Coinbase Advanced Trade Review 2024

This review takes an in-depth look at the Coinbase Advanced Trade and its key features, examining how it empowers users with professional-grade cryptocurrency trading on an intuitive platform.

Coinbase Pro has evolved into Advanced Trade, bringing a whole range of previously exclusive features to all users through the main Coinbase app. Get all the exciting details about Coinbase's Advanced Trade in this comprehensive review!

Hailing from San Francisco and founded by Brian Armstrong and Fred Ehrsam in June 2012, Coinbase is a premier cryptocurrency exchange that has firmly established itself within the industry. As one of the oldest and largest exchanges around, it offers a dynamic duo of a digital wallet and a robust trading platform. Making a splash in the crypto world, Coinbase made a historic move in 2021 by becoming the first crypto exchange to go public, with its listing on the NASDAQ.

Standing its ground as a dominant player in the digital currency exchange market, Coinbase confidently competes with industry titans like Binance. It's even clinched top spots in Coinmarketcap's global exchange rankings for traffic, liquidity, and trading volume. With a whopping 98 million verified users and a dazzling revenue of $3.1 billion as of 2022, it's clear that Coinbase is a force to be reckoned with!

Fully regulated and licensed to operate in all US states (bar Hawaii), Coinbase's institutional business has grown impressively, now serving over 9,000 institutions. In 2023 alone, the institutional trading volume hit a staggering $78 billion, and the platform held $128 billion in assets. Coinbase has also built powerful alliances with industry heavyweights such as Third Point LLC, SpaceX, Tesla, and WisdomTree Investments.

Providing a smorgasbord of services, Coinbase caters to an array of needs. From cryptocurrency investing and an advanced trading platform to custodial accounts for institutions, a wallet for everyday investors, a credit card, an NFT marketplace, derivative products, staking, borrowing, and even its very own US dollar stable coin (USDC), Coinbase truly has something for everyone!

Coinbase Advanced Trade vs Coinbase Pro

While the Coinbase Pro landing page is still up, any new signups will be ushered directly to Advanced Trade, which comes in lieu of Coinbase Pro. This exciting transition comes as Coinbase has integrated aspects of Coinbase Pro — including its attractive lower, volume-based trading fees — into a new feature branded as "Advanced Trade."

Advanced Trade is Coinbase's cutting-edge trading platform, designed specifically for the more seasoned traders out there. It offers a safe and effortless way to buy, sell, and trade digital assets online across a variety of trading pairs. Packed with enhanced tools like interactive charts powered by TradingView, advanced order types, and access to all the other cool features offered by Coinbase like staking, borrowing, cards, and dapp wallets. The best part? The combined service is still free to sign up, just like its predecessors. Plus, the company offers a subscription service called Coinbase One, which gives you no-fee trades and other fantastic benefits for a monthly fee of just around $30.

The "Advanced Trade" features have been introduced to the main service to spice up what was a simpler interface that might have appealed to beginners. But worry not, those features are still around, and you can now use the basic service to switch to a mode that offers lower fees for some transactions and additional data tools.

Below is a quick snapshot of the main differences between Coinbase Pro and Coinbase Advanced. You'll see that Advanced Trade lets you earn up to a sizzling 7% APY on eligible crypto balances like USDC, staked ETH, and others. It also offers stronger and more advanced security features and superior charting instruments. It's clearly a game-changer!

Fig. 1. Differences between Coinbase Pro and Advanced Trade. Courtesy of coinbase.com

Manual and Automated Trading with Coinbase

Users can enjoy the convenience of an easy-to-navigate platform accessible via a web browser or mobile apps for Android or iOS devices, including the more advanced trading feature, Coinbase Advanced.

Coinbase offers a seamless entry point for those newly venturing into cryptocurrency investment. With its intuitive interface, educational resources, and strong security protocols, Coinbase stands as an ideal choice for trading and investing in crypto. Users can acquire, store, and track the value of their digital coins over time.

