Your Forking Amazing Guide to Crypto Hard Forks

Crypto hard forks are like high-stakes Jenga, reshaping fortunes with every move. Unravel the thrilling chaos and its impact on your investments.

Crypto hard forks are radical blockchain upgrades that redefine the crypto space by reshaping networks, creating entirely new offshoot coins, and often dividing communities in the process. Learn how to navigate and benefit from this seismic landscape.

A number of contentious hard forks have shaken crypto over the years. In 2016 and 2017 alone, both the Ethereum and Bitcoin universes were forever altered as they split into two separate, parallel dimensions: Ethereum and Ethereum Classic, and Bitcoin and Bitcoin Cash. Communities may choose to embark on these daring hard fork adventures for a myriad of reasons, from boosting their network speed to reaching new heights of efficiency.

But crypto hard forks are far more than technical tweaks — they are mechanisms of blockchain revolution and evolution. They often represent deep philosophical divides over a cryptocurrency’s values, vision, and future.

If you want to master crypto, it’s crucial to understand the ins and outs of forking. This primer will help you do just that. Here, you’ll learn what exactly hard forks are, how they differ from soft forks, how they impact cryptocurrency prices and communities, and why they represent both the promise and perils of decentralized blockchain networks.

What Are Crypto Blockchain Forks?

The definition of blockchain forks is as contentious as the forks themselves. However, the community typically agrees that forks represent a split in the blockchain network as a result of a change in protocol or a divisive change of rules that can either unite or fracture a crypto community.

Most forks are fleeting, caused by the normal growing pains of reaching consensus in a decentralized network. But some forks are pivotal and permanent, used either to push a blockchain forward with a breakthrough upgrade or pull it back from the brink of disaster.

👉 For instance, in 2016, Ethereum forked to reverse the effects of a catastrophic hack, while Ethereum Classic continued on the original chain. The fork was a divisive moment that gave rise to two competing visions of the network. Bitcoin also famously forked in 2010 to fix a devastating bug that could have destroyed the young cryptocurrency.

Forks represent the messy but vital process of blockchain progress. They enable breakthrough changes to solve vulnerabilities, add new features, or remedy hacks and bugs. Yet they also destabilize, divide, and disrupt.

In short, forks are the mechanisms by which a blockchain's community chooses between forging ahead to a new future or sticking with a familiar path from the past.

What Is a Cryptocurrency Hard Fork?

