TOP Peer-to-Peer (P2P) Crypto Exchanges 2024

Looking to trade crypto directly with other users? This guide explores the top peer-to-peer (P2P) exchanges, explaining how P2P trading works, its benefits, and key features to consider when choosing a platform.

The world of cryptocurrency trading offers a variety of approaches, and peer-to-peer (P2P) exchanges have emerged as a prominent player. This article provides a comprehensive guide to the top P2P crypto exchanges, starting with the fundamentals of P2P trading itself.

We'll explore what P2P trading entails and how it differs from other trading methods. We'll then delve into the concept of P2P exchanges in general, followed by a focused look at P2P crypto exchanges and how they distinguish themselves from centralized and decentralized exchanges.

Finally, we'll review some of the leading P2P crypto exchanges in the market today, providing insights into their features, security, and overall user experience.

What Is P2P Trading?

Peer-to-peer (P2P) trading, at its core, connects buyers and sellers directly, facilitating transactions without the intermediation of a centralized authority. Unlike traditional trading models where a central exchange acts as the intermediary, P2P trading empowers individuals to transact directly with one another. Think of it as a digital classifieds section specifically for cryptocurrencies.

Here's how P2P trading differs from other common methods:

- Centralized Exchanges (CEXs): CEXs operate as centralized platforms, holding users' funds and managing the order book. They act as the counterparty to every trade. In contrast, P2P trading bypasses this central authority, allowing users to retain more control over their assets and negotiate terms directly with their trading partner.

- Decentralized Exchanges (DEXs): DEXs leverage blockchain technology to facilitate trustless trading without a central intermediary. While similar to P2P in the absence of a central authority, DEXs often rely on automated market makers (AMMs) and liquidity pools to execute trades. P2P trading, however, involves direct negotiation and agreement between individual buyers and sellers.

In essence, P2P trading offers a more direct and personalized trading experience. Buyers and sellers can interact, agree on prices and payment methods, and complete transactions independently. This direct interaction often leads to greater flexibility and potentially better pricing than relying on a centralized order book. However, it also introduces the need for robust security measures and escrow services to mitigate potential risks associated with direct transactions.

What Is P2P Exchange?

A P2P exchange provides a platform that facilitates direct trading between individual buyers and sellers. It acts as a meeting place where users can post offers to buy or sell assets, specify their desired prices and payment methods, and connect with potential trading partners. Crucially, the exchange itself doesn't hold custody of user funds or directly participate in the trades. Instead, it provides the infrastructure, communication tools, and often escrow services to ensure secure and smooth transactions. Think of it as a digital marketplace where buyers and sellers can connect and negotiate directly.

Different Types of P2P Exchanges:

P2P exchanges can cater to various asset classes, not just cryptocurrencies. Some common types include:

- Currency Exchange: These platforms facilitate the exchange of fiat currencies directly between individuals, often offering more competitive rates than traditional currency exchange services.

- Goods and Services: These platforms allow individuals to buy and sell goods and services directly, often using escrow services to protect both buyers and sellers.

- Lending and Borrowing: P2P lending platforms connect borrowers directly with individual lenders, bypassing traditional financial institutions.

P2P Exchange vs. P2P Crypto Exchange: Is it the Same?

While the underlying principle of direct trading remains the same, a general P2P exchange and a P2P crypto exchange have distinct focuses:

- P2P Exchange: This broader term encompasses any platform facilitating direct trade between individuals, regardless of the asset class. It could be for fiat currencies, goods, services, or even lending.

- P2P Crypto Exchange: This refers specifically to a P2P exchange that deals exclusively with cryptocurrencies. It provides a platform for users to buy and sell Bitcoin, Ethereum, and other digital assets directly with one another.

Therefore, a P2P crypto exchange is a type of P2P exchange, but a general P2P exchange is not necessarily a crypto exchange. The key difference lies in the specific asset being traded.