Coinbase Advanced Trade, the company's proprietary feature, provides users with a trading terminal furnished with comprehensive research tools, an order book, and a trading history. It empowers seasoned traders to manually trade and implement third-party automated trading services, including trading bots like Bitsgap, by leveraging Application Programming Interfaces (APIs). Users can execute market, limit, and stop orders at a reduced commission fee and engage in margin trading using sophisticated charting tools.

Coinbase Advanced Trade presents lower fees than the standard Coinbase exchange and offers more features, although it does sport a slightly more complex user interface. These attributes make Coinbase Advanced Trade a preferred choice for implementing automated bots, particularly those that capitalize on high-frequency trading.

User Interface

Coinbase presents a crisp, user-friendly layout that's free of clutter and a breeze to navigate. Its dashboard neatly showcases portfolio holdings, price charts, and recent trading activities at a glance. Quick access to trading tools, features, and account settings are conveniently located on the side. The clean interface, coupled with fiat purchase functionality, is a key reason why Coinbase is a top choice for those new to the crypto world.

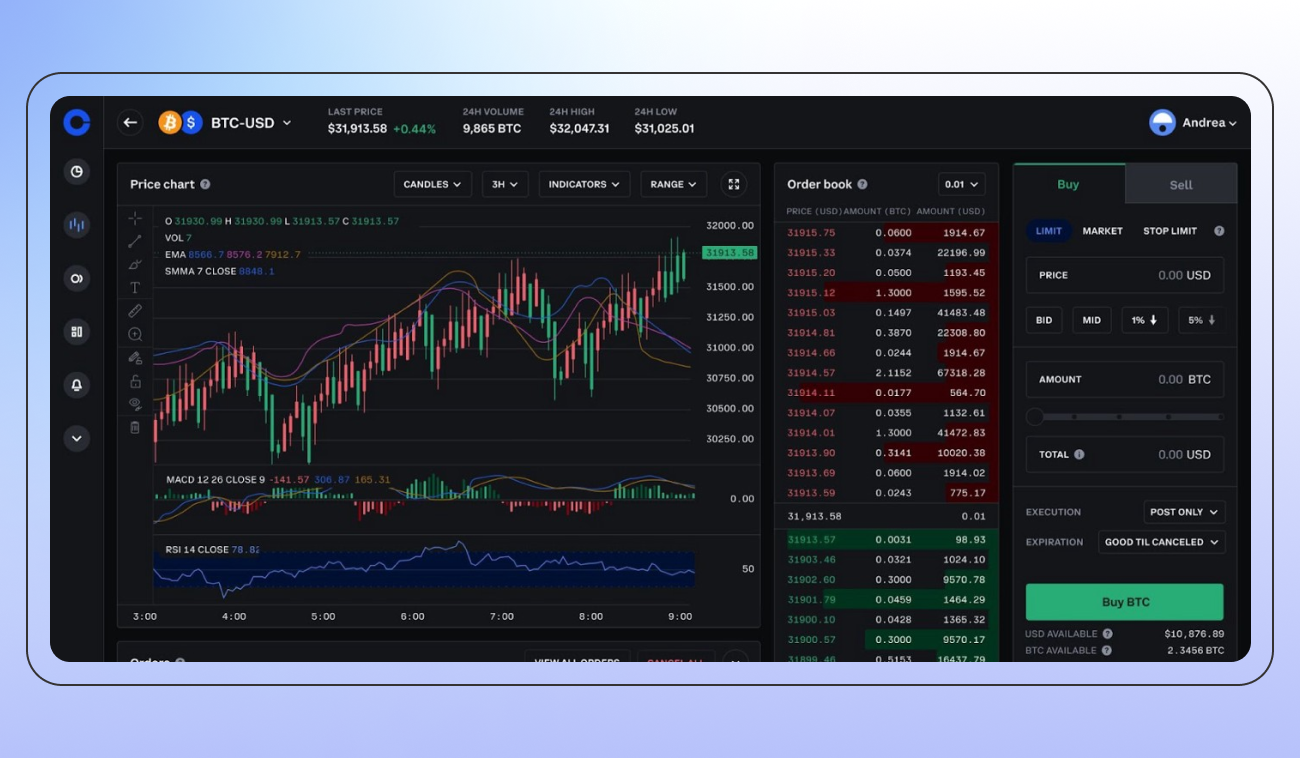

Coinbase Advanced Trade adopts Coinbase's sleek and clutter-free design ethos to its user interface. It sports a cool dark theme and is thoughtfully partitioned into various sections. As seen, the left-hand side lets you choose a market type, view your balance, and place an array of buy and sell orders. The central area houses the order book and price chart, with open orders neatly displayed beneath the chart. The right section, meanwhile, hosts a list of trade history.

The user interface is intuitive and ideal for anyone aiming to explore crypto beyond the basics.

Available Trading Pairs on Coinbase

Coinbase offers an expansive selection of over 240+ assets for trading, leading to more than 500+ unique trading pairs. However, the available coins come with differing limits. For instance, some coin pairs are classified as "limit only," which means they accept only limit orders and not market orders. Also, depending on where you're located, there may be restrictions on trading certain coins. All these details can be conveniently found in Coinbase's asset directory.

Among the pantheon of coins available on the platform, Bitcoin (BTC), Ethereum (ETH), Uniswap (UNI), and Dogecoin (DOGE) stand out as some of the more popular choices, open for both automated and manual trading.

Coinbase Trading Volumes

Even though Coinbase has consistently demonstrated commendably high trading volumes and carved itself a significant niche in the cryptocurrency realm by 2023, it's clear that it's seen sunnier days. However, Coinbase isn't alone in this. Centralized exchanges (CEXs) are experiencing a drop in trading volumes, largely due to increasing regulatory pressures, wider geopolitical uncertainties, and perhaps even a dip in investor interest as some seek alternative ventures or hold onto their funds for more promising opportunities.

