers a 7-day free trial! It's the perfect opportunity for newcomers to get a taste of its premium service.

How to connect a Poloniex Account to Bitsgap Trading Bots?

In this section, we'll walk you through the steps to create, set up, and link your Poloniex API key to the Bitsgap platform.

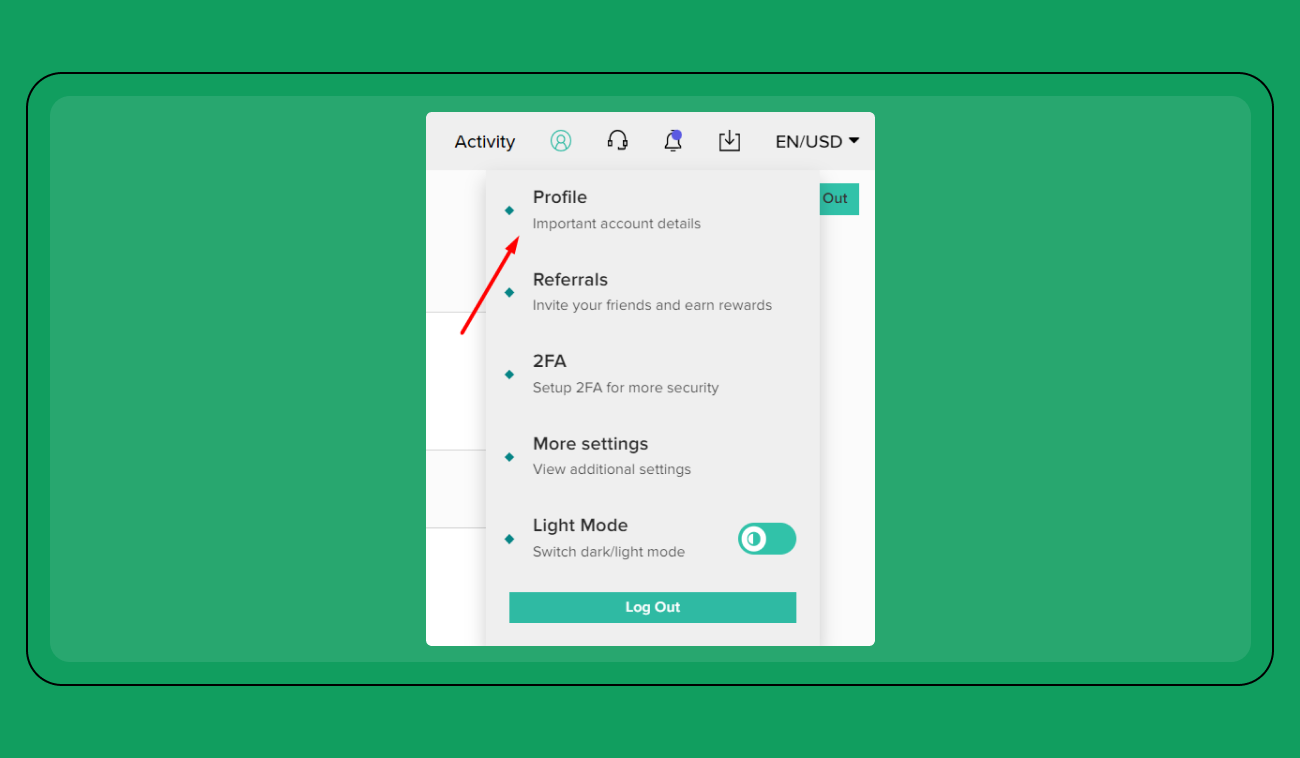

- Log in to your existing Poloniex account or set up a new one.