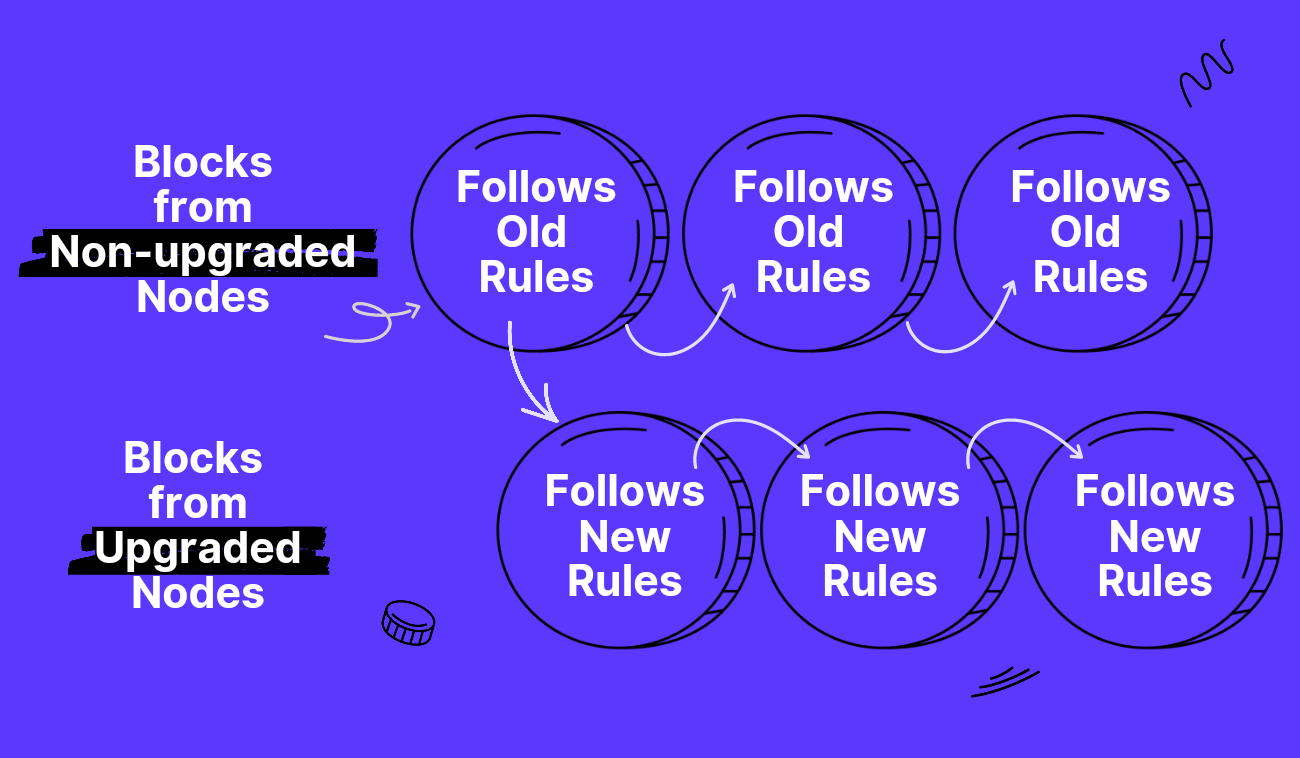

What exactly constitutes a hard fork is hotly debated. There is no universal consensus on when a software upgrade crosses the line to become a hard fork. The emergence of Bitcoin Cash from Bitcoin is a clear example of what most agree was a hard fork. Bitcoin Cash made previously invalid blocks and transactions valid, creating two separate chains with different rules — the hallmark of a hard fork (Pic. 1).

So, typically, for a fork to be considered “hard,” it has to:

- Make previously invalid blocks and transactions valid, or vice versa, effectively creating two separate chains with different rules.

- Require all nodes to upgrade to a new version of the software that is incompatible with the older version.

In contrast, updates like Bitcoin's Segregated Witness are typically considered soft forks. Soft forks introduce new rules but remain compatible with the older version of the software. Only those who upgrade to the new rules are affected, while those who don't upgrade can still interact with the upgraded chain. The network remains united rather than splintering into two.

The debate around “crypto hard fork vs soft fork” mirrors the deeper controversy over what should constitute "radical" change in a decentralized network. For some, any disruption to the status quo is too contentious. For others, hard forks enable necessary progress that introduces new features or fixes vulnerabilities.

There’s also a controversy over what constitutes a “chain split.” Nevertheless, it’s typically agreed that a chain split creates two or more competing versions of the blockchain that share history up to a split point. It’s important to note that both soft forks and hard forks can trigger chain splits, as was the case with a 2016 Bitcoin soft fork and a 2013 hard fork. What is even more confusing is that chain splits can occur without any hard or soft forks, as inconsistencies between two distinct full node software versions can lead to splits in the blockchain. In essence, splits are relatively commonplace.

How Does the Crypto Hard Fork Work?

A hard fork represents a substantial alteration to a blockchain, such as transitioning from one protocol to another. It involves major changes to a blockchain's block structure or interpretation. Historically, hard forks have led to the suspension of the previous protocol, the establishment of new rules, or the resumption of the chain. It's important to note that a hard-forked chain will deviate from the previous version, rendering the pre-forked blockchain data inaccessible.

When a cryptocurrency opts for a hard fork, the previous rules and structures become obsolete on the day of the transition. This means that everyone must update their nodes and previously mined blocks to be compatible with the new software version.

So when nodes from the latest blockchain version cease to accept previous iterations, you’re in for a hard fork. A blockchain effectively forks when someone adds a new rule to the code — one path continues along the updated blockchain, while the other remains on the original path.

To better understand how it all works, consider the functioning of blockchain technology.