Best Peer to Peer Crypto Exchanges

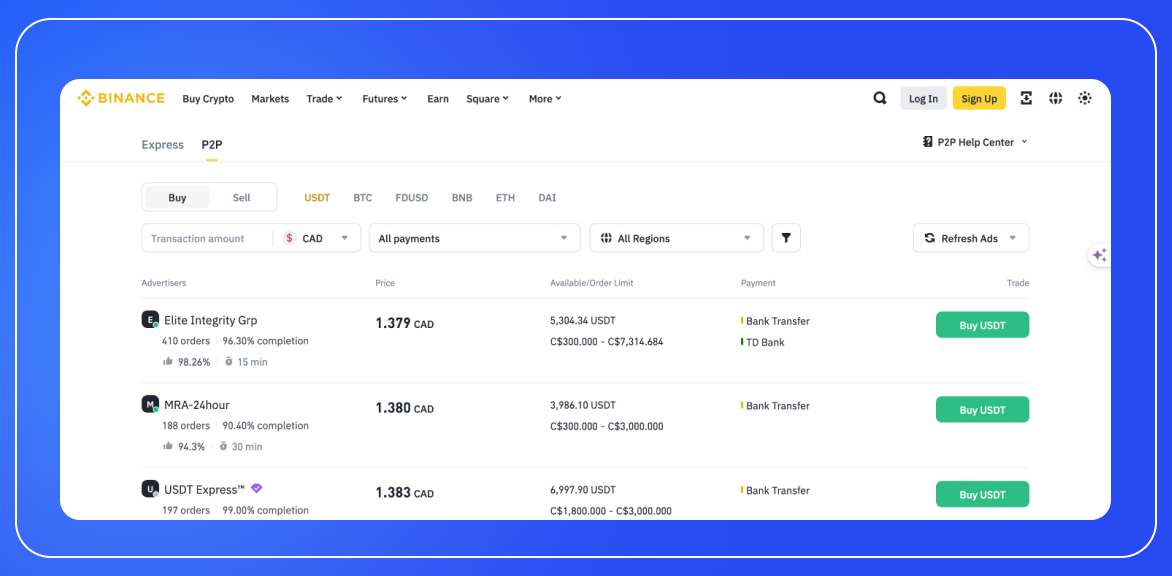

Binance P2P

Binance P2P stands out as a robust and user-friendly peer-to-peer trading platform within the cryptocurrency ecosystem. As part of Binance, the world's largest cryptocurrency exchange, it leverages the company's reputation and infrastructure to provide a secure and efficient P2P trading experience.

Key Features

- Decentralized Trading: Binance P2P facilitates direct cryptocurrency trading between users, aligning with the decentralized ethos of cryptocurrencies.

- Escrow Service: The platform's escrow service adds a crucial layer of security, holding the cryptocurrency until both parties confirm the transaction. This significantly reduces the risk of fraud, a common concern in P2P trading.

- Communication Tools: The integrated chat function enables direct communication between buyers and sellers, fostering transparency and allowing for negotiation or clarification when needed.

- Customer Support: With 24/7 customer support, Binance P2P ensures that users can get assistance at any time, enhancing the overall user experience and providing peace of mind.

- Zero Transaction Fees: The absence of transaction fees makes Binance P2P an economically attractive option for both buyers and sellers, potentially leading to better pricing and increased trading activity.

- Wide Cryptocurrency Support: The platform supports major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and Binance Coin (BNB), catering to a broad range of trader preferences.

- Extensive Payment Options: With over 700 payment methods available, including bank transfers, digital wallets, and local payment solutions, Binance P2P offers unparalleled flexibility in how users can conduct their trades.

Strengths

- Security: The combination of Binance's reputation and the escrow service provides a high level of security for transactions.

- Flexibility: The wide range of supported cryptocurrencies and payment methods makes the platform accessible to a global user base.

- Cost-Effectiveness: Zero transaction fees make it an attractive option for cost-conscious traders.

- User Support: 24/7 customer support ensures that help is always available when needed.

Potential Limitations

While the provided information doesn't mention any specific drawbacks, potential users should be aware of general P2P trading considerations:

- Liquidity: Depending on your location and chosen payment method, you might experience varying levels of liquidity.

- Transaction Speed: P2P transactions can sometimes be slower than instant trades on centralized exchanges, depending on the responsiveness of the counterparty.

- Price Volatility: As with all cryptocurrency trading, users should be aware of the potential for rapid price fluctuations.

KuCoin P2P

KuCoin P2P, an offering from the KuCoin exchange, has established itself as a notable player in the peer-to-peer cryptocurrency trading space. This platform combines a user-friendly interface with robust security measures, catering to both novice and experienced traders.

Key Features

- Direct Trading: The platform facilitates direct cryptocurrency trades between users without intermediaries, embodying the true spirit of P2P transactions.

- Cryptocurrency Support: KuCoin P2P supports a wide range of cryptocurrencies, including major ones like Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and platform-specific KuCoin Shares (KCS), as well as USD Coin (USDC).

- Fiat Currency Support: The platform supports over 30 fiat currencies, including USD, NGN, INR, MYR, and RUB, enhancing its global accessibility.

- Payment Methods: With over 100 payment methods available, KuCoin P2P offers flexibility and convenience to its users.

- Trading Interface: Users can create and browse listings, negotiate prices, and select preferred payment methods within the platform.

- Security Measures:

- Escrow services to hold cryptocurrency until both parties confirm the transaction

- Mandatory KYC protocols for user identity verification

- Feedback and rating system to assess trading partner reliability

- Customer Support: 24/7 customer support is available to resolve issues or disputes.

- Integration: KuCoin is integrated with third-party platforms, including automation vendors like WunderTrading, which can be used to potentially increase profits.

Strengths

- User-Friendly Interface: The platform is designed to be intuitive, making it accessible for both beginners and experienced traders.