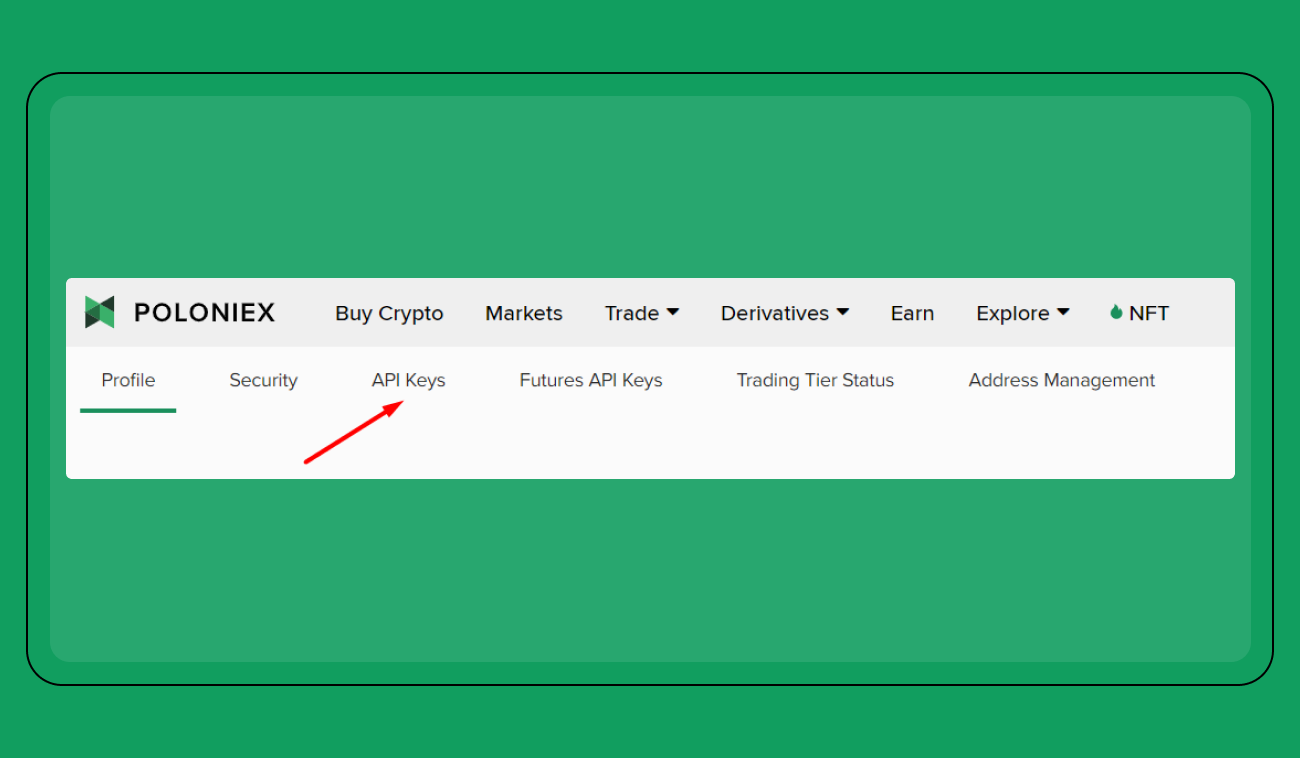

- Find your profile icon on the top bar and make your way to the [Profile] page.

- Click on the [API keys] tab at the top.

