How OnlyFake’s AI IDs Help Bypass Crypto Security Checks

As the OnlyFakes AI Generator blurs lines between fact and forgery, the crypto community stands on high alert. Discover how this tool is outsmarting security checks, the risks it poses, and why your role in maintaining vigilant authenticity is more critical than ever.

The advent of sophisticated technology has brought with it a host of cybersecurity challenges, one of the most alarming being the proliferation of fake identification documents. In a concerning development, an underground website known as OnlyFake has recently gained notoriety for its claims of employing cutting-edge "neural networks" to create highly convincing fake IDs. This unsettling trend poses significant threats to the integrity of cybersecurity measures and identity verification processes. The instantaneous production of these fake IDs by OnlyFake could serve as a gateway to a host of criminal activities, including bank fraud and money laundering.

In this article, we will delve into the murky world of fake IDs, dissect the operations of OnlyFake, discuss the legal implications of fabricating and using such documents, and elaborate on the importance of Know Your Customer (KYC).

What Is a Fake Digital ID?

A fake digital ID is an illegitimate or counterfeit version of an electronic identification document that has been altered, created, or obtained through false pretenses. Digital IDs typically serve as the electronic equivalent of personal identification documents such as driver's licenses, passports, or national identity cards. They are used to verify an individual's identity and facilitate transactions and interactions that require proof of identity.

These counterfeit IDs can be used for a variety of illegal purposes, such as:

- Identity Theft: Assuming another person's identity to carry out fraudulent activities.

- Age Misrepresentation: Underage individuals attempting to bypass age restrictions for purchasing alcohol, tobacco, or accessing age-restricted websites.

- Financial Fraud: Applying for loans, opening bank accounts, or conducting financial transactions under a false identity.

- Accessing Restricted Services: Gaining unauthorized access to services or locations that require proof of identity.

👉 The creation, distribution, and use of fake digital IDs are illegal activities that are punishable by law. They undermine trust in digital transactions, pose security risks, and have far-reaching consequences for both individuals and organizations. It is essential to protect personal identification information and be vigilant against the threats posed by fake digital IDs.

What Is Onlyfakes AI Generator?

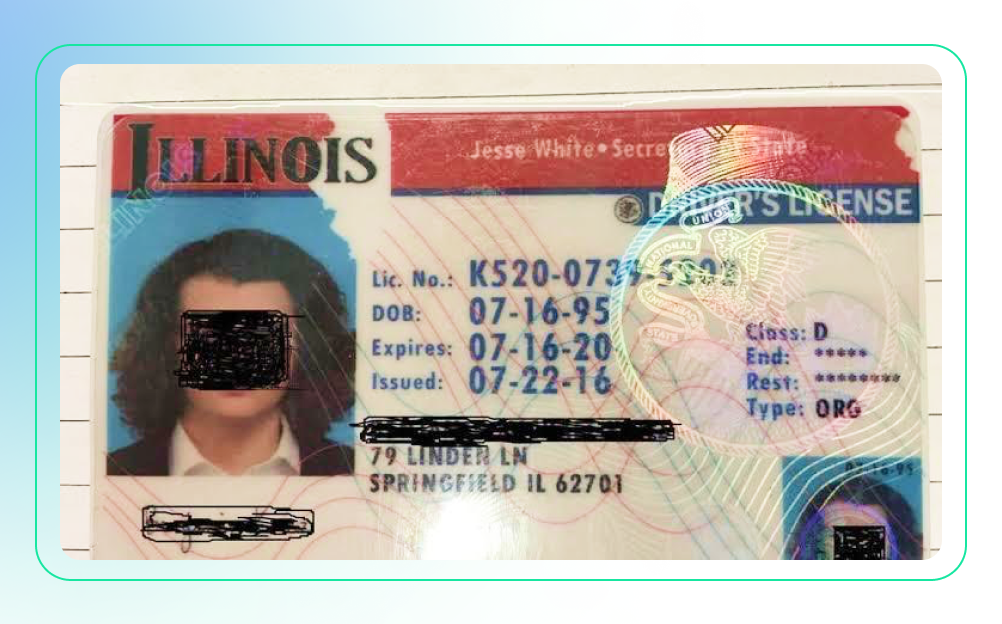

OnlyFake is exploiting AI to create deceptively real fake IDs with minimal effort. For just $15, users can rapidly generate convincing counterfeit documents that could bypass traditional verification checks.

OnlyFake boasts the ability to quickly produce realistic licenses and passports from over two dozen countries using "neural networks." Users simply input their details and select a document type to initiate an automated process involving signature and texture generation.

Within minutes, ultra-realistic fakes are delivered that replicate intricate security features like barcodes, holograms, and background patterns used to validate authenticity. The level of detail surpasses what's achievable manually, while the anonymity and automation drastically lowers barriers to obtaining high-quality counterfeits.