Blockchain is bit more than just a distributed ledger recording transaction history, it also relies on a set of rules known as protocols to govern how the network functions. As open and decentralized systems, blockchains depend on their users to approve any changes to these protocols. Hard forks introduce radical protocol changes that create an entirely new blockchain alongside the original one. They are a mechanism for pushing through substantial upgrades or resolving disagreements over a network's direction. When a hard fork occurs, a blockchain splinters into two parallel versions that share the same history up until the fork. Users and developers must then choose which forked chain to adopt based on which path or vision they support.

Hard Fork Examples

Here are some of the most significant hard forks in cryptocurrency history:

- SegWit2x and Bitcoin Cash: In 2017, debate raged over how to scale Bitcoin. SegWit2x proposed increasing the block size, but excluded Bitcoin Core developers. In response, users campaigned for SegWit via soft fork. Fearing SegWit2x would fail, supporters forked Bitcoin to create Bitcoin Cash with 8 MB blocks. The fork highlighted hard forks' disruptive power and the values driving community divisions.

- The DAO Hack: In 2016, the DAO raised $150M in ether before being hacked for $60M. Initially, a soft fork was proposed to blacklist the hacker's funds. But the hacker threatened legal action. A hard fork then rolled back the Ethereum blockchain to recover funds, dividing the community. Supporters saw it as protecting investors; critics saw it as damaging immutability. The dissent led to Ethereum Classic.

- Hashrate Wars: Bitcoin Cash split again in 2018 over block size. Bitcoin Cash ABC wanted 32 MB blocks; Bitcoin Cash SV and Craig Wright wanted 128 MB. At block 556,767, the chain split. Mining pools battled for hashrate, threatening 51% attacks. Ultimately, Bitcoin Cash ABC emerged victorious with the majority of mining power while retaining the BCH ticker symbol on exchanges and services. Meanwhile, Bitcoin Cash SV adopted the ticker BSV and continued as a separate blockchain.

Crypto Hard Forks Many Reasons: Why Do Crypto Hard Forks Happen?

Though disruptive, hard forks enable blockchain networks to improve, evolve, and resolve internal divisions. As such, they happen for many reasons, both positive and negative:

- To add new features and functionality. Forks allow networks to expand their capabilities based on community needs.

- To fix critical security issues or reverse fraudulent transactions. Forks enable quick responses to threats and vulnerabilities.

- To resolve disagreements over a network's direction. Forks give dissenting groups an opportunity to split off and follow their own vision.

- By accident. Unintentional forks occur frequently due to software issues but are usually resolved once detected. Miners simply move on to the dominant chain.

While hard forks can temporarily reduce security, they highlight the democratic nature of blockchains. They are a mechanism for open networks to rapidly upgrade based on the diverse values of their members. As for the hard fork’s destabilizing effects, everything can be mitigated through constructive dialogue, right?

What Happens to Your Coins After a Hard Fork

Don't worry—your coins are safe after a hard fork. Here's what happens:

A hard fork copies your blockchain and transaction history up until the fork point. So if you had 400 coins, you'll have 400 coins on both the original chain and the new forked chain. Any transactions after the fork will be separate. If you send 50 coins on one chain, you'll still have 400 on the other.

To access your coins on both chains, you just need to update your wallet software. If using an exchange or online storage, they'll likely support both chains and credit your account. However, some exchanges may only support one chain or keep the coins from one chain for themselves. To ensure full control and access, use a local wallet or hardware wallet.

Exchanges often halt deposits and withdrawals during a hard fork until they upgrade their systems to properly handle both chains. This helps prevent issues for users, even if it can be an inconvenience. Once exchanges resume operations, your funds on both chains will be available.

The bottom line is that your money is not at risk due to a hard fork. While the mechanics of a fork can seem complex, the outcome for users is simple — your coins are duplicated, not deleted. As long as you take the basic steps to access both chains, your cryptocurrency holdings will be unaffected.

In for a bit of trading crypto? On Bitsgap, you can connect to as many as 15 top exchanges and trade your coins within one single interface. Talk about convenience!

Apart from a bird's eye view of what's happening across a dozen exchanges, you’ll get access to advanced trading tools, slick TradingView charts, and a whole array of super-smart trading options that will make you feel like a trading pro in no time. The best part? You can sign up today and get a free 7-day trial of Bitsgap PRO to experience what it's like to trade crypto on steroids.