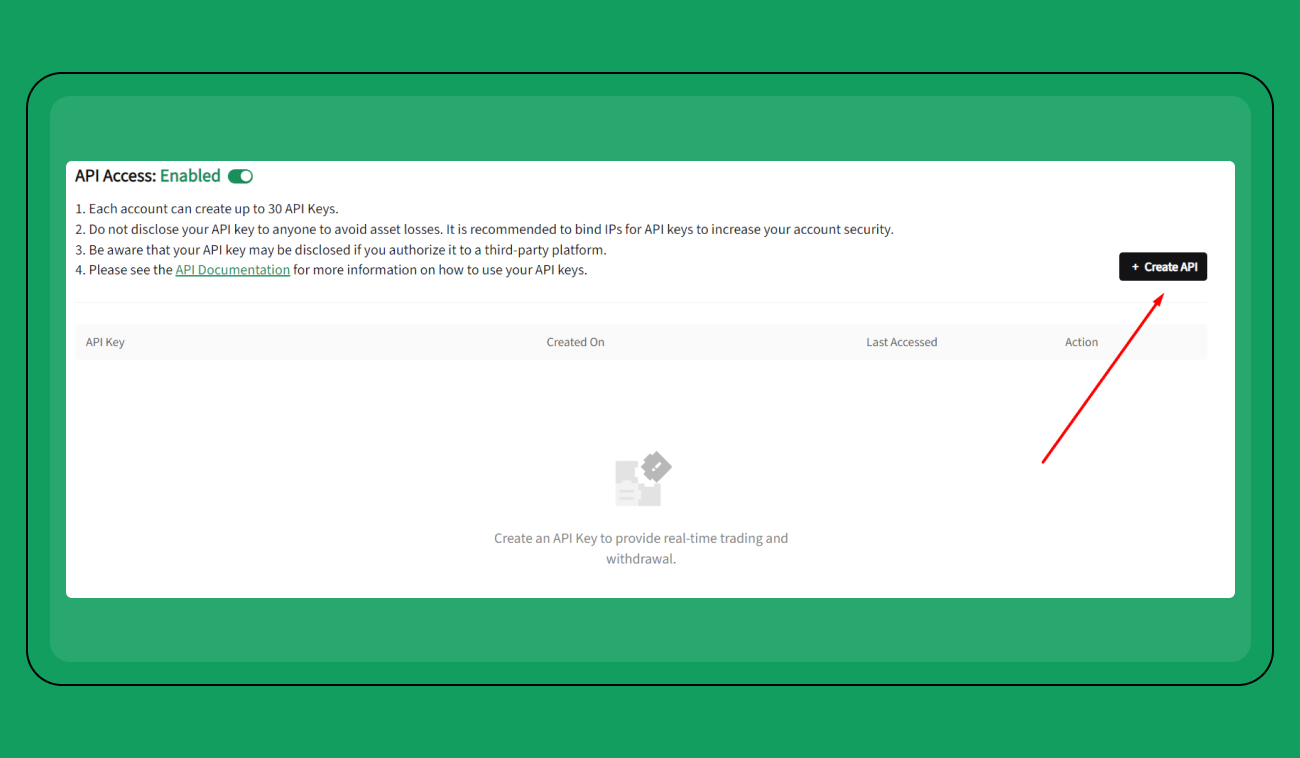

- Click the [Create API] button to whip up a new API key.

