Win on Downtrend With Updated Bitsgap’s Trailing Down

The new version of Bitsgap's Trailing Down offers you improved mechanics, detailed representation on a chart, and a higher chance to profit in the downtrend markets.

Bitsgapians, we have news for you! You asked — we’ve delivered. Trailing Down is back. How does it work, and how can you take advantage?

For the past few months, we’ve put extra effort into catching up with your demand to develop, return, or update Bitsgap’s functionality. Trailing Down (TD), in particular, was among the features many continuously asked to put back in the terminal.

When TD was first introduced, some traders complained it tapped into their pockets a little too much, so we took it down. Others, on the contrary, wanted the feature back because TD allowed them to profit from a falling market.

So, what did we do?

We set to work on fixing, testing, and upgrading the feature to bring it back to you. TD has been honing for the last couple of weeks in the Early Access mode and is now available for all users. So, how does the newly released TD work, and how can you benefit from it?

Without further ado, let’s dive into it.

What Is Trailing Down?

Trailing Down (TD) is a GRID bot feature that allows you to extend your bot’s grid below the initial setup and continue to trade even if the price falls beyond the grid’s range.

To continue trading in a falling market, the bot with an enabled TD will execute market buy orders in the quote currency and place new sell orders below the lower price border, thereby extending the grid with more sell orders.

The bot will continue to place new orders until it reaches the Stop Trailing Down price, which you add in the bot’s settings, or until there’s not enough quote currency to execute new trades.