- Wide Cryptocurrency Selection: KuCoin P2P offers an impressive list of supported coins, including popular assets and obscure selections.

- Security: Robust security measures, including escrow services and KYC protocols, enhance overall platform safety.

- Global Accessibility: Support for numerous fiat currencies and payment methods makes the platform accessible to a wide user base.

- Trading Volume: The platform boasts impressive trading volume, which can contribute to better liquidity.

- Low Commissions: Relatively low fees make it an attractive option for cost-conscious traders.

- Integration: Compatibility with third-party automation tools offers potential for advanced trading strategies.

Limitations

- Limited Payment Methods: Despite claiming over 100 payment methods, the review suggests that users "won't be able to use a wide range of payment methods," which seems contradictory and may indicate limitations for certain regions or currencies.

- Learning Curve: The platform may be challenging for novices, suggesting a steeper learning curve compared to some competitors.

- Overwhelming Selection: While the extensive coin selection is a strength, it might be overwhelming for new traders.

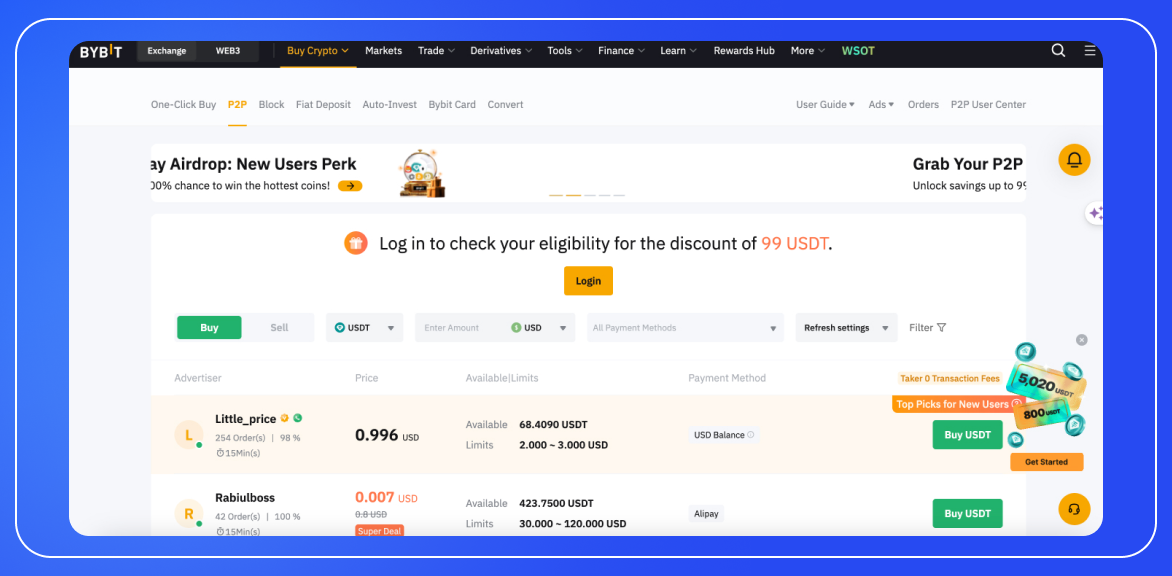

Bybit P2P

Bybit, primarily known for its leveraged trading offerings, has established itself as a competitive player in the peer-to-peer (P2P) cryptocurrency trading space. This platform combines its robust trading infrastructure with a P2P marketplace, catering to both experienced traders and those looking for direct crypto transactions.

Key Features

- Leveraged Trading: While not directly related to P2P trading, Bybit's main platform offers margin trading with up to 100x leverage and spot trading with up to 10x leverage.

- Low Commission Structure: Bybit boasts one of the lowest commission structures in the crypto space, with spot trading commissions starting at 0.1% and leveraged perpetual and futures contracts from 0.06%.

- P2P Marketplace: Bybit's P2P platform supports four major cryptocurrencies and dozens of fiat currencies.

- Multiple Payment Methods: A wide range of payment options are available to facilitate trades between users from different regions.

- Zero P2P Fees: No fees are charged for P2P transactions, benefiting both buyers and sellers.

- Competitive Rates: Sellers on Bybit often offer competitive rates, with USDT frequently available at $1.00.

- International Focus: Bybit caters to a global audience with its diverse payment options and currency support.

Supported Cryptocurrencies for P2P Trading

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- USD Coin (USDC)

Strengths

- Fee Structure:

- Zero fees for P2P transactions

- Low fees for spot and leveraged trading on the main exchange

- Leverage Options: Ideal for traders interested in leveraged cryptocurrency trading.

- Payment Flexibility: Over 80 different payment options available, facilitating international trades.

- Competitive Pricing: Sellers often offer favorable rates, particularly for stablecoins like USDT.

- User Interface: The platform's interface is familiar to those with prior investment experience, making it accessible for newcomers with some financial background.