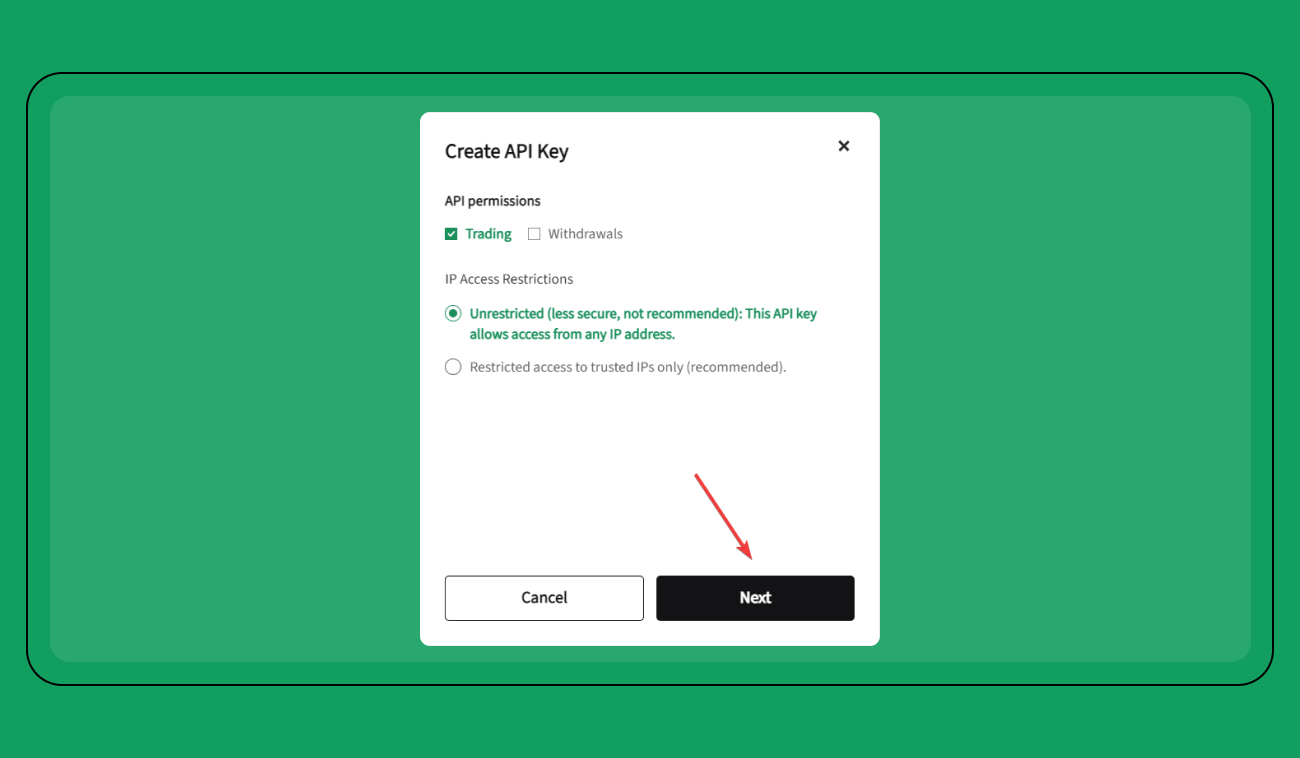

- Modify your permissions as shown in the Pic. 6. These will allow us to read your history, current balance, and execute trades on your exchange account.

Here are the necessary permissions: - Trading - on.

- Withdrawals - off.

- IP Access Restrictions - Unrestricted.

- Once you've set these, hit [Next].

- You'll receive a code via email from Poloniex. Enter it into the security verification window and press [Submit].

- You've successfully created your Poloniex trading key! Make sure to safely record your API key and Secret key before adding it to Bitsgap.

- Log into your Bitsgap account, go to the [My Exchanges] page, and click [Add new exchange].

- In the pop-up window, select ‘Poloniex’. A new window will appear where you can enter your API key and Secret key. After entering these, click [Connect].