Once you start using Bitsgap, mundane tasks like switching between exchanges and placing routine orders will seem boring. That's because Bitsgap automates trading so you can focus on the exciting parts — navigating the volatile crypto markets and spotting big opportunities.

While Bitsgap packs some serious tech under the hood, it's also super simple to use. The platform is perfect for newbie traders but also sophisticated enough for the pros. In short, Bitsgap is your crypto trading command center — all you need, all in one place.

Hard Fork Crypto Price Effect: How Can Hard Forks Affect a Coin’s Price

The value of coins on each chain after a hard fork depends on which chain the majority of users adopt.

If most users switch to the new forked chain, the original chain will likely lose value quickly. Without the support of miners and the community, the original chain will be slower, less secure, and accepted by fewer people. The forked chain, now dominant, will hold the greater value.

However, the original chain could also survive and retain value if enough users continue to support it. Multiple factors determine which chain prevails:

- Benefits to users: The chain that offers users the most benefits—whether technical upgrades, new features, or philosophical vision—will be most appealing. Community support will follow.

- Miner support: The chain with the most hash power, and hence greatest security, will be most attractive to users and exchanges. Miners move to the chain most profitable for them to mine.

- Exchange support: The chain accepted for trading on major exchanges will gain legitimacy and value. Exchanges list the chain they believe their users prefer and will actively trade.

- Brand recognition: The chain able to claim the network's brand benefits from built-in recognition and trust. But brand confusion can also result, undermining the value of both chains.

- Community values: Some users will support the chain that aligns closest with their priorities and values—whether technical, ideological, or financial. The rest of the community's actions then determine if their chosen chain prevails.

Crypto Fork Risks vs Crypto Fork Rewards

Hard forks have significant advantages for open blockchain networks:

- They enable rapid upgrades to fix critical issues like performance problems, security vulnerabilities, or software bugs. Hard forks allow networks to quickly pivot in response to threats or new priorities.

- They facilitate changes to a network's mining algorithm or payouts. This allows communities to shift their mining incentives and security approaches.

- They give dissenting community members an opportunity to split off and pursue their own vision. This expands choice and allows competing ideas to develop independently.

However, hard forks also introduce risks and downsides:

- They can leave networks temporarily vulnerable to attacks as hackers try to exploit the disruption. For example, a network may be at risk of 51% attacks or replay assaults following a hard fork.

- The original blockchain may continue to exist even after a hard fork, creating brand confusion and threatening the forked network's legitimacy. This can undermine cohesion and dilute the value of the cryptocurrency.

- Too many hard forks may indicate instability and internal divisions that weaken a network. While forks enable choice, they also risk fracturing communities if not navigated well.

- Hard forks suggest the lack of a coherent vision or roadmap for a network's progress. While openness is a virtue, it works best when balanced with leadership and direction.

Bottom Line: Forking the Unforkable

Hard forks can be a bit of a disturbance, but they actually demonstrate the true democratic essence of blockchains. They allow open networks to quickly adapt and improve based on the diverse perspectives and priorities of their members. Of course, with any major change, there is potential for disruption, but with honest communication and agreement, the destabilizing effects are minimal. The key is finding the perfect balance between openness and stability. This means ensuring that everyone's voice is heard while still working together towards shared objectives.

FAQs

How to Profit from a Cryptocurrency Hard Fork

There are two main ways to potentially profit from a cryptocurrency hard fork.

Firstly, hold the original coins. If you hold coins on the original blockchain before the fork, you will receive an equal amount of coins on the forked chain after the split. You now own coins on two separate blockchains that you can hold or sell for profit. The value of the new forked coins may increase over time if the new network becomes successful.

Secondly, trade the volatility. As talk of an impending hard fork spreads, trading volume and price volatility will likely increase for the original cryptocurrency. Savvy traders can potentially profit from these price swings before and after the fork occurs. However, trading volatility also introduces risks if prices move against expectations.

Is Hard Fork Good or Bad?

Some argue that hard forks are key to the blockchain's ability to survive and grow through decentralized decision-making. But while hard forks provide a mechanism for open choice, they can also be misused or driven by questionable motivations. When navigated well, hard forks allow cryptocurrencies to adapt and thrive.