- Rich Asset Catalog: Beyond the four P2P-supported cryptocurrencies, the main exchange offers a wide range of crypto assets including BCH, LTC, XTZ, LINK, ADA, and Polkadot.

- Fair Deal Facilitation: The platform focuses on ensuring both buyers and sellers reach optimal prices and quick agreements.

Limitations

- Limited P2P Crypto Selection: While the main exchange offers a wide range of cryptocurrencies, the P2P platform only supports four.

- Navigation Challenges: Some users may find the website difficult to navigate, potentially due to its feature-rich nature.

- Learning Curve: The platform's advanced features and leveraged trading options might be overwhelming for complete beginners.

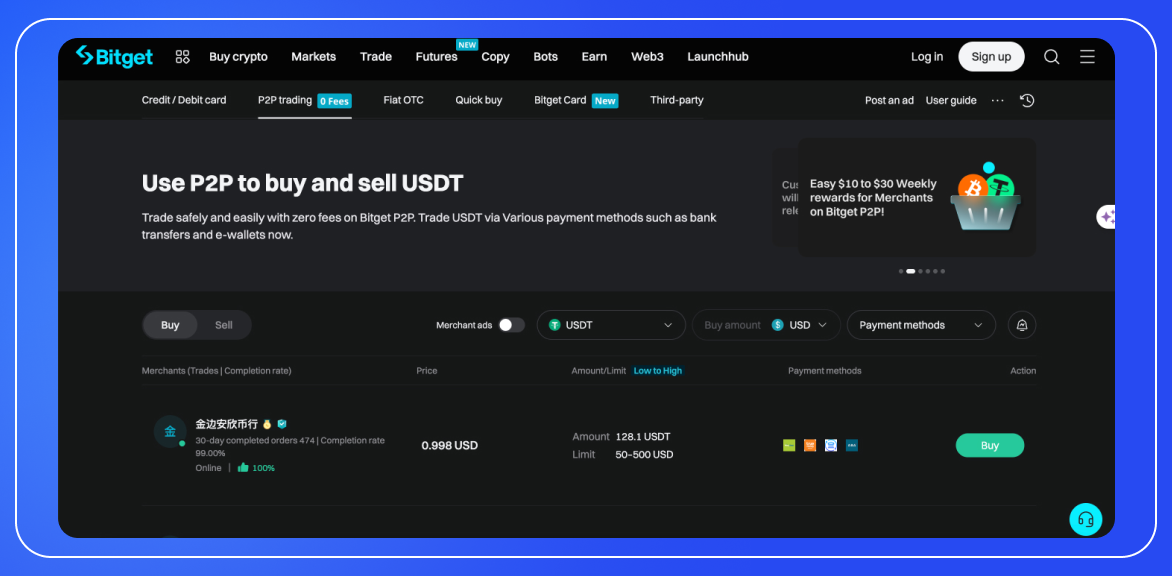

Bitget P2P

Bitget has established itself as a prominent player in the cryptocurrency exchange landscape, with a strong offering in peer-to-peer (P2P) crypto trading. Known for its robust liquidity and secure environment, Bitget caters to users seeking a reliable and versatile trading experience.

Key Features

- Extensive Cryptocurrency Support: Bitget supports over 550 cryptocurrencies, including major tokens like Bitcoin and Ethereum, along with a diverse selection of altcoins.

- P2P Marketplace: The P2P platform supports trading of USDT, BTC, ETH, USDC, and BGB (Bitget's native token).

- Fiat Currency Support: Over 65 fiat currencies are supported.

- Payment Methods: More than 100 payment methods are available.

- User-Friendly Interface: The platform is designed to be intuitive for traders of all levels.

- Copy Trading: A unique feature allowing less experienced traders to replicate the moves of seasoned professionals.

- Futures Trading: Available for users looking to engage in more advanced trading strategies.

- Security Measures:

- Multi-signature wallets

- Encryption

- Escrow service for P2P trades

- Bitget P2P Shield (financial protection service)

- Customer Support: 24/7 live customer support in over 15 languages.

- Accessibility: Available via web browser and mobile app.

Strengths

- No P2P Fees: Bitget does not charge a service fee for buying or selling on the peer-to-peer exchange.

- Global Accessibility: Support for numerous fiat currencies and payment methods makes the platform accessible to a wide user base.

- Security: Robust security measures, including escrow services and the Bitget P2P Shield, enhance overall platform safety.

- User-Friendly Design: The intuitive interface facilitates quick access to account management, trade execution, and P2P transaction settings.

- Copy Trading: This feature is particularly valuable for less experienced traders, allowing them to learn from and potentially replicate the success of seasoned professionals.

- Large User Base: With over 30 million global users, Bitget offers a potentially liquid market for P2P trades.

- Customer Support: 24/7 live support in multiple languages ensures users can get help when needed.

Limitations

- Limited P2P Cryptocurrency Selection: While the main exchange supports over 550 cryptocurrencies, the P2P platform only supports five (USDT, BTC, ETH, USDC, and BGB).