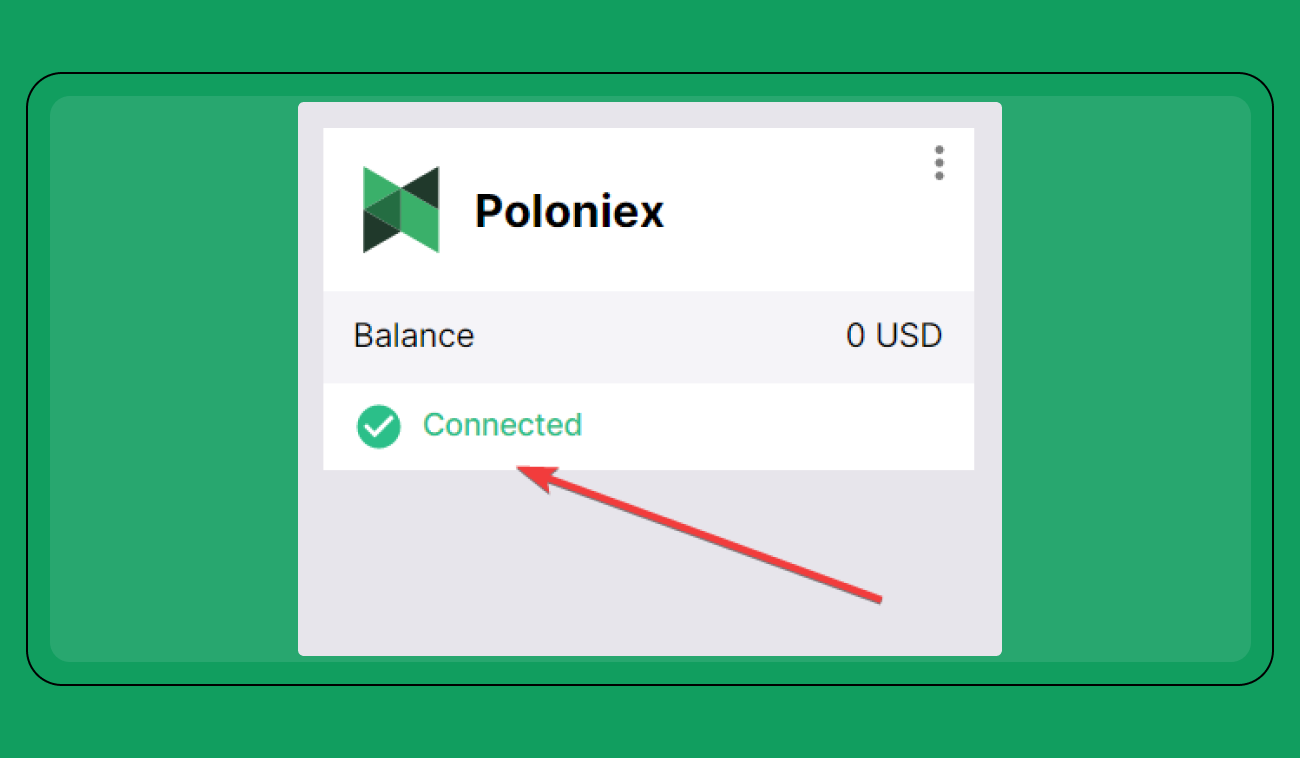

- If you've followed the steps correctly, Poloniex will appear in your list of connected exchanges, marked as ‘Connected’, and showing the trading balance available on your account.

Happy trading!

Ready to connect your Poloniex exchange to Bitsgap? Do so now!

Bottom Line

Poloniex boasts a broad spectrum of cryptocurrencies and affordable fees, including a selection of emerging and lesser-known coins. However, the platform has had some regulatory and security hiccups and it's not accessible in certain regions. Although Poloniex is based in Boston, Massachusetts, U.S., its services are not available to U.S. users. So, if you’re in the US, consider Coinbase, Gemini, or Kraken.

FAQs

What Is Poloniex API Trading?

API trading on Poloniex involves the employment of software that interfaces directly with Poloniex's system to carry out automated trading operations. By leveraging the Poloniex API, traders have the ability to craft bespoke trading algorithms and bots. These tools can perform trades autonomously, adhering to pre-set strategies and regulations.

Is Poloniex Good for Bot Trading?

Poloniex, as a cryptocurrency exchange, has a somewhat restricted range of built-in solutions for automated trading. That being said, it's still possible to incorporate trading bots within Poloniex. You can either code your own trading bot or leverage third-party modular trading bots such as Bitsgap, which are designed to seamlessly integrate with Poloniex.

Is Poloniex Safe?

Poloniex has faced security issues in its history, with the platform being hacked multiple times. This has led to concerns about the safety of user funds. However, Poloniex does take measures to secure user funds. The exchange maintains a 95% cold storage ratio, keeping the majority of assets offline and inaccessible to potential hackers. They also offer security features like address whitelisting, two-factor authentication, and bug bounty programs.