👉 By leveraging AI to manufacture incredibly convincing fake credentials with unprecedented scale and efficiency, OnlyFake poses major threats to security and identity verification systems. This demonstrates how AI's generative power, when misused, can spread disinformation and erode trust.

Threats and Ramifications of Fake IDs

The implications of OnlyFake's counterfeits extend beyond KYC hurdles. These deceptive credentials also enable more insidious fraud targeting platforms and users. Tactics include impersonating high-value accounts, deceiving customer service agents, and hijacking logins by changing associated credentials.

Fraudsters can compromise pivotal services like social media, banking, and crypto exchanges linked to wealthy victims. By overriding security measures like 2FA phone verification, huge financial damages can follow. For example, an exploit of this kind recently hijacked crypto influencer V God's Twitter account.

OnlyFake represents a major cybersecurity threat given its ability to effortlessly create highly convincing fake IDs. This effectively lowers the barriers for identity fraud, enabling even novices to rapidly generate forged documents capable of bypassing verification systems.

The implications are alarming, as OnlyFake counterfeits have already fooled checks on major platforms like the OKX cryptocurrency exchange. Its fakes surmount obstacles that previously hindered identity deception, granting this power to anyone willing to pay trivially low fees.

The proliferation of these tools to generate or create fake IDs not only jeopardizes the security protocols of businesses but also threatens the broader spectrum of sectors that depend on identity verification, including financial services. This technology paves the way for a surge in illicit activities, from bank fraud and money laundering to various identity theft crimes, directly challenging the reliability of online verification infrastructures.

Importance of KYC

As a user of financial services, especially when trading or investing on exchanges, you may sometimes be asked to complete KYC, which stands for "Know Your Customer." While it might feel like a bit of a hassle to submit personal documents, it's important to understand why KYC checks are not just a formality but a crucial step in ensuring your safety and the integrity of your financial transactions.

Here's why KYC is so important:

- Protecting Your Identity: KYC processes help protect your identity from being stolen or used in fraudulent activities. By verifying that you are truly the person you claim to be, exchanges can prevent fraudsters from accessing your account and funds.

- Securing Your Investments: When an exchange knows its customers, it can better safeguard your investments against illegal activities like money laundering. This creates a more secure platform where your assets are less likely to be tangled up with illicit funds.

- Compliance with Regulations: Financial regulations are designed to protect the market and its participants. By complying with KYC checks, you're helping exchanges adhere to these legal requirements, which ultimately works to maintain order and stability in the financial system.

- Personal Security: By ensuring all users are KYC verified, exchanges can trace and deter potential hackers or malicious actors, making the platform safer for you to conduct your transactions.

- Trust and Credibility: A platform that enforces KYC is one that takes its responsibility seriously. This builds trust and credibility, assuring you that the exchange is a reputable place for your financial dealings.

- Enhancing Recovery Options: Should you ever lose access to your account or forget your credentials, having completed KYC can make the recovery process more straightforward since you've already established your identity with the exchange.

- Limiting Fraud and Financial Crime: By deterring scammers and reducing financial crime, KYC checks help create a cleaner ecosystem that benefits all legitimate users and investors.

What Documents Might You Need?

Typically, KYC verification involves submitting documents like a government-issued ID (passport, driver's license, or national ID), proof of address (utility bill, bank statement), and sometimes a live picture or video to confirm your identity matches your documentation.

👉 Remember, by completing KYC checks, you're playing an important role in creating a safer, more reliable crypto environment. Think of it as a small step for you, but a giant leap for the security and integrity of the entire financial ecosystem. So, when you're asked to provide your documents, understand that this is a measure designed with your best interests in mind, keeping your assets and identity well-protected.

Does Bitsgap Require a KYC?

No, Bitsgap does not require you to go through a separate KYC process. The reason is simple: you've already completed the necessary document submission when setting up your accounts at the exchanges. After your accounts are verified with those exchanges, you link them to Bitsgap, eliminating the need for redundant document requests. You've taken care of that part. In reality, using Bitsgap is among the most secure trading methods since we don't store any information regarding your identity or assets. All of that is managed by your exchange. Our role is to enhance your trading experience by offering advanced tools and automated features that help you make the most of the exchange markets. Rest assured, we have additional security protocols in place to keep you even more protected. By the way, signing up is free and you’re welcome to try:

Conclusion

AI-generated IDs being used to sneak past exchange security shows how digital threats are always adapting. It's a cat and mouse game to stay ahead of new hacking tactics. Crypto exchanges will need to keep stepping up their verification tech. But we can all do our part too — submit real docs, follow the rules, stick to reputable services, and well, not create fake IDs. Remember the golden rule: be an upstanding person, not a sneaky mouse. Working together, we can outsmart these evolving scams.