- Liquidity Issues for Some Cryptocurrencies: Cryptocurrencies aside from USDT have few buyers and sellers on the P2P platform.

- Potential Additional Costs: While Bitget doesn't charge P2P fees, users may incur additional transaction costs depending on their chosen payment method.

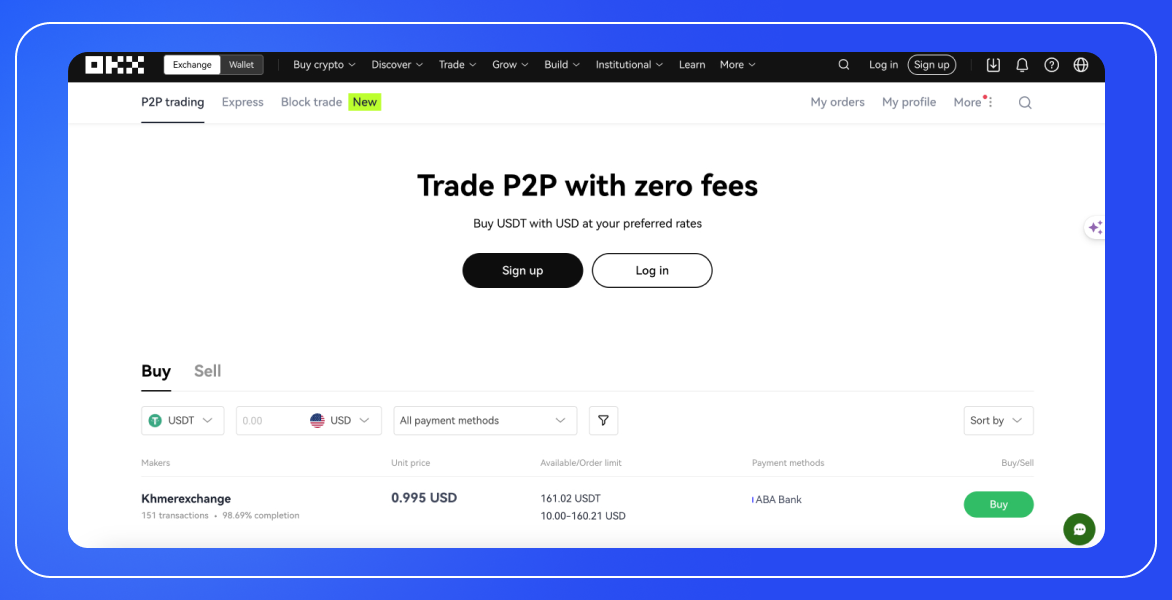

OKX P2P

OKX has established itself as a leading player in the cryptocurrency exchange landscape, with a strong offering in both centralized and peer-to-peer (P2P) trading. Lauded by millions of users globally, OKX combines the benefits of a centralized exchange with a robust P2P marketplace, catering to a wide range of trading preferences.

Key Features

- P2P Marketplace: OKX offers a full-featured P2P marketplace where traders can interact directly without intermediation.

- Cryptocurrency Support: The P2P platform supports six cryptocurrencies: Bitcoin, Ethereum, Tether, USD Coin, True USD, and Dai.

- Fiat Currency Support: Over 100 fiat currencies are supported.

- Payment Methods: More than 900 payment methods are available, ranging from local bank transfers to TransferWise.

- Mobile App: OKX offers a mobile app with rich functionality and diverse analytical tools.

- Trading Volume: OKX averages daily trading volumes of $2 billion.

- Escrow Service: OKX provides a secure escrow system for P2P trades.

- User Ratings: The platform includes a rating system for buyers and sellers.

- KYC Requirements: All users must upload KYC (Know Your Customer) documents.

- Flexible Trading Options: Users can access both P2P and centralized trading, as well as various financial instruments including margin accounts.

Strengths

- No P2P Fees: OKX does not charge any fees on P2P trades.

- Global Accessibility: Support for numerous fiat currencies and payment methods makes the platform highly accessible to a global user base.

- Security: The escrow service enhances the safety of P2P trades.

- Flexibility for Sellers: Sellers can set their own cryptocurrency prices and accepted payment methods.

- Buyer Options: Buyers can select sellers based on various preferences, including cryptocurrency, fiat currency, payment method, and purchase amount.

- User Integrity: The rating system and feedback mechanism encourage good behavior among traders.

- Diverse Trading Options: Users can easily switch between P2P trading and other financial instruments on the same platform.

- High Liquidity: With significant daily trading volumes, users are likely to find trades easily.

Limitations

- Limited P2P Cryptocurrency Selection: While the main exchange supports a wide range of cryptocurrencies, the P2P platform only supports six.

- Centralization Concerns: Some users may be uncomfortable with the centralized nature of the main platform, despite the P2P offering.