How Trailing Down Works

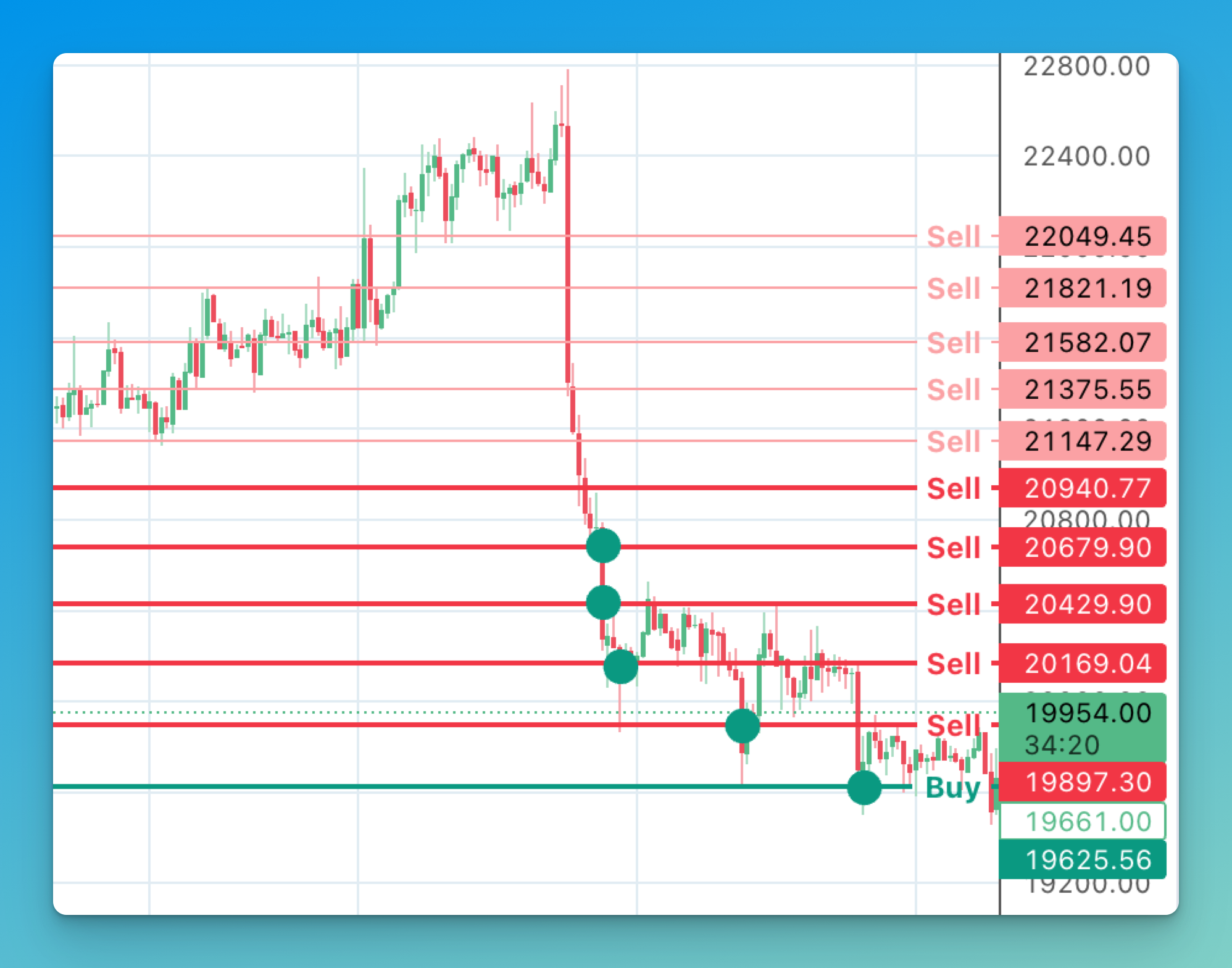

Suppose you’re trading with a GRID bot, the market moved downwards, and the price fell below the price limit of your initial grid (Pic. 1).

The bot will have to expand the grid with new sell orders to continue trading. To create those new sell orders, the bot must buy a new base currency first. So, with an enabled TD, the bot will execute a market buy order in the quote currency which it will take from the available balance.

After it buys the currency, the bot places a new sell order below the bottom of the grid, setting up a new, lower price level and extending the grid by one extra order.

Every time the price drops one level, the bot repeats the same actions — executes another market order and places a new sell order one step down — until the price reaches the Stop Trailing Down or there’s not enough quote currency (Pic. 2).

How the New TD Is Different From the Old TD

Here are a few key changes to the new Trailing Down that will allow you to uncover the full downtrend trading potential on any exchange, for example, Binance or OKX:

- The new TD expands the grid using a new investment rather than just moving the grid down. This allows the bot to keep the top sell orders at the correct price to achieve a profitable trade.

- The bot will create a Super Sell order if you reach your exchange’s maximum open orders limit. Some sell orders will get canceled and placed into one large order using the weighted average price. There may be several such orders.

- Unlike the previous version, the new TD will go down to the set limit that you specify in percentage points in the settings. Unfortunately, the calculation for the required funds is still a work in progress, but you can calculate them manually (see below).

To calculate the additional investment required before the bot reaches Stop Trailing Down, follow these steps:

- Identify the grid line investment value = (Your Initial Investment)/(Grid Levels).

- Estimate the number of additional grid lines (Number of TD grid lines) for trailing down before it reaches Stop Trailing Down set in percentage

For example, with a grid step of 0.75% and TD of 20%, there are 26 more additional levels) = (TD,%)/(Current grid step,%). - Calculate the required amount of additional funds = (Grid Line Investment Value)*(Number of TD grid lines).

Benefits of Using Trailing Down

So, why would you use Trailing Down?

- TD allows you to continue trading even if the market price drops below the initial grid.

- You can still profit from price fluctuations in the falling market.

- You can stack the base currency, and if its price spikes up later, you can sell it at a much higher price, dramatically increasing your profits.

How to Activate Trailing Down on Bitsgap

You can enable Trailing Down for new and active GRID bots. If you want to start the new bot, follow these steps:

- Click on the “Start New Bot” → “GRID” → “Custom” (or Sbot in the older interface).

- In the settings on the top right, toggle on “Trailing Down” (see the picture below).

- Enter the “Stop Trailing Down” price or drag it on the chart.

If you want to modify a running bot, follow these steps:

- Select the bot to modify.

- Click “Modify” on the top right.

- Toggle on Trailing Down.

- Enter the Stop Trailing Down price.

- Click “Confirm.”

You can enable or disable Pump/Dump protection for both new and active bots. To learn more about the switcher, click here.

For more information on Trailing Down, please visit our Help Center.

We hope you enjoyed the article and are as excited as we are about this newly updated cool Trailing Down feature!