In April 2023, the trading volume of the NASDAQ-listed Coinbase group slipped to $26.8 billion (Pic. 2), the lowest it's been in 16 months. The group's shares have fallen by 17%, with diminishing hope for a quick recovery following a disappointing 2022. Additionally, a Securities and Exchange Commission investigation into potential securities law violations has added to the challenges.

In response to these mounting issues, Coinbase is looking to broaden its revenue streams. This strategy has so far led to an increase in tradable assets and the introduction of non-trading revenue sources like allowing users to lend their tokens for a return yield.

On several occasions, company executives have stated their aim to diversify away from trading revenues. They envision Coinbase as the primary interface for users to interact with various facets of the crypto ecosystem, rather than just serving as an exchange platform.

While current trends indicate that overall cryptocurrency trading activities may not see an immediate resurgence, Coinbase continues to hold a strong second place, trailing only Binance among global exchanges in trading volumes. It proudly posts a 24-hour trading volume of $464 million. Moreover, BTC/USD, its most actively traded pair, records a 24-hour volume reaching $201 million.

Coinbase Trading Fees

Compared to other exchanges, Coinbase's trading fees are often seen as a substantial drawback. The fee structure in place for the standard Coinbase account tends to be costly, although this is improved on Coinbase Advanced. The actual fee amount can depend on several factors, including the payment method, the purchase volume, and prevailing market conditions, including volatility and liquidity.

Coinbase Advanced utilizes a maker-taker fee structure to define transaction costs. Maker orders, which contribute liquidity to the market, incur different fees from Taker orders. Fees are determined based on the pricing tier you're in at the time the order is placed, not the tier you would fall into once a trade is finalized.

Users of Advanced Trade can expect to pay up to 0.6% per trade in accordance with this structure, which also offers discounts for high-volume traders. This fee system mirrors the one previously used on Coinbase Pro.

For instance, if you place a buy limit order at 20% below the current market price, your order is added to the order book. If another customer places an order that matches yours, and your order is partially or entirely filled, you are considered the maker for that trade and will pay the associated maker fee.

Taker fees are calculated based on your total USD trading volume over the previous 30-day period across all order books. Transactions conducted on USD-quoted books are accounted for as the total USD amount of each completed order. Transactions made on non-USD books are converted to USD based on the most recent fill price on the respective book.