- Past Security Issues: OKX has reportedly had some security issues in the past, which may concern some users.

- KYC Requirements: While enhancing security, the mandatory KYC process may deter users seeking more privacy.

HODL HODL

HODL HODL stands out in the peer-to-peer (P2P) cryptocurrency trading landscape as a unique platform that prioritizes privacy, security, and Bitcoin-centric trading. Named after a popular meme in the Bitcoin community, HODL HODL positions itself as an attractive option for early adopters and committed cryptocurrency enthusiasts.

Key Features

- Cryptocurrency Support:

- Primary focus on Bitcoin

- Also supports trading of other cryptocurrencies like Solana, Ethereum, Cardano, and others

- Privacy: No KYC (Know Your Customer) verification required, enhancing user anonymity

- Security: Utilizes multisig escrow contracts for secure transactions

- Global Trading: Supports worldwide trading with various payment systems and currencies

- Non-Custodial: Users retain control of their funds throughout the transaction process

- Lending Service: Offers financial assistance to help users finalize deals

- User-Friendly Interface: Designed for ease of use and efficient navigation

- Transparent Fee Structure:

- Trading fees range from 0.5% to 0.6%

- Fees are split between buyer and seller

- Fiat Currency Support: Transactions in any fiat currency based on user agreement

- Payment Methods: Supports a wide range of payment options including credit cards, bank transfers (SWIFT, SEPA), PayPal, Venmo, MoneyGram, and Western Union

Strengths

- Privacy: The absence of KYC requirements makes it an attractive option for users prioritizing anonymity

- Security: Multisig escrow contracts provide a robust security measure for transactions

- User Control: Non-custodial nature ensures users maintain control of their funds

- Flexibility: Support for global trading and various payment methods offers users significant flexibility

- Reasonable Fees: Competitive fee structure with a maximum of 0.6% per transaction

- Diverse Cryptocurrency Support: While focusing on Bitcoin, the platform also supports trading of other popular cryptocurrencies

- User-Friendly Design: The interface is described as efficient and simple to navigate

- Community Focus: Positions itself as a platform for Bitcoin enthusiasts and early adopters

Limitations

- Limited Liquidity: The platform reportedly has relatively low liquidity compared to some competitors

- Narrow Cryptocurrency Focus: While supporting multiple cryptocurrencies, the primary focus on Bitcoin may not suit all users

- Payment Options: Despite supporting various methods, the selection of payment options is described as lacking

- Fiat Limitations: While USD can be used, it's not favored on the platform, which may be inconvenient for some users

Paxful

Paxful stands out in the peer-to-peer (P2P) cryptocurrency trading landscape as a platform focused on accessibility, security, and a wide variety of payment methods. While it supports a limited number of cryptocurrencies, Paxful has carved out a niche for itself by prioritizing user safety and offering an extensive range of payment options.

Key Features

- Cryptocurrency Support:

- Bitcoin (BTC)

- Tether (USDT)

- USD Coin (USDC)

- Payment Methods: Over 350 options, including:

- Bank transfers

- PayPal

- Gift cards

- Digital wallets (Apple Pay, Google Pay)

- Security Measures:

- Escrow service for secure transactions

- High level of security and safety protocols

- Proprietary Wallet: BitGo-powered Bitcoin wallet tailored for Paxful users

- User Interface: User-friendly interface, although some may find it confusing

- Customer Support: 24/7 live chat and email support

- Global Accessibility: Supports worldwide trading with various payment systems

- Focus: Primarily centered on peer-to-peer USDT and Bitcoin trading

Strengths

- Payment Flexibility: The extensive range of payment methods (over 350) provides users with unparalleled flexibility

- Security: Strong emphasis on security, including an escrow service and a proprietary BitGo-powered wallet

- Accessibility: User-friendly platform suitable for both novice and experienced traders

- Customer Support: 24/7 live chat and email support enhance user experience

- Global Reach: Worldwide trading support increases the platform's accessibility

- No Fees: Offers P2P exchanges with no fees and additional payments

- Reliable Core Product: Strong focus on ensuring a secure and safe trading environment

Limitations

- Limited Cryptocurrency Selection: Only supports Bitcoin, Tether, and USD Coin

- Lack of Additional Services: Some users criticize the platform for not offering additional crypto services common on other exchanges

- User Interface: While generally user-friendly, some users may find the interface confusing

- Narrow Focus: The platform's strict focus on P2P trading of a few cryptocurrencies may not suit users looking for a more diverse trading experience

LocalCoinSwap

LocalCoinSwap stands out in the peer-to-peer (P2P) cryptocurrency trading landscape as a decentralized platform that prioritizes user privacy, flexibility, and a wide range of supported cryptocurrencies. It caters to users looking for a diverse trading experience with minimal restrictions.

Key Features

- Cryptocurrency Support:

- Supports 15 different cryptocurrencies

- Includes popular coins like Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC)

- Also supports lesser-known assets like Dash (DASH), Monero (XMR), and Polkadot (DOT)

- Payment Methods: Over 300 options, including:

- Bank transfers

- PayPal

- Skrill

- Cash deposits

- Credit cards

- Gift cards (Amazon, Google Play)

- Fiat Currency Support: Over 190 local currencies supported

- Privacy: No mandatory KYC verification (optional for higher trust)

- Security Measures:

- Escrow services to protect transactions

- Smart contracts for escrow

- Reputation system

- Fee Structure: 1% commission on all transactions

- Decentralized Nature: Users trade directly with each other

Strengths

- Cryptocurrency Diversity: Wide range of supported cryptocurrencies, including both mainstream and less popular options

- Payment Flexibility: Extensive range of payment methods and support for numerous local currencies

- Privacy: No mandatory KYC verification, appealing to privacy-conscious users

- Low Fees: 1% commission is lower than the market average

- Security: Escrow services and smart contracts provide transaction protection

- Global Accessibility: Support for numerous local currencies and payment methods increases accessibility

- Decentralized Model: Aligns with the ethos of decentralization in cryptocurrency

Limitations

- Limited Protection: Beyond escrow smart contracts, there's no additional protection for users

- Low Trading Volume: Often experiences very low trading volumes, which can affect liquidity

- Payment Method Restrictions: Despite the wide range, some international users may find the selection of payment methods lacking

- Optional KYC: While a strength for privacy, the lack of mandatory KYC might increase the risk of fraudulent activities

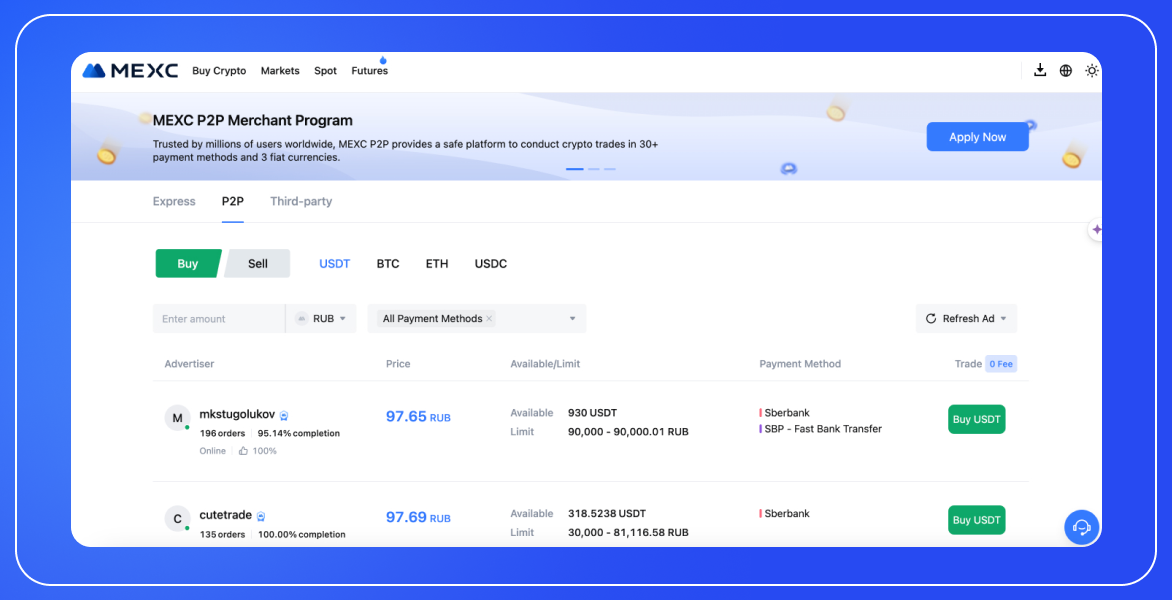

MEXC

MEXC, while primarily known for its centralized exchange features, has carved out a unique niche in the peer-to-peer (P2P) cryptocurrency trading landscape. The platform offers a blend of P2P trading with the security and features of a well-established exchange, focusing on specific geographic regions.

Key Features

- Geographic Focus: P2P services available in Vietnam, South Korea, and Russia

- Cryptocurrency Support:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- USD Coin (USDC)

- Payment Methods: Vary by country, including:

- Vietnam: Local bank transfer, MoMo, Zalo Pay, ShopeePay

- South Korea: Bank transfers, KaKAOPAY

- Russia: Payeer, domestic bank wires

- Fee Structure: No fees for P2P trading

- Security Measures:

- Escrow service to protect both parties

- KYC required for buyers and sellers

- User Interface: User-friendly interface accessible to newcomers

- Seller Information: Displays number of previous trades and ratings from other buyers

- Trade Execution: Often completed within minutes

- Centralized Exchange Integration: P2P platform is part of a larger exchange ecosystem