More detailed information about Advanced Trade fees can be found in the dedicated section on the Coinbase help page.

Coinbase Security Policy

Coinbase holds a reputation as one of the most secure cryptocurrency exchanges available. It has consistently demonstrated strong defense mechanisms against hacking efforts. For the protection of customer funds, the majority are stored in cold wallets, which are offline and therefore resistant to online hacking attempts. Only a small fraction of cryptocurrencies, roughly 2%, are kept online to support trading volume.

To further bolster its security, Coinbase uses backup drives and paper wallets, which are securely stored in different locations around the globe, such as vaults and safe deposit boxes.

For customers based in the U.S., Coinbase offers FDIC Insurance for cash balances kept in its wallets, covering up to $250,000 per individual. However, it's crucial to note that this insurance does not apply to cryptocurrency holdings, urging users to take necessary precautions to secure their assets. Additionally, the insurance policy does not cover losses resulting from unauthorized access to personal accounts.

Other security measures implemented by Coinbase include two-factor authentication (2FA), biometric logins, and data encryption. Users are strongly encouraged to enable 2FA to prevent unauthorized access, particularly when using third-party automated trading bots.

Coinbase Know Your Customer Policy

To open an account on Coinbase, new users must provide identifying documents to verify their identities. This mandatory verification aligns with Know Your Customer (KYC) rules that aim to prevent account misuse. Users must submit a valid government ID, such as a passport or driver's license, to complete the process.

If users do not fully finish account verification, they may face restrictions on accessing Coinbase's offerings. However, after successfully completing identity confirmation, users gain full access to Coinbase's range of products and services. The verification requirement, while an extra step, ensures a compliant and secure trading environment.

Using Bitsgap Bots on Coinbase Advanced

Don’t you think it’s time to tap into the power of automated trading and experience the sheer convenience it brings to managing your cryptocurrency portfolio?!

Bitsgap is a dynamic, automated trading platform that serves as a comprehensive one-stop solution for all your crypto trading needs. With integrations across more than 17 major crypto exchanges, including the renowned Coinbase Advanced Trade, Bitsgap's automated bots are here to revolutionize your trading experience, providing a secure and highly effective choice for automated trading.

Linking your Coinbase Advanced Trade account with Bitsgap is a breeze thanks to the easy-to-use API keys. Once connected, you can unleash the power of Bitsgap's proprietary trading bots or even tailor-make your own to perform automated trades on your behalf. The choice is vast with a range of bots for Coinbase Advanced, including the likes of GRID, BTD, and DCA. These bots have certainly proved their mettle in the spot market, gaining an impressive following of over 500K traders globally.

And there's more! By subscribing to Bitsgap right away, you can benefit from a one-week trial on the coveted PRO plan. Plus, you'll have the option to extend this to both real and demo modes once your trial period ends.

Integrating Coinbase Advanced with Bitsgap Automated Trading Bots

To successfully link your Bitsgap account to your Coinbase Advanced Trade exchange account, follow these steps:

- Sign into your CAT account or create a new one if necessary.

- Select the [My account] icon located in the top-right corner and choose [Settings] from the ensuing drop-down menu.

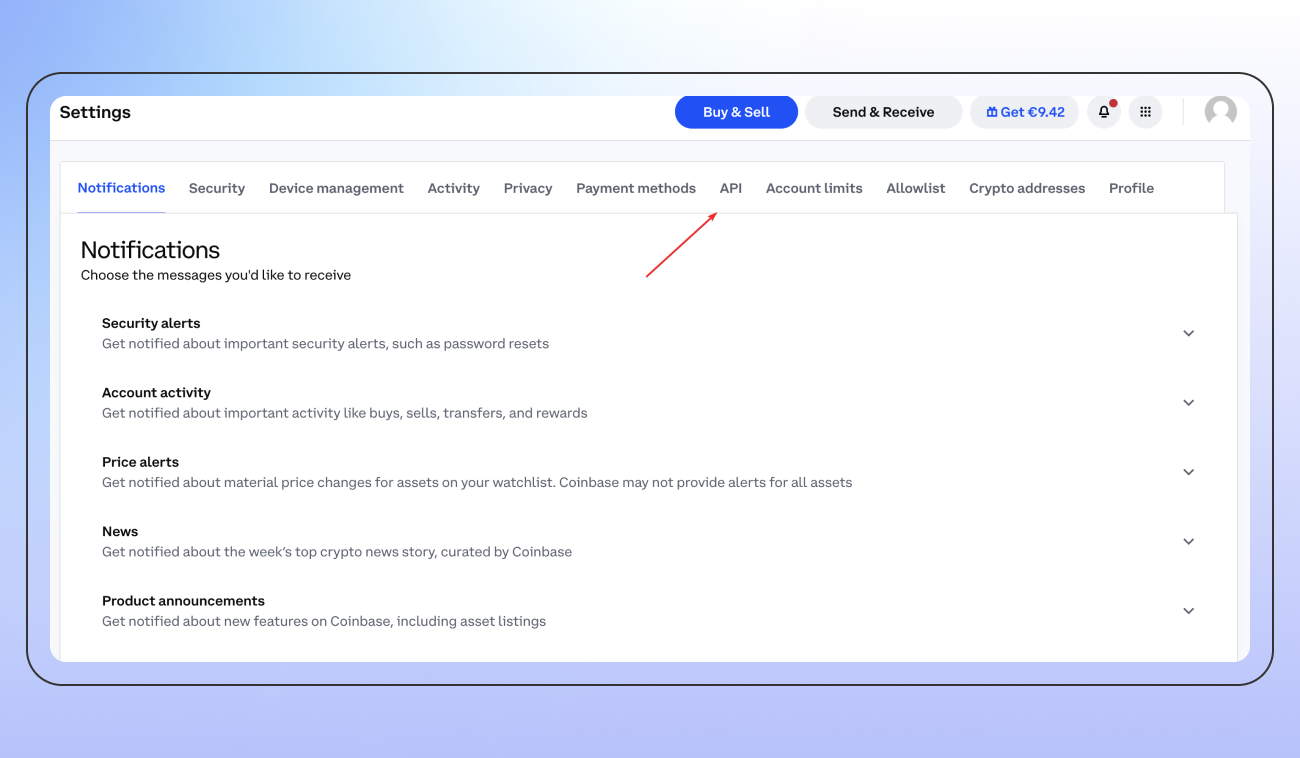

- On the [Settings] page, find and click on the [API] tab (Pic. 3):

- On the [API] page, locate and click on the [+ New API Key] button positioned in the top left corner.

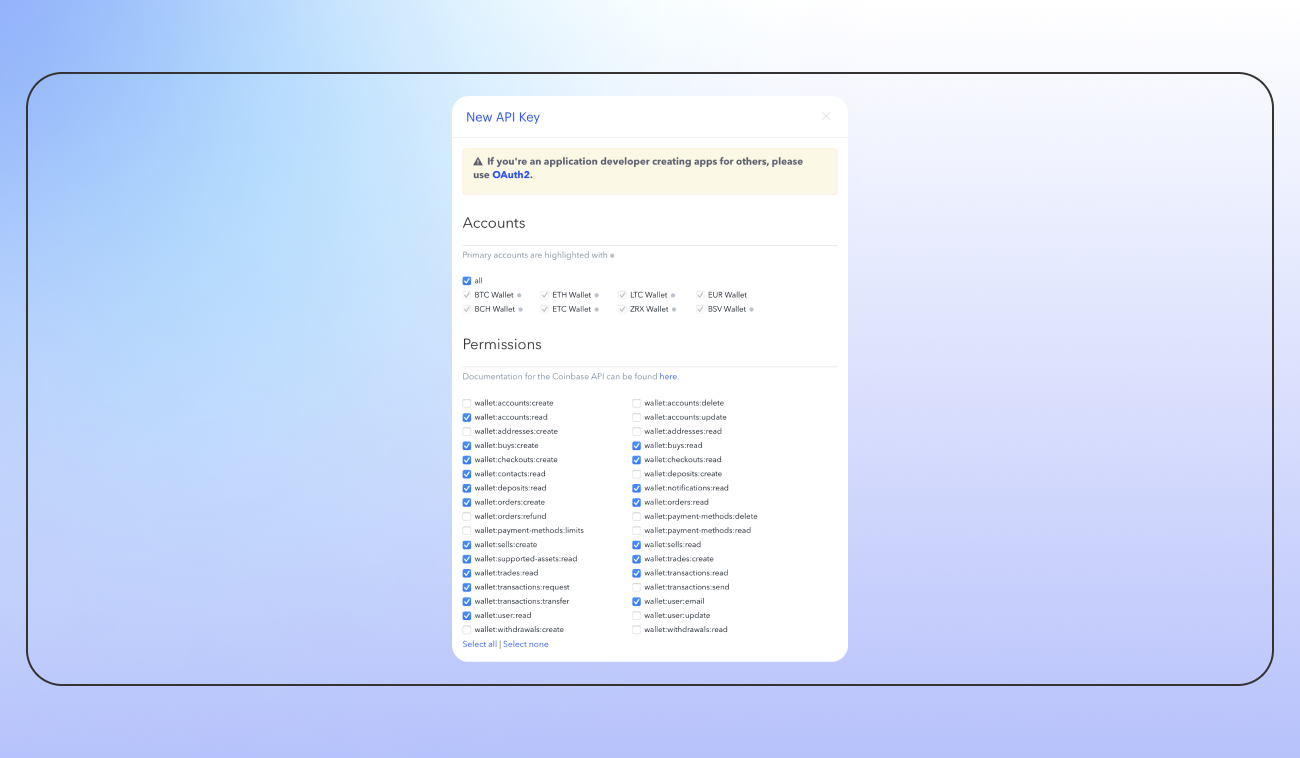

- A new window will open where you must adjust your permissions to match those given in the image below (Pic. 4). These permissions will grant Bitsgap access to your trading history and balance and permit trade executions. Once done, scroll to the bottom and hit the [Create] button.

- Upon creation, a new window will display your newly minted Coinbase Advanced Trade API key. Make sure to copy both Public and Secret keys and store them in a secure place. For new users, please note that your keys will be activated after a 48-hour waiting period.

- Now, return to Bitsgap and proceed to [My Exchanges] to connect your CAT account.

- On the [My Exchanges] page, select [+Add new exchange] and choose Coinbase Advanced Trade from the list.

- Paste your Coinbase Advanced Trade API key and Secret key and hit [Connect]

Congratulations, you are now successfully connected to CAT!

Bottom Line

Coinbase holds a prestigious position as one of the top cryptocurrency exchanges. The platform's basic service interface is not only intuitive and speedy, but also replete with a variety of features that cater to the needs of seasoned users. With dependable security measures, excellent mobile apps, commendable customer service, a wide selection of trading pairs and products, and support from substantial institutional investors, Coinbase remains a solid choice in the crypto world. Add to this the fact that it's one of the few crypto exchanges accessible to U.S. customers, and you can see why it's a top pick. If you're based in the U.S., your options might seem limited, but with Coinbase, you're certainly in good hands.

FAQs

Does Coinbase Have Automated Trading?

No, Coinbase Advanced Trade doesn't have a native trading bot, but don't let that stop you! You can easily link up with a third-party trading bot like Bitsgap. And guess what? Connecting is a breeze! All you need to do is generate CAT API keys and integrate them with Bitsgap. Rest assured, these APIs are encrypted, providing a secure wall that prevents access to your funds or personal data. You're in safe hands!

How to Automate Trading on Coinbase?

To automate your trading on Coinbase Advanced Trade, you’ll have to connect a third-party service like Bitsgap. The process is straightforward: simply generate CAT API keys on Coinbase, and then copy and paste them into Bitsgap.