Strengths

- Fee-Free Trading: No commissions charged for P2P transactions

- Security: Solid escrow system to protect both parties

- Speed: Trades often completed within minutes

- User Information: Detailed seller information helps ensure legitimacy

- Competitive Rates: Some sellers offer rates below the spot price

- User-Friendly Interface: Accessible even to those new to crypto trading

- Multiple Payment Methods: Enhances accessibility across different regions

- Integration with Centralized Exchange: Provides additional features and liquidity options

Limitations

- Limited Geographic Availability: P2P services only available in Vietnam, South Korea, and Russia

- Limited Cryptocurrency Selection: Only four cryptocurrencies supported for P2P trading

- KYC Requirements: Mandatory for both buyers and sellers, which may deter privacy-focused users

- Restricted Payment Methods: Options vary by country and are limited compared to some competitors

How to Choose the Best Crypto P2P Exchange

Selecting the right peer-to-peer (P2P) cryptocurrency exchange is crucial for a safe, efficient, and cost-effective trading experience. Here's a comprehensive guide to help you make an informed decision:

- Security Measures: Security should be your top priority when choosing a P2P exchange:

- Escrow Service: Look for platforms that offer escrow services to protect both buyers and sellers during transactions.

- Two-Factor Authentication (2FA): Ensure the platform supports 2FA for added account security.

- Reputation System: A robust user rating and feedback system can help you identify trustworthy trading partners.

- KYC Policies: Decide whether you prefer platforms with strict KYC (Know Your Customer) requirements for enhanced security, or those with minimal KYC for greater privacy.

- Supported Cryptocurrencies: The range of supported cryptocurrencies can significantly impact your trading options.

- Consider platforms that support the specific cryptocurrencies you're interested in trading.

- Some exchanges focus on major cryptocurrencies like Bitcoin and Ethereum, while others offer a wider range including altcoins.

- Payment Methods: The availability of preferred payment methods is crucial for smooth transactions.

- Look for exchanges that support payment methods convenient for you, such as bank transfers, credit cards, or digital wallets.

- Consider the variety of payment options, especially if you plan to trade internationally.

- Fees and Costs: Understanding the fee structure is essential for cost-effective trading.

- Compare transaction fees, withdrawal fees, and any other charges across different platforms.

- Some P2P exchanges are fee-free, which can be attractive but ensure this doesn't come at the cost of reduced security or features.

- Liquidity and Trading Volume: Higher liquidity generally means easier and faster trades.

- Check the trading volume and the number of active users on the platform.

- Consider how quickly you can complete trades, especially for less popular cryptocurrencies.

- User Interface and Experience: A user-friendly interface can significantly enhance your trading experience.

- Look for platforms with intuitive designs, especially if you're new to P2P trading.

- Consider mobile app availability if you plan to trade on-the-go.

- Geographic Availability: Ensure the platform is available and legal in your country.

- Some P2P exchanges operate globally, while others focus on specific regions.

- Check if there are any restrictions or additional requirements for users in your location.

- Customer Support: Reliable customer support can be crucial, especially when dealing with financial transactions.

- Look for exchanges that offer responsive customer service through multiple channels (e.g., live chat, email, phone).

- Check user reviews to gauge the quality of customer support.

- Additional Features: Consider any extra features that might enhance your trading experience.

- Some platforms offer integrated wallets, while others might provide educational resources or advanced trading tools.

- Features like automatic matching or the ability to set your own rates can be beneficial.

- Community and Reputation: The platform's standing in the crypto community can provide insights into its reliability.

- Research user reviews and community feedback on forums and social media.

- Look into the platform's history, including how it has handled any past security incidents or disputes.

Conclusion

As we've explored in this article, peer-to-peer (P2P) cryptocurrency exchanges have carved out a unique niche in the digital asset trading landscape. These platforms enable direct transactions between users, offering a decentralized alternative to traditional centralized exchanges. P2P exchanges stand out for their ability to support a wide range of payment methods, often including local options that may not be available on larger exchanges. This flexibility, combined with the potential for increased privacy and reduced fees, makes P2P exchanges an attractive option for many traders.

However, like any trading method, P2P exchanges come with their own set of advantages and challenges. While they offer greater control over transactions and often provide access to a broader global market, users must be vigilant about security and may face issues with liquidity or transaction speed. The lack of intermediaries, while appealing to many, also means that users bear more responsibility for ensuring safe and successful trades.

It's worth noting that while P2P exchanges offer unique benefits, they're not the only option for cryptocurrency traders looking to optimize their strategies. For those seeking to leverage the advantages of multiple platforms tools like Bitsgap can be invaluable. Although not a P2P exchange itself, Bitsgap is a comprehensive crypto aggregator and trading platform that connects to over 15 centralized exchanges, many of which offer P2P services.

Remember, the world of cryptocurrency trading is dynamic and complex. Continuous learning, careful research, and starting with small transactions are always wise approaches, regardless of the platforms or tools you